Optical Fibers in Endoscopy Market Outlook:

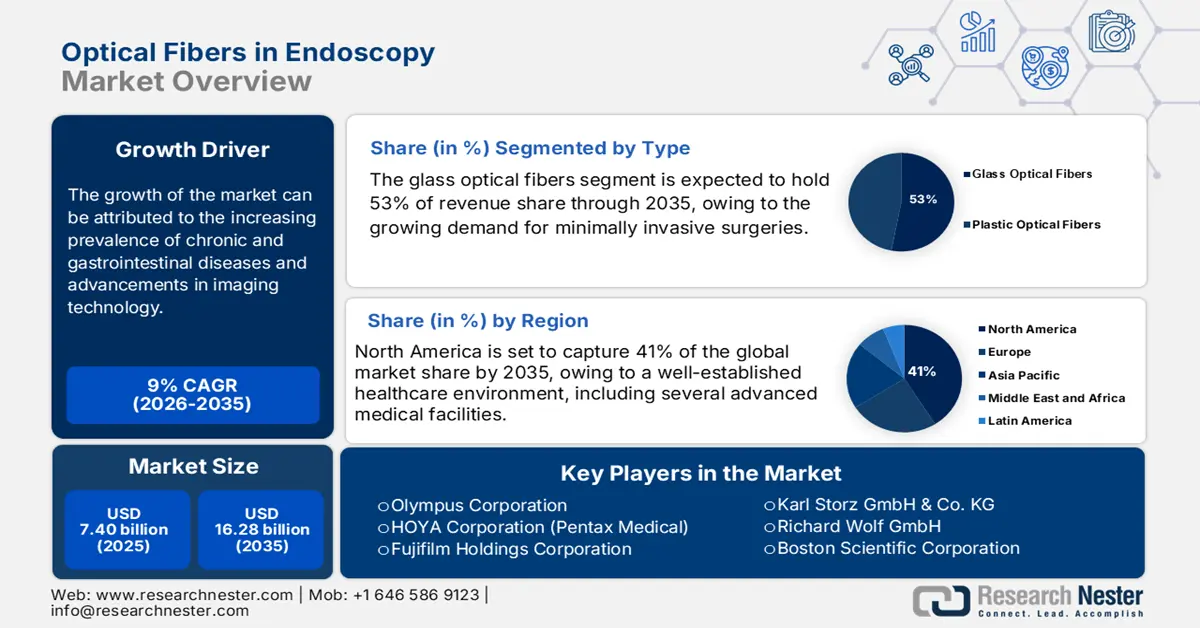

Optical Fibers in Endoscopy Market size was valued at USD 7.40 billion in 2025 and is projected to reach USD 16.28 billion by the end of 2035, rising at a CAGR of 9% during the forecast period, i.e., 2026-2035. In 2026, the industry size of optical fibers in endoscopy is evaluated at USD 7.99 billion.

The optical fiber technology of the endoscopy market is advancing rapidly, thanks to rapid changes in technological development. One example is the incorporation of high-definition (HD) and 4K imaging technologies with fiber-optic endoscopes, which provide enhanced viewing of internal body tissues with greater detail and clarity. The combination of these technologies enhances diagnostic capabilities and the effectiveness of minimally invasive techniques and procedures. Additionally, the addition of flexibility and ultra-thin optical fibers has expanded capabilities for accessing the anatomical region of interest using fiber optic endoscopy. Image processing and data analytics, artificial intelligence (AI) based algorithms, with new illumination systems, are allowing clinicians to improve their ability to perform absolutely accurate measurements to detect abnormalities with respect to time and accuracy.

Another important trend influencing the market is the increase in procedure demand for minimally invasive surgery globally due to increasing chronic disease rates, coupled with a growing aging population. Hospitals and healthcare centers are putting more emphasis on investing in optical fiber-based endoscopy systems as a means to mitigate risk related to surgery compared to the use of traditional surgical techniques, shorten recovery, and reduce costs for healthcare delivery. There is increased regional expansion to emerging markets in the Asia-Pacific and Latin America as more healthcare infrastructure is being established, leading to greater awareness of adoption for more advanced medical procedures. Collaboration and strategic partnerships with manufacturers and research facilities are helping to accelerate innovation and product development.

