Offshore Drilling Rigs Market Outlook:

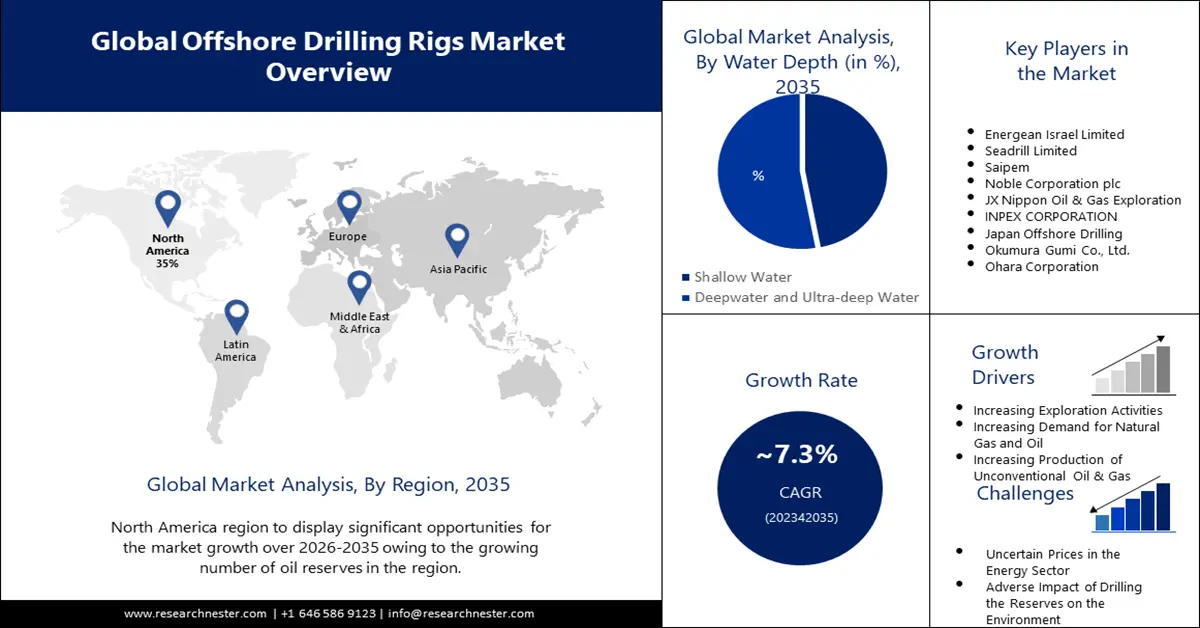

Offshore Drilling Rigs Market size was valued at USD 95.79 billion in 2025 and is expected to reach USD 193.78 billion by 2035, registering around 7.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of offshore drilling rigs is evaluated at USD 102.08 billion.

The increased global demand for oil and gas is a crucial factor in the market's expansion. Global gas demand is anticipated to increase by 140 billion cubic meters between 2021 and 2025. Also anticipated for 2023 is an increase in global oil demand of 1.9 million barrels per day. The need for drilling rigs and other equipment is expanding as a result of manufacturers' need to extract more oil and gas.

The chances for the drilling rig industry to grow will also be driven by the latest developments in drilling rig technology. One of the main issues in drilling the deposits was environmental risks. However, cutting-edge drilling rigs have somewhat eliminated these problems. For instance, modern rigs can drill smaller holes, increasing extraction and reducing waste generation.

Key Offshore Drilling Market Insights Summary:

Regional Highlights:

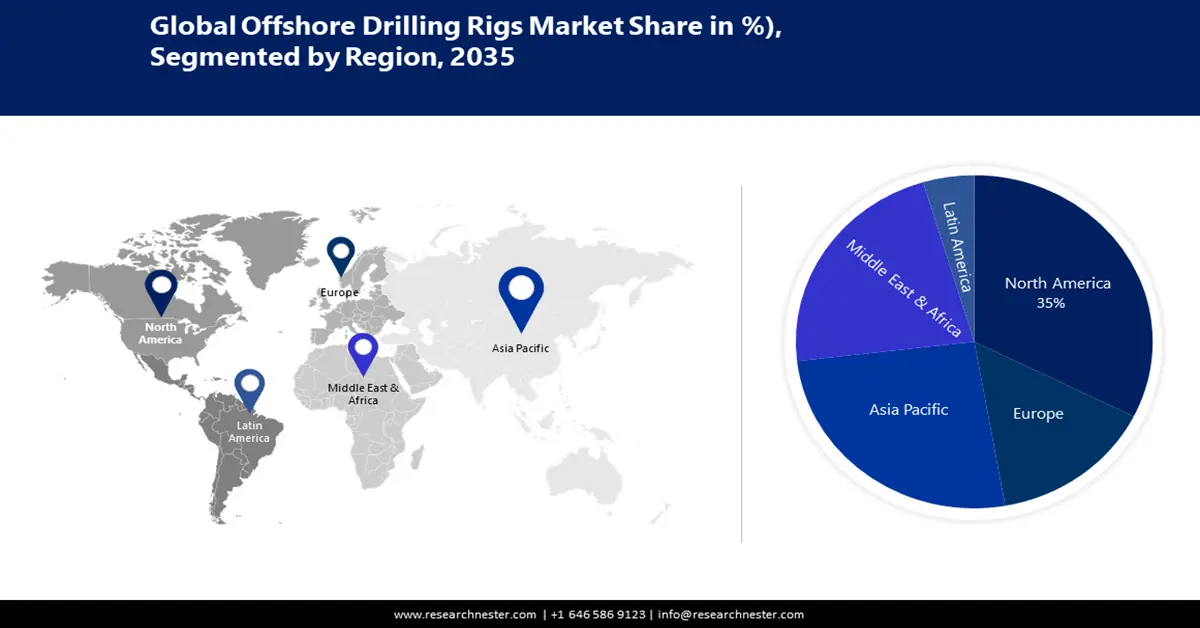

- The North America offshore drilling rigs market is projected to capture a 35% share by 2035, attributed to growing number of oil reserves and investments in offshore drilling to increase oil output.

- The Asia Pacific market is expected to secure a 27% share by 2035, driven by stepping up offshore exploration and production efforts to boost domestic energy production and reduce reliance on foreign oil and gas imports.

Segment Insights:

- The deepwater & ultra-deepwater segment in the offshore drilling rigs market is poised for substantial growth by capturing a 53% share by 2035, driven by the discovery of large offshore reserves and investments in offshore exploration.

- The jack-up rigs segment in the offshore drilling rigs market is projected to hold a 36% share by 2035, influenced by increasing demand in the Middle East and suitability of jack-up rigs for moderate water depths.

Key Growth Trends:

- Increasing Exploration Activities

- Increasing Demand for Natural Gas and Oil

Major Challenges:

- Transition to Renewable Energy

- Uncertain Prices in the Energy Sector may hamper Market Growth

Key Players: Stena Drilling, Energean Israel Limited, Seadrill Limited, Saipem, Noble Corporation plc, JX Nippon Oil & Gas Exploration, INPEX CORPORATION, Japan Offshore Drilling, Okumura Gumi Co., Ltd., Ohara Corporation.

Global Offshore Drilling Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 95.79 billion

- 2026 Market Size: USD 102.08 billion

- Projected Market Size: USD 193.78 billion by 2035

- Growth Forecasts: 7.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Norway, United Kingdom, Brazil

- Emerging Countries: China, India, Singapore, Japan, South Korea

Last updated on : 11 September, 2025

Offshore Drilling Rigs Market Growth Drivers and Challenges:

Growth Drivers

- Increasing Exploration Activities – With the discovery, the need for drilling and energy extraction surged as a result of the necessity to commercialize its use, which in turn raised the requirement for drilling rigs. Another significant reason driving up the need for drilling rigs is the increase in exploratory operations occurring all over the world. 2022 was a breakthrough year for the worldwide oil and gas exploration sector, with an average discovery of more than 150 million barrels of oil equivalent, roughly twice the average for the preceding ten years.

- Increasing Demand for Natural Gas and Oil – The increase in fuel consumption in developing nations is predicted to raise the demand for natural gas over the course of the forecast years. Offshore well reserves are less than onshore well reserves. These substantial reserves will be used and produced by the upstream businesses. As a result, there will be an increase in the demand for oil and gas, which will lead to increased offshore drilling.

- Increasing Production of Unconventional Oil & Gas – To harvest unconventional energy resources, drilling rigs are employed to inject high-pressure fluid into the fractures needed. Additionally, it facilitates the digging of wells for storage deep within the earth's crust. By 2035, it is anticipated that the output of unconventional oil, including shale oil from the United States, will reach about 6 million barrels per day.

