Polyurethane Elastomers Market Outlook:

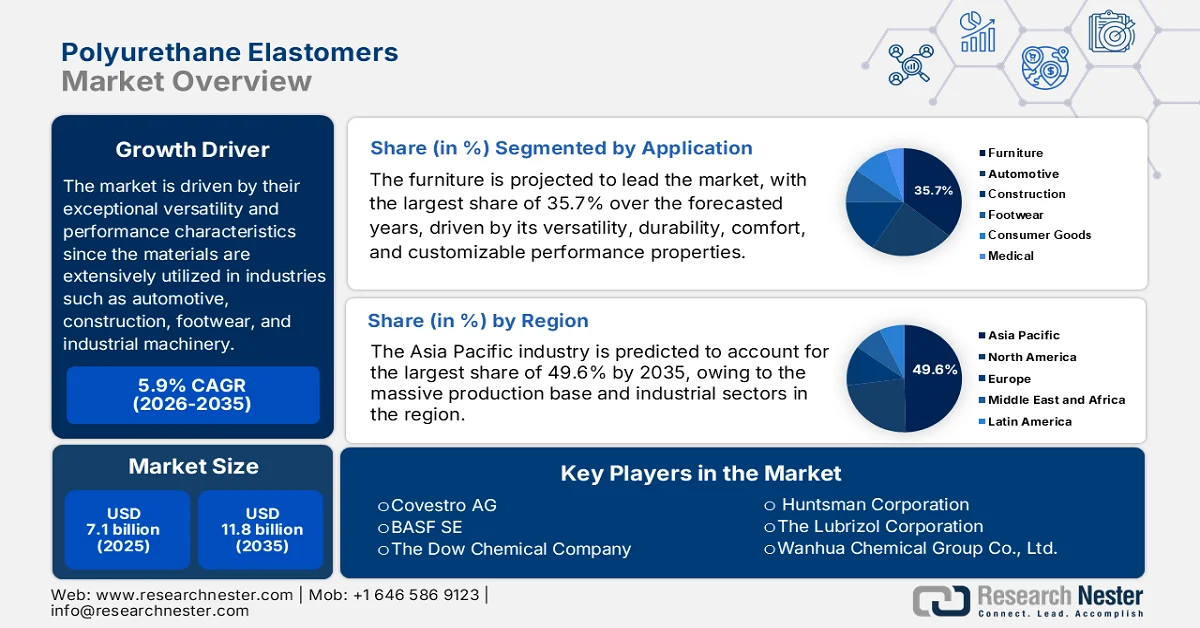

Polyurethane Elastomers Market size was valued at USD 7.1 billion in 2025 and is projected to reach USD 11.8 billion by the end of 2035, rising at a CAGR of 5.9% during the forecast period, i.e., 2026-2035. In 2026, the industry size of polyurethane elastomers is assessed at USD 7.5 billion.

The market is effectively driven by their exceptional versatility and performance characteristics since the materials are extensively utilized in industries such as automotive, construction, footwear, and industrial machinery. In March 2025, Huntsman Polyurethanes announced that its TPU production sites in Jinshan, China, and Osnabrück, Germany, achieved ISCC+ Certification. Therefore, this globally recognized standard ensures full traceability and sustainability in supply chains, allowing the company to offer mass balance certified TPU products. Also, such achievements by the major pioneers expand the market potential by making products more attractive to sustainability-conscious customers and brands that are looking for verified green materials, and potentially commanding a price premium in this field.

Furthermore, the ongoing innovations in terms of formulation and processing techniques are enabling polyurethane elastomers to meet evolving performance requirements, driving business in the market. In March 2025, the Royal Society of Chemistry revealed that recent improvements in functional polyurethane elastomers are mainly focused on enhancing mechanical properties and biomedical applicability through strategies such as monomer design, segment modification, and nanofiller incorporation. Also, the techniques such as hydrogen-bond sacrificial bonds and supramolecular molecular zippers improve strength, toughness, and fatigue resistance, whereas chain segment regulation enables self-healing and customizable elasticity. Therefore, these findings support diverse biomedical applications such as tissue engineering, artificial organs, wound healing, and bio-flexible electronics, providing encouraging opportunities for pioneers to make innovations other than traditional applications.

