Open Radio Access Network Market Outlook:

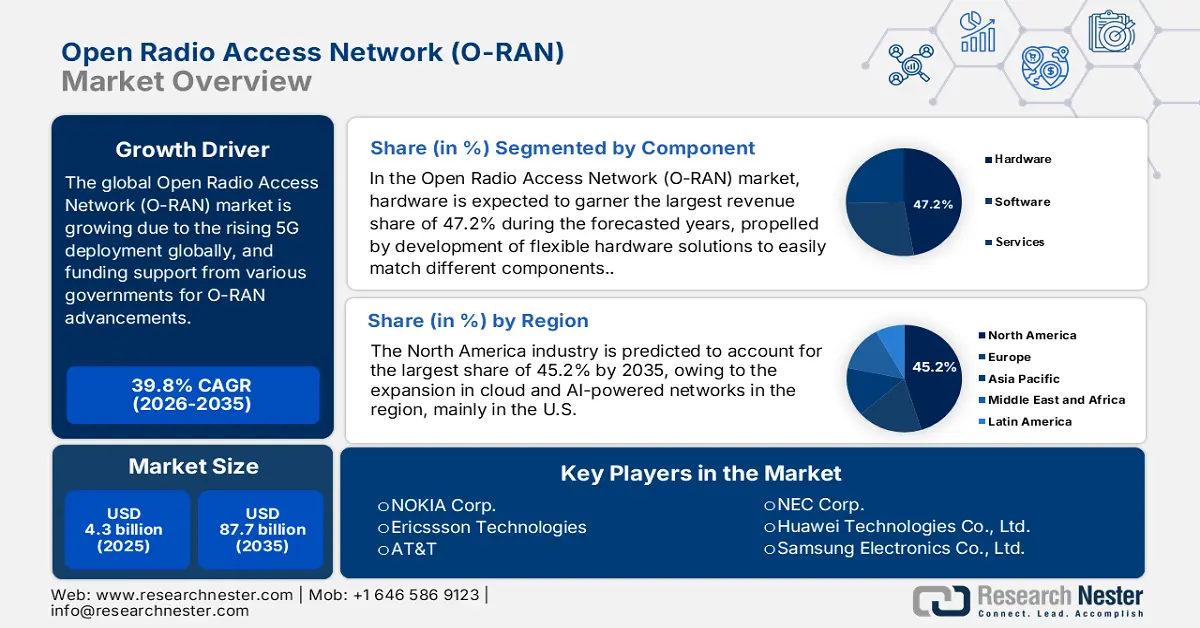

Open Radio Access Network Market size was valued at USD 4.3 billion in 2025 and is projected to reach USD 87.7 billion by the end of 2035, rising at a CAGR of 39.8% during the forecast period, i.e., 2026-2035. In 2026, the industry size of open radio access network at USD 6 billion.

The open radio access network market is projected to showcase steady growth during the forecast period, owing to the shift of telecom operators towards more flexible, cost-effective, and interoperable network solutions. With rising demand for high-speed data, 5G services, and new digital applications, operators are adopting O-RAN to break away from traditional, proprietary systems and use components from multiple vendors. This open and modular approach supports faster innovation, easier upgrades, and better network performance. Growth is also supported by increasing investments in 5G infrastructure, supportive industry standards, and partnerships between technology providers. As a result, the O-RAN market is anticipated to expand rapidly, creating opportunities for equipment vendors, software developers, and network operators alike.

In addition, the open radio access network market is benefiting from growing interest in network automation and artificial intelligence. O-RAN supports intelligent network management, which helps operators monitor performance, reduce downtime, and optimize energy use. This is especially important as networks become more complex and traffic continues to increase. Governments and regulators in several regions are also encouraging open and secure network architectures, further supporting adoption. For instance, in July 2024, EchoStar Corporation launched the Open RAN Center for Integration and Deployment (ORCID), which is a state-of-the-art O-RAN testing and evaluation test center in Wyoming. This facility is supported by USD 50 million grant from the U.S. Department of Commerce's National Telecommunications and Information Administration (NTIA) Public Wireless Supply Chain Innovation Fund (Innovation Fund).