Challenges

- Transition to Renewable Energy – The consumption of oil and gas is significantly outpacing a variety of alternative energies. Oil and gas use, particularly those for water heating, are being replaced by geothermal, solar, and wind energy. transportation, energy production, and even space heating.

- Uncertain Prices in the Energy Sector may hamper Market Growth

- Adverse Impact of Drilling the Reserves on the Environment.

Offshore Drilling Rigs Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

7.3% |

|

Base Year Market Size (2025) |

USD 95.79 billion |

|

Forecast Year Market Size (2035) |

USD 193.78 billion |

|

Regional Scope |

|

Offshore Drilling Rigs Market Segmentation:

Type Segment Analysis

Offshore drilling rigs market from the jack-up rigs segment is anticipated to grow majorly with a share of 36% during the foreseen period. The expansion of the market is being driven by the steadily increasing demand for jack-up rigs, particularly in the Middle East. Leading jack-up fleet owners also predict that in the upcoming quarters, the global demand for contemporary jack-up fleets will approach 95%. Additionally, there are several offshore development projects in progress across the globe, and because jack-up drilling can operate in both severe conditions and moderate water depths, it is used in these projects for oilfield services.

Water Depth Segment Analysis

Offshore drilling rigs market from the deepwater and ultra-deepwater segment is expected to hold a substantial share of 53% by the end of 2035. Large undiscovered oil and gas reserves are found in deepwater and ultra-deepwater locations. Oil and gas corporations increasingly concentrate on finding and producing hydrocarbon resources from these deepwater and ultra-deepwater areas as onshore and shallow-water reserves run out. It fuels the demand for drilling rigs equipped to work in such demanding conditions. To safeguard future energy supply, governments and energy firms also spend money on offshore exploration and production. Several places throughout the world, including the Gulf of Mexico, Brazil's pre-salt reserves, West Africa, and the Asia-Pacific region, are actively exploring and developing deepwater and ultra-deepwater regions. The increased need for deepwater and ultra-deepwater drilling rigs is a result of these investments.

Our in-depth analysis of the global market includes the following segments:

|

Type |

|

|

Water Depth |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Offshore Drilling Rigs Market Regional Analysis:

North American Market Insights

The offshore drilling rigs market in North America is expected to hold a share of 35% during the foreseen period. The growth can be attributed to the growing number of oil reserves increasing the demand for drilling rigs for extracting oil and further maintenance. Offshore oil and gas reserves have been found in the region in both the US and Canada. As per a report, Canada’s oil reserves, including its oil sands deposits, made up about 75% of the total. One of the largest oil shale reserves in the world is found in the United States. These areas have an abundance of energy resources, and both public and private organizations are investing in offshore drilling to increase oil output there.

APAC Market Insights

Asia Pacific Offshore Drilling Rigs Market is anticipated to hold a share of 27% during the projected period. Asia Pacific nations are stepping up their offshore exploration and production (E&P) efforts to boost domestic energy production and lessen their reliance on foreign oil and gas imports. Due to developing nations like China, India, Japan, Indonesia, and Thailand, the Asia-Pacific region has experienced the fastest economic development in the entire world over the past ten years. Additionally, the steep increase in energy consumption brought on by rapid economic expansion has increased reliance on imported oil and gas. The region's nations are stepping up their investments in offshore exploration and production, which is anticipated to spur the development of offshore drilling rigs.

Offshore Drilling Rigs Market Players:

- Stena Drilling

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Energean Israel Limited

- Seadrill Limited

- Saipem

- Noble Corporation plc

- JX Nippon Oil & Gas Exploration

Recent Developments

- Two new offshore drilling contracts worth a combined total of over 550 million dollars have been given to Saipem, one in the Middle East and the other in the Mediterranean Sea. By securing a ten-year extension to the current contract in the Middle East, Saipem has ensured the continuation of the ongoing activity of the Perro Negro 7 jack-up drilling unit beginning in the second half of the year. This was made possible in part by the asset's excellent performance during the execution of the activities.

- The business combination between Noble Corporation plc ("Noble") and The Drilling Company of 1972 A/S ("Maersk Drilling") has been completed successfully, according to a press release from Noble. Through the successful completion of Noble's suggested voluntary public share exchange offer to Maersk Drilling shareholders, the transaction was completed. From October 3, 2022, the businesses will work together as a single entity.

- Report ID: 4895

- Published Date: Sep 11, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Offshore Drilling Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.