Offshore Support Vessel (OSV) Market Outlook:

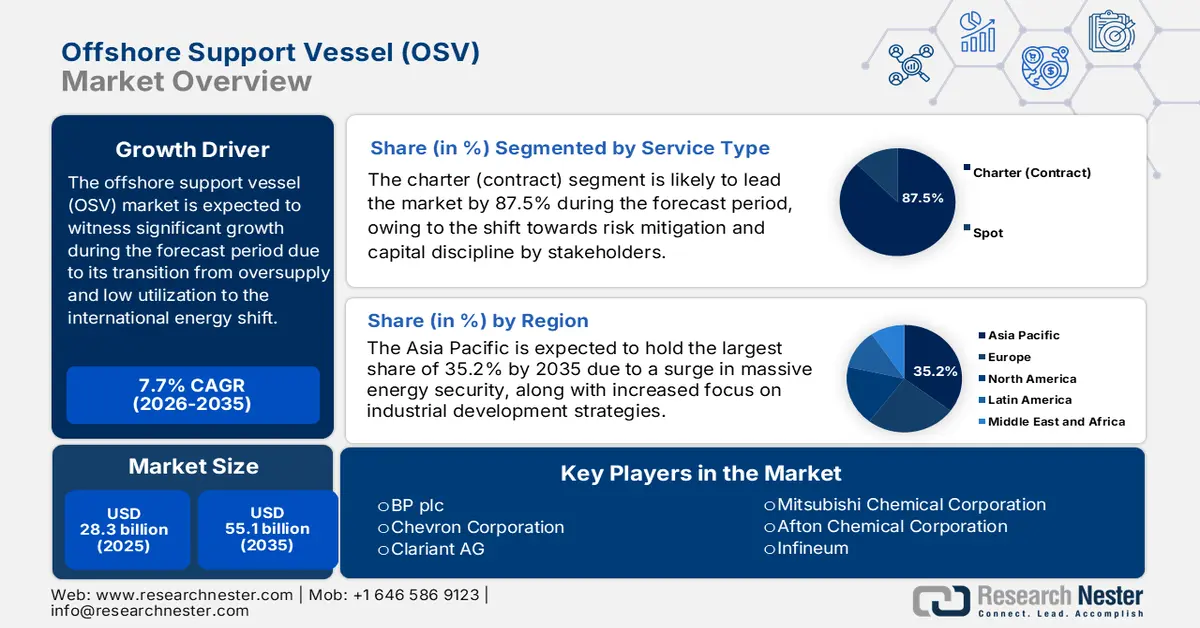

Offshore Support Vessel (OSV) Market size was over USD 28.3 billion in 2025 and is estimated to reach USD 55.1 billion by the end of 2035, expanding at a CAGR of 7.7% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of offshore support vessel (OSV) is assessed at USD 30.4 billion.

The offshore support vessel (OSV) market is witnessing a definitive resurgence as well as structural transformation, and emerging from a long-lasting period of low utilization and oversupply. While gas and oil exploration continue to remain the ultimate demand pillar, the overall market’s future is being readily rewritten by the international energy transition. For instance, according to a data report published by the IEA Organization in 2025, the growth in international oil demand is subject to increased consumption by 0.8% and reaching 193 EJ after jumping by 1.9% in 2023. On the contrary, there has been an increase in natural gas demand by a 2% growth rate and almost 1% as of 2023. Therefore, with the co-existence of both natural gas and oil, there is a huge growth opportunity, and these aspects are projected to ensure continuous growth in their sales in the upcoming years.

