Organic Electronics Market Outlook:

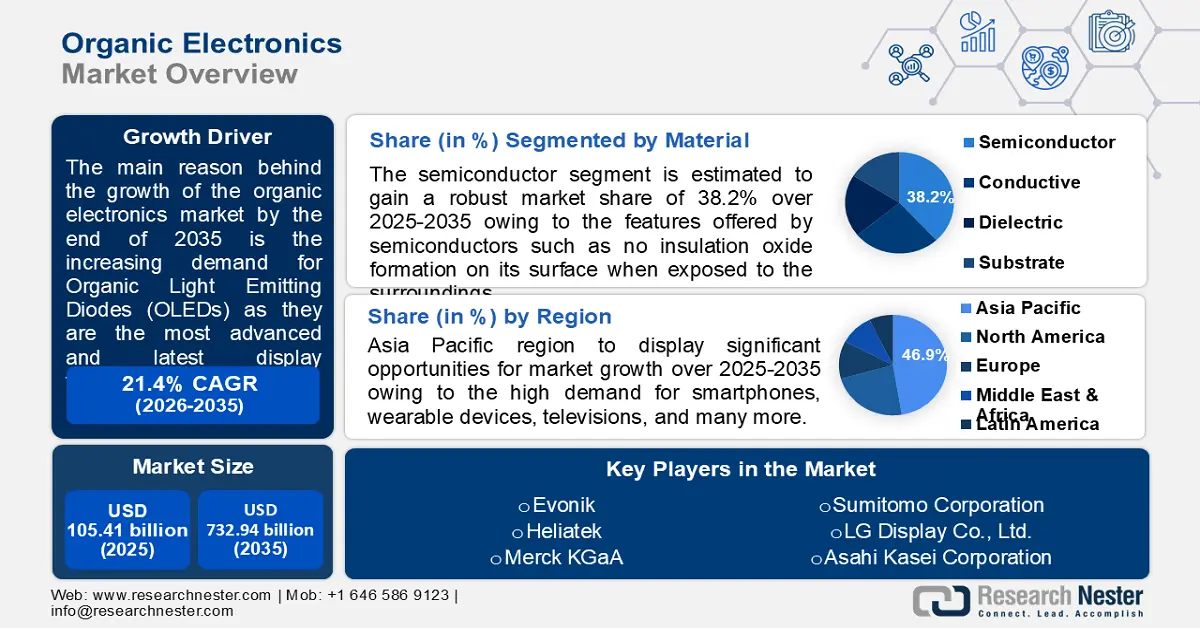

Organic Electronics Market size was over USD 105.41 billion in 2025 and is projected to reach USD 732.94 billion by 2035, witnessing around 21.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of organic electronics is evaluated at USD 125.71 billion.

Growing demand for organic semiconductors and organic light-emitting diodes (OLEDs) has boosted the need for the organic electronics market. Organic electronics are cost-effective, offer mechanical flexibility, and has the ability to chemically modify the electronic as compared to inorganic counterparts made from gallium arsenide and silicon. OLEDs are advanced and latest display technology used in televisions, mobile phones, laptops, and various other display-related electronics. For instance, in May 2024, at SID Display Week 2024, California, LG announced its next-gen OLED and advanced display technologies under the theme “A Better Future.” Owing to this, color expression accuracy is improved by 97% according to the DCI-P3 standard.

Key Organic Electronics Market Insights Summary:

Regional Highlights:

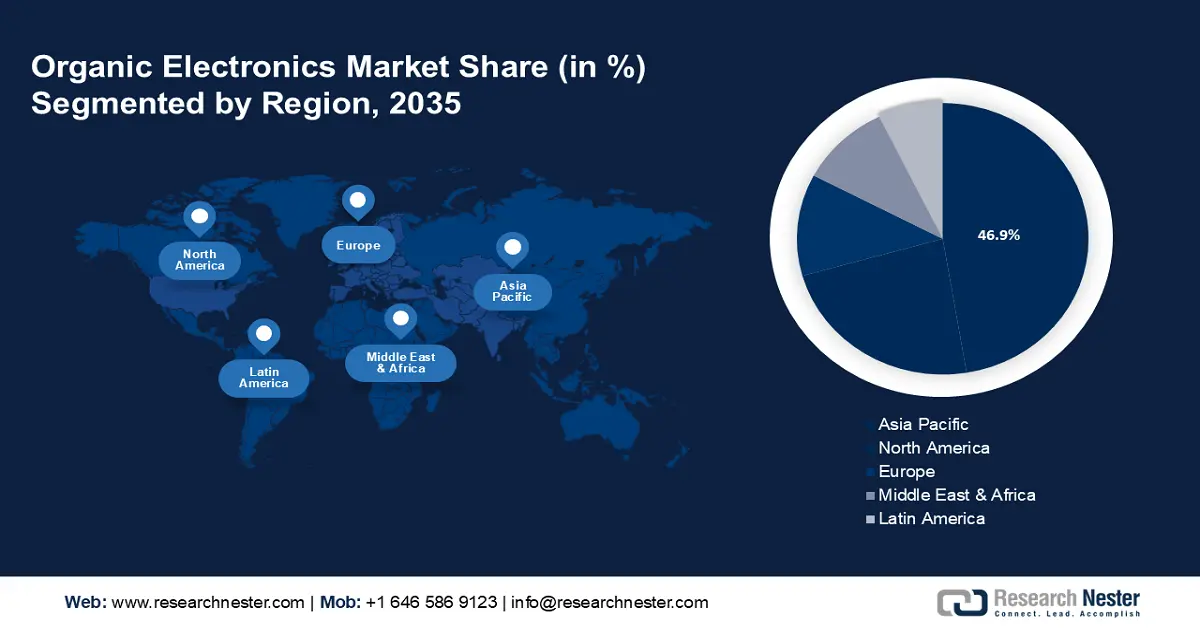

- The Asia Pacific organic electronics market is anticipated to capture 47% share by 2035, driven by rising demand for smartphones, wearable devices, and televisions in the region.

Segment Insights:

- The semiconductor segment in the organic electronics market is anticipated to grow significantly by 2035, fueled by mechanical flexibility, low-cost fabrication, and growing sustainability awareness.

Key Growth Trends:

- Advancements in the consumer electronic industry

- Increasing energy-efficient solutions

Major Challenges:

- Less demand than conventional alternatives

- Reduced efficiency after a specific period

Key Players: Evonik, Heliatek, Merck KGaA, Sumitomo Corporation, LG Display Co., Ltd., Asahi Kasei Corporation, AU Optronics Corporation, Universal Display Corporation, BASF.

Global Organic Electronics Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 105.41 billion

- 2026 Market Size: USD 125.71 billion

- Projected Market Size: USD 732.94 billion by 2035

- Growth Forecasts: 21.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (47% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, South Korea, Germany

- Emerging Countries: China, Japan, South Korea, India, Taiwan

Last updated on : 18 September, 2025

Organic Electronics Market Growth Drivers and Challenges:

Growth Drivers

-

Advancements in the consumer electronic industry: The preference for organic electronics has increased for the manufacturing of lighting solutions, infotainment systems, and dashboards. Additionally, due to the prominent performance, durability, and efficiency of organic electronics such as OLED in flexible displays of curved/semi-curable, and foldable smartphones are in high demand as compared to inorganic materials. For instance, in February 2024 Samsung published a report stating that the collective sales of foldable phones in 2024 will exceed 20 million units globally. Meanwhile, in the next 5 years, the annual sales will witness significant gain surpassing 100 million units. The electronics & smart devices share has increased, augmented by the rising wireless connectivity technology of organic electronics.

-

Increasing energy-efficient solutions: The demand for energy-efficient technology is surging in several countries such as the U.S., and Canada. For instance, the Department of Energy published a report estimating that LEDs would be the most energy-efficient and fastest-developing lighting technology. In addition, it was projected that most lighting installations will be LED-powered by 2035, and the annual energy savings from LED lighting could surpass 569 TWh, which is the equivalent of more than 92 1,000 MW power plants. Therefore, organic electronics are being driven by energy efficiency in several industries, such as consumer electronics and automotive and architectural lighting, influencing the adoption and use of organic electronics.

Challenges

-

Less demand than conventional alternatives: The market penetration of organic electronics is lower than that of its conventional alternatives such as inorganic semiconductors and conductors. Primarily as a result of outdated technologies used in the process, variations in the cost of raw materials, and a lack of knowledge about the product. For the market to expand and generate greater profits over time, awareness levels must rise.

-

Reduced efficiency after a specific period: Integrating organic electronics technology with the traditional semiconductor industry is a challenging task. For instance, after a certain amount of time, OLED TVs begin to lose their display's vibrant and bright color quality. Additionally, the production of organic electronics is less expensive than that of conventional technologies, but since the technology is new, it takes more experienced scientists, engineers, and developers to create organic electronics, raising the final cost to the user.

Organic Electronics Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

21.4% |

|

Base Year Market Size (2025) |

USD 105.41 billion |

|

Forecast Year Market Size (2035) |

USD 732.94 billion |

|

Regional Scope |

|

Organic Electronics Market Segmentation:

Material Segment Analysis

Semiconductor segment is predicted to capture around 38.2% organic electronics market share by the end of 2035. Significant growth in the revenue share is anticipated as a result of various features offered by semiconductors such as no insulation oxide formation on its surface when exposed to the surroundings. Accredited to this, a clean interface is maintained on the surface while interacting with other materials. A non-metallic substance with semiconducting qualities forms an organic semiconductor, when compared to inorganic semiconductors, these materials have several benefits, such as being mechanically flexible, lightweight, and affordable.

This offers a chance to develop such devices using less expensive fabrication techniques. Additionally, governments all around the globe are highly investing in the R&D of semiconductors such as the CHIPS incentives grant program and more. The Semiconductor Industry Association published a report in June 2024, estimating that under the CHIPS incentives grant program, around USD 11 billion and USD 2 billion will be granted by the Department of Commerce and the Department of Defense respectively for the progress of CHIPS R&D Programs. Furthermore, the demand for organic electronics has increased due to growing awareness of sustainable development and the fact that these semiconductors are biodegradable, making them much more preferred over other materials. Growth in this sector will boost the semiconductor manufacturing equipment value in the near future.

Application Segment Analysis

The display segment in the organic electronics market is poised to dominate majority share by the end of the forecast period. This tremendous gain is credited to the usage of advanced technologies in several applications of television, smartphones, laptops, and other electronics, healthcare, and military industries. A significant increase is predicted due to the surge for organic electronics in the coming years as advancements in display technology, such as organic LED (OLED) displays are observed. OLED displays have many benefits for users, including improved image quality with higher contrast, a wider viewing angle, more brightness, faster refresh rates, a wider color gamut, and less power consumption. Owing to this various technological companies are shifting over to OLED to cater to these requirements. A press release by Apple in May 2024 revealed that the iPad Pro will have a breakthrough Ultra Retina XDR display with advanced OLED technology.

Our in-depth analysis of the global market includes the following segments:

|

Material |

|

|

Vertical |

|

|

Application |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Organic Electronics Market Regional Analysis:

Asia Pacific Market Insights

Asia Pacific industry is likely to dominate majority revenue share of 47% by 2035. The surge in smartphones, wearable devices, and televisions due to the high demand for smartphones drives the growth of organic electronics in this region. A report by GSMA in 2023 estimated that in Asia Pacific more than 3 billion smartphone connections were expected with a smartphone adoption rate of 94%.

Increasing usage of advanced technologies such as ML (machine learning) and AI (artificial intelligence) in organic electronics would integrate several features such as remote sensing and automated start. This will fuel the sales of organic electronics in China. Harward Business Review in 2021 projected that based on several indicators China is the global frontier in the technological development of AI.

IoT-compatible organic devices in Japan are at a surge owing to the presence of prominent companies like Panasonic and Sony which integrate OLEDs into their devices such as TVs, wearable devices, and more. For instance, in August 2023, Sony announced the release of ECX344A, an HD, large with 4K resolution along with a 1,3-type OLED Microdisplay. This is preferably used in VRs and Ars head-mounted displays. This growth will augment the market share of virtual reality in the forecast period.

North America Market Insights

North America will also encounter huge growth in the organic electronics market share during the forecast period with a notable size. This region will account for the second position in this landscape owing to the increasing IT & software, automotive, and consumer electronics industries and its demand in the rapidly increasing population growth. Researchers at Research Nester published a report in May 2024, estimating that about 50-60% of the whole year’s revenue in North America is attributed to IT services firms.

Increasing disposable income in the U.S. is projected to increase the demand for organic electronics market growth. According to a report by the Bureau of Economic Analysis in March 2024, in just one month from April to May, personal income increased by 0.5% valued at USD 114.1 billion.

Canada has shown a lucrative increase in sustainable development technologies, as they demand low-power consumption and the latest premium products such as organic batteries, monitors, TVs, smartphones, and more. In July 2023, the Government of Canada published a report estimating that in 2021, the environmental and clean technology (ECT) sector contributed 1.6% of employment and 2.9% of Canada's GDP.

Organic Electronics Market Players:

- Novaled GmbH

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Evonik

- Heliatek

- Merck KGaA

- Sumitomo Corporation

- LG Display Co., Ltd.

- Asahi Kasei Corporation

- AU Optronics Corporation

- Universal Display Corporation

- BASF SE

Organic electronics market expansion is estimated to witness a lucrative share during the forecast period. The competitive environment is attributed to the advancements in the consumer electronic industry and increasing energy-efficient solutions. More companies are entering this sector owing to the potential growth opportunities. In the forecast period, the market will observe emerging competitors and a growing demand for organic electronics around the world.

Some of the key players include:

Recent Developments

- In November 2022, Heliatek made a collaboration distribution deal with PETA Engineering, a top organic electronics maker. As a result, these two businesses now work closely together and have already finished two significant projects in Korea.

- In May 2022, Evonik announced the purchase of its TAeTTOOz materials technology by InnovationLab GmbH to utilize it for printable rechargeable batteries. From the first concept draft to industrial production, the innovation lab offers custom-tailored solutions with a focus on developing organic electronics.

- Report ID: 6360

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Organic Electronics Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.