Portable Filtration Systems Market Outlook:

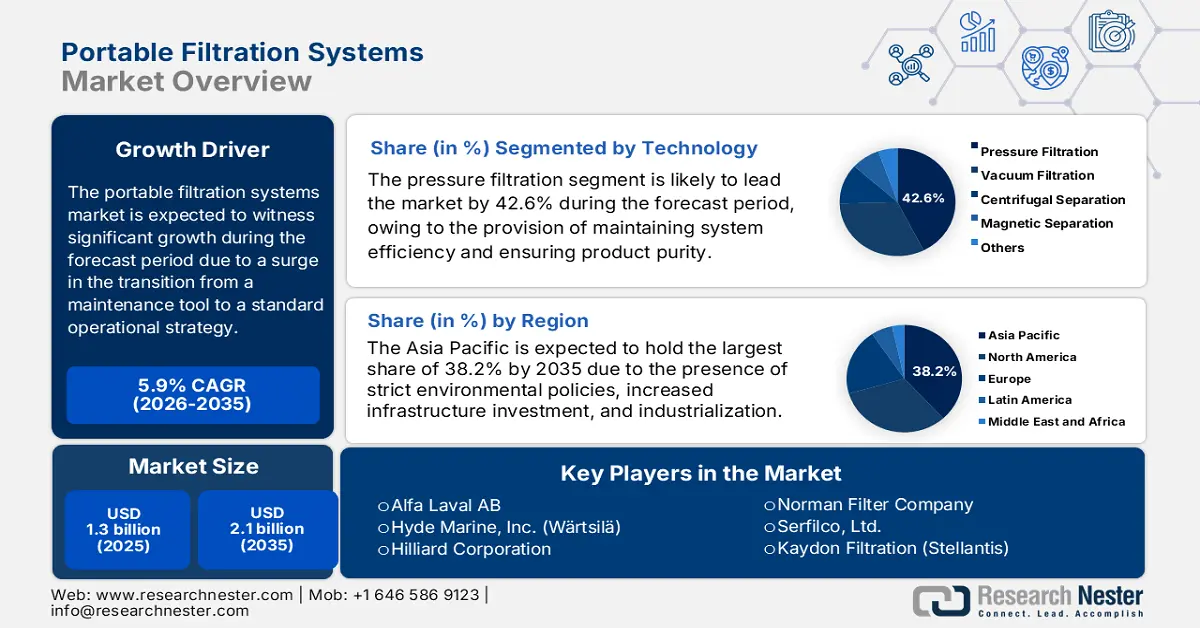

Portable Filtration Systems Market size was over USD 1.3 billion in 2025 and is estimated to reach USD 2.1 billion by the end of 2035, expanding at a CAGR of 5.9% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of portable filtration systems is estimated at USD 1.4 billion.

The international portable filtration systems market is presently undergoing a tactical evolution, gradually transitioning from a peripheral maintenance tool to an ultimate component of industrial operational strategy. This shift is further fueled by the technological evolution of Industry 4.0, the economic imperative of increasing asset utilization, and the convergence of strict sustainability mandates. For instance, according to an article published by the World Economic Forum in April 2022, based on Industry 4.0, the production line availability is estimated to increase by 5% to 15%, resulting in the provision of standard opportunities for sustainability and an energy-saving approach through optimization. In addition, this technological advancement successfully diminished the power consumption in one of its facilities by nearly 40%, which effectively saved USD 200,000 per year in energy, thereby making it suitable for boosting the market’s exposure globally.

Furthermore, the aspect of smart filtration and digitalization, a sudden shift towards circular and service-based models, an increase in the demand for application-driven and high-efficiency designs, and the availability of compact and modularity system design are other factors driving the portable filtration systems market globally. As stated in an article published by the International Journal of Research in Management in October 2024, the water filtration technology in India witnessed an increase in revenue, amounting to USD 43.2 billion as of 2022. In addition, USD 270 billion and 350 billion liters of bottled water has been produced internationally in 2023, which is uplifting the market. Besides, according to an article published by the Green Energy & Environment in June 2023, the PM2.5 filtration system possesses the ability to absorb more than 99.9% of aerogel efficiently without the need for a drop in the pressure level. Moreover, this filtration system is also useful to filter out synthetic polymers, thus proliferating the market’s exposure.

