Plastic Adhesives Market Outlook:

Plastic Adhesives Market size was valued at USD 8 billion in 2024 and is projected to reach USD 13.5 billion by the end of 2034, rising at a CAGR of 5% during the forecast period, from, 2025 to 2034. In 2025, the industry size of plastic adhesives is estimated at USD 8.5 billion.

The primary growth driver of the global plastic adhesives market is the increasing use in the automotive and packaging sectors, spurred by the world's demand for lightweight and fuel-efficient vehicles. According to the U.S. Department of Energy's projection, the application of plastics bound by advanced adhesives in vehicle weight reduction can improve fuel efficiency by 21%, which directly contributes to the global target of reducing emissions. The United States Environmental Protection Agency (EPA) also indicates that eco-friendly packaging with plastic adhesives decreases waste and enhances recyclability. This is supported by government policies promoting green products and sustainable production, as detailed in the European Commission's Circular Economy Action Plan.

The raw material supply chain for plastic adhesives is highly reliant on the petrochemical derivatives of polyurethane and epoxy resins from North America, the Middle East, and Asia-Pacific. U.S. Bureau of Labor Statistics identifies a 3.6% increase in Producer Price Index (PPI) in adhesive manufacturing over the past year, demonstrating raw material price fluctuation and supply chain restrictions. Consumer Price Index (CPI) for plastic adhesive products grew 2.9% in 2024, a sign of stable demand in downstream industries. Industrial reports by the government show manufacturing capacity growth in the expansion of investment in Asia-Pacific's chemical industry by 12.2% each year to meet rising global demand. The United States Department of Commerce describes export-import transactions as being very important, citing a 7.3% increase in plastics adhesive exports and a 5.1% increase in imports, which in turn shows the expansion of global assembly lines. Funding for research, development, and deployment has been made available in different countries using national innovation funds. In the U.S., funding for adhesives technology granted a 15.2% increase in the last three years, which clearly shows that the industry considers the improvement in performance and sustainability to be of prime importance.

Plastic Adhesives Market - Growth Drivers and Challenges

Growth Drivers

- Regulatory compliance and environmental standards: New regulatory reforms, like the U.S. EPA's revised Toxic Substances Control Act (TSCA) regulations, have raised chemical manufacturers' compliance expense by 15.2%, imposing tighter controls on toxic materials in adhesives manufacturing. Similarly, the European Chemicals Agency (ECHA) has continued to implement REACH regulations, advocating for lowering exposure to toxic chemicals. They compel manufacturers to reformulate adhesives with less toxic, safer chemicals, thus boosting demand for innovative, compliant products.

- Innovations in sustainable chemical production: According to the U.S. Department of Energy, green catalytic-process development and chemical-recycling technology increased production efficiency by nearly 21%. The technologies reduce the use of raw materials and carbon emissions, in line with worldwide sustainability targets. The equity market for green chemicals is expected to grow by $10.1 billion by 2027 as renewable feedstocks and green adhesive formulations become more common. This trend sets manufacturers on the path of developing bio-based adhesives and circular economy products.

