Offshore Wind Tower Market Outlook:

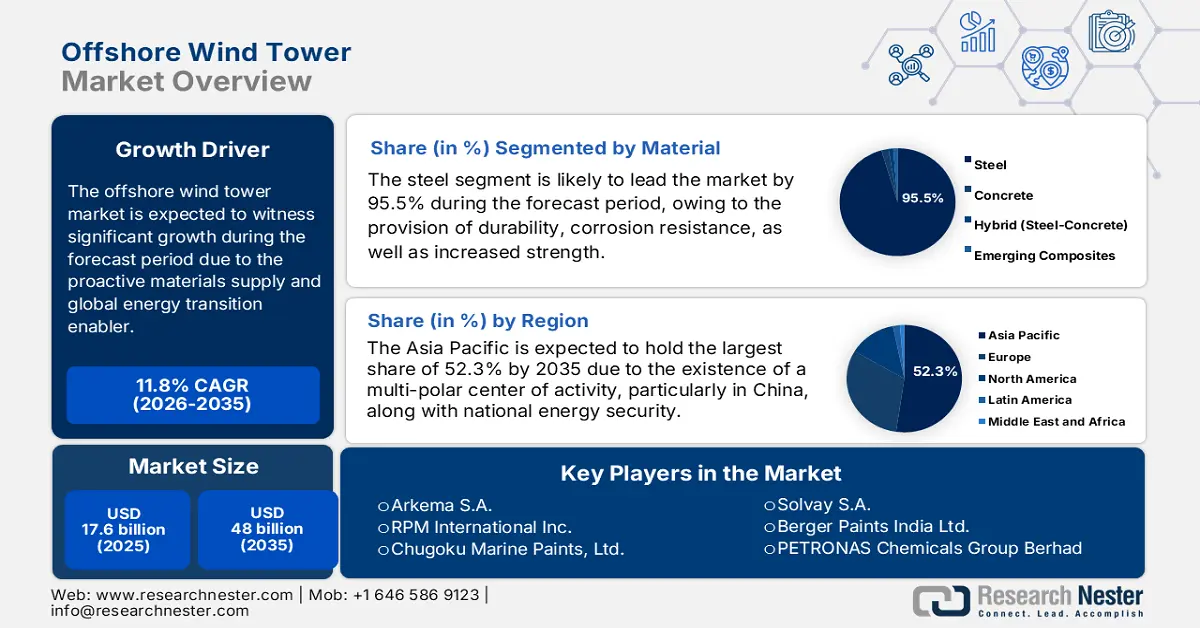

Offshore Wind Tower Market size was over USD 17.6 billion in 2025 and is estimated to reach USD 48 billion by the end of 2035, expanding at a CAGR of 11.8% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of offshore wind tower is evaluated at USD 19.6 billion.

The international offshore wind tower market is witnessing a period of unprecedented growth and transformation, owing to the need to supply structural and proactive materials that are essential for the industry’s huge infrastructure. In addition, the offshore wind tower market is no longer considered a niche segment, but a suitable enabler of the international energy transition, which is directly scaling the exponential surge in offshore wind capacity. According to an article published by the GWRC in June 2025, there has been the addition of 8GW of capacity as of 2024, which has made it the fourth-highest year ever. Additionally, this has brought the overall installed offshore wind capacity internationally to 83 GW, which is extremely suitable to power 73 million households. Therefore, with such an increase in the installation capacity, there is a huge growth opportunity for the offshore wind tower market across different regions.

Total and New Offshore Wind Installation Across Different Countries (2025)