Oil and Natural Gas Growth Demand by Sector and Region (2025)

|

Oil |

Natural Gas |

||||

|

Year |

Sector |

Demand Growth (mb/d) |

Year |

Regions |

Demand Growth (EJ) |

|

2021 |

|

|

2000-2010 |

|

|

|

2022 |

|

|

2010-2019 |

|

|

|

2023 |

|

|

2019-2023 |

|

|

|

2024 |

|

|

2024 |

Rest World |

|

Source: IEA Organization

Furthermore, the Green and Dual-Fuel technology integration, specialization for offshore wind, fleet scrappage and modernization, and integrated and digitalization services are other factors that are significantly driving the offshore support vessel (OSV) market globally. As per an article published by the Atmospheric Environment: X in January 2025, maritime transport caters to 80% to 90% of international trade and is deliberately responsible for 3% of international carbon dioxide emissions. Therefore, to keep control, liquefied natural gas (LNG) is adopted since it is a sulfur-free fuel and its overall combustion produces 90% to 99% less sulfur oxide as well as 90% less particulate matter. In addition, based on the capability to reduce carbon dioxide emissions, LNG is primarily composed of methane, which emits less carbon dioxide, and meanwhile its combustion produces almost 20% to 25% less carbon dioxide in comparison to heavy fuel oil.

Key Offshore Support Vessel Market Insights Summary:

Regional Highlights:

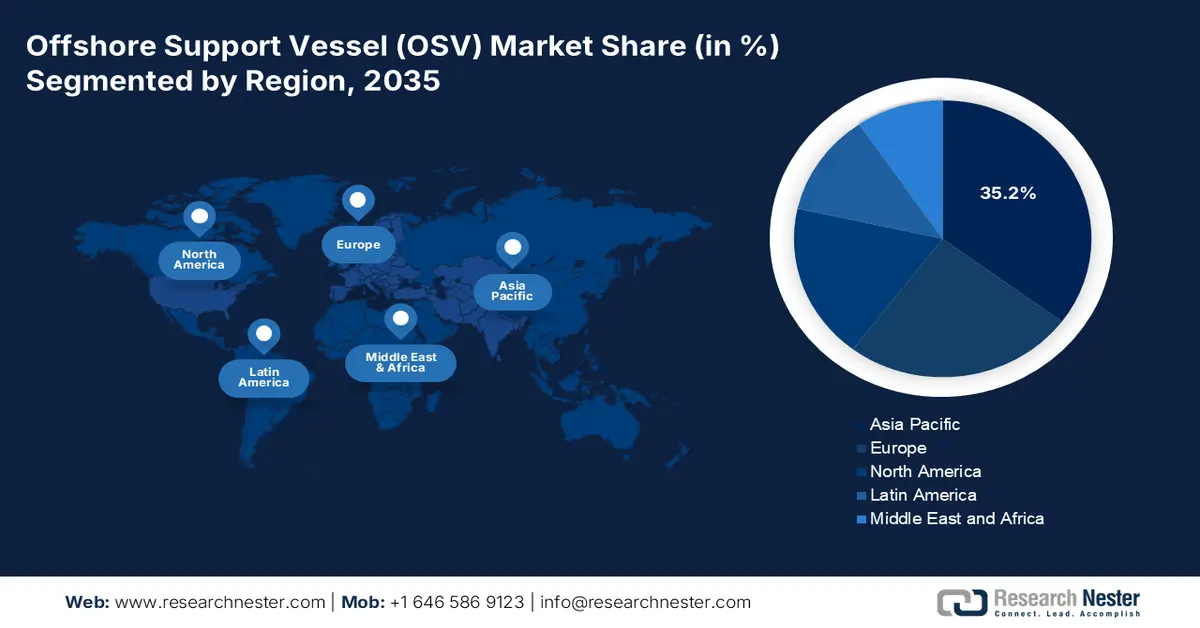

- Asia Pacific is anticipated to secure a 35.2% share by 2035 in the offshore support vessel (osv) market, supported by robust state-backed energy security priorities and expanding industrial development agendas.

- North America is projected to rise as the fastest-growing region by 2035, strengthened by sustained hydrocarbon activity and accelerating federal investments in offshore wind.

Segment Insights:

- The charter (contract) sub-segment is expected to command an 87.5% share by 2035 in the offshore support vessel (osv) market, underpinned by a strategic shift toward capital discipline and comprehensive risk mitigation.

- The diesel-electric/hybrid segment is estimated to attain the second-largest share by 2035, bolstered by substantial fuel efficiency gains and lower emissions that help meet stringent environmental mandates.

