Battery Management System Market Outlook:

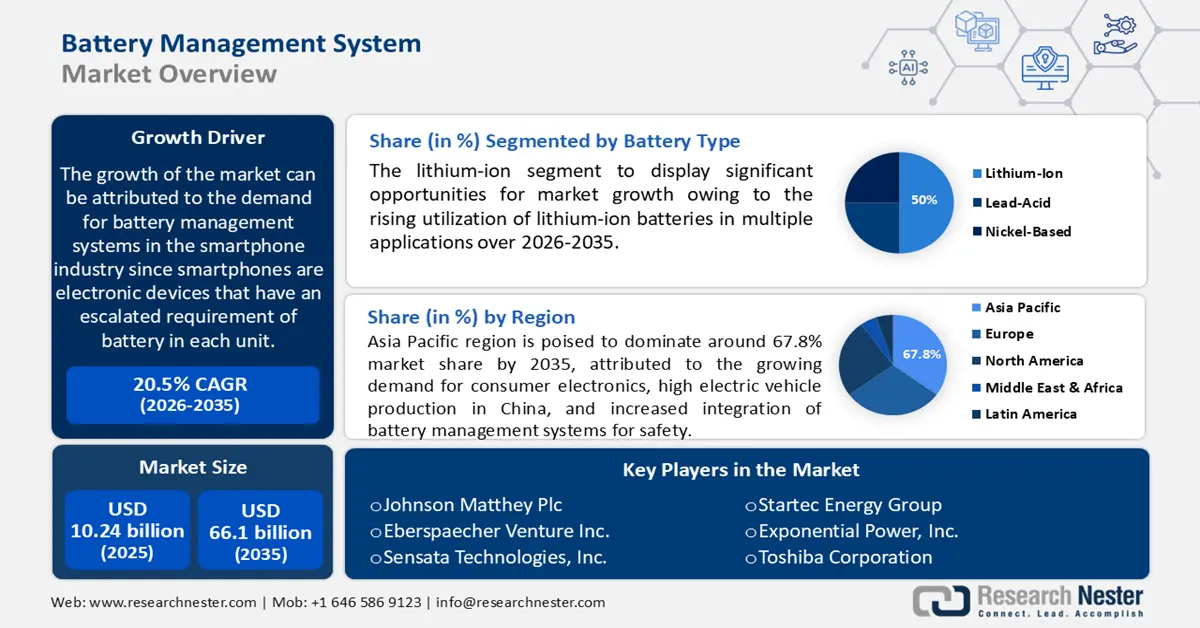

Battery Management System Market size was valued at USD 10.24 billion in 2025 and is set to exceed USD 66.1 billion by 2035, registering over 20.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of battery management system is estimated at USD 12.13 billion.

The market growth is driven by demand for battery management systems in the smartphone industry since smartphones are electronic devices that have an escalated requirement of battery in each unit. For instance, in 2022, it was estimated that nearly 6 billion people across the globe were observed to be using smartphones.

In addition, utilization of batteries in various products that are wireless electronics, toys, handheld power tools, and others are expected to influence the market revenue. For instance, in 2022, around USD 30 billion were generated from the sales of electric toys in the United States alone. Furthermore, escalating demand for the management of lithium-ion batteries backed by the growing consumer electronic industry is will enlarge the market size.

Key Battery Management System Market Insights Summary:

Regional Highlights:

