Railway Gearbox Market Outlook:

Railway Gearbox Market size was valued at USD 3.23 billion in 2025 and is set to exceed USD 5.47 billion by 2035, registering over 5.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of railway gearbox is evaluated at USD 3.39 billion.

The railway industry is rapidly expanding due to advancements in rail technology and contemporary gearboxes. This has resulted in rising investments in developing advanced gearboxes with excellent performance and efficiency. The growing emphasis on incorporating energy-efficient technology in innovative gearbox designs to improve operational efficiencies is expected to drive railway gearbox market growth. For instance, in December 2023, to achieve zero emissions while upholding the highest standards of dependability and quality, CAF MiiRA unveiled its latest generation of lightweight, effective gearboxes. In addition to providing cost-effective solutions, this achievement reflects the company's development presence and market expertise and is committed to the development of full wheels for cars and platform diversity.

Key Railway Gearbox Market Market Insights Summary:

Regional Highlights:

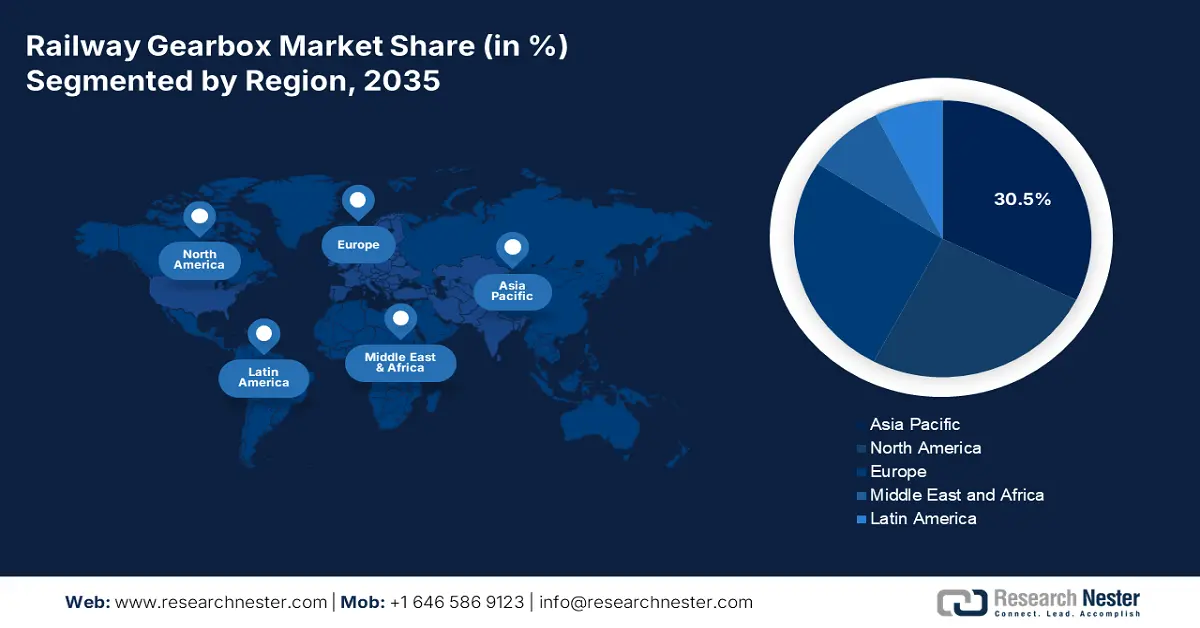

- Asia Pacific leads the Railway Gearbox Market with a 30.5% share, driven by significant expenditures in rail infrastructure and development of high-speed rail networks, ensuring growth through 2026–2035.

- The North America Railway Gearbox Market is forecasted to achieve stable growth by 2035, driven by continuous renovation initiatives and adoption of advanced gearbox technologies focusing on sustainability and energy efficiency.

Segment Insights:

- The high-speed rail segment is expected to achieve over 45.4% share by 2035, driven by global investments and demand for reliable, low-noise gearboxes.

- Helical Gearbox segment is projected to hold around a 40.5% share by 2035, driven by its quiet operation, superior torque, and durability for high-speed trains.

Key Growth Trends:

- Reduction in dependency on fossil fuels

- Rise in the need for freight transportation

Major Challenges:

- Expensive production costs

- Strict adherence to regulations

- Key Players: Siemens AG, Voith GmbH & Co. KgaA, ZF Friedrichshafen AG, Bombardier Inc., Alstom SA, ABB Ltd., Huawei, and Wabtec Corporation.

