Underwater Robotics Market Outlook:

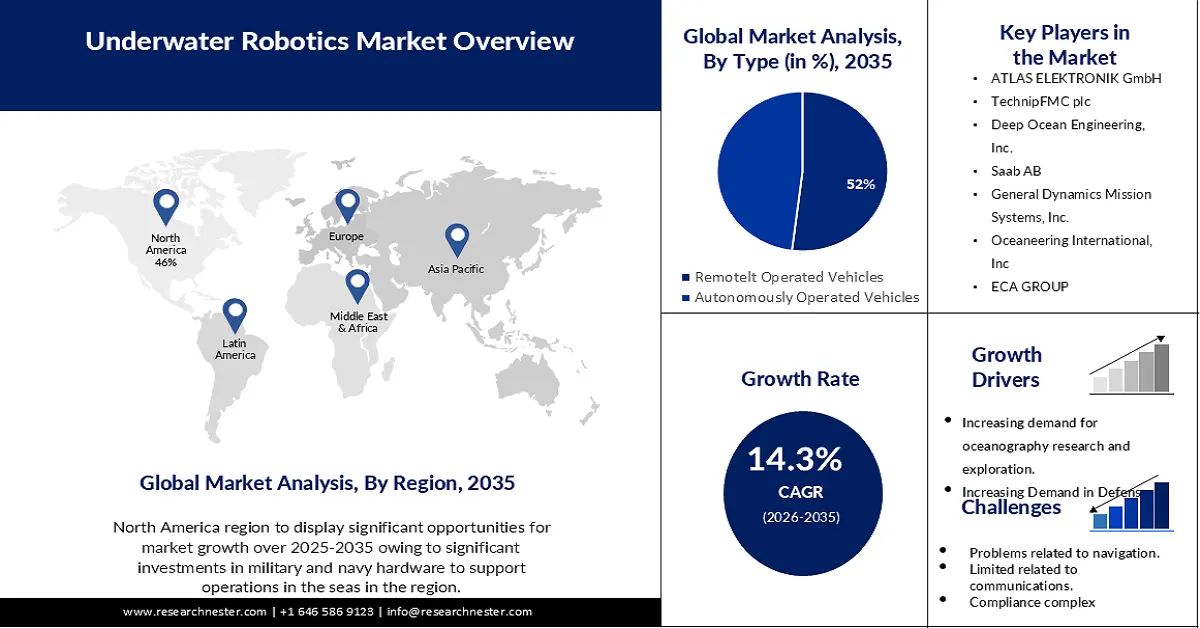

Underwater Robotics Market size was over USD 5.24 billion in 2025 and is anticipated to cross USD 19.94 billion by 2035, witnessing more than 14.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of underwater robotics is estimated at USD 5.91 billion.

The demand for underwater robotics is increasing due to growth of offshore oil and gas activities, which require underwater robots for exploration, drilling, and maintenance. The increasing demand for oceanography research and exploration is also driving the market expansion. With the help of these underwater robots, it was found that more than 138,000 smaller structures known as knolls (rising 500-1,000 m) and hills (rising < 500 m) and over 33,400 seamounts (raising 1,000 m or more from the seafloor) are thought to exist worldwide (Pitcher, 2007). An estimated 17.2 million km^2, or 4.7% of the world's ocean floor, is made up of seamounts. The mechanics of seamount-related currents result in oceanographic upwelling, which transports nutrients to surface waters and fosters the growth of organisms like sponges, corals, anemones, and featherstars.

Exploration of mineral resources located on the sea floor is being reinvigorated due to increased demand for minerals and metals, which are used in sectors such as technology. This has caused Increased demand for underwater robots for mining, oil & gas exploration, and environmental monitoring, which are driven by growing resources. Deep sea mining is predicted to be the new frontier of exploration, with rich unexploited resources on the horizon. However, there is also a high level of concern over the environmental impact of this emerging practice. Since July 2019, China has allocated a total area of 161,211.2 hectares for deep-sea mining exploration corresponding to 263 separate licences.

