Online Payment Gateway Market Outlook:

Online Payment Gateway Market size was over USD 130.08 billion in 2025 and is anticipated to cross USD 353.05 billion by 2035, witnessing more than 10.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of online payment gateway is assessed at USD 142.37 billion.

According to the World Bank Group’s Global Findex Database 2021, 76% of the global population and 71% of the population in developing countries held account ownership worldwide. The market has become a vital part of the global digital economy in recent years, driven by the rapid growth of e-commerce, mobile banking, and contactless payment methods. These gateways act as the bridge between businesses and financial institutions, ensuring secure and efficient transactions. With the increasing preference for cashless transactions, businesses across sectors are integrating payment gateways to offer seamless checkout experiences.

The World Bank Group further stated that in 2021, over 40% of adults in low and middle-income economies, excluding China, made merchant in-store or online payments using a card, phone, or the internet for the first time since the start of the pandemic. The rise in digital transformation, with a surge in internet and smartphone penetration, has further accelerated the adoption of online payment gateways. For instance, according to IBEF August 2024, India’s smartphone market showcased a 7.2% YoY growth during 2024’s first half. As per IDC Worldwide Quarterly Mobile Phone Tracker 2024, the second quarter of CY24 witnessed 35 million smartphone shipments, noting a 3.2% YoY growth.

Key Online Payment Gateway Market Insights Summary:

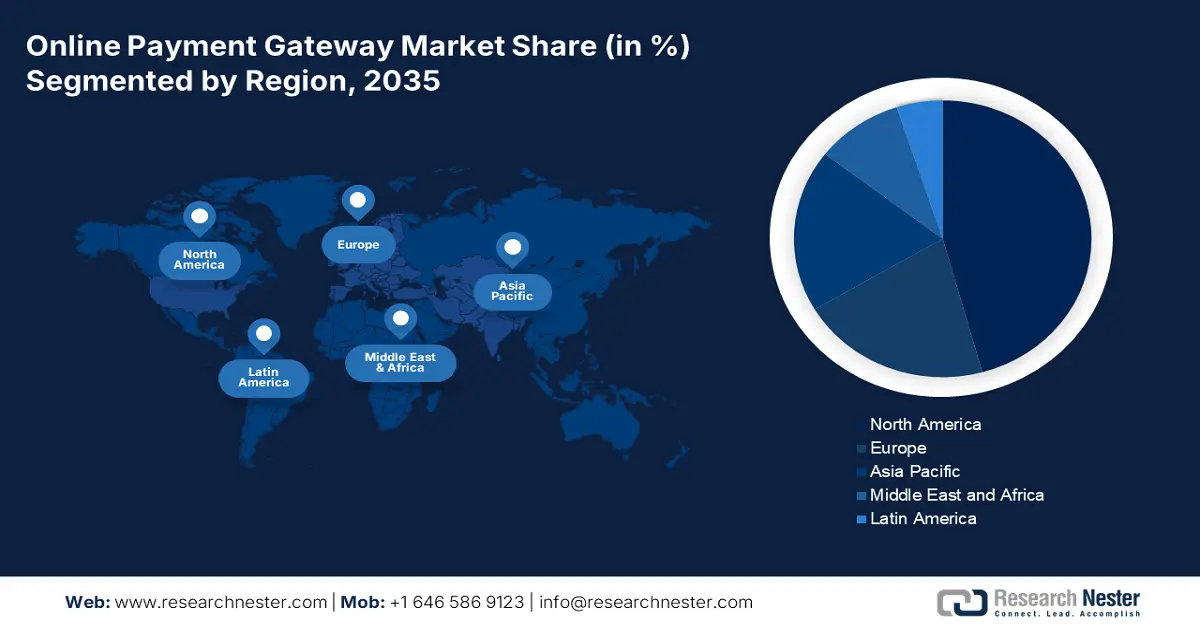

Regional Highlights:

- The North America online payment gateway market is expected to hold the largest share by 2035, driven by widespread adoption of digital payments and advanced technological infrastructure.

- The Asia Pacific market is anticipated to experience the fastest growth over the forecast period 2026–2035, driven by supportive government initiatives and investments in fintech innovations.

Segment Insights:

- The large enterprises segment in the online payment gateway market is projected to experience significant growth during 2026-2035, driven by high transaction volumes, multi-currency support, and fraud detection requirements.

- The retail segment in the online payment gateway market is anticipated to achieve considerable share by 2035, driven by the explosive growth of e-commerce and need for seamless checkout experiences.

Key Growth Trends:

- E-commerce expansion

- Rise in Fintech

Major Challenges:

- Security and fraud risks

Key Players: PayPal, Amazon, Avangate, Stripe, AsiaPay, Dwolla, Pagosonline, MyGate, CCBill, MercadoPago.

Global Online Payment Gateway Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 130.08 billion

- 2026 Market Size: USD 142.37 billion

- Projected Market Size: USD 353.05 billion by 2035

- Growth Forecasts: 10.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, India, Japan, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 8 September, 2025

Online Payment Gateway Market Growth Drivers and Challenges:

Growth Drivers

- E-commerce expansion: The global boom of online shopping has significantly accelerated the need for reliable and secure payment gateways. Moreover, with the rise of mobile commerce and social media shopping, gateways are being optimized for multiple platforms and devices, ensuring convenience and accessibility for users across demographics. Online payment gateways serve as the backbone of this ecosystem by enabling fast, encrypted, and real-time transactions. This growing dependence on digital retail continues to push the demand for advanced, callable, and user-friendly payment solutions.

