Produced Water Treatment Market Outlook:

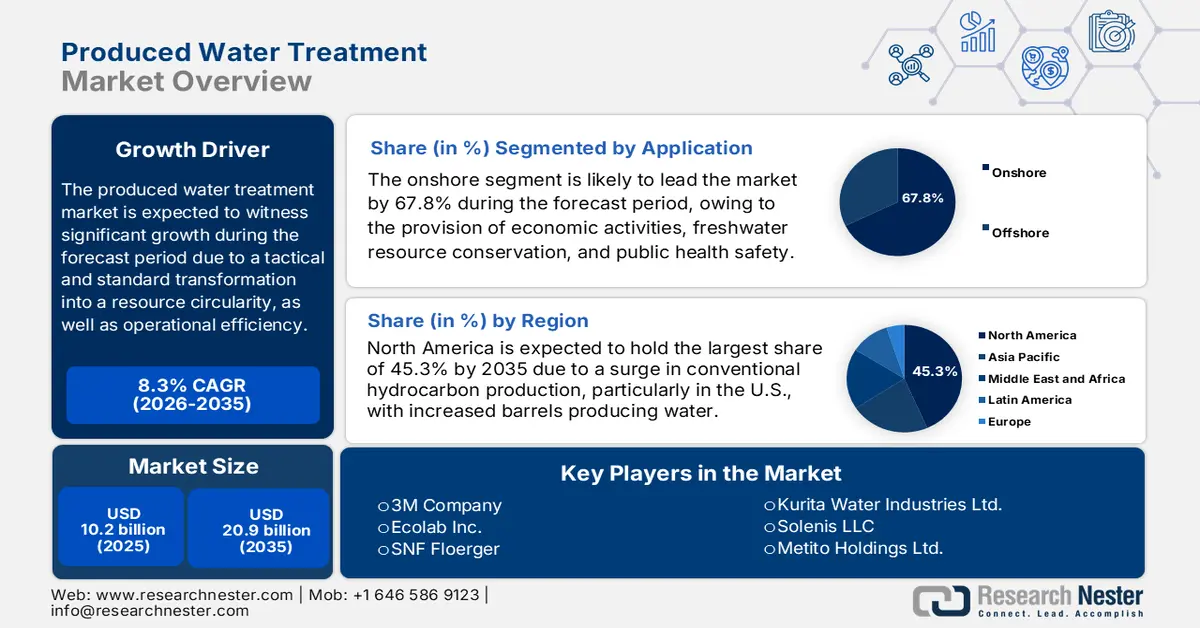

Produced Water Treatment Market size was over USD 10.2 billion in 2025 and is estimated to reach USD 20.9 billion by the end of 2035, expanding at a CAGR of 8.3% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of produced water treatment is estimated at USD 11 billion.

The international produced water treatment market is currently witnessing a standard and tactical transformation, evolving from a compliance-based cost center into a severe nexus of operational efficacy, resource circularity, and environmental stewardship. This particular transition is uplifted by the focus on economic imperatives to maximize asset valuation, strict environmental, social, and governance (ESG) mandates, and water scarcity. According to an article published by the World Resources Institute in August 2023, approximately 50% of the world’s population, which accounts for nearly 4 billion people, reside under highly water-based conditions for almost one month every year. This, however, is projected to surge to an additional 1 billion people residing across extreme water stress locations by the end of 2050, thus making it suitable for propelling the produced water treatment market’s demand globally.

Furthermore, the presence of mobile and modular treatment solutions, along with advanced treatment and technology convergence adoption, the Internet of Things (IoT) integration and digitalization, increased focus on circular economy and resource recovery, and service model evolution are other drivers for the produced water treatment market. For instance, as per an article published by the NLM in March 2025, the Cintropur UV Lamp 2100 significantly emits ultraviolet-C light at 254 nm, which is increasingly effective in reducing viruses, bacteria, and other pathogens. In addition, the max flow rate accounts for 2,000 L/h, along with constituting a lifespan of 9,000 h, and a lamp replacement after 9,000 h of operation. Moreover, the Watex Mo-2 Ecosoft and Pure Flow 1,600 GPD industrial systems are other technologies that are suitable for ensuring water treatment, thus bolstering the market’s growth and expansion.