Common Synthetic Polymer for PM2.5 Filtration (2023)

|

Material Type |

Particle Size (μm) |

EPM (%) |

ΔP (Pa) |

QF (Pa−1) |

|

Polyimide |

2.5 |

99.9 |

73 |

0.1 |

|

Polystyrene |

2.5 |

99.9 |

145 |

0.1 |

|

Polyurethane |

2.5 |

99.7 |

28 |

0.2 |

|

Polyacrylonitrile |

2.5 |

96.1 |

133 |

0.02 |

|

Polyvinyl Alcohol |

2.5 |

96.7 |

178 |

0.01 |

|

Polyvinylpyrrolidone |

2.5 |

95 |

101 |

0.02 |

|

Polyacrylic Acid |

2.5 |

99.6 |

146.3 |

0.03 |

|

Polyvinylidene Fluoride |

2.5 |

98.1 |

30 |

0.1 |

Source: Green Energy & Environment

Key Portable Filtration Systems Market Insights Summary:

Regional Highlights:

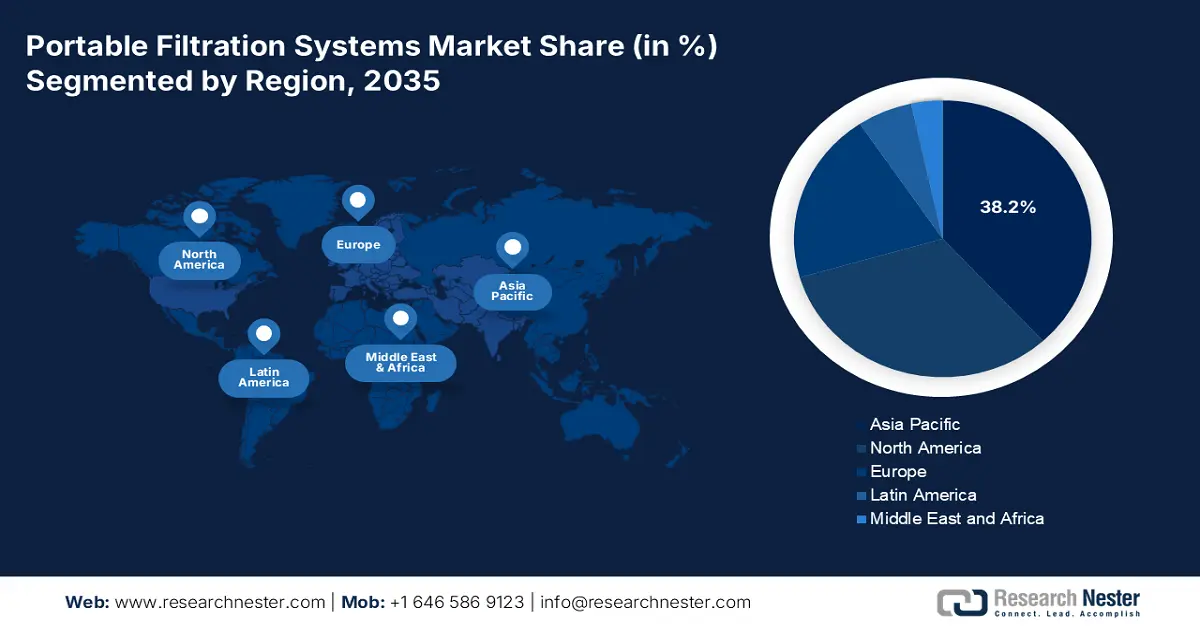

- Asia Pacific is anticipated to secure a 38.2% share by 2035 in the portable filtration systems market, owing to tightened environmental regulations, rising infrastructure investments, and accelerated industrialization.

- By 2035, Europe is expected to emerge as the fastest-growing region, underpinned by strong industrial circularity initiatives, stringent regulatory frameworks, and innovation-led demand.