Key Optical Fibers in Endoscopy Market Insights Summary:

Regional Highlights:

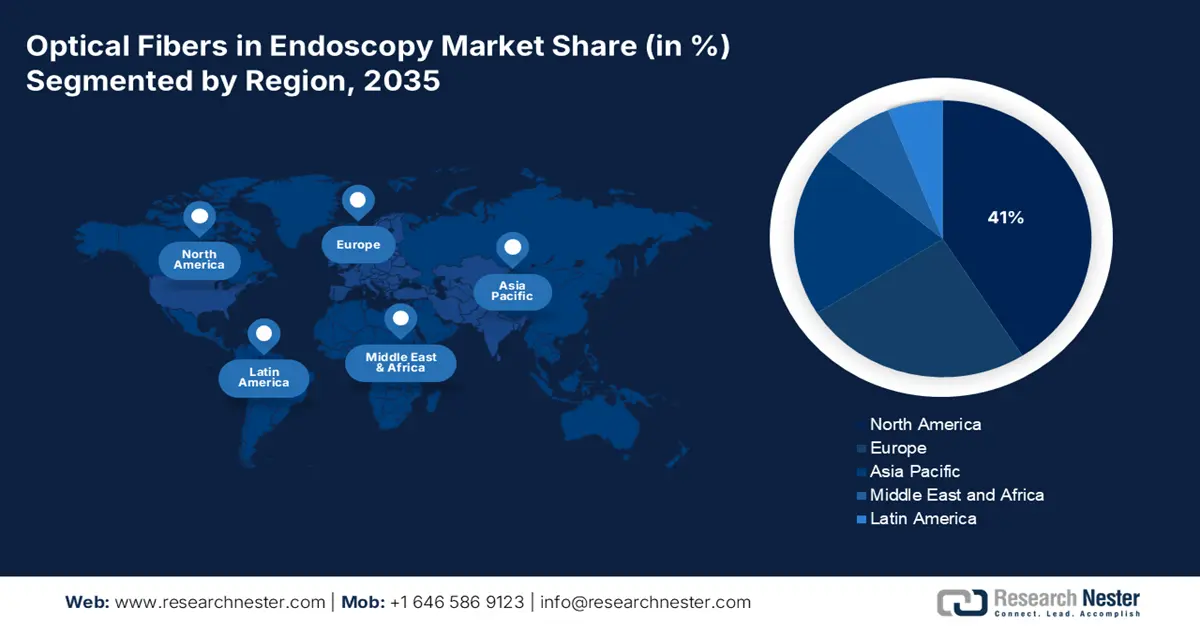

- North America is anticipated to secure a 41% share in the Optical Fibers in Endoscopy Market by 2035, owing to its advanced healthcare infrastructure and significant R&D investment supporting continual innovation in fiber-optic endoscopy systems.

- Europe is projected to register a strong CAGR during 2026–2035, impelled by robust R&D spending, growing prevalence of chronic diseases, and supportive reimbursement policies for advanced endoscopic technologies.

Segment Insights:

- The glass optical fibers segment is expected to hold a 53% share by 2035 in the Optical Fibers in Endoscopy Market, driven by their superior image transmission, tensile strength, and compatibility with advanced imaging technologies like HD and 3D.

- The hospitals segment is projected to capture a 41% share by 2035, supported by their advanced surgical infrastructure, high patient inflow, and continual investments in minimally invasive endoscopic systems.

Key Growth Trends:

- Increasing prevalence of chronic and gastrointestinal diseases

- Advancements in imaging technology

Major Challenges:

- High cost of advanced endoscopic Equipment

- Technical limitations of optical fibers

Key Players: Olympus Corporation, HOYA Corporation (Pentax Medical), Fujifilm Holdings Corporation, Karl Storz GmbH & Co. KG, Richard Wolf GmbH, Boston Scientific Corporation, Strauss Surgical, Vimex Endoscopy (Vimex SP. Z O.O.), Schott AG, Timbercon, Leoni, Coherent Corporation, Trumpf, Vitalcor, Cogentix Medical (Vision Sciences Inc.), Happersberger Otopront GmbH, Xion GmbH, Myriad Fiber Imaging Tech. Inc., OmniGuide Inc., Precision Optics Corporation.

