Online Gaming Edutainment Market Outlook:

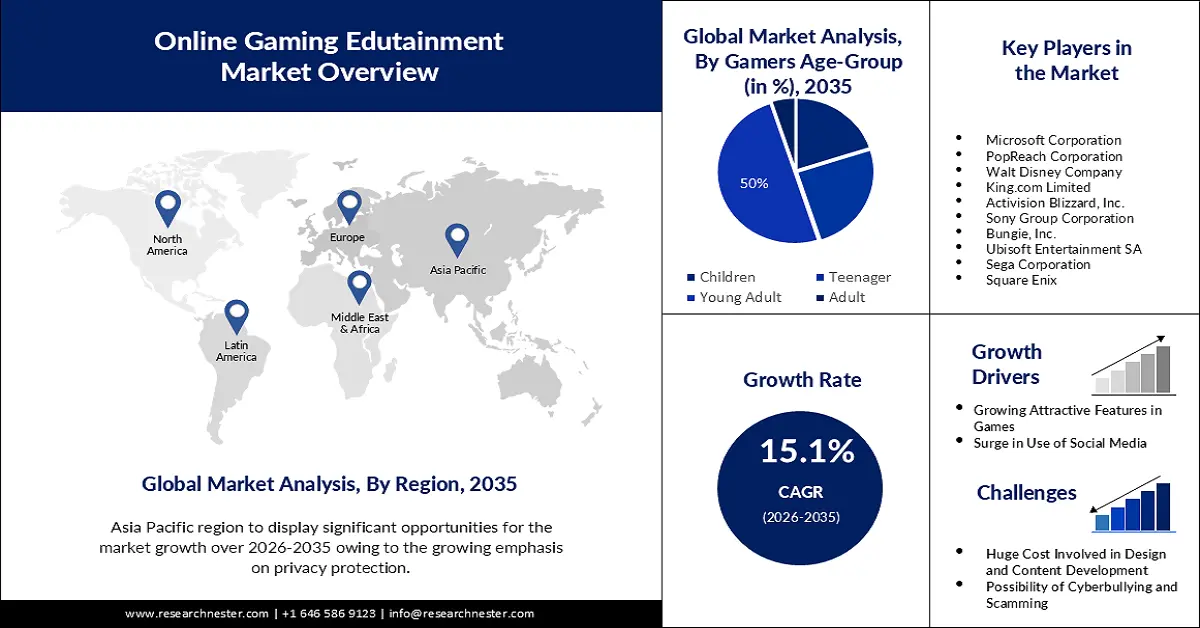

Online Gaming Edutainment Market size was over USD 3.6 billion in 2025 and is anticipated to cross USD 14.69 billion by 2035, growing at more than 15.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of online gaming edutainment is assessed at USD 4.09 billion.

The growth of the market is primarily attributed to the growing number of internet users worldwide which has boosted digital transformation or web-based games. For instance, it was observed that, till July 2022, more than 63% of the global population used the internet.

The edutainment industry is constantly thriving and is showcasing an upward trend with online games becoming the most popular form of entertainment among teens as well as elders. The online gaming edutainment market is expected to boost with more children spending their leisure time using digital mediums and demanding fun yet educational content which would aid in improving their thinking skills, problem-solving as well and social skills.

Key Online Gaming Edutainment Market Insights Summary:

Regional Highlights:

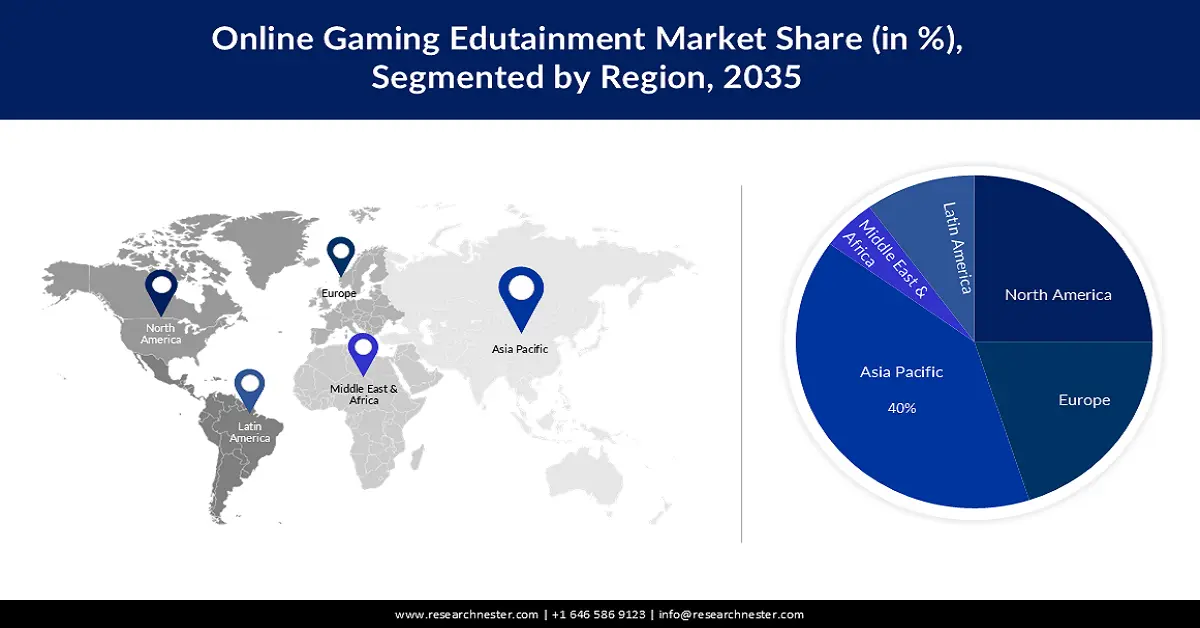

- By 2035, the Asia Pacific online gaming edutainment market is projected to command a 40% share, propelled by the growing emphasis on privacy protection.

- North America is anticipated to witness notable expansion through 2035 as the region benefits from increasing integration of cloud technology.

Segment Insights:

- The free-to-play games segment in the online gaming edutainment market is forecast to secure a 40% share by 2035, supported by the growing number of people playing these games worldwide.

- The young adult segment is expected to capture about a 50% share over the forecast period, underpinned by their higher consumption of games easily available on the internet and downloadable on smartphones.

Key Growth Trends:

- Growing Attractive Features in Games

- Surge in the Use of Social Media

Major Challenges:

- Huge Cost Involved in Design and Content Development

- Possibility of Cyberbullying and Scamming

Key Players: Microsoft Corporation, PopReach Corporation, Walt Disney Company, King.com Limited, Activision Blizzard, Inc., Sony Group Corporation, Bungie, Inc., Ubisoft Entertainment SA, Sega Corporation, Square Enix.

Global Online Gaming Edutainment Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.6 billion

- 2026 Market Size: USD 4.09 billion

- Projected Market Size: USD 14.69 billion by 2035

- Growth Forecasts: 15.1%

Key Regional Dynamics:

- Largest Region: Asia Pacific (40% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, China, Japan, South Korea, United Kingdom

- Emerging Countries: India, Brazil, Indonesia, Mexico, United Arab Emirates

Last updated on : 21 November, 2025

Online Gaming Edutainment Market - Growth Drivers and Challenges

Growth Drivers

- Growing Attractive Features in Games: Games manufacturer are coming up with various attractive feature which is driving people of all age group towards it. Features such as a live chat room, achievement leader board various attractive prices, and more are estimated to drive more gamers. Additionally, graphics play an equally important role in driving gamers. Due to the ability of pictures and art to affect thinking, emotion, and eventually, immersion in a Gameworld, graphics are a crucial indicator of a game's value.

