Drilling Rig Market Outlook:

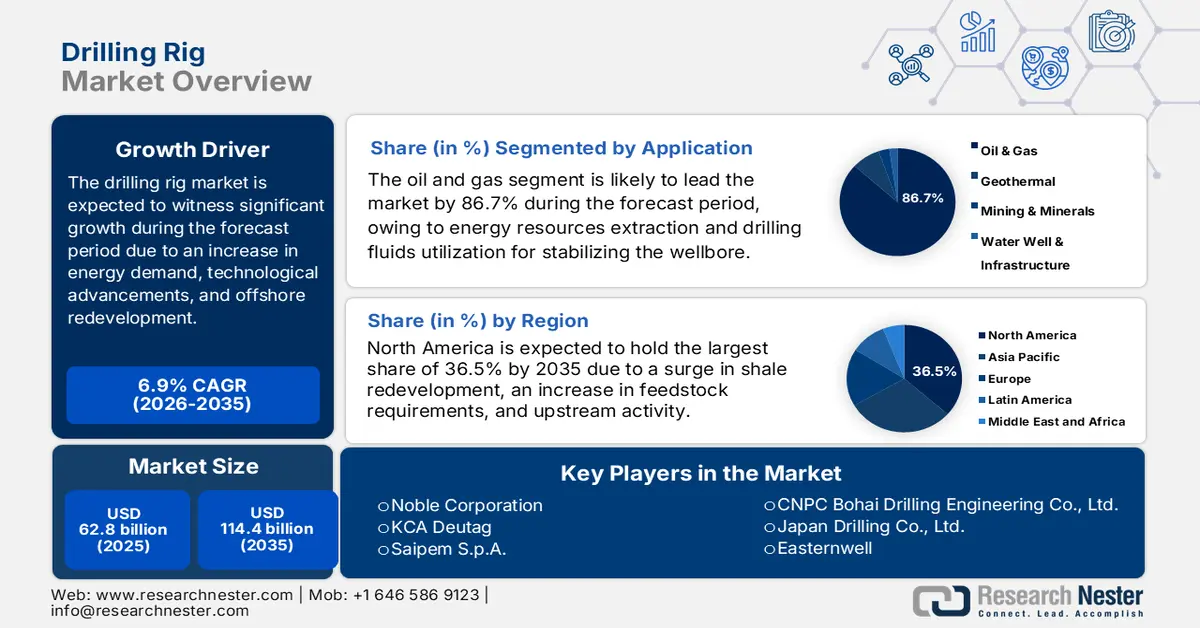

Drilling Rig Market size was over USD 62.8 billion in 2025 and is estimated to reach USD 114.4 billion by the end of 2035, expanding at a CAGR of 6.9% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of drilling rig is estimated at USD 67.1 billion.