Key Growth Trends:

- Expansion in offshore wind

- Exploration of deep-water and ultra-deep-water

Major Challenges:

- Workforce transition and skilled crew shortage

- Geopolitical risk and regulatory uncertainty

Key Players: Dow Inc. (U.S.), ExxonMobil Corporation (U.S.), Shell plc (United Kingdom), TotalEnergies SE (France), BP plc (United Kingdom), Chevron Corporation (U.S.), Clariant AG (Switzerland), Lubrizol Corporation (U.S.), Nalco Champion (an Ecolab Company) (U.S.), Baker Hughes Company (U.S.), Croda International Plc (United Kingdom), Mitsubishi Chemical Corporation (Japan), Afton Chemical Corporation (U.S.), Infineum (United Kingdom), Idemitsu Kosan Co., Ltd. (Japan), PETRONAS Chemicals Group Berhad (Malaysia), GS Caltex Corporation (South Korea), India Oil Corporation Ltd (IOCL) (India), AMSOIL INC. (U.S.).

Global Offshore Support Vessel Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 28.3 billion

- 2026 Market Size: USD 30.4 billion

- Projected Market Size: USD 55.1 billion by 2035

- Growth Forecasts: 7.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (35.2% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, Brazil, China, Norway, United Kingdom

- Emerging Countries: China, India, Singapore, South Korea, Japan

Last updated on : 4 December, 2025

Offshore Support Vessel (OSV) Market - Growth Drivers and Challenges

Growth Drivers

- Expansion in offshore wind: This is considered the single-most potent driver for the market. In this regard, ambitious governments have targeted global offshore wind capacity installation, which has created a long-lasting and non-cyclical, pipeline need for specialized crew transfer, maintenance, and installation. According to the 2025 IEA Organization data report, 1,015 GW of wind capacity has been successfully installed in 2023, of which 93% was located across onshore systems, and the remaining 7% in offshore wind farms. Besides, offshore reach is anticipated to increase in the upcoming years since different nations are planning or developing their first-ever offshore wind farms. Moreover, 9% of the overall wind capacity growth of 116 GW has been delivered by offshore technology, thus suitable for uplifting the market internationally.

- Exploration of deep-water and ultra-deep-water: This particular exploration type is moving into challenging and in-depth frontiers since shallow-water reserves are maturing. These complicated projects need innovative and high-horsepower vessels with sophisticated dynamic positioning capabilities, which is driving the offshore supply vessel (OSV) market’s demand. Besides, as per an article published by the U.S. Department of Energy in 2025, the Ultra-Deepwater and Unconventional Natural Gas and Other Petroleum Resources Research Program, which has been unveiled by the Energy Policy Act of 2005 (EPAct), caters to a USD 400 million partnership for more than 8 years. Additionally, notable aspects of the program include using a non-profit consortium to significantly manage the research by establishing federal advisory committees and funding USD 50 million every year, thus positively impacting the overall market.

- Investment for resurgent oil and gas: The aspect of international transition and increased focus on energy security has resulted in a rebound, especially in final investment decisions for hydrocarbon projects in the offshore support vessel (OSV) market. This is suitable for regions such as West Africa, Guyana and Brazil from South America, and the Middle East. This has sustained the core demand for MPSVs, AHTS, and PSVs, suitable for field logistics and development. As per an article published by the IEF Organization in June 2024, the yearly gas and oil capital spending is projected to rise by 22% by the end of 2030 to ensure increasing supplies, owing to cost inflation and growing demand. In addition, a generous USD 4.3 trillion in new investments is required between 2025 and 2030. Furthermore, the continuously growing expenditure demands are effectively based on the outlook that witnesses the need for oil rising from 103 million barrels every day as of 2023 to an expected 110 million bpd by the end of 2030.