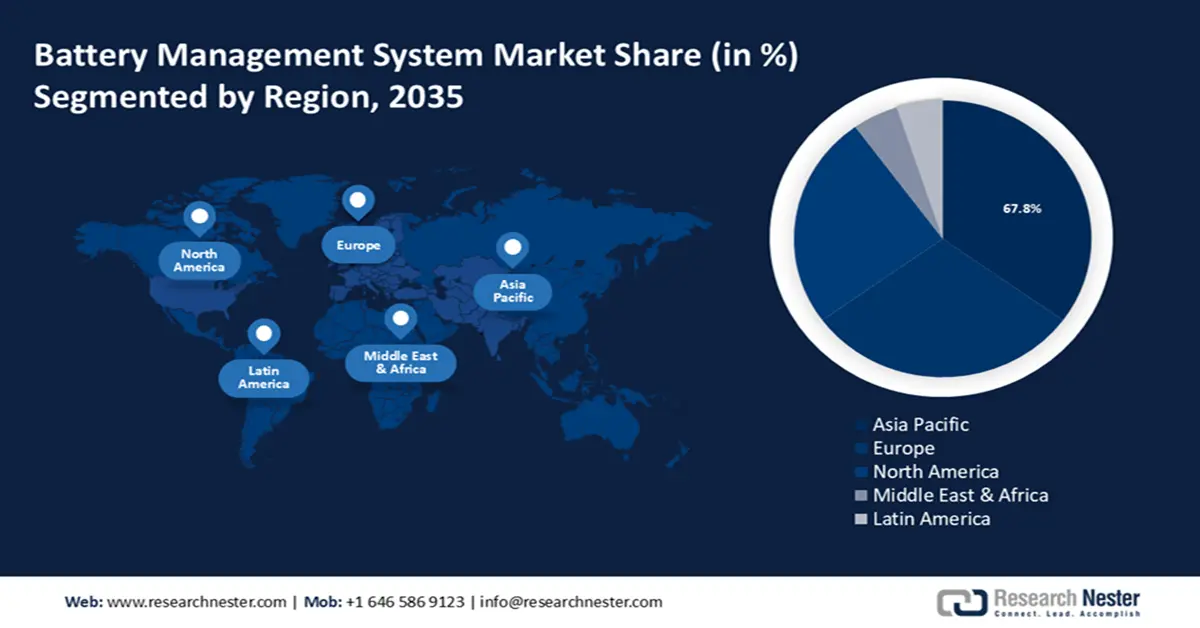

- Asia Pacific battery management system market will dominate over 67.8% share by 2035, attributed to the growing demand for consumer electronics, high electric vehicle production in China, and increased integration of battery management systems for safety.

Segment Insights:

- The lithium-ion segment in the battery management system market is expected to hold the largest share by 2035, attributed to rising utilization in electronics and lower battery failure rates.

- The automotive segment in the battery management system market is projected to hold the majority market share by 2035, fueled by rising electric vehicle production and demand.

Key Growth Trends:

- Growing Utilization of Battery Management Systems in the Automotive Industry

- Increasing Manufacturing of Electric Vehicles and Hybrid Electric Vehicles

Major Challenges:

- High Upfront Cost of Battery Management Systems

- The Requirement for the Additional Space

Key Players: Texas Instruments Incorporated, Johnson Matthey Plc, Eberspaecher Venture Inc., Sensata Technologies, Inc., Startec Energy Group, Exponential Power, Inc., Toshiba Corporation, Robert Bosch GmbH, East Penn Manufacturing Company, Panasonic Corporation.

Global Battery Management System Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 10.24 billion

- 2026 Market Size: USD 12.13 billion

- Projected Market Size: USD 66.1 billion by 2035

- Growth Forecasts: 20.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (67.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, South Korea, Germany

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 9 September, 2025

Battery Management System Market Growth Drivers and Challenges:

Growth Drivers

-

Growing Utilization of Battery Management Systems in the Automotive Industry - Automobiles have a higher demand for battery management systems since each automobile requires the installment of a battery. The main purpose of a battery in the automobile is to create a spark for starting the engine. Hence, the battery is a major part of the starting system of a car. As of 2021, approximately 80 million motor vehicles were estimated to be manufactured across the globe.

-

Increasing Manufacturing of Electric Vehicles and Hybrid Electric Vehicles – battery management system is highly required in electric vehicles since each function in these vehicles is operated by electricity that is generated by using batteries. The main type of battery used in electric vehicles is lithium-ion batteries. For instance, in 2020, around 3 million hybrid electric vehicles were produced while the number is further estimated to reach around 6 million by 2025.

-

Growing Need for Battery Monitoring in Renewable Energy Systems – it was anticipated that in 2021, around 550 TWh of renewable energy were generated across the globe. Batteries are noticed to be used in this industry to power turbines.

