Optoelectronic Transistor Market Outlook:

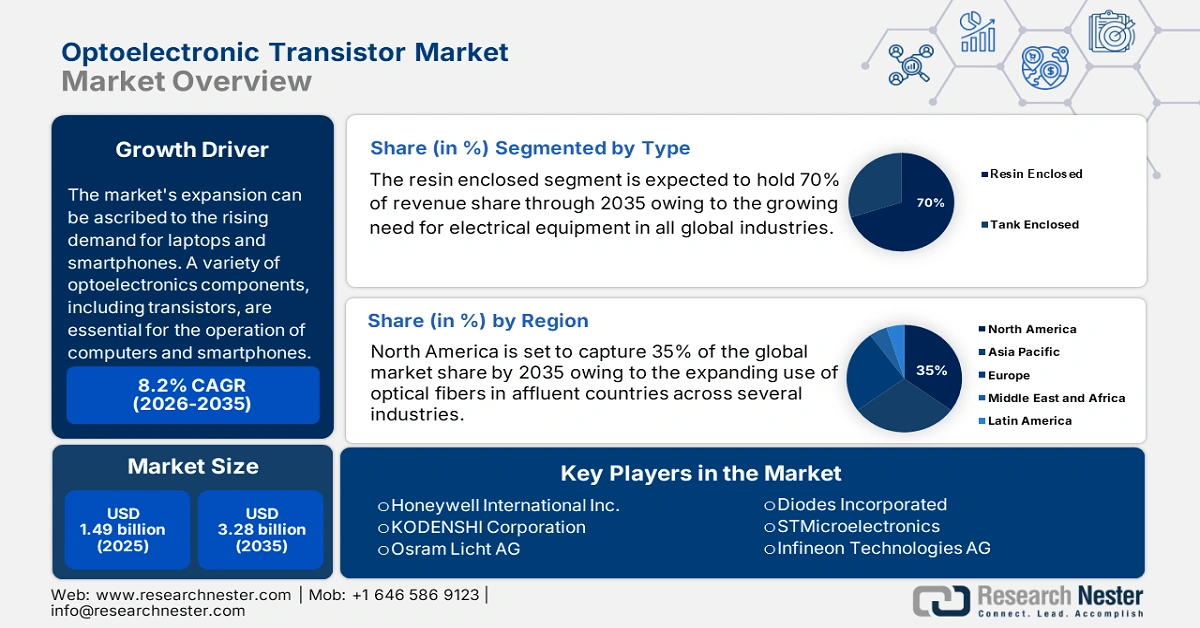

Optoelectronic Transistor Market size was valued at USD 1.49 billion in 2025 and is expected to reach USD 3.28 billion by 2035, expanding at around 8.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of optoelectronic transistor is evaluated at USD 1.6 billion.

The growth of the market can be attributed to the increasing demand for smartphones and laptops. A variety of optoelectronics components, including transistors, are essential for the operation of computers and smartphones. Therefore, the demand for optoelectronic transistors rises as a result of the rising demand for these devices. According to statistics, in 2022, there were over 7 billion mobile subscribers worldwide. By 2025 it is predicted that the total number of mobile users is anticipated to reach around 8 billion.

In addition to these, factors that are believed to fuel the market growth of optoelectronic transistors include the rise in technological advancements. For instance, technology for optoelectronic devices has advanced significantly, owing to the creation of novel materials and fabrication methods. As a result, optoelectronic transistors are now being produced that are more effective and potent.

Key Optoelectronic Transistor Market Insights Summary:

Regional Highlights:

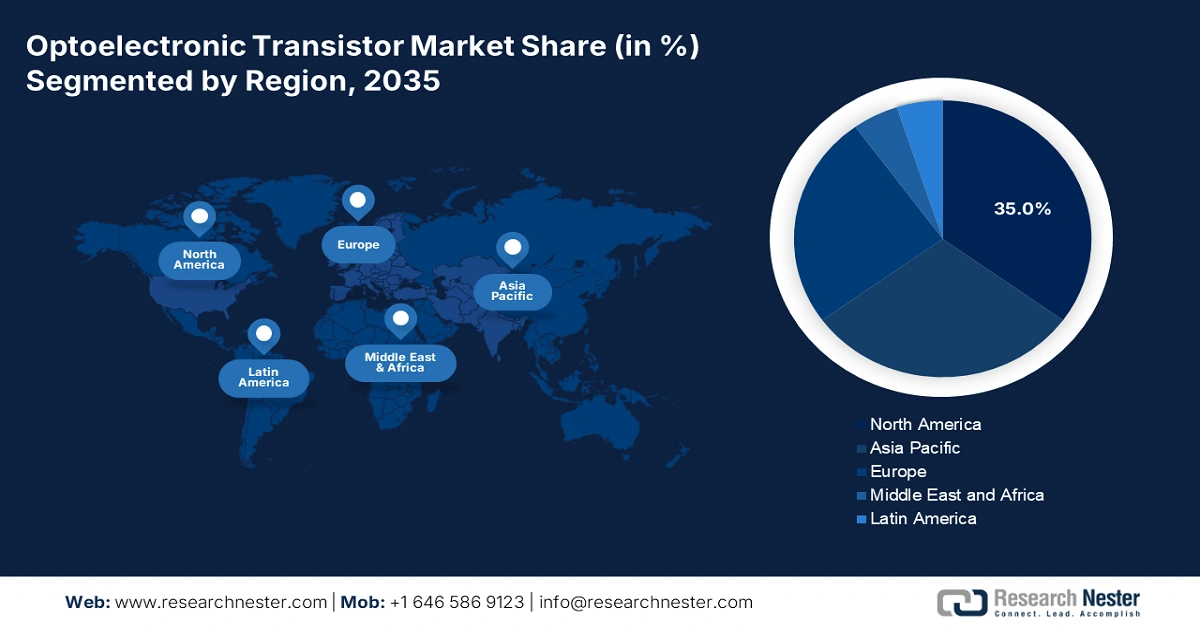

- North America optoelectronic transistor market holds the largest share by 2035, fueled by the growing adoption of optical fibers across businesses in developed nations, along with increased demand for optoelectronic transistors.

- Asia Pacific market will capture the second largest share by 2035, driven by increasing demand for optoelectronics-based products, along with advancements like 5G networks and IoT development.

Segment Insights:

- The optical sensors (application) segment in the optoelectronic transistor market is anticipated to hold a significant share by 2035, attributed to the rising complexity and adoption of optical sensors in various fields like medical and automotive systems.

- The optical sensors (application) segment in the optoelectronic transistor market is anticipated to hold a significant share by 2035, attributed to the rising complexity and adoption of optical sensors in various fields like medical and automotive systems.

Key Growth Trends:

- Growing Shift towards Renewable Energy

- Rising Adoption of the Internet of Things (IoT)

Major Challenges:

- Exorbitant Cost of Optoelectronic Transistors

- Lack of Standardization

Key Players: Honeywell International Inc., KODENSHI Corporation, Cypress Semiconductor Corporation, Diodes Incorporated, STMicroelectronics, Infineon Technologies AG, Renesas Electronics Corporation, SHARP Fukuyama Semiconductor Co., Ltd., Vishay Intertechnology Inc.

Global Optoelectronic Transistor Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.49 billion

- 2026 Market Size: USD 1.6 billion

- Projected Market Size: USD 3.28 billion by 2035

- Growth Forecasts: 8.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, South Korea, Germany

- Emerging Countries: China, India, Japan, South Korea, Taiwan

Last updated on : 9 September, 2025

Optoelectronic Transistor Market Growth Drivers and Challenges:

Growth Drivers

- Growing Shift towards Renewable Energy– The adoption of optoelectronic components in the solar sector is being driven by the transition towards renewable energy sources, which as a result is estimated to drive market growth. In 2020, renewable energy now accounted for over 15% of the electrical generation in the US.

- Rising Adoption of the Internet of Things (IoT) – The growing popularity of the IoT is anticipated to increase the demand for optoelectronics components since they are being widely used in a variety of applications, such as smart home appliances, wearable technology, and industrial automation. By 2025, there will be over 38 billion Internet of Things (IoT)-connected gadgets globally.

- Increasing Automotive Industry – As electric vehicles become more popular, the demand for optoelectronics transistors in battery management systems and charging stations is expected to increase. By 2026, the automobile industry in India is anticipated to generate over USD 250 billion.

- Growing Prevalence of Chronic Diseases – It is expected that patients with chronic illnesses, including gastroesophageal reflux disease, celiac disease, or cancer, are anticipated drive the market growth. More than 27% of US people had several chronic illnesses in 2018.

Challenges

- Exorbitant Cost of Optoelectronic Transistors- The high cost associated with optoelectronic transistors, is one of the major factors predicted to slow down the market growth. For instance, transistors made of optoelectronics frequently require sophisticated fabrication processes and materials, which might increase their cost relative to conventional electronic components. This may restrict their use in applications where cost is an issue.