Key Polyurethane Elastomers Market Insights Summary:

Regional Highlights:

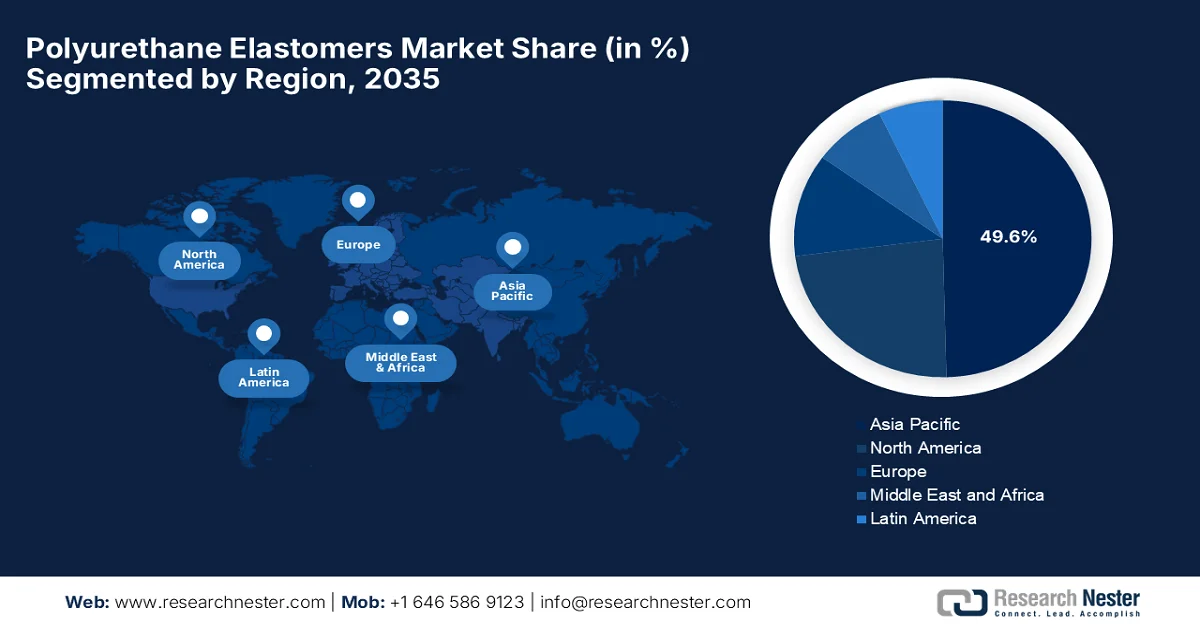

- Asia Pacific is projected to command a 49.6% share by 2035 in the polyurethane elastomers market, attributed to its massive production base and expanding automotive and construction industries.

- North America is anticipated to witness notable growth by 2035, propelled by advancements in sustainable materials and high-performance industrial applications.

Segment Insights:

- Furniture is forecasted to account for a 35.7% share by 2035 in the polyurethane elastomers market, driven by their versatility, durability, comfort, and customizable performance properties.

- Thermoplastic polyurethane is expected to grow at a considerable rate during 2026–2035, impelled by increasing recyclability requirements aligned with circular-economy goals.

Key Growth Trends:

- Strong demand from automotive & EV Sectors

- Growth in footwear & consumer goods

Major Challenges:

- Environmental and regulatory constraints

- Competition from alternative materials

Key Players: Covestro AG (Germany), BASF SE (Germany), The Dow Chemical Company / Dow Inc. (U.S.), Huntsman Corporation (U.S.), The Lubrizol Corporation (U.S.), Wanhua Chemical Group Co., Ltd. (China), Mitsui Chemicals, Inc. (Japan), LANXESS AG (Germany), Era Polymers Pty Ltd (Australia), American Urethane, Inc. (U.S.), Argonics, Inc. (U.S.), Coim Group (Italy), Hexpol AB (Sweden), Zibo Huatian Rubber & Plastic Technology Co., Ltd. (China), Huafeng Group (China), Huide Technology Co., Ltd. (China), Zhongke Yourui (China), P+S Polyurethan‑Elastomere GmbH & Co. KG (Germany), Reckli GmbH (Germany), Baule SAS (France).