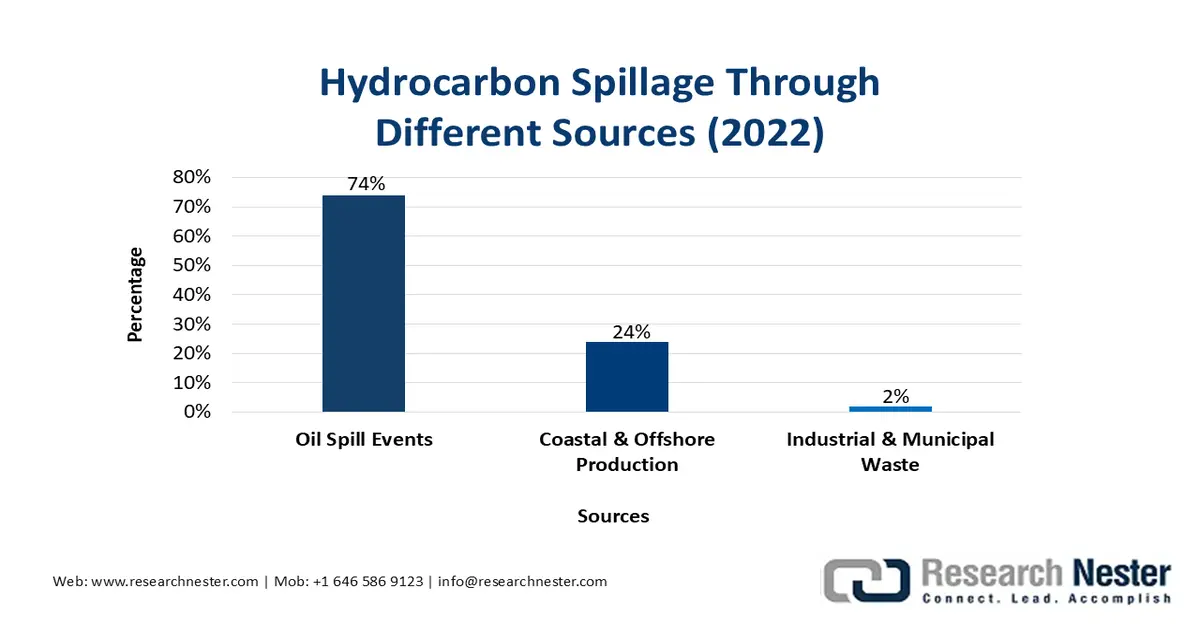

The international drilling rig market is being readily fueled by a rise in energy demand, technological advancement, and offshore redevelopment. The overall industry is witnessing a massive transformation toward digitalization, sustainability, and automation, with an increase in the demand for hydrocarbons across emerging economies. Besides, according to an article published by NLM in May 2022, oil spills tend to affect household food security by 60% and effectively lower the ascorbic acid content in vegetables and cassava crude protein content by 36% and 40%. Moreover, approximately 2.37 × 106 tonnes of petroleum effectively enter the environment every year, either through natural activities or anthropogenic activities. A significant 65.2% portion of this originates from industrial and municipal wastes, and the remaining 26.2% from oil spill incidents, thereby driving the market’s demand globally.

Source: NLM

Furthermore, digitalized and automation rigs, offshore redevelopment, ESG alignment and sustainability, along with regional transformations, and fleet high-grading are other factors responsible for bolstering the market’s growth internationally. As per an article published by the U.S. Department of Energy in 2025, the Ultra-Deepwater and Unconventional Natural Gas and Other Petroleum Resources Research Program, unveiled by the Energy Policy Act of (EPAct), is considered a public and private partnership, which is valued at USD 400 million for more than 8 years. It has been significantly designed to provide suitability to consumers by creating technologies to enhance America’s regional oil and gas production and diminish the region’s reliance on worldwide imports. Moreover, the continuous liquefied natural gas and crude petroleum supply chain is denoting a positive outlook for the overall market globally.

2023 Liquefied Natural Gas and Crude Petroleum Export and Import

|

|

Liquefied Natural Gas |

Crude Petroleum |

|

|

|

Countries/Components |

Export (USD) |

Import (USD) |

Export (USD) |

Import (USD) |

|

Australia |

46.2 billion |

- |

- |

- |

|

U.S. |

39.6 billion |

- |

124 billion |

168 billion |

|

Qatar |

37.3 billion |

- |

- |

- |

|

Japan |

- |

45.1 billion |

- |

- |

|

China |

- |

43.7 billion |

- |

312 billion |

|

France |

- |

13.8 billion |

- |

- |

|

Saudi Arabia |

- |

- |

181 billion |

- |

|

Russia |

- |

- |

122 billion |

- |

|

India |

- |

- |

- |

140 billion |

Source: OEC

Key Drilling Rig Market Insights Summary:

Regional Highlights:

