Palm Recognition Biometrics Market Outlook:

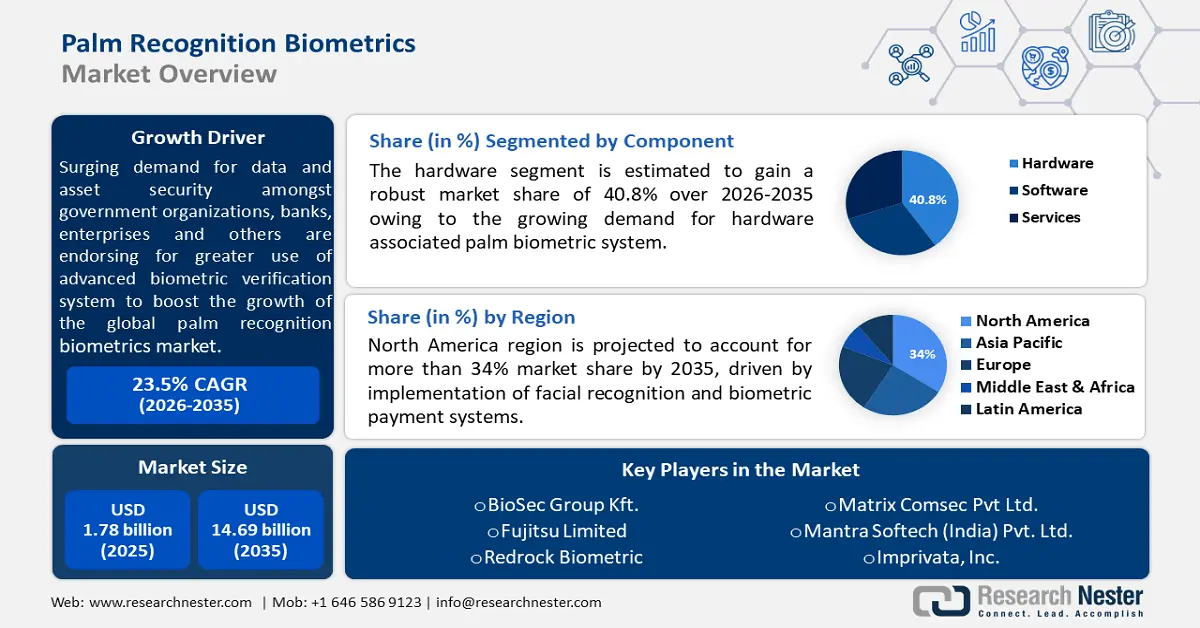

Palm Recognition Biometrics Market size was valued at USD 1.78 billion in 2025 and is likely to cross USD 14.69 billion by 2035, registering more than 23.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of palm recognition biometrics is estimated at USD 2.16 billion.

The market growth is driven by rising concern for data and asset security amongst government organizations, banks, enterprises, hospitals, telecommunication organizations, and, individuals, among others, are endorsing for greater use of advanced biometric verification systems. As of 2021, approximately 100 thousand scheduled banks were observed to be functioning in India alone.

In addition, the global palm recognition biometrics market revenue is impelled by increasing number of crimes worldwide, as well as the need for forensic organizations to adapt to technologies that can help them stay ahead of criminals. Additionally, adoption of biometric technology by the FBI is further anticipated to be a major market growth factor. There is escalating need for accurate patient identification systems in the healthcare sector, which in turn is set to promote the demand for palm recognition biometrics.

Key Palm Recognition Biometrics Market Insights Summary:

Regional Highlights:

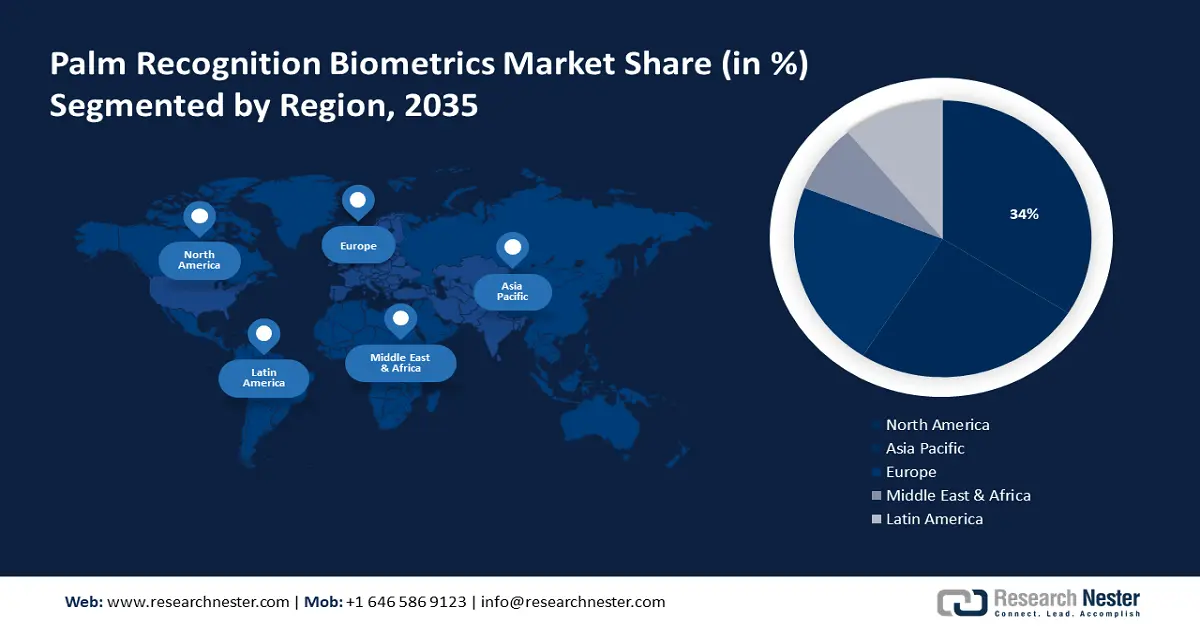

- North America palm recognition biometrics market will hold around 34% share by 2035, driven by implementation of facial recognition and biometric payment systems.

- Asia Pacific market projects significant growth during the forecast timeline, driven by increasing population and digital connectivity.

Segment Insights:

- The palm vein biometrics segment in the palm recognition biometrics market is poised for lucrative growth during 2026-2035, driven by its contactless nature making it ideal for hygiene-sensitive environments.

- The palmprint segment in the palm recognition biometrics market is anticipated to maintain the largest share by 2035, driven by its user-friendly nature and wide adoption in forensic and commercial sectors.

Key Growth Trends:

- Growing Prevalence Cybercrimes to Boost the Market Growth

- Rising Cases of E-commerce Fraud

Major Challenges:

- High Deployment Costs of Palm Recognition Biometrics

Key Players: Imprivata, Inc,BioSec Group Kft., Fujitsu Limited, iDLink Systems Pte Ltd., M2SYS Technology, Identytech Solutions America Inc., Mantra Softech (India) Pvt. Ltd., Redrock Biometrics, Matrix Comsec Pvt. Ltd.

Global Palm Recognition Biometrics Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.78 billion

- 2026 Market Size: USD 2.16 billion

- Projected Market Size: USD 14.69 billion by 2035

- Growth Forecasts: 23.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (34% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, South Korea

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 8 September, 2025

Palm Recognition Biometrics Market Growth Drivers and Challenges:

Growth Drivers

-

Growing Prevalence Cybercrimes to Boost the Market Growth – cybercrimes are generally committed via the internet which to break palm recognition biometrics, a hacker needs physical access to it. This factor is a major restraint between a security system and a hacker. Hence, the surge in cybercrimes is projected to hike the market growth over the forecast period. For instance, in 2022, around 200,000 cybercrimes took place across the globe.

-

Rising Cases of E-commerce Fraud – a surge in the cases of E-commerce fraud is stated to drive the market growth since biometrics are difficult to copy and use for malicious activities. Hence, the number of E-commerce fraudulent can be reduced using Recognition Biometrics. For instance, in 2022, approximately USD 40 billion were lost to online payment fraud around the world.

