Polypropylene Nonwoven Fabrics Market Outlook:

Polypropylene Nonwoven Fabrics Market size was valued at USD 31.56 billion in 2025 and is likely to cross USD 59.24 billion by 2035, registering more than 6.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of polypropylene nonwoven fabrics is assessed at USD 33.41 billion.

The primary growth factor of the global polypropylene nonwoven fabrics market is the rapid expansion of the textile industry. The expanding textile industry indicates the rising power to escalate the production rate of polypropylene nonwoven fabrics. As per recent reports, the revenue generated by the global textile industry stood at USD 900 billion in the year 2018. It is further projected to reach approximately USD 1,250 billion by 2024, with a steady CAGR of nearly 5%.

Polypropylene nonwoven fabrics have many added benefits such as strong impermeability, high tensile strength, flexibility, and good stability. These benefits are expected to propel the demand for polypropylene nonwoven fabrics in various end-use industries such as automotive, healthcare, hygiene, furnishings, geotextiles, and others in the upcoming years. Furthermore, the increase in the prevalence of diseases is also estimated to increase the sales of polypropylene nonwoven fabrics as it is being used to prepare medical products and hygiene items which are imperative in the treatment process of diseases and illnesses. In addition to the aforementioned factors, the rapid growth in the automotive industry and the adoption of polypropylene nonwoven fabrics for making durable and lightweight automotive components are projected to bring favorable opportunities for the expansion of the market size. Moreover, the recent development of advanced polypropylene nonwoven fabrics that could be used in a wide range of industries is forecasted to create a positive outlook for market growth in the next few years.

Key Polypropylene Nonwoven Fabrics Market Insights Summary:

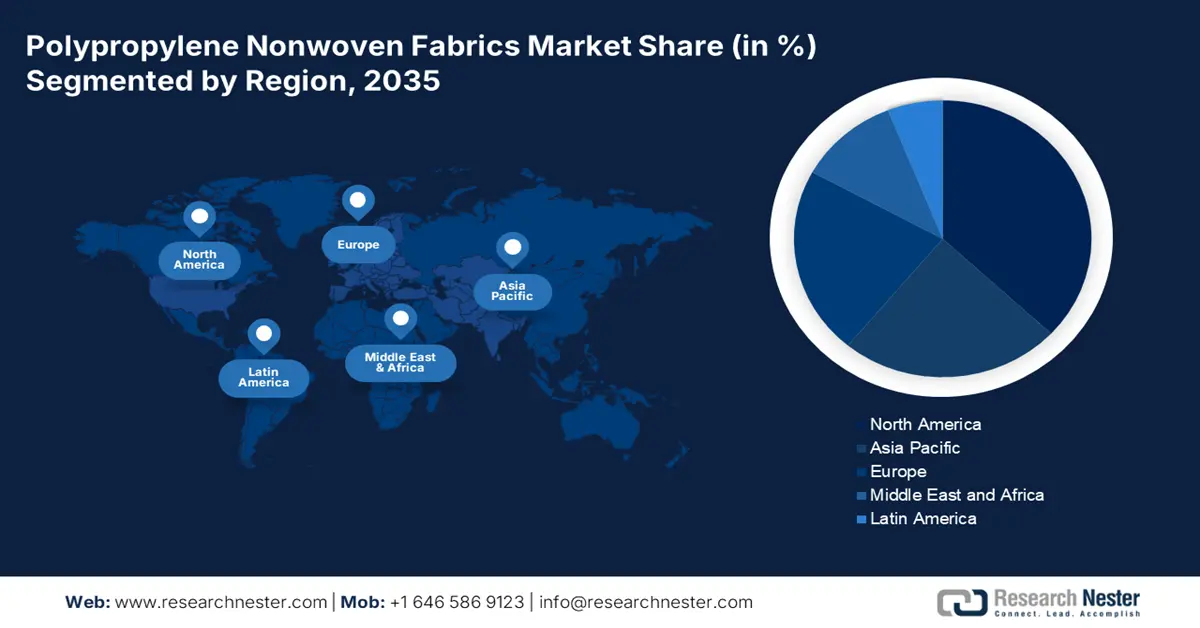

Regional Highlights:

- North America polypropylene nonwoven fabrics market holds the largest share by 2035, driven by healthcare sector expansion and rising polypropylene usage.

