Online Classified Market Outlook:

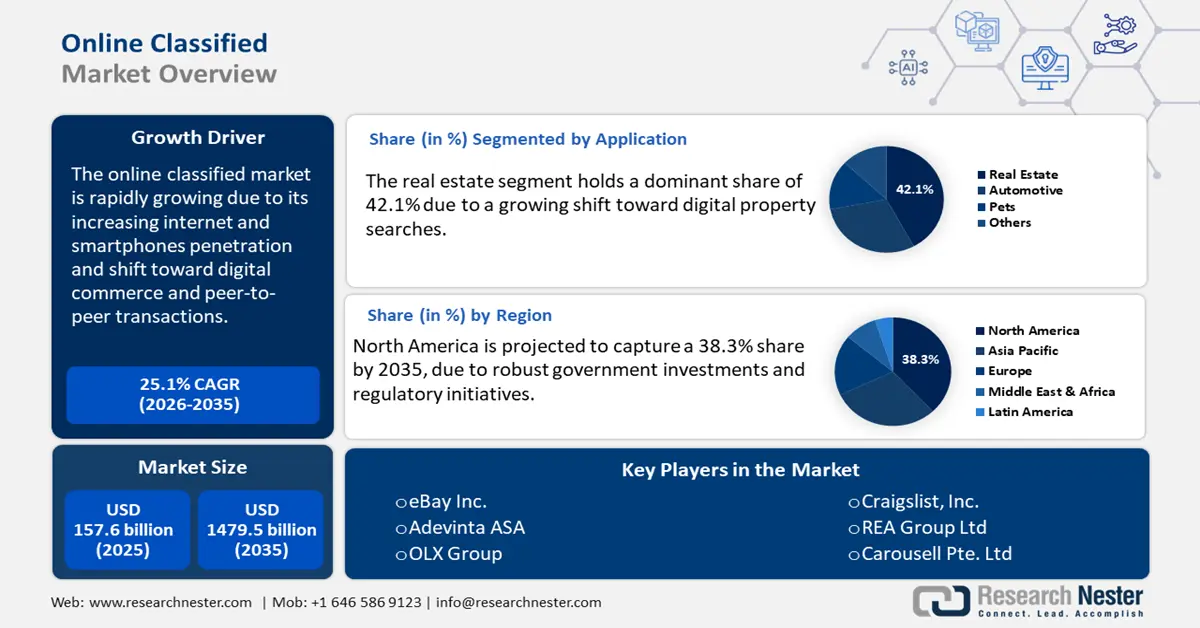

Online Classified Market size was valued at USD 157.6 billion in 2025 and is projected to reach USD 1479.5 billion by the end of 2035, rising at a CAGR of 25.1% during the forecast period, i.e., 2026-2035. In 2026, the industry size of online classified is assessed at USD 197.1 billion.