Global Polyurethane Elastomers Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 7.1 billion

- 2026 Market Size: USD 7.5 billion

- Projected Market Size: USD 11.8 billion by 2035

- Growth Forecasts: 5.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (49.6% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, China, Germany, Japan, India

- Emerging Countries: South Korea, Brazil, Mexico, Vietnam, Indonesia

Last updated on : 16 February, 2026

Polyurethane Elastomers Market - Growth Drivers and Challenges

Growth Drivers

- Strong demand from automotive & EV Sectors: Polyurethane elastomers are used in automotive components such as bushings, mounts, seals, vibration dampers, suspension parts, and interior trims since they offer high durability and are lightweight in nature. Also, there has been a shift toward electric vehicles with a prime focus on improving fuel efficiency and battery range, which is significantly boosting demand in the market. In November 2025, Hyundai Transys and BASF together reported that they introduced a modular concept seat for purpose-built vehicles, featuring headrests and armrests made for the first time using Elastollan thermoplastic polyurethane that consists of supercritical fluid (SCF) injection foaming technology. Also, the fully recyclable TPU solution supports sustainable vehicle design and compliance with the EU’s proposed end-of-life vehicle regulation, hence encouraging more players to make investments in the market.

- Growth in footwear & consumer goods: This particular factor is mainly influenced by the rising worldwide demand for athletic and casual shoes, which use polyurethane elastomers in soles and cushioning materials for comfort, wear resistance, and performance. As per the article published by the Bureau of Indian Standards in June 2023, it has revised the standard for sports footwear under IS 15844 in India, which looks into quality and performance requirements for athletic and casual shoes that are being sold in the country. It also states that these standard covers materials used in midsoles and sock liners, where polyurethane and thermoplastic urethane are listed along with other materials such as EVA for cushioning and outsole applications, thereby recognizing their role in terms of athletic footwear, hence increasing the polyurethane elastomers market uptake with evidence-based factors.

- Industrial & manufacturing applications: Industries such as mining, manufacturing, logistics, and material handling are mostly showcasing a preference for PU elastomers for wear-resistant wheels, rollers, conveyor belts, and seals that reduce maintenance and downtime. In March 2025, Huntsman notified that it had partnered with RÄDER-VOGEL to develop a new generation of PEVOTEC anti-static wheels using TECNOTHANE polyurethane elastomers, which are especially designed to reduce static build-up in industrial settings and protect equipment and personnel. The wheels, available in 55 to 97 shore A hardness, are suitable for applications including AGVs in logistics, automated car parks, clean rooms, and mining lift shafts. Such moves showcase the continued adoption of the market and support efficiency in manufacturing, logistics, mining, & material handling operations.

Challenges

- Environmental and regulatory constraints: The aspect of strict environmental regulations associated with emissions, chemical handling, and waste disposal major obstacle for the market expansion. These elastomers are mostly petroleum-based and consist of chemicals that might cause health and environmental risks if they are not managed properly. Governments across North America, Europe, and parts of Asia are tightening regulations on volatile organic compounds, hazardous substances, and carbon emissions. Therefore, to comply with the regulations, certain investments are required in cleaner technologies, reformulation of products, and adoption of sustainable practices, which can increase operational costs. Furthermore, addressing these hurdles with performance and cost efficiency is a major challenge for manufacturers operating in this field.

- Competition from alternative materials: Polyurethane elastomers face competition from alternative materials such as thermoplastic elastomers, rubber, silicone, and bio-based polymers. Also, these alternatives often come with alternatives such as easier recyclability, lower processing costs, or compliance with sustainability goals. Therefore, in certain applications, end users may look for substitute materials that provide adequate performance at lower prices. In addition, continuous advancements in competing materials are narrowing the performance factors of polyurethane elastomers. This competitive pressure forces manufacturers in the polyurethane elastomers market to make investments in performance enhancement, increasing R&D costs while simultaneously dealing with price-sensitive customers in various sectors.

Polyurethane Elastomers Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.9% |

|

Base Year Market Size (2025) |

USD 7.1 billion |

|

Forecast Year Market Size (2035) |

USD 11.8 billion |

|

Regional Scope |

|

Polyurethane Elastomers Market Segmentation:

Application Segment Analysis

The furniture sub-segment is anticipated to lead the entire market, with the largest share of 35.7% during the discussed timeframe, mainly driven by their versatility, durability, comfort, and customizable performance properties. Also, their applications in cushions, mattresses, and structural components reflect their prominent role in producing high-quality, long-lasting furniture. As per the article published by NIH in June 2025, polyurethanes are polymers that are widely used in furniture due to their advantages of durability, flexibility, and lightweight properties. In addition, PU elastomers are composed of alternating soft and hard segments, providing a unique combination of elasticity and strength, making them ideal for cushions, mattresses, and structural components. Also, improvements in terms of processing techniques, thermoplastic formulations, and sustainability efforts, including chemical recycling and biobased PUs, are expanding their industrial applications, hence denoting a wider segment scope.