-

Increasing Biometric Payment Method – nowadays, people prefer online methods to make payments. Online payments are more convenient and safer than using real money. For instance, in the United States, around 72% of people were ready to use fingerprint authentication than PIN code in 2021 while this figure for Saudi Arabia was anticipated to be around 88%.

-

Growing Sales of Smartphones across the Globe – fingerprints and biometrics are highly utilized in smartphones nowadays to enhance the security of these devices. For instance, the unit sales of smartphones were projected to be around 1.5 billion in 2021 while nearly 1 billion mobile phones were shipped across the globe.

Challenges

-

High Deployment Costs of Palm Recognition Biometrics

-

Most organizations restrict to technology updates owing to the fear of the high costs that they would have to pay for them. As palm recognition biometrics usually cost high, hence, upgrading the existing systems of the end-users to the new technology would require significant investments, which is anticipated to hamper the market growth during the forecast period. Moreover, as businesses and governments are under constant threat from hackers, the fear of data theft or fraud is also therefore anticipated to limit market growth over the forecast period.

- Fear of Privacy Intrusions to Hamper the Market Growth

- Lack of IT Professionals to Operate Palm Recognition Biometrics

Palm Recognition Biometrics Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

23.5% |

|

Base Year Market Size (2025) |

USD 1.78 billion |

|

Forecast Year Market Size (2035) |

USD 14.69 billion |

|

Regional Scope |

|

Palm Recognition Biometrics Market Segmentation:

Type Segment Analysis

The palmprint segment is predicted to account for largest market share by 2035. Palmprint recognition authentication systems are based on the information that has been acquired from the palm imprints of an individual. The key advantages of using palmprint recognition are its user-friendly nature and greater flexibility. Palmprints are used in the applications such as criminal, forensic, or commercial. For instance, it was estimated that 30% of the latent prints found at crime scenes come from palms.

The palm vein biometrics segment, on the other hand, is also projected to grow at lucrative CAGR through 2035. Palm vein recognition authentication systems measure the vein patterns and utilize infrared light to map the vein structure underneath the skin of an individual's palm. Moreover, as palm vein biometric systems use a contactless authentication technology, hence it finds massive utilization in hospitals and other environments where hygiene is a key factor.

Our in-depth analysis of the global market includes the following segments:

|

By Type |

|

|

By Component |

|

|

By Technique |

|

|

By Application |

|

|

By End-User Industry |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Palm Recognition Biometrics Market Regional Analysis:

North American Market Insights

North America region is projected to account for more than 34% market share by 2035. The market growth is attributed to increasing implementation of facial recognition and biometric payment systems in the region which is mainly installed in banks, offices, and other organizations. Apart from that surge in the regional population to purchase mobile phones and laptops with robust security features is further expected to propel the market growth. The United States is estimated to be the world's largest region with smartphone users. For instance, as of 2021, nearly 300 million smartphone users were noticed to be living in the United States.

APAC Market Insights

The Asia Pacific palm recognition biometrics market is estimated to observe significant CAGR during the forecast period. The market growth is impelled by increasing population in the region which is anticipated to boost smartphone sales and financial activities. Higher penetration of the internet in the region is set to flourish these activities.

Palm Recognition Biometrics Market Players:

- Imprivata, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- BioSec Group Kft.

- Fujitsu Limited

- iDLink Systems Pte Ltd.

- M2SYS Technology

- Identytech Solutions America Inc.

- Mantra Softech (India) Pvt. Ltd.

- Redrock Biometrics

- Matrix Comsec Pvt. Ltd.

Recent Developments

-

Imprivata, Inc. announced that it has launched the touchless biometric palm scanner, a solution designed by the joint expertise of Keyo, Inc. along with Imprivata. The touchless scanner is aimed at enabling healthcare organizations to ensure that clinicians have the access to the correct records of the patients.

-

BioSec Group ltd. announced that the integration of its LifePass biometric authentication middleware with the SIPORT access control and time tracking system of Siemens is under process. The integration of the middleware system of BioSec would benefit Siemens SIPORT system with the functionalities of palm vein recognition technology.

- Report ID: 2865

- Published Date: Sep 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Palm Recognition Biometrics Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.