- Rise in Fintech: The emergence of financial technology startup companies has revolutionized the payment landscape by introducing innovative financial technologies such as BuyNow, Pay Later (BNPL), digital wallets, one-click checkouts, and real-time settlements, to enhance transaction speed, flexibility, and user experience. For instance, in January 2025, MobiKwik partnered with the RBI and Yes Bank, and launched a complete version of India’s Central Bank Digital Currency, e-rupee (e₹). Such innovations compelled traditional players to modernize their services, leading to a healthy competition and continuous improvement in the market.

Challenge

- Security and fraud risks: One of the major challenges in the market is ensuring robust security against cyber threats and fraudulent activities. With the rising number of digital transactions, attempts at phishing, data breaches, and unauthorised access are also increasing. Balancing strong security with seamless user experience remains a complex task, especially in a rapidly evolving digital landscape.

Online Payment Gateway Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

10.5% |

|

Base Year Market Size (2025) |

USD 130.08 billion |

|

Forecast Year Market Size (2035) |

USD 353.05 billion |

|

Regional Scope |

|

Online Payment Gateway Market Segmentation:

Sector Type Segment Analysis

Based on sector, the retail segment in online payment gateway market is anticipated to register a considerable share by the end of 2035, owing to the explosive growth of e-commerce and evolving consumer buying behaviours. With increasing demand for online buying, both brick-and-mortar retailers and digital-first brands are integrating payment gateways to offer smooth, secure, and fast checkout experiences. The need to support various payment methods, including cards, wallets, and UPI, makes payment gateways essential in driving customer satisfaction and repeat purchases in the retail space.

Application Type Segment Analysis

Based on application, large enterprises segment in online payment gateway market are projected to witness significant growth during the forecast period as they require scalable and secure payment gateway solutions to handle high transaction volumes across global markets. These businesses often operate across multiple regions and platforms, making it crucial to integrate advanced payment technologies that support multi-currency processing, fraud detection, and compliance. With greater resources and higher stakes, large enterprises invest heavily in customizing their payment infrastructure to enhance customer trust and operational efficiency.

Our in-depth analysis of the global online payment gateway market includes the following segments:

|

Sector Type |

|

|

Product Type |

|

|

Application Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Online Payment Gateway Market Regional Analysis:

North America Market Insights

North America online payment gateway market is anticipated to experience significant growth by 2035, driven by widespread adoption of digital payments and advanced technological infrastructure, and the increasing preference for cashless transactions among consumers and businesses. In November 2022, Opn from Japan announced the acquisition of MerchantE and entered the U.S market. The industry is projected to continue its upward trajectory with hosted payment gateways and innovations in fraud prevention and user experience contributing to sustained growth.

The U.S. market is supported highly by a digital consumer base and a booming e-commerce industry. Furthermore, the country’s businesses and consumers demand faster and instant payment services, boosting the market growth further. For instance, according to a survey conducted by Federal Reserve Financial Services, in May 2024, digital wallet usage witnessed noteworthy growth in 2023, with efficiency-focused businesses increasing the usage by 31% and convenience-minded consumers experiencing an increase of 32%.

Asia Pacific Market Insights

APAC online payment gateway market is experiencing notable expansion and is projected to register the fastest growth during the forecast period. Countries including China, Japan, India, and South Korea are at the forefront with industries and customers embracing online transactions. Additionally, supportive government initiatives and investments in fintech innovations are fostering a conducive environment for the expansion of digital payment infrastructures.

India market is propelled by the government’s Digital India movement and a booming e-commerce landscape. The introduction of Unified Payments Interface (UPI) has revolutionized the payment ecosystem, offering a unified platform for multiple bank accounts and fostering interoperability among banks. According to the Press Information Bureau, Government of India, Ministry of Finance, in January 2025, announced that UPIs recorded a hit of 16.73 billion transactions in December 2024.

Online Payment Gateway Market Players:

- PayPal

- Company Overview

- Key Product Offerings

- Business Strategy

- SWOT Analysis

- Financials

- Amazon

- Avangate

- Stripe

- AsiaPay

- Dwolla

- Pagosonline

- MyGate

- CCBill

- MercadoPago

Companies dominating the market adopt several key strategies to maintain their lead. This includes investing heavily in robust security infrastructure to build trust and ensure safe transactions. Seamless user experience is prioritized through intuitive interfaces and quick payment processing. Furthermore, they also often form strategic partnerships with banks, e-commerce platforms, and fintech firms to expand their reach. Continuous innovation, such as integrating AI for fraud detection and introducing flexible payment options, also plays a crucial role in retaining the market.

Recent Developments

- In August 2024, PhonePe Payment Gateway launched PhonePe PG Bolt and offers the fastest in-app payment experience to customers with a 99% success rate.

- In August 2024, Ayden announced its expansion in India to operate as an Online Payment Aggregator in India for domestic and cross-border payments.

- In August 2024, Zoho Corporation announced entry into the payments sector with the launch of Zoho Payments, which is a unified payment solution to help businesses accept money online from their customers.

- Report ID: 846

- Published Date: Sep 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Online Payment Gateway Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.