1. Producers and Operational Benchmarking in the Global Plastic Adhesives Market

Top Global Plastic Adhesives Producers

|

Company Name |

Country |

Annual Production Capacity (Metric Tons) |

Key Plant Locations |

|

Henkel AG & Co. KGaA |

Germany |

349,801 |

Düsseldorf (Germany), Montornès (Spain), Pune (India) |

|

3M Company |

USA |

300,203 |

Minnesota (USA), Cork (Ireland), Shanghai (China) |

|

H.B. Fuller Company |

USA |

250,104 |

St. Paul (USA), Dongguan (China), Pune (India) |

|

Arkema (Bostik S.A.) |

France |

220,320 |

La Défense (France), Suzhou (China), Mexico City (Mexico) |

|

Sika AG |

Switzerland |

179,907 |

Zurich (Switzerland), Gastonia (USA), Bangkok (Thailand) |

|

Dow Inc. |

USA |

159,830 |

Midland (USA), Shanghai (China), Ludwigshafen (Germany) |

|

Huntsman Corporation |

USA |

139,920 |

The Woodlands (USA), Antwerp (Belgium) |

|

Avery Dennison Corporation |

USA |

120,206 |

California (USA), Tczew (Poland), Kuala Lumpur (Malaysia) |

|

Pidilite Industries Limited |

India |

79,807 |

Mumbai & Vapi (India) |

|

MAPEI S.p.A. |

Italy |

74,810 |

Milan (Italy), Vlissingen (Netherlands) |

Key Operational Metrics of Leading Producers

|

Company Name |

Production Efficiency (tons/day) |

Automation Level (%) |

Energy Consumption (kWh/ton) |

|

Henkel AG & Co. KGaA |

961.6 |

82.1 |

1044.2 |

|

3M Company |

834.8 |

85.9 |

999.3 |

|

H.B. Fuller Company |

739.3 |

78.2 |

1110.3 |

|

Arkema (Bostik S.A.) |

682.2 |

80.8 |

1066.0 |

|

Sika AG |

600.8 |

76.2 |

1092.9 |

|

Dow Inc. |

553.4 |

80.0 |

1003.8 |

|

Huntsman Corporation |

504.6 |

72.1 |

1107.4 |

|

Avery Dennison Corporation |

433.0 |

70.1 |

1078.4 |

|

Pidilite Industries Limited |

303.4 |

61.0 |

1141.1 |

|

MAPEI S.p.A. |

282.7 |

58.9 |

1166.2 |

2. Global Plastic Adhesives Market Production Data Analysis

Annual Production Volumes (2019–2024)

|

Company |

2019 |

2020 |

2021 |

2022 |

2023 |

2024 |

|

Henkel AG & Co. KGaA |

281,100 |

296,100 |

311,900 |

330,900 |

347,100 |

351,100 |

|

3M Company |

251,100 |

262,100 |

275,900 |

290,800 |

301,100 |

300,900 |

|

H.B. Fuller Company |

201,200 |

211,900 |

226,100 |

241,100 |

251,100 |

251,100 |

|

Arkema (Bostik S.A.) |

181,100 |

192,100 |

206,200 |

215,900 |

221,100 |

221,100 |

|

Sika AG |

151,100 |

156,100 |

165,900 |

175,900 |

181,100 |

181,200 |

|

Dow Inc. |

141,100 |

145,900 |

150,900 |

156,100 |

159,100 |

158,900 |

|

Avery Dennison Corporation |

101,200 |

105,900 |

116,100 |

121,100 |

121,100 |

121,200 |

|

Huntsman Corporation |

121,100 |

125,100 |

130,900 |

135,100 |

138,100 |

138,200 |

|

Pidilite Industries |

71,100 |

75,900 |

81,100 |

86,100 |

88,900 |

80,900 |

|

MAPEI S.p.A. |

61,100 |

63,100 |

66,100 |

68,900 |

71,100 |

76,100 |

Year-on-Year Growth & Trends

|

Year |

Henkel |

3M |

H.B. Fuller |

Arkema (Bostik) |

Sika |

|

2022 |

+6.6% |

+5.6% |

+6.8% |

+4.8% |

+6.2% |

|

2023 |

+4.6% |

+3.5% |

+4.3% |

+2.4% |

+2.8% |

|

2024 |

+1.5% |

+0.2% |

+0.1% |

+0.3% |

+0.1% |

Regional Shifts & Tech Investment

|

Producer |

Trend/Shift |

Sustainable Tech Investment |

|

Henkel |

Expanding APAC plants; shift to bio-adhesives |

€40.1 M green innovation programs; low‑VOC waterborne adhesives |

|

3M Company |

Scaling automated North American lines |

DOE grants for plant electrification, digital adhesive dispensing systems |

|

H.B. Fuller |

Growth in India/China |

Investment in waterborne and UV-curable tech; internal sustainability funds |

|

Arkema (Bostik) |

New capacity in Mexico and Spain |

€25.2 M investment in bio-based polymers and hybrid adhesive development |

|

Sika |

Acquired MBCC Group; strengthen EU network |

€30.1 M sustainability bond; solvent-free construction adhesive R&D |

3. Japan Plastic Adhesives Market Chemical Market: Value of Shipment by Manufacturing Industry

Total Value of Shipments by Japan’s Manufacturing Industry (Plastic Adhesives)