- Lack of Standardization

- Highly Sensitive to Environmental Factors such as Temperature, Humidity, and Vibration

Optoelectronic Transistor Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

8.2% |

|

Base Year Market Size (2025) |

USD 1.49 billion |

|

Forecast Year Market Size (2035) |

USD 3.28 billion |

|

Regional Scope |

|

Optoelectronic Transistor Market Segmentation:

Type Segment Analysis

The market is segmented and analyzed for demand and supply by type into tank enclosed, resin enclosed, and others. Out of the three types of optoelectronic transistors, the resin-enclosed segment is estimated to gain the largest market share in the year 2035. The growth of the segment can be attributed to the growing demand for electronics across the globe. Owing to the rising demand for electrical devices across every industry in the world is anticipated to drive market growth. For instance, resin is widely employed to insulate electrical and electronic parts. Thus, the market will continue to rise in the coming years as more people throughout the world use electronic products where resin is often used. According to data, Indian domestic electronics production increased from over USD 65 billion in 2021.

Application Segment Analysis

The global optoelectronic transistor market is also segmented and analyzed for demand and supply by application into circuit coupling, optical sensors, and others. Amongst these three segments, the optical sensors segment is expected to garner a significant share in the year 2035. In a variety of applications, such as medical devices, automotive systems, and environmental monitoring, optical sensors are being employed more and more. The need for high-performance optoelectronic transistors rises as these sensors become more complex. Besides this, in the creation of optical sensors, optoelectronic transistors are becoming more and more significant. This, as a result, is anticipated to create numerous opportunities for the growth of the segment in the coming years.

Our in-depth analysis of the global market includes the following segments:

|

By Type |

|

|

By Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Optoelectronic Transistor Market Regional Analysis:

North America Market Insights

North America industry is poised to hold largest revenue share by 2035. The growth of the market can be attributed majorly to the growing adoption of optical fibers across a variety of businesses in developed nations. The need for optoelectronic transistors is projected to increase as optical fibers become more widely used in the region. For instance, optical fibers, which are often constructed of glass or plastic fibers that use light to transport data, are essential elements in the design of optical communication systems. They are used for high-speed data transmission over large distances. Further, the growing demand for optoelectronic transistors in the production of electrical industrial machinery and medical equipment in the region, along with the surging adoption of LED lights, is also anticipated to contribute to the market growth in the region. In North America, the adoption rate of fiber optic connections in a variety of end-use applications is over 8 %, and it is anticipated to rise by 2025.

APAC Market Insights

The Asian Pacific optoelectronic transistor industry is estimated to hold the second largest, registering a share by the end of 2035. The growth of the market can be attributed majorly to the increasing need for optoelectronics-based products. The market for optoelectronic transistors is probably going to increase since there is a greater requirement for products based on optoelectronics in the region. For instance, in many products based on optoelectronics, optoelectronic transistors play a crucial role. For optical communication systems, optical sensing devices, and other optoelectronics-based products to operate properly, they are utilized to amplify and detect optical signals. Moreover, with the presence of nations such as China, Japan, and South Korea being prominent players in the industry, the Asia Pacific region is known to be a crucial market for products based on optoelectronics. Further, the growing advancements in technology, such as the development of 5G networks, and the Internet of Things (IoT), are also anticipated to contribute to the market growth in the region. In addition, the region's expanding electronic industry is also anticipated to boost the market growth during the forecast period.

Europe Market Insights

Europe region is set to witness significant growth till 2035. The growth of the market can be attributed majorly to the increasing optoelectronics industry. Owing to the rising demand for energy-efficient lighting, displays, and sensors in the region, the optoelectronics sector is expanding quickly. For instance, the demand for these devices in the area may be fueled as optoelectronic transistors are a necessary component of these devices. Further, the growing investment by the government in research and development in the region, along with the increasing technological advancements, are also anticipated to contribute to the market growth in the region.

Optoelectronic Transistor Market Players:

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Honeywell International Inc.

- KODENSHI Corporation

- Cypress Semiconductor Corporation

- Diodes Incorporated

- STMicroelectronics

- Infineon Technologies AG

- Renesas Electronics Corporation

- SHARP Fukuyama Semiconductor Co., Ltd.

- Vishay Intertechnology Inc.

Osram Licht AG

Recent Developments

- April 2020: Infineon Technologies AG acquired Cypress Semiconductor Corporation, to provide clients with the most complete portfolio available on the market for bridging the physical and digital worlds and influencing digitalization.

- July 2022: Diodes Incorporated launched a new transistor array The DIODES ULN62003A, which is capable of driving a wide range of loads, including solenoids, relays, DC motors, and LED displays. Further, the product can be used in air conditioners, microwaves, dryers, and washing machines.

- Report ID: 4013

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Optoelectronic Transistor Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.