Watex Mo-2 Ecosoft and Pure Flow 1,600 GPD Industrial Systems Comparison (2025)

|

Components |

Watex Mo-2 Ecosoft |

Pure Flow 1,600 GPD Industrial |

|

Flow capacity |

2 m3/h |

0.26 m3/h |

|

Permeate recovery |

75% |

65% |

|

Maximum TDS |

3,000 mg/L |

2,200 mg/L |

|

Influent flow rate (service) |

2.7 to 4 m3/h |

0.4 to 0.6 m3/h |

|

Influent flow rate (rinse) |

10 m3/h |

1.1 m3/h |

|

Inlet pressure of water |

2 to 4 bar |

4 to 6 bar |

|

Operating pressure |

8 to 12 bar |

10 to 12 bar |

|

Electrical requirements |

3 × 380 V, 50 Hz |

220 to 380 V, 50/60 Hz |

|

Electrical power |

3 kW |

2 to 3 kW |

Source: NLM

Key Produced Water Treatment Market Insights Summary:

Regional Highlights:

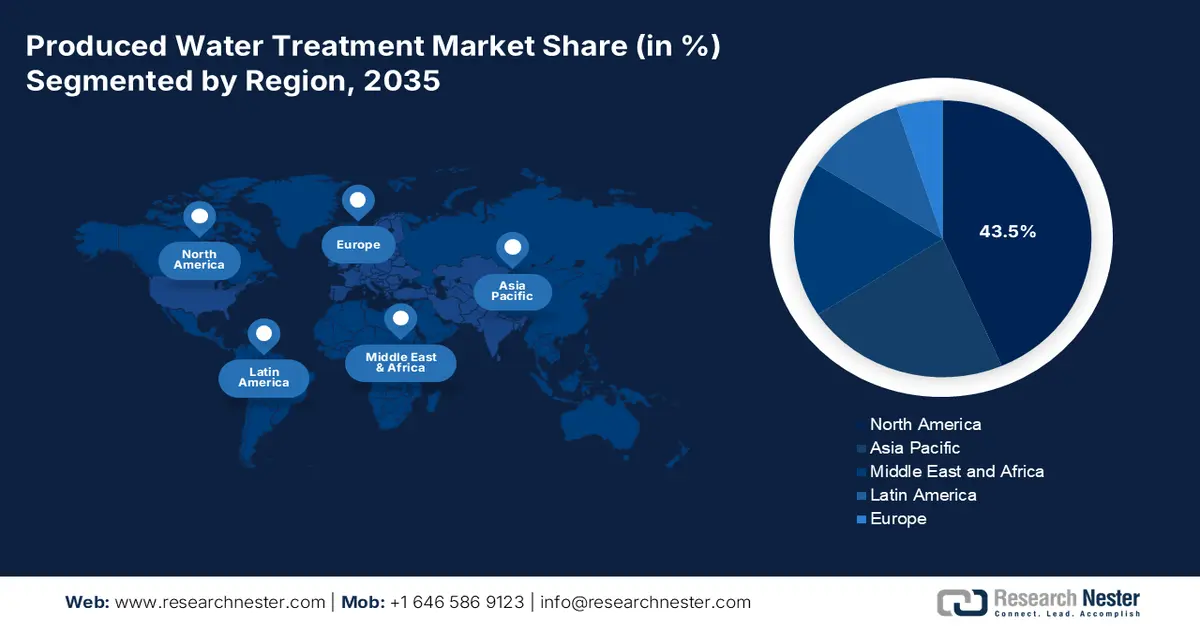

- North America is anticipated to capture a 45.3% share by 2035 in the produced water treatment market, underpinned by its vast hydrocarbon output that generates substantial produced water volumes.

