Water Heater Market Outlook:

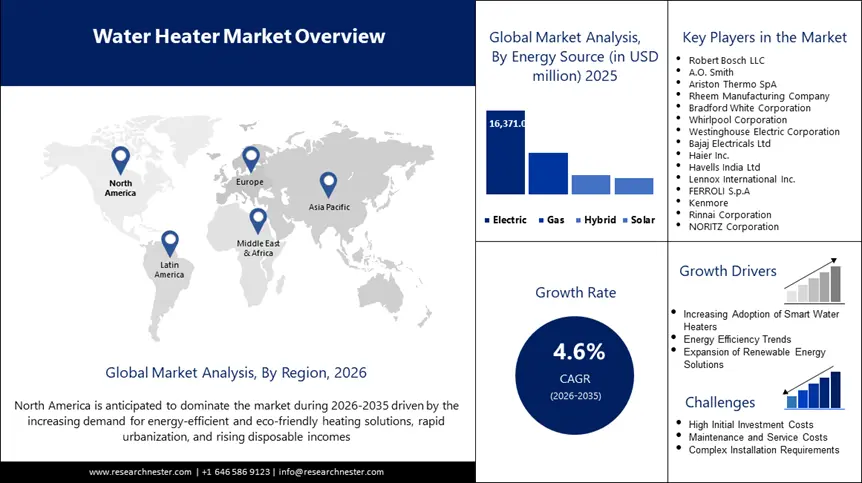

Water Heater Market size was over USD 31.83 billion in 2025 and is projected to reach USD 49.91 billion by 2035, witnessing around 4.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of water heater is evaluated at USD 33.15 billion.

The water heater market is expanding steadily due to the increase in urbanization, improved living standards, and the need for an efficient heating system. Consumers are moving to smart, energy-efficient, and hybrid water heating solutions for better energy management and convenience. In February 2025, Symphony Ltd. developed a new geyser to combat hair fall, a major problem with water quality. This innovation signifies a shift towards more individual-focused water heating solutions and opens further opportunities for market growth.

Governments are encouraging energy efficient heating solutions through measures that support the use of efficient appliances in homes. For instance, a U.S. Census Bureau report estimates the US population to be at 404 million in 2058, which will create more need for energy-efficient water heating in the residential and commercial sectors. In addition, the water heater market is evolving attributed to the increase in energy efficiency standards, technological development, and growing consumer awareness regarding the availability of affordable and efficient solutions. The proposed energy conservation standards are expected to lead to reduced energy use and at the same time bring about consumers’ cost savings.

|

Projected Economic and Energy Impact of Energy-Efficient Water Heaters (2023-2059) |

||

|

Category |

Metric |

Value |

|

Consumer Impact |

Average Life-Cycle Cost (LCC) Savings (Gas) |

USD 29 per unit |

|

Average Life-Cycle Cost (LCC) Savings (Electric) |

USD 859 per unit |

|

|

Simple Payback Period (Gas) |

9.1 years |

|

|

Simple Payback Period (Electric) |

5.6 years |

|

|

Manufacturer Impact |

Industry Net Present Value (INPV) (2023-2059) |

USD 1,478.8 million |

|

Change in INPV Due to Regulations |

-USD 275.3 million to +USD 28.2 million |

|

|

Total Conversion Costs for Compliance |

USD 239.8 million |

|

|

National Energy Impact |

Projected Energy Savings (2030-2059) |

17.6 quadrillion BTUs (quads) |

|

Percentage Reduction in Energy Use |

10% |

|

Source: DEPARTMENT OF ENERGY (DOE)

The table shows a comparison of the economic and energy benefits that can be derived from energy efficient water heaters. Customers save significantly on the lifetime cost, especially for the electric models, whereas the automobile manufacturers face regulatory changes that call for additional costs. The total saving estimated at 17.6 quadrillion BTUs over three decades indicates the significance of energy-efficient water heaters in the reduction of overall energy consumption in the country. The adaptability of the industry to efficiency standards will determine the competition for efficiency and opportunities presented by increased consumer demand for lower costs of operation and greater sustainability.

Key Water Heater Market Insights Summary:

Regional Highlights:

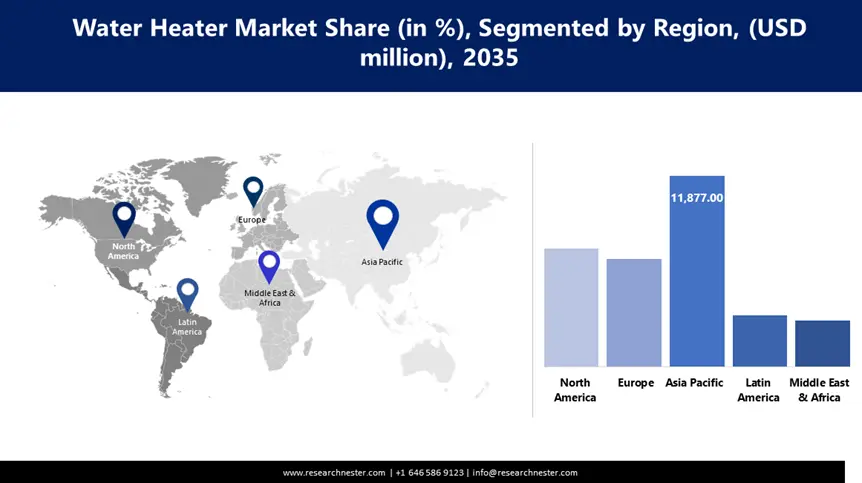

- Asia Pacific holds a 37% share in the water heater market, fueled by increasing urbanization, population, and spending on home appliances, positioning it for significant growth through 2035.

- North America's Water Heater Market is experiencing stable growth through 2026–2035, driven by innovations in energy-efficient heating and increased consumer awareness.

Segment Insights:

- The Residential segment is expected to experience robust growth through 2035, driven by increasing disposable income and adoption of energy-efficient products.

- The Electric segment of the Water Heater Market is projected to hold over 51% share by 2025, driven by innovations in energy-efficient heating systems and electrification of homes.

Key Growth Trends:

- Growing demand for energy-efficient water heaters

- Increasing the integration of smart technologies in water heaters

Major Challenges:

- Supply chain disruptions and component shortages

- Regulatory compliance and environmental standards

- Key Players: Robert Bosch LLC, A.O. Smith, Ariston Thermo SpA, Rheem Manufacturing Company, Rinnai Corporation, Bradford White Corporation, NORITZ Corporation, Whirlpool Corporation, Westinghouse Electric Corporation, Bajaj Electricals Ltd, Haier Inc., Havells India Ltd, Lennox International Inc., FERROLI S.p.A, Kenmore.

Global Water Heater Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 31.83 billion

- 2026 Market Size: USD 33.15 billion

- Projected Market Size: USD 49.91 billion by 2035

- Growth Forecasts: 4.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (37% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, Germany, South Korea

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 12 August, 2025

Water Heater Market Growth Drivers and Challenges:

Growth Drivers

- Growing demand for energy-efficient water heaters: Customers are now more conscious of the energy-saving and environmentally friendly water heating system in order to save electricity costs. Heat pumps and solar water heaters are being widely used due to low operation cost and the fact that they are environmentally friendly. In September 2023, the company launched an energy-efficient heat pump water heater, further promoting the development of affordable and energy-saving products in the industry. The escalating cost of electricity and increased standards of energy efficiency are some reasons that are pushing the adoption of the next-generation water heaters. With the global trends towards decarbonization and energy saving, manufacturers are interested in creating efficient and energy-saving heating systems.

- Increasing the integration of smart technologies in water heaters: The water heating industry is evolving with smart technologies being incorporated into water heating systems to offer convenience to the users. Some of the additional options include Wi-Fi connection, remote control, and compatibility with voice commands in the higher-end models. In April 2023, Ariston introduced Wi-Fi enabled electric storage water heaters and consumers could control temperature settings using Alexa and Google Home. The rise of smart home automation and IoT is driving the need for intelligent water heating systems. Smart water heaters offer improved efficiency and user convenience through energy management and the ability to set different schedules.

- Increasing adoption of CO2 heat pump water heaters: The shift toward the use of environment-friendly refrigerants is also driving the growth of CO2-based heat pump water heaters, which are comparatively more energy-efficient than the traditional ones. These heaters have higher efficiency and lower emissions of greenhouse gases, which makes them suitable for use in homes and businesses. In November 2024, Mitsubishi Electric introduced a CO₂ heat pump water heater in the U.S., adding to the change in the market for sustainable water heater options. As governments around the world continue to set higher standards of carbon emissions, there will be increased market demand for low GWP refrigerants. This market expansion is further complemented by the increasing use of renewable energy-based appliances across the world.

Challenges

- Supply chain disruptions and component shortages: The supply chain constraints are becoming a major problem in the water heating industry due to delays in the procurement of some essential parts such as heat exchangers, electronic controller, and smart sensors. According to the US Energy Information Administration, supply chain disruptions in 2023 affected the supply of heating appliances for the market and there were delays in the release of new models and installation of the products. Manufacturers are facing issues with logistics, shortage of chips, and increasing costs of raw materials that hinder new product development and market expansion. It is important to note that in an effort to reduce risks and achieve diversification, domestic manufacturing and other forms of sourcing are emerging as strategic solutions.

- Regulatory compliance and environmental standards: Increasingly stringent energy efficiency and emissions standards set by governments around the globe are forcing water heater manufacturers to improve their technologies and manufacturing techniques. Adherence to standards such as the U.S. Department of Energy (DOE) energy efficiency rules and EU Ecodesign Directive raises the costs of development and certification. Also, some regions are gradually introducing the ban on fossil fuel-based water heaters, thus stimulating the development of electric and hybrid systems. Therefore, low emission and high efficiency water heaters are manufactured, but meeting international compliance continues to be a major concern.

Water Heater Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.6% |

|

Base Year Market Size (2025) |

USD 31.83 billion |

|

Forecast Year Market Size (2035) |

USD 49.91 billion |

|

Regional Scope |

|

Water Heater Market Segmentation:

Energy Source (Electric, Gas, Solar, Hybrid)

Electric segment is anticipated to capture water heater market share of over 51% by 2035, owing to innovations in energy-efficient heating systems and the shift towards electrification of homes. Electric heaters are more environmentally friendly than gas-powered heaters, simpler to install, and can be integrated with renewable energy systems. In December 2023, Vaysunic launched a hybrid photovoltaic water heater that combines the use of solar power with other conventional heating systems, which shows the shift towards more environmentally friendly products. The availability of smart grid systems and government incentives for energy-efficient appliances also increases the rate of adoption of electric water heaters.

End user (Commercial, Industrial, Residential)

In water heater market, residential segment is set to dominate revenue share of over 53.5% by 2035. Increase in disposable income, better living standards, and shift towards energy efficient products are some of the factors that are fueling demand for sophisticated water heating systems. In September 2024, Kwikot launched a smart geyser system that is powered by solar PV and the grid, reflecting the increasing trend toward solar energy integration in home appliances. The increasing trend towards energy conservation and integration of smart homes will further promote the use of intelligent and energy-saving water heaters.

Our in-depth analysis of the global water heater market includes the following segments:

|

Product Type |

|

|

Energy Source |

|

|

Capacity |

|

|

Installation |

|

|

End user |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Water Heater Market Regional Analysis:

Asia Pacific Market Statistics

Asia Pacific water heater market is expected to dominate revenue share of over 37% by 2035, due to factors such as increasing urbanization, population, and spending on home appliances. Governments in the region are encouraging the use of energy-efficient technologies with the move towards the use of solar and heat pump water heaters. The company’s entry into the market indicates that there is stiff competition and that there is a rising need for better heating technologies.

The water heater market is rapidly expanding in India due to the growth in the economy, increase in the number of households, and government initiatives towards energy conservation. The increasing trend in smart home implementations and the shift toward environmentally friendly heating solutions are fueling the demand for heat pump and solar water heaters. As most rural areas are now experiencing electrification, the market for electric and tankless water heaters is growing. In October 2023, Voltas forayed into the heating appliances segment by introducing its water heater range in India. The company intends to capitalize on its brand reputation to effectively capture the expanding market, especially within the residential and commercial segments.

China is leading Asia Pacific water heater market backed by government policies regarding energy conservation and energy from renewable sources. China’s government policies promoting carbon neutrality are stimulating the market for solar and CO₂ heat pump water heaters, which corresponds to the country’s long-term objectives. Furthermore, the growth of the real estate industry and the rising levels of disposable income in China also help to drive the demand for high-end water heating systems. China has maintained its dominance in the global water heater industry as the leading domestic manufacturers continue to develop new and better technologies in heating.

North America Market Analysis

North America water heater market is poised to observe notable growth in the coming years, due to the innovations in energy-efficient heating and increased consumer awareness. The heat pump and tankless water heaters are gaining popularity as consumers seek efficient and renewable sources of water heating systems, not using electricity and gas. In January 2025, Midea launched a new Heat Pump Water Heater (HPWH) for the residential market in North America. The launch comes at a time when the region is striving to cut down on carbon emissions, with governments offering incentives and implementing regulations on energy efficiency.

The U.S. is observing rapid adoption of water heating solutions backed by the wealthy consumers and their penchant for luxury products. As stated by the Henley & Partners and New World Wealth’s 2024 USA Wealth report, the U.S. has the highest concentration of millionaires globally, with 5.5 million HNWIs accounting for 37% of the global total. Furthermore, 97% of households in the U.S. own at least one bathtub, and there is a trend towards the more popular freestanding and soaking tubs because of their sleek and luxurious appearance. This trend is increasing the need for effective water heating systems, especially in the premium housing and remodeling markets.

The demand for water heaters in Canada is steadily growing due to the high levels of disposable income and the harsh climate, which demands efficient and constant heating of water. Canada has 367,500 HNWIs and is ranked fourth in the world in terms of UHNWIs with 27,928 people possessing more than USD 30 million worth of assets. This economic stability and affluence lead to enhanced investment in high-end residential and commercial heating solutions. Due to increased sustainability regulation, the Canada water heating market is predicted to experience an increase in the demand for energy efficient products, encouraging companies to diversify their green product offerings.

Key Water Heater Market Players:

- Robert Bosch LLC

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- A.O. Smith

- Ariston Thermo SpA

- Rheem Manufacturing Company

- Bradford White Corporation

- Whirlpool Corporation

- Westinghouse Electric Corporation

- Bajaj Electricals Ltd

- Haier Inc.

- Havells India Ltd

- Lennox International Inc.

- FERROLI S.p.A

- Kenmore

- Rinnai Corporation

- NORITZ Corporation

The water heater market is saturated, and major manufacturers are investing in research and development, partnerships, and eco-friendly products. Some of the major players in the global market are Robert Bosch LLC, A.O. Smith, Ariston Thermo SpA, Rheem Manufacturing Company, Rinnai Corporation, Bradford White Corporation, NORITZ Corporation, Whirlpool Corporation, Westinghouse Electric Corporation, Bajaj Electricals Ltd, Haier Inc., Havells India Ltd, Lennox International Inc., FERROLI S.p.A, and Kenmore. These companies are constantly diversifying their offerings for heat pump, hybrid, and AI integrated water heating systems.

One of the major market developments was observed in November 2024, when Nyle and HTEC introduced a commercial heat pump water heater with PCM storage system. This innovation improves energy use efficiency and guarantees constant hot water supply for commercial uses, which indicates the increasing attention paid to the development of sophisticated thermal storage systems in the water heating sector.

Here are some leading companies in the water heater market:

Recent Developments

- In January 2025, Symphony expanded its product line by launching smart water geysers alongside its range of coolers. These smart geysers are equipped with IoT features, allowing users to control and monitor water heating remotely. This development underscores Symphony's focus on integrating smart technology into home appliances for improved user experience.

- In December 2024, Eco2 Systems announced plans to launch Modbus connectivity for their CO2 heat pump water heaters. This feature aims to facilitate seamless integration with building management systems, enhancing control and monitoring capabilities. The initiative reflects Eco2 Systems' commitment to providing technologically advanced and user-friendly heating solutions.

- In October 2024, Kent launched an instant drinking water heater, revolutionizing winter comfort by providing immediate access to hot drinking water. This appliance is designed to offer convenience and efficiency, catering to the increased demand for hot beverages during colder months. Kent's innovation reflects its dedication to enhancing consumer lifestyle through advanced technology.

- Report ID: 7488

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Water Heater Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.