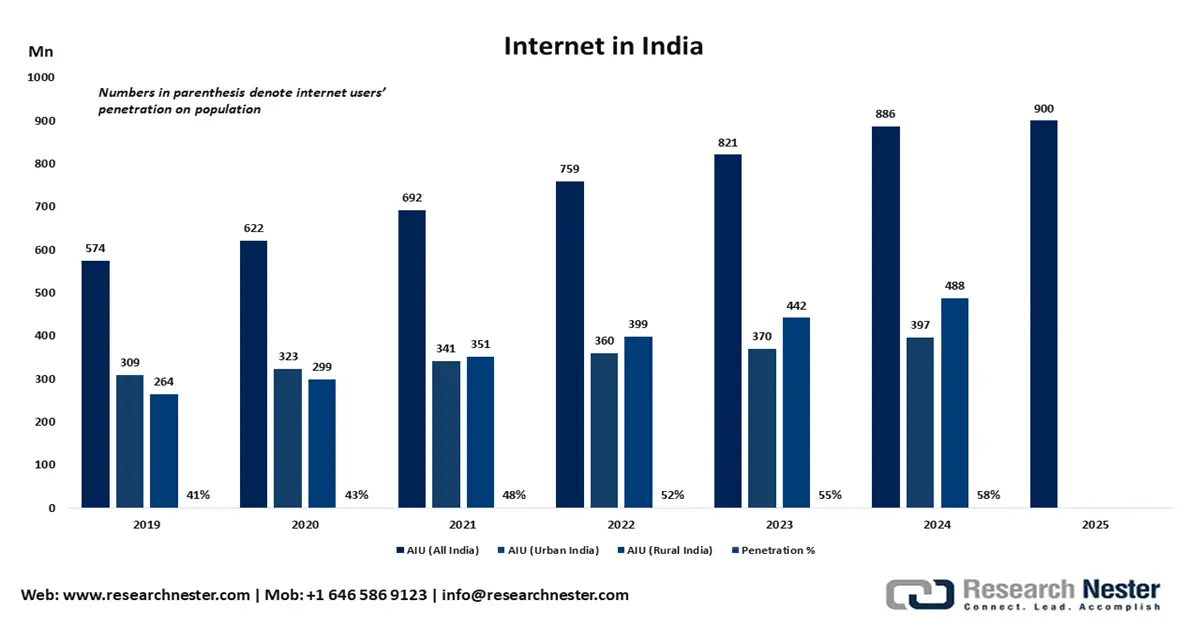

The increasing Internet and smartphones penetration is a primary driver of the online classified market. This has revolutionized the way people connect, communicate, and transact, especially in emerging markets. As entry-level smartphones become cheaper and data plans more accessible, a broader demographic, including people from rural and underserved areas, is gaining access to online platforms. This digital inclusion extends the potential consumer base for online classifieds, which depend heavily on user-generated listings and peer-to-peer interaction. With improved connectivity, individuals who relied on physical bulletin boards, local newspapers, or word-of-mouth now post listings, search offers, and communicate with potential buyers in real time. This has been particularly effective in markets where online classifieds serve as a low-barrier entry point for business.

Source: IAMAI

Moreover, smartphones equipped with GPS, cameras, and user-friendly apps allow users to easily take photos of the product, tag locations, and engage in instant messaging, streamlining the entire process of listing and selling. Additionally, push notifications and personalized recommendations improve user engagement, making mobile devices the only source for online classified usage. For instance, as per the Internet and Mobile Association of India (IAMAI), internet users in India are expected to surpass 900 million by the end of 2025, with over 50% coming from rural areas. This surge has enabled platforms such as OLX to penetrate deeper into non-metro markets, where demand for used goods and local services is high.

Key Online Classified Market Insights Summary:

Regional Highlights:

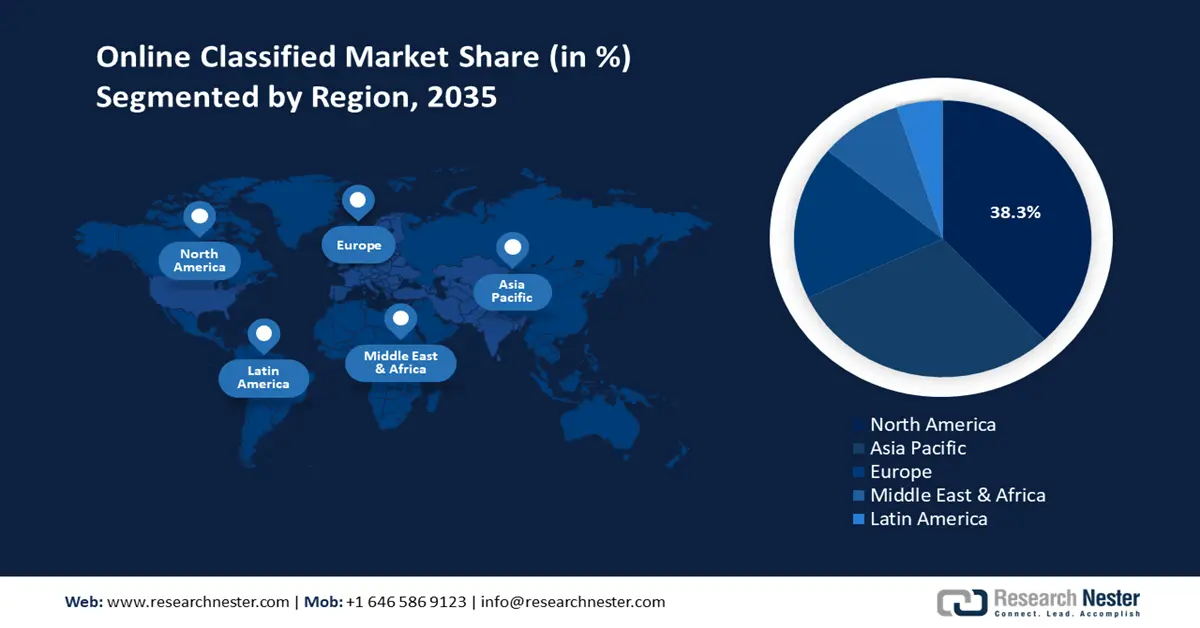

- By 2035, North America is anticipated to secure a 38.3% share of the Online Classified Market, owing to robust government investment and regulatory initiatives.

- The Asia Pacific region is projected to capture a 35% share by 2035, attributed to rapid digital infrastructure expansion and rising internet penetration.

Segment Insights:

- By 2035, the residential listings segment in the Online Classified Market is expected to hold a 42.1% share, propelled by a growing shift toward digital property searches.

- The social media classified segment is projected to account for 45.5% of the market through 2035, supported by enhanced targeting capabilities.

Key Growth Trends:

- Shift toward digital commerce and peer-to-peer transactions

- Growth in e-commerce and gig economy ecosystems

Major Challenges:

- User trust and platform credibility

- Intense Competition

Key Players: Meta Platforms, Inc. (Facebook Marketplace), eBay Inc., Adevinta ASA, OLX Group (Naspers), Craigslist, Inc., REA Group Ltd, Carousell Pte. Ltd, Quikr India Pvt Ltd, Mudah.my Sdn Bhd, Naver Corporation (used via LINE classifieds), LIFULL Co., Ltd., ZIGExN Co., Ltd., Next Co., Ltd., Kakaku.com, Inc., Recruit Holdings Co., Ltd. (Indeed, SUUMO).

Global Online Classified Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 157.6 billion

- 2026 Market Size: USD 197.1 billion

- Projected Market Size: USD 1479.5 billion by 2035

- Growth Forecasts: 25.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38.3% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, China, United Kingdom, Germany, Japan

- Emerging Countries: India, Brazil, Indonesia, Mexico, United Arab Emirates

Last updated on : 25 September, 2025

Online Classified Market - Growth Drivers and Challenges

Growth Drivers

- Shift toward digital commerce and peer-to-peer transactions: Consumers and small businesses are adopting digital transactions in businesses, from buying and selling second-hand goods to renting property, or offering local services via classified platforms. The rising preference for digital and contactless transactions has increased, especially post-pandemic. Thus, online classified platforms are combining secure payment methods and escrow services to enable safe transactions. According to the American Marketing Association (AMA), in 2024, around 73% of marketers find social media marketing to be somewhat or very effective for growing their businesses. The same source also states that Facebook is the leading social media platform, with 3.05 billion monthly active users, nearly 37% of the world’s population. This indicates the direct consumer interaction trend aiding the online classifieds’ growth.

- Growth in e-commerce and gig economy ecosystems: The rise of e-commerce and the gig economy has transformed into online classifieds, where freelancers, service providers, and small sellers find an accessible marketplace. This also consists of classified ads for jobs, services, and rentals. In Southeast Asia, platforms such as Carousell have expanded beyond second-hand goods into services and jobs. In December 2023, Carousell announced that its user community prevented 116,577 tons of carbon emissions in 2022 in four goods categories. This is equal to the amount of CO2 absorbed by 5.3 million trees in a year. This indicates the lesser use of paper for classifieds.