Global Railway Gearbox Market Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.23 billion

- 2026 Market Size: USD 3.39 billion

- Projected Market Size: USD 5.47 billion by 2035

- Growth Forecasts: 5.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (30.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, Japan, India, Germany, France

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 14 August, 2025

Railway Gearbox Market Growth Drivers and Challenges:

Growth Drivers

- Reduction in dependency on fossil fuels: Railways are investigating alternative energy options such as electrification and hybrid systems to reduce the reliance on fossil fuels. This has resulted in increasing demand for specialist gearboxes designed for electric and hybrid trains. Technologically advanced gearbox designs are being deployed in electric trains for their efficiency and lower emissions. The switch drives the railway gearbox market to alternative energy sources in train systems as manufacturers adjust to these changing demands.

- Rise in the need for freight transportation: The need for freight transportation has significantly increased as a result of increased global trade, fueling the growth of the railway gearbox market. As rail networks can inexpensively transport large volumes over long distances, they are preferred for logistical efficiency, especially for bulk items. The significance of rail freight systems is further highlighted by the growth of e-commerce and the demand for dependable logistical solutions. For example, the global retail e-commerce market reached over 4.1 trillion dollars in 2024. To improve load-bearing capacity and reliability, railway operators are investing in modernizing their fleets and infrastructure, which calls for sophisticated gearbox systems.

- Investments and initiatives by the government: To support economic growth and enhance transportation networks, governments across the globe are investing in improving railway infrastructure. In August 2024, the Indian government announced an initiative in close collaboration with the Ministry of Railways to enhance coal logistics with the launch of 38 fast-track rail projects. Moreover, railway gearbox manufacturers and suppliers have more opportunities to meet the growing need for dependable and long-lasting parts. Partnerships between the public and commercial sectors are increasing to improve railway infrastructure and encourage innovation. Government financial incentives and regulatory support will expand the market potential for railway gearboxes since improved infrastructure is essential to urban mobility.

Challenges

- Expensive production costs: High manufacturing costs of railway gearboxes have the potential to severely limit railway gearbox market expansion. The total costs increase due to the use of advanced materials and technology such as high-strength composites and lightweight metals. Furthermore, the intricacy of design and production procedures calls for qualified labor, which raises expenses even further. Many railroad operators are unable to invest in sophisticated gearing systems due to financial limitations. Manufacturers may be reluctant to invest in cutting-edge gearbox technology as the rail sector places a greater emphasis on cost-effectiveness, which would limit the market's potential to a certain extent.

- Strict adherence to regulations: Strict regulatory compliance requirements present a major obstacle hampering the global railway gearbox market growth. Extensive testing and certification are required to meet safety and performance criteria set by international organizations and government agencies. Manufacturers are responsible for ensuring adherence to several regulations, some of which can differ greatly between geographical areas. The stringent compliance procedure frequently results in higher development expenses and time. Furthermore, noncompliance may lead to product recalls, legal action, and obstacles to new competitors entering the market. As a result, businesses might put compliance before creativity, which would impede the introduction of innovative gearbox designs and slow down technical progress.

Railway Gearbox Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.4% |

|

Base Year Market Size (2025) |

USD 3.23 billion |

|

Forecast Year Market Size (2035) |

USD 5.47 billion |

|

Regional Scope |

|

Railway Gearbox Market Segmentation:

Product (Bevel, Helical, Planetary, Others)

Helical segment is expected to capture around 40.5% railway gearbox market share by the end of 2035. The adoption of helical gearboxes is rising due to their ability to convey motion silently and smoothly. As these gears are favored for high-speed applications, they can be used in passenger trains and high-speed trains where noise reduction is essential. Furthermore, compared to other gearbox types, the helical design offers superior torque transmission and longer durability, which lowers maintenance needs and operating expenses. Helical gearboxes are becoming popular as railroad operators look to enhance the performance and dependability of their fleets. Their allure is further highlighted by ongoing developments in materials and precision technologies, which fuel high market demand.

Application (Passenger Rail, Freight Rail, High-Speed Rail, Light Rail)

By the end of 2035, high-speed rail segment is set to hold over 45.4% railway gearbox market share. High-speed rail is a key component of many nations' plans to improve their public transit networks. It is imperative to have sophisticated gearbox systems that can withstand high speeds while maintaining dependability and safety. Due to this, governments in several countries are making significant investments in ongoing high-speed rail network projects.

