Dental Handpiece Air Turbines Market Outlook:

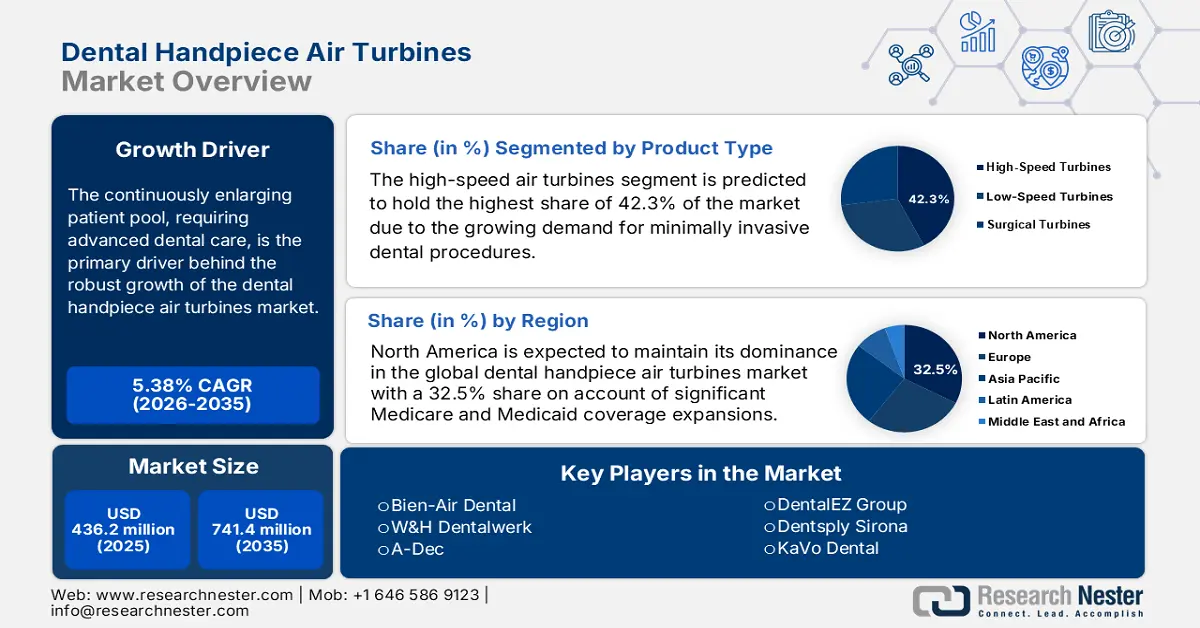

Dental Handpiece Air Turbines Market size was over USD 436.2 million in 2025 and is estimated to reach USD 741.4 million by the end of 2035, expanding at a CAGR of 5.38% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of dental handpiece air turbines is estimated at USD 461.3 million.

The continuously enlarging patient pool, requiring advanced dental care, is the primary driver behind the robust growth of the market. This can be testified by a 2023 report from the World Health Organization (WHO), revealing the number of people with untreated dental caries worldwide to be approximately 3.7 billion. This demography indicates the presence of a sustainable consumer base, demanding efficient dental equipment, including air turbines. The frequent occurrence of oral health disorders, coupled with rapidly growing geriatric populations, is also increasing adoption in this sector. Particularly, in large-scale clinical settings, where productivity and precision are critical, these tools are highly preferred and utilized.

Technological advancements, evolving regulations, and changing user needs affect the dental handpiece air turbine market. One of the trends is the integration of smart elements in handpieces to increase visibility and improve accuracy. Additionally, manufacturers are progressing on the path towards environmental sustainability, with handpiece manufacturers aiming for suppliers to either have biodegradable materials or use energy efficient technologies to lessen their environmental impact. Increased comfort and smaller handpieces are on the rise.

Key Dental Handpiece Air Turbines Market Insights Summary:

Regional Highlights:

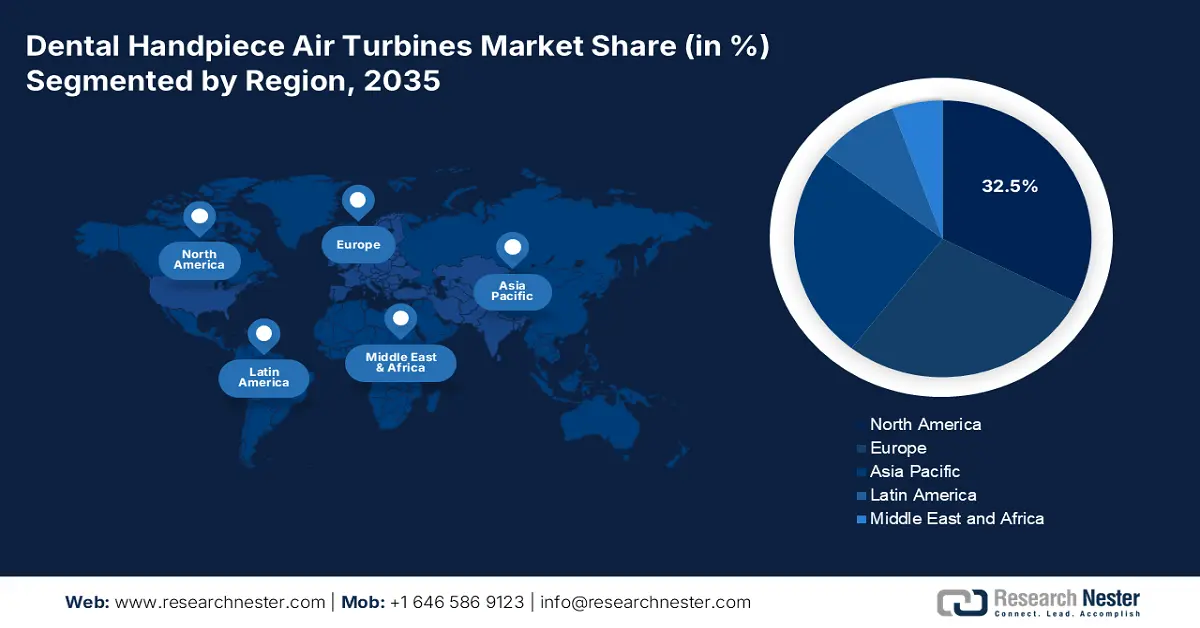

- North America is projected to retain its leading 32.5% share in the dental handpiece air turbines market by 2035, owing to its advanced dental healthcare infrastructure and strong presence of leading manufacturers.

- Asia Pacific is anticipated to witness the fastest growth through 2026-2035, impelled by increasing healthcare investments, modernization of dental facilities, and rising oral health awareness.

Segment Insights:

- The high-speed air turbines segment of the dental handpiece air turbines market is anticipated to command a 42.3% revenue share by 2035, propelled by the increasing adoption of minimally invasive dental procedures.

- The dental clinics segment is forecasted to account for a 55.1% share by 2035, driven by the rising investment in advanced dental technologies and the expansion of specialized dental practices.

Key Growth Trends:

- Technological advancements and innovation

- Rising demand for infection control and sterilization

Major Challenges:

- Sterilization and infection control compliance

- Tariffs & local production requirements

Key Players: Dentsply Sirona, KaVo Dental, Bien-Air Dental, W&H Dentalwerk, A-Dec, DentalEZ Group, SciCan, Medidenta, MK-dent, Dentflex, Saeshin Precision, Dentium, LM-Instruments, Beyes Dental, Codent, Tealth Dental, MDT Micro Diamond Tech.

Global Dental Handpiece Air Turbines Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 436.2 million

- 2026 Market Size: USD 461.3 million

- Projected Market Size: USD 741.4 million by 2035

- Growth Forecasts: 5.38% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (32.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, United Kingdom, China

- Emerging Countries: India, South Korea, Brazil, Mexico, Thailand

Last updated on : 15 September, 2025

Dental Handpiece Air Turbines Market - Growth Drivers and Challenges

Growth Drivers

- Technological advancements and innovation: The market for dental handpiece air turbines is developing steadily, due to continual advancements in technology such as LED, fiber-optic lighting, and live feedback systems are moving forward. These advances offer improved visibility, reliability, and usability, which allows the dentist perform procedures with more precision and efficiency. Along with density and comfort, ergonomics, lighter weights and effortless manipulation have increased the operator's ability to continue working without operator fatigue. Innovations have encouraged dentists to replace their devices with the latest up-to-date equipment.

- Rising demand for infection control and sterilization: With increased focus on infection control comes the request for more air turbines that contain features that ensure better sterilization. Autoclavable and anti-retraction valve options, and single-use turbine heads are considered less risky when it comes to cross-contamination. They help to reduce risk and improve overall patient safety. Regulatory guidance concerning acceptable levels of hygiene in a dental clinic environment reinforces this. In many ways, the dental market is being driven by the need to provide for more suitable and hygienic dental instruments.