-

Growing Utilization of Batteries in Wireless Headphones – there are separate batteries given in wireless headphones which require a battery management system. Therefore, the growing sales volume of wireless headphones is expected to boost the market growth over the forecast period. As of 2021, approximately 290 million units of wireless headphones were sold out across the globe.

Challenges

- High Upfront Cost of Battery Management Systems - The battery management system is expensive since they need an enhanced mechanism to shift energy from one point to another. Hence, it requires most upgraded equipment to be included which also plays a significant role in increasing the price of the battery management system. Therefore, this factor is anticipated to hamper the market growth over the forecast period.

- The Requirement for the Additional Space

- Less Durable and Lower Reliability

Battery Management System Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

20.5% |

|

Base Year Market Size (2025) |

USD 10.24 billion |

|

Forecast Year Market Size (2035) |

USD 66.1 billion |

|

Regional Scope |

|

Battery Management System Market Segmentation:

Battery Type Segment Analysis

The lithium-ion segment is poised to acount for largest market share by 2035. The segment growth can be attributed to rising utilization of lithium-ion (Li-ion) batteries in multiple applications such as electronics, handheld power tools, toys, wireless headphones, and others. For instance, as of 2021, the presence of lithium reserves across the globe was estimated to be around 15 million tons. Furthermore, the less possibility of battery failure is expected to hike the segment growth. Lithium-ion batteries are used widely in multiple sectors, especially in electronic industries to power electronic devices. The failure rate of lithium-ion batteries is estimated to be around 1 battery in a million.

Application Segment Analysis

The automotive segment is expected to domiate the majority market share by 2035, due to higher demand and production volume of electric vehicles across the globe backed by the rising awareness of global pollution owing to CO2 emission. Electric vehicles use electric energy and lithium-ion batteries are a highly suitable medium to provide energy to these cars. The higher sales volume of electric vehicles was anticipated to hike the segment growth over the forecast period. For instance, it was anticipated that between 2012 to 2021, the number of electric vehicles sold out across the globe was estimated to be around 18 million units. Electric cars are considered to be beneficial for the environment since they do not require fuel that generates CO2. For instance, nearly 38 billion metric tons of carbon dioxide were emitted into the environment by fossil fuels in 2021.

Our in-depth analysis of the global market includes the following segments:

|

By Battery Type |

|

|

By Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Battery Management System Market Regional Analysis:

APAC Market Insights

The Asia Pacific battery management system market is set to account for majority share of 67.8% by the end of 2035. The market growth is led by growing demand for consumer electronics, high volumes of production of electric vehicles in China, and increasing integration of battery management systems in several applications for safety purposes. For instance, electric vehicle sales in China grew by more than 5o percent in 2021 since 2020. About 1.3 million EVs were sold in the country in 2020. Asia Pacific is the region to have a highly developed automotive industry with higher demand for batteries.

Europe Market Insights

The European battery management system market is anticipated to grow at significant growth during the forecast period. The market growth is owing to the rise in manufacturing capacities of prominent automobile manufacturers and the surge in demand for renewables for energy generation in the region. Apart from these, the strong presence of major market players will drive the regional market size. For instance, as of 2021, nearly 2500 TWh of electricity was anticipated to be generated in Europe.

Battery Management System Market Players:

- Texas Instruments Incorporated

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Johnson Matthey Plc

- Eberspaecher Venture Inc.

- Sensata Technologies, Inc.

- Startec Energy Group

- Exponential Power, Inc.

- Toshiba Corporation

- Robert Bosch GmbH

- East Penn Manufacturing Company

- Panasonic Corporation

Recent Developments

-

Texas Instruments, Inc launched a scalable Arm Cortex-MO+ microcontroller (MCU) portfolio that includes a variety of pinout, computing, and integrated analog options. This new portfolio is affordable and suitable for all sorts of applications.

-

Johnson Matthey Plc stepped into a strategic partnership with Plug Power to accelerate the green hydrogen economy. Johnson Matthey Plc is required to become the supplier of MEA components

- Report ID: 3475

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Battery Management System Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.