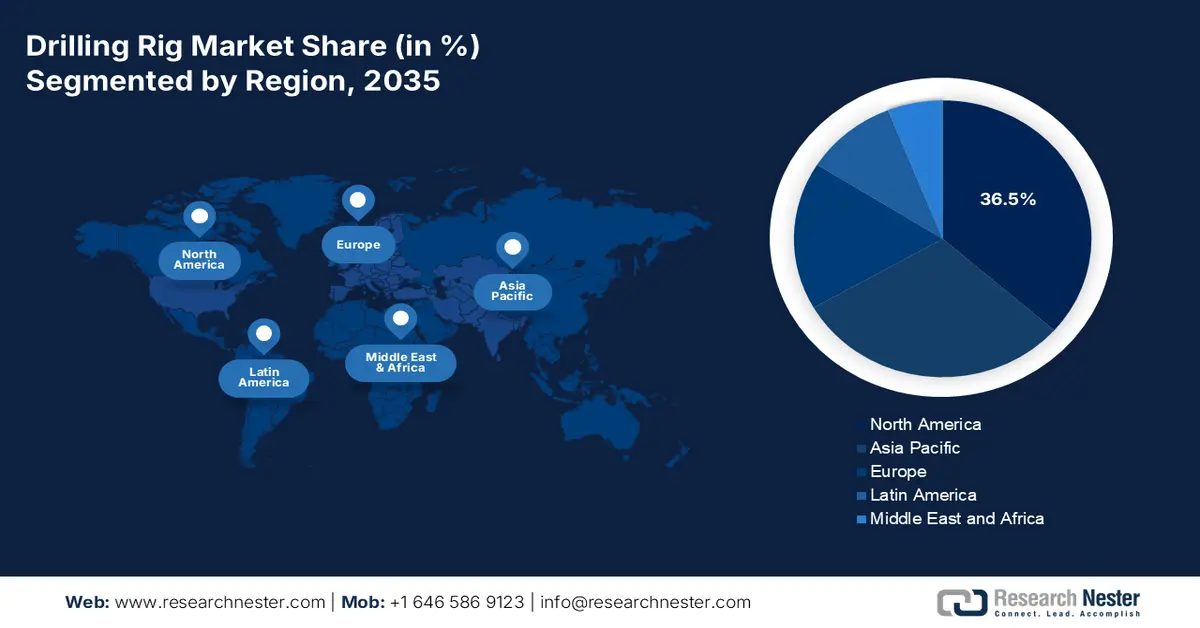

- North America is projected to command a 36.5% share by 2035 in the drilling rig market, supported by sustained shale redevelopment, rising feedstock demand, and resilient upstream operations bolstered by methane-reduction funding initiatives.

- Europe is anticipated to emerge as the fastest-growing region by 2035, underpinned by selective offshore redevelopment and a mature mix of onshore activities across the North Sea, Barents, and East Mediterranean driven by accelerated clean-energy investments.

Segment Insights:

- The oil and gas segment within the drilling rig market is forecast to account for a dominant 86.7% share by 2035, reflecting its critical role in deep resource extraction and the essential use of drilling fluids for wellbore stability and operational safety enabling efficient drilling operations.

- The diesel-electric segment is expected to secure the second-highest share by 2035, benefiting from its balance of efficiency and reliability across onshore and offshore environments supported by the adoption of emissions-reduction and hybrid integration technologies.

Key Growth Trends:

- Surge in energy demand

- Focus on technological innovation

Major Challenges:

- Increased volatility in oil and gas expenses

- High capital expenditure (CAPEX) requirements

Key Players: NOV Inc. (U.S.), Nabors Industries (U.S.), Helmerich & Payne (U.S.), Patterson-UTI Energy (U.S.), Transocean Ltd. (Switzerland), Valaris plc (UK), Seadrill Limited (UK), Noble Corporation (U.S.), KCA Deutag (UK), Saipem S.p.A. (Italy), Weatherford International (U.S.), China Oilfield Services Limited (China), CNPC Bohai Drilling Engineering Co., Ltd. (China), Japan Drilling Co., Ltd. (Japan), Easternwell (Australia), Hyundai Heavy Industries (South Korea), Aban Offshore Limited (India), ONGC (India), Sapura Energy Berhad (Malaysia).

Global Drilling Rig Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 62.8 billion

- 2026 Market Size: USD 67.1 billion

- Projected Market Size: USD 114.4 billion by 2035

- Growth Forecasts: 6.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (36.5% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, China, Canada, Saudi Arabia, Russia

- Emerging Countries: India, Brazil, Norway, United Arab Emirates, Australia

Last updated on : 5 January, 2026

Drilling Rig Market - Growth Drivers and Challenges

Growth Drivers

- Surge in energy demand: The aspects of industrialization and international population growth are readily uplifting the hydrocarbon consumption, especially in Africa and the Asia Pacific, which is positively impacting the drilling rig market’s growth. According to a data report published by the IEA Organization in March 2025, the global energy demand surged by 2.2% in 2024. In addition, there has been an increase in the need for technologies and fuels, led by the power industry, since electricity requirements have increased by 4.3%, much above the 3.2% growth in the worldwide gross domestic product (GDP). Besides, renewables accounted for the largest share of 38% in the international energy supply. This has been followed by 28% of natural gas, 15% of coal, 11% of oil, and 8% of nuclear, thus suitable for proliferating the market’s growth.

