Sensor Fusion Market Outlook:

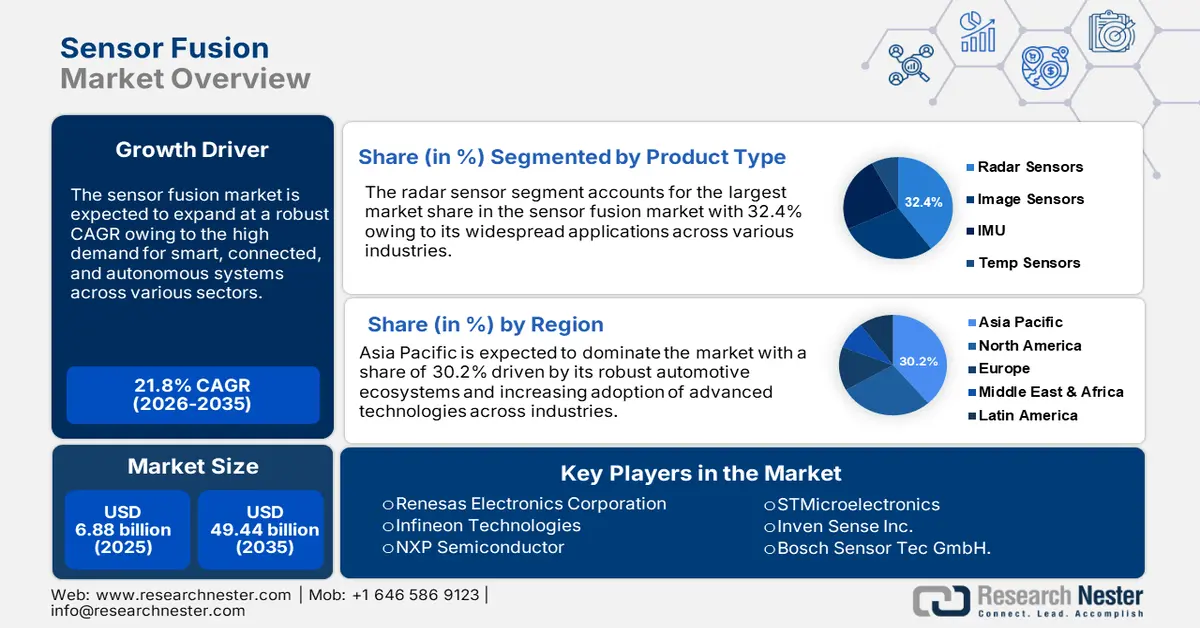

Sensor Fusion Market size was valued at USD 6.88 billion in 2025 and is set to exceed USD 49.44 billion by 2035, expanding at over 21.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of sensor fusion is estimated at USD 8.23 billion.

High demand for smart, connected, and autonomous systems across different industries is fueling the growth of the market. Latest technologies including the Internet of Things (IoT) are incorporated with advanced technologies including artificial intelligence (AI) and machine learning (ML) for better optimization of processes, prediction of maintenance needs, and meeting changing requirements of the market by fusing multiple sensor data to it. For instance, Siemen’s Simotics sensor has incorporated sensor fusion, AI, and ML to monitor motor performance and analyze maintenance needs beforehand. The demand for sensor fusion is rapidly increasing from autonomous vehicles and industrial automation to consumer electronics and healthcare. It is deemed to be a crucial technological tool that can meet the growing demand for high accuracy, noise reduction, enhanced performance, and better decision-making.

Key Sensor Fusion Market Insights Summary:

Regional Highlights:

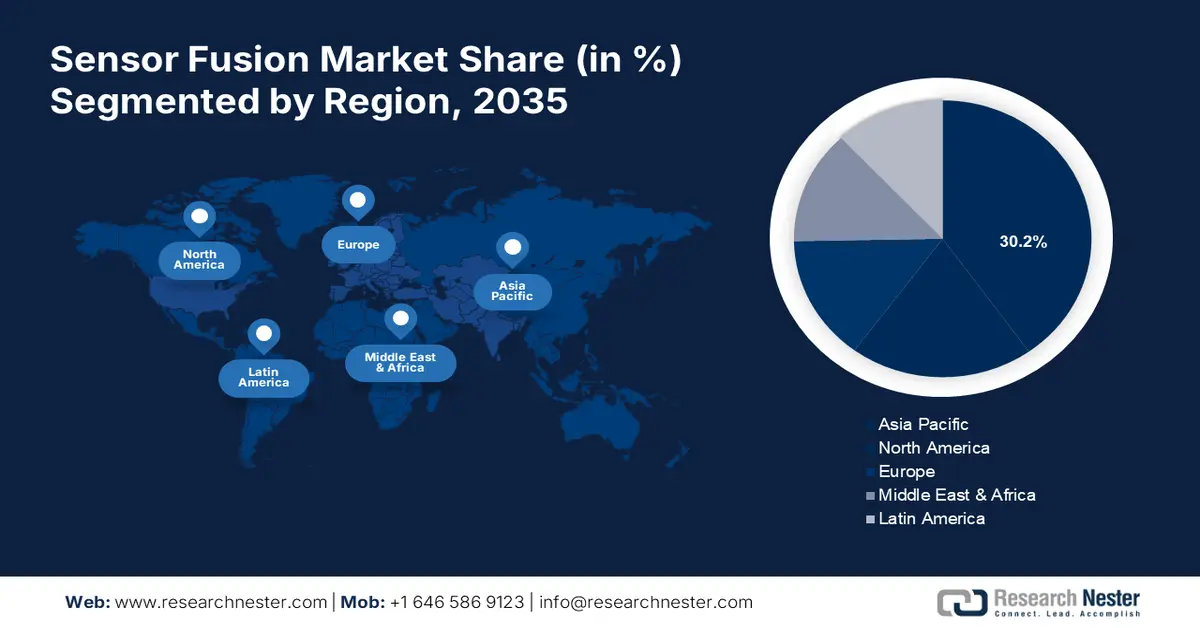

- Asia Pacific’s sensor fusion market is anticipated to capture 30.2% share by 2035, driven by rising adoption of industrial automation, autonomous vehicles, and government initiatives.

Segment Insights:

- The radar sensors segment in the sensor fusion market is projected to achieve notable growth till 2035, driven by its use in adaptive cruise control and pedestrian avoidance due to high accuracy.

- The mems segment in the sensor fusion market is anticipated to exhibit a staggering CAGR through 2035, driven by rising adoption in automotive, aerospace, and consumer electronics for accuracy and efficiency.

Key Growth Trends:

- Rising need for industrial automation

- Advancements in AI and ML

Major Challenges:

- Data synchronization

- Security threat

Key Players: NXP Semiconductor, Renesas Electronics Corporation, Bosch Sensor Tec GmbH, Inven Sense Inc., Infineon Technologies, STMicroelectronics.

Global Sensor Fusion Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 6.88 billion

- 2026 Market Size: USD 8.23 billion

- Projected Market Size: USD 49.44 billion by 2035

- Growth Forecasts: 21.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (30.2% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, South Korea

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 18 September, 2025

Sensor Fusion Market Growth Drivers and Challenges:

Growth Drivers

- Rising need for industrial automation: Sensor fusion is in great demand in the case of industrial automation, wherein several sensors' output signals, which generally emanate from temperature, pressure, and vibration sensors, are combined into a single microcontroller that oversees and regulates a complicated process in real-time. This would involve integrating data from such sensors, enabling valuable insight into equipment performance from manufacturers, detecting potential issues well in advance, and making data-driven decisions on the improvement of overall production.

- Advancements in AI and ML: AI and ML drive new frontiers in the market, making the system more accurate, efficient, and autonomous. AI-driven sensor fusion increases the circle of accuracy and reduces errors, while real-time processing with edge computing provides faster decision-making and reduced latency. For instance, Tesla’s autopilot feature has a combination of sensor fusion with AI and ML using 8 cameras, 12 ultrasonic sensors, radar, sensors, and GPS to provide an autonomous and effortless driving experience with increased safety and convenience.

- Upgradation in MEMS technology: Advances in MEMS technology have made sensors perform much better, boosting growth in the market. MEMS sensors are becoming smaller, more accurate, and power-efficient. These could be integrated into smaller devices and systems. Further, MEMS sensors are being integrated with AI and machine learning algorithms for developing advanced applications such as predictive maintenance and autonomous vehicles. These innovations have been revolutionary in industries such as IoT, automotive, aerospace, and industrial automation.

Challenges

- Data synchronization: Sensor fusion serves as a challenge in data synchronization as the alignment of data concerning different sampling rates, formats, and resolutions concerning time and places from multiple sensors becomes complex. It covers clock synchronization, latency, and jitter considerations, as well as the consideration of the physical location of sensors and the environment.

- Security threat: One of the biggest challenges in the market is the threat to security, as the number of sensor fusions and data sources opens up potential and wide doors to cyber-attacks and breaches. The sensitive data, normally transmitted and processed from different sensors, may be subjected to hacking and tampering, resulting in unauthorized access, corruption of data, or even physical harm. Also, advanced modern algorithms and machine learning techniques used in sensor fusion systems introduce new vulnerabilities such as model poisoning and data spoofing.