Gearbox technology advancements that prioritize longevity, noise abatement, and ease of maintenance are essential for meeting the demanding needs of high-speed trains and delivering care, which will propel market expansion. For example, in January 2024, Sojitz Corporation and Larsen & Toubro Limited received an order for electrification system works encompassing 508 km of the Mumbai-Ahmedabad High-Speed Rail project by India's National High-Speed Rail Corporation Limited.

Our in-depth analysis of the market includes the following segments:

|

Product |

|

|

Application |

|

|

Material |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Railway Gearbox Market Regional Analysis:

Asia Pacific Market Analysis

Asia Pacific industry is poised to dominate majority revenue share of 30.5% by 2035, owing to significant expenditures in rail infrastructure and the quick development of high-speed rail networks. Gearbox solutions are constantly in demand due to the continent's vast and established rail networks, which need to be maintained and upgraded. China, Japan, and India are leading the way in this expansion, with massive rail development projects in progress.

China's dedication to sustainable mobility results in investments in new infrastructure and electricity projects. There is a growing need for specialist gearbox technologies that can support high-speed rail operations due to the expansion of high-speed rail service throughout China. Overall, the China rail network presents a varied and expanding railway gearbox market, which is encouraging manufacturers to produce more innovative products.

In India, the market is anticipated to register significant revenue growth by the end of 2035 owing to strong and affordable solutions required for India's expanding passenger and freight railway networks. In addition, rising investments in R&D activities and government initiatives to support the deployment of advanced gearboxes are expected to boost market growth going ahead.

North America Market Analysis

North America is expected to experience a stable CAGR during the forecast period due to the strong rail system and continuous renovation initiatives. With an emphasis on enhancing both freight and passenger rail services, the U.S. and Canada are major players in this industry. The railway gearbox market's expansion in this region is propelled by the use of advanced gearbox technologies and a growing focus on sustainability and energy efficiency. For instance, in September 2024, Siemens Mobility opened the country's first high-speed rail manufacturing plant in Horseheads, New York. It will run on Brightline West's line from Las Vegas to Southern California.

The railway gearbox market in the U.S. is expected to account for a significant share during the forecast period owing to technological advancements in railway gearboxes, the presence of leading companies in the country, and the rising need for advanced gearboxes catering to modernization initiatives and infrastructure investments.

In Canada, the adoption of railway gearboxes is rapidly increasing owing to rising preference for environmentally stable, low-yield gearbox solutions and presence of well-developed railway network. The railroad network in Canada is diversified and expanding, providing enormous growth potential for the gearbox manufacturing sector. Developments in materials and manufacturing techniques will propel the ongoing drive for more eco-friendly and efficient gearbox designs.

Key Railway Gearbox Market Players:

- Hyundai Rotem Company

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Siemens AG

- Voith GmbH & Co. KGaA

- ZF Friedrichshafen AG

- Bombardier Inc.

- Alstom SA

- ABB Ltd.

- Huawei

- Wabtec Corporation

The global railway gearbox market is highly competitive, comprising key players operating at global and regional levels. Several major manufacturers are competing for market share in the market and are striving to launch advanced products and solutions and cater to the rising demand. These key players are focused on adopting several strategies such as product developments, mergers and acquisitions, and partnerships to enhance their product launches and maintain their market position. Here are some leading players in the railway gearbox market:

Recent Developments

- In June 2024, Huawei Accelerates Intelligent Urban Rail Development with the Release of a Technical White Paper on Smart Urban Rail All-Optical Network. Bangkok recently hosted the Asia Pacific Rail 2024 Huawei Global Railway Summit with great success. Xiang Xi, the director of Huawei Smart Transportation BU's Overseas Railway Development Department, presented the "Smart Urban Rail All-Optical Network technical whitepaper" and the solution "Leading Infrastructure to Accelerate Transportation Intelligence" at the event.

- In April 2024, Wabtec Corporation and Australian Rail Track Corporation (ARTC) signed a digital solutions agreement. The two businesses will work together to create one of the few strategies being explored to address rail system interoperability in Australia.

- in May 2023, ZF announced the launch of the Smart Oil Plug, a wireless, sensor-based solution developed in collaboration with industry data specialists. ZF's connect@rail portfolio, which provides extensive data and insights on the functionality and condition of railroad infrastructure and cars, will incorporate Smart Oil Plug. Consequently, this will lessen downtime and enhance maintenance.

- Report ID: 6712

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Railway Gearbox Market Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.