Key Open Radio Access Network Market Insights Summary:

Regional Highlights:

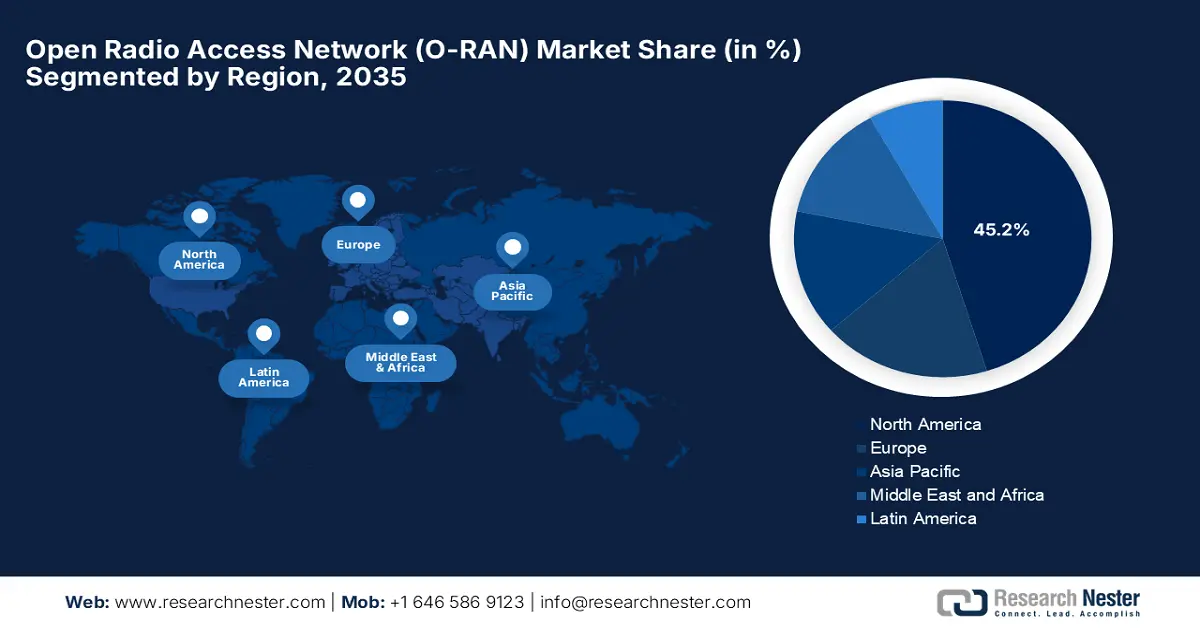

- North America in the open radio access network market is projected to secure a dominant 45.2% share by 2035, supported by the region’s accelerating transition toward cloud-native, AI-enabled networks and reinforced telecom supply chain initiatives.

- Asia Pacific is anticipated to emerge as the fastest-growing region by 2035, capturing a considerable share as expanding mobile subscriber bases and proactive government-backed 5G infrastructure programs stimulate adoption.

Segment Insights:

- The hardware segment in the open radio access network market is anticipated to command a 47.2% share by 2035, supported by the shift toward virtualized and interoperable RAN components that encourage multi-vendor participation and cost optimization.

- The hybrid deployment segment is expected to secure a notable share during the 2026–2035 period, benefiting from its ability to combine low-latency on-premise control with scalable public cloud capabilities that enhance operational flexibility and efficiency.

Key Growth Trends:

- Improved network automation

- Growing demand for 5G networks

Major Challenges:

- High initial investment

- Skill and expertise gap

Key Players: Nokia Corporation (Finland), Samsung Electronics Co., Ltd. (South Korea), ZTE Corp. (China), NEC Corp. (Japan), Ericsson (Sweden), Huawei Technologies Co., Ltd. (China), AT&T Inc. (United States), Fujitsu Limited (Japan), Intel (U.S.), Juniper Networks (U.S.), Mavenir (U.S.), Parallel Wireless (U.S.), Radisys Corporation (U.S.)

Global Open Radio Access Network Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 4.3 billion

- 2026 Market Size: USD 6 billion

- Projected Market Size: USD 87.7 billion by 2035

- Growth Forecasts: 39.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (45.2% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: India, Vietnam, Canada, Australia, France

Last updated on : 13 January, 2026

Open Radio Access Network Market - Growth Drivers and Challenges

Growth Drivers

- Improved network automation: It is a key benefit of O-RAN market is it allows operators to use intelligent software (like RIC and rApps) to manage and optimize the network automatically, reducing manual work. In February 2023, Juniper Networks, in partnership with Vodafone, successfully tested Open RAN applications on Juniper’s RAN Intelligent Controller (RIC) platform. The trial used live traffic on Vodafone’s network and showed that open, software-based networks can help mobile operators manage costs, improve services, enhance customer experience, and support sustainability.

