Nonwoven Fabrics Market Outlook:

Nonwoven Fabrics Market size was valued at USD 57.51 billion in 2025 and is expected to reach USD 100.11 billion by 2035, registering around 5.7% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of nonwoven fabrics is evaluated at USD 60.46 billion.

The growth of the market can be attributed to surge in demand for medical masks owing to the spread of covid19. However, in various part of world, even though the restrictions have been eased, the masks have been made mandatory. There were about 590 million COVID-19 cases that had been confirmed as of August 2022, in the world and number is estimated to grow further. Hence, it has been urged that mask wearing is necessary to lessen the spread of the virus as it's an infectious disease that does so through respiratory droplets and close contact. Therefore, the demand for nonwoven fabrics is estimated to increase.

The most essential component of medical masks is non-woven fabric, which is also essential for the virus and bacterium filtering action. Moreover, it could be also used in manufacturing surgical gowns, drapes, and gloves and this could be owing to the growing demand for surgeries among people. Hence, this factor is estimated to boost the growth of the nonwoven fabrics market over the forecast period. Moreover, the prevalence of hospital infection is also high which is also boosting the demand for nonwoven products in hospitals. An indwelling urinary catheter (IUC) would be present in about 12%–16% of adult hospital inpatients at some point during their stay, and for every day the IUC is present, the risk of developing a catheter-associated urinary tract infection increases by 3%–7%. Hence, the demand for nonwoven wound dressings, cotton pads, and bandages are estimated to increase.

Key Nonwoven Fabrics Market Insights Summary:

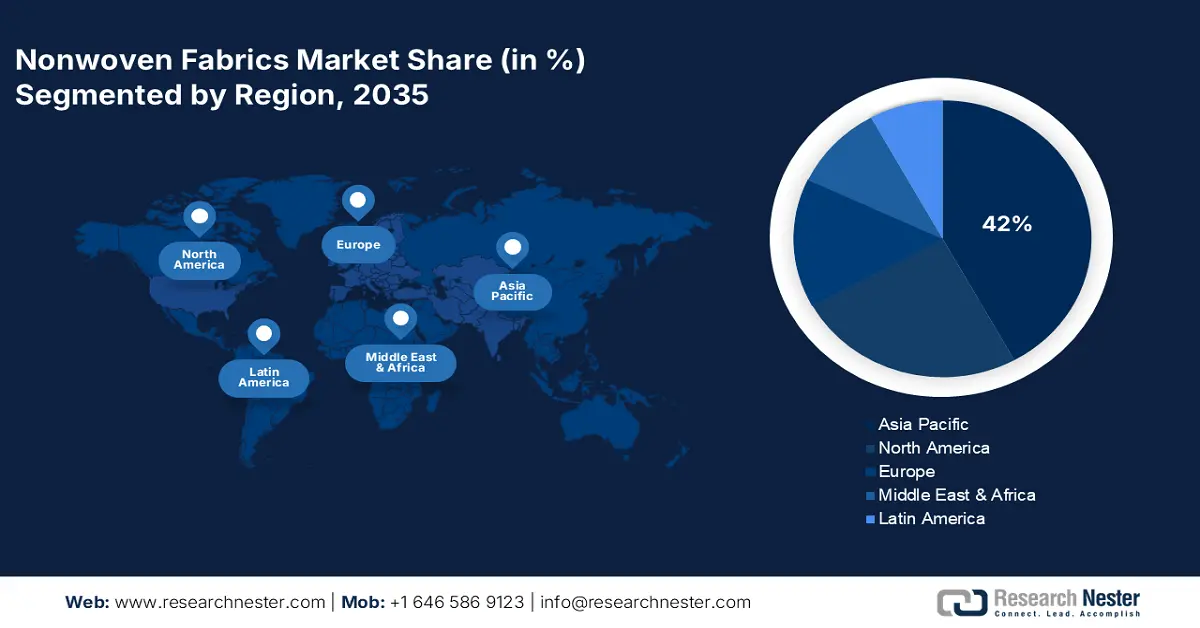

Regional Highlights:

- Asia Pacific nonwoven fabrics market will dominate more than 42% share by 2035, growing birth rate and urbanization boosting demand for hygienic products.

- North America market will secure the second largest share by 2035, growing concerns about safety and sanitation among female population.

Segment Insights:

- The polypropylene segment in the nonwoven fabrics market is forecasted to experience significant growth over 2026-2035, driven by its cost-effectiveness and durability in commercial and industrial applications.