Challenges

- Workforce transition and skilled crew shortage: The offshore maritime sector is grappling with a critical and growing human capital crisis, which is negatively impacting the offshore support vessel (OSV) market globally. Previously, the market downturn drove experienced engineers, officers, and seafarers to stabilize maritime and shoreside industries. Therefore, recapturing this is a challenge, and significantly attracting a new generation is risky, owing to the sector’s historical cyclicality, as well as the perception of demanding work schedules. Besides, the adoption of the newest vessel technologies, such as complicated hybrid propulsion systems, innovative dynamic positioning, and wind farm-based equipment, demands a more technical and diverse skillset, thus creating a gap in the market’s development.

- Geopolitical risk and regulatory uncertainty: The offshore support vessel (OSV) market readily operates at the intersection of complicated and at times conflicting regulatory frameworks, along with geopolitical tensions. Besides, on the environmental front, the specific pathway remains uncertain since the direction towards decarbonization is clear. Moreover, regulations on acceptable future fuels, emissions control areas, and carbon pricing are continuing to evolve, thus making long-lasting vessel design and investment decisions extremely speculative. Key growth regions are considered frequent hotspots of geopolitical instability, while territorial disputes in areas such as the South China Sea, including regional conflicts and sanction regimes, can immediately invalidate contract terms, alter trade routes, and disrupt operations.

Offshore Support Vessel (OSV) Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

7.7% |

|

Base Year Market Size (2025) |

USD 28.3 billion |

|

Forecast Year Market Size (2035) |

USD 55.1 billion |

|

Regional Scope |

|

Offshore Support Vessel (OSV) Market Segmentation:

Service Type Segment Analysis

The charter (contract) sub-segment, a part of the service type segment, is anticipated to garner the largest share of 87.5% in the market by the end of 2035. The sub-segment’s upliftment is highly driven by ensuring a fundamental transition towards capital discipline and risk mitigation by overall stakeholders. The sub-segment’s high share is further propelled by the long-cycle and complex nature of offshore projects. Besides, energy developers, whether in renewables or oil and gas, need absolute certainty of vessel availability for long-lasting maintenance, installation, and field development to protect their generous investments. Moreover, for vessel owners, gaining a multi-year contract offers crucial revenue visibility, which is the pivotal prerequisite for achieving financing for fleet upgrades or newbuilds.

Fuel Type Segment Analysis

The diesel-electric/hybrid segment, which is part of the fuel type, is projected to cater to the second-largest share in the offshore support vessel (OSV) market during the predicted period. The segment’s growth is highly driven by its significant fuel savings that lower operating expenses and diminished emissions that assist in meeting stringent environmental regulations. According to an article published by the U.S. Department of Energy (DOE) in October 2024, the 50-foot Resilience is considered the first-ever hybrid diesel-electric research vessel, which comprises a 5,000-pound payload and has the ability to enable various research capabilities. In addition, the Resilience can effectively cruise comfortably at 20 knots by utilizing diesel engines and almost 7 knots on battery power. Therefore, with the launch of this research vessel, there is a huge growth opportunity for the segment.

Application Segment Analysis

Based on the application, the deep-water segment is expected to account for the third-largest share in the offshore support vessel (OSV) market by the end of the forecast timeline. The segment’s development is highly fueled by its role as the technologically-intensive and high-value frontier of offshore activities. Besides, deep-water projects are usually capital magnets, providing the scale of reserves, particularly in oil and gas, and continuous wind resources that tend to justify the immense upfront investment. This depth has necessitated highly sophisticated and expensive vessels, such as multipurpose support vessels (MPSVs) and robust platform supply vessels (PSVs), along with advanced and dynamic positioning (DP2/DP3) systems. Moreover, the operational complexity has translated into increased day rates in comparison to shallow-water tasks, thus making it suitable for bolstering the segment.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

Service Type |

|

|

Fuel Type |

|

|

Application |

|

|

Water Depth |

|

|

End user |

|

|

Vessel Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Offshore Support Vessel (OSV) Market - Regional Analysis

APAC Market Insights

Asia Pacific in the offshore support vessel (OSV) market is anticipated to garner the highest share of 35.2% by the end of 2035. The market’s upliftment is highly attributed to the state-backed and huge energy security, along with industrial development agendas. Besides, according to an article published by the Fundamental Research in September 2024, wind energy resources are abundant in China, with an approximate power generation of almost 17.5 PWh. In addition, the present utilization of offshore wind energy in China caters to 21% of international capacity; the overall share is restricted, readily supplying just 0.4% of regional electricity demands. Besides, countries in Southeast Asia, such as Vietnam, Malaysia, and Indonesia, have strongly developed into conventional oil and gas sectors, and nascent offshore wind projects to uplift the economic growth of the market.

