Acoustic Insulation Market Outlook:

Acoustic Insulation Market size was estimated at USD 16.76 billion in 2025 and is expected to surpass USD 27.94 billion by 2035, rising at a CAGR of 5.4% during the forecast period, i.e., 2026-2035. In 2026, the industry size of acoustic insulation is estimated at USD 17.64 billion.

The growing demand for noise reduction across various industries, such as aerospace, automotive, and construction, has resulted in significant improvements in the acoustic insulation market. The primary factors influencing this market include the increasing need for energy-efficient structures, stricter regulations governing noise, and heightened awareness of the detrimental effects of noise pollution on human health. These factors promote the widespread adoption of advanced insulation materials, enhancing the thermal insulation properties of buildings and vehicles while reducing sound transmission. In October 2023, Lios, a leader in acoustic metamaterial technology, announced that SoundBounce, its ground-breaking innovation, had been honored at the esteemed European Patent Office (EPO) Museum in Munich. This accomplishment represents an important turning point in SoundBounce's history and demonstrates its revolutionary influence on the acoustics industry. Lios' SoundBounce is a significant advancement in acoustic engineering and physics. It has outstanding capacity to reduce noise, an unmatched space-saving design, and steadfast dedication to sustainability.

Acoustic insulation's ability to enhance comfort, functionality, and sound quality has led to a significant increase in its use across specialized industries. It is utilized in the healthcare sector to reduce hospital noise, improving patient recovery and well-being. Hotels and resorts employ it in the hospitality industry to ensure that guests enjoy a tranquil environment, particularly in rooms and common areas. The automotive and aerospace sectors have adopted specialized materials to boost passenger comfort and overall experiences by minimizing noise in automobile and aircraft cabins. Furthermore, entertainment venues such as theaters and concert halls depend on acoustic insulation to establish optimal sound conditions and prevent outside noise interference, significantly enhancing audio quality and audience experience. These specific applications highlight the adaptability and importance of acoustic insulation across various sectors.

Key Acoustic Insulation Market Insights Summary:

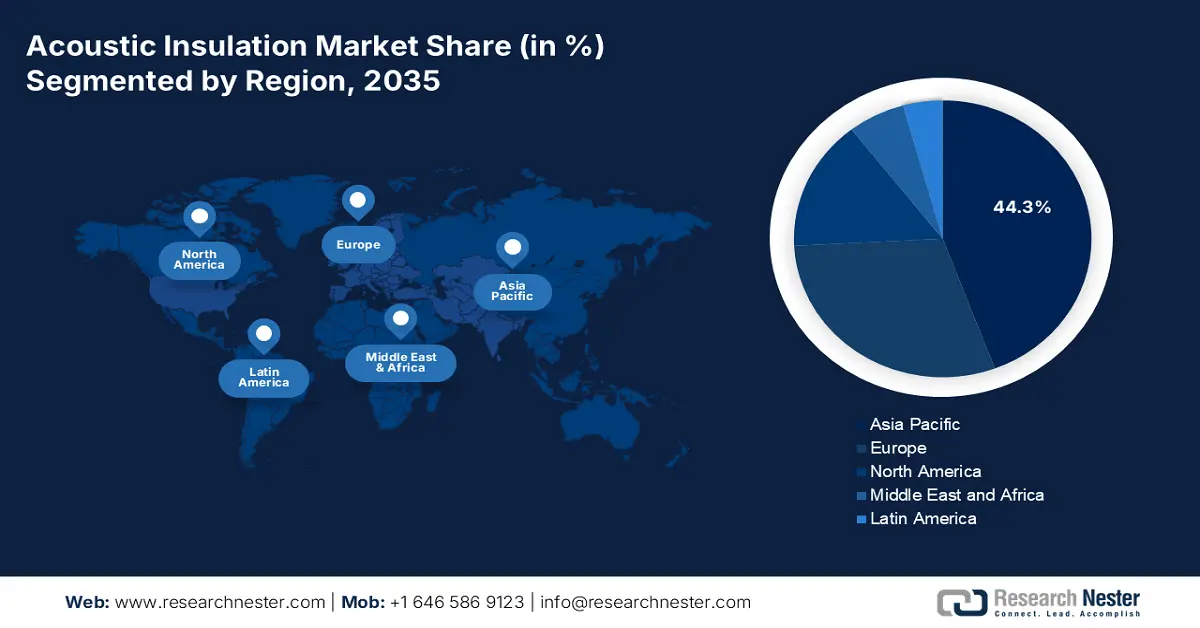

Regional Highlights:

- Asia Pacific is expected to lead the acoustic insulation market with a 44.3% share by 2035, owing to rapid infrastructure expansion, stringent acoustic regulations, and growing transportation and construction sectors.