- Asia Pacific is expected to emerge as the fastest-growing region through 2026–2035, supported by rising domestic energy demand and intensifying regulatory pressures across major producing nations.

Segment Insights:

- The onshore segment is projected to command a 67.8% share by 2035 in the produced water treatment market, bolstered by its role in sustaining economic activity, preserving freshwater resources, protecting the environment, and ensuring public health.

- By 2035, the unconventional oil and gas segment is expected to secure the second-largest share, propelled by its capacity to generate high initial water volumes from shale, tight oil, and coalbed methane formations.

Key Growth Trends:

- Economic imperatives for water utilization

- Rise in water-intensive and complicated resources

Major Challenges:

- Policy uncertainty and inconsistent regulatory frameworks

- Infrastructure and logistical constraints

Key Players: Veolia Environnement S.A. (France), SUEZ S.A. (France), Schlumberger Limited (U.S.), Halliburton Company (U.S.), Baker Hughes Company (U.S.), Thermax Limited (India), Siemens Energy AG (Germany), DuPont de Nemours, Inc. (U.S.), 3M Company (U.S.), Ecolab Inc. (U.S.), SNF Floerger (France), Kurita Water Industries Ltd. (Japan), Solenis LLC (U.S.), Metito Holdings Ltd. (UAE), IDE Technologies (Israel), Aquatech International LLC (U.S.), GEA Group AG (Germany), Wärtsilä Oyj (Finland), Calgon Carbon Corporation (U.S.), Pentair plc (U.K.).

Global Produced Water Treatment Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 10.2 billion

- 2026 Market Size: USD 11 billion

- Projected Market Size: USD 20.9 billion by 2035

- Growth Forecasts: 8.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (45.3% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, India, Canada, United Kingdom

- Emerging Countries: Brazil, Indonesia, Saudi Arabia, UAE, Mexico

Last updated on : 9 December, 2025

Produced Water Treatment Market - Growth Drivers and Challenges

Growth Drivers

- Economic imperatives for water utilization: The volatile and high expenses of freshwater acquisition, deepwell disposal, and transportation are readily compelling operators to reuse and treat produced water, especially in hydraulic fracturing operations. This has created a calculable and direct return on investment (ROI) for treatment infrastructure. According to an article published by the U.S. Environmental Protection Agency in October 2025, recycled water is regarded as a suitable water supply, and there are more than 500 facilities in the U.S. for recycling water to cater to community demands. Besides, 48 states in the U.S. witnessed drought as of 2024, and water reutilization assisted in diminishing the impact by offering a reliable water supply. Besides, the continuous water supply chain also plays a major role in uplifting the produced water treatment market globally.

2023 Water Export and Import

|

Countries |

Export (USD) |

Import (USD) |

|

France |

1.1 billion |

- |

|

Italy |

896 million |

- |

|

China |

715 million |

- |

|

U.S. |

- |

1.0 billion |

|

Hong Kong |

- |

638 million |

|

Germany |

- |

265 million |

|

Global Trade Valuation |

4.8 billion |

|

|

Global Trade Share |

0.021% |

|

|

Export Growth |

7.0% |

|

Source: OEC

- Rise in water-intensive and complicated resources: The creation of non-traditional resources and boosted oil recovery technologies, which tend to generate increased produced water than traditional wells, has exceptionally increased the addressable produced water treatment market, along with the demand for efficient treatment. As per an article published by the World Bank Group in October 2025, natural water storage in aquifers, wetlands, and soils has readily reduced by 27 trillion cubic meters for more than 50 years, which has eroded a crucial buffer against climatic shocks. Besides, groundwater offers almost half of the international domestic water utilization and supports 43% of irrigation, which is pivotal for food resilience and security, thereby creating a positive impact on the market’s demand.