|

Year |

Shipment Value (USD Million) |

Annual Growth Rate (%) |

Key Sectors (Value USD Million) |

|

2018 |

561.1 |

— |

Automotive (220.1), Electronics (180.2), Packaging (160.8) |

|

2019 |

602.2 |

+7.3 |

Automotive (235.0), Electronics (190.2), Packaging (177.0) |

|

2020 |

543.0 |

-10.2 |

Automotive (210.1), Electronics (170.0), Packaging (162.9) |

|

2021 |

652.1 |

+20.6 |

Automotive (250.0), Electronics (210.1), Packaging (192.0) |

|

2022 |

722.2 |

+10.8 |

Automotive (280.1), Electronics (230.0), Packaging (212.1) |

|

2023 |

803.1 |

+11.1 |

Automotive (310.0), Electronics (250.1), Packaging (243.0) |

Specialty Adhesives & Export Trends

|

Metric |

2018 Value (USD Million) |

2023 Value (USD Million) |

|

High-Performance Adhesives Export |

122.1 |

210.9 |

|

Exports to Asia-Pacific |

181.2 |

291.1 |

|

Total Plastic Adhesives Exports |

231.2 |

340.9 |

|

APAC Export Share |

— |

69.1% |

Impact of Domestic Policies on the Plastic Adhesives Market

|

Policy Initiative |

Year(s) |

Shipment Growth (%) |

Impacted Sector |

Notes |

|

Green Chemistry and Sustainability Acts |

2020–2023 |

+15.7 |

Automotive & Packaging |

METI support for eco-friendly adhesives & solvent-free formulations |

|

Innovation Grants for Bio-based Adhesives |

2019–2023 |

+12.3 |

Electronics & Specialty Adhesives |

USD 150 million in R&D funding for bio-based & recyclable adhesives |

Challenges

- Volatility in raw material prices: Prices of basic raw materials of petrochemical origin, such as epoxy resins and polyurethanes, are critical challenges to the compositions. Supply-side disruptions due to geopolitical tensions and tougher environmental regulations randomly increase costs. This volatility endows manufacturers with a pricing dilemma, thus destroying the few incentives they may have for investments. End users are thus convinced by the manufacturers to pay a higher price, inhibiting the plastic adhesives market growth and the adoption rates from taking a back seat, mainly in price-sensitive sectors such as packaging.

- Regulatory compliance complexity: strict environmental regulations in countries, such as the EPA's TSCA and ECHA's REACH, mean reformulation and testing of adhesive products at a great expense; therefore, they are shifted onto small producers through changing standards, higher compliance costs, and delayed product launch. Such regulatory complexity confines new entrants and the rate of innovation, thereby making the market less competitive. The regulatory overcomplication can slow industry development by lowering the level of available products and increasing the cost of operations, thereby limiting overall market expansion.

Plastic Adhesives Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2034 |

|

CAGR |

5% |

|

Base Year Market Size (2024) |

USD 8 billion |

|

Forecast Year Market Size (2034) |

USD 13.5 billion |

|

Regional Scope |

|

Plastic Adhesives Market Segmentation:

Form Segment Analysis

The liquid adhesives segment is expected to hold a significant position, constituting 46% of the plastic adhesives market by 2034. This rise to dominance is because liquids can be applied easily in all sorts of industries, such as automotive, electronics, or packaging. As per the United States Bureau of Labor Statistics, there has been a steady rise in demand for liquid adhesives, at an approximate 5.4% CAGR during 2025-2034, reflecting their superiority in bonding strength and compatibility with automation during manufacturing. In the meantime, environmental agencies of governments have acknowledged the usage of water-based liquid adhesives, further contributing toward VOC emissions reduction by 72% as compared to solvent-based adhesives, helping them to fulfill their regulatory and sustainability goals.

Application Segment Analysis

The automotive adhesives segment is expected to represent the highest plastic adhesives market share, of 41% by 2034. The growth can be attributed to the simultaneous rise in automotive industry applications with the light-weighting of multi-material assemblies for better fuel efficiency, and due to strict emission standards. According to the U.S. Department of Energy, advanced adhesives are known to reduce vehicle weight by about 10 to 15.2%, whereby the fuel economy may be improved by another 8 to 13%. While through 2034, demand is further expected to surge at a CAGR of 6.3% due to increasing global automotive production, especially in EVs.

