Peracetic Acid Market Outlook:

Peracetic Acid Market size was valued at USD 1.11 billion in 2025 and is likely to cross USD 2.29 billion by 2035, expanding at more than 7.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of peracetic acid is assessed at USD 1.18 billion.

The growth of the market can be attributed to its various uses in the food processing and packaging industry. The chemical is used effectively for sanitizing sealing systems and containers that are used to store food before distribution. Good food packaging plays a crucial role in preventing food spoilage and in extending its shelf life, eventually reducing food wastage. It is estimated that more than 1 billion tons of food is wasted worldwide annually.

Another significant factor that is expected to lead to unprecedented growth in the market for peracetic acid is the growing demand for disinfectants following the COVID-19 pandemic. The pandemic made the use of sanitizers and disinfectants necessary to check the spread of the virus attack. SARS-CoV-2 was observed to survive in the air for more than 2 hours while it survived on cardboard surfaces for a whole day. Similarly, the persistence of the virus on plastic and stainless steel was observed to be up to 4 hours. This varying range of persistence of the virus makes it imperative to regularly disinfect hospitals and other public places to contain the pandemic effectively, and this is expected to drive market growth.

Key Peracetic Acid Market Insights Summary:

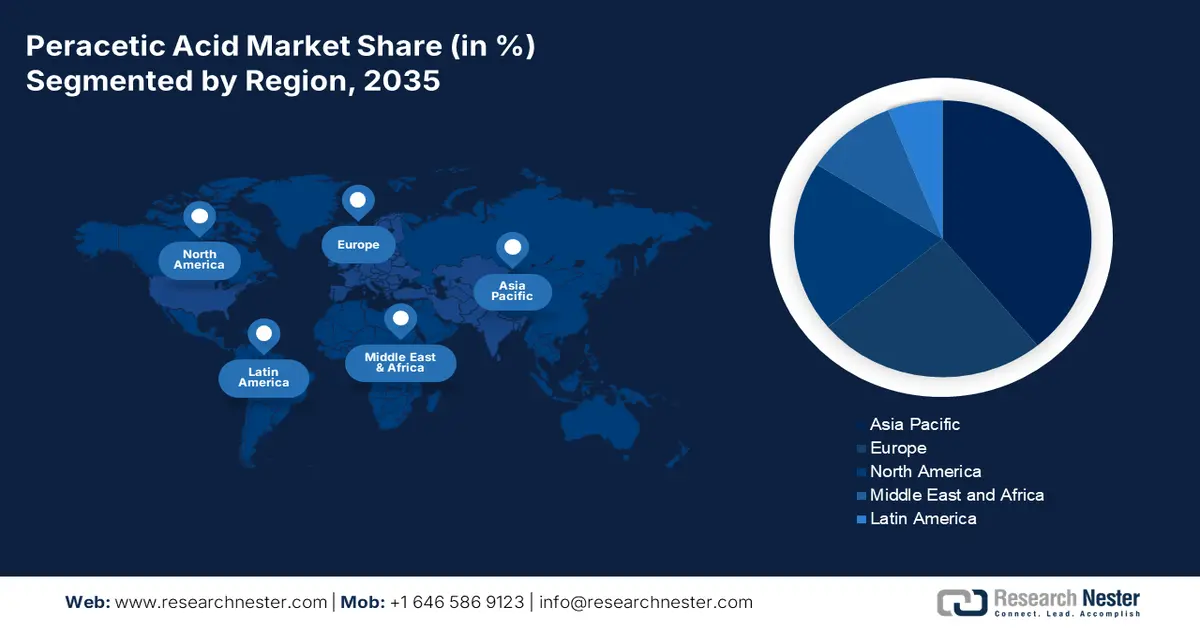

Regional Highlights:

- Europe peracetic acid market holds the largest share by 2035, driven by prioritization of wastewater treatment.

- Asia Pacific market will exhibit the fastest growth during the forecast timeline, fueled by rising demand for peracetic acid in industries.

Segment Insights:

- The disinfectant segment in the peracetic acid market is anticipated to achieve the largest share by 2035, driven by heightened hygiene standards and post-pandemic awareness.

- The food and beverage segment in the peracetic acid market is expected to hold a significant share by 2035, driven by the effectiveness of peracetic acid in killing pathogens in food and beverage processing.

