Neuraminidase Inhibitors Drug Market Outlook:

Neuraminidase Inhibitors Drug Market size was valued at USD 5.1 billion in 2025 and is projected to reach USD 9.7 billion by the end of 2035, rising at a CAGR of 6.8% during the forecast period, i.e., 2026-2035. In 2026, the industry size of neuraminidase inhibitors drug is assessed at USD 5.4 billion.

The neuraminidase inhibitors drug market is driven by the rising patient population suffering from influenza. The CDC data in May 2025 has reported that more than 47 million to 82 million people experience severe cases of flu illness, and nearly 27,000 to 130,000 deaths related to flu illness occur every year. Most of the elderly people and children are at high risk, and also people suffering from chronic illness. The CDC report has also stated that the U.S. has recorded 1.3 million hospitalization for flu, highlighting a high incidence rate that directly impacts the antiviral drug demand in the year 2023 to 2024. Neuraminidase inhibitors, including zanamivir and oseltamivir, are important for both inpatient and outpatient treatment, mainly during pandemics and flu outbreaks.

On the supply chain side, the active pharmaceutical ingredients for neuraminidase inhibitors are produced in parts of the EU, China, and India, with the final production made in Japan, Europe, and the U.S. According to the U.S. International Trade Commission's import/export data, most oseltamivir phosphate is imported from China to the U.S. in 2023. According to a March 2022 Gates Foundation report, the Bill & Melinda Gates Foundation, Novo Nordisk Foundation, and Open Philanthropy have contributed more than USD 90 million to the development of pandemic antiviral drugs. These investments focus on enhancing drug efficacy and the timely availability of neuraminidase inhibitors during seasonal and pandemic outbreaks.

Key Neuraminidase Inhibitors Drug Market Insights Summary:

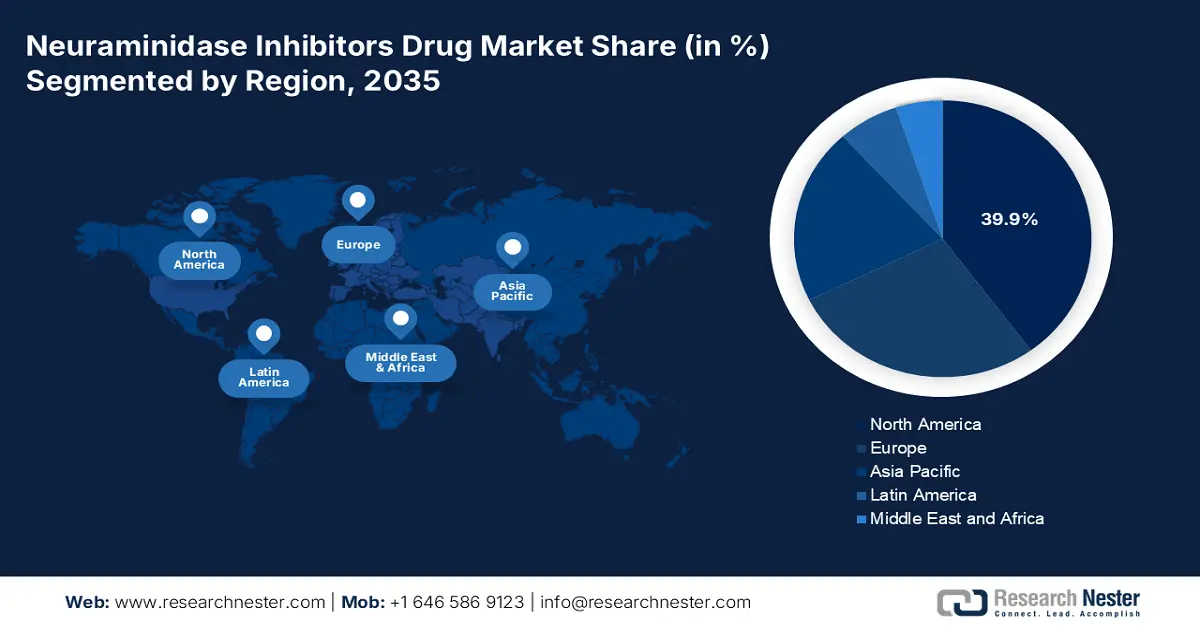

Regional Insights:

- North America is projected to hold a 39.9% share by 2035, impelled by robust public health investment, extensive antiviral use, and government support in the Neuraminidase Inhibitors Drug