- Growing demand for 5G networks: The rising 5G networks demand is strongly driving the market as telecom companies need networks that are faster, more flexible, and more affordable. O-RAN helps by allowing operators to use equipment and software from different vendors instead of relying on just one supplier. This makes building and expanding 5G networks easier and less expensive. It also helps improve network performance, supports new services, and encourages innovation. According to a press release by IBEF, in March 2025, India’s 5G subscriber base is anticipated to expand up to 2.65 times, reaching 770 million by 2028, up from 290 million in 2024. As more people and businesses use high-speed mobile data, cloud services, and smart devices, telecom companies are increasingly choosing O-RAN to meet these growing 5G needs efficiently.

- Innovation and rapid technology updates: These are important factors driving the O-RAN market because they allow telecom companies to quickly improve and upgrade their networks. O-RAN uses open and flexible systems, making it easier to add new features, update software, and adopt the latest technologies without changing the entire network. This helps operators keep up with fast-changing technology, improve network performance, and introduce new services faster. In October 2023, Vodafone announced the fast-track development of new platforms for Open RAN using the Arm architecture intended to meet the rising demand for faster, and environmentally sustainable mobile connectivity. As the telecom industry continues to evolve, open radio access network market is supported by continuous innovation while reducing costs and complexity.

Challenges

- High initial investment: Operators of the Open RAN networks require a significant amount of investment to purchase multiple equipment from different sellers, set up cloud infrastructure, and integrate new software with existing systems for installation. Unlike traditional networks where a single vendor provides end-to-end solutions, Open RAN needs additional testing, validation, and coordination to ensure all components work together smoothly. This increases the deployment time and cost. The Open RAN can reduce long-term expenses, but the initial setup cost remains a major financial challenge for telecom operators in the Open Radio Access Network (O-RAN) market.

- Skill and expertise gap: Open RAN networks are comparatively more complicated than traditional single-vendor networks. It requires engineers and technicians with specialized skills, as it is important to understand how to handle equipment from different companies, use cloud-based software, control network automation, and manage tools that improve performance. A number of operators lack skilled people, leading to slows down of setup, causing significant problems with network performance. To overcome this, companies in the market are investing in training programs or hiring experts, which adds extra time and cost.

Open Radio Access Network Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

39.8% |

|

Base Year Market Size (2025) |

USD 4.3 billion |

|

Forecast Year Market Size (2035) |

USD 87.7 billion |

|

Regional Scope |

|

Open Radio Access Network Market Segmentation:

Component Segment Analysis

The hardware segment is projected to dominate the market with a 47.2% share by 2035. Highly common hardware components include virtualized RAN servers, BBUs (baseband units), and RRUs (remote radio units). The open RAN hardware can replace the legacy 2G/3G/4G systems with open RAN technology, which is completely virtualized. The players are significantly focused on developing flexible and consistent hardware solutions, which allow manufacturers and suppliers to mix and match the components. This promotes participation of different vendors, improves cost efficiency, and supports open RAN evolution towards a better adjustable network infrastructure. Furthermore, in May 2024, the Department of Commerce’s NTIA announced USD 420 million funding to build radio equipment required for open network adoption advancement in the U.S. Initiatives as such is also promoting the segment’s growth.

Deployment Segment Analysis

The hybrid segment is projected to gather a considerable share during the forecast period in the open radio access network (O-RAN) market, owing to the balance it offers between performance, flexibility, and control for the telecom operators. Due to the advantages of both public and private cloud, the operators can keep delay-sensitive network functions on their local systems, ensuring speed and reliability. Further, they can also use public cloud data analysis, management, and automation. This makes it easier to deploy, flexible, and cost-effective, making it a popular choice for Open RAN.

Frequency Segment Analysis

The sub 6-GHz segment is anticipated to garner a substantial share in the market by the end of 2035, as it offers a good balance between coverage, speed, and cost. This frequency range suits both cities and rural areas, supporting a wide network coverage, which is easier for operators to deploy using existing infrastructure. Telecom operators also prefer sub-6 GHz because it can be deployed using existing network infrastructure, reducing deployment time and expenses. In addition, it supports everyday stable and reliable connectivity of mobile services, making it the most widely used frequency range in Open RAN deployments.