Segment Insights:

- The pressure filtration segment is projected to attain a 42.6% share by 2035 in the portable filtration systems market, propelled by its effectiveness in sustaining system efficiency, ensuring product purity, and safeguarding machinery.

- By 2035, the microfiber glass segment is expected to capture the second-largest share, underlined by its superior sub-micron particulate filtration capability and high dirt-holding performance.

Key Growth Trends:

- Expansion in critical end-use sectors

- Economic pressure for operational and supply chain efficiency

Major Challenges:

- Lack of standardized expertise and technical complexity

- Competition from technologies and integrated OEM solutions

Key Players: Parker Hannifin Corporation (U.S.), Eaton Corporation plc (U.S.), Donaldson Company, Inc. (U.S.), Pall Corporation (Danaher) (U.S.), Graco Inc. (U.S.), MP Filtri S.p.A. (Italy), Bosch Rexroth AG (Germany), Freudenberg Filtration Technologies (Germany), Alfa Laval AB (Sweden), Hyde Marine, Inc. (Wärtsilä) (Finland), Hilliard Corporation (U.S.), Norman Filter Company (U.S.), Serfilco, Ltd. (U.S.), Kaydon Filtration (Stellantis) (U.S.), Y2K Filtration Inc. (U.S.), Schroeder Industries (U.S.), Purolator Advanced Filtration (U.S.), Bollfilter Corporation (Germany), Lenz GmbH (Germany), Filtrec Corporation (Italy).

Global Portable Filtration Systems Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.3 billion

- 2026 Market Size: USD 1.4 billion

- Projected Market Size: USD 2.1 billion by 2035

- Growth Forecasts: 5.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (38.2% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Indonesia, Mexico

Last updated on : 9 December, 2025

Portable Filtration Systems Market - Growth Drivers and Challenges

Growth Drivers

- Expansion in critical end-use sectors: The aspect of huge investments in industries, such as semiconductor fabrication, battery gigafactories, and renewable energy, are creating high-value and new application segments. This is possible for the provision of non-negotiable purity requirements, which is positively driving the portable filtration systems market. According to a report published by the IEA Organization in 2025, the international renewable energy capacity is projected to double, and increase by 4,600 GW by the end of 2030. Additionally, in over 80% of global nations, the renewable power capacity is expected to increase rapidly between 2025 and 2030. Therefore, with such optimistic development and projection for the capacity, there is a huge growth opportunity for the portable filtration systems market.

- Economic pressure for operational and supply chain efficiency: The increased expense of new process fluids, synthetic lubricants, and unplanned downtime has created a strong return on investment (ROI). As stated in the 2022 IIP Series data report, the lubricant field in India is worth Rs. 240 billion and significantly produces 2 million metric tons per year. In addition, this particular industry is rapidly growing in the country, accounting for a growth rate ranging between 3% to 5%. Moreover, the industry is expected to upsurge by 1.5% by the end of 2026, based on which the demand for portable filtration systems is also poised to increase in the country, as well as across other regions. Furthermore, the continuous filtration equipment and water purification supply are also bolstering the portable filtration systems market’s exposure.

2023 Filtration Equipment and Water Purification Export and Import

|

Countries |

Export (USD) |

Import (USD) |

|

China |

1.9 billion |

592 million |

|

Germany |

1.3 billion |

524 million |

|

U.S. |

1.2 billion |

2.0 billion |

|

Global Trade Valuation |

USD 11.9 billion |

|

|

Global Trade Share |

0.05% |

|

|

Product Complexity |

0.79 |

|

|

Export Growth |

2.4% |

|

Source: OEC

- Increase in infrastructure development: The rapid growth in manufacturing, particularly in the Asia Pacific, which is driven by policies, including the China+1 strategy and India’s PLI schemes, is deliberately enhancing the portable filtration system market’s growth. In addition, the international infrastructure megaprojects are also propelling the greenfield demand for standard fluid management systems in the latest facilities. According to an article published by the UNCTAD Organization in June 2024, Asia, as a developing economy, is the ultimate home to 60% of the world’s megaprojects, which are responsible for driving the market’s exposure. This particular economy witnessed a 44% rise in the total greenfield investment as of 2023, along with a 22% increase in the investment announcement, based on which organizations established or expanded their respective overseas operations.