|

Countries |

New Installation |

Total Installation |

|

China |

50.4% |

50.3% |

|

UK |

14.7%` |

19.2% |

|

Taiwan |

11.6% |

3.7% |

|

Germany |

9.1% |

10.9% |

|

France |

8.2% |

1.8% |

|

Japan |

1.2% |

- |

|

South Korea |

1.2% |

- |

|

Others |

1.6% |

1.2% |

Source: GWEC

Furthermore, the sustainability-based innovation dominance, system and integration-driven solutions, tactical vertical partnerships, and a rise in progressive material science are also responsible for propelling the offshore wind tower market globally. As per an article published by NLM in January 2023, the demand for carbon fiber reinforced polymers globally is expected to reach almost 20 ktons every year by the end of 2025. In addition, with an estimated 6,000 to 8,000 commercial aircraft projected to reach their end-of-life by 2030, there is a huge demand for developing recycling techniques and economically and sustainably managing waste. Besides, the international epoxy composite industry is valued at USD 28.4 billion, which is anticipated to increase by 8.3% by the end of 2028. Therefore, with continuous developments for these materials, there is a huge demand for thermoplastic composites, which are suitable for recycling smart coating and internal platforms. This, in turn, ensures real-time monitoring, thereby upscaling the overall offshore wind tower market into high-tech specialty chemical territory.

Key Offshore Wind Tower Market Insights Summary:

Regional Highlights:

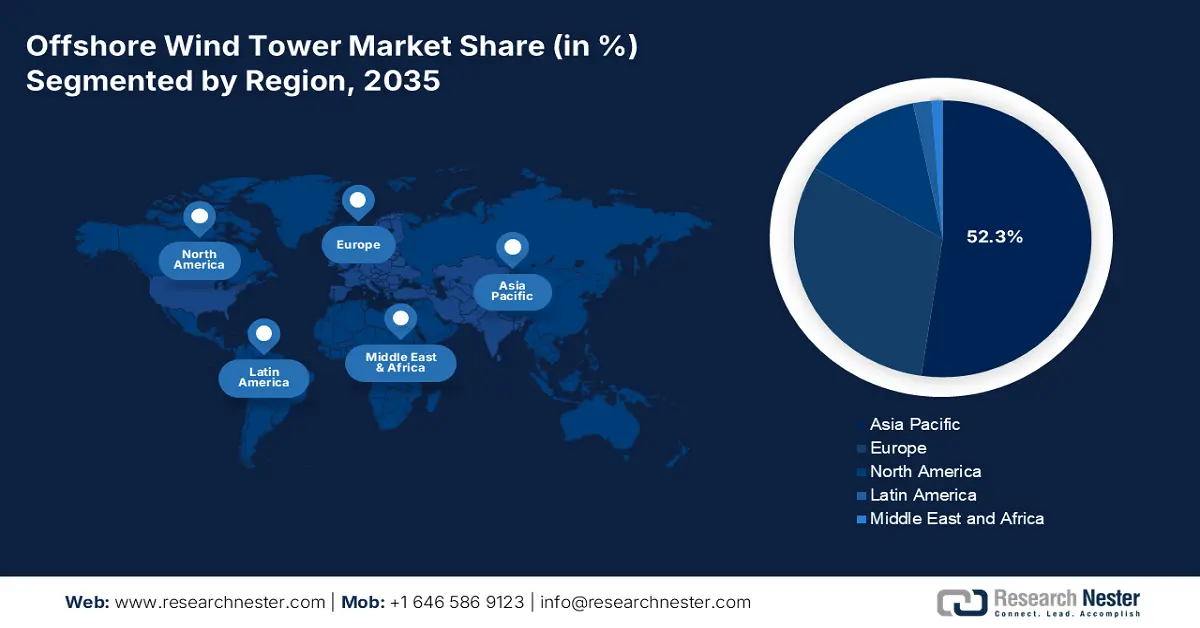

- By 2035, the Asia Pacific is anticipated to secure a 52.3% share in the offshore wind tower market, supported by its shift toward a multi-polar industry structure and strong supply-chain localization impelled by industrial policy and national energy security.

- North America is set to become the fastest-growing region in the stipulated period, underpinned by state-level targets and ambitious federal strategies energizing offshore wind capacity expansion.

Segment Insights:

- The steel sub-segment within the material segment is expected to command a 95.5% share by 2035 in the offshore wind tower market, bolstered by its corrosion resistance, durability, and load-bearing suitability.

- The fixed-bottom foundations segment is poised to capture the second-largest share by 2035, lifted by its cost-effectiveness, scalable supply chains, and compatibility with large turbine designs.