- Focus on technological innovation: The significant integration of digitalized solutions, robotics, and automation has resulted in optimizing projects to effectively ensure energy security, which is positively impacting the market across different nations. For instance, the chemical processing sector in Europe has aimed o gain climate neutrality by the end of 2050, owing to increased focus on the regional Green Deal approach, driving the Brightsite initiative at Chemelot. Besides, as stated in an article published by Digital Chemical Engineering in September 2024, the aspect of surged expenses in the U.S. increased by 50% as of 2023, amounting to an estimated USD 4 billion. Therefore, digitalization is one of the strategies to readily enact necessary modifications to cater to these growing financial pressures.

- Increase in industrial associations: The petrochemical and chemical industries depend on stabilized hydrocarbon feedstocks, along with the reinforced demand for drilling rigs. For instance, as per an article published by the IBEF Organization in October 2025, India is regarded as the sixth-largest chemical producer, readily contributing to 7% of the GDP. This particular sector is estimated to be valued at USD Rs. 21,50,750 crore (USD 250 billion) in 2024, and is further projected to increase to USD 300 billion by 2028 and Rs. 86,03,000 (USD 1 trillion) by the end of 2040. Moreover, a generous investment of Rs. 8 lakh crore (USD 107.3 billion) has been estimated to be suitable for the chemicals and petrochemicals sector in the country, thereby denoting an optimistic outlook for the market in the country.

Challenges

- Increased volatility in oil and gas expenses: The drilling rig market is highly sensitive to fluctuations in crude oil and natural gas prices. When prices fall below breakeven levels, exploration and production companies often cut back on drilling activity, leading to reduced rig utilization and delayed investments. For instance, there has been a drop in rig counts, which has forced contractors to idle fleets and lay off workers. In addition, geopolitical tensions and OPEC-based production decisions continue to drive uncertainty in oil markets. This volatility makes long-term planning difficult for rig operators, as capital-intensive offshore projects require stable price environments to justify investment. Moreover, unpredictable price swings discourage smaller players from entering the market, consolidating power among larger contractors.

- High capital expenditure (CAPEX) requirements: The presence of drilling rigs, particularly offshore units such as semi-submersibles and drillships, requires massive upfront investments. A new ultra-deepwater rig can constitute increased expenses, excluding operating expenses. This high CAPEX creates barriers to entry, limiting competition and concentrating market share among a few global players. Even established contractors face financing challenges, as banks and investors increasingly scrutinize fossil fuel projects under ESG frameworks. Maintenance and upgrades further add to costs, with digital retrofits, emissions-reduction systems, and safety compliance requiring tens of millions annually. Smaller operators often struggle to secure funding, leading to reliance on leasing or joint ventures, thus creating a hindrance in the market globally.

Drilling Rig Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.9% |

|

Base Year Market Size (2025) |

USD 62.8 billion |

|

Forecast Year Market Size (2035) |

USD 114.4 billion |

|

Regional Scope |

|

Drilling Rig Market Segmentation:

Application Segment Analysis

The oil and gas segment, part of the application, is projected to garner the highest share of 86.7% in the drilling rig market by the end of 2035. The segment’s upliftment is highly attributed to its importance for extracting energy resources by drilling deep. In addition, there lies the utilization of drilling fluids for cleaning, stabilizing, and cooling the wellbore, which is crucial for efficient drilling, preventing blowouts, and ensuring safety. According to an article published by Energy Institute Organization in 2025, an estimated 33% of methane emissions is caused by human activity are attributed to fossil fuels. Meanwhile, 34% of the overall energy demand as of 2024 has been met by oil, approximately 120 million tons of methane emissions in 2024 derived from fossil fuel production, and 50 million tons of carbon dioxide is presently captured yearly from carbon capture infrastructure globally.