- Surge in the Use of Social Media : Currently, the world consists of about 5 billion individuals who use social media. This means that approximately 60% of the population globally are social media users. Hence, this has made it easy for game developers to promote their games on social media. For instance, about 48% of internet users claim they are inclined to make a purchase from a company they encounter on social media. Consequently, this could bring in more demand for online gaming edutainment.

- Rise in Amount of Stress: Large number of populations play games online in order to relief their stress. The majority of video games are entertaining and pleasant. Dopamine, or "happy hormone," is released when one plays video games, making one feel good and reducing the stress of daily living. Therefore, online gaming edutainment is estimated to offer both fun and education which is further driving more attention of parents.

Challenges

- Huge Cost Involved in Design and Content Development - It takes a lot of time, very keen efforts, and huge investment to design an error-free game. The expectation regarding the smoother user interface goes higher when it comes to online live gaming and edutainment content. Therefore, the huge cost of design and content development is estimated to hamper the growth of the market.

- Possibility of Cyberbullying and Scamming

- Limiting Academic Progress

Online Gaming Edutainment Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

15.1% |

|

Base Year Market Size (2025) |

USD 3.6 billion |

|

Forecast Year Market Size (2035) |

USD 14.69 billion |

|

Regional Scope |

|

Online Gaming Edutainment Market Segmentation:

Game Type Segment Analysis

The free-to-play games segment is anticipated to account for 40% share of the global online gaming edutainment market during] the forecast period, backed by the growing number of people playing these games worldwide. For instance, it was found that, globally gamers spent more than 55% of their time playing free-to-play games(core) in 2021. Furthermore, the rapidly increasing count of smartphone and tablet users is also fueling the growth of the market over the forecast time period.

Gamers Age-Group Segment Analysis

Online gaming edutainment market from the young adult segment is poised to generate the largest share of about 50% over the forecast period. Young adults are estimated to consume more games usually which are easily available on the internet and could be downloaded of smartphones. Additionally, various organizations might promote the use of educational games to their employees the in near future in their free time in order to improve their fundamental skills.

Our in-depth analysis of the global market includes the following segments:

|

Game Type |

|

|

Gamers Age-Group |

|

|

Category |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Online Gaming Edutainment Market - Regional Analysis

APAC Market Insights

The online gaming edutainment market is Asia Pacific industry is predicted to account for largest revenue share of 40% by 2035. The growth of the market in this region is set to be influenced by a growing emphasis on privacy protection. Hence, this has boosted security, especially among parents which is expected to influence the market expansion in this region.

North American Market Insights

The North America is also expected to have significant growth in the online gaming edutainment market during the coming years. The market growth in this region is dominated by a rise in the integration of cloud technology. North America stands for about 93% of cloud adoption currently by organizations. Hence, this is projected to make interaction between players more fluent, therefore reaching to large number of people. As a result, online gaming edutainment is also expected to be greatly influenced in this region.

Online Gaming Edutainment Market Players:

- Microsoft Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- PopReach Corporation

- Walt Disney Company

- King.com Limited

- Activision Blizzard, Inc.

- Sony Group Corporation

- Bungie, Inc.

- Ubisoft Entertainment SA

- Sega Corporation

- Square Enix

Recent Developments

- Sony Interactive Entertainment (SIE), announced the acquisition of Savage Game Studios through a definitive agreement. Savage Game Studios to join the newly created PlayStation Studios Mobile Division, which is an independent operation from console development. The acquisition complements the commitment of SIE to deliver innovative experiences to new players globally.

- Microsoft Corporation, announced plans to acquire Activision Blizzard Inc. Activision Blizzard Inc. is a leader in game development and interactive entertainment content publisher. Microsoft's gaming business across mobile, PC, console and cloud is visioned to grow with this acquisition with additionally providing a building block for the metaverse.

- Report ID: 4306

- Published Date: Nov 21, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Online Gaming Edutainment Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.