Refurbished Dental Equipment & Maintenance Market Outlook:

Refurbished Dental Equipment & Maintenance Market size was over USD 2.03 billion in 2025 and is projected to reach USD 4.59 billion by 2035, growing at around 8.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of refurbished dental equipment & maintenance is evaluated at USD 2.19 billion.

The growth is majorly due to the rising cost-consciousness among dental practitioners, the increasing number of dental clinics in emerging economies, and the rising adoption of eco-friendly practices in the dental sector. Additionally, the refurbished tools offer viable solutions for clinics seeking high-quality tools at affordable costs, thus driving high demand.

Furthermore, the extended warranties to ensure operational efficiency along with environmental awareness are also contributing to the refurbished dental equipment & maintenance market’s positive outcomes. According to a study by the Journal of Dentistry in March 2022, a study across four dental sites in the U.K. observed 152 dental procedures and recorded high usage of single-use plastic items in both number and weight. The highest usage was seen in restorative procedures, with dental examinations alone accounting for 78 observations. These findings highlight the requirement for sustainable equipment as a better alternative supporting the refurbished dental equipment & maintenance market progression.

Key Refurbished Dental Equipment and Maintenance Market Market Insights Summary:

Regional Highlights:

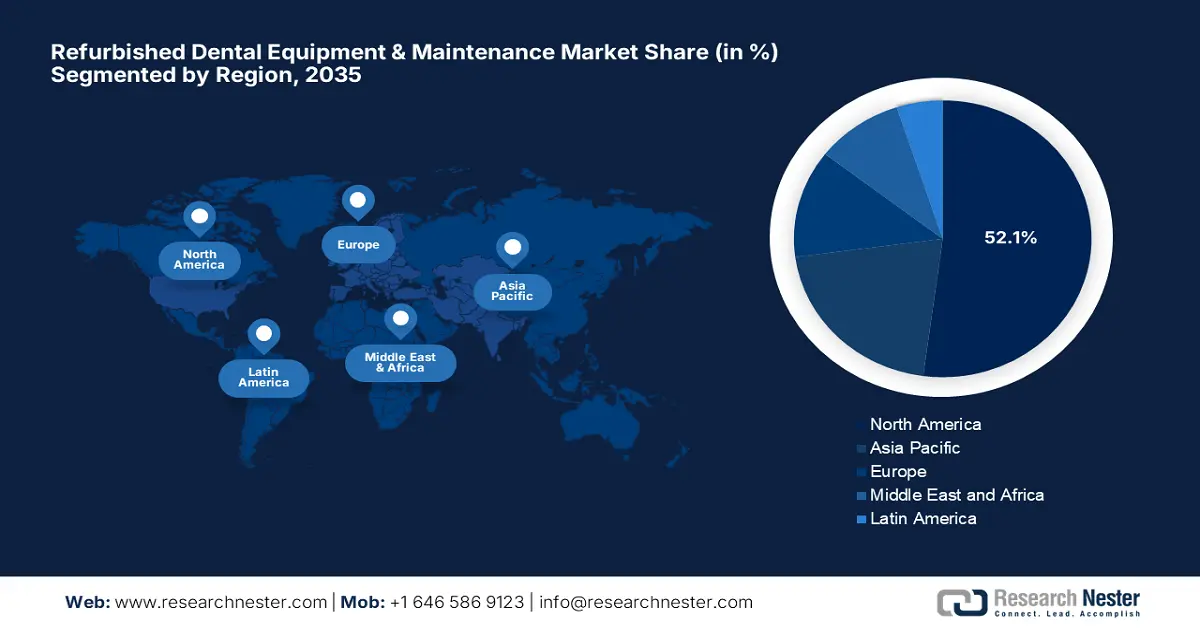

- North America commands a 52.00% share in the Refurbished Dental Equipment & Maintenance Market, driven by domestic companies amplifying manufacturing operations and innovative product launches, fostering growth by 2035.

Segment Insights:

- Specialized Dental Equipment segment is anticipated to capture over 69.3% share by 2035, fueled by growing demand for affordable, high-quality, and sustainable dental solutions.

- The hospital segment is anticipated to grow at a considerable rate by 2035, driven by increasing government-backed initiatives to enhance oral healthcare infrastructure.