Type Segment Analysis

Thermoplastic polyurethane, which is a part of the type segment, is expected to grow at a considerable rate due to recyclability and compatibility with circular-economy goals. Governments across the globe are tightening material sustainability and recyclability standards, particularly in transportation and consumer products, which drives consistent growth of the TPU when compared to thermoset alternatives. In this context, the UNEP and UNITAR in January 2026 reported a few statistical guidelines for measuring flows of plastic throughout the life cycle by providing a standardized methodology for tracking plastics, which includes thermoplastics, across production, consumption, and waste streams. It also notes that by enabling consistent, high-quality statistics, this guideline deliberately supports policymaking for circular-economy initiatives and sustainable material management. This is encouraging the adoption of recyclable polymers such as TPU in consumer products and transportation applications, benefiting the polyurethane elastomers market.

Processing Method Segment Analysis

Injection molding leads among processing methods due to its material efficiency, scalability, and suitability for high-volume automotive and medical components. Also, the government-backed manufacturing modernization programs and industrial efficiency initiatives support the adoption of advanced polymer processing technologies in major manufacturing economies. Injection molding is best known for enabling very precise dimensional control and complex geometries, making it highly suitable for producing ergonomic and safety-critical parts. On the other hand, its compatibility with thermoplastic elastomers allows for recyclability and alignment with circular-economy objectives in most nations. Furthermore, integration with smart manufacturing and Industry 4.0 technologies enhances quality assurance in high-volume production environments, thereby fostering a profitable business environment for the polyurethane elastomers market.

Our in-depth analysis of the polyurethane elastomers market includes the following segments:

|

Segment |

Subsegments |

|

|

|

Type |

|

|

Processing Method |

|

|

Form |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Polyurethane Elastomers Market - Regional Analysis

APAC Market Insights

The Asia Pacific polyurethane elastomers market has registered its position as the largest regional landscape with around 49.6% share during the forecast duration. The region’s dominance in this field is mainly attributable to a massive production base and industrial sectors across China, Japan, and India. Also, the aspects of ongoing industrialization and expanding automotive and construction sectors support high demand for elastomer products in the region. In this context International Trade Administration in November 2025 reported that Japan is the fourth largest automotive industries at the international scale, which sold 4.42 million new vehicles in 2024, contributing 2.9% to GDP and employing 5.58 million people. Furthermore, domestic brands dominate the market (95%), whereas the government proactively promotes EV adoption, with a key goal for full EV penetration in new passenger car sales by 2035, positively impacting market growth.

New Vehicle Sales and Segment Share in Japan (2024)

|

Segment |

2024 Sales (Units) |

% of Total New Vehicle Sales |

|

Total New Vehicles |

4,421,494 |

100% |

|

Passenger Cars |

3,725,200 |

84.2% |

|

Trucks |

686,197 |

15.5% |

|

Buses |

10,097 |

0.3% |

|

Kei Cars |

1,557,868 |

35.3% |

|

Hybrid Vehicles (HV) |

2,040,181 |

46.1% |

|

Electric Vehicles (EV) |

59,736 |

1.35% |

Source: International Trade Administration

The increased urbanization and smart city initiatives are driving China market. Elastomers are being applied in infrastructure projects, which include high-traffic flooring, modular construction, and vibration-resistant public transport components. Simultaneously, manufacturers in the country are making investments in scalable production technologies to meet domestic demand and support export growth. As per the article published by NIH in January 2026, a bioinspired polyurethane elastomer was developed in the country by using multiple hydrogen bonds (UPy) and metal coordination bonds (DAP-Fe(III)) to achieve exceptional mechanical properties. The material demonstrated high tensile stress, i.e., approximately 30 MPa, extreme stretchability 4100%, toughness 470 MJ m⁻³, along with tremendous self-healing and recoverability. Therefore, this use of dynamic sacrificial bonds offers a highly reliable strategy for durable polymer applications in electronics, soft robotics, and wearable devices.