- The healthcare segment in the nonwoven fabrics market will hold the highest market share in 2026-2035, driven by the benefits of nonwoven hygiene materials improving quality of life and skin health.

Key Growth Trends:

- Rise in Production of Automotive

- Growing Child Population

Major Challenges:

- Unavailability of Raw Materials

- Availability of Eco-Friendly Alternatives

Key Players: Glatfelter Corporation, DuPont, Lydall Inc., Ahlstrom, Berry Global Inc., Fitesa S.A., Suominen Group, TWE GmbH & Co., Freudenberg SE, PFNonwovens Holding S.R.O.

Global Nonwoven Fabrics Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 57.51 billion

- 2026 Market Size: USD 60.46 billion

- Projected Market Size: USD 100.11 billion by 2035

- Growth Forecasts: 5.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (42% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, South Korea

- Emerging Countries: China, India, Japan, South Korea, Indonesia

Last updated on : 10 September, 2025

Nonwoven Fabrics Market Growth Drivers and Challenges:

Growth Drivers

- Rise in Production of Automotive - Around 79 million automobiles were produced globally in 2021. Comparing this number to the prior year, a rise of about 2% may be calculated. Nonwovens are being used much more frequently these days. Nowadays, nonwoven fabrics are used to make more than 40 automobile components, ranging from air and fuel filters to carpets and trunk liners. Nonwovens contribute to the weight reduction of the vehicle, improve comfort and aesthetics, and offer advanced insulation, fire retardancy, and resistance to water, fuels, extremes of temperature, and abrasion by incorporating the essential attributes required for good performance and safety. They help make automobiles more appealing, durable, cost-efficient, and environmentally friendly. Hence, with the growing production of vehicles, the demand for nonwoven fabrics is estimated to grow.

- Growing Child Population - India is home to 67,385 births each day, or about 1/6 of all births worldwide. Hence, with the growing child population the demand for diapers is also estimated to grow. Since nonwovens are gentle on the skin and have good water absorption capabilities, they are frequently utilized in disposable diapers. Urine from the baby travels through the nonwoven and is absorbed by the absorbent substance inside when the baby urinates.

- Surge in Demand for Sanitary Pads - In 2019, almost 70% of women in urban India and 48% of women in rural India used sanitary pads. Sanitary pads are frequently made of non-woven fabrics to reduce the risk of side leakage. Hence, the growing demand for sanitary pads is estimated to boost the demand for nonwoven.

- Growth in Geriatric Population - According to the World Health Organization, one in six individuals worldwide would be 60 or older by the year 2030. From 1 billion people in 2020 to 1.4 billion people at this point, more people would be 60 years of age or older. Hence, the demand for adult incontinence such as adult diapers is estimated to increase.

- Upsurge in Sale of Shoes - An estimated 13 billion to about 18 billion pairs of shoes were used globally each year, which equates to approximately two to two and a half pairs for every person in the world in 2018. Hence, the demand for nonwoven fabrics is expected to grow. Nonwoven materials are used to make parts of shoes such as inner sole lining, athletic shoe & sandal reinforcement, and shoelace eyelet reinforcement.

Challenges

- Unavailability of Raw Materials

- Volatility in Prices of Raw Material - The expansion of the global nonwoven fabrics market is only marginally hampered by higher raw material costs. Changes in consumer demand, high oil costs, and patterns of international commerce all have an impact on the market. Although the oil market is naturally volatile, polypropylene prices may not rise or fall in the medium term from their current levels. Given the increasing cost of inputs for intermediary goods as a result of the rising price of oil, either the price would be passed on to customers or margins would be reduced. The price of finished goods is affected in a cascading manner by the changes.

- Availability of Eco-Friendly Alternatives

Nonwoven Fabrics Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.7% |

|

Base Year Market Size (2025) |

USD 57.51 billion |

|

Forecast Year Market Size (2035) |

USD 100.11 billion |

|

Regional Scope |

|

Nonwoven Fabrics Market Segmentation:

End-user Industry Segment Analysis

The global nonwoven fabrics market is segmented and analyzed for demand and supply by end-user industry into construction, textile, healthcare, and automotive. Out of which, the healthcare segment is anticipated to garner the highest revenue by the end of 2035. The growth of the market can be attributed to nonwoven hygiene materials. Contemporary disposable, absorbent nonwoven hygiene products have significantly improved millions of people's quality of life and skin health. The benefits of using NHMs (nonwoven hygiene materials) instead of conventional textiles include their strength, excellent absorption, smoothness, stretchability, comfort and fit, high strength and elasticity, good strike-through, low wet-back and run-off, cost-effectiveness, stability and tear resistance, opacity/stain hiding power, and high breathability. Some of the nonwoven hygiene materials include, baby diapers, feminine pads, and more. Moreover, the demand for adult diapers is also growing owing to the growing urinary incontinence problems among people. Urinary incontinence affects about 4% of men and approximately 11% of women overall, however symptoms could range from mild and transient to severe and chronic. Hence, owing to this the segment growth is estimated to boost.