- Europe is projected to hold a 29.9% market share by 2035, driven by strict building codes, energy efficiency mandates, and rising demand for quieter urban environments.

Segment Insights:

- The Rock Wool segment is projected to gain a 43.5% share of the acoustic insulation market through 2035, owing to its superior thermal insulation, fire resistance, and sound absorption properties.

- The Building & Construction segment is likely to hold a significant share by 2035, propelled by rapid urbanization, noise pollution awareness, and the demand for energy-efficient acoustic solutions.

Key Growth Trends:

- Increasing demand in the construction sector

- Expansion in the automotive sector

Major Challenges:

- Fluctuation in raw material prices

- Limited awareness

Key Players: ROCKWOOL International A/S, NIHON GLASS FIBER INDUSTRIAL CO., LTD., Owens Corning (Owens Corning LLC), Knauf Insulation GmbH / Knauf Insulation, Johns Manville Corporation, Kingspan Group plc, Armacell International S.A., BASF SE, K-FLEX S.p.A., Fletcher Insulation, KCC Corporation, Superlon Worldwide Sdn. Bhd., Polybond Insulation Pvt. Ltd., Asahi Kasei Corporation, Toray Industries, Inc.

Global Acoustic Insulation Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 16.76 billion

- 2026 Market Size: USD 17.64 billion

- Projected Market Size: USD 27.94 billion by 2035

- Fastest Growing Region: Growth Forecasts: 5.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (44.3% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, Japan, Germany, France, United States

- Emerging Countries: India, South Korea, Brazil, Canada, Australia

Last updated on : 29 September, 2025

Acoustic Insulation Market - Growth Drivers and Challenges

Growth Drivers

- Increasing demand in the construction sector: The construction industry is a major contributor to the growth of acoustic insulation market, which is made possible by strict building norms and regulations that require soundproofing to reduce noise pollution. The increasing emphasis on creating noise-free surroundings to satisfy both customer preferences and legal requirements for advanced acoustic environments is demonstrated by the broad product usage. Furthermore, the need for acoustic insulation is significantly fueled by the expanding construction industry, which is further exacerbated by ongoing urbanization and infrastructure development. The construction industry in India is expected to retain a robust revenue growth momentum in FY2025, with a forecast YoY growth of 12-15% following a remarkable 18-20% revenue growth in FY2024. It is encouraging for the industry as the government has increased capital expenditures to USD 13.11 trillion (+16.9% YoY) in the FY2025 budget estimates (BE), which reflects its emphasis on infrastructure.

- Expansion in the automotive sector: Automobile manufacturers are requiring acoustic insulation to lessen engine and road noise in an attempt to enhance interiors. EVs, which are comparatively quieter than traditional automobiles but still need to be soundproofed, are becoming more and more popular, which is contributing to this trend. Acoustic insulation has grown as a result of the car industry's ongoing focus on improving passenger comfort and meeting stringent noise pollution regulations. According to IEA data, there were 58 million electric car sales worldwide in 2024. In 2024, China's share of the world's electric car sales grew by nearly 40% year over year. Premium acoustic materials are being easily incorporated by the automotive industry to provide a more comfortable and peaceful driving experience, hence meeting changing customer demands and legal requirements.

- Technological advancements in materials: The development of lightweight, eco-friendly, and high-performance insulation materials, such as recycled fiber composites, aerogels, and advanced foams, further improves noise abatement while also offering improved fire resistance, thermal efficiency, and reduced overall labor installation costs, while opening up additional applications for architects, contractors, and automotive manufacturers. Research and development continue to create new and innovative multifunctional materials that meet the increasing expectations of durable and sustainable material advancements, combined with new evolutionary building performance standards.