Key Underwater Robotics Market Insights Summary:

Regional Highlights:

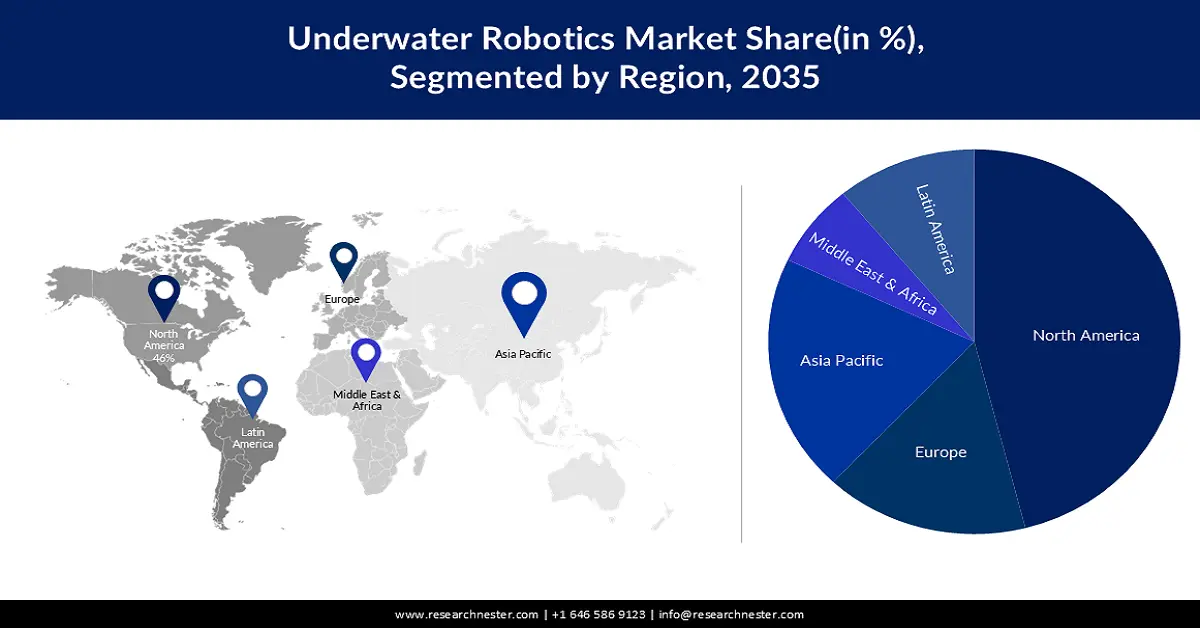

- North America underwater robotics market will hold around 46% share by 2035, driven by investments in military hardware and offshore infrastructure efficiency.

- Asia Pacific market will register significant growth during the forecast timeline, driven by extensive coastlines and increased investments in marine and defense sectors.

Segment Insights:

- The remotely operated vehicles segment in the underwater robotics market is projected to capture a 52% share by 2035, driven by the deep sea oil drilling industry’s increasing reliance on these vehicles.

- The commercial exploration segment in the underwater robotics market is projected to maintain a dominant share by 2035, fueled by rising demand for underwater robots in oil exploration.

Key Growth Trends:

- Increasing Demand in Defense

- Technological Advancements

Major Challenges:

- Increasing Demand in Defense

- Technological Advancements

Key Players: International Submarine Engineering Limited, Soil Machine Dynamics Ltd., ATLAS ELEKTRONIK GmbH, TechnipFMC plc, Deep Ocean Engineering, Inc., Saab AB, General Dynamics Mission Systems, Inc., Oceaneering International, Inc, ECA GROUP, Kawasaki Motors Corp.

Global Underwater Robotics Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 5.24 billion

- 2026 Market Size: USD 5.91 billion

- Projected Market Size: USD 19.94 billion by 2035

- Growth Forecasts: 14.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (46% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Japan, Germany, China, United Kingdom

- Emerging Countries: China, Japan, South Korea, Singapore, India

Last updated on : 8 September, 2025

Underwater Robotics Market Growth Drivers and Challenges:

Growth Drivers

- Increasing Demand in Defense- Rising global security concerns boost the adoption of underwater robots for tasks such as mine clearance and surveillance. There is a great potential for underwater drones to change the way warships are fought. To collect information on enemy vessels and submarines, they may be used to carry out reconnaissance missions. Additionally, in case of conflict, underwater drones can be launched for the delivery of bombs and other materials to targets.

- Technological Advancements – Ongoing innovations in AI, autonomy, and materials improve the capabilities and cost-effectiveness of underwater robots, through technological advances and leveraging AI, underwater robots are enabled to perform autonomously increasingly complex and hazardous jobs in the most challenging conditions. With the development of technology underwater robots can now undergo object perception and recognition systems, point cloud modeling using the system’s sensor, and distance deployment for long-range missions. All these innovations cumulatively are fostering the underwater robotics market growth.

- Maintaining Off-Shore Infrastructure- The oil and gas sector is among the industries that employ underwater robots most frequently. They can enable safer and more effective operations of these facilities by inspecting and maintaining offshore pipelines and rigs. Engineers can examine photos and movies of structures taken by UUVs with cameras and other sensors to look for indications of deterioration, corrosion, or other structural problems. This lessens the chance of serious mishaps or equipment malfunction. The business is expanding because underwater robots can also carry out regular maintenance duties like painting and cleaning, which may be challenging or even dangerous for human workers.