- Resource security and water scarcity: Across arid producing locations, such as the Permian Basin and the Middle East, the produced water treatment is increasingly observed as a tactical alternative water source option for municipal, agricultural, and industrial utilization. This has readily transformed the market from just a liability into a potential asset. As stated in an article published by UNESCO in February 2024, globally, agriculture accounts for an estimated 70% of freshwater, which is followed by 20% of industry and almost 12% of domestic users. In addition, groundwater supplies nearly 25% of the overall water utilization for half of the freshwater and irrigation for domestic purposes. Therefore, with the existence of such water development systems, there is a huge growth opportunity for the market globally.

Challenges

- Policy uncertainty and inconsistent regulatory frameworks: While regulations are a driver, their inconsistency across and even within regions has created a huge challenge for technology developers and operators planning long-lasting investments in the produced water treatment market. Besides, standards for discharge, reinjection, and beneficial reuse vary widely between provinces, countries, and states, developing a fragmented landscape in the produced water treatment market. Further, an operator might deploy a particular technology to meet standards in one basin, only to find it non-compliant or over-engineered in another. Moreover, based on the policy uncertainty, future standards tend to freeze investments, while organizations cause delays for CAPEX-based decisions, thereby negatively impacting the market’s growth.

- Infrastructure and logistical constraints: The produced water treatment market is frequently hindered by infrastructural restrictions and fundamental physical limitations. In the case of offshore platforms, the paramount constraints are weight and space. Besides, highly reliable, lightweight, and compact systems are crucial but frequently available at a premium expense with technological trade-offs. Besides, for onshore, especially in sprawling shale plays, the challenge is the transportation and collection of water from different and dispersed well pads to a central treatment facility. Therefore, developing this pipeline network is capital-intensive and faces right-of-way and permitting obstacles, thereby limiting the market’s expansion.

Produced Water Treatment Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

8.3% |

|

Base Year Market Size (2025) |

USD 10.2 billion |

|

Forecast Year Market Size (2035) |

USD 20.9 billion |

|

Regional Scope |

|

Produced Water Treatment Market Segmentation:

Application Segment Analysis

The onshore segment, which is part of the application, is anticipated to garner the largest share of 67.8% in the produced water treatment market by the end of 2035. The segment’s upliftment is highly attributed to its importance for supporting economic activities, conservation of freshwater resources, environmental preservation, and public health protection. According to an article published by the World Health Organization (WHO) in September 2023, internationally, nearly 1.7 billion people utilize a drinking water source, which is contaminated with faeces as of 2022. Meanwhile, 6 billion, which is 73% of the international population, utilize a safe and managed drinking-water service, which is located on premises, free from contamination, and easily available when required. Therefore, with such facilities and advancements, the segment is continuously growing.

Source Segment Analysis

By the end of 2035, the unconventional oil and gas segment in the source is projected to cater to the second-largest share in the produced water treatment market. The segment’s exposure is highly driven by its ability to encompass shale, tight oil, and coalbed methane, representing the most significant and fastest-growing source of produced water by volume. Unlike traditional wells that produce increasing water over time, non-traditional wells generate huge volumes of water, which is more than hydrocarbons by barrel equivalent, from the very start of production due to the flowback of injected fracturing fluids and the characteristics of the geologic formations. This has created a perpetual and high-volume waste stream from the moment a well is brought online. Moreover, the sheer scale of activity in basins, such as the Permian in the U.S. and the Sichuan in China, ensures that this segment has pushed innovation toward efficient treatment systems.