- Asia Pacific market will register significant growth from 2026 to 2035, attributed to high R&D investment and growth in textile businesses.

Segment Insights:

- The medical segment in the polypropylene nonwoven fabrics market is projected to achieve the highest market share by 2035, driven by the increase in chronic and acute diseases worldwide.

- The spunbound segment in the polypropylene nonwoven fabrics market is projected to exhibit a remarkable CAGR over 2026-2035, attributed to high demand across industries due to low cost and eco-friendly properties.

Key Growth Trends:

- Growing Global Healthcare Sector

- Quick Growth in the Global Automotive Industry

Major Challenges:

- Volatility in Raw Material Prices

- Rising Concern Related to Stringent Government Rules

Key Players: Asahi Kasei Corporation, Kimberly-Clark Corporation, Berry Global Group, Inc., Lydall, Inc., First Quality Nonwovens, Inc., PFN Nonwovens A.S., Schouw & Co., Mitsui Chemicals, Inc., Toray Industries, Inc., Freudenberg Group.

Global Polypropylene Nonwoven Fabrics Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 31.56 billion

- 2026 Market Size: USD 33.41 billion

- Projected Market Size: USD 59.24 billion by 2035

- Growth Forecasts: 6.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, South Korea

- Emerging Countries: China, India, Japan, South Korea, Indonesia

Last updated on : 9 September, 2025

Polypropylene Nonwoven Fabrics Market Growth Drivers and Challenges:

Growth Drivers

-

Growing Global Healthcare Sector – The growing number of diseases, illnesses, and disorders are putting a burden on the global economy which brings the need for polypropylene nonwoven fabrics for producing healthcare essentials such as face masks, isolation gowns, drapes, single-use caps, shoes, head covers, and others. Thus, the swift expansion of the global healthcare sector is estimated to attract lucrative growth opportunities for market growth in the forecast period. Recent data has revealed that the global healthcare segment is expected to grow with a steady CAGR of 10% and reach approximately USD 93 billion in 2027.

-

Quick Growth in the Global Automotive Industry – The characteristics of polypropylene nonwoven fabrics such as high durability, increased absorbency, resistance to heat and flames, liquid repellence, better thermal and acoustic insulation, protection against bacteria, and washability has propelled the demand for polypropylene nonwoven fabrics for manufacturing lightweight and efficient vehicles for mobility. Thus, the rapid growth in the automotive industry is projected to fuel the growth of the global polypropylene nonwoven fabrics in the assessment period. The latest report suggests that the revenue generation by the global automotive industry to reach approximately USD 9 trillion by 2030.

-

Rising Awareness Regarding Personal Hygiene – Owing to the spread of pandemics, epidemics, and other illnesses, people are focusing more on personal hygiene and grooming. As a result, the demand for polypropylene nonwoven fabric is anticipated to grow as it is used to produce personal protective equipment. Thus, the enlargement of the hygiene market is estimated to push forward the growth of the market by the end of the analysis period. Recently, it was calculated that the global personal hygiene industry generated a revenue of almost USD 525 billion in 2021 and is estimated to grow further and reach approximately USD 720 billion by 2030.

-

Increased Spending by Companies in R&D Activities – With the recent augmentation of various industries, major key players and governments of different nations are spending money on research and development activities for developing high-quality polypropylene nonwoven fabrics. Thus, the high investment in the R&D sector is anticipated to boost market growth during the forecast period. As to World Bank, Global Research and Development expenditure accounted for 2.63% of the total GDP in 2020. This was a rise from 2.13% of the total GDP in 2017.