The growth in the automotive and two-wheeler sectors, particularly in interior components, dashboards, and seating systems, is increasing the pace of progress of the market in India. Also, the government’s push for Make in India and the modernization of domestic manufacturing plants is encouraging local development of high-performance elastomeric materials. In November 2025, as stated by IBEF, the country’s automotive sector is a key driver of economic growth and technological advancement, wherein the two-wheelers lead the market in volume, driven by a young population, a growing middle class, and rising rural demand. In addition, the vehicle electrification, particularly in two- and three-wheelers and small passenger cars, is shaping future growth. Furthermore, it is supported by strong export performance, and the automobile exports rose 19% in FY25 to more than 5.3 million units. Government initiatives such as the Automotive Mission Plan 2026, scrappage policy, and PLI scheme, India is poised to strengthen its position in the global market, increasing the demand for polyurethane elastomers.

North America Market Insights

The North America polyurethane elastomers market is mainly driven by innovations in terms of sustainable materials and high-performance industrial applications. Research institutions and universities in the country collaborate with manufacturers to develop bio-based polyols and thermoplastic polyurethane blends, positioning North America as a major hub for advanced polymer research. In March 2025, BASF announced that it had launched biomass balance grades of Elastoflex polyurethane foam systems for the region’s furniture industry, with a main goal to replace fossil feedstocks with renewable materials. These REDcert2-certified products can reduce the product carbon footprint by up to 75% when compared to conventional polyurethane foams and are suitable for seating, headrests, and armrests, hence making it suitable for standard market growth.

The aerospace and defense sectors, where their lightweight and flexible properties are highly used in seals, gaskets, and vibration-damping components fosters growth of the U.S. market. The market is also supported by government-funded initiatives, which are promoting lightweighting technologies to improve fuel efficiency and reduce emissions in transportation systems. The U.S. Department of Energy revealed that in the U.S., the Vehicle Technologies Office supports research and development of lightweight and advanced materials to improve fuel efficiency and vehicle performance. It states that utilizing lightweight components such as polymers and composites can reduce vehicle weight by 10% to 75%, enhancing fuel economy, extending electric vehicle range, and lowering battery requirements, hence increasing the growth potential of the market.

There is a huge opportunity for Canada polyurethane elastomers market since it is closely linked to innovations in sustainable construction materials, such as high-performance insulation panels and energy-efficient building coatings. Besides, the country’s government proactively supports green building certifications and energy conservation programs, which efficiently encourage the adoption of PU-based materials with superior thermal and acoustic properties. In this context, the country’s government reported that the Investing in Canada Plan (IICP), which was led by Housing, Infrastructure, and Communities Canada, has committed over USD 157.5 billion through 2024-25 to modernize infrastructure and promote a low-carbon economy. In addition, the plan also advances energy-efficient infrastructure, creating strong opportunities for high-performance materials such as polyurethane elastomers in construction.

Europe Market Insights

The emphasis of sustainability and circular economy initiatives allowed Europe polyurethane elastomers market to acquire a prominent position in the international landscape. Countries in the region are mainly focused on recycling programs and the use of bio-based feedstocks. Simultaneously, manufacturers are exploring different types of eco-friendly elastomer production, which aim to reduce carbon footprints. For instance, in October 2024, Henkel reported that its Düsseldorf site became its third facility in the region to receive ISCC PLUS certification for polyurethane production, marking a significant step in sustainable operations. Besides, the certification ensures the use of bio-based, recycled, or CO₂-based raw materials through the mass balance model, enhancing both transparency and traceability across the supply chain, hence making it suitable for standard market growth in the years ahead.

Supported by its strong engineering and automotive industries, which are looking to advance PU elastomer applications in high-precision machinery and industrial rollers, the Germany polyurethane elastomers market is growing. The country also has a priority towards digitalization and Industry 4.0 integration in production lines, enhancing process efficiency in elastomer manufacturing. Covestro, in December 2024, announced plans to build a pilot plant in Leverkusen to chemically recycle high-performance elastomers such as Vulkollan, which will allow it to recover more than 90% of end-of-life material. The process significantly reduces carbon footprint when compared to virgin materials, while maintaining product quality for applications such as forklift wheels and automotive components. Therefore, with the presence of all such expansions, the market is growing in the country.

