Robotic Vacuum Cleaner Market Outlook:

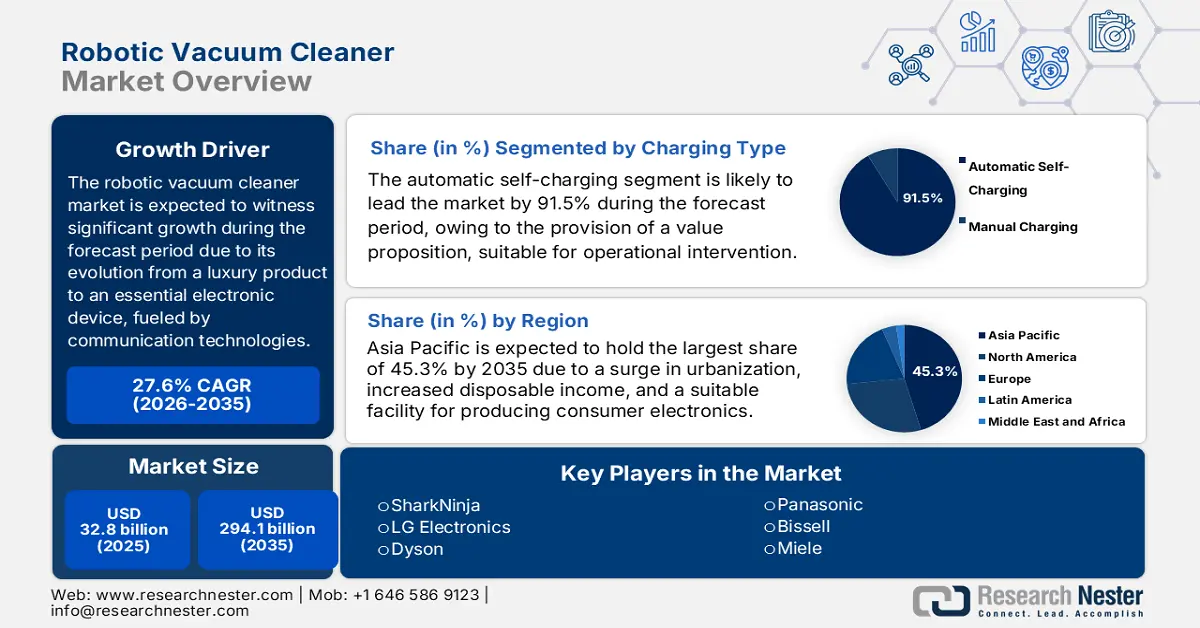

Robotic Vacuum Cleaner Market size was over USD 32.8 billion in 2025 and is estimated to reach USD 294.1 billion by the end of 2035, expanding at a CAGR of 27.6% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of robotic vacuum cleaner is estimated at USD 41.8 billion.

The international market is witnessing a profound shift, rapidly evolving from merely a niche luxury product into a mainstream consumer electronics staple. This transformation is not only fueled by the convenience pursuit but is fundamentally driven by an increase in the convergence with information and communication technologies. According to an article published by NLM in September 2024, the robotic hoover sector in China reached RMB 12.4 billion, along with a 3.4% growth rate by the end of 2022. This indicates the aspect of intelligent cleaning products demand since consumers are rapidly evolving, which is positively impacting the overall market’s growth globally.

Furthermore, a rise in the connected ecosystem, with the seamless integration into wide-ranging Internet of Things (IoT)-based platforms, such as Alexa, Apple HomeKit, Google Assistant, and Amazon, is readily driving the market for robotic vacuum cleaners. In this regard, as per a data report published by the NIST Government in October 2024, McKinsey and the World Economic Forum predicted that the Internet of Things (IoT), along with adjacent technologies, such as machine learning (ML), big data, cloud computing, and analytics, will produce almost USD 21.6 trillion by the end of 2022. Therefore, this has a massive impact on the operational activities of the robotic vacuum cleaner market across different nations.