Disposal Method Segment Analysis

Based on the disposal method, the reinjection and underground disposal segment is expected to account for the third-largest share in the produced water treatment market during the forecast period. The segment’s development is highly fueled by its operational certainty and regulatory acceptance, but it is witnessing a severe strategic evolution. Traditionally, this comprises simply injecting produced water into deep saline aquifers for permanent disposal. However, the segment is now bifurcating into pure disposal for increasing regulatory scrutiny and public opposition due to induced seismicity concerns. Additionally, reinjection is becoming the high-growth, value-driven sub-segment. In both cases, treated water is injected into reservoirs to maintain pressure and improve hydrocarbon recovery, transforming a waste product into a valuable operational input.

Our in-depth analysis of the produced water treatment market includes the following segments:

|

Segment |

Subsegments |

|

Application |

|

|

Source |

|

|

Disposable Method |

|

|

Technology |

|

|

Service |

|

|

Treatment method |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Produced Water Treatment Market - Regional Analysis

North America Market Insights

North America in the produced water treatment market is anticipated to garner the highest share of 45.3% by the end of 2035. The market’s upliftment in the region is highly attributed to the huge scale of traditional hydrocarbon production, especially in the U.S., effectively generating barrels of produced water every year. For instance, according to an article published by the U.S. Department of Energy in June 2024, shale plays in the U.S., such as Haynesville, Niobrara, Anadarko, Bakken, Appalachia, Eagle Ford, and Permian, readily and collectively account for more than 70% of oil and gas production. Besides, more than 1,500 metric tons of lithium every year is recovered from the Permian shale play, which is 5 times the U.S.’s yearly consumption of 3,000 metric tons every year. Therefore, with such consumption levels, there is a huge growth opportunity for the produced water treatment market in the region.

The U.S. in the produced water treatment market is growing significantly, due to an increase in the demand for the chemical sector, the federal budget allocation based on specific programs, and the presence of critical materials, along with innovative manufacturing. According to an article published by the U.S. Department of Energy in November 2022, the administrative body promptly issued a USD 12 million Funding Opportunity Announcement (FOA) with the intention of supporting the conversion and extraction of lithium from geothermal brines. Additionally, the purpose is to utilize these materials in batteries for electric vehicles and stationary storage, as well as to support projects that strengthen and effectively diversify the lithium supply chain system. Moreover, as stated in the March 2023 EPA Government report, the 2024 Budget offers USD 150 million for the Diesel Emissions Reduction Act (DERA) Grant Program, denoting a USD 50 million surge, to enhance the DERA grant availability for reducing harmful diesel emissions.

Canada in the produced water treatment market is also growing, owing to a strict federal and provincial regulatory framework, oil sands tailings water management imperative, increased focus on water recycling for operational efficiency, national net-zero commitment and ESG investments, along with government-aided research and development for sustainable hydrocarbons. According to an article published by the EDC in April 2025, the country’s government offers almost USD 30 billion in public financing and direct subsidies to the gas and oil industry. In addition, the government has also provided USD 29.6 billion in financial support to petrochemical and fossil fuel companies. This comprises USD 21 billion in the TransMountain expansion pipeline, along with USD 7.5 billion through the crown corporation Export Development Canada.

5-Year Fossil Fuel Funding in Canada

|

Year |

Funding Amount |

|

2020 |

USD 18 billion |

|

2021 |

USD 8.6 billion |

|

2022 |

USD 20.2 billion |

|

2023 |

USD 18.6 billion |

|

2024 |

USD 29.6 billion |

Source: EDC

APAC Market Insights

The Asia Pacific in the produced water treatment market is expected to emerge as the fastest-growing region during the forecast period. The market’s development in the region is highly fueled by a surge in the domestic energy demand, along with an increase in the regulatory pressure in the majority of producing nations. For instance, as stated in the 2025 IEA Organization, the region’s electricity consumption increased by 192% as of 2023, and renewables' share accounted for 23.3% as of 2022. In addition, 23% of oil caters to the overall energy supply, which is followed by 11% of natural gas, and 218% of coal production in 2023, which has resulted in an increase in the energy demand. This increase, in turn, has created an optimistic outlook for the market’s development and expansion.

