Internet of Things Market Outlook:

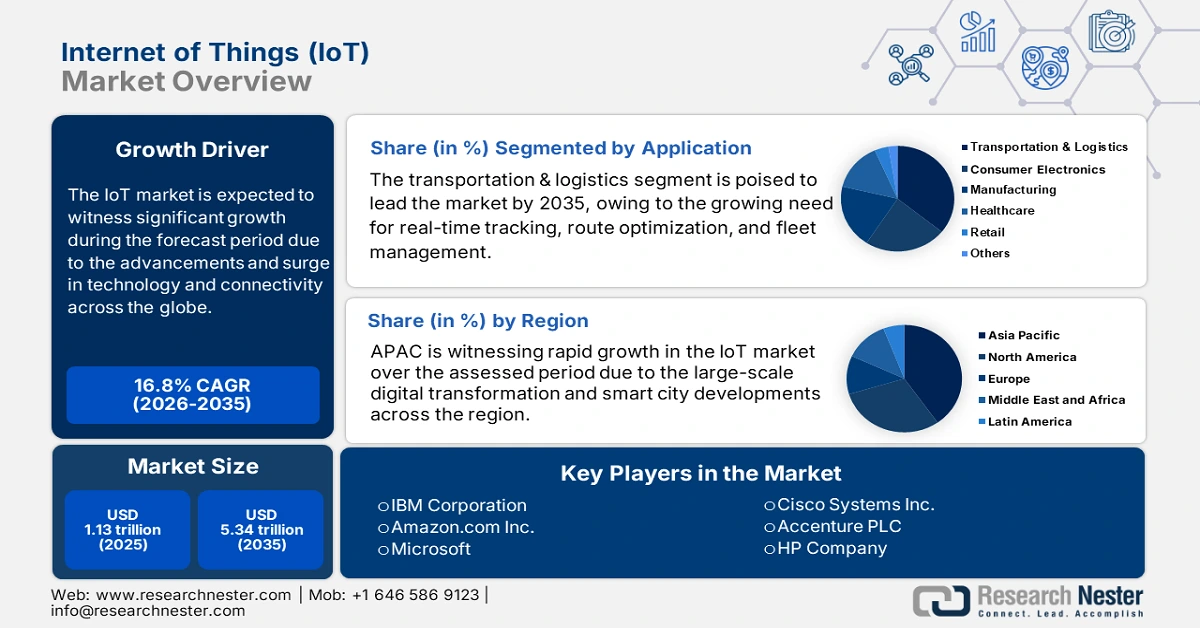

Internet of Things Market size was valued at USD 1.13 trillion in 2025 and is likely to cross USD 5.34 trillion by 2035, expanding at more than 16.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of internet of things is assessed at USD 1.3 trillion.

The global market growth is boosted by several key factors, including the widespread adoption of smart devices across consumer and industrial segments. Presently, a worldwide shift towards industrial automation, where IoT plays a crucial role in enabling predictive maintenance, process optimization, and enhanced productivity, has been observed. In February 2024, Oracle released Enterprise Communications Platform, intending to distribute secure, real-time, dependable communications for industry applications. Integrated with proficiencies including IoT device management, clients can remove complex combinations and network contracts management burden, and distribute the connectivity and data intelligence needed to power new complicated services.

Expansion of 5G networks, which offer faster, more reliable, and lower latency connectivity, is another significant growth driver. The implementation of Industry 4.0 principles is a major catalyst driving the growth of the market. As manufacturers and industrial enterprises strive to modernize their operations, IoT technologies are becoming essential for achieving the core objectives of Industry 4.0. In February 2024, Digi International Inc. launched Digi IX40, which is an industrial IoT cellular router solution with 5G edge computing, purposely built for use cases of Industry 4.0. This includes advanced robotics, asset monitoring, predictive maintenance, smart manufacturing, and industrial automation.

Key Internet of Things (IoT) Market Insights Summary:

Regional Highlights:

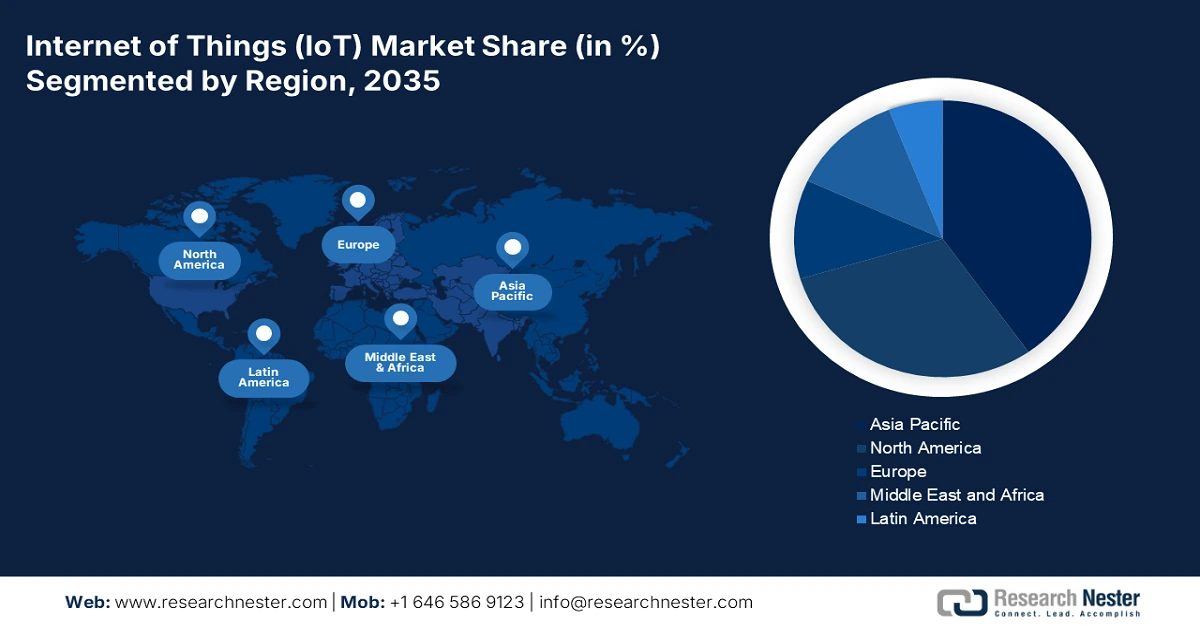

- Asia Pacific IoT market leads with the highest share by 2035, driven by large-scale digital transformation and smart city developments.

- North America market will maintain a considerable share by 2035, driven by early technological adoption and mature digital infrastructure.

Segment Insights:

- The transportation & logistics segment in the internet of things market is expected to secure a 35.80% share by 2035, fueled by the need for real-time tracking and fleet management.

- The component segment in the internet of things market is projected to experience considerable growth over 2026-2035, driven by increasing demand for connected devices and hardware.

Key Growth Trends:

- Advancements in wireless technologies

- Industrial automation and smart manufacturing

Major Challenges:

- Vulnerabilities in the IoT ecosystem

Key Players: Amazon.com Inc., Microsoft, Cisco Systems Inc., PTC Inc., HP Company, Accenture PLC, Qualcomm Technologies, Inc., InnoPhase IoT, Inc., ABB, IBM Corporation.

Global Internet of Things (IoT) Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.13 trillion

- 2026 Market Size: USD 1.3 trillion

- Projected Market Size: USD 5.34 trillion by 2035

- Growth Forecasts: 16.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 8 September, 2025

Internet of Things Market Growth Drivers and Challenges:

Growth Drivers

-

Advancements in wireless technologies: This rapid growth is significantly boosting the adoption of IoT around the world. Faster data transfer speeds, lower latency, and wider coverage make it easier for devices to stay connected reliably and in real-time. In December 2024, Press Information Bureau, India, published a Press Release stating the progress of Bharat 6G Vision, which was initiated in March 2023, at the international level, and is currently under development. It is anticipated to be accessible by 2030. Such developments and futuristic plans are boosting the market growth further.

-

Industrial automation and smart manufacturing: IoT is playing a transformative role in these industries by enabling real-time data collection, monitoring, and control of equipment and processes. Manufacturers are leveraging IoT solutions to improve productivity, ensure quality control, and optimize supply chain operations. In July 2024, the U.S. Department of Energy (DOE) released a funding prospect of USD 33 million to fast-track smart manufacturing technology advancements and processes required for developing and deploying the groundbreaking technologies and materials crucial for the country’s transition to clean energy.

Challenge

-

Vulnerabilities in the IoT ecosystem: As billions of devices become interconnected, each one becomes a potential entry point for cyberattacks. Many IoT devices lack proper encryption, regular updates, or secure authentication, making them vulnerable to data breaches and unauthorized access. This not only risks user data but also undermines trust in IoT technology, posing a significant hurdle to widespread adoption.

Internet of Things Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

16.8% |

|

Base Year Market Size (2025) |

USD 1.13 trillion |

|

Forecast Year Market Size (2035) |

USD 5.34 trillion |

|

Regional Scope |

|

Internet of Things Market Segmentation:

Application Segment Analysis

The transportation & logistics segment is projected to garner the highest internet of things market share of 35.8% in 2035, driven by the need for real-time tracking, route optimization, and fleet management. According to a report published by the IoT Advisory Board in October 2024, demand for telematics devices is on the rise, with shipments estimated at 160 million units by 2026. Embedded car OEM telematics units are also increasing, with 375 million units projected to be in use by 2026. The integration of IoT in this sector enhances safety, supports predictive maintenance, and ensures better customer service.

Product Segment Analysis

The component segment in Internet of Things (IoT) market is expected to register considerable growth during the forecast period, primarily due to the critical role of sensors, actuators, and connectivity modules in enabling data collection and communication between devices. As demand for connected devices grows, so does the need for robust and efficient hardware, reinforcing its leading position in the global market.

Our in-depth analysis of the global internet of things market includes the following segments:

|

By Product |

|

|

By Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Internet of Things Market Regional Analysis:

Asia Pacific Market Insights

APAC region is witnessing rapid IoT market growth and is anticipated to register the highest share in 2035, fueled by large-scale digital transformation and smart city developments. According to Trading Economics, disposable personal income in Australia increased to USD 259.1 billion in the fourth quarter of 2024 from USD 255.4 billion in the third quarter of 2024. The rise in disposable income, increasing internet and mobile penetration, and expanding urban infrastructure create a favorable landscape for IoT adoption in the region. The strong presence of manufacturing hubs also supports the adoption of IoT in industrial automation and supply chain optimization.

India IoT market is expanding at a robust pace, driven by the government’s Digital India initiative and proliferation of affordable internet and smartphones. IoT adoption is increasing in key sectors such as agriculture, where smart farming techniques help optimize resource use, and healthcare, where remote monitoring and telemedicine are gaining traction. In April 2021, eSanjeevani was launched by the government to provide safe Doctor-to-Patient consultations. Fruthermore, according to the Ministry of Health and Family Welfare, as of January 2025, over 73 crore Ayushman Bharat Health Accounts have been created successfully, with over 5 lakh health professionals registered.

North America Market Insights

North America IoT market is driven by early technological adoption and a mature digital infrastructure and is projected to hold a considerable share by 2035. The region benefits from strong investment in innovation and a high concentration of leading IoT companies that continuously push advancements in connectivity, cloud computing, and AI. Smart city projects are also driving the market. For instance, in June 2024, the Administrator of the U.S. General Services Administration invested USD 80 million from the IRA in smart building technologies, which was projected to help reduce emissions, increase efficiency and reduce costs, and enhance comfort across an estimated 560 federal buildings.

The U.S. IoT market experiences significant growth owing to high consumer demand for smart home devices, wearables, and connected cars. Government support through cybersecurity frameworks also plays a vital role in promoting IoT usage in the country. For instance, in January 2025, the White House launched the U.S. Cyber Trust Mark, a cybersecurity label for internet-connected devices, approving 11 companies as Cybersecurity Label Administrators.

Internet of Things Market Players:

- IBM Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Amazon.com Inc.

- Microsoft

- Cisco Systems Inc.

- PTC Inc.

- HP Company

- Accenture PLC.

- Qualcomm Technologies, Inc.

- InnoPhase IoT, Inc.

- ABB

Key players in the Internet of Things (IoT) market are adopting various strategies to stay competitive in the market and drive growth. These include investing in heavy R&D, forming strategic partnerships and alliances for better integration and scalability, and focusing on markets such as the healthcare and semiconductor industries. For instance, in August 2024, IBM, the Government of Canada, and the Government of Quebec signed agreements to strengthen Canada's semiconductor industry and further develop the assembly, testing, and packaging (ATP) capabilities for semiconductor modules valued at approximately USD 134.5 million. Some of these companies are:

Recent Developments

- In October 2024, Qualcomm Technologies, Inc. introduced a new product portfolio for the industrial IoT- Grade IQ Series for the AI era.

- In September 2024, UnaBiz launched three innovative solutions, UBZ310, CT Series, and the VS Series, targeting the Smart Building sector at BEX Asia 2024, designed to automate monitoring, optimise operations, and help building owners meet their sustainability goals.

- In December 2023, InnoPhase IoT, Inc. announced expansion of its design partner program to implement OEM designs using Talaria TWO Wi-Fi/BLE connectivity solutions for long battery life.

- In June 2023, ABB and China Telecom together unveiled an IoT laboratory for digitalization and industrial in Hangzhou, China, intending to concentrate on developing end-to-end industrial IoT solutions for industrial companies based in the country.

- Report ID: 1189

- Published Date: Sep 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Internet of Things (IoT) Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.