China market is growing significantly, owing to the staggering scale of the offshore wind objective with coastal provinces, such as Jiangsu and Guangdong, mandating to installation of facilities as part of the national target. In this regard, as per an article published by NLM in November 2022, Jiangsu comprises the highest amount of offshore wind power of 4.2 GW, while Guangdong is projected to escalate offshore wind power construction to 30 GW by the end of 2035, along with 65 GW as of 2050. In addition, Guangdong has showcased the largest growth rate of offshore wind power, denoting an increase from 3.0% in 2025 to 11.4% in 2030, and it is further projected to increase to 24.8% in 2050, thereby boosting the market’s growth in the overall country.

India in the offshore support vessel (OSV) market is also growing due to the convergence of policy reforms, tactical energy security demands, and the launching of unexplored and massive offshore basins. In addition, the government’s Hydrocarbon Exploration and Licensing Policy (HELP), along with the recent introduction of the 52-block Discovered Small Fields (DSF) bidding rounds, has strongly attracted private investment into offshore oil and gas. As stated in a report published by the PIB Government in February 2024, the government of India has permitted bids for developing offshore wind energy, with an overall capacity of 4GW. This particular bid includes 4 blocks of 1 GW each on an open access basis off the Tamil Nadu coast. Moreover, offshore wind in the country approaches nearly 50% of the Capacity Utilization Function (CUF), which positively impacts the market’s growth.

North America Market Insights

North America in the offshore support vessel (OSV) market is projected to emerge as the fastest-growing region by the end of the forecast period. The market’s development in the region is highly fueled by sustained hydrocarbon activity in the Gulf of Mexico, along with the unprecedented U.S. federal investment in offshore wind. Besides, the region is gradually shifting from a historically dominated market to energy transition projects, which is also uplifting the market. As per an article published by the U.S. Department of Energy (DOE) in 2025, a clean hydrogen standard of 4 kg CO2e/kg H2 has been unveiled by the Hydrogen and Fuel Cell Technologies Office. This has also been introduced based on the Clean Hydrogen Production Tax Credit to provide almost USD 3 per kg to clean hydrogen producers. Besides, the DOE has launched the Energy Earthshots approach to diminish clean hydrogen cost by 80% to USD 1 per kg within 10 years, thus suitable for boosting the market.

The U.S. market is gaining increased traction, owing to a surge in federal spending, the offshore energy association, along with an increase in government expenditure. According to the 2022 United States Energy Association data report, the U.S. is on the pathway to diminish greenhouse gas (GHG) emissions between 24% and 35% by the end of 2030. In addition, if the Inflation Reduction Act (IRA) emerges as the ultimate law, then the GHG emission reduction will increase between 31% and 44% by the end of the same year. Besides, the progressive industrial facilities deployment program has created the latest USD 5.8 billion program under the Office of Clean Energy Demonstration (OCED). The purpose is to significantly invest in projects that are aimed at lowering emissions from energy-intensive sectors. Moreover, the aspect of clean hydrogen production tax credit is also creating a positive impact on the market in the country.