- Integration of AI, search filters, and location-based services: The incorporation of AI, intelligent search filters, and location-based services improves user experience by showing more relevant, personalized, and secure interactions. This builds trust and results in increased engagement and conversion rates on these platforms. For instance, Dubizzle in the UAE has integrated AI-driven chatbots and fraud detection tools to streamline the buyer-seller interaction. In June 2025, Dubizzle Group announced a big achievement that in just one month, over 100,000 product listings were made using their Sell with AI tool. Thus, continuous technological innovations are set to increase the market dominance of key players in the years ahead.

Challenges

- User trust and platform credibility: One of the key challenges in the online classified market is building and maintaining user trust. Unlike structured e-commerce platforms, online classifieds depend heavily on peer-to-peer interactions, often involving unverified users, informal transactions, and in-person meetings. This creates an increased risk of scams, fake listings, misrepresentation, and safety concerns, which can significantly deter user confidence. For instance, platforms such as Facebook Marketplace and OLX have faced huge complaints of fraudulent activities, prompting them to introduce AI-driven content moderation, user verification tools, and safety guidelines. Despite these efforts, ensuring a secure and trustworthy environment remains a major hurdle, particularly in regions with lower digital literacy or regulatory oversight. Without strong user trust, platform growth, engagement, and retention are difficult to sustain.

- Intense Competition: The online classified market is highly competitive due to the thousands of websites worldwide, pushing platforms to work hard to keep users engaged and loyal. Users have many options and easily switch to other sites for better experiences, lower prices, or more listings, making it tough for companies to engage them and build strong, lasting connections. Further, some key players are investing in marketing to stay noticeable among competitors.

Online Classified Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

25.1% |

|

Base Year Market Size (2025) |

USD 157.6 billion |

|

Forecast Year Market Size (2035) |

USD 1479.5 billion |

|

Regional Scope |

|

Online Classified Market Segmentation:

Application Segment Analysis

The residential listings segment holds a dominant share of 42.1% due to a growing shift toward digital property searches. Homebuyers and renters depend on online platforms for their ease of use, broader access to listings, and instant updates. Expanding urban populations and rising housing demand, particularly in developing regions, are contributing to the surge in listings. Enhanced features such as virtual tours, AI-driven recommendations, and location-based searches improve user engagement and decision-making. Moreover, these platforms provide an affordable marketing channel for property owners and agents, speeding up the transition from traditional to digital real estate classifieds.

Revenue Source Segment Analysis

The social media classified segment is projected to account for 45.5% of the global online classified market share through 2035, as they combine massive user bases with enhanced targeting capabilities. Platforms such as Facebook, Instagram, and X have billions of active users, which are aiding sellers to have direct access to highly engaged audiences. The American Marketing Association (AMA) states that Instagram is one of the top platforms for visual social media, with 2.04 billion monthly active users, making it a great choice for brands aiming to reach a young, active audience. Unlike regular classified websites, social media platforms use advanced algorithms and user information to connect listings with buyers based on their interests, location, and browsing habits. This targeted approach contributes to the segmental growth.

Business Model Segment Analysis

The horizontal model segment is anticipated to capture the largest revenue share throughout the study period. This model is widely preferred as it offers a broad, multi-category platform that attracts both sellers and buyers at scale. Horizontal platforms also cover multiple categories, including automobiles, housing, electronics, and services under one umbrella, which uplifts their position among other business models. Also, the diversity driving higher user traffic and engagement contributes to the segmental growth.

Our in-depth analysis of the online classified market includes the following segments:

|

Segment |

Subsegments |

|

Type |

|

|

Business Model |

|

|

Revenue Source |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Online Classified Market - Regional Analysis

North America Market Insights

The online classified market in North America is anticipated to hold a notable share of 38.3% through 2035, due to robust government investment and regulatory initiatives, high digital maturity, and widespread use of smartphones. Consumers generally prefer digital platforms for convenience, real-time listings, and localized transactions. Strict regulatory frameworks and consumer protection laws improve trust, pushing individuals to choose online transactions. Additionally, AI-driven personalization and rising demand for second-hand goods in North America are encouraging user engagement across categories, namely real estate, jobs, and used cars.