Key Robotic Vacuum Cleaner Market Insights Summary:

Regional Highlights:

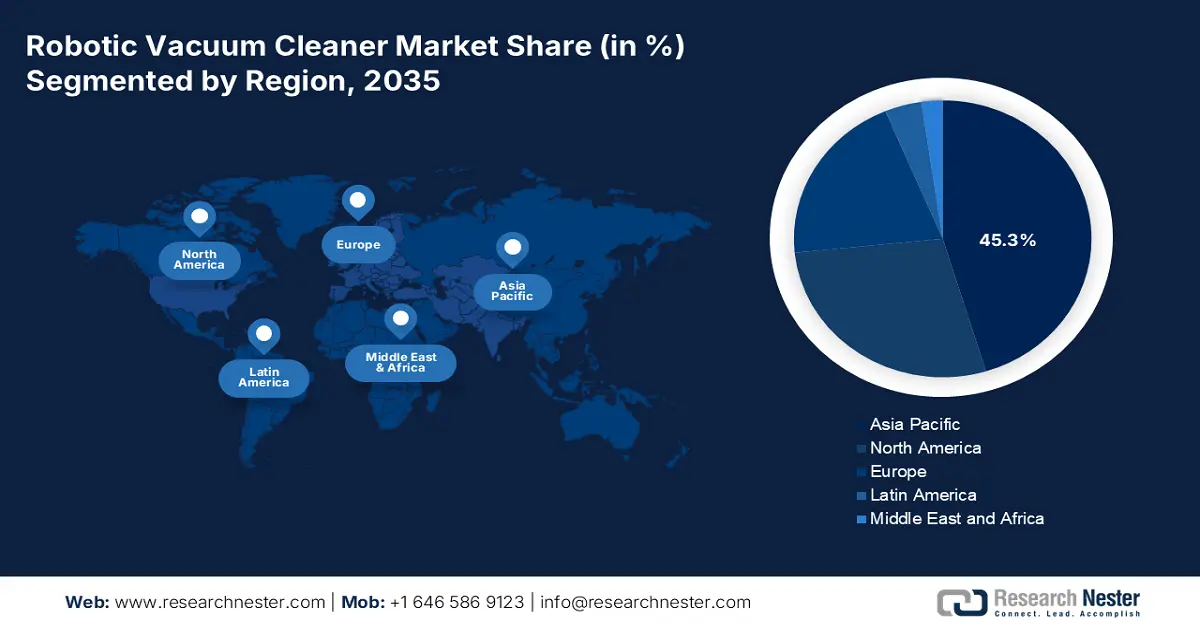

- Asia Pacific market is anticipated to secure the highest share of 45.3% by 2035, owing to increased urbanization, a growing middle class, and the region’s status as a global consumer electronics hub.

- Europe market is projected to emerge as the fastest-growing region during 2026–2035, impelled by smart home device integration, energy efficiency, and data privacy trends.

Segment Insights:

- The automatic self-charging segment in the robotic vacuum cleaner market is anticipated to account for the largest share of 91.5% by 2035, propelled by its essential role in delivering complete autonomy.

- The Wi-Fi segment is projected to secure the second-largest share during the forecast period 2026–2035, driven by its ability to offer remote control, smart home integration, and customized cleaning schedules.

Key Growth Trends:

- Changing lifestyles and a surge in modernization

- Proliferation of smart home infrastructure

Major Challenges:

- Increased consumer value perception and initial expense

- Technological restriction in object and navigation interaction

Key Players: iRobot (U.S.), Samsung Electronics (South Korea), Ecovacs (China), Xiaomi (China), Roborock (China), SharkNinja (U.S.), LG Electronics (South Korea), Dyson (UK), Panasonic (Japan), Bissell (U.S.), Miele (Germany), Yujin Robot (South Korea), Neato Robotics (U.S.), Cecotec (Spain), Philips (Netherlands), Deebot (China), Coredy (China), Ilife (China), Karcher (Germany), Matsutek (Taiwan, China)

Global Robotic Vacuum Cleaner Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 32.8 billion

- 2026 Market Size: USD 41.8 billion

- Projected Market Size: USD 294.1 billion by 2035

- Growth Forecasts: 27.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (45.3% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, China, Japan, Germany, South Korea

- Emerging Countries: India, Brazil, Mexico, Indonesia, Vietnam

Last updated on : 4 November, 2025

Robotic Vacuum Cleaner Market - Growth Drivers and Challenges

Growth Drivers

- Changing lifestyles and a surge in modernization: The international trend towards an urban style of living, along with dual-income households and busy lifestyles, is resulting in a robust need for automated and time-saving home management solutions. According to an article published by the Investigative Economics Organization in October 2024, the actual median household income accounted for USD 59,000 as of 2023, which gradually increased to nearly USD 81,000 by the end of the same year. Besides, as per the October 2024 Congressional Budget Office article, there has been a rise in family wealth, particularly in the U.S., denoting a rise from USD 52 trillion as of 2022 to USD 199 trillion. This resulted in a 4% increase, owing to which there is a huge demand for the market.