Emerging Trade Dynamics

Slag Wool, Rock Wool & Similar Mineral Wools Trade in 2023

|

Exporting Country |

Value (USD thousands) |

Quantity (kg) |

|

Poland |

516,154.17 |

259,488,000 |

|

European Union |

408,891.19 |

196,596,000 |

|

China |

347,862.01 |

252,127,000 |

|

Netherlands |

259,052.06 |

97,131,200 |

|

Germany |

212,403.48 |

132,370,000 |

|

United Kingdom |

159,653.62 |

30,160,000 |

|

Croatia |

153,417.80 |

136,828,000 |

|

Japan |

144,473.18 |

- |

|

Slovenia |

125,745.52 |

102,639,000 |

|

France |

121,238.54 |

74,410,400 |

Source: WITS

Challenges

- Fluctuation in raw material prices: The acoustic insulation market’s expansion will be severely hampered by the high cost of the materials. The rate of market expansion will be slowed by changes in raw material prices. Additionally, the market growth rate in the underdeveloped economies will be further disrupted by ignorance. The market growth rate is expected to be hampered by the slowdown in the European construction sector and unfavorable circumstances resulting from the COVID-19 pandemic.

- Limited awareness: The acoustic insulation market is negatively impacted by factors such as the high capital costs of acoustic insulation in buildings and the lack of awareness of acoustic insulation materials in emerging nations. In developing markets such as India, Africa, and other Southeast Asian nations, acoustic insulation is still viewed as a luxury rather than a need. Additionally, these economies exhibit a general lack of acoustic awareness as well as a lack of knowledge regarding the main advantages of the most cost-effective insulation. Customers in these nations view acoustic insulation as only a soundproofing method that should be used only in the home's entertaining areas. This market would expand in these nations due to rising acoustic awareness.

Acoustic Insulation Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.4% |

|

Base Year Market Size (2025) |

USD 16.76 billion |

|

Forecast Year Market Size (2035) |

USD 27.94 billion |

|

Regional Scope |

|

Acoustic Insulation Market Segmentation:

Product Segment Analysis

The rock wool segment is projected to gain a 43.5% share through 2035. This is due to the extraordinary capacity for thermal insulation, fire resistance, and sound absorption. Because of these qualities, it is a popular option for many different applications in the building sector. Rock wool's fibrous structure efficiently captures sound waves, minimizing the transmission of noise at different frequencies. In addition, it is non-combustible, it improves building safety, and guarantees adherence to strict fire regulations. In keeping with an eco-friendly environment, rock wool acoustic insulation is also made from recycled materials. Rock wool has been used in notable construction projects, such as the new Istanbul Airport, because of its superior acoustic qualities and affordability when compared to synthetic alternatives. The innovative architecture of the new USD 12 billion Istanbul Airport in Turkey heavily relies on Armourcoat's Acoustic Seamless Plaster system. The airport, which is expected to be finished by 2028, will be able to handle 200 million passengers a year, making it the biggest in the world. Its market dominance, especially in major commercial and industrial projects, has been further strengthened by this.

End use Segment Analysis

The building and construction segment is likely to hold a noteworthy share by the end of 2035. The rapid industrialization and urbanization that fueled more building projects, together with noise-cancelling measures. By 2040, India’s urban population is projected to grow by about 270 million, comparable to adding a city the size of Los Angeles each year. Despite this massive expansion, 50% of India’s total population is expected to reside in urban areas. For increased productivity and user experience, commercial venues, including offices, theaters, movie theaters, and schools, need to have the best acoustics possible. Growing awareness of the detrimental effects of noise pollution on health also led to a greater use of soundproofing materials, which in turn drove the market. Additionally, the use of acoustic insulating materials for energy efficiency and sound resistance has been encouraged by the movement toward green buildings and sustainable construction methods.

Application Segment Analysis

The wall insulation segment is likely to hold a noteworthy share by the end of 2035. Wall insulation is the largest component of the acoustic insulation market, as vertical surfaces are the biggest contributor to sound transmission between rooms and adjacent structures. Walls have the greatest surface area and are the main contributor to achieving residential, commercial, and industrial noise regulations. Structural insulated panels (SIPs) are prefabricated elements for walls, roofs, ceilings, and floors, delivering airtight construction with 12-14% energy savings, enhanced insulation, improved comfort, and reduced noise. The increases in urbanization, multi-family housing, and open-plan office spaces have increased the demand for higher performing wall assemblies, making wall insulation not only the most important, but the most used sub-segment compared to floors, ceilings, roofs, doors, and windows.