China in the produced water treatment market is gaining increased traction, owing to the top-down regulatory push for ecological civilization and the increased scale of its national energy production. Moreover, the presence of the governmental mandate to boost domestic gas and oil production from unconventional and complicated conventional resources, generating challenging and large produced water streams, is also fueling the produced water treatment market. As per an article published by the ITA in September 2025, the country has significantly aimed to gain sewage treatment by more than 95% across country-based areas and an increase in the recycled water utilization rate to over 25% across water-scarce cities. Besides, there has been an increase in the rural residential sewage treatment by more than 40%, thus denoting an optimistic outlook for the overall market’s growth and expansion.

India in the produced water treatment market is also developing due to the national water crisis, robust production enhancement, and a rise in energy import bills. In addition, the government’s Urja Ganga and Hydrocarbon Vision 2030 approach, aiming to bolster the domestic natural gas production, especially from high-water-cut and complicated offshore fields, is also uplifting the market in the country. According to a data report published by the Be India Government in December 2024, the country’s energy supply increased by 54.5% and rose from 589 Mtoe to 910 Mtoe. In addition, the overall electricity consumption has doubled from 874 billion units to 1,534 billion units between 2023 and 2024, denoting a yearly 5.8% growth. Therefore, based on these statistical data, the produced water treatment market is poised to gain increased exposure in the overall country.

Middle East and Africa Market Insights

The Middle East and Africa in the produced water treatment market is projected to witness considerable growth by the end of the stipulated period. The market’s growth in the region is propelled by the tactical pivot toward Zero Liquid Discharge (ZLD), colossal produced water volumes from mature onshore fields, and large-scale water reuse. Furthermore, the aspect of acute water scarcity and the region’s leadership in mega-project desalination is also fueling the market’s growth. According to a data report published by the International Water Management Institute in April 2023, the water scarcity in the region is projected to diminish the average gross domestic product (GDP) in the overall region by 6% to 14% by the end of 2050 and lower the labor demand by almost 12%. Additionally, it has also been estimated that nearly 36% of the municipal wastewater is effectively reused indirectly after water bodies dilution.

The produced water treatment market in Saudi Arabia is gaining increased exposure, owing to the national vision for inextricably linking water security to gas and oil production and the sheer scale of hydrocarbon production. As per a data report published by the ITA in January 2024, the country readily possesses an estimated 17% of the world’s proven petroleum reserves, and also ranks as the largest net exporter of petroleum. Besides, the average hydrocarbon production in Aramco has been recorded to be 13.6 mmbpd as of 2022, which includes 11.5 mmbpd of crude oil. In addition, the organization recorded a net income, amounting to SAR 604.0 billion (USD 161.1 billion in the same year, along with a cash dividend of SAR 73.0 billion (USD 19.5 billion), thereby making it suitable for the market’s growth in the country.

The produced water treatment market in Israel is also growing, owing to the outstanding focus on pioneering traditional hydrocarbon extraction, as well as high-tech water advancement. The potential commercial development of its massive onshore shale oil resources in the Shefela Basin is also responsible for boosting the market’s growth in the country. As per an article published by the Ministry of Environmental Protection in December 2025, the country is considered the international leader in effluent reclamation and water recycling, with more than 80% of treated effluents significantly designated for agricultural utilization. Meanwhile, as per the January 2024 The Government Water and Sewage Authority report, almost 600 million cubic meters of wastewater are readily discharged every year into the country’s sewage system, and more than 80% of the treated wastewater is used for agricultural irrigation through suitable reclamation plants.

Key Produced Water Treatment Market Players:

- Veolia Environnement S.A. (France)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- SUEZ S.A. (France)

- Schlumberger Limited (U.S.)

- Halliburton Company (U.S.)

- Baker Hughes Company (U.S.)

- Thermax Limited (India)

- Siemens Energy AG (Germany)

- DuPont de Nemours, Inc. (U.S.)