Our in-depth analysis of the open radio access network market includes the following segments:

|

Segment |

Subsegments |

|

Component |

|

|

Unit |

|

|

Deployment |

|

|

Network |

|

|

Frequency |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Open Radio Access Network Market - Regional Analysis

North America Market Insights

North America open radio access network market is projected to dominate the industry by the end of 2035 with a significant share of 45.2%. In North America, O-RAN is growing due to operators wanting more flexible, software-based networks that are easier to upgrade. Furthermore, the move to cloud and AI-powered networks, the need for stronger and more secure supply chains, and the rising demand for private 5G and enterprise services are driving further growth. O-RAN helps operators roll out new features faster and adapt their networks more easily. In January 2025, Airspan Networks, was awarded USD 42,729,740 from the Public Wireless Supply Chain Innovation Fund by the NTIA. The funding is aimed at advancing Open RAN planning by developing an extensible radio unit (O-RU) platform that can integrate advanced features and maximize power efficiency and performance.

U.S. is steadily developing its market, with major operators like Verizon and DISH running pilot projects and testing networks that use equipment from multiple vendors. Open RAN is helping make networks more flexible, lower in cost, and better at covering both cities and rural areas. The U.S. government is supporting these efforts through funding programs and policies to encourage adoption and strengthen the domestic telecom supply chain.

Canada open radio access network market is still in the early stages. Trials and pilot deployments are underway to test Open RAN solutions and see how they can make networks more flexible, cost-efficient, and able to reach remote or underserved areas. The Canadian government and industry groups are supporting research and development to encourage adoption. Large-scale commercial rollouts are limited for now, but Canada is following global trends closely. Open RAN deployment is expected to expand gradually over the next decade as the technology matures and more vendor options become available.

APAC Market Insights

Asia Pacific open radio access network (O-RAN) market is projected to be the fastest-growing region by 2035, gaining a considerable share. The region's development is attributed to the growing demand for advanced infrastructure for telecommunication, a rising subscriber base in terms of mobile, and advantageous government regulations. Strategic initiatives by the major providers and the government to boost 5G connectivity are advancing the market growth in the region. In November 2024, Viettel High Tech announced the commercial launch of its Open RAN (O-RAN) 5G Network, featuring key equipment developed in-house. Furthermore, the company deployed over 300 sites across various Vietnamese provinces in Q1 2025.

India is developing its O-RAN market network rapidly, with support from the government and interest from major telecom operators. Open RAN is currently being tested to reduce costs, improve network flexibility, and expand coverage to more areas, including rural regions. Several operators in India are running pilot projects and small-scale deployments to see how the technology works in real networks. The market in India is expected to grow significantly during the forecast period as more operators adopt it and the ecosystem matures.

Australia is gradually developing its Open Radio Access Network (O-RAN) market, with several telecom operators conducting trials and small-scale deployments to test how the technology works in real networks. Open RAN allows networks to be more flexible and cost-efficient, which is especially helpful for expanding coverage to rural and remote areas. Australia is also collaborating with other Quad countries, such as the US, Japan, and India, to share knowledge, best practices, and lessons from Open RAN trials. The government and industry are encouraging these efforts to prepare for future 5G upgrades and ensure that networks remain competitive and scalable.

Europe Market Insights

Europe Open Radio Access Network (O-RAN) market is growing as operators and governments push for more open, flexible 5G networks instead of relying on a few big vendors. Key things driving this growth are government support and funding, especially from the European Union and national telecom programs that encourage open standards and network sovereignty (less dependence on single suppliers). Strong interest from major carriers like Vodafone, Deutsche Telekom, Orange, and Telefónica, who are running trials and planning larger O-RAN rollouts, is also helping adoption. Europe’s focus on digital transformation, interoperability, and competitive innovation makes O-RAN attractive as networks expand and modernize across the region.

Germany O-RAN market is quickly developing Open RAN with real network deployments. O₂ Telefónica has opened its first commercial Open RAN and virtual RAN sites in Bavaria with Samsung, and more sites are planned. This is one of the first real Open RAN rollouts in Europe and shows the technology is moving from testing to actual use. In May 2024, Samsung Electronics, in partnership with O2 Telefonica, launched their first Open RAN and virtualized RAN commercial site in Germany. This site provides high-performance, reliable 4G and 5G services to customers in the country.