Key Growth Trends:

- Increasing demand for cost-effective solutions

- Focus on sustainability

Major Challenges:

- Compliance barriers

- Limited awareness

Key Players: Atlas Resell Management, A & K Dental Equipment, Capital Dental Equipment, and Collin’s Dental Equipment Inc..

Global Refurbished Dental Equipment and Maintenance Market Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.03 billion

- 2026 Market Size: USD 2.19 billion

- Projected Market Size: USD 4.59 billion by 2035

- Growth Forecasts: 8.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (52.1% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, United Kingdom, France

- Emerging Countries: China, India, Brazil, Russia, Mexico

Last updated on : 12 August, 2025

Refurbished Dental Equipment & Maintenance Market Growth Drivers and Challenges:

Growth Drivers

- Increasing demand for cost-effective solutions: One of the major drivers for the refurbished dental equipment & maintenance market is the increasing demand for affordable dental care, especially in developing countries. Besides, in February 2024, A-dec launched its certified pre-owned equipment program to make high-quality dental tools more accessible to healthcare professionals, mostly beginners. The refurbished equipment will be sold on a dedicated website with a three-year warranty. Such initiatives, in turn, drive the demand for specialized dental equipment, supporting complex recycling and regulatory needs.

- Focus on sustainability: This refurbished equipment will allow the firms to leverage sustainable and eco-friendly practices to build a substantial consumer base in the refurbished dental equipment & maintenance market. Through these practices dental industry can reduce electronic waste and carbon footprints, supporting environmental safety. According to a clinical study by NLM in February 2020, water contamination was detected in dental clinics due to biofilms and aerosols from equipment. It further reported the presence of harmful pathogens such as legionella, pseudomonas, and hepatitis C. Hence, it boosts the demand for refurbished equipment with infection control systems, ensuring safety and sustainability.

Challenges

- Compliance barriers: These services require extensive compliance requirements regarding the refurbishment, resale, and usage of medical equipment to ensure patient safety and product reliability. Thus, navigating through various regulatory standards poses a major challenge in the refurbished dental equipment and maintenance market. Each country has different compliance procedures, making it difficult for international players to penetrate the market with such lengthy and time-consuming processes. This can further limit the impact on innovative approaches and global operations.

- Limited awareness: Another significant hurdle is the lack of awareness and trust among dental professionals regarding refurbished dental equipment. These complications occur as most healthcare professionals in developing countries remain skeptical regarding the used equipment, its longevity, and performance. This perception limits their adoption of refurbished tools in dental procedures, anchoring a negative impact on refurbished dental equipment & the maintenance market.

Refurbished Dental Equipment & Maintenance Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

8.5% |

|

Base Year Market Size (2025) |

USD 2.03 billion |

|

Forecast Year Market Size (2035) |

USD 4.59 billion |

|

Regional Scope |

|

Refurbished Dental Equipment & Maintenance Market Segmentation:

Product (Specialized Dental Equipment, Essential Dental Equipment)

Based on product, the specialized dental equipment segment is set to hold refurbished dental equipment & maintenance market share of over 69.3% by the end of 2036. The dominance is attributable to the contribution of affordable and great quality dental practices favoring sustainability. For instance, in October 2021, Leica Microsystems launched the M320 dental microscope, featuring an integrated 4k camera enabling ultra-high-resolution imaging and streaming App. It enhances patient communication and diagnosis. With a strong demand for cost-effective dental technologies, the market is expected to benefit from a huge patient base.

End User (Hospitals, Independent Dental Clinics, Ambulatory Surgical Centers)

Based on end user, the hospital segment is projected to grow at a considerable rate in the refurbished dental equipment & maintenance market during the forecast period. A wide range of equipment is currently used for oral care with optimized costs due to a significant need among the population. In August 2021, a completely automated dental unit was inaugurated at Hezükhu Memorial District Hospital, Zunheboto, in the presence of key officials. The facility was provided by the Directorate of Health and Family Welfare through the National Oral Health Programme. Thus, hospitals are undertaking several initiatives to enhance their presence in the oral healthcare sector with support from the government.

Our in-depth analysis of the global market includes the following segments:

|

Product |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Refurbished Dental Equipment & Maintenance Market Regional Analysis:

North America Market Analysis

North America in refurbished dental equipment & maintenance market is expected to hold more than 52.1% revenue share by 2036. Domestic companies in North America have amplified their manufacturing operations in the industry. For instance, in June 2023, A-dec launched the first-ever digitally connected delivery systems that are the A-dec 500 Pro and A-dec 300 Pro platforms, a major milestone in the dental equipment industry. It is an advanced, updatable software system that supports healthcare providers to seamlessly use and integrate. Such innovative developments by the global players accelerate the market in the region.