- Expansion of dental care in emerging markets: Emerging economies in Asia-Pacific, Latin America, and the Middle East are experiencing soaring growth in dental healthcare infrastructure and dental healthcare awareness. Increased disposable income, urbanization, and cosmetic dentistry all drive a greater number of people to seek dental treatment than ever before. Governments and the private sector are both investing in modern dental facilities, and this process represents an increasingly favorable environment for modern dental equipment, such as air turbines. The increased market footprint present in emerging markets is a significant driver of growth within the global marketplace.

Challenges

- Sterilization and infection control compliance: The market faces notable cost pressures from stringent sterilization requirements. Strict infection control demands are fundamental and right; they may inadvertently reduce public expenditure and therefore impede market growth through increased costs and/or the accelerated adoption of alternative technology. Typical air turbine handpieces usually cannot provide internal design features that would make compliance with modern sterilization protocols practical.

- Tariffs & local production requirements: The hurdles in localization have the potential to restrict the expansion of the market in emerging economies. Many countries impose significant import tariffs on medical devices (including dental handpieces), further raising end-user pricing and restricting access to some markets, especially price-sensitive markets. To avoid these tariffs, manufacturers often must establish local manufacturing facilities or maintain a local joint partnership through a regional partner.

U.S. National Dental Expenditures by Source of Financing (2018-2023, in Billions of Constant 2023 Dollars)

|

Year |

Out of Pocket |

Private Health Insurance |

Government Programs |

Other |

|

2018 |

$71B |

$73B |

$23B |

$2B |

|

2019 |

$63B |

$65B |

$22B |

$2B |

|

2020 |

$72B |

$73B |

$27B |

$12B |

|

2021 |

$68B |

$69B |

$30B |

$10B |

|

2022 |

$68B |

$69B |

$32B |

$2B |

|

2023 |

$68B |

$69B |

$35B |

$2B |

Source: American Dental Association

Dental Handpiece Air Turbines Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.38% |

|

Base Year Market Size (2025) |

USD 436.2 million |

|

Forecast Year Market Size (2035) |

USD 741.4 million |

|

Regional Scope |

|

Dental Handpiece Air Turbines Market Segmentation:

Product Type Segment Analysis

Based on product type, the high-speed air turbines segment is predicted to hold the highest share of 42.3% of revenue generation in the market over the assessed period. The growing demand for minimally invasive procedures, such as caries removal and crown preparations, is the primary driver behind the leadership. Moreover, because of their swift capabilities and efficacy, high-speed dental handpieces are considered necessary for many interventions. Therefore, they often represent the preferred option in dental practices and facilities around the world. The mix of cost, capability, and dependable operation creates sustained high demand and generates the vast majority of revenue in the market.

End User Segment Analysis

In terms of end users, the dental clinics segment is poised to represent the position of the largest shareholder in the market by the end of 2035, with a 55.1% share. Dental clinics are often heavily invested in new dental technology, providing better efficiencies, improved comfort for their patients, and improved treatment outcomes. Therefore, dental clinics will always require reliable and high-performance automotive and electric-powered handpieces if they want to continue delivering efficient services to their patient base. With a notable increase in the amount of private and specialized dental practices globally, as well as patient awareness and affordability, the unique patient base visiting clinics can be seemingly endless. The more procedures that can be performed (volume) on a one-time purchase of equipment, the more profitable for clinics.

Our in-depth analysis of the global dental handpiece air turbines market includes the following segments:

|

Segment |

Subsegments |

|

Product Type |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Dental Handpiece Air Turbines Market - Regional Analysis

North America Market Insights

North America is predicted to keep dominating the global dental handpiece air turbine market throughout the evaluation period at 32.5% market share. The region exists within a well-established and highly developed dental healthcare system. Additionally, there are leading dental manufacturers and distributors present in the region, ensuring product availability and innovation has no barriers. The whole region benefits from high health expenditure and dental infrastructure supporting fast adoption of innovative turbine technology. According to the American Medical Association, in 2023, U.S. health spending increased 7.5% to USD 4.9 trillion, or USD 14,570 per capita.

The dental handpiece air turbine market is the dominant part of the U.S., which has a very large and established dental health care sector with an abundance of dental insurance and consumers who demand many of the modern state-of-the-art dental treatments. Lastly, there is a U.S. focus on modern innovation and willingness to adopt newer, modern dental copious dental technologies. Together, these events help create a growing air turbine dental handpiece market. Moreover, the many number of leading manufacturers and distributors of dental supplies and dental equipment operate across the U.S. delivering new products almost immediately.

The dental handpiece air turbine market in Canada is experiencing steady growth, supported by its universal dental plans. Moreover, significant federal budget allocations and spending increases demonstrate the country's commitment to expanding dental care access. The increased awareness of oral health and preventative care has created additional demand for modern dental equipment in dental practices throughout Canada. In particular, Canadian dental practices value infection control and patient comfort, contributing to the trend toward more advanced, sterilizable air turbine handpieces.