Key Growth Trends:

- Rapid Growth of the Food Processing Industry in Different Parts of the World

- Effective Waste Water Treatment Measures World Wide

Major Challenges:

- Threat Posed by the High Reactivity of Peracetic Acid

- Lack of Awareness of the Various Effects of Peracetic Acid

Key Players: ACURO ORGANICS LIMITED, Aditya Birla Management Corporation Private Ltd., Airedale Chemical Company Limited., Belinka Perkemija, d.o.o., Biosan LLC, BioSafe Systems, LLC., Diversey, Inc, Ecolab Inc., Enviro Tech Chemical Services, Inc., Evonik Industries AG.

Global Peracetic Acid Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.11 billion

- 2026 Market Size: USD 1.18 billion

- Projected Market Size: USD 2.29 billion by 2035

- Growth Forecasts: 7.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Europe

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, France

- Emerging Countries: China, India, Brazil, Mexico, Thailand

Last updated on : 10 September, 2025

Peracetic Acid Market Growth Drivers and Challenges:

Growth Drivers

-

Rapid Growth of the Food Processing Industry in Different Parts of the World - Food processing is an important sector in all parts of the world. It is through food processing that food is made more safe, edible, and palatable for consumers. Food processing also brings a variety of choices of products to consumers. The improvement in the shelf life of the food products from processing should help farmers in the better storage and transportation of their agricultural produce. Thus, food processing plays a very significant role in the economic development of a nation. For instance, as per the Ministry of Food Processing Industries under the Government of India, the food processing sector contributed to 1.69% of the total Gross Value added (GVA) in the nation in 2019-20.

-

Effective Waste Water Treatment Measures World Wide - For instance, the European Union has a strong urban wastewater treatment directive that has helped improve the quality of the waterbodies in the region over the years significantly. Further, according to the Organization for Economic Co-operation and Development (OECD), 99.5% of the population in the Netherlands was connected via a public sewage network to a wastewater treatment plant in 2020. Peracetic acid is a strong disinfectant of wastewater, as about 91% of its effects can be observed within a minute. Hence, the evolving wastewater management systems in the world, which also emphasizes eco-friendliness, are expected to lead to market growth.

-

Rapid Rise in the Demand for Cleaning Products All Over the World - Even at a low concentration, peracetic acid acts as an effective antimicrobial. This trait of the chemical is relevant for its market growth in the days to come as the demand for cleaning products has risen unprecedentedly following the pandemic. For instance, there was a growth of about 385% in the sales of aerosol disinfectants alone in the United States (U.S.) in 2020.

-

Significant Rise in the Production of Poultry Meat World Wide - Peracetic acid is an approved cleaning agent, disinfectant, and anti-microbial in the processing of chicken and other poultry meat. It is also used to disinfect the equipment used in poultry processing. Hence, the rising production of various kinds of poultry meat is expected to lead to market growth. For instance, the total volume of broiler meat produced in the world was observed to increase from about 93 million metric tons in 2018 to more than 100 million metric tons in 2021.

Challenges

-

Threat Posed by the High Reactivity of Peracetic Acid - Peracetic Acid of ~36% has been observed to have characteristics similar to explosives. The different concentration rates make peracetic acid a complex solution. Carelessness could lead to dangerous reactions when unstable peracetic acid comes into contact with other solutions or combustible materials. Further, peracetic acid also exhibits high corrosiveness and strong oxidizing features.

-

Health Hazards that Result from the Prolonged Use of the Chemical

- Lack of Awareness of the Various Effects of Peracetic Acid

Peracetic Acid Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

7.5% |

|

Base Year Market Size (2025) |

USD 1.11 billion |

|

Forecast Year Market Size (2035) |

USD 2.29 billion |

|

Regional Scope |

|

Peracetic Acid Market Segmentation:

Application Segment Analysis

The global peracetic acid market is segmented and analyzed for demand and supply by application into disinfectant, oxidizer, sterilant, and others. Out of the four types of applications, the segment of disinfectant is estimated to gain the largest market share during the forecast period. The growth of the segment can be attributed to its significance in maintaining stipulated hygiene standards in various industries around the world. Peracetic acid, being a strong antimicrobial, is used vastly in industries such as agriculture, food processing, and pharmaceuticals. Their demand got a boost during the pandemic, as it can be observed from the increased use of many surface disinfectant chemicals. The demand for hand sanitizers went up dramatically after their use was declared one of the major measures for maintaining the health of the public by reducing SARS-CoV-2 transmission. For instance, significant growth was observed in the use of hand sanitizer among the Canadian population in non-occupational settings after the onset of COVID-19. It was observed that 66% of adults in the country were using hand sanitizer up to 5 times a day while 36% had more than 5 times of application of hand sanitizers daily.