Global Optical Fibers in Endoscopy Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 7.40 billion

- 2026 Market Size: USD 7.99 billion

- Projected Market Size: USD 16.28 billion by 2035

- Growth Forecasts: 9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (41% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, Germany, Japan, China, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Mexico, Australia

Last updated on : 8 September, 2025

Optical Fibers in Endoscopy Market - Growth Drivers and Challenges

Growth Drivers

- Increasing prevalence of chronic and gastrointestinal diseases: A 2024 report by the U.S. Centers for Disease Control and Prevention states that in the U.S., an estimated 129 million people suffer from at least one serious chronic illness. With the ever-increasing need for early diagnosis and diminutive invasive treatment methods due to modern endoscopic techniques, the need to take immediate action within the confines of effective patient management is evident. For instance, gastrointestinal cancers are among the leading causes of death globally, according to the World Health Organization. This illustrates the need for high-quality diagnostic instruments such as fiber optic endoscopes.

- Advancements in imaging technology: Advances in technology, in the form of high-definition (HD), 4K, and 3D imaging with artificial intelligence incorporation, are revolutionizing optical fiber endoscopy. The clearer visualization, more accurate diagnostics, and improved surgical precision afforded by the aforementioned technological advances make optical fiber endoscopy significantly more effective than it was in the past. The introduction and adoption of flexible and ultra-thin fiber optics allows access into increasingly difficult anatomical regions, broadening the range of applications for the clinical use of optical fiber endoscopy. Furthermore, the advances in image processing and illumination, which are also real-time, not only improve the effectiveness of the procedure but also make the optical fiber endoscopy system an important piece of equipment in modern healthcare.

- Growing demand for minimally invasive procedures: Because of the reduced recovery time, lower infection risk, and lower scarring than conventional surgery, minimally invasive procedures are the procedure of choice. Optical fibers enabled these procedures by providing excellent imaging as well as illumination. Less invasive procedures in gastroenterology, urology, and pulmonology have stimulated the uptake of fiber optic endoscopy systems around the world.

Challenges

- High cost of advanced endoscopic Equipment: A key challenge is the expense of advanced systems that incorporate optical fiber endoscopes with HD and 4K imaging technology. Unfortunately, the cost limits adoption rates, especially in countries developing their healthcare systems and among smaller healthcare facilities with fixed budgets. In addition to the costs associated with the system, there are ongoing maintenance and work to calibrate these elaborate devices. Hospitals and clinics may find it difficult to make the upfront investment despite the long-term benefits to their institution, hence it slows the market penetration rate in areas where the cost is a strong consideration.

- Technical limitations of optical fibers: While optical fibers provide significant improvements to reproduce high performing imaging systems, there are still technical limitations associated with optical fibers as well. Optical fiber systems are subject to signal attenuation, and also fragile and restrictive bend radius. These various issues can influence the durability and performance of tools for endoscopic procedures that can be very complex. Finding a way to implement fiber optics with new technology without bruising or compromising the quality of the images produced is a continuous effort. Manufacturers need to improve the reliability and lifespan of fiber optic products in a medical context.

Public and Private Health Expenditure Per Person for G7 Countries

|

U.S. |

USD 12,000 |

|

Germany |

USD 7600 |

|

Canada |

USD 6600 |

|

France |

USD 6300 |

|

UK |

USD 6200 |

|

Japan |

USD 4700 |

|

Italy |

USD 4400 |

Source: Our World in Data

Optical Fibers in Endoscopy Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

9% |

|

Base Year Market Size (2025) |

USD 7.40 billion |

|

Forecast Year Market Size (2035) |

USD 16.28 billion |

|

Regional Scope |

|

Optical Fibers in Endoscopy Market Segmentation:

Type Segment Analysis

The glass optical fibers segment is estimated to account for the largest share of 53% in the optical fibers in endoscopy market over the discussed timeframe. Glass optical fibers have become the gold standard of the marketplace for a widely used modality because they are better capable of transmitting high-quality images during procedures. Their high tensile strength, low signal attenuation, robust temperature and chemical corrosion resistance, make them suited for their intended medical uses when higher precision is needed. The growing demand for minimally invasive surgeries will spur new demand for quality fibers that will give the practitioner high quality and clear visualization that improves any diagnostic ability. Newer imaging technologies such as HD and 3D imaging, among others, will fit better seamlessly using glass fibers in the clinical setting.

