Contactless Biometrics Technology Market Outlook:

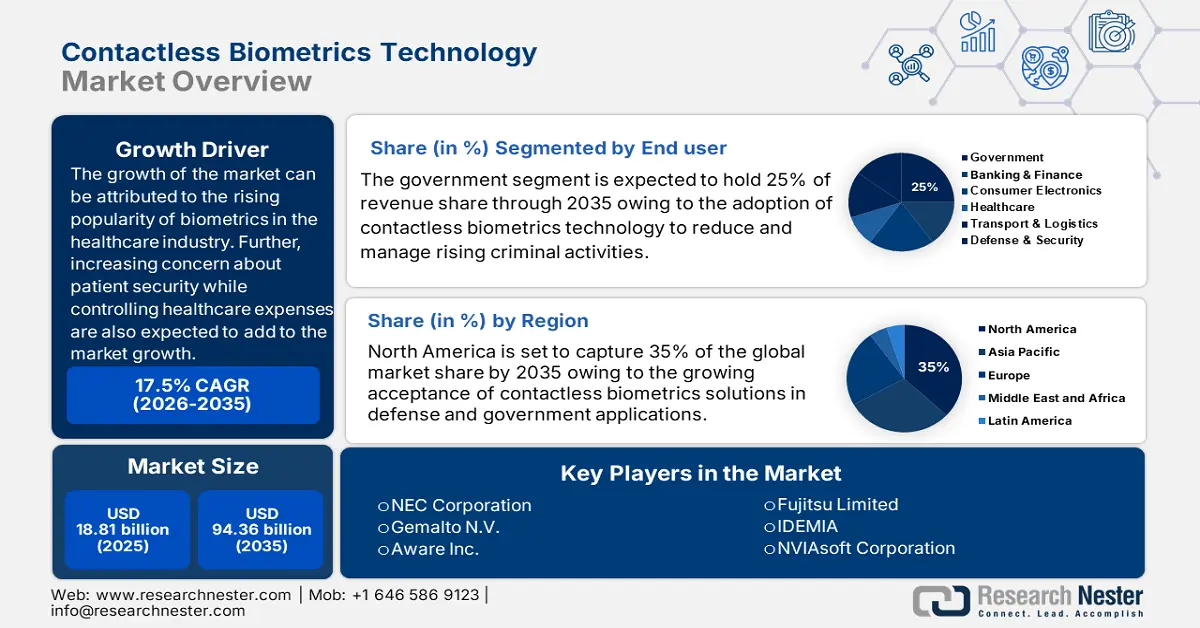

Contactless Biometrics Technology Market size was valued at USD 18.81 billion in 2025 and is set to exceed USD 94.36 billion by 2035, expanding at over 17.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of contactless biometrics technology is estimated at USD 21.77 billion.

The growth of the market can be attributed to the rising popularity of biometrics in the healthcare industry. Further, increasing concern about patient security while controlling healthcare expenses are also expected to add to the market growth. Biometrics are used to track medical equipment, prescriptions, and other assets in the healthcare industry. For instance, the most popular biometric in medical sector is fingerprint recognition, which helps to confirm the identities of patients and employees. In 2021, more than 30% of healthcare institutions in US, encountered a serious cyber security event that had an impact on patient safety.

In addition to these, factors that are believed to fuel the market growth of contactless biometrics technology include the growing usage of smartphones. The most widely used biometric technology in smartphones and tablets today is fingerprint recognition. Further, facial recognition is also gaining popularity in mobile phones, as all smartphones have RGB cameras that are appropriate for capturing facial details. According to data, at the moment, over 40% of smartphone users utilize some sort of biometric authentication with their devices.

Key Contactless Biometrics Technology Market Insights Summary:

Regional Highlights:

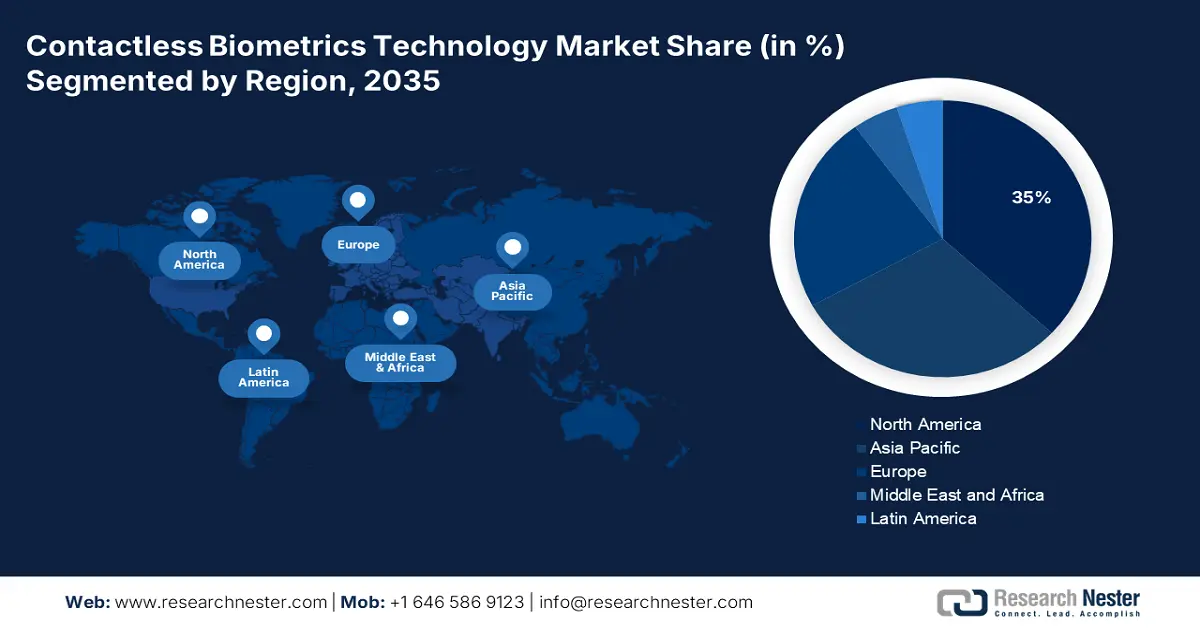

- North America contactless biometrics technology market will hold around 35% share by 2035, driven by the growing acceptance of contactless biometrics solutions in defense and government applications.

- Asia Pacific market will achieve the highest CAGR from 2026 to 2035, fueled by increasing frequency of terrorist attacks leading to heightened national security concerns.

Segment Insights:

- The government segment in the contactless biometrics technology market is projected to capture the largest share by 2035, driven by rising adoption of biometrics to combat crime and ensure secure elections.

- The software segment in the contactless biometrics technology market is projected to hold a significant share by 2035, driven by the integration of AI and ML with cloud-based biometric solutions.

Key Growth Trends:

- Growing Usage of Contactless Biometrics in Banking Firms

- Rising Rate of Air Travelers

Major Challenges:

- Exorbitant Price of Contactless Biometrics Solutions

- High Probability of Identity or Data Theft

Key Players: Fingerprint Cards AB, NEC Corporation, Gemalto N.V., Aware Inc., Touchless Biometric Systems AG, Fujitsu Limited, IDEMIA, NVIAsoft Corporation, HID Global, M2SYS Technology.

Global Contactless Biometrics Technology Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 18.81 billion

- 2026 Market Size: USD 21.77 billion

- Projected Market Size: USD 94.36 billion by 2035

- Growth Forecasts: 17.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 9 September, 2025

Contactless Biometrics Technology Market Growth Drivers and Challenges:

Growth Drivers

-

Growing Usage of Contactless Biometrics in Banking Firms – On account of the increasing concern for the protection of financial transactions, the market is expected to expand more in the upcoming years. As of 2020, contactless transactions increased by more than 30% across the globe.

-

Rising Rate of Air Travelers – Growth in the economy and in the population across the globe is estimated to drive market growth. The use of biometrics verifies a traveler's identification at both entrance and departure points and helps in verifying if passengers are on the right plane, match luggage from the right person to the right aircraft, check passport and visa information. For instance , in 2022, India's air passenger traffic increased by over 40%.

-

Increasing Adoption of Automated Identification and Data collection (AIDC) Technologies in the Retail and E-Commerce Sectors– The retail industry's growing concern over data security is anticipated to drive the market growth. The use of biometric technology in retail can increase sales by enhancing shop security and improving the accuracy and dependability of transactional data. Furthermore, retailers use biometric technology to create a database of potential shoplifters. Approximately, 4000 data security risks are experienced by the retail industry each year.

-

Growing Internet Accessibility around the Globe – As of 2021, there were over 4 billion internet users globally.

Challenges

-

Exorbitant Price of Contactless Biometrics Solutions - The high cost of contactless biometrics solutions mostly in emerging economies, is one of the major factors predicted to slow down the market growth. For instance, the type of sensor employed in the biometric device determines how much a fingerprint recognition system will cost. Additionally, the cost of iris and retina scanners is greater than that of other biometric devices.

-

High Probability of Identity or Data Theft

- Frequent Changes in Human Face, Pose, and Expressions

Contactless Biometrics Technology Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

17.5% |

|

Base Year Market Size (2025) |

USD 18.81 billion |

|

Forecast Year Market Size (2035) |

USD 94.36 billion |

|

Regional Scope |

|

Contactless Biometrics Technology Market Segmentation:

End-user Segment Analysis

The global contactless biometrics technology market is segmented and analyzed for demand and supply by end user into government, banking & finance, consumer electronics, healthcare, transport & logistics, defense & security, and others. Out of these seven, the government segment is estimated to gain the largest market share over the projected time frame. The growth of the segment can be attributed to the adoption of contactless biometrics technology to reduce and manage rising criminal activities. This technology offers several benefits, such as it allows for the identification of criminals and terrorists. Further, governments are also increasingly utilizing biometric voting technology to assist and enable free from fraud and illegal acts elections, in addition to employing it to help in managing crime. As of 2022, robberies and severe assaults went up by more than 2% and 10%, in America.

Component Segment Analysis

The global contactless biometrics technology market is also segmented and analyzed for demand and supply by component into hardware, software, and services. Amongst these three segments, the software segment is expected to garner a significant share. The growth of the segment can be attributed to the rising popularity of cloud-based services, artificial intelligence (AI), and machine learning (ML) for contactless biometrics solutions. For instance, by evaluating face traits and comparing them to a database, AI can make facial identification by computers considerably simpler, as behavioral biometrics are linked to artificial intelligence (AI), and machine learning (ML). Mostly, this technology is used with augmented reality programmes. Moreover, AI uses 3D biometrics and learns from millions of images to accurately identify a person's face. Furthermore, AI and biometrics helps in businesses safeguard their operations, clients, and staff.

Our in-depth analysis of the global market includes the following segments:

|

By Component |

|

|

By Application |

|

|

By End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Contactless Biometrics Technology Market Regional Analysis:

North American Market Insights

North America industry is predicted to account for largest revenue share of 35% by 2035. The growth of the market can be attributed majorly to the growing acceptance of contactless biometrics solutions in defense and government applications. The need for contactless biometric technologies to maintain high levels of security has grown in the US as a result of growing criminal activities. For instance, the Department of Homeland Security uses biometrics to identify and detect unauthorized entry into the US. According to data, approximately 40 million American adults were affected by identity fraud in 2022, causing damages of over USD 50 billion.

APAC Market Insights

The Asian Pacific contactless biometrics technology market, amongst the market in all the other regions, is projected to grow with the highest CAGR during the forecast period. The growth of the market can be attributed majorly to the increasing frequency of terrorist attacks, which has led to increased concerns regarding national security in the region. Biometric technology has gained popularity in the defense sector to verify a person's identification and prevent unauthorized people from entering certain areas where armed troops are stationed. For instance, in India Foreign military officers are being recognized on the other side of the border using facial recognition technology, and lately they are also used to detect pirates in the Indian Ocean, and monitor movements of terrorists worldwide.

Europe Market Insights

Europe region is poised to witness substantial growth through 2035. The growth of the market can be attributed majorly to the increasing need for contactless identification in crowded places. For instance, using contactless biometrics in congested areas of the region has numerous advantages, such as better efficiency and higher cyber security. In addition, this technology enables the identification and authentication of people, without the need of standard identity documents such as ID cards or passports or any physical touch. Further, the biometric identification technologies allow authorized travelers to move freely, seamlessly, safely, and securely while preserving the security of EU borders, which is also anticipated to contribute to the market growth in the region.

Contactless Biometrics Technology Market Players:

- Fingerprint Cards AB

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- NEC Corporation

- Gemalto N.V.

- Aware Inc.

- Touchless Biometric Systems AG

- Fujitsu Limited

- IDEMIA

- NVIAsoft Corporation

- HID Global

- M2SYS Technology

Recent Developments

-

Fingerprint Cards AB teamed up with Flywallet, to introduce biometric wearable products for the market in Europe. The availability of multifunctional Fingerprints sensors will allow the products to provide enhanced security, privacy, and improved user experience.

-

HID Global introduced OMNIKEY Secure Element, to replace the iCLASS SE Processor. OMNIKEY Secure Element is claimed to offer broader integration capabilities, as it enables existing and new secure access identification and authentication applications, ranging from locker management to electric car charging, and adds support for credential technologies.

- Report ID: 3924

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.