The polyurethane elastomers market in France is primarily driven by diverse industrial applications and stringent sustainability standards in the region. The high-performance polymers are being used in automotive components, industrial machinery parts, and construction materials due to their durability and resistance to abrasion. Besides, manufacturers and suppliers in the country, often influenced by strict EU REACH and circular economy regulations, are focusing on advanced, environmentally compliant polyurethane elastomer formulations and bio-based alternatives to meet green innovation goals, whereas major chemical producers like Arkema play a significant role in supplying specialty elastomer products domestically and for export. The market also benefits from the country’s growing interest in medical and consumer applications, reflecting broader trends toward sustainability and multi-sector usage.

Key Polyurethane Elastomers Market Players:

- Covestro AG (Germany)

- BASF SE (Germany)

- The Dow Chemical Company / Dow Inc. (U.S.)

- Huntsman Corporation (U.S.)

- The Lubrizol Corporation (U.S.)

- Wanhua Chemical Group Co., Ltd. (China)

- Mitsui Chemicals, Inc. (Japan)

- LANXESS AG (Germany)

- Era Polymers Pty Ltd (Australia)

- American Urethane, Inc. (U.S.)

- Argonics, Inc. (U.S.)

- Coim Group (Italy)

- Hexpol AB (Sweden)

- Zibo Huatian Rubber & Plastic Technology Co., Ltd. (China)

- Huafeng Group (China)

- Huide Technology Co., Ltd. (China)

- Zhongke Yourui (China)

- P+S Polyurethan‑Elastomere GmbH & Co. KG (Germany)

- Reckli GmbH (Germany)

- Baule SAS (France)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Covestro AG is a leading player in this field, and it is one of the major manufacturers of high-performance polyurethane materials. The firm’s strategy includes expanding regional service networks, strengthening customer-centric solutions, and integrating circular economy principles. In addition, Convestro’s elastomer solutions are suitable for industries such as automotive, construction, logistics, and offshore applications.

- BASF SE is identified as one of the world’s largest chemical producers, which provides a wide portfolio of polyurethane elastomers under the Elastollan brand. The company is focused mainly on performance optimization and sustainability, developing TPU grades with high hydrolysis resistance, mechanical durability, and recyclability.

- The Dow Chemical Company is yet another prominent player in this field, which produces polyurethane elastomers for diverse industrial and consumer applications. Besides, the company makes continued investments in R&D to improve mechanical properties, chemical resistance, and processing efficiency.

- Huntsman Corporation is offering both cast and thermoplastic varieties through product lines such as IROGRAN, IROSTIC, and AVALON. Expanding distribution networks and obtaining sustainability certifications are a few strategies opted for by the firm to maintain its strong position in the industry.

- The Lubrizol Corporation specializes in terms of high-performance TPU elastomers, particularly for industrial, transportation, and consumer applications. The company focuses on enhancing mechanical properties, durability, and chemical resistance, and invests in application development, regional technical support, and sustainable product offerings.

Below is the list of some prominent players operating in the global market:

The polyurethane elastomers market hosts major companies that are pursuing constant growth tactics such as innovation, sustainability, and regional expansion to maintain a strong market share. Leading pioneers such as Covestro, BASF, Dow, Huntsman, and Lubrizol are focused on high-performance formulations, circular economy integration, and R&D partnerships. On the other hand, players based in emerging economies such as Wanhua, Huafeng, and Mitsui Chemicals are looking to expand capacity and diversify applications to meet regional demand. In this context, Volatile Free, Inc., in January 2024, announced a new liquid polyurethane rubber line that significantly improves demolding, reducing breakage rates in cast stone and manufactured stone veneer production by up to 80% when compared to the typical 8% to 10% breakage. Hence, such moves from the market players enhance the market growth by efficiently driving technological advancements and expanding a wide range of high-performance applications.

Corporate Landscape of the Market:

Recent Developments

- In July 2025, Covestro announced the expansion of its cast polyurethane elastomers business in Taiwan for industries such as smart logistics, automated equipment, offshore wind, construction, and pulp & paper. The move strengthens service support for products such as Desmodur, Vulkollan, Baytec, and Baulé, for industrial casters, subsea cable protection, and waterproofing systems.

- In February 2025, Nordmann announced the expansion of its 12-year partnership with Wanhua Chemical Group, extending from thermoplastic polyurethanes to the distribution of Polymethylmethacrylate (PMMA, Acryplas) across Europe. The collaboration focuses on the automotive, construction, and consumer electronics industries.

- Report ID: 2842

- Published Date: Feb 16, 2026

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Polyurethane Elastomers Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.