End User Segment Analysis

The hospitals segment is poised to dominate the optical fibers in endoscopy market with a share of 41% during the analyzed period. Hospitals will continue to be the principal end-user of optical fibers in endoscopy because they are the only end-users with the comprehensive infrastructure, support for more advanced surgical approaches, and ability to deliver these instruments to patients. Based on some statistics referenced by the American Hospital Association, hospitals conduct most complex endoscopic surgeries, and therefore rely on effective and high-quality fiber optic technologies (aha.org). As hospitals invest in new, state-of-the-art medical technologies and begin to transition towards minimally invasive surgeries, the demand for optical fiber endoscopy systems will remain robust. Hospitals also experience a larger patient population, an aging population, and increased hospital spending, which support this segment. The ability of hospitals to provide medical professionals with training on new advanced endoscopy systems also supports the development and adoption cycle.

Application Segment Analysis

During the examined period, the gastrointestinal (GI) endoscopy segment is expected to hold a 36% optical fibers in endoscopy market share. Gastrointestinal (GI) endoscopy is the leading application segment, owing largely to the high rate of digestive disorders around the world, particularly colorectal cancer and inflammatory bowel disease. As per the National Institutes of Health, about 153,020 people received a colorectal cancer diagnosis in 2023, and 52,550 people passed away from the illness, including 19,550 cases and 3750 deaths in people under 50. The ability of optical fibers in GI endoscopy to provide real-time visualization and allow for tissue sampling is likely a key driver of GI endoscopy because it allows for early diagnosis and minimally invasive options for treatment. Moreover, the increasing emphasis on preventive health and growing awareness about screening programs in both developed and developing countries further promotes the implementation of GI endoscopy procedures, while advancements such as fiber optic sensors with AI, gastrointestinal endoscopy is likely to continue to grow.

Our in-depth analysis of the optical fibers in endoscopy market includes the following segments:

|

Segments |

Subsegments |

|

Type |

|

|

Material |

|

|

End User |

|

|

Application |

|

|

Technology |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Optical Fibers in Endoscopy Market - Regional Analysis

North America Market Insights

North America is anticipated to capture the highest share of 41% in the global optical fibers in endoscopy market by the end of 2035. There were a number of contributing factors to this growth. The region has a well-established healthcare environment, including several advanced medical facilities, which will rapidly treat the patient and then use advanced devices as standard practice. The Centers for Medicare & Medicaid Services predicts that in 2023, U.S. health care spending increased by 7.5% to USD 4.9 trillion, or USD 14,570 per person. Many of these companies are the largest in the world and provide solid R&D investment to support the optical fibre endoscopy system, resulting in a constantly developing technology.

The U.S. ranks first due to its superior healthcare infrastructure and expenditures. The country has leading large medical device manufacturers that invest in research and development to develop innovative optical fiber technologies. The high incidence of chronic disease, coupled with a strong emphasis on minimally invasive procedures, generates a strong demand. In addition, protectionism and government reimbursement of insurance further push adoption across hospitals and clinics.

Canada benefits from a developed healthcare system for early disease detection and minimally invasive care. Government initiatives are increasing healthcare access, and the growing number of age-related diseases creates the need for sophisticated endoscopy solutions. The government invests in training programs, and injects capital in healthcare technology stanchions, encourages and increases usage of optical fiber endoscopes and services throughout the urban and rural landscape.

Europe Market Insights

Throughout the projection period, Europe is anticipated to experience a strong CAGR in the global optical fibers in endoscopy market. The area has a solid healthcare system, with considerable access to leading-edge medical technologies and extensive forms of patient care at a high standard. European nations have some of the highest spending levels across the board on R&D, which gives way to innovative optical fiber technologies and endoscopic devices. The aging demographic increases the occurrence of chronic diseases, such as gastrointestinal diseases and cancers, necessitating a higher demand for minimally invasive procedures for diagnostics and treatments. In addition, well-known laws and regulations and other forms of reimbursement for innovative solutions for endoscopy also lend themselves to growth.

Germany's medical device industry is one of the most developed in Europe and is very innovative. It's older people mean there is a high demand for diagnostics and therapeutics that involve optical fibers. Its solid health care system and enabling regulatory system bring state-of-the-art endoscopic technologies to market quickly. The academic/industrial partnerships help to ensure the continued growth of the market.

