Dental Digital X-ray Equipment Market Outlook:

Dental Digital X-ray Equipment Market size was valued at USD 5.8 billion in 2025 and is projected to reach USD 16.6 billion by the end of 2035, rising at a CAGR of 11.2% during the forecast period, i.e., 2026-2035. In 2026, the industry size of dental digital X-ray equipment is assessed at USD 6.4 billion.

The global patient pool necessitating dental diagnostic imaging has broadened the market significantly over the past ten years and is driven by the rising incidence of dental caries and periodontal diseases, increasing aging populations, and expanded access to public oral health programs. As per the WHO report on oral health published in March 2025, it is projected that nearly 3.7 million people suffer from oral disease. Further, the report also states that people aged above 20 experience a complete 7% of tooth loss, and above 60 face 23% of the tooth loss. The global cancer of oral cavity in 2022 was 389,846.

On the trade side, the world trade of dental X-ray equipment reached USD 719 million in 2023, resulting in a reduction of 20.7% since 2022, as per the OEC report in 2023. The annual growth rate over the past five years has declined by 4.28% and ranks 2529th position out of 4766. As per the Product Complexity Index (PCI), the device was the 132nd most complex device out of 2987, holding the PCI value of 1.37. The leading exporters of the machines are Germany, Finland, and South Korea. Whereas the key importers are France, Canada, and the U.S.

Key Dental Digital X-ray Equipment Market Insights Summary:

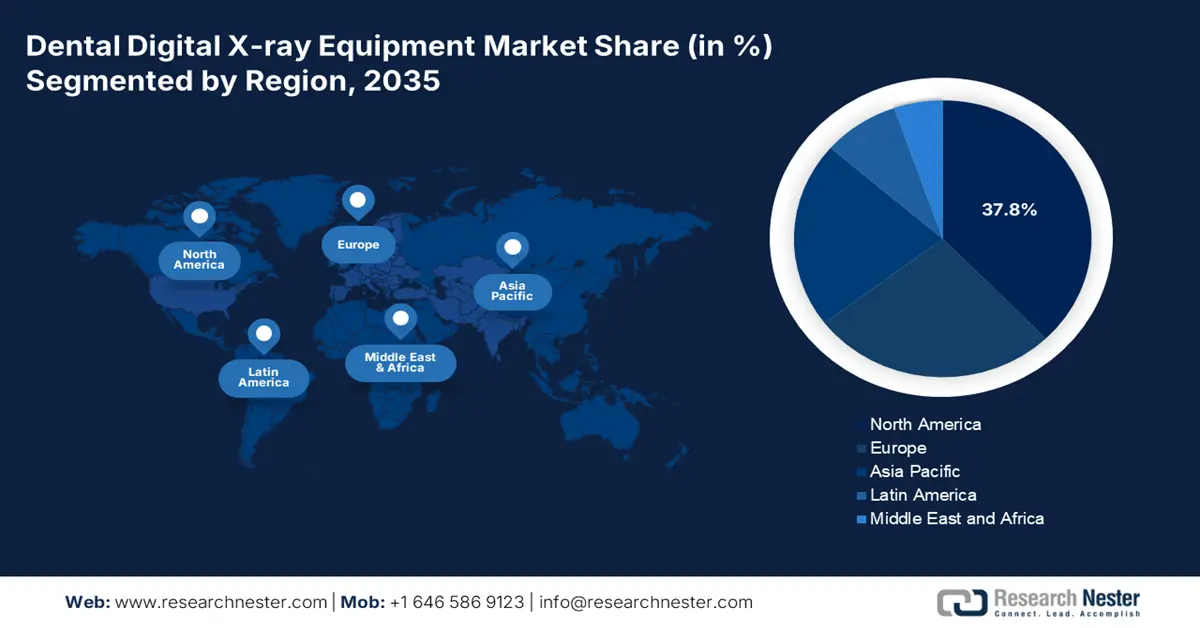

North America dental digital X-ray equipment market is projected to capture a 37.8% share, growing at a CAGR of 8.2 % through 2035.

Asia Pacific is projected to be the fastest-growing region, capturing a significant market share with strong growth expected by 2035.

Europe is expected to hold a substantial portion of the market, with steady growth projected through 2035.

Among end users, dental hospitals and clinics are set to dominate the segment with a projected market share of 75.3% by 2035.