Our in-depth analysis of the acoustic insulation market includes the following segments:

|

Segment |

Subsegments |

|

Product |

|

|

End Use |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Acoustic Insulation Market - Regional Analysis

Asia Pacific Market Insights

Asia Pacific is expected to lead the acoustic insulation market with a share of 44.3% by 2035. The market for acoustic insulation is expected to expand over the next several years due to the expanding transportation sector and infrastructure. The market for acoustic insulation materials is expanding due to several causes, including the stringent building acoustic isolation regulations, the need to control noise in industrial equipment and transportation, and others. An optimistic outlook for market expansion has been provided by the construction industry. A typical lightweight office partition provides about 45 dB Dw sound insulation, reducing 65 dB of speech to roughly 20 dB. If the source noise rises to 75 dB, the adjacent room experiences about 30 dB, making conversation audible. The industry has grown as a result of advanced building methods and stringent requirements for these structures, one of which is acoustic comfort.

The China acoustic insulation market is expanding as Chinese consumers become more conscious of the negative health impacts of noise pollution, including stress, sleep disorders, and decreased productivity, driving up demand for soundproof living and working spaces. China’s three-year civil airport noise action plan aims to build a pollution control standard system by 2025. Airports handling nearly 5 million passengers must enable real-time noise monitoring, while by 2027, areas around airports with more than 10 million passengers should see improved environmental quality. As more individuals place a higher priority on soundproofing to create calm and healthy interior environments, this trend is propelling the usage of acoustic insulation materials in the residential, commercial, and healthcare sectors. In February 2025, China built 2,132 quiet communities, installed 4,005 noise-monitoring stations in 338 cities, and placed 177,000 industrial enterprises under a noise-emissions permit system. In 2024, 11 provinces designated over 860 square kilometers as noise-sensitive building zones.

In India, the need for efficient acoustic insulation solutions has increased due to the fast urbanization of the nation, especially in major cities. Due to the construction growth, there is a greater requirement for noise reduction in both residential and commercial settings. The region's industry is expanding more quickly now that more reasonably priced and effective materials are available, which has made it simpler for manufacturers and builders to incorporate acoustic solutions. Budgetary allotments for infrastructure in India have increased rapidly, reaching ₹10 lakh crore in 2023-2024. The need for acoustic insulation solutions has been fueled by India's expanding infrastructure development and growing awareness of the value of acoustics in building projects, especially in places such as Mumbai and New Delhi.

Europe Market Insights

Europe is expected to lead the acoustic insulation industry with a share of 29.9% by 2035. Strict building code requirements for energy efficiency and noise pollution are the main drivers of the rising demand for soundproofing solutions. The use of acoustic insulation in residential and commercial structures has been pioneered by nations such as France, Germany, and the U.K. This demand has been driven by a rise in development projects aimed at improving the quality of life, as well as a growing focus on creating quieter urban areas. One of the main goals of the EU's zero pollution action plan is to lessen the adverse effects of exposure to environmental noise. By 2030, the plan seeks to cut the number of individuals who are regularly bothered by noise from transportation by 30%.

Germany's growing need for acoustic insulation solutions has been fueled by significant construction projects, including the expansion of public transportation networks and the remodeling of commercial buildings. The region's supremacy has also been aided by the growth of green building programs and the use of sustainable construction techniques. Its significant building industry and dedication to sustainability have led to a dramatic increase in the use of acoustic insulation solutions. Knauf Insulation glasswool, made with advanced German fiberisation and ECOSE Technology from recycled glass, offers non-combustibility per AS 1530.1. In steel stud systems with 13mm plasterboard, it's 11kg/m³ acoustic batts deliver superior STC ratings compared to polyester insulation. Furthermore, the technological developments in the area of insulating material manufacturing have aided in the market's overall expansion.