France O-RAN market is led by major operator Orange, is progressing steadily in O‑RAN through innovation partnerships and field pilots. Orange has conducted successful pilot tests of virtualized RAN and Open RAN technology, including live 4G and 5G calls on O‑RAN networks with partners such as Samsung, moving beyond lab environments. France has strong industry engagement with several Open RAN deployments and integration labs that foster ecosystem development.

Key Open Radio Access Network Market Players:

- Nokia Corporation (Finland)

- Samsung Electronics Co., Ltd. (South Korea)

- ZTE Corp. (China)

- NEC Corp. (Japan)

- Ericsson (Sweden)

- Huawei Technologies Co., Ltd. (China)

- AT&T Inc. (United States)

- Fujitsu Limited (Japan)

- Intel (U.S.)

- Juniper Networks (U.S.)

- Mavenir (U.S.)

- Parallel Wireless (U.S.)

- Radisys Corporation (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- NOKIA is one of the oldest players in the open radio access network market, offering a broad portfolio of O-RAN. The company incorporates concepts of O-RAN, including open interfaces, cloud-native architectures, and automation into its existing AirScale platform. Further, the company emphasizes interoperability and network efficiency, and also works closely with mobile operators to modernize radio networks. NOKIA’s strategy showcases the adoption of O-RAN capabilities without fully disrupting legacy network investments.

- Ericsson Technology is one of the leading companies in Open Radio Access Network (O-RAN) market and helps create the standards for it. They make sure their open and virtual RAN solutions are fast, secure, and reliable enough for telecom operators. Ericsson promotes a careful approach that balances using different vendors’ equipment and cloud-based systems, while providing expert help with putting everything together. The company also has strong partnerships with telecom operators around the world, making it both an innovator in technology and a trusted partner for large-scale Open RAN projects.

- Samsung Electronics Co., Ltd. is a big company that makes equipment and software for mobile networks, including Open RAN. It focuses on creating solutions that are fast, reliable, and easy for telecom operators to use. Samsung also helps operators set up and manage networks, making sure that all parts work well together. By combining its technology and support services, Samsung plays an important role in helping operators build large and efficient Open RAN networks.

- Huawei Technologies Co., Ltd. is one of the largest telecom equipment providers in the world. The company works around products that are flexible, secure, and capable of handling high network performance. Huawei works with telecom operators around the globe to help them deploy and manage networks that use equipment from different vendors. The company also helps improve Open RAN technology by contributing to standards and sharing new ideas for better network performance and reliability.

- AT&T Inc. is a major telecom operator that uses and tests Open RAN technology in its own networks. The company works with equipment makers to find ways to make networks more flexible, cost-effective, and easier to manage. By testing Open RAN in real-world conditions, AT&T helps improve the technology and shares practical experience that guides network standards and best practices.

Below is a list of key players operating in the global market:

The open radio access network market is witnessing commercial integration on a large scale. There is a healthy competition between older players, including Ericsson and Nokia, and comparatively newer challengers such as Parallel Wireless and Samsung. Network streamlining has gained investor attention, particularly in AI-RAN, where artificial intelligence is used to bring out more efficiency from the radio waves. For instance, in October 2025, NVIDIA and Nokia announced a strategic partnership to add NVIDIA-powered, commercial-grade AI-RAN products to Nokia’s industry-leading RAN portfolio. NVIDIA also invested USD 1 billion in Nokia at a subscription price of USD 6.01 per share.

Corporate Landscape of the Open Radio Access Network Market:

Recent Developments

- In March 2025, Ericsson Technology, in partnership with o2 Telefónica, announced the launch of the first Cloud RAN network, which is the initial implementation in a commercial 5G standalone network worldwide, of Ericsson Cloud RAN.

- In September 2024, the Ministry of Communications of India inaugurated 5G O-RAN testing lab in Bangalore, in addition to launching the Tejas Centre of Excellence for Wireless Communications and its indigenously designed 32T32R Massive MIMO radio capable of delivering 1+ Gbps download speeds using 5G mid-band spectrum.

- In February 2024, Rakuten Symphony launched the Real Open RAN Licensing Program, a revolutionary initiative designed to democratize Radio Access Network (RAN) technology worldwide.

- Report ID: 2781

- Published Date: Jan 13, 2026

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Open Radio Access Network Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.