In the portability category, fixed systems are expected to lead the segment with a 66.8% share by 2035.

Key Growth Trends:

- Government Support and Patient Spending Trends

- Rising disease occurrence and patient pool

Key Players:

- Dentsply Sirona, Envista Holdings (KaVo Kerr), Carestream Dental, Planmeca Group, Vatech Co., Ltd, ACTEON Group, Midmark Corporation, FONA Dental (Part of Dentsply Sirona), Cefla Group (MyRay), Genoray Co., Ltd, Runyes Medical Instrument Co., Ltd, Aribex (NOMAD, part of Envista), Villa Sistemi Medicali, HDX Will, Owandy Radiology

Global Dental Digital X-ray Equipment Market Forecast and Regional Outlook:

2026 Market Size: USD 6.4 billion

2025 Market Size: USD 5.8 billion

Projected Market Size: USD 16.6 billion by 2035

Growth Forecasts: 11.2 % CAGR (2026-2035)

Largest Region: North America

Fastest Growing Region: Asia Pacific

Last updated on : 18 August, 2025

Dental Digital X-ray Equipment Market - Growth Drivers and Challenges

Growth Drivers

- Rising disease occurrence and patient pool: As per the CDC report, the prevalence of dental screening, examination or cleaning among people aged above 18 is 65.5% in the 2023. These utilization rates impact the rise in the preventive dental care across elderly populations. Further, the growing public health campaigns and insurance coverage expansions driving the participation in oral health checkups. These trends demand the advanced dental diagnostic imaging technologies in the future.

- Advancements in dental devices via AI: AI-enabled dental X-ray devices are actively redefining the imaging efficiency. Vatech Green X CBCT system is an AI enabled dental imaging system approved by FDA in 2023 for anatomical landmark detection. The system has reduced the operator errors and enhanced the implant planning further. Companies including Dentsply Sirona and Carestream Dental have enhanced the system using cloud to enable real time diagnostics, aiding the workflow in dental practices. These innovations are implemented via FDA Breakthrough Device Designations surging the timely market reach for digital solutions for enhanced clinical benefits.

- Health program expansion: Government supported programs by the oral health programs surge the device demand. As per the CDC report released in May 2024, many adults and children have poor oral health in U.S. accounting to half of the children and adolescents age from 12 to 19, which is 57% of the overall population. This has supported public health interventions focused on treatment and early detection. Further, increased funding for school dental programs surges the diagnostic technologies.

Total Global Sales of Dental Products

|

2018 |

2019 |

2020 |

2021 |

2022 |

2023 |

|

29,157 |

30,808 |

32,850 |

34,926 |

36,904 |

38,940 |

|

Percent Increase |

5.6 |

6.6 |

6.3 |

5.7 |

5.5 |

Source: International Trade Administration, December 2024

AI Advancements in Dental Applications, 2022

|

AI Software |

Origin |

Type of Image |

Application |

|

AssistDent |

Manchester, UK |

Bitewing images |

Detecting proximal enamel and dentin caries |

|

WebCeph |

Seongnam, Korea |

Cephalometric images |

Cephalometric tracing and analysis |

|

Ceppro |

Seoul, Korea |

Cephalometric images |

Cephalometric tracing and analysis |

|

dentalXr.ai |

Berlin, Germany |

Bitewing, periapical and panoramic images |

Identifying and numbering teeth, detecting carries and anatomical structure segmentation

|

|

Relu |

Leuven, Belgium |

CBCT images |

Identifying and numbering teeth Segmenting teeth, jaws, mandibular canal, and pharyngeal airway |

|

Promaton |

Amsterdam, Netherlands |

Panoramic and CBCT images |

Identifying and numbering teeth and detection of dental implants, prosthetic crowns, fillings, root remnants, and root canal treatment |

Source: NLM article on Personalized dental medicine, artificial intelligence, and their relevance for dentomaxillofacial imaging published in December 2022

Challenges

- Reimbursement gap and limited access in developing markets: In most LMICs (Low- and Middle-Income Countries), dental diagnosis is usually not covered by universal health schemes. For example, in India, based on the Healthcare Express report released in June 2024 depicts that public insurance programs do not cover dental issues, resulting in out-of-pocket costs for patients. Further, there occurs a diagnostic delay, particularly in children and the elderly, which burdens the market growth for device manufacturers. Further, this exclusion significantly impacts timely oral disease detection, often resulting in more invasive and expensive treatment delays. Manufacturers experience low levels of adoption and limited commercial feasibility, particularly in rural and underprivileged areas.