New Clean Hydrogen Production Tax Credit in the U.S. (2022)

|

Carbon Intensity (kg CO2e/kg H2) |

Max Hydrogen PTC Credit ($/kg H2) |

|

0 to 0.4 |

USD 3.0 |

|

0.4 to 1.5 |

USD 1.0 |

|

1.5 to 2.5 |

USD 0.7 |

|

2.5 to 4 |

USD 0.6 |

Source: United States Energy Association

Canada in the offshore support vessel (OSV) market is gradually developing due to the presence of the Atlantic Canada offshore wind catalyst, investment tax credits, federal regulatory reform, decommissioning liability, sustained offshore hydrocarbon activity, as well as the Arctic sovereignty nexus and critical minerals. For instance, in September 2022, the Government of Nova Scotia has readily targeted to provide 5 gigawatts of offshore wind energy by the end of 2030 to significantly support its budding green hydrogen sector. Besides, as per an article published by the Government of Canada in November 2023, the country’s Budget 2023 has readily proposed to unveil the Clean Hydrogen ITC initiative, with the objective to support clean ammonia production at a 15% credit rate. Besides, proposed tax measures have ensured revenue impacts, which are also positively affecting the market’s growth in the country.

Yearly Revenue Impacts of Proposed Tax Measures in Canada (2023)

|

Tax Type |

2024-2025 |

2025-2026 |

2026-2027 |

2027-2028 |

2028-2029 |

Total |

|

Clean Technology and Clean Electricity Investment Tax Credits- Equipment Using Waste Biomass |

26 |

193 |

214 |

210 |

210 |

853 |

|

Regional Journalism Labour Tax Credit |

60 |

30 |

30 |

5 |

4 |

129 |

|

Dividend Received Deduction by Financial Institutions- Exception |

40 |

45 |

40 |

45 |

45 |

215 |

Source: Government of Canada

Europe Market Insights

Europe in the offshore support vessel (OSV) market is predicted to witness development at a considerable rate during the stipulated duration. The market’s growth in the region is highly propelled by its evolution as the regulatory epicenter and global innovation for energy transition-based marine support. The market’s growth is also driven by the legally binding regional Green Deal as well as the REPowerEU plan, which has mandated huge offshore renewable extensions to gain energy independence and climate neutrality. Besides, as per an article published by the World Economic Forum in December 2023, the low-carbon hydrogen strategy of readily producing almost 30 TWh (an estimated 0.9 Mtpa) of green hydrogen by the end of 2030 effectively comprises scenarios for pipeline exports to the region, which is suitable for bolstering the market.

The offshore support vessel (OSV) market in the UK is gaining increased exposure, owing to the legally mandated and unmatched offshore wind expansion, along with the presence of an active and mature hydrocarbon industry. Besides, according to an article published by the UK Government in April 2022, with the adoption of smart planning, high environmental standards can be maintained by enhancing the deployment pace by 25%. In addition, the government has the ambition to effectively deliver 50GW by the end of 2030, which comprises almost 5GW of advanced floating wind. This is further poised to result in 90,000 employment opportunities in the industry within the same timeline. Moreover, this overall deployment is significantly backed by almost £160 million in supply chains and ports, as well as £31 million in research and development.

The offshore support vessel (OSV) market in Norway is also growing due to the aggressive and pioneering state-based push into the offshore wind as well as the electrification of the overall maritime industry. For instance, as per an article published by the Wind Europe Organization in June 2022, the country’s government is poised to allocate 30 GW of offshore wind capacity by the end of 2040. Regarding this objective, the government has successfully identified two zones for upliftment and is steadily planning to ensure an auction for a 1.5 GW floating wind farm from the upcoming year. Besides, at present, the overall region comprises only 3 floating wind farms with a total capacity of more than 100 MW. Moreover, players in the country can adopt 5 % to 14% of the international floating wind market, which is equivalent to a turnover amounting to €9.5 billion, thus making it suitable for the market’s growth.

Key Offshore Support Vessel (OSV) Market Players:

- BASF SE (Germany)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Dow Inc. (U.S.)

- ExxonMobil Corporation (U.S.)

- Shell plc (United Kingdom)

- TotalEnergies SE (France)

- BP plc (United Kingdom)

- Chevron Corporation (U.S.)

- Clariant AG (Switzerland)

- Lubrizol Corporation (U.S.)

- Nalco Champion (an Ecolab Company) (U.S.)

- Baker Hughes Company (U.S.)

