Polyvinyl Alcohol Market Outlook:

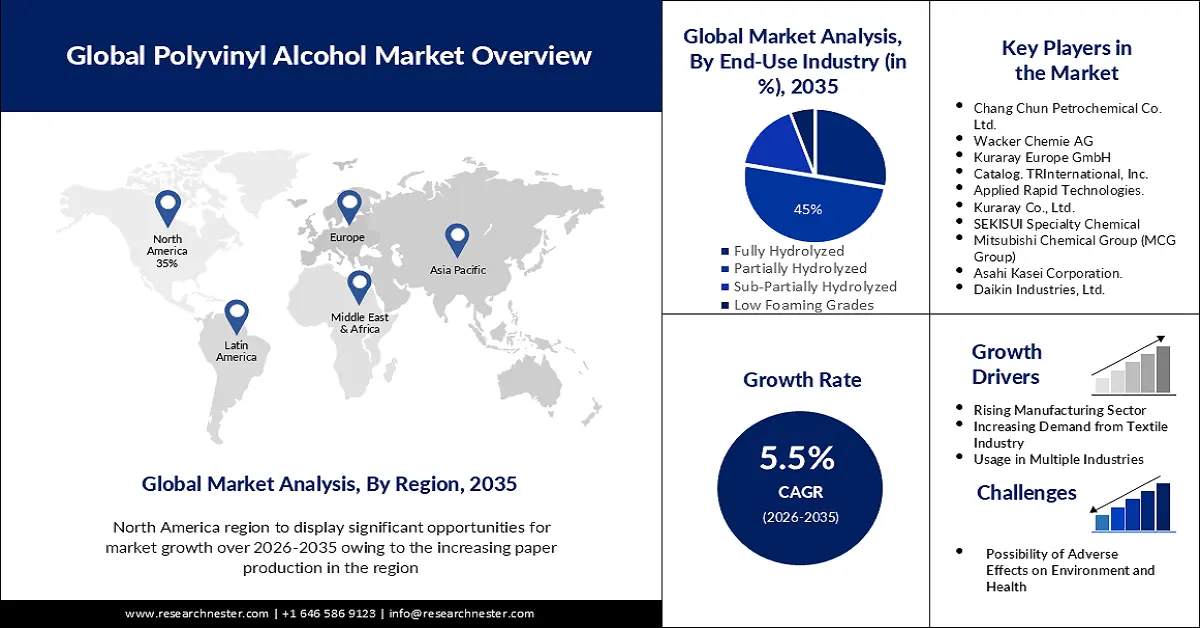

Polyvinyl Alcohol Market size was over USD 1.57 billion in 2025 and is projected to reach USD 2.68 billion by 2035, witnessing around 5.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of polyvinyl alcohol is evaluated at USD 1.65 billion.

The growth of the market can be attributed to the surging production volume of the manufacturing sector worldwide. It was found that in the third quarter of 2022, global manufacturing production reached about 3.6% year-over-year growth rate.

The growing demand as well as the soaring production of textiles worldwide, the global PVOH market is expected to boom over the forecast period as this product is typically used in sizing agents to give greater strength to textile yarn. As per estimations, with the radically expanding global population base which is anticipated to reach over 8 billion by 2025, the demand for textiles, all across the globe is expected to grow manifold. Based on this, the global apparel & textile industry is projected to amount to nearly USD 2 trillion by 2025.

Key Polyvinyl Alcohol Market Insights Summary:

Regional Highlights:

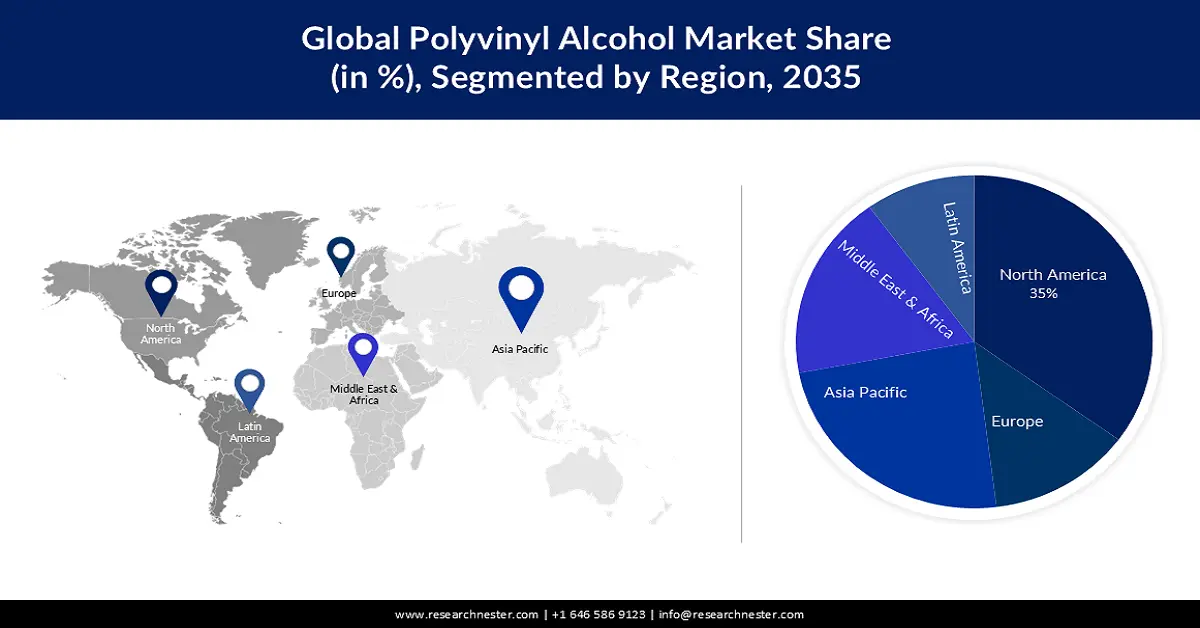

- North America polyvinyl alcohol (PVA) market will dominate over 35% share by 2035, driven by rising paper production and applications in biotechnology and electronics.

- Asia Pacific market will account for 28% share by 2035, driven by growth in construction and output from pharma, chemical, and textile sectors.

Segment Insights:

- The partially hydrolyzed segment in the polyvinyl alcohol market is anticipated to capture a 45% share by 2035, fueled by the booming agrochemicals sector and rising use of chemical fertilizers.

- The food packaging segment in the polyvinyl alcohol market is forecasted to achieve a 33% share by 2035, driven by rising demand for packaged foods and the growth of online delivery services.

Key Growth Trends:

- Growing Pharmaceutical Sector

- Expanding Construction Industry

Major Challenges:

- Possibility of Adverse Effect on Environment and Health

- Fluctuation in the Prices of Raw Materials

Key Players: Wacker Chemie AG, Chang Chun Petrochemical Co. Ltd, Kuraray Europe GmbH, Catalog TRInternational, Inc, Applied Rapid Technologies., Kuraray Co., Ltd., SEKISUI Specialty Chemical, Mitsubishi Chemical Group (MCG Group), Asahi Kasei Corporation., Daikin Industries, Ltd..

Global Polyvinyl Alcohol Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.57 billion

- 2026 Market Size: USD 1.65 billion

- Projected Market Size: USD 2.68 billion by 2035

- Growth Forecasts: 5.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, Japan, United States, Germany, India

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 9 September, 2025

Polyvinyl Alcohol Market - Growth Drivers and Challenges

Growth Drivers

-

Growing Pharmaceutical Sector – pharma companies are prospering worldwide with a wave of innovations which has led to the increased spending of their revenues on research & development (R&D). For instance, it was found that the United States (US) pharmaceutical industry spent nearly USD 101 billion in 2021. The rise of the pharmaceutical industry is anticipated to boost the polyvinyl alcohol market as PVOH is safe to use and safe to consume and has a widening scope of expansion in pharmaceutical applications, especially for ophthalmic drug formulations. Moreover, Food and Drug Administration has approved PVOH for use in food packaging and pharmaceutical applications.

-

Expanding Construction Industry – the rising number of residential buildings as well as the increasing construction of commercial spaces worldwide together with the escalating demand for PVOH for its utilization in materials, such as joint cement, drywall mud, caulks, and sealants is forecasted to elevate the market growth in the upcoming years. It was found that the construction industry in the United States accounted for around 4.3% of the US GDP as of January 2023 with 1,406,000 new housing units completed, depicting about a 12.5% increase from January 2022.

-

Upsurging Packaging Industry –the changing demography worldwide as well as the rising culture of online shopping, and takeaway meals, along with the prospering pharmaceuticals, FMCG, manufacturing industry, and healthcare sector is responsible for the rising demand for sustainable packaging leading to the growth of the packaging industry. PVOH is a synthetic vinylic alcohol polymer and is water-soluble and highly impermeable to gases, which is why it is widely used as a barrier layer for paper or packaging films. This as a result is expected to bolster the market growth over the forecast years. As per findings, the percentage of consumers that now demand sustainable packaging rose to 81%, since January 2023.