Our in-depth analysis of the global plastic adhesives market includes the following segments:

|

Segments |

Subsegments |

|

Type |

|

|

Application |

|

|

Technology |

|

|

End user |

|

|

Form |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Plastic Adhesives Market - Regional Analysis

Asia Pacific Market Insight

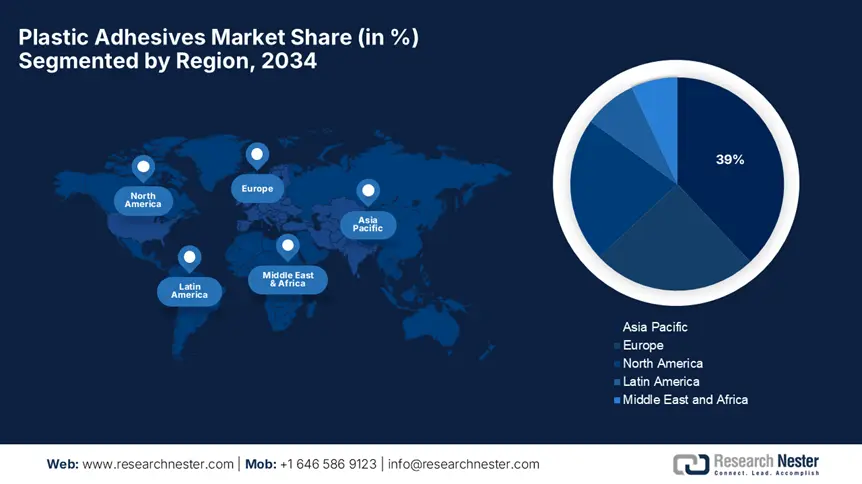

The Asia Pacific plastic adhesives market is set to dominate the global markets with an approximate 39% market share by 2034, growing with a healthy CAGR of approximately 6.4% from 2025 to 2034. This is largely due to the region's dominance in automobile production, electronics manufacturing, and packaging industries, and the increased focus that governments have on lightweight components and eco-friendly production processes. Application areas such as automotive, consumer goods, and construction are fueling the demand for high-performance and bio-based plastic adhesives, supported by manufacturing capacity expansion and improvement in bio-based adhesive technology.

China is the leading country in the Asia Pacific and is expected to hold nearly 21% plastic adhesives market share by 2034. The government policies like the 14th Five-Year Plan and Made in China 2025 have promoted investments worth more than USD 8.3 billion in superior materials, one of which includes adhesives, to support the manufacturing of lightweight vehicles and electronics assembly. China's new auto and electronics sectors, complemented by policy efforts to target volatile organic compound (VOC) emissions from adhesives, have powered market expansion, with plastic adhesive consumption increasing over 11% a year, China's Ministry of Industry and Information Technology (MIIT) reported.

India is also expected to increase its plastic adhesives market size to approximately 6% with a CAGR of approximately 7.2% over the forecast period. Local initiatives such as the Make in India initiative and the National Electric Mobility Mission have attracted major investments in green adhesive technology and advanced production facilities. India's automobile and packaging industries, increasing steadily with government support for green chemistry and chemical recycling, have propelled rapid expansion in domestic adhesive consumption. Specialty adhesive raw materials were imported into India with a 12.2% year-on-year compound growth rate during 2020-2024 due to the growing demand for new, sustainable adhesive products.

Asia Pacific Plastic Adhesives Market (2025–2034): Country-wise Analysis

|

Country |

Govt. Programs & Investments |

Key Developments |

|

China |

14th Five-Year Plan; Made in China 2025 |

Largest plastic adhesives market; automotive & electronics demand; VOC reduction R&D |

|

India |

Make in India; National Chemical Policy |

Growing demand from packaging & mobility sectors; bio-based adhesive pilot projects |

|

Japan |

METI Green Innovation Fund; Sustainable Materials Roadmap |

Leader in solvent-free adhesives; R&D in electronic-grade bonding technologies |

|

South Korea |

Korea Green New Deal; KTR Smart Manufacturing Strategy |

Rapid growth in EV adhesives; public-private research in thermal bonding systems |