Power Source Segment Analysis

Based on the power source, the diesel-electric segment in the drilling rig market is projected to account for the second-highest share during the forecast timeline. The segment’s growth is highly driven by its popularity stemming from the balance they provide between efficiency, reliability, and adaptability across both onshore and offshore environments. Unlike purely mechanical rigs, diesel-electric systems use diesel engines to generate electricity, which then powers rig components such as drawworks, rotary tables, and mud pumps. This configuration allows for smoother operations, better load management, and reduced mechanical wear. A key driver of growth is the integration of emissions-reduction technologies, as governments and regulators enforce stricter environmental standards. Diesel-electric rigs can be retrofitted with hybrid systems, battery storage, and advanced monitoring tools to minimize carbon output.

Deployment Segment Analysis

The onshore sub-segment, which is part of the deployment segment, is expected to hold the third-highest share in the market by the end of the stipulated period. The sub-segment’s development is highly fueled by lower operational costs, established infrastructure, and widespread availability across mature basins. Onshore drilling is particularly critical in regions such as North America, India, and China, where shale redevelopment and conventional oil fields underpin energy security. Compared to offshore rigs, onshore units require less capital expenditure, shorter mobilization times, and offer greater flexibility in redeployment, making them attractive for operators managing volatile oil price cycles. Technological advancements, including directional and horizontal drilling, have significantly enhanced productivity, allowing operators to maximize recovery from mature reservoirs.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

Application |

|

|

Power Source |

|

|

Deployment |

|

|

Drilling Method |

|

|

Rig Capacity (Rated HP) |

|

|

Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Drilling Rig Market - Regional Analysis

North America Market Insights

North America is projected to hold the largest share of 36.5% in the drilling rig market by the end of 2035. The market’s uplift in the region is highly driven by shale redevelopment, increased feedstock demand, and the presence of resilient upstream activity. According to an article published by the Department of Energy in December 2024, the administrative body, along with the U.S. Environmental Protection Agency (EPA), notified an estimated USD 850 million for 43 projects that have been selected for negotiation. This funding opportunity is suitable for assisting regional tribes, oil and gas operators, and other sectors in quantifying, measuring, monitoring, and reducing methane emissions from the oil and gas industry. In addition, the EPA finalization rule has further diminished methane emissions from covered oil and gas sources by 80% as of 2024, thereby suitable for proliferating the market’s growth.

The drilling rig market in the U.S. is growing significantly, owing to shale drilling, the existence of non-traditional wells for crude oil production, as well as methane emissions reduction programs, the chemistry industry feedstock requirement, digitalization and automation. As per a data report published by the EIA Government in December 2025, the oil production in the country averaged 13.3 million barrels per day, while the natural gas production averaged 128.0 billion cubic feet per day. In addition, there has been an increase in domestic oil and natural gas production, along with pricing strategy as of 2024, with natural gas accounting for 128.8 billion cubic feet per day and oil catering to 13.4 million barrels per day. Moreover, the country accounts for 1,031,161 wells, with a surge in horizontal wells increasing from 10% to 22% between 2014 and 2024, thus suitable for boosting the market’s exposure.

Natural Gas 2025 Pricing Strategy in the U.S. (USD per Thousand Cubic Feet)

|

Price Components |

April |

May |

June |

July |

August |

September |

|

Imports Price |

2.2 |

2.0 |

1.9 |

2.0 |

1.7 |

1.7 |

|

By Pipeline |

2.2 |

2.0 |

1.9 |

2.0 |

1.7 |

1.5 |

|

As Liquified Natural Gas |

6.7 |

6.9 |

6.9 |

7.1 |

7.4 |

15.0 |

|

Exports Price |

6.3 |

5.4 |

5.6 |

5.7 |

5.4 |

5.2 |

|

By Pipeline |

2.8 |

2.6 |

2.7 |

2.9 |

2.5 |

2.1 |

|

As Liquefied Natural Gas |

8.4 |

7.4 |

7.6 |

7.6 |

7.5 |

7.0 |

|

Citygate Price |

4.5 |

4.6 |

4.8 |

5.1 |

5.1 |

5.1 |

|

Residential Price |

16.0 |

19.2 |

23.2 |

25.4 |

26.1 |

24.5 |

Source: EIA Government

The drilling rig market in Canada is also growing due to robust oil development, oil sands, the provision of governmental clean energy funding, export and pipeline infrastructure, as well as safety and environmental regulations. As stated in an article published by the Government of Canada in November 2022, the Government of Alberta declared a standard path for net zero, based on which the federal government invested USD 300 million through the Strategic Innovation Fund’s Net Zero Accelerator approach, along with the USD 161.5 million contribution. This is extremely suitable for supporting the USD 1.6 billion project, led by Air Products Canada Ltd, to initiate advancements for clean energy and fuels in the country and secure employment opportunities. Therefore, with such funding provision, there is a huge growth opportunity for the market in the country.