-

Increasing Sales of Cosmetic Products – the surging production of cosmetics globally as well as the rising demand for low-hazard ingredients in cosmetics is anticipated to boost the market growth. As per a report, each year more than USD 49 billion is generated by cosmetics sales in the United States.

Challenges

- Possibility of Adverse Effect on Environment and Health – The growth of polyvinyl alcohol is hampered owing to the lack of appropriate research worldwide regarding the biodegradability of PVOH, which is still debatable. It is found that PVOH films like detergent pods and sheets are prone to causing pollution when they are discharged directly into the wastewater system. Moreover, the market growth is further hampered owing to a lack of unbiased, dedicated research on its effects on human and environmental health effects, which makes its utilization as unfamous as plastics.

- Fluctuation in the Prices of Raw Materials

- Stringent Regulatory Policies for Synthetic Plastic Polymer

Polyvinyl Alcohol Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.5% |

|

Base Year Market Size (2025) |

USD 1.57 billion |

|

Forecast Year Market Size (2035) |

USD 2.68 billion |

|

Regional Scope |

|

Polyvinyl Alcohol Market Segmentation:

End-Use Segment Analysis

Food packaging segment is estimated to hold 33% share of the global polyvinyl alcohol market in the year 2035. The growth of the segment can be attributed to the growing culture of packaged foods worldwide with the increasing purchasing power of the middle-class population, coupled with the upliftment of online ordering & home delivery services with digital development worldwide. For instance, it was found that the GDP per capita in the United States amounted to around USD 70,000 in 2021. Therefore, with the surge in the sale of packaged food, takeaways, online groceries, and other packaged food items, the food packaging industry is anticipated to boom in the upcoming years.

Grade Segment Analysis

Partially hydrolyzed segment is expected to garner a significant share of around 45% in 2035. The segment growth is backed by the escalating agrochemicals industry as well as the increasing production of chemicals such as fertilizers, pesticides, and herbicides worldwide with their growing demand from the agricultural sector. For instance, according to a finding, in the US more than 1 billion pounds of pesticides are used every year with nearly 5.6 billion pounds used globally.

Our in-depth analysis of the global market includes the following segments:

|

Grade |

|

|

End Use Industry |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Polyvinyl Alcohol Market Regional Analysis:

North American Market Insights

The polyvinyl alcohol market in North America is projected to be the largest with a share of about 35% by the end of 2035. The growth of the market can be attributed majorly to the growing production volume of paper as well as the increasing development of materials that are biocompatible and can be used in neuroendovascular therapy, uterine fibroids, pharmaceuticals, medicine, and biotechnology besides the growing consumer electronics market in the region. It was found that the United States produced almost 48.5 million metric tons of pulp for paper in 2021. Moreover, the rising demand for PVOH as laundry detergents, disinfectants, and industrial cleaning chemicals, is also expected to boost the regional market growth over the forecast period.

APAC Market Insights

The Asia Pacific polyvinyl alcohol market is estimated to be the second largest, registering a share of about 28% by the end of 2035. The growth of the market can be attributed majorly to the increasing infrastructural projects in the region with the progress of the construction industry in emerging nations of the region such as China, India, Singapore, and Malaysia. The boom in the construction industry is the result of the existence of a vast pool population in the region who are also responsible for the skyrocketing output of various industries, including paper, pharma, chemical, automotive, textile, and others. As per recent data, Asia and the Pacific region is the most populous region of the globe as it is home to around 60% of the global population and has some rapidly emerging economies such as China, and India.

Polyvinyl Alcohol Market Players:

- Wacker Chemie AG

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Chang Chun Petrochemical Co. Ltd.

- Kuraray Europe GmbH

- Catalog. TRInternational, Inc.

- Applied Rapid Technologies.

- Kuraray Co., Ltd.

Recent Developments

- Kuraray Europe GmbH a global specialty chemicals company announced its establishment plan of a new polyvinyl alcohol water-soluble film plant in Poland, which will expectedly begin production in mid-2022.

- Polymers such as polyvinyl alcohol are likely to expand due to increasing awareness among people about plastic pollution.

- Report ID: 3664

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Polyvinyl Alcohol Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.