In the U.K., consumers in the market were looking for better interior surroundings, particularly in commercial settings. Due to this demand, businesses, educational institutions, theaters, and entertainment venues are prioritizing the best possible acoustics for both customer satisfaction and efficiency. Furthermore, the market has benefited from increased spending on cars and leisure activities brought on by rising disposable income. In May 2024, the PERFORMANCE Technology Group company Mayplas introduced a thermal and acoustic insulation product for suspended ceiling systems in May 2024 that is derived from industrial hemp farmed in the United Kingdom. The hemp pad, named 'Thermapad', is part of the company's new GroundID line of insulating products that incorporate natural fibers. A natural fiber hemp slab is sliced and enclosed by Mayplas to create Thermapad, which comes in various sizes to match metal tray ceiling systems from various manufacturers.

North America Market Insights

North America is expected to lead the acoustic insulation industry with a share of 15.3% by 2035. Owing to strict building regulations to improve energy efficiency and manage noise in commercial as well as residential applications. Increased urbanization, growth in the construction infrastructure, and heightened awareness of the benefits of indoor acoustic comfort encourage the use of acoustic insulation. Demand stretches across the construction, automotive, and industrial market segments, and increased innovations in environmentally-friendly materials, along with an active government commitment to developing green buildings, will all continue to stimulate growth across this region. North America is expected to remain a recognized global leader in providing acoustic insulation solutions.

Dramatic growth in the U.S. acoustic insulation market is driven primarily by an increased focus on federal and state energy-efficiency regulations in combination with sustainable construction practices. The combination of high urban density and a healthy renovation activity has increased demand for residential and commercial buildings. Approximately 40-60% of fiberglass products are made from recycled glass. In the production of mineral wool, 75% post-industrial recycled material is typically used. Vehicle manufacturers are increasingly incorporating high-performance acoustic materials to meet comfort and emission standards. Wool’s unique chemistry allows it to absorb up to 30% of its weight in moisture without feeling damp, helping regulate and maintain balanced humidity levels inside a car’s interior.

The expansion of the acoustic insulation market in Canada is driven by various factors, which include building codes, adverse climatic conditions, and government drives for energy-efficient, noise-reducing constructions. Urban activity continues to drive demand for multi-family units with improved soundproofing in cities like Toronto and Vancouver. Growth of new developments in automotive and industrial applications, along with ambitious sustainability goals and incentives to procure sustainable materials, is driving rapid innovations in the market. Likewise, Canada's ongoing commitment to low-carbon and high-performance buildings will allow more and more advanced acoustic insulation to be adopted in residential, commercial, and industrial projects.

Key Acoustic Insulation Market Players:

- ROCKWOOL International A/S

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- NIHON GLASS FIBER INDUSTRIAL CO., LTD.

- Owens Corning (Owens Corning LLC)

- Knauf Insulation GmbH / Knauf Insulation

- Johns Manville Corporation

- Kingspan Group plc

- Armacell International S.A.

- BASF SE

- K-FLEX S.p.A.

- Fletcher Insulation

- KCC Corporation

- Superlon Worldwide Sdn. Bhd.

- Polybond Insulation Pvt. Ltd.

- Asahi Kasei Corporation

- Toray Industries, Inc.

The market for acoustic insulation is expected to grow steadily due to its versatile properties and growing demand across several industries, particularly in the infrastructure, automotive, and advanced manufacturing sectors. To take advantage of new market opportunities and technological advancements, future industry expansion will require addressing competition, raw resource availability, and environmental concerns.

Some of the key players operating in the market are listed below:

Recent Developments

- In July 2022, Rockwool International introduced NyRock stone wool technology to the UK. It is claimed that this product is the "lowest lambda stone wool insulation available in the UK." This product, which is made with a proprietary technique, has a low thermal conductivity of 0.032W/mK. When compared to comparable goods, NyRock offers better insulation even with thinner constructions.

- In August 2021, Owens Corning introduced PINK Next Generation Fiberglas Insulation, a significant development in building insulation technology. This new product range prioritizes sustainability and environmental responsibility while offering exceptional thermal and acoustic performance. In keeping with the company's goal of lowering its carbon footprint, the PINK Next Gen insulation has a more environmentally friendly production method that uses less energy and emits fewer greenhouse gases.

- Report ID: 4974

- Published Date: Sep 29, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Acoustic Insulation Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.