- Pollution Detection- Robots equipped with sensors can monitor water quality in real-time, sending the data back to researchers. They can measure temperature, conductivity, and toxicity in waterways, and collect samples that researchers can analyze in the lab. The robots take samples of microorganisms such as bacteria and plankton. Assessing the density and biodiversity of lines in a water sample can provide clues about how habitable the water is.

Challenges

- Communication Limitations- Underwater communication uses sound waves, free space optical fiber (FSO), or electromagnetic waves to convey information. Temperature gradients and ambient noise on the surface can have a significant impact on the utilization of sound waves for communication underwater. Underwater environments, especially those with salt water, are not ideal for electromagnetic waves to operate effectively, and FSO waves can only travel extremely limited distances. Moreover, sophisticated signal processing and underwater communication demand substantial power. It is difficult to overcome obstacles like poor communication and navigation when implementing underwater robotics, which hurts underwater robotics market expansion.

- Underwater robots often need to navigate autonomously in complex, unstructured environments. Achieving accurate navigation without human intervention remains a challenge.

- Compliance with maritime and environmental regulations can be complex.

Underwater Robotics Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

14.3% |

|

Base Year Market Size (2025) |

USD 5.24 billion |

|

Forecast Year Market Size (2035) |

USD 19.94 billion |

|

Regional Scope |

|

Underwater Robotics Market Segmentation:

Type Segment Analysis

The remotely operated vehicles segment is estimated to hold 52% share of the global underwater robotics market by 2035. The segment's growth is primarily attributed to deep sea oil drilling industry's growing need for such vehicles According to our analysis, more than 30% of global oil consumption comes from overseas sources. In addition, it was estimated that in 2021, there would be 16 rigs offshore the United States Gulf of Mexico as opposed to 12 by 2020. It is utilized for tasks that were previously carried out by humans and were subject to human mistakes, such as surveying, inspection, and sampling. Additionally, remotely operated vehicles are also employed for seafloor experiments, which may call for difficult procedures like drilling and precise instrument position.

End-User Segment Analysis

Underwater robotics market from the commercial exploration segment is set to dominate the revenue share during the forecast period. Commercial applications include exploration of oil and gas, shipwreck rescue, inspection of factory infrastructure as well and surveying in the marine environment. As demand increases, the oil and gas sector continues to grow. The use of underwater robots can greatly contribute to deep-sea drilling in the oil and gas sector, they are better able to perform maintenance tasks as soon as possible and can penetrate hitherto inaccessible locations so that they may then be explored.

Our in-depth analysis of the global underwater robotics market includes the following segments:

|

Type |

|

|

End-User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Underwater Robotics Market Regional Analysis:

North American Market Insights

North America is anticipated to account for 46% share of the global underwater robotics market by 2035. In recent years, the region has made significant investments in military and navy hardware to support operations in the seas. Reports stated that the United States spent 71 billion dollars more on defense in 2022 than it did in 2021, totaling 811 billion dollars for the country's security. AUVs will play a bigger role in the future, particularly in the military since more countries are developing AUVs to protect their marine interests. In addition, as the area becomes more industrialized and urbanized, there is a growing demand for gas and oil. Moreover, the market demand is being driven by investments in cutting-edge machinery and infrastructure to boost offshore activities' efficiency.

APAC Market Insights

Asia Pacific underwater robotics market size is predicted to record significant growth during the forecast period. The region's extensive coastlines and access to deep-sea areas drive demand for underwater robots in marine research, resource exploration, and fisheries management. Further, rapid economic development in countries like China and South Korea has led to increased investments in underwater robotics for various applications, including offshore energy production and defense. Asia Pacific is the hub for robotics innovations, fostering the development of cutting-edge underwater robotics technologies.

Underwater Robotics Market Players:

- MacArtney Group

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- International Submarine Engineering Limited

- Soil Machine Dynamics Ltd.

- ATLAS ELEKTRONIK GmbH

- TechnipFMC plc

- Deep Ocean Engineering, Inc.

- Saab AB

- General Dynamics Mission Systems, Inc.

- Oceaneering International, Inc

- ECA GROUP

Recent Developments

- March 2020- The ECA Group is to provide the Navy of Lithuania with KTOPER mine disposal vessels for use in countermeasures at sea.

- February 2020- Saab will provide the Australian Navy fleet of Hunter frigates with a tactical interface, as SAAB and Australia's Department of Defence announced. The tactical interface shall be based on Saab's Next Generation Combat Management System CMS, which will become a part of any large surface vessel in the Navy.

- Report ID: 1520

- Published Date: Sep 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Underwater Robotics Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.