- 3M Company (U.S.)

- Ecolab Inc. (U.S.)

- SNF Floerger (France)

- Kurita Water Industries Ltd. (Japan)

- Solenis LLC (U.S.)

- Metito Holdings Ltd. (UAE)

- IDE Technologies (Israel)

- Aquatech International LLC (U.S.)

- GEA Group AG (Germany)

- Wärtsilä Oyj (Finland)

- Calgon Carbon Corporation (U.S.)

- Pentair plc (U.K.)

- Veolia Environnement S.A. is a global leader in integrated water and waste management, bringing unparalleled expertise in large-scale and complex industrial water solutions to the produced water market. The organization's strength originates from its ability to design, build, and operate massive, centralized treatment facilities, often for National Oil Companies, leveraging technologies from membrane desalination to thermal evaporation for Zero Liquid Discharge (ZLD) projects. Additionally, according to its 2024 annual report, the organization generated €44,692 million in revenue, along with €2,881 million in operating income and €3,012 million in net income.

- SUEZ S.A. is considered a notable technology and solutions provider, specializing in innovative membrane systems and chemical treatment programs for the oil and gas industry. The company readily contributes through tailored and high-efficiency solutions for both offshore and onshore applications, focusing on water reuse and resource recovery to help operators meet stringent environmental and economic targets.

- Schlumberger Limited offers integrated and fit-for-purpose treatment solutions, which are deeply embedded within the oilfield lifecycle, from well construction to production. Its contribution is its proprietary technology portfolio and on-site execution capability, providing modular mobile units, along with permanent installations, with a robust focus on operational efficiency and water recycling for frac operations.

- Halliburton Company is regarded as a dominant force in the well completion and production chemical segment, providing its extended knowledge of wellbore chemistry to the produced water challenge. The company’s contribution centers on its strong chemical treatment programs and its closed-loop, mobile CleanWave and H2O Forward service technologies, which effectively treat water at the wellsite for immediate reuse in hydraulic fracturing.

- Baker Hughes Company significantly contributes as a full-stream provider, combining its strength in process engineering, equipment manufacturing, and digitalized monitoring under its Nexus control platform. The organization’s tactical focus is on offering optimized and data-driven treatment systems that diminish the overall expense of ownership and boost water management efficiency across both conventional and unconventional assets.

Here is a list of key players operating in the global produced water treatment market:

The international produced water treatment market is extremely fragmented and stratified into worldwide integrated service giants, such as Veolia and Schlumberger, along with specialized technology or chemical providers, including Solenis and Kurita. Moreover, notable players readily pursue growth through tactical and vertical integration, and technology-focused mergers and acquisitions to provide end-to-end solutions, from primary separation to innovative desalination. Furthermore, localized partnership with National Oil Companies (NOCs) in high-growth regions, such as the Middle East and Asia Pacific, is also critical for market accessibility. Besides, in November 2024, Yokogawa, along with the Water Technologies Entrepreneurship and Research (WaTER) Institute at Rice University, declared their partnership for readily supporting reuse processes and modular autonomous water treatment, thus suitable for the produced water treatment market.

Corporate Landscape of the Produced Water Treatment Market:

Recent Developments

- In December 2025, IDE Technologies notified that is has achieved the Engineering, Procurement and Construction (EPC) contract by the Brihanmumbai Municipal Corporation (BMC) for designing and developing a standard and large-scale maintenance and operations management.

- In July 2025, ZwitterCo has introduced three products, including Expedition, Elevation, and Evolution, which are designed to cater to the most pressing filtration demands across hard-to-treat industrial wastewater, water reutilization, and food processing.

- In September 2024, Veolia Water Technologies made a suitable contribution to Suzano by effectively delivering innovative industrial and demineralized water, along with effluent treatment facilities for the organization’s newest plant.

- Report ID: 8290

- Published Date: Dec 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Produced Water Treatment Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.