- Croda International Plc (United Kingdom)

- Mitsubishi Chemical Corporation (Japan)

- Afton Chemical Corporation (U.S.)

- Infineum (United Kingdom)

- Idemitsu Kosan Co., Ltd. (Japan)

- PETRONAS Chemicals Group Berhad (Malaysia)

- GS Caltex Corporation (South Korea)

- India Oil Corporation Ltd (IOCL) (India)

- AMSOIL INC. (U.S.)

- BASF SE is regarded as the international chemical leader, as well as a critical supplier of high-performance additives, lubricants, and corrosion inhibitors, crucial for offshore operations. The organization’s contributions comprise creating advanced fuel and lubrication solutions that tend to enhance engine efficacy and cater to strict environmental regulations in sensitive marine ecosystems. Besides, as stated in its 2024 annual report, the organization has generated €65.3 billion in sales, followed by €7.9 billion in EBITDA, and 5.1% in ROCE.

- Dow Inc. offers essential specialty chemicals and innovative materials, such as coatings and fluids that protect severe components from extreme pressures and harsh saltwater corrosion. Its advancement in formulation chemistry assists in reducing maintenance and extending equipment life for offshore fleets.

- ExxonMobil Corporation is a major integrated chemical and energy company, along with a primary supplier of high-performance marine lubricants and base oils, which are specifically engineered for the demanding conditions of offshore support vessels. Its technical expertise contributes to dependable engine operation and optimized fuel economy across international OSV operations. Therefore, based on its 2024 annual report, the company has gained USD 34 billion in earnings, USD 55 billion in cash flow from operations, and more than USD 12 billion in structural costs.

- Shell plc is regarded as the dominating force in the OSV chemical market, offering a wide-ranging portfolio of marine fuels, specialized hydraulic fluids, and lubricants under its well-known brands. The organization is considered a notable contributor through its investment in research and development for cutting-edge and low-carbon bio-lubricants, along with digitalized conditions for monitoring services of offshore assets.

- TotalEnergies SE is a notable supplier of high-quality drilling fluids, fuel additives, and lubricants, which are tailored for the offshore gas, oil, and renewable energy sectors. Its market contribution is readily marked by a robust commitment to creating sustainable chemical solutions that assist in reducing the environmental footprint of offshore maritime activities.

Here is a list of key players operating in the global market:

The worldwide market is considered oligopolistic and is highly dominated by integrated energy majors, such as TotalEnergies, ExxonMobil, and Shell, as well as by diverse chemical firms, including Dow and BASF. Their tactical benefit originates from vertical integration and supplying both lubricants and high-value additive packages. Moreover, tactical strategies effectively revolve around digitalization and sustainability, which is also driving the market’s upliftment. Leaders are significantly investing in research and development for biodegradable and bio-based lubricants, as well as fuels to cater to strong predictive analytics and condition-monitoring services. Besides, in November 2024, Sea1Offshore has successfully set the growth objective by introducing two latest next-generation Offshore Energy Support Vessels from Cosco Shipping. Therefore, after delivering the two newbuilds by 2027, the company is projected to own a fleet of 19 modernized offshore vessels.

Corporate Landscape of the Offshore Support Vessel (OSV) Market:

Recent Developments

- In November 2025, Windcat effectively signed a contract with Damen Shipyards Group for the latest Multi-Purpose Accommodation Support Vessel (MP-ASV), with the option of 5 more vessels, which will combine a massive open deck with a subsea crane and ensure fuel-efficient operations.

- In January 2025, Rolls-Royce readily powers the world’s fastest offshore crew transfer vessels, with sea trials demonstrating 53 knots as maximum speed, along with each ship being powered by four 16-cylinder mtu Series 2,000 engines.

- In May 2024, Sumitomo Corporation reached a strategic deal with IWS Fleet AS, intending to grab a share in IWS Fleet. Therefore, based on this agreement, both these companies are predicted to contribute to the carbon neutral society through expanding renewable energy production.

- Report ID: 5025

- Published Date: Dec 04, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Offshore Support Vessel Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.