Sensor Fusion Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

21.8% |

|

Base Year Market Size (2025) |

USD 6.88 billion |

|

Forecast Year Market Size (2035) |

USD 49.44 billion |

|

Regional Scope |

|

Sensor Fusion Market Segmentation:

Technology Segment Analysis

The micro-electro-mechanical-systems (MEMS) segment in sensor fusion market is expected to register a staggering CAGR owing to its effective utilization among the automotive, aerospace, defense, industrial automation, and consumer electronics sectors. Advanced MEMS-based sensors such as gyroscopes, accelerometers, and pressure sensors render crucial benefits such as high accuracy and precision, low power consumption, and energy efficiency. Key factors that add to the rising demand for MEMS include, the rising demand for advanced driver assistance systems (ADAS) and autonomous vehicles and the increasing trend of adopting automation in the industrial domain.

Product Type Segment Analysis

Radar sensor segment is set to hold sensor fusion market share of more than 32.4% by 2035 and is a crucial component in sensor fusion, especially in the automotive industry. It is used in adaptive cruise control, lane-keeping assistance, and pedestrian avoidance systems and can detect and track objects, offering a 360-degree view of vehicle environment conditions. The advantages that accrue include high accuracy, long-range detection, and robustness against environmental conditions. Developments in radar sensor technology include the use of phased arrays and millimeter-wave frequencies providing higher resolution and accuracy in complicated environments.

End user Segment Analysis

The automotive segment in sensor fusion market is anticipated to grow at a fast pace during the forecast period owing to rapid expansion of the global automotive sector and high usage in applications such as forward collision, automatic braking emergency function, adaptive cruise control, assistance to traffic jams, and vehicle-to-everything (V2X) communication. Manufacturers such as Tesla, General Motors, and Ford are incorporating sensor fusion solutions into their vehicles to enhance system capabilities with advanced features such as lane-keeping assistance, adaptive cruise control, and pedestrian avoidance.

Our in-depth analysis of the global market includes the following segments:

|

Technology |

|

|

Product Type |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Sensor Fusion Market Regional Analysis:

Asia Pacific Market Insights

Asia Pacific industry is estimated to account for largest revenue share of 30.2% by 2035, owing to rising adoption of industrial automation, high demand for autonomous vehicles, and the growing need for well-established infrastructure aided by government initiatives and investments in IoT and AI. Additionally, the rise in concern for safety measures, demand for sustainability, and energy efficiency is enabling the market to flourish and expand significantly.

China is making a significant stride in the market owing to rising investments in its smart city projects and autonomous vehicles. The country is involved in investing in advanced sensor technologies such as LiDAR and radar to become a leader in autonomous driving. Key players are also investing in R&D activities to launch new sensor fusion devices and technologies. For instance, in 2022, Xiaomi entered into a partnership to launch smartphones with improved image-sensing capabilities by leveraging the advanced optical features of Leica, owing to the great demand for sensor fusion in consumer electronics.

In South Korea, the automotive industry is witnessing a surge within the market and is investing in ADAS, autonomous and electric vehicles. For example, in January 2024, TDK Corporation announced its newly designed product namely KLZ2012-A, a series inductor offering high durability, super inductance tolerance capabilities, applicable across several applications.

North America Market Insights

North America sensor fusion market is expected to rise considerably during 2026-2035 owing to increasing investments in advanced technologies, a strong industry ecosystem, and favorable business culture. It has a strong geographic location and strategic economic foundation that creates a lucrative environment for the market to thrive. Additionally, robust semiconductor manufacturing, the presence of research institutions, and easy access to funding enhance the avenue for technological development.

The U.S. and Canada are the leading hubs in the region. High demand in autonomous vehicles, consumer electronics, and smart cities with the existence of innovative players such as Apple, Google, and Microsoft in the U.S., fuels the market growth. For instance, Apple embarked on augmented reality by inducing ARKit 4 with a sensor fusion feature, active in iPhones and iPads which integrates video images and motion sensing data from the device’s camera, accelerometer, and gyroscope.

Sensor Fusion Market Players:

- Analog Devices Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Renesas Electronics Corporation

- Bosch Sensor Tec GmbH

- Inven Sense Inc.

- Infineon Technologies

- STMicroelectronics

- Microsoft

- Apple

The companies are catalyzing the sensor fusion market as they drive substantial growth through innovative endeavors, strategic alliances, and lucrative investments. The strong presence of technological giants, automotive leaders, semiconductor specialists, sensor manufacturers, and software providers collectively shapes the forthcoming years with advancements and upgrades. Some of the prominent leaders are-

Recent Developments

- In June 2024, iMerit announced the launch of a 3D multi-sensor fusion tool intended to revolutionize 3D data segmentation and annotation.

- In May 2024, lattice Semiconductor, a low-power programmable leader, launched a 3D sensor fusion design to enhance advanced autonomous application development.

- Report ID: 6414

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Sensor Fusion Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.