Key Growth Trends:

- Shift to floating wind and large turbines

- Repowering early wind farms

Major Challenges:

- Regulatory complexity and intensified technology

- Application quality control and shortage in skilled labor

Key Players: AkzoNobel N.V. (Netherlands), Hempel A/S (Denmark), PPG Industries, Inc. (U.S.), Jotun Group (Norway), Sherwin-Williams Company (U.S.), BASF SE (Germany), Sika AG (Switzerland), Arkema S.A. (France), RPM International Inc. (U.S.), Chugoku Marine Paints, Ltd. (Japan), Nippon Paint Holdings Co., Ltd. (Japan), Kansai Paint Co., Ltd. (Japan), KCC Corporation (South Korea), Ashland Inc. (U.S.), Huntsman Corporation (U.S.), 3M Company (U.S.), Axalta Coating Systems Ltd. (U.S.), Solvay S.A. (Belgium), Berger Paints India Ltd. (India), PETRONAS Chemicals Group Berhad (Malaysia).

Global Offshore Wind Tower Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 17.6 billion

- 2026 Market Size: USD 19.6 billion

- Projected Market Size: USD 48 billion by 2035

- Growth Forecasts: 11.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (52.3% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: China, United States, Germany, United Kingdom, Japan

- Emerging Countries: India, South Korea, Vietnam, Poland, Denmark

Last updated on : 8 December, 2025

Offshore Wind Tower Market - Growth Drivers and Challenges

Growth Drivers

- Shift to floating wind and large turbines: The sudden shift to floating foundations and turbines has created the demand for more innovative and high-performance chemical solutions that can readily withstand harsh environments, deep waters, and stresses. Therefore, this moves the offshore wind tower market toward high-value products. According to a data report published by the U.S. Department of Energy in 2023, the 52,687 MW in the U.S. offshore wind energy pipeline demonstrates 15% growth. In addition, the majority of the 6,915 MW of growth in the country’s capacity is driven by the latest leasing activity that has created three new lease areas, especially in the Gulf of Mexico, with an approximate 4,885 MW capacity. Therefore, with the presence of such offshore wind energy projects, the market is continuously growing globally.

- Repowering early wind farms: The first generation of Europe-based offshore wind farms is gradually approaching end-of-life and creating a high-value and secondary platform for the offshore wind tower market. This is extremely suitable for specialized chemical solutions that are utilized in the repowering, repair, and maintenance of current infrastructure. As per an article published by the World Wind Energy Association in November 2023, wind power has set a new record for latest installations as of 2023, with 110 GW of capacity within a year. Besides, at present, the largest wind turbines are within the 5 MW range, in comparison to the 1 MW range two decades ago. However, the world record is readily held by China’s Mingyang with 18 MW, along with a 22 MW model that is under development. Therefore, with such developments, there is a huge growth opportunity for the overall offshore wind tower market.

- Localizing supply chains: The presence of policies, such as the Green Deal mandate in Europe and the U.S. Inflation Reduction Act, has readily compelled chemical organizations to establish localized production centers. This particular driver is uplifting the offshore wind tower market from a centralized export model to a regionalized and decentralized manufacturing footprint. As stated in an article published by the International Journal of Applied Earth Observation and Geoinformation in August 2022, the UK Government unveiled the Net Zero Strategy, which deliberately targets to enhance its very own offshore wind energy capacity from 10.5 GW to 40 GW by the end of 2030. In addition, with a generous investment of EUR 800 billion, it has been projected to ensure expansion in the offshore wind energy capacity from 12 GW to 60 GW by 2030, and further to 300 GW by the end of 2050. Therefore, with such futuristic development, the offshore wind tower market is gradually experiencing increased exposure globally.

Challenges

- Regulatory complexity and intensified technology: The operating environment for the offshore wind tower market is considered the most corrosive, which requires chemical systems to effectively operate with minimal maintenance. Besides, the aspect of developing coatings that can tend to withstand continuous ultraviolet exposure, mechanical impact, cathodic protection, and saltwater immersion from debris or sea ice needs massive research and development investment. Besides, the administrative landscape is regarded as a moving target for the offshore wind tower market. Environmental policies, especially in North America and Europe, are increasingly limiting volatile organic compounds and are effectively banning specific biocides, which are utilized in anti-fouling paints. Therefore, manufacturers need to reformulate high-performance products to meet these standards, suitable for the market’s growth.