France's healthcare system is advanced and, similarly, its patients have a reasonably high awareness of the importance of early disease diagnosis, supporting the growing use of fiber optic endoscopy. Also assisted by Government healthcare provision and insurance reimbursement policies being supportive of investment in new minimally invasive medical technologies and procedures. Moreover, ongoing research and collaborative projects with international medical device companies also enhance the product development of optical and fiber optic medical devices.

APAC Market Insights

The Asia Pacific is forecasted to take a substantial share of the overall optical fibers in the endoscopy market by 2035 for several reasons. The region has a growing and aging population, resulting in an increased prevalence of chronic diseases like gastrointestinal disease, cancer, and respiratory disease. The growing healthcare infrastructure, due to increased government expenditure on health services and improved access to advanced medical technology, is promoting the adoption of optical fiber endoscopy systems. Further, greater public health awareness combined with more disposable income is encouraging the population to seek out early diagnosis and minimally invasive treatment for relatively prevalent ailments.

India is emerging as a potential market due to its rapidly developing healthcare infrastructure, increase in healthcare expenditure, and increasing reliance on technology-based solutions. Combined with a large population and growing incidence of aging diseases, there is a strong demand for more affordable, cost-effective diagnostic technology. Increasing health consciousness, together with urbanization, offers other factors to help drive the demand for more optical fiber-based endoscopy systems. Better healthcare access through government programs also increases utilization potential.

China's healthcare industry is being modernized very quickly through investment both in developing advanced medical equipment and upgrading medical technology. The size of China's patient population, combined with higher incidences of aging or chronic diseases, represents a strong and growing demand for surgical procedures required under less invasive conditions. The World Health Organization (WHO), estimates that China's population is aging at one of the quickest rates in the world. Due to rising life expectancy and falling birth rates, 28% of China's population is expected to be over 60 by 2040. Government investments to further facilitate healthcare access and enhance the adoption of advanced medical technology, together with the country's domestic manufacturing capacity, position China in a better position to become a leader of growth in the optical fibers in the endoscopy market.

Key Optical Fibers in Endoscopy Market Players:

- Olympus Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- HOYA Corporation (Pentax Medical)

- Fujifilm Holdings Corporation

- Karl Storz GmbH & Co. KG

- Richard Wolf GmbH

- Boston Scientific Corporation

- Strauss Surgical

- Vimex Endoscopy (Vimex SP. Z O.O.)

- Schott AG

- Timbercon

- Leoni

- Coherent Corporation

- Trumpf

- Vitalcor

- Cogentix Medical (Vision Sciences Inc.)

- Happersberger Otopront GmbH

- Xion GmbH

- Myriad Fiber Imaging Tech. Inc.

- OmniGuide Inc.

- Precision Optics Corporation

Intense rivalry exists in the Optical Fibers in Endoscopy market, particularly with established players. Important players also include HOYA Corporation (Pentax Medical) and Fujifilm Holdings Corporation and Karl Storz GmbH & Co. KG, which collectively participated in a considerable portion of the market in 2021. Companies are investing in higher-definition imaging systems, AI-assisted diagnostics, and minimally invasive surgical instruments to improve preferred outcomes for patients and more efficient procedures. Companies are also expanding product lines to offer diverse catalogs of endoscopic solutions in other medical specialties to increase market scope. Companies are forming partnerships and acquiring complementary businesses to advance technology and increase market scope. Companies are also entering into underserved markets to take advantage of increasing demand for advanced medical technologies as a means to increase worldwide market share.

Recent Developments

- In July 2022, Zsquare obtained Food and Drug Administration 510K clearance to market its first product, the Zsquare ENT-Flex Rhinolaryngoscope, indicated for use in diagnostic ENT procedures by way of the nose and throat, and is the only scalable platform capable of transmitting high-resolution images in flexible, single-use endoscopes.

- In December 2021, A group of researchers led by the Optics Group at the University of Glasgow constructed a 3D imager that can record video at 5 Hz using a single optical fiber. Through a 40cm optical fiber, the prototype device transmits images with a depth resolution of about 5mm and up to 4,000 independently resolvable features each frame.

- Report ID: 8077

- Published Date: Sep 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Optical Fibers in Endoscopy Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.