The U.S. online classified market is rapidly expanding, owing to widespread internet access, strong digital infrastructure, and a digitally active population. Additionally, changes in consumer behavior to digital-first platforms for convenience, swift action, and access to hyperlocal listings drive growth. The strong data privacy regulations enforced by the FTC ensure a secure environment, fostering user trust and repeat activity. Moreover, AI adoption by Craigslist and eBay improves customized services to users and helps to detect fraud, boosting consumer engagement and trust. The International News Media Association (INMA) reports that in 2024, 22% of people in the U.S. said they paid for online news or used a paid online news service in the past year. This indicates that the strong presence of early adopters is propelling the sales of online classifieds.

Asia Pacific Market Insights

The online classified market in Asia Pacific is projected to capture a 35.0% share by 2035, due to rapid digital infrastructure expansion and rising internet penetration across diverse economies such as Japan, China, India, Indonesia, Malaysia, Australia, and South Korea. Government-backed investments in ICT are playing a key role, particularly in developing countries, where digital adoption is changing business and consumer behavior. The market growth is also driven by increased mobile usage, e-commerce integration, and supportive regulations around data privacy and platform security. Additionally, the region’s urbanization, growing middle class, and youthful demographics are boosting demand for fast, user-friendly online classified solutions.

The online classified market in China is expected to hold the highest share during the forecast period, owing to strong government backing, a mature e-commerce ecosystem, and a large tech-savvy population. The infrastructure and trust-enabling regulations are expected to propel the sales of online classified services in the years ahead. Consumers are increasingly using platforms such as 58.com and Ganji for listing everything from housing and jobs to used cars by AI-powered search, verified listings, and in-app payments. Urban migration and the rising demand for second-hand goods among consumers are fueling continuous platform engagement.

Europe Market Insights

The Europe online classified market is foreseen to expand at the fastest CAGR from 2026 to 2035. The region’s high internet penetration and smartphone adoption are influencing the sales of online classified services. The rising preference for digital-first commerce is also contributing to the increasing popularity of online classified platforms. Horizontal platforms are highly demanded, such as OLX Group, eBay Classifieds, and Adevinta in the EU countries. The regulatory initiatives targeting digital transparency and consumer protection are also driving the use of online classified platforms among both individuals and businesses.

Germany online classified market is expected to lead the sales of online classified services in the years ahead, owing to its large digital consumer base. The robust rise in e-commerce activities and cultural acceptance of secondhand trade is also contributing to the increasing application of online classified platforms. Further, the country’s strong economy and high purchasing power are making it attractive for advertisers, while widespread smartphone penetration is supporting mobile-first transactions.

Key Online Classified Market Players:

- Meta Platforms, Inc. (Facebook Marketplace)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- eBay Inc.

- Adevinta ASA

- OLX Group (Naspers)

- Craigslist, Inc.

- REA Group Ltd

- Carousell Pte. Ltd

- Quikr India Pvt Ltd

- Mudah.my Sdn Bhd

- Naver Corporation (used via LINE classifieds)

- LIFULL Co., Ltd.

- ZIGExN Co., Ltd.

- Next Co., Ltd.

- Kakaku.com, Inc.

- Recruit Holdings Co., Ltd. (Indeed, SUUMO)

The global online classified market is highly competitive, led by industry giants and influenced by emerging new companies. The companies situated in Europe and Asia are employing localized strategies and targeting niche categories, including real estate and autos, to boost their revenue shares. Some of the leading companies are also investing in mobile platforms, user verification, and fraud prevention to stand out in the competitive landscape. The increased digital adoption and rising platform engagement in emerging markets such as India, Malaysia, and South Korea are creating a high-earning environment for key players. Given below is a table of the top players in the online classified market with their respective shares.

Recent Developments

- In January 2025, Meta and eBay entered into a strategic collaboration to grow the roster of channels. This move is set to expand eBay listings to appear on Facebook Marketplace in the U.S., Germany, and France.

- In April 2025, eBay rolled out a new AI feature that enables automated responses to buyer inquiries. This tool uses information from sellers' listings and order details to provide accurate answers, aiming to improve customer service efficiency.

- Report ID: 2337

- Published Date: Sep 25, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Online Classified Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.