Europe Market Insights

Europe in the drilling rig market is expected to emerge as the fastest-growing region during the forecast timeline. The market’s development in the region is highly attributed to selective offshore redevelopment and has matured a balanced mixture of onshore activities, especially in the East Mediterranean, Barents, and the North Sea. According to an article published by the EIB Government in October 2024, the Sopi-Tootsi farm, developed by Enefit Green, provides generous green energy to effectively power 197,000 homes every year within the region, which is approximately 10% of Estonia’s electricity demands. Besides, countries in the region have readily invested nearly €110 billion in renewable energy generation as of 2023, and the overall region presently spends 10 times more funds for clean energy, thereby driving the market’s growth.

The UK in the market is gaining increased traction, owing to targeted and advanced funding for enhancing environmental performance and operational efficiency, along with decommissioning programs and the North Sea redevelopment. As stated in the July 2025 UK Government article, the Government committed £163 million, as part of the Industrial Energy Transformation Fund, for Phase 1, 2, and 3 projects in the 2024 Autumn Budget. Besides, as per the February 2025 Energy Advice Hub Organization article, the country’s government has estimated that the energy industry significantly employs almost 400,000 skilled workers, resulting in an increase in the overall domestic exports by almost 28%. Moreover, there has been the introduction of the £315 million Industrial Energy Transformation Fund for lowering bills and reducing carbon emissions. This comprises nearly Phase 2 projects offering £70 million in grant funding, thus creating a positive impact on the market.

Norway in the market is also developing due to the high-specific rig demand for complicated wells, electrification of programs, and continuous offshore investment in the Norway Continental Shelf. As per an article published by the ITA in January 2024, the country’s government notified the strategy of promoting offshore wind power for generating 30 GW by the end of 2040. Additionally, for the upcoming 20 years, the government’s plan is focused on constructing 2 offshore wind turbines in operation to have almost 1,500 turbines. To achieve this, 11 8 MW floating turbines have been installed to cover nearly 35% of the needed energy on 5 large-scale offshore oil and gas installations. Besides, the Hywind Tampen project is projected to diminish carbon dioxide emissions by 200,000 metric tons every year, thus denoting an optimistic outlook for the market’s development.

APAC Market Insights

The Asia Pacific in the drilling rig market is predicted to witness considerable growth by the end of the stipulated period. The market’s growth in the region is uplifted by offshore redevelopment in Southeast Asia, upstream expansion in India, and China’s scale. In addition, the aspect of resilience macro momentum, and IMF projects are also responsible for bolstering the market in the overall region. According to an article published by Infrastructure Asia Organization in 2025, the region is expected to make up 61% of the newest wind capacity by the end of 2030 globally. Besides, China is deliberately leading in the international market with more than 76% of the region’s offshore wind installations. Additionally, by the end of 2030, 122 GW of standard capacity from offshore wind is projected to be derived from the region, thereby making it suitable for boosting the market’s exposure.

China in the drilling rig market is gaining increased traction due to the industrial demand, sustained upstream investment, and upscaling. As stated in an article published by the State Council Information Office in February 2025, the China National Petroleum Corporation (CNPC) declared that it has successfully accomplished the drilling of the deepest vertical well in the overall region, with a borehole that reached 10,910 meters in the country’s northwestern desert. Based on this completion, the country effectively strengthened its ultra-deep oil and gas exploration capabilities. Additionally, with upgraded domestically developed drilling equipment and technologies, scientists also initiated a suitable approach for understanding the Earth, ancient climate modifications, and geological evolution. Therefore, with such development, the market is poised to grow in the country.

India in the market is also growing, owing to the support provided by robust upstream redevelopment, industrial decarbonization programs, and unconventional resource exploration. As per an article published by the PIB in July 2025, the country’s 3.5% share in the international chemical value chains, along with its chemical trade deficit, amounting to USD 31 billion as of 2023, has readily underscored its increased dependence on specialty chemicals and imported feedstock. Besides, with targeted reforms gradually encompassing a wide-ranging non-fiscal and fiscal interventions is poised to enable the country to account for a USD 1 trillion chemical industry and significantly gain 12% of global value chain share by the end of 2040. Furthermore, the 2030 vision for the country is to emerge as the international chemical manufacturing powerhouse with a 5% to 6% share of the global chemical value chain, thus suitable for boosting the market’s growth.