- Application quality control and shortage in skilled labor: The performance of any particular chemical system is appropriate as its application, which in the offshore wind tower market is a monumental challenge. Therefore, applying multi-layer systems to irregular steel structures and saline port environments need highly trained and certified applicators. Besides, there is a critical restriction on this specialized labor, which is also causing a hindrance in the market’s expansion. Besides, an improper application deviation or surface preparation can develop a failure point that results in catastrophic corrosion, potentially demanding multiple repairs. Moreover, this human-dependent variable unveils significant project risk, thus negatively impacting the overall market’s growth and exposure.

Offshore Wind Tower Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

11.8% |

|

Base Year Market Size (2025) |

USD 17.6 billion |

|

Forecast Year Market Size (2035) |

USD 48 billion |

|

Regional Scope |

|

Offshore Wind Tower Market Segmentation:

Material Segment Analysis

The steel sub-segment, which is part of the material segment, is anticipated to hold the highest share of 95.5% in the offshore wind tower market by the end of 2035. The sub-segment’s upliftment is highly attributed to its corrosion resistance, durability, and high strength, which are suitable for supporting heavy loads and withstanding severe marine environments. Besides, according to an article published by the Renewable and Sustainable Energy Reviews in August 2022, the offshore wind energy exploration demands huge quantities of raw materials, including 120 million tons to 235 million tons of steel, along with 8.2 million tons to 14.6 million tons of iron, which is followed by 3.8 million tons to 25.9 million tons of concrete, 0.5 million tons to 1.0 million tons of copper, and 0.3 million tons to 0.5 million tons of aluminium. Therefore, with this requirement, the segment is gaining increased exposure for the market’s welfare globally.

Installation Type Segment Analysis

By the end of 2035, the fixed-bottom foundations segment, part of the installation type, is projected to account for the second-largest share in the offshore wind tower market. The segment’s growth is highly propelled by its cost-effectiveness, industrialized supply chains, and proven engineering in water depths, which readily cover the majority of leased seabed areas. In addition, the segment’s primary driver is the continuous monophile production industrialization, with increased diameters. This is suitable for supporting cutting-edge turbines, thereby creating a predictable and huge demand for specialized welding and steel, along with grouting chemicals and coating. Besides, in mature economies, such as Europe, the trend is focused on repowering early sites with large turbines on present and newest foundations. These demand standard chemical solutions for executing retrofit projects and complex life extension projects, thus suitable for boosting the segment’s growth.

Turbine Capacity Segment Analysis

The 12 to 20 MW class segment, which is under the turbine capacity, is expected to cater to the third-largest share in the offshore wind tower market during the forecast period. The segment’s development is highly fueled by radically optimizing project economics by lowering expensive installations, large turbines generating increased power per foundation, and the relentless pursuit of Levelized Cost of Energy (LCOE) reduction. Besides, for the chemical and tower industry, this has significantly created a robust value-upgradation effect. For instance, turbine towers need high-grade steel, sophisticated corrosion protection systems, and advanced welding techniques, owing to huge structural loads and large surface areas. Moreover, this segment is also characterized by standardization pressure as well as increased design iteration, which is driving the overall upliftment.

Our in-depth analysis of the offshore wind tower market includes the following segments:

|

Segment |

Subsegments |

|

Material |

|

|

Installation Type |

|

|

Turbine Capacity |

|

|

Support Structure |

|

|

Component |

|

|

Water Depth |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Offshore Wind Tower Market - Regional Analysis

APAC Market Insights

The Asia Pacific in the offshore wind tower market is anticipated to hold the largest share of 52.3% by the end of 2035. The market’s upliftment in the region is highly propelled by the transition from an industry that is led by China’s multi-polar center of activity. In addition, the industrial policy, national energy security, along with the government’s strategy to leverage offshore wind to cater to decarbonization targets and build export-driven manufacturing champions. Besides, the supply chain localization is also a suitable trend, which is also uplifting the offshore wind tower market. In this regard, as stated in the November 2025 OEC data report, China is considered the top exporter of steam turbines amounts to USD 606 million, and Indonesia is the top importer, with amounts to 401 million. In addition, the continuous steam turbines supply chain is also fueling the market’s growth in the overall region.