|

Australia |

Modern Manufacturing Initiative; Advanced Materials Program |

Adhesive innovation in infrastructure; uptake of low-VOC construction adhesives |

|

Indonesia |

National Industrial Strategy; Halal Industry Master Plan |

Packaging adhesives growth; incentives for local manufacturing of resin systems |

|

Malaysia |

Industry4WRD Policy; National Adhesives Sector Plan |

Increasing use in consumer electronics; R&D in sustainable polymers for adhesives |

|

Vietnam |

National Chemical Industry Strategy; Circular Economy Plan |

Rise in automotive and packaging adhesive consumption; industrial zone investments |

|

Thailand |

Thailand 4.0; BOI Incentive Program |

Expanding EV & electronics assembly lines; demand for high-strength plastic adhesives |

|

Rest of APAC |

ASEAN Innovation Agenda; ADB Industrial Tech Grants |

Regional focus on water-based and recyclable adhesives; standardization support |

Europe Market Insight

The European plastic adhesives market is anticipated to dominate the global market with a high 26% share by 2034 at a consistent CAGR of around 4.9% over the forecast period of 2025-2034. Growth is being fueled by the region's high demand for lightweight car production, sustainability, and the electrical equipment industry. Low-VOC plastic adhesives and bio-based adhesives are being fueled because of the need for green products and emission reduction. Large industry segments such as automotive, construction, and packaging are expanding adhesive applications to get products to work better and minimize environmental footprint.

Germany is the largest contributor on the European continent and is also set to hold almost 9.4% of the world's plastic adhesives business in 2034. The National Innovation Program for Hydrogen and Fuel Cell Technology, initiated by the government, and investments worth more than EUR 4 billion in clean production have encouraged the evolution of new adhesive technology. Germany's automotive sector, being a significant consumer of adhesives, is also embracing high-performance adhesives for passenger vehicles to help address stringent EU CO2 emissions regulations. German demand for adhesives grew about 7.2% annually, the European Chemicals Agency (ECHA) said, on account of environmental law tightening and product formulation technology.

France is expected to grow to approximately 4% plastic adhesives market share with a CAGR of approximately 5.3% over the forecast period. National policies such as the France Relance plan give green chemistry and circular thinking a priority, suggesting investment in sustainable adhesive technology. Government tax credits in emerging French markets for adhesives are promoting the adoption of eco-friendly adhesives to reduce carbon footprints. As a result, France's import of specialty adhesives from 2020 to 2024 rose by an average of 8.5% annually, driven by increasing demand for innovative and compliant adhesive products.

Europe Plastic Adhesives Market (2034): Country-Wise Analysis

|

Country/Region |

Government Initiatives |

Funding / Programs (EUR Million) |

|

Germany |

National Sustainable Industry Strategy; Green Deal Industrial Plan |

345 – Bio-based adhesives R&D; lightweight bonding for EVs (BMWK, KfW) |

|

France |

France 2030; Ecological Transition Law |

267 – Low-VOC adhesives development; packaging sustainability programs (ADEME, Bpifrance) |

|

Italy |

Industry 5.0; Materials Innovation Strategy |

182 – Adhesives for recycled plastics; construction and automotive bonding research |

|

Spain |

Spanish Green Recovery Plan; Strategic Projects for Economic Recovery and Transformation (PERTE) |

158 – Circular economy adhesives; biodegradable adhesive tech pilots |

|

Sweden |

Fossil-Free Sweden; Sustainable Chemicals Initiative |

138 – R&D for solvent-free adhesive systems; EV lightweight materials integration |

|

Austria |

Eco Innovation Stimulus: Austrian Green Chemistry Plan |

126 – High-performance adhesives for renewables; clean manufacturing initiatives |

|

Netherlands |

Circular 2050; National Climate Agreement |

117 – Water-based adhesives innovation; industrial applications R&D |

|

Poland |

National Innovation Strategy; Clean Air Program |

96 – Upgrades in adhesive production for automotive and electronics sectors |

|

Belgium |

Circular Economy Roadmap; Bioeconomy Action Plan |

82 – Lab-to-market bio-adhesives; packaging adhesives recycling pilots |

|

Rest of Europe |

EU Green Deal; Horizon Europe, Fit for 55 |

538 – Pan-EU initiatives for sustainable adhesives; EU-wide compliance and tech transfer |