- Proliferation of smart home infrastructure: The foundational driver for the market is the worldwide extension of wireless networking and high-speed internet in households. According to a report published by UNESCO in September 2022, 54% of the global population readily utilized the Internet in 2019, which continued to grow to approximately 66% by the end of 2022, representing 5.3 billion of the overall population. Therefore, with an increase in internet utilization, there has been a surge in the purchase of automated vacuum cleaners, which denotes an optimistic approach for readily uplifting the market across different nations.

- Continuous supply of vacuum cleaners: The evolving and ongoing supply of vacuum cleaners is one of the crucial growth drivers for the robotic vacuum cleaner market, depending on strong ICT supply sources and relentless advancements. Manufacturers are not only producing units but are actively engaged in an increased iteration cycle, which is upliftment by progression in battery chemistry, processor efficiency, and sensor technology. Besides, as per the September 2025 OEC data report, the global trade valuation of vacuum cleaners accounts for USD 20.9 billion, along with a 0.09 share, and 1.2 as the product complexity, thus suitable for bolstering the market’s exposure.

Vacuum Cleaners 2023 Export and Import

|

Countries |

Export |

Import |

|

China |

USD 10.0 billion |

- |

|

Germany |

USD 2.1 billion |

USD 2.0 billion |

|

Vietnam |

USD 1.6 billion |

- |

|

U.S. |

- |

USD 5.2 billion |

|

France |

- |

USD 912 million |

Source: OEC

Challenges

- Increased consumer value perception and initial expense: Despite a reduction in component expenses, innovative robotic vacuum cleaners with standard ICT features, such as artificial intelligence (AI) and LiDAR obstacle avoidance, continue to remain a purchase in comparison to conventional vacuums. This increased cost has created a substantial gap in the mass-market adoption, especially across price-sensitive emerging nations. This challenge is also compounded by customer skepticism regarding the device’s capability to completely replace physical cleaning, particularly in terms of deep-cleaning activities or on thick carpets, which is negatively impacting the market.

- Technological restriction in object and navigation interaction: While navigation has dramatically optimized, effective technological obstacles continue to remain, thus causing a hindrance in the market globally. Based on this, robots are continuing to struggle with complicated home layouts, high-gloss or dark floors that often create confusion among sensors. The most common challenge is dependable object communication, and despite the AI relevance, units can still get stuck on pet waste, tassels, or cables, resulting in negating the autonomy promise and user frustration.

Robotic Vacuum Cleaner Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

27.6% |

|

Base Year Market Size (2025) |

USD 32.8 billion |

|

Forecast Year Market Size (2035) |

USD 294.1 billion |

|

Regional Scope |

|

Robotic Vacuum Cleaner Market Segmentation:

Charging Type Segment Analysis

The automatic self-charging segment in the market is anticipated to garner the largest share of 91.5% by the end of 2035. The segment’s upliftment is extremely attributed to its essential role in successfully delivering the core value proposition of complete autonomy. This particular feature readily transforms the devices from a semi-automated tool into a standard appliance, demanding zero user intervention for a fundamental operational requirement. In addition, this is considered the foundational technology that allows ongoing and scheduled cleaning cycles without the need for human assistance, thus bolstering the segment’s development.

Connectivity Segment Analysis

The Wi-Fi segment in the robotic vacuum cleaner market is expected to cater to the second-largest share during the projected period. The segment’s growth is driven by its ability to ensure innovative features, such as remote control through smartphone application, smart home integration for voice commands, and customized cleaning schedules. Besides, according to the May 2024 Wi-Fi Organization article, there exist 4.1 billion wi-fi devices, which have been successfully shipped in 2024, readily contributing 45.9 billion in cumulative wi-fi shipments. The present year has also witnessed 21.1 billion such devices in use, thereby making it suitable for the segment’s growth.

Application Segment Analysis

The residential segment is projected to account for the third-largest share by the end of the forecast timeline. The segment’s development is highly fueled by strong macroeconomic as well as societal trends, such as an increase in value placed on time-saving, urbanization, and a rise in disposable income. Besides, the actual growth driver caters to the proliferation of smart home facilities, with the presence of devices, such as robotic vacuums, emerging as the central component of the connected living experience. The value of these devices is readily amplified by voice assistant and automated routines integration, thereby making the segment suitable for the market’s growth.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

Charging Type |

|

|

Connectivity |

|

|

Application |

|

|

Product Type |

|

|

Distribution Channel |

|

|

Navigation Technology |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Robotic Vacuum Cleaner Market - Regional Analysis

APAC Market Insights

Asia Pacific market is anticipated to garner the highest share of 45.3% by the end of 2035. The market’s upliftment in the region is attributed to increased urbanization, a burgeoning middle-class enhanced with a rise in disposable income, and the overall region’s status as the global manufacturing center for consumer electronics. Additionally, an upsurge in economic development, continuous urbanization, and digitalization is projected to bolster the economic growth in the region by the end of 2050. Therefore, with such growing opportunities and development, the market is poised to witness more upliftment in the overall region.