Challenges

- Volatility in Raw Material Prices – Polypropylene nonwoven fabrics are manufactured using different raw materials. However, the constant fluctuation in the prices of raw materials makes it difficult for manufacturers to produce polypropylene nonwoven fabrics. This trend is therefore estimated to lower the production rate of polypropylene nonwoven fabrics and subsequently hamper market growth during the forecast period.

- Rising Concern Related to Stringent Government Rules

- Less Level of Awareness about the Benefits of Polypropylene Nonwoven Fabrics

Polypropylene Nonwoven Fabrics Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.5% |

|

Base Year Market Size (2025) |

USD 31.56 billion |

|

Forecast Year Market Size (2035) |

USD 59.24 billion |

|

Regional Scope |

|

Polypropylene Nonwoven Fabrics Market Segmentation:

End-user

The medical segment is attributed to garner the highest polypropylene nonwoven fabrics market share by the end of 2035. The major factor for the segment expansion is the rising case of chronic and acute diseases across the world which requires safe and efficient medical equipment such as gowns, caps, masks, gloves, and others which generates the need for polypropylene nonwoven fabrics owing to its various advantages. The data published in 2023 stated that in the United States, approximately 133 million suffer from at least one chronic disease including hypertension, heart disease, and arthritis. In addition, the increased focus on enhancing the infrastructure of the medical sector has propelled the key players to invest in developing enhanced equipment and products such as disposable protective apparel made with polypropylene nonwoven fabrics is also estimated to create a positive outlook for segment growth in the upcoming years.

Product

The spun bound segment is projected to hold the most significant share with a remarkable CAGR value during the forecast period. The primary factor attributed to segment growth is the high demand for spun bound polypropylene nonwoven fabrics in numerous end-use industries owing to its advantages such as low cost and eco-friendly. These types of fabrics are manufactured through the process of fiber spinning, integration of web formation, and bonding process which results in high-quality fabric that is durable, flexible, and resistant to harsh conditions. This factor is anticipated to drive segment growth in the upcoming years. It has also found its application in the personal care and hygiene industry owing to its softness, liquid repellence, and absorbent features which are estimated to bring opportunities for segment expansion.

Our in-depth analysis of the global market includes the following segments:

|

By Application |

|

|

By Product |

|

|

By End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Polypropylene Nonwoven Fabrics Market Regional Analysis:

North American Market Insights

The North America polypropylene nonwoven fabrics market, amongst the market in all the other regions, is projected to hold the largest market share by the end of 2035. The major factor that is projected to expand the market size in the North American region is the rising utilization of polypropylene nonwoven fabrics in manufacturing medical items along with the rapid expansion of the healthcare industry and increased healthcare expenditure of the people in the region. According to the data from the U.S. Centers for Medicare & Medicaid Services, national Medicare spending grew by 3.5% to USD 829.5 billion in 2020. Furthermore, the presence of major key players in the region and major end-use industries such as construction, agriculture, automotive, healthcare, and others is also expected to escalate the utilization rate of polypropylene nonwoven fabrics in the forecast period. Furthermore, the high demand for vehicles and automobiles is also considered to be a factor for market growth in the region during the forecast period.

APAC Market Insights

Asia Pacific region is set to witness significant growth till 2035. High investments in research and development activities to introduce novel textiles such as polypropylene nonwoven fabrics are also anticipated to impetus revenue generation in the forecast period.

Polypropylene Nonwoven Fabrics Market Players:

- Asahi Kasei Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Kimberly-Clark Corporation

- Berry Global Group, Inc.

- Lydall, Inc.

- First Quality Nonwovens, Inc.

- PFN Nonwovens A.S.

- Schouw & Co.

- Mitsui Chemicals, Inc.

- Toray Industries, Inc.

- Freudenberg Group

Recent Developments

-

Lydall, the maker of specialty filtration products worked in collaboration with the White House to replenish the PPE stockpile.

-

Asahi Kasei Corporation launched a premium stretch fiber under the brand of ROICA. This fiber has superior performance features enabled by integrated production from raw material to finished yarn based on its advanced technology.

- Report ID: 4007

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.