2023 Gas Turbines Export and Import in Asia

|

Countries |

Export (USD) |

Import (USD) |

|

China |

8.0 billion |

14 billion |

|

Japan |

6.3 billion |

8.4 billion |

|

India |

2.4 billion |

4.3 billion |

|

Singapore |

6.5 billion |

13.2 billion |

|

South Korea |

1.1 billion |

2.7 billion |

|

Thailand |

1 billion |

2.2 billion |

|

Malaysia |

643 million |

1.3 billion |

|

Vietnam |

642 million |

1.0 billion |

Source: OEC

The offshore wind tower market in China is growing significantly due to the sustained policy ambition, integrated domestic supply chain, and unprecedented scale. In addition, the dual-carbon policy objective, along with offshore wind as a tactical pillar, is also considered the core driver for the market’s growth in the country. According to an article published by the Global Energy Monitor organization in July 2024, the country is gradually cementing its position as the international leader in renewables development, with 180 GW of utility-driven solar as well as 159 GW of wind power. Additionally, the 339 GW of utility-scale wind and solar have successfully reached the construction stage, accounting for 1/3rd of the overall proposed capacity in the country. This is further supported by a cost-competitive and complete industrial ecosystem, with the implementation of the MingYang Smart Energy and China Three Gorges Corporation, thus bolstering the market’s exposure.

The offshore wind tower market in South Korea is also growing, owing to the governmental and monumental-based industrial pivot to emerge as a floating wind export powerhouse. As per a report published by the EEAS in 2024, the offshore wind energy target in the country is projected to reach 14.3 GW by the end of 2030. However, in 2023, only 142.1 MW of the capacity has been installed, and in June 2024, the country’s government introduced the Basic Plan for Long-Term Electricity Supply and Demand, which has set ambitious objectives for renewable energy to constitute 21.6% of the electricity mix by the end of 2030, as well as 32.9% by 2038. Moreover, the 2023 Clean Technologies and Environmental Policy article, the world’s largest floating offshore wind farm with a 6 GW capacity, is projected to be developed at the Ulsan offshore, thus contributing to the market’s growth.

North America Market Insights

North America in the offshore wind tower market is expected to emerge as the fastest-growing region during the stipulated period. The market’s development in the region is highly fueled by the presence of state-level targets and ambitious federal strategies. As per a report published by the NREL Government in August 2024, the first-ever commercial-based offshore wind power plant in the U.S., which is the 132 MW South Fork Wind Farm, commenced delivering power to New York in November 2023, and it completed its commission in March 2024. Besides, the offshore wind energy pipeline in the U.S. comprises 4,097 MW, and meanwhile, the project development has reached a suitable capacity of 80,523 MW. Therefore, with the existence of such standard projects, there is a huge growth opportunity for the market in the region.

The U.S. in the offshore wind tower market is gaining increased traction, owing to the federal funding analysis, the chemical industry association, and an increase in the presence of gallium arsenide wafers. Additionally, the EPA’s Green Chemistry and Safer Choice programs are promoting sustainable chemical products, thus suitable for the market’s growth. Besides, as per an article published by the EIA Government in December 2023, the overall yearly electricity generation in the country from wind energy has surged by almost 6 billion kWh to 434 billion kWh as of 2022. In addition, within the same year, wind turbines emerged as the ultimate source of nearly 10.3% of the overall country’s utility-scale electricity generation. Moreover, utility scale comprises infrastructure with almost 1,000 kilowatts of electricity generation capacity, which is readily driving the market in the country.