The U.S. refurbished dental equipment & maintenance market is growing steadily, dominating the North America region due to the emerging technologies in oral healthcare and partnerships between the firms. The presence of key market players is another major factor contributing to the growth in the country. In March 2026, OmniVision Technologies Inc. announced a partnership with Biotech Dental to develop highly accurate 3d intraoral scanners featuring miniature camera modules. The groundbreaking collaborations to enhance the product portfolio will enhance the market progression to showcase lucrative growth opportunities.

Canada's market is growing steadily, supported by the government, a strong research environment, and collaborative industry partnerships. The country’s focus on innovation and regulatory advancements such as the Pathway to Affordable Solutions, is strengthening the refurbished dental equipment & maintenance market in the country. In March 2025, the Government of Canada announced the expansion of the Canada Dental Care Plan (CDCP) to improve access to affordable dental care. With over 3.4 million of the population approved, additional applications will be open from May 2025. Therefore, the growing focus on dental care is expected to drive for solutions such as refurbished dental equipment & maintenance services.

APAC Market Statistics

Asia Pacific region houses a large and assorted population, including a substantial patient number from diseases that can be treated potentially through refurbished dental equipment. This grants a considerable market prospect for establishments providing manufacturing services in the region, further driving the refurbished dental equipment & maintenance market growth. The region is experiencing increased dental awareness with rising healthcare expenditures significantly improving market expansion. Emerging economies such as India and China are expanding their dental services, boosting the region's market.

India’s refurbished dental equipment & maintenance market is particularly supported by a robust healthcare industry. International players are setting down their footprint in the country, aiming to introduce cutting-edge technologies and positioning India as a global hub for refurbished dentistry. For instance, in December 2024, Japan-based Morita Group established Morita Dental India Private Limited in Haryana to strengthen its presence in the rapidly evolving dental market in India. Therefore, with such strategic expansion aspirations, the demand for refurbished dental equipment and services will showcase lucrative growth opportunities.

The China refurbished dental equipment & maintenance market is driven by a large patient base. In addition, the commitment to technological innovation, coupled with strategic acquisitions, has fostered a favorable environment for business growth. In November 2023, Changzhou Sifary Medical Technology Co., Ltd (Eighteeth) acquired ZHEAN Healthcare Co., Ltd., the developer of the Helios Series Intraoral Scanner. The purpose is to strengthen its capability in dental digitalization, and ZHEAN brings a strong team and AI–driven innovations that are crucial for expanding Eighteeth’s product portfolio. Hence, the country’s market is anticipated to witness considerable growth during the forecast period with such acquisition strategies.

Key Refurbished Dental Equipment & Maintenance Market Players:

- American Dental Refurbishment

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Atlas Resell Management

- A & K Dental Equipment

- Capital Dental Equipment

- Collin’s Dental Equipment Inc.

- Independent Dental Inc.

- Pre-Owned Dental Inc.

- SPS Dental

- Renew Digital LLC

- DCI Dental Equipment

- Benco Dental

- BIOLASE, Inc.

- ZimVie Inc.

One of the key strategies adopted by companies involved in the refurbished dental equipment & maintenance market is investing in acquisitions. This is majorly done through integrating with new organizations or upgrading existing ones to adopt new technologies. For instance, in February 2025, Argen Canada acquired Dental Axess Canada’s Lab and Denture Clinic Business to enhance its reach in digital dentistry manufacturing and to strengthen Argen’s position in the country’s dental market by expanding its consumer base with the best tools, materials, and technology. Such moves are projected to influence positive significant refurbished dental equipment & maintenance market market activities, maintaining healthy competition between the players.

Some of the prominent players in the market are:

Recent Developments

- In August 2024, Benco Dental announced the acquisition of M&S Dental Supply and A-Dent Dental Equipment to enhance its product portfolio, offering a wide range of dental equipment.

- In February 2024, BIOLASE, Inc. announced the launch of the state-of-the-art all-tissue laser system, Waterlase iPlus Premier Edition, the latest evolution in laser dentistry with modular design and remote diagnostic features.

- Report ID: 7553

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Refurbished Dental Equipment and Maintenance Market Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.