End-user Segment Analysis

The global peracetic acid market is also segmented and analyzed for demand and supply by end-user industry into food and beverage, waste water, paper, pharmaceutical, chemicals, and others. Amongst these segments, the food and beverage segment are expected to garner a significant share of the global market. The effectiveness of peracetic acid in killing pathogens, bacteria, fungi, and spores is what makes the chemical highly preferred anti-microbial in the food and beverage sector. Peracetic acid is also used as a sanitizer of bottles and surfaces in the brewing process of various beverages, including beer. It is estimated that the beer industry helped raise tax revenue of USD 267 billion for the governments of over 69 countries around the world. This tremendous growth of the brewing industry worldwide is expected to lead to an increased demand for peracetic acid and thus, to market growth.

Our in-depth analysis of the global market includes the following segments:

|

By Application |

|

|

By End-user Industry |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Peracetic Acid Market Regional Analysis:

APAC Market Insights

The Asia Pacific peracetic acid market, amongst the market in all the other regions, is projected to grow at the fastest rate by the end of 2035. China should play a significant role in the regional market growth in the Asia Pacific region. Moreover, China is one of the major producers of chemicals in the world. The country also stands out as a main hub for the processing and production of specific chemicals such as hydrogen peroxide. It is estimated that the demand for hydrogen peroxide in China, which stood at about 363000 tons in 2020, should surpass 654000 tons by 2030. Peracetic acid is one of the major raw materials in the production of hydrogen peroxide. Hence, this projected increase in hydrogen peroxide demand is expected to be favorable for regional market growth. Further, the increasing demand for peracetic acid in different industries in China and other developing countries in the region, such as Japan and India, should benefit the chemical's regional market. The massive consumption of water for domestic, municipal, agricultural, and industrial purposes in China and India is expected to surge the market’s growth in the Asia Pacific.

Europe Market Insights

Europe is the region that is expected to hold the largest market share in the market by 2035. The regional market growth in Europe is expected to be driven majorly by the priority given to the treatment of wastewater by the different nations in the region. Many countries in Europe, such as Belgium, France, Norway, and Finland, had more than 80% of their population connected to a wastewater treatment plant in 2020. In places such as the Netherlands, Luxembourg, and Denmark, the share of such population ranged between 90 and 100%. Another factor that is expected to benefit the market for peracetic acid in Europe is the vast presence of various end-user industries. Also, new processes followed in Europe, including membrane filtration and UV disinfection, are also thought to influence the market’s growth favorably.

Peracetic Acid Market Players:

- ACURO ORGANICS LIMITED

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Aditya Birla Management Corporation Private Ltd.

- Airedale Chemical Company Limited.

- Belinka Perkemija, d.o.o.

- Biosan LLC

- BioSafe Systems, LLC.

- Diversey, Inc

- Ecolab Inc.

- Enviro Tech Chemical Services, Inc.

- Evonik Industries AG

Recent Developments

-

Enviro Tech Chemical Services, Inc., showcased PeraGuard, the first and only dry peracetic acid in the world, at the Food Safety Summit for 2022 held in Chicago. The chemical product has a formulation specifically suitable for the sanitization and environmental security of surfaces favorable for the growth and the spread of microorganisms.

-

Evonik Industries AG acquired PeroxyChem, a US-based producer of peracetic acid and hydrogen peroxide, for USD 625 million. The company expressed hopes for the expansion of its portfolio in high-growth and environmentally friendly applications. The company was also looking forward to benefiting from an attractive free cash flow as a result of the stable and growing financial status of PeroxyChem during the time of the acquisition

- Report ID: 4725

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Peracetic Acid Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.