The robotic vacuum cleaner market in China is growing significantly, owing to the government’s expenditure on its regional artificial intelligence and semiconductor sector, essential for robotic vacuum production. As stated in the CSET article published in August 2023, the country’s governments set up 2,107 guidance funds as of 2022, with a registered target valuation of 12.8 trillion RMB (USD 1.8 trillion). This has been suitable to infuse generous capital in prioritized industries, such as AI and emerging technologies. Therefore, with such official support, there is a huge growth opportunity for the market to flourish in the country.

The market in South Korea is also growing due to the aspect of the Digital New Deal, initiating investment in smart home technologies, which in turn. Has boosted the adoption of IoT-based devices, such as robotic vacuums. For instance, as per an article published by the MOFA Government in July 2025, the country aimed to lead digitalized transition with the Digital New Deal by investing 23.4 trillion KRW, of which 18.6 trillion KRW caters to government expenditure as of 2022. In addition, 58.2 trillion KRW has been projected to be invested, of which 44.8 trillion KRW constitutes government spending, along with 903,000 job opportunities by the end of 2025.

Europe Market Insights

Europe market is expected to emerge as the fastest-growing region during the projected period. The market’s development in the overall region is highly driven by increased emphasis on smart home device integration, energy efficiency, and data privacy with compact living spaces. As per the August 2025 ITA data report, Germany comprises one of the largest ICT economies in the region, with EUR 222.6 billion (USD 240.9 billion) turnover as of 2024, which has been predicted to increase to EUR 232.8 billion (USD 252.0 billion) by the end of 2025. Therefore, this is a huge driver that is proliferating the market’s exposure in the overall region, and is continuously growing.

The robotic vacuum cleaner market in Germany is gaining increased traction, owing to its strong manufacturing base, along with consumer emphasis on engineering and quality. Additionally, the Industry 4.0 integration into customer products has resulted in highly dependable and efficient robotic vacuums. As per the August 2025 ITA report, the advanced manufacturing sector in the country, with a focus on Industry 4.0, rose from USD 955.0 billion as of 2022 to more than USD 1.0 trillion in 2023, and further to USD 991.0 billion by the end of 2024. This has resulted in a strong focus on control systems, precision engineering, and machine building, thus suitable for the market’s productivity.

Historical Growth of the Advanced Manufacturing Sector in Germany Uplifting the Market

|

Components |

2022 |

2023 |

2024 |

|

Overall export |

USD 955,316 million |

USD 1,026,836 million |

USD 991,050 |

|

Overall import |

USD 753,557 million |

USD 764,300 million |

USD 721,621 million |

|

Import from the U.S. |

USD 35,978 million |

USD 38,998 million |

USD 36,753 million |

|

Trade surplus and deficit |

USD 201,759 million |

USD 262,536 million |

USD 269,429 million |

|

EUR-USD exchange rate |

1.05 |

1.08 |

1.08 |

Source: ITA

The robotic vacuum cleaner market in the UK is also growing due to a rise in the population density in urban centers, as well as a robust e-commerce cultural presence, and the increased internet penetration rate, offering a huge installed base for connected devices. In this regard, the January 2025 UK Government article indicated that nearly 131,000 hard-to-reach businesses and homes in the country are projected to gain lightning-fast broadband speed, assisting in overcoming gaps in economic growth. Furthermore, a more than £289 million contract has been successfully signed to connect a few of Britain’s remote locations and provide suitable accessibility to crucial online services.

North America Market Insights

North America market is predicted to grow steadily by the end of the forecast duration. The market’s upliftment in the region is fueled by an increase in the smart home platforms adoption rate, including Apple HomeKit, Google Assistant, and Amazon Alexa. The robotic vacuum in the region is no longer considered a standalone application, but an essential component of the connected home. According to an article published by the NPR Organization in June 2022, there has been an increase in the utilization of voice technology, with 35% of the population, aged more than 18 years, currently owning a smart speaker. In addition, 62% of the population within the same age category uses a voice assistant on any device, highlighting the market’s growth.

The robotic vacuum cleaner market in the U.S. is gaining increased exposure, owing to the rapid incorporation of smart home ecosystems and an increase in customer purchasing power. Besides, the sudden shift towards devices readily functioning as data-based home management platforms, which is fueled by strong IoT facilities. As per a data report published by the FCC Government in February 2024, 49 million households in the country own at least one IoT device, and USD 16 has been estimated in time savings based on an individual’s potential choice for research products, which is positively impacting the market’s development.

The robotic vacuum cleaner market in Canada is growing due to federal initiatives and urbanization, which are aimed at boosting the digital economy. The aspect of focusing on performance and reliability in diversified living environments, especially in multi-level climates and homes, is also fueling the market’s demand in the country. Besides, as stated in the June 2023 Nolan Quinn article, the Government of Ontario and the whole of Canada invested more than USD 71 million to provide high-speed internet accessibility to over 22,000 businesses and homes across 74 communities. This has resulted in increased exposure to robotic vacuum cleaner purchases and usability, thus driving its upliftment.

Key Robotic Vacuum Cleaner Market Players:

- iRobot (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Samsung Electronics (South Korea)

- Ecovacs (China)

- Xiaomi (China)

- Roborock (China)

- SharkNinja (U.S.)

- LG Electronics (South Korea)

- Dyson (UK)

- Panasonic (Japan)

- Bissell (U.S.)

- Miele (Germany)

- Yujin Robot (South Korea)

- Neato Robotics (U.S.)

- Cecotec (Spain)

- Philips (Netherlands)

- Deebot (China)

- Coredy (China)

- Ilife (China)

- Karcher (Germany)

- Matsutek (Taiwan, China)

- iRobot is considered the pioneering force in the overall market, well-known for establishing the category with its very own Roomba series. The organization’s notable contribution depends on continuously refining and popularizing autonomous home mapping and navigation technologies for potential consumers. Based on this, the company generated USD 172.0 million in revenue, along with 9.5% as GAAP gross margin, as stated in its 2024 annual report.

- Samsung Electronics has readily leveraged its massive consumer electronics ecosystem to significantly integrate its robotic vacuums, such as the Jet Bot, which is seamless with its SmartThings platform. Besides, its market contribution is successfully centered on developing AI-based and connected devices that operate as the ultimate component of the smart home.

- Ecovacs has evidently gained an international scale by providing a comprehensive product portfolio, from entry-level to premium models that feature innovative mopping and self-emptying abilities. The organization is considered one of the key drivers in developing feature-rich robotic vacuums, accessible to a wide-ranging global audience.

- Xiaomi has successfully fueled the market with competitively priced and high-specification products, especially through its Roborock, which is a sub-brand ecosystem and Mi Home company. In addition, its initiative to significantly escalate the incorporation of features, such as LIDAR navigation, which eventually resulted in RMB 365,906,350 in revenue as of 2024, with RMB 76,560,194 in gross profit, as has been depicted in its 2024 annual report.

- Roborock has effectively established itself as one of the technology leaders, continuously uplifting the envelope with its precise LIDAR navigation as well as advanced multi-function cleaning systems. Besides, the firm’s focus on reliability and superior performance has set a high benchmark for the premium segment of the market.

Here is a list of key players operating in the global market:

The international robotic vacuum cleaner market is intensely fragmented and competitive, which is readily characterized by a tactical clash between broad-based consumer electronic firms and dedicated robotic giants. Notable players are strongly adopting two crucial approaches, including market expansion and technological differentiation. In this regard, technological strategies usually focus on creating superior AI for navigation, and market expansion caters to price-competitive models. Meanwhile, in May 2024, LionsBot and Nifisk, jointly introduced the latest robotic cleaning machine, and this innovation collaborates with Singapore-based next-generation robotics and Danish cleaning excellence to provide support and optimize cleaning staff in SMEs, thus bolstering the market’s demand.

Corporate Landscape of the Robotic Vacuum Cleaner Market:

Recent Developments

- In August 2024, LG Electronics unveiled its newest stick vacuum cleaning solution, known as LG CordZero All-in-One Tower Combi, to redefine style, charging, and storage, thus making regular cleaning efficient and simple.

- In December 2023, Samsung Electronics Co., Ltd. declared its introduction of its latest vacuum cleaner lineup, with innovative AI, known as the Bespoke Jet Bot Combo, with the intention of enhancing steam cleaning and provide easy cleaning experience to customers.

- Report ID: 8208

- Published Date: Nov 04, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Robotic Vacuum Cleaner Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.