APAC Market Insights

Asia Pacific is poised to register the fastest pace of growth in the dental handpiece air turbines market by the end of 2035. The rising healthcare investments, expanding oral health awareness, and government-led modernization of dental infrastructure are collectively magnifying the volume of the region's financial output in this category. On the other hand, Japan is consolidating its technological leadership, securing a favorable environment for advanced dental devices. Moreover, the aging demographics, expanding dental tourism industry, and rapid AI adoption are establishing APAC as the epicenter of globalization.

China dominates the APAC dental handpiece air turbines market on account of continuous government spending on dental equipment. Further, rapid urbanization and rising disposable incomes are increasing access to advanced dental care across the country. Moreover, China is an important manufacturing base for dental equipment with a low-cost production capacity and a strong export market. The growing demand for preventive and cosmetic dental treatments, due to the rising middle class, supports consistent uptake of air turbine use.

India is one of the emerging landscapes of the regional dental handpiece air turbine market, which is backed by government healthcare spending. The significance in this category is also being amplified by its massive patient pool. Moreover, the National Oral Health Program is improving access to advanced dental care nationwide, attracting greater public investments and treatment volumes in this sector. Government programs and public-private partnerships promoting access to oral health care have also encouraged procurement of equipment. Further, India has a wide network of dental colleges and training institutions, which supports the ubiquitous use and replacement of air turbine handpieces within the country.

Europe Market Insights

The Europe dental handpiece air turbine market is predicted to grow at a steady pace during the timeline between 2026 and 2035. The aging population, requiring advanced and accessible dental care, is fostering a strong demand base in this sector. Besides, the growing dental tourism industry and tightening sterilization regulations are forcing medical settings to accommodate cutting-edge interventional solutions. Moreover, aging populations in several European countries are increasing the restorative and preventive nature of dental services, which continues to drive up market demand.

Germany dominates the Europe dental handpiece air turbine market with a dominant 30.5% revenue share and is supported by comprehensive insurance coverage and its rapidly aging population. The country also demonstrates strong technological adoption. In addition, government initiatives, such as G-BA's 2024 tender system, are accelerating the shift toward energy-efficient models. Moreover, with severe caries cases rising, Germany solidifies its position as the region's most advanced marketplace.

The UK holds a 25.4% share in the regional dental handpiece air turbines market due to its being a well-developed dental care system and a strong public-private health system. The UK has a high standard for infection prevention and control and is diligent about the safety of dental equipment and instruments; as a result, it frequently upgrades to new sterilizable and high-performance air turbine models. Furthermore, the UK has a growing emphasis on cosmetic and preventive dentistry, increasing procedural volume, thus requiring a consistent supply of dependable, high-speed products.

Key Dental Handpiece Air Turbines Market Players:

- Dentsply Sirona

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- KaVo Dental

- Bien-Air Dental

- W&H Dentalwerk

- A-Dec

- DentalEZ Group

- SciCan

- Medidenta

- MK-dent

- Dentflex

- Saeshin Precision

- Dentium

- LM-Instruments

- Beyes Dental

- Codent

- Tealth Dental

- MDT Micro Diamond Tech

The current dynamics of the dental handpiece air turbines market are characterized by intense competition among MedTech pioneers. Over 45.4% of the global revenue generation in the sector is controlled by the consortium of Dentsply Sirona, KaVo, and NSK. The commercial operations of these leaders are crafted with excellence in technological advances and strategized expansion. On the other hand, key players in Europe, such as W&H Dentalwerk and Bien-Air, are prioritizing the development of ergonomic and regulatory-compliant models. Whereas, firms in South Korea are solidifying their strong emphasis on implant-compatible turbines.

Recent Developments

- In May 2022, KaVo Dental launched a new starter handpiece set for Planmeca dental unit in partnership with Planmeca Group. The KaVo Planmeca handpiece set includes a turbine, a 1:1 contra-angle, and a KaVo MULTIflex connection. KaVo instruments, which are built on dependable and effective technology, are well known for their high quality, robustness, and ergonomic design.

- In January 2023, W&H announced the launch of a new, cutting-edge Assistina and a new Lexa Plus Class B sterilizer tool that improves workflow in a dental office by preventing infections and reprocessing. The Lexa Plus is designed to provide more of everything that matters when it comes to daily dental infection prevention. Its color touch screen display makes daily tasks simpler, quicker, and more effective with its user-friendly menu structure and extensive selection of settings.

- Report ID: 7889

- Published Date: Sep 15, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.