Challenges

- Lack of standardized expertise and technical complexity: An increase in the sophistication of portable filtration systems, integrating innovative real-time sensors, separation technologies, and complicated control software, has created a dual challenge of system complexity and a skills gap in the portable filtration systems market. Besides, end users frequently lack the in-house expertise to appropriately select, operate, and maintain these progressive systems, resulting in suboptimal performance, premature failures, and a loss of confidence in the technology. Moreover, the lack of universal industry standards for fluid cleanliness reporting or system interoperability tends to lead to confusion and misapplication, thus causing a hindrance in the portable filtration systems market’s growth.

- Competition from technologies and integrated OEM solutions: The portable filtration systems market is experiencing competitive pressure from alternative waste management solutions and integrated OEM designs. Based on these, a few industries might readily opt for alternative and less sustainable solutions, such as more frequent fluid changes and bulk disposal, especially in regions with less strict environmental enforcement costs. Furthermore, OEMs of turbines, presses, and heavy machinery are increasingly designing built-in, fixed filtration systems as standard, reducing the perceived need for add-on portable units, thereby creating a negative impact on the market’s development.

Portable Filtration Systems Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.9% |

|

Base Year Market Size (2025) |

USD 1.3 billion |

|

Forecast Year Market Size (2035) |

USD 2.1 billion |

|

Regional Scope |

|

Portable Filtration Systems Market Segmentation:

Technology Segment Analysis

The pressure filtration segment, which is part of the technology, is anticipated to garner the largest share of 42.6% in the portable filtration systems market by the end of 2035. The segment’s upliftment is highly attributed to its ability to maintain system efficiency, ensure product purity, and protect machinery. This is significantly possible by utilizing pressure to force fluids through a standard medium filter by efficiently removing contaminants, such as oils, metals, and solids. According to an article published by the MDPI in August 2025, highly efficient filters demonstrate a 37% reduction in net supply airflow under strongly clogged filters. In addition, this results in an increase in exhaust air transfer, usually ranging between 7.2% to 17.7%, thereby denoting an optimistic outlook for the overall segment’s growth.

Filter Media Segment Analysis

Based on the filter media, the microfiber glass segment is expected to cater to the second-largest share in the portable filtration systems market during the forecast duration. The segment’s growth is highly driven by its unmatched performance in achieving sub-micron particulate contamination. In addition, its upliftment is rooted in an outstanding combination of high dirt-holding capacity, consistent porosity, and thermal stability, permitting it to gain the high-efficiency ratings, which are essential for protecting sensitive components in hydraulic and lubrication systems. This particular media is crucial for meeting strict ISO cleanliness codes in industries, such as power generation and aerospace. Therefore, with such benefits, the segment is gradually poised to increase and expand, which in turn, is suitable for bolstering the portable filtration systems market’s growth internationally.

End use Industry Segment Analysis

By the end of 2035, the power generation sub-segment, part of the end use industry, is projected to cater to the third-largest share in the portable filtration systems market. The sub-segment’s development is extremely propelled by an absolute imperative for reliability and asset protection. Additionally, the sub-segment’s exposure is also driven by the catastrophic expense of unplanned turbine or generator downtime, which can readily increase the overall duration. Besides, portable systems are easily deployed for continuous lube oil conditioning for turbines and bearings, fuel polishing for backup diesel generators and gas turbine fuel lines, and insulating oil treatment for transformers. Moreover, the development is structurally supported by the international fleet of aging thermal power plants, which demand intensified maintenance and life-extension strategies, along with the expansion of renewable energy, wherein wind turbine gearboxes and hydraulic pitch systems demand precise lubrication cleanliness.