Material Segment Analysis

The global nonwoven fabrics market is also segmented and analyzed for demand and supply by material into polyester, polypropylene, polyethylene, and rayon. Amongst which, polypropylene segment is anticipated to have a significant growth over the forecast period. Polypropylene is a thermoplastic synthetic resin that is commonly used in packing, transport, chemical fibres, and nonwoven fabrics. Polypropylene nonwoven fabrics are the most popular form of fabric and are used in both commercial and industrial sectors. Moreover, PP nonwoven textiles are as inexpensive as possible, right from the raw ingredients to the manufacture cost to the consumer end. The first decision in a long time is settled by this border. Also, it frequently undergoes high temperatures of use, is climatically safe, and is not bacterially degraded. As a result, both its usable time and length of use are long. The majority of the materials are completely durable and reusable. Hence, its demand is growing.

Our in-depth analysis of the global nonwoven fabrics market includes the following segments:

|

By Technology |

|

|

By Material |

|

|

By End-User Industry |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Nonwoven Fabrics Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is expected to dominate majority revenue share of 42% by 2035, backed by growing birth rate in this region, along with surge in improvement in literacy rate which is driving people towards more hygienic products. Owing to this the two major factors, the demand for diapers is also growing. Moreover, growing urban population is also estimated to boost the growth of the market. In the Asia-Pacific area, urbanization is still an important megatrend to watch. More than 2.2 billion people, or 54% of all urban dwellers worldwide, reside in Asia. It is anticipated that 1.2 billion more people would live in metropolitan areas in Asia by 2050, a growth of 50%. This urban people are estimated to spend more on interior of the homes. Nonwovens have a wide range of uses in the home, from cleaning and filtering to enhancing the interior design. High performance nonwovens could be used in bedrooms, kitchens, dining areas, and living rooms to provide cozy, useful, hygienic, safe, stylish, and clever solutions for modern life. Hence, the demand for nonwoven fabrics market is estimated to grow in this region.

North American Market Insights

The North America nonwoven fabrics market is estimated to be the second largest, to have the highest growth. Given the growing worries about safety and sanitation among the region’s female population, the market in the North America is predicted to rise. Nonwoven fiber producers would probably have to adjust their focus to producing durable products as a result of shifting trends in the sanitary business in the United States to replace disposable protective items. On the other hand, given a rise in nonwoven fabric use across a wide range of applications, Canada is anticipated to propel future growth in the North American region. To boost the products' sustainability, they are commonly employed in hygiene and healthcare items.

Europe Market Insights

Additionally, the nonwoven fabrics market in Europe region is also estimated to have a significant growth over the forecast period. One of the most significant industries that supports the region's still-emerging but rising technical textile industry is the nonwoven fabric sector in Europe. The manufacturing of functional textiles and nonwoven goods is receiving strong investment from an increasing number of developed markets in Europe, and as a result, the demand for nonwoven fabrics is steadily rising. After the North America region, it is the market with the third-largest nonwoven fabric revenue.

Nonwoven Fabrics Market Players:

- Glatfelter Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- DuPont

- Lydall Inc.

- Ahlstrom

- Berry Global Inc.

- Fitesa S.A.

- Suominen Group

- TWE GmbH & Co.

- Freudenberg SE

- PFNonwovens Holding S.R.O

Recent Developments

-

The launch of a new multibeam Reicofil 5 line in Europe, announced by Fitesa S.A., is anticipated for the second quarter of 2023. The new equipment would be located in one of Fitesa's existing facilities in the area and would be capable of producing Full High Loft and standard spunmelt products using a number of environmentally friendly raw materials, such as bioPE and PLA.

-

Suominen Group introduces BIOLACE Zero, a nonwoven fabric that is carbon neutral. For a variety of wiping uses, including baby, personal care, and home wipes, BIOLACE Zero is a great product. It is incredibly soft and has good wet and dry strength. It is made entirely of cellulosic lyocell fibres and is completely biodegradable, compostable, and plastic-free.

- Report ID: 4808

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Nonwoven Fabrics Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.