Dental Digital X-ray Equipment Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

11.2% |

|

Base Year Market Size (2025) |

USD 5.8 billion |

|

Forecast Year Market Size (2035) |

USD 16.6 billion |

|

Regional Scope |

|

Dental Digital X-ray Equipment Market Segmentation:

End user Segment Analysis

In the end user segment, dental hospitals and clinics lead the segment and are expected to hold the share value of 75.3% by 2035. The segment is driven based on their size, infrastructure, and patient handling. According to the NLM article released in January 2024 on the distribution of X-ray machines in hospitals states that nearly 93.22% of the hospitals in Taiwan provide dental X-ray machines for periapical radiography, panoramic/cephalometric radiography, and cone-beam computed tomography. These environments are better positioned to implement sophisticated digital imaging technology, such as 3D CBCT and artificial intelligence-based diagnostics.

Portability Segment Analysis

Under the portability segment, fixed systems are projected to hold a considerable share by 2035. Fixed dental digital X-ray systems are the top choice for installations within high-volume offices, as they deliver stable integration with practice management software, ergonomic patient positioning, and panoramic and cephalometric scanning support. The European Centre for Disease Prevention and Control states that fixed systems are mostly preferred in cross-infection control systems as they have higher levels of hygiene zoning. This preference is further reinforced by their longer operational lifespan, which reduces the total cost of ownership for large dental facilities.

Trade Segment Analysis

The original equipment manufacturer is expected to lead the trade segment by 2035. The segment is driven by virtue of high output capacities, vertical integration, and meeting international regulatory requirements. As per the OEC report released in 2023, the U.S. has imported $208 million worth of dental imaging products sourced mainly from Germany, Finland, and South Korea. The FDA device registration database highlights that OEMs are enhancing the devices in the pipeline approved under 510(k) routes, allowing for timely market introduction. These benefits, along with government-sponsored procurement contracts, tend to favor OEM-dominated manufacturing and distribution networks.

Our in-depth analysis of the global dental digital X-ray equipment market includes the following segments:

|

Segment |

Subsegments |

|

Product Type |

|

|

Technology |

|

|

Component |

|

|

Portability |

|

|

End user |

|

|

Trade |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Dental Digital X-ray Equipment Market - Regional Analysis

North America Market Insights

The North America dental digital X-ray equipment market is expected to hold a market share of 37.8% at a CAGR of 8.2% by 2035. The dental digital X-ray equipment market is fueled by superior healthcare infrastructure, elevated dental service usage, favorable reimbursement practices, and substantial federal and provincial investment. The Centers for Medicare & Medicaid Services (CMS) improved reimbursement avenues for cone-beam computed tomography (CBCT) and 3D digital X-rays, fueling adoption in dental clinics. The synergy of solid institutional funding, patient-led demand, and policy promotion places North America in a mature, innovation-led market for dental digital X-ray systems until 2034.

Canada’s dental digital X-ray equipment market is expanding actively with increased provincial and federal investments and improved access to dental diagnostic infrastructure. As per the report by the government of Canada on the dental care plan in December 2023 depicts that the government has planned to invest $13 billion in the first five years and $4.4 billion annually to implement the Canadian Dental Care Plan (CDCP), focusing on affordable and accessible dental care services for people in Canada. Further, Innovative Medicines Canada and BioteCanada surge their focus on domestic R&D investments, mainly in AI-enabled digital imaging systems.

Export Data Instruments and Appliances in Dental Sector

|

Country |

Exported To |

Trade Value |

Year |

|

Germany |

U.S. |

409,828.84 |

2023 |

|

Israel |

U.S. |

104,602.00 |

2023 |

|

European Union |

Canada |

61,096.17 |

2021 |

|

Austria |

Canada |

11,426.11 |

2021 |

Sources: WITS

APAC Market Insights

The Asia Pacific is the fastest-growing region in the dental digital X-ray equipment market and is projected to lead the dental digital X-ray equipment market by 2035. The region is driven by the expanding healthcare infrastructure, rising patient demand for preventive dental care, and increased government spending. The region has experienced a significant boost in public health funding, focusing on digitizing diagnostic capabilities. As per the International Trade Administration article released in March 2025 states that 70% of the private dental clinics demand the market in Malaysia. On the other hand, South Korea is the leading exporter of dental X-ray machines, reaching USD 194 million in 2023, stated to the OEC report in 2023. The rising adoption of digital health technologies is driving the market in the region.