Our in-depth analysis of the portable filtration systems market includes the following segments:

|

Segment |

Subsegments |

|

Technology |

|

|

Filter Media |

|

|

End use Industry |

|

|

System Type |

|

|

Application |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Portable Filtration Systems Market - Regional Analysis

APAC Market Insights

The Asia Pacific in the portable filtration systems market is anticipated to garner the largest share of 38.2% by the end of 2035. The market’s upliftment in the region is highly attributed to tightened environmental regulations, huge infrastructure investment, and increased industrialization. In addition, the market in the region is also fueled by greenfield installations in extended power generation, semiconductor industries, and petrochemical sectors. According to the 2024 EDB Government report, the oil refining and petrochemical industry in Singapore has been established, accounting for USD 1.3 billion as a transaction charge. Besides, the petroleum and petrochemicals sector in the nation caters to 63.7% of nominal VA, and meanwhile, there has been an increase in the output rise by 1.7% solely in the petroleum sector. Moreover, the continuous supply of filters and purifying machines is also making it suitable for the portable filtration systems market’s growth.

2023 Filter Parts and Liquid Purifying Machines Export and Import in Asia

|

Countries |

Export (USD) |

Import (USD) |

|

China |

2.9 billion |

1.2 billion |

|

Japan |

891 million |

549 million |

|

South Korea |

549 million |

434 million |

|

India |

282 million |

445 million |

|

Thailand |

277 million |

249 million |

|

Singapore |

129 million |

313 million |

|

Malaysia |

123 million |

259 million |

Source: OEC

China in the portable filtration systems market is growing significantly, owing to the tactical modernization of the industrial base and sheer upscaling. In addition, the country also generates an unparalleled and basic need for filtration across power generation, steel, and petrochemicals. As per an article published by the ITA in September 2025, the country is regarded as the largest economy for environmental technology products, increasing at an average yearly rate of 12.8%. In addition, the industry further generated USD 329 billion in operating income, accounting for 1.8% of GDP, and significantly employing 3.2 million people. Besides, based on different administrative bodies, the country is projected to gain a sewage treatment rate of more than 95% in country-driven cities, along with a recycled water utilization rate of more than 25% across water-scarce prefecture-level cities.

India in the portable filtration systems market is also growing due to the robust policy push for sustainability and self-reliance, strong infrastructure development, and an explosive manufacturing growth. Regarding this, as per an article published by the PIB Government in August 2025, the PLI scheme caters to the country’s manufacturing contribution to 25% of GDP. In addition, the scheme provides ₹1.9 lakh crore, which is positively catering to the market’s growth. Besides, the nation’s vision of a USD 5 trillion economy readily fuels the Make in India strategy by reviving regional manufacturing at scale. Moreover, the India Semiconductor Mission has allocated a ₹76,000 crore package, intended to financially support semiconductor fabrication, chip design, and display manufacturing ideas, thereby making it suitable for uplifting the overall market in the country.

Europe Market Insights

Europe in the portable filtration systems market is expected to emerge as the fastest-growing region by the end of the forecast period. The market’s development in the region is highly propelled by the strong push for industrial circularity, strict regulatory frameworks, and innovation-driven demand. The market’s growth is also driven by derivative regulations and the regional Green Deal, especially the Industrial Emissions Directive (IED) and the Circular Economy Action Plan, for mandating pollution prevention and resource efficiency. According to a data report published by the CEFIC Organization in January 2025, the chemical industry demonstrates nearly EUR 655 billion in overall turnover and almost EUR 165 billion in added value. Additionally, this displays 5% to 7% of overall industrial sales, along with over 1.2 million direct employment opportunities, as well as a network of 31,000 organizations, thereby bolstering the portable filtration systems market’s growth.

Germany in the portable filtration systems market is gaining increased traction, owing to targeted fiscal investment, regulatory leadership, and an unparalleled manufacturing base. Besides, the country readily generates high-value and sustained demand for administrative frameworks, such as the ambitious Climate Action Law and the strict Federal Immission Control Act (BImSchG) that compels sectors to implement available technologies for waste and emission reduction. As per a data report published by the ITA in August 2025, oil is considered the most essential energy source in the country, with a 36.1% share, and this is followed by 25.9% for natural gas. Besides, there has been an increase in crude oil imports from 73 million to 78.4 million tons as of 2024, denoting a 7% year-over-year (YoY) surge, thereby ensuring a huge demand for the portable filtration systems market.

Poland in the portable filtration systems market is also developing due to the burgeoning manufacturing centers, increased industrial modernization, and massive regional cohesion fund investments. Besides, as per an article published by the Europe Commission in 2025, the Polish Recovery and Resilience Plan amounts to €59.8 billion, along with €25.3 billion as RRF grants and €34.5 billion as RRF loans. In addition, the plan takes into consideration 55 reforms and 56 investment streams, and meanwhile, 46.6% of the plan readily supports green transition, along with 21.3% of the plan supporting the digitalized transition. Therefore, this funding, along with the overall plan, directly fuels the market’s demand in the country for modernizing power plants, as well as making expansions in battery gigafactories and chemical facilities.

North America Market Insights

North America in the portable filtration systems market is projected to witness considerable growth by the end of the stipulated timeline. The market’s growth in the region is highly driven by the non-negotiable focus on administrative compliance, operational sustainability, and cost savings. In addition, the presence of strict EPA regulations on utilized air quality and oil management has mandated on-site fluid conditioning to reduce wastage. For instance, in April 2025, the Department of the Interior (DOI) declared a suitable increase in oil and gas reserves in the Gulf of America Outer Continental Shelf. Based on this, the Bureau of Ocean Energy Management’s analysis revealed an additional 1.3 billion oil barrels, which has brought the overall reserve to 7.0 billion oil barrels in the region. Moreover, this comprises 5.7 barrels, along with 7.1 trillion cubic feet of natural gas, thereby denoting a 22.6% surge in remaining recoverable reserves.

The portable filtration systems market in the U.S. is gaining increased exposure, owing to the advanced manufacturing, funding for environmental sustainability, the presence of waste and chemical safety programs, and the government’s support for innovative semiconductor materials. For instance, in September 2025, the U.S. Department of Energy (DOE) declared the Industrial Efficiency and Decarbonization FOA, which is a USD 104 million funding opportunity for advancing decarbonization technologies to diminish the carbon footprint of the industry. Besides, as per an article published by the DOE in October 2023, the administrative body, along with the Industrial Efficiency and Decarbonization Office (IEDO), renewed funding for the Rapid Advancement in Process Intensification Deployment (RAPID) Institute, amounting to a USD 40 million investment for 5 years. The purpose is to propel research and development for advanced process technologies, thus boosting the portable filtration systems market’s exposure.

The portable filtration systems market in Canada is also growing due to the carbon pricing, environmental regulation, dominance of heavy industries and resources, federal clean-tech and infrastructure investment, the existence of operational and harsh climatic conditions, and alignment with circular economy objectives. According to an article published by the Government of Canada in June 2025, the direct contribution of the country’s metals and minerals sector to the nation’s gross domestic product (GDP) amounts to USD 117 billion as of 2023, representing 4% of the country’s overall GDP. In addition, the indirect contribution from the sector has further added USD 42 billion to the GDP, bringing the overall to USD 159 billion. Besides, the total mineral production, in terms of commodity group, is essential for driving the adoption of innovative portable filtration for process water, equipment lubrication, and solvent recovery in the country.

Mineral Production by Commodity Group in Canada (2014-2023)

|

Year |

Metals (USD Million) |

Non-Metals (USD Million) |

Coal (USD Million) |

Total (USD Million) |

|

2014 |

24,225 |

15,779 |

3,897 |

43,900 |

|

2015 |

23,129 |

13,393 |

3,126 |

41,153 |

|

2016 |

23,302 |

13,724 |

4,009 |

39,420 |

|

2017 |

25,738 |

13,304 |

6,281 |

45,323 |

|

2018 |

27,059 |

15,531 |

6,459 |

49,049 |

|

2019 |

29,695 |

14,144 |

5,625 |

49,464 |

|

2020 |

32,513 |

12,681 |

3,957 |

49,151 |

|

2021 |

37,595 |

15,193 |

8,521 |

61,309 |

|

2022 |

38,034 |

25,251 |

15,217 |

78,503 |

|

2023 |

38,884 |

20,824 |

12,214 |

71,922 |

Source: Government of Canada

Key Portable Filtration Systems Market Players:

- Parker Hannifin Corporation (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Eaton Corporation plc (U.S.)

- Donaldson Company, Inc. (U.S.)

- Pall Corporation (Danaher) (U.S.)

- Graco Inc. (U.S.)

- MP Filtri S.p.A. (Italy)

- Bosch Rexroth AG (Germany)

- Freudenberg Filtration Technologies (Germany)

- Alfa Laval AB (Sweden)

- Hyde Marine, Inc. (Wärtsilä) (Finland)

- Hilliard Corporation (U.S.)

- Norman Filter Company (U.S.)

- Serfilco, Ltd. (U.S.)

- Kaydon Filtration (Stellantis) (U.S.)

- Y2K Filtration Inc. (U.S.)

- Schroeder Industries (U.S.)

- Purolator Advanced Filtration (U.S.)

- Bollfilter Corporation (Germany)

- Lenz GmbH (Germany)

- Filtrec Corporation (Italy)

- Parker Hannifin Corporation is one of the global leaders and accounts for a dominating position by adopting its expanded motion control and fluid connector expertise into a wide-ranging line of high-performance portable filtration units. The organization’s strength remains in offering an engineered system for severe mobile and industrial hydraulic applications.

- Eaton Corporation plc is considered a powerhouse in power management, for translating its in-depth expertise in hydraulic and electric systems into strong filtration solutions for vehicle, industrial, and aerospace markets. The company is focused on dependability and system protection, providing innovative condition monitoring technologies within its filtration products to offer support to predictive maintenance strategies.

- Donaldson Company, Inc. is regarded as a filtration pure-play and technology leader, and well-known for its advanced filter media and engineered systems that readily serve diversified sectors from industrial dust collection to hydraulic and lubrication. Its portable filtration business benefits from aggressive cross-selling opportunities within its massive installed base and a continuous research and development focus on efficiency and durability.

- Pall Corporation (Danaher) has successfully brought a legacy of high-purity, as well as scientific-grade filtration, to the demanding industrial process applications, including chemicals and petrochemicals. The organization has leveraged its proprietary membrane and separation technologies to provide portable systems for severe tasks, such as catalyst recovery and ultra-fine chemical purification.

- Graco Inc. is a renowned and premier specialist in fluid handling and dispensing, with its portable filtration systems naturally expanding from its core expertise in pumps, seals, and lubricants. The company excels in offering durable, user-friendly solutions for lubricant transfer, conditioning, and waste oil management, particularly in manufacturing and maintenance operations.

Here is a list of key players operating in the global portable filtration systems market:

The international portable filtration systems market is semi-consolidated and is readily dominated by large-scale multinationals, such as Donaldson, Eaton, and Parker Hannifin, significantly leveraging worldwide broad product and distribution portfolios for achieving standard market share. The market’s competitive landscape is readily defined by strategies, including tactical specialization and technological innovation. Moreover, notable players are generously investing in IoT-enabled and smart systems that provide predictive maintenance data to enhance consumer valuation. Besides, in November 2024, the Micronics Engineered Filtration Group announced the tactical acquisition of Action Filtration for making expansion in its portfolio of engineered filtration solutions. The purpose is to significantly serve our consumers’ filtration demands across industries, wherein environmental emissions require in-depth technical filtration knowledge and application expertise.

Corporate Landscape of the Portable Filtration Systems Market:

Recent Developments

- In February 2025, Samsung Electronics introduced the 6G white paper and readily outlined direction for AI-driven and sustainable communication technologies. This significantly includes market evolution, technological demands, emerging services, and 6G attributes.

- In October 2024, Donaldson Company proudly notified the launch of its latest distribution center in Mississippi, to strengthen its ability to meet the increasing consumer need in the mobile solutions aftermarket business and ensure standard filtration services.

- Report ID: 8288

- Published Date: Dec 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Portable Filtration Systems Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.