Key Drilling Rig Market Players:

- SLB (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- NOV Inc. (U.S.)

- Nabors Industries (U.S.)

- Helmerich & Payne (U.S.)

- Patterson-UTI Energy (U.S.)

- Transocean Ltd. (Switzerland)

- Valaris plc (UK)

- Seadrill Limited (UK)

- Noble Corporation (U.S.)

- KCA Deutag (UK)

- Saipem S.p.A. (Italy)

- Weatherford International (U.S.)

- China Oilfield Services Limited (China)

- CNPC Bohai Drilling Engineering Co., Ltd. (China)

- Japan Drilling Co., Ltd. (Japan)

- Easternwell (Australia)

- Hyundai Heavy Industries (South Korea)

- Aban Offshore Limited (India)

- ONGC (India)

- Sapura Energy Berhad (Malaysia)

- SLB, formerly known as Schlumberger, remains the largest oilfield services company globally, holding the highest market share as of 2025. Its drilling rig services are increasingly integrated with digital solutions, focusing on automation, emissions monitoring, and advanced reservoir characterization to maintain leadership in both onshore and offshore markets.

- NOV Inc. is one of the leading rig equipment manufacturers and service providers, with its 2025 Rig Census highlighting industry consolidation and efficiency gains. NOV’s strength lies in supplying rig components and systems worldwide, enabling operators to modernize fleets and adopt high-spec rigs for complex drilling environments.

- Nabors Industries reported Q2 2025 revenues of USD 833 million, supported by its SANAD joint venture with Saudi Aramco deploying newbuild rigs. The company is a major land drilling contractor, with a strong presence in the U.S. shale basins and international markets, leveraging partnerships to expand its global footprint.

- Helmerich & Payne posted Q3 2025 adjusted EBITDA of $268 million, reflecting strong margins amid debt reduction efforts. The company operates one of the largest U.S. land rig fleets, with utilization around 64.5% in late 2025, and continues to expand internationally through acquisitions like KCA Deutag.

- Patterson-UTI Energy operated an average of 40 drilling rigs in April 2025 across the U.S. Despite a softening completions market, the company maintained solid margins by focusing on high-efficiency rigs and gas-powered frac fleets, positioning itself well for LNG-driven demand growth expected from 2026.

Here is a list of key players operating in the global market:

The competitive landscape in the global drilling rig market is fragmented, with international contractors and OEMs competing across onshore and offshore segments. North America remains the largest market, while Asia Pacific is the fastest-growing, intensifying competition for high-spec rigs and digital drilling solutions. Strategic initiatives include fleet high-grading, electrification and emissions-reduction retrofits, and adoption of automation, AI-driven optimization, and remote operations. Consolidation among offshore drillers, long-term contracts with national oil companies, and partnerships for advanced manufacturing and maintenance are common. Besides, in February 2024, TotalEnergies and Vantage Drilling International have significantly signed a binding deal to develop the latest joint venture. Based on this agreement, TotalEnergies paid USD 199 million for a 75% interest, along with Vantage effectively owning the remaining 25%, thereby making it suitable for the market’s growth internationally.

Corporate Landscape of the Drilling Rig Market:

Recent Developments

- In September 2025, ARO Drilling and Saudi Aramco declared the signing of a Trial and Evaluation Agreement to effectively pilot the Saudi Aramco Intelligent Rig Optimizer (SAIRO), which is a proprietary software solution created by Saudi Aramco to readily enhance drilling performance through data-driven insights.

- In September 2025, Haynes Boone readily advised March GL Company on a suitable agreement with Pelican Acquisition Corporation as well as Greenland Exploration Limited, based on an implied valuation of USD 215 million.

- In April 2024, bp notified the commencement of the oil production from the new Azeri Central East (ACE) platform, which is part of the ACG field development in the Azerbaijan sector of the Caspian Sea.

- Report ID: 4976

- Published Date: Jan 05, 2026

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Drilling Rig Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.