India's dental digital X-ray device market is expected to capture a maximum share by 2035 and is fueled by increasing oral health consciousness and government investment in diagnostic equipment. As per the OEC 2023 report, India imported USD 16.9 million of dental X-ray machines in 2023. In 2024, more than 32.80 crore patients received oral screening under the government-funded program, as stated in the Ministry of Health & Family Welfare report in 2024. Further, the Digital India Health program encourages digitization in primary health centers, surging the usage of digital imaging technologies in urban and rural healthcare facilities.

Europe Market Insights

The dental digital X-ray equipment market in Europe is expected to expand rapidly. The market is driven by the rising dental awareness, national-level reimbursement improvements, and early diagnostic initiatives. The UK, Germany, and France have increased investments for dental imaging and moving forward towards digital transformation in the healthcare sector. The Europe government has funded via EU4Health with €4.4 billion for health innovation, including dental diagnostics. Further, the regulations under the Medical Device Regulation have ensured widespread equipment adoption and enhanced safety protocols across clinics.

Germany's dental digital X-ray devices in Europe to hold a considerable amount of market share by 2035. The federal government has spent €3 billion in hospital funds to upgrade digital diagnosis, modern infrastructure, and IT security, as per the bundesgesundheitsministerium report in June 2024, including dental radiology. The device adoption in the nation is further fueled by rising outpatients in dental clinics and insurance reimbursement. On the trade side, Germany is the leader in exporting dental X-ray machines and have exported USD 110 million in 2024, as stated in OEC report in 2023. Germany's streamlined regulatory process under the MDR facilitates market entry for manufacturers.

Top Exporters of Dental X-ray Machines to Germany in 2023

|

Country |

Year |

Exports |

Share |

ECI |

|

Italy |

2023 |

USD 954 K |

3.96% |

1.29 |

|

France |

2023 |

USD 1.15 M |

4.78% |

1.34 |

|

Finland |

2023 |

USD 3.81 M |

15.8% |

1.46 |

Source: OEC, 2023

Key Dental Digital X-ray Equipment Market Players:

- Dentsply Sirona

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Envista Holdings (KaVo Kerr)

- Carestream Dental

- Planmeca Group

- Vatech Co., Ltd

- ACTEON Group

- Midmark Corporation

- FONA Dental (Part of Dentsply Sirona)

- Yoshida Dental Mfg. Co.

- Morita Corporation

- Asahi Roentgen

- Takara Belmont Corp.

- Panasonic Healthcare (J. Morita tie-up)

- Cefla Group (MyRay)

- Genoray Co., Ltd

- Runyes Medical Instrument Co., Ltd

- Aribex (NOMAD, part of Envista)

- Villa Sistemi Medicali

- HDX Will

- Owandy Radiology

The global dental digital X-ray equipment market is very competitive and is driven by the integration with CAD/CAM workflows, innovation in imaging technology, and AI-assisted diagnostics. Major players such as Dentsply Sirona, Planmeca, and Envista are leading the market due to their wide product portfolios, strong R&D, and global networks. Strategic collaborations such as KaVo Kerr’s alliance with hospital chains and Panasonic’s tie-up with Morita are aiding companies to overcome regional regulatory barriers. Further, portable X-ray units from Aribex and manufacturers in APAC, such as Vatech and Genory, are capturing emerging markets via compact design innovation and affordability.

Below is the list of some prominent players operating in the global market:

Recent Developments

- In March 2025, Planmeca launched the Planmeca Onyx and the Planmeca Creo X, a 3D printer for streamlined CAD/CAM workflows. Both devices are wireless, high-speed performance devices for labs and are used for an intraoral scanner.

- In June 2024, Dentsply Sirona and Siemens Healthineers together developed the first dental-dedicated magnetic resonance imaging (ddMRI) system. The device is developed to advance oral diagnostics by introducing magnetic resonance imaging in dentistry.

- Report ID: 318

- Published Date: Aug 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.