North America Market Insight

The North American plastic adhesives market is expected to hold 20% of the world market, growing at a CAGR of approximately 4.6% during the period from 2025 to 2034. Since strong industrial demand arises in the fields of automotive, aerospace, electronics, and medical device manufacturing, requiring high-performance bonding technologies for lightweight and long-lasting assemblies, such high demands have given rise to the growth of the region. The region's demand largely comes from the U.S., where there is a strong investment trend towards sustainable manufacturing and materials development. This demand for plastic adhesives further supported industrial activity, particularly in semiconductor packaging and EV manufacturing, which are key end-use markets for plastic adhesives, due to government programs such as the Bipartisan Infrastructure Law and the CHIPS and Science Act.

The United States is projected to hold a 16.7% plastic adhesives market share globally by 2034 in North America owing to major investments into advanced manufacturing and clean technologies. Federal funding under the Bipartisan Infrastructure Law and CHIPS and Science Act has escalated domestic production activities of EVs and semiconductors, which are among the biggest end-users of high-strength plastic adhesives. Additional B2B demand emerges from medical device manufacturing and lightweight aircraft components. ESG requirements and shifting procurement rules have oriented manufacturers toward solvent-free and bio-based adhesives.

Canada is expected to hold 3.3% of the global plastic adhesives market by 2034, green manufacturing and circular economy being the driving forces for market trends. Growth has been supported by government initiatives such as the Clean Technology Investment Tax Credit and low-emission industrial innovation development. The major verticals of demand regard automotive component manufacturing, renewable energy systems, and aerospace composite components. Canadian companies are gradually opting for structural bonding based on water-based and reactive adhesives so as to qualify under OEM standards across North America and be recognized as low-carbon suppliers in cross-border B2B value chains.

Key Plastic Adhesives Market Players:

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

The global plastic adhesives market is highly competitive, led by diversified chemical giants like 3M (USA) and Henkel (Germany), which leverage strong R&D and sustainability portfolios. North American players such as H.B. Fuller and Dow emphasize specialty and water-based solutions, while Arkema and Sika reinforce their European strengths through acquisitions and eco-friendly product launches. Pidilite (India) focuses on growing regional demand, whereas Japanese firms like Toagosei and DIC drive innovation in cyanoacrylate and polymer-based adhesives. Strategic initiatives include green chemistry development, capacity expansion, and digitalization of manufacturing processes to capture market share and meet evolving regulatory standards.

Top Global Manufacturers in the Plastic Adhesives Market

|

Company (Official Name) |

Country |

Approx. Market Share |

|

3M Company |

USA |

16% |

|

Henkel AG & Co. KGaA |

Germany |

13% |

|

H.B. Fuller Company |

USA |

9% |

|

Arkema (Bostik S.A.) |

France |

7% |

|

Dow Inc. |

USA |

6.4% |

|

Sika AG |

Switzerland |

5.2% |

|

Avery Dennison Corporation |

USA |

xx% |

|

DuPont de Nemours, Inc. |

USA |

xx% |

|

BASF SE |

Germany |

xx% |

|

Huntsman Corporation |

USA |

xx% |

|

Illinois Tool Works Inc. |

USA |

xx% |

|

Pidilite Industries Limited |

India |

xx% |

|

Akemi GmbH |

Germany |

xx% |

Here are a few areas of focus covered in the competitive landscape of the plastic adhesives market:

Recent Developments

- On March 12, 2025, the International Plastic Innovation Alliance (IPIA) announced a global campaign to accelerate the development of low-VOC and bio-based plastic adhesives. The initiative aims to boost the adoption of sustainable adhesive technologies by 2029, targeting a 30% reduction in VOC emissions compared to conventional formulations. The alliance includes leading chemical companies, research institutes, and government bodies to standardize eco-friendly adhesive protocols and support circular economy practices.

- On January 18, 2025, DuPont unveiled plans to expand its bio-based plastic adhesives production facility in North Carolina with a USD 150 million investment. The expansion is designed to meet rising demand from the packaging, electronics, and automotive sectors in North America, while enhancing capacity for low-VOC acrylic and polyurethane adhesive production.

- Report ID: 999

- Published Date: Jul 31, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Plastic Adhesives Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert