Point of Care Lipid Test Market Outlook:

Point of Care Lipid Test Market size was valued at USD 440.64 million in 2026 and is expected to reach USD 690.88 million by 2035, registering around 4.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of point of care lipid test is evaluated at USD 458.88 million.

Point-of-care lipid test market is in heightened demand being driven by strong fundings in biosensing technologies. For instance, in April 2024, in order to improve metabolic health, Biolinq obtained USD 58 million in new funding to develop its biosensor technology. Moreover, advancements and innovations such as miniaturized user-focused devices, which deliver efficacy and accuracy in testing fuel the market growth. For instance, in October 2024, STMicroelectronics unveiled a new bio-sensing chip, the ST1VAFE3BX. In order to ensure faster performance with lower power consumption, it combines a high-accuracy biopotential input with ST's proven inertial sensing and AI core, which detects activity within the chip.

In addition, growing preventive healthcare awareness and escalating demands for individualized care propel market development. For instance, in March 2026, a new AI-powered genetic testing tool called HEALTHSTRING has been introduced by Bengaluru-based SugarStrings.ai. This product promises 100% specificity in detecting more than 6,000 diseases, including different types of cancer. The goal of preventive healthcare is to detect health risks early so that people can take preventative action. Therefore, the change of paradigm toward de-centralized models of healthcare and greater emphasis on disease detection at an earlier stage are also spurring the demand for POC lipid tests to achieve early interventions and maximize patient outcomes.

Key Point of Care Lipid Test Market Insights Summary:

Regional Highlights:

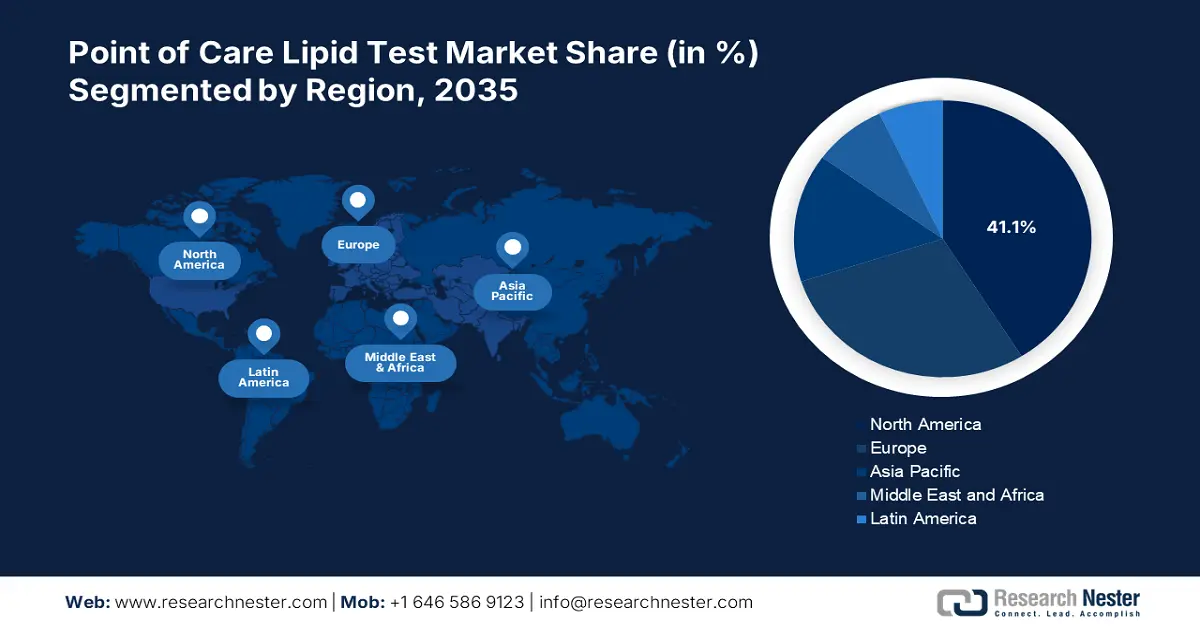

- North America dominates the Point of Care Lipid Test Market with a 41.1% share, driven by preventive healthcare initiatives and growing public-private collaboration, strengthening its position through proactive health measures by 2035.

- Asia Pacific's Point of Care Lipid Test Market is poised for remarkable growth by 2035, attributed to rising cardiovascular cases and demand for rapid testing devices.

Segment Insights:

- The Endogenous Hyperlipemia segment is expected to secure a lucrative market share through 2026-2035, propelled by the chronic need for frequent lipid testing in patients with endogenous hyperlipidemia.

- The Consumables segment of the Point of Care Lipid Test Market is expected to hold a 59.3% share by 2035, driven by the fundamental reliance on single-use consumables like test strips and lancets for precise and hygienic lipid testing.

Key Growth Trends:

- Rising prevalence of cardiovascular disease

- Government initiatives

Major Challenges:

- Quality control and assurance

- Potential for misuse

- Key Players: Abbott Laboratories, Mico Bio Med, Nova Biomedical Corporation, VivaChek Biotech (Hangzhou) Co., Ltd., and more.

Global Point of Care Lipid Test Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 440.64 million

- 2026 Market Size: USD 458.88 million

- Projected Market Size: USD 690.88 million by 2035

- Growth Forecasts: 4.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (41.1% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, China, UK

- Emerging Countries: China, India, Brazil, Russia, Mexico

Last updated on : 12 August, 2025

Point of Care Lipid Test Market Growth Drivers and Challenges:

Growth Drivers

- Rising prevalence of cardiovascular disease: One of the major drivers of growth for the point-of-care lipid test market is the surging global burden of cardiovascular diseases (CVDs). For instance, as per the World Heart Report 2023, over half a billion people worldwide still suffer from cardiovascular diseases, which caused 20.5 million deaths in 2021, or nearly 1/3rd of all deaths worldwide and an increase over the estimated 121 million deaths from CVD. Therefore, the demand for rapid, decentralized testing of lipids, as enabled by POC testing, becomes more crucial in the detection of at-risk individuals, enabling timely clinical decision-making, and prevent the development of CVD.

- Government initiatives: The initiatives prompted by the government is propelling the point of care (PoC) lipid test market through an emphasis on preventive healthcare measures. For instance, as per the International Trade Administration, in year 2023, the Indian government suggested raising public healthcare spending from the current 1.2% of GDP to 2.5% by 2026, with a particular emphasis on disadvantaged groups. The point of care test has grown in importance in India since over 65% of the country's population lives in rural areas, where access to high-quality healthcare is still a major problem. By 2030, this industry's total market value is projected to reach USD 70 million.

Challenges

- Quality control and assurance: A crucial obstacle in the point of care lipid test market is to uniformly and consistently implement the testing and maintain its quality without impacting its clinical utility and widespread adoption. The basic cause is the decentralization drift of POC testing, under which procedures are carried out by different staff members, including medical workers, chemists, and even patients, in the majority of instances beyond the controlled environment of a central laboratory. The heterogeneity of skill level of operators and adherence to standard operating procedures leads to significant variability of test performance.

- Potential for misuse: The danger of misuse of data represents a significant menace to the rightful and effective utilization of point-of-care lipid testing, including potential negation of its therapeutic advantage. The ease and availability of POC machines, as part of a concerted process to render lipid monitoring accessible to patients, actually facilitate inappropriate or unjustified testing regimens. Furthermore, absence of proper clinical decision support mechanisms and sharing of explicit clear guidelines for applying tests appropriately. This deficiency gives rise to a series of less-than-ideal circumstances with no accompanying clinical oversight, prompted by anxiety or misinformation regarding risk status, hence hampers point of care (PoC) lipid test market growth.

Point of Care Lipid Test Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.6% |

|

Base Year Market Size (2025) |

USD 440.64 million |

|

Forecast Year Market Size (2035) |

USD 690.88 million |

|

Regional Scope |

|

Point of Care Lipid Test Market Segmentation:

Product Type (Consumables, Devices)

By 2036, consumables segment is anticipated to dominate over 59.3% point of care lipid test market share, owing to the fundamental design and operational requirements of such diagnostic platforms. POC lipid tests by nature are reliant upon single-use consumables in the form of test strips, cartridges, or lancets in an effort to achieve precise and hygienic testing of samples. For instance, in August 2024, India's drug regulator has approved Siemens Healthineers to manufacture mpox testing kits, boosting the country's efforts in detecting and treating the disease effectively and timely. This chronic demand for consumables is in proportion to the frequency of monitoring of lipids, typically prescribed in patients with established cardiovascular risk factors or on lipid-lowering therapy.

Application (Endogenous Hyperlipemia, Combined Hyperlipidemia, Familial Hypercholesterolemia)

Based on the application, endogenous hyperlipemia segment in point of care lipid test market is anticipated to attain a lucrative share by 2036, primarily to the inherent character base and its treatment requirement. The asymptomatic, chronic character of endogenous hyperlipidemia requires ongoing monitoring of the amount of lipids in an effort to direct therapeutic intervention through diet, exercise, and pharmacotherapy. This need for frequent testing, often repeated every few months, maintains a considerable and ongoing requirement for POC lipid testing reagents and products. For instance, in May 2024, Arrowhead Pharmaceuticals, Inc. reported the findings of the Phase 2b double blind, randomized MUIR study of investigational plozasiran in patients with mixed hyperlipidemia. In the MUIR study, plozasiran treatment resulted in decreases in triglyceride rich lipoproteins.

Our in-depth analysis of the global point of care lipid test Market includes the following segments:

|

Product Type |

|

|

Application |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Point of Care Lipid Test Market Regional Analysis:

North America Market Statistics

By the end of 2036, North America point of care lipid test market is set to capture around 41.1% revenue share. Furthermore, large pharmaceutical and biopharmaceutical firms in the region are to spur the market demand. In addition, the market is anticipated to grow as preventive healthcare becomes more crucial. Moreover, as a result of initiatives by the public and private sectors encourage healthy living push the market demand.

The U.S. point of care (PoC) lipid test market is largely driven by the companies strategic moves to invest in other competitive firms or startups to escalate their scale of operations and expertise. For instance, in October 2024, Trinity Biotech paid about USD 2.5 million to acquire a 12.5% equity stake in Novus Diagnostics. About 1.4 million American Depository Shares (ADS) in Trinity Biotech were issued in order to make this investment, which after the investment values Novus at USD 20 million.

The Canada point of care lipid test market is characterized by robust regulatory ecosystem that facilitates the growth of market. For instance, in January 2026, Astellas Pharma Canada Inc. announced that Health Canada has approved VYLOY (zolbetuximab for injection). This medication is intended to be used in conjunction with chemotherapy with locally advanced, metastatic, or unresectable HER2-negative gastric or gastroesophageal junction (GEJ) adenocarcinomas. Furthermore, the company also announced that a draft recommendation to reimburse VYLOY with conditions was recently released by Canada's Drug Agency (CDA-AMC).

Asia Pacific Market Analysis

The Asia Pacific point of care lipid test market is growing at a remarkable pace due to the growing global geriatric population base and rising awareness levels. Moreover, the growing demand for technological innovations intended to improve speed, accuracy, and user-friendliness. In addition, over the past few years, cardiovascular diseases have emerged as the leading cause of death and morbidity worldwide. Hence, market demands for a comprehensive testing devices to consult physicians spontaneously.

The India point of care lipid test market is changing rapidly due to significant investment moves made by companies to expand their portfolios and global reach. For instance, in May 2024, Achira Labs received an additional investment from Cipla of USD 300 million. Four tranches of this investment will be made, subject to the accomplishment of certain milestones. This strategic funding allowed Achira to commercially launch and further develop test panels with the goal of closing the current ecosystem gap.

China point of care (PoC) lipid test market is characterized by expanding the roots of medical industry into other regions and countries to attain specialization in testing accuracy and authenticity. For instance, in November 2024, with a strategic new alliance with China's BGI Group, Saudi Arabia is well-positioned to strengthen its healthcare system. To better serve the people of the Kingdom, the partnership will prioritize advancing preventive care, strengthening supply chains, and localizing medical services. With this partnership reciprocally China’s medical ecosystem bolstered and helped to expand its global footprints.

Key Point of Care Lipid Test Market Players:

- Callegari Sinocare Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Abbott Laboratories

- Mico Bio Med

- Nova Biomedical Corporation

- VivaChek Biotech (Hangzhou) Co., Ltd.

- F. Hoffmann-La Roche Ltd.

- Zoetis Inc.

- Menarini Group

- SD Biosensor, Inc.

The competitive landscape in the point of care lipid test market is exponentially being fueled by the intense strategies to delve into R&D and product development to put forth innovative products. For instance, in May 2023, Danaher Corporation unveiled the Dxl 9000 access immunoassay analyzer, capable of conducting up to 215 tests in an hour. This initiative expanded the company's point-of-care diagnostics offering.

Here's the list of some key players in point of care lipid test market:

Recent Developments

- In September 2024, GE HealthCare announced the introduction of improved Venue ultrasound systems along with Venue Sprint, a new solution that is leading the way in point-of-care ultrasound (POCUS).

- In January 2023, Cipla Limited announced the release of a point-of-care testing tool called Cippoint. The device has been approved by the European In-Vitro Diagnostic Device Directive (CE IVD), which guarantees dependable testing solutions.

- Report ID: 7327

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Point of Care Lipid Test Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.