Annual Electricity Generation and Share in the U.S. (2012-2022)

|

Year |

Generation (Billion kWh) |

Share (%) |

|

2012 |

140.8 |

3.4 |

|

2013 |

167.8 |

4.1 |

|

2014 |

181.6 |

4.4 |

|

2015 |

190.7 |

4.6 |

|

2016 |

226.9 |

5.5 |

|

2017 |

254.3 |

6.3 |

|

2018 |

272.6 |

6.5 |

|

2019 |

295.8 |

7.1 |

|

2020 |

337.9 |

8.4 |

|

2021 |

378.2 |

9.2 |

|

2022 |

434.8 |

10.2 |

Source: EIA Government

Canada in the offshore wind tower market is also developing due to the hydrogen strategy, federal policy ambition, feed-in tariffs, provincial leadership, industrial and supply chain transformation, export potential, and geopolitical energy security. According to an article published by the Government of Canada in March 2025, there has been a 24% surge in offshore wind capacity in the country between 2022 and 2023. Besides, the country is well-positioned in the international offshore wind industry with the existence of long coastlines, which is expected to attract USD 1 trillion in investment by the end of 2040. Moreover, the government of Nova Scotia is projected to set a provincial offshore wind target by offering leases for nearly 6 GW of offshore wind by the end of 2030. Therefore, with all these investments and future developments, the market in the country is poised to develop.

Europe Market Insights

Europe in the offshore wind tower market is projected to witness considerable growth by the end of the forecast duration. The market’s growth in the region is extremely driven by the shift from a feed-in-tariff-based industry to an industrial and competitive-scale powerhouse, with increased focus on massive capacity extension and repowering old sites in the Atlantic, Baltic Sea, and North Sea. As per the 2025 Europe Commission article, countries in the region comprise regional cumulative offshore objectives of achieving 86 GW to 89 GW by the end of 2030, followed by 355 GW to 366 GW by 2050. Based on these goals, offshore renewables are predicted to emerge as the main pillar of the region’s futuristic electricity mix. Besides, the already installed offshore wind capacity in the region was 19.3 GW as of 2023. However, the revised Renewable Energy Directive adoption in 2023 has set the regional renewables target by almost 42.5%, which is poised to demand a rise in the installed wind capacity to over 500 GW by 2030.

The UK in the offshore wind tower market is gaining increased exposure, owing to the mature regulatory regime and the unparalleled project pipeline. As stated in the September 2023 Offshore Wind Biz article, the country’s government has readily provided 3.7 GW of renewable energy projects with Contracts for Difference (CfDs). Besides, the maximum bid price for floating wind is GBP 114/MWh, which is nearly EUR 132.7/MWh. Meanwhile, as per the April 2022 UK Government article, with smart and advanced planning, the nation can easily maintain increased environmental standards while boosting the deployment pace by 25%. In addition, the country’s objective is to deliver nearly 50 GW by the end of 2030, which includes 5 GW of progressive floating wind, thereby making it suitable for driving the market’s growth and expansion in the overall nation.

France, in the offshore wind tower market, is also growing significantly due to the government’s decision to upgrade offshore wind. Besides, according to a report published by the French Durable Government in March 2025, based on the government’s plans for transforming the energy system, the prime objective is to shift from an energy mixture, which is made up of nearly 60% imported fossil fuels as of 2023, to an energy mixture of nearly 60% low-carbon energy by the end of 2030. Moreover, there is 0.8 GW offshore wind capacity, which is further projected to increase to 3.6 GW by 2030 and 40 GW to 18 GW by 2035. Besides, the overall region has set itself the goal of diminishing its greenhouse gas emissions by approximately 55% net by 2030 in comparison to previous years. Therefore, with such existence and future possibilities, the market is continuously growing in the country.

Key Offshore Wind Tower Market Players:

- AkzoNobel N.V. (Netherlands)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Hempel A/S (Denmark)

- PPG Industries, Inc. (U.S.)

- Jotun Group (Norway)

- Sherwin-Williams Company (U.S.)

- BASF SE (Germany)

- Sika AG (Switzerland)

- Arkema S.A. (France)

- RPM International Inc. (U.S.)

- Chugoku Marine Paints, Ltd. (Japan)

- Nippon Paint Holdings Co., Ltd. (Japan)

- Kansai Paint Co., Ltd. (Japan)

- KCC Corporation (South Korea)

- Ashland Inc. (U.S.)

- Huntsman Corporation (U.S.)

- 3M Company (U.S.)

- Axalta Coating Systems Ltd. (U.S.)

- Solvay S.A. (Belgium)

- Berger Paints India Ltd. (India)

- PETRONAS Chemicals Group Berhad (Malaysia)

- AkzoNobel N.V. is regarded as the global leader in marine coatings, as well as a crucial supplier of durable and high-performance protective systems for offshore wind foundations and towers. The organization is heavily invested in sustainable advancements, including its very own biocide-free Intersleek foul-release coatings, which have effectively diminished maintenance and drag for underwater structures. Besides, as stated in its 2024 annual report, the organization generated €10,711 million in revenue, €1,478 million in adjusted EBITDA, 13.8% as adjusted EBITDA margin, and 41% in carbon footprint.

- Hempel A/S is regarded as one of the specialists in corrosion-driven protection for extreme environments and offers cornerstone coating solutions for the offshore wind industry, including its Hempasil and Hempadur product lines. The company is tactically extending its production footprint with the latest facilities in notable markets, such as Taiwan and the U.S., to effectively localize the supply for massive wind farm developments.

- PPG Industries, Inc. is one of the major forces in marine and protective coatings, providing wide-ranging systems, such as PPG PSX silicone-based coatings, that offer long-lasting fouling and corrosion resistance for offshore assets. The organization has leveraged its international scale and research and development capabilities to create innovative and compliant coatings that cater to meeting specific risks of larger and next-generation turbines in critical marine conditions. Besides, as per its 2024 annual report, the organization has generated USD 3.7 billion in net sales, USD 0.01 as EPS, along with USD 1.6 as adjusted EPA, thus denoting a 3% year-over-year (YoY) rise.

- Jotun Group is well-known for its pioneering Baltoflake and SeaQuantum coating technologies, which have set industrial standards for long-lasting corrosion protection of offshore wind substructures. With in-depth roots in the offshore gas and oil industry, the company has applied its expanded experience in critical environmental durability to provide reliable and proven solutions for the wind sector’s floating platforms, jackets, and monopiles.

- Sherwin-Williams Company offers a massive portfolio of high-performance epoxy, zinc-rich coatings, and polyurethane, which are crucial for protecting offshore wind towers from corrosion. Its tactical acquisitions, including Vince, have permitted it to provide a more integrated chemical products suite for the overall wind tower structure.

Here is a list of key players operating in the global offshore wind tower market:

The competitive landscape in the worldwide offshore wind tower market is highly concentrated, with the U.S. and Europe-based coating giants and specialty chemical organizations garnering a joint share by leveraging decades of expertise in marine corrosion protection. Notable approaches include focus on sustainability and localization, which are uplifting the overall market globally. Moreover, leaders, such as AkzoNobel and Hempel, are readily establishing regional production centers in North America and the Asia Pacific to cater to emerging wind economies. Besides, in December 2024, bp and JERA formed a collaborative deal to develop a strategic platform by combining high-quality development and operational offshore wind assets, with an overall 13GW net generating capacity. This particular 50:50 venture has been formed to initially make progress in existing innovative developments from an expanded portfolio, thereby making it suitable for boosting the offshore wind tower market internationally.

Corporate Landscape of the Offshore Wind Tower Market:

Recent Developments

- In December 2025, Ørsted’s largest offshore wind farm, Borkum Riffgrund 3, produced its first power, in association with Nuveen by leveraging notable Europe-based suppliers to effectively deliver a 913 MW offshore wind farm.

- In August 2024, Sumitomo Corporation successfully reached a business and investment operation participation deal with EEW Offshore Wind EU Holding, which is suitable for the foundation of bottom-fixed offshore wind power generation.

- In June 2024, Vestas significantly received an order for RWE’s 660 MW Nordseecluster A offshore wind project in Germany for supplying 44 V236-15.0 MW wind turbines, and is equally responsible for commissioning, delivering, and supplying turbines.

- Report ID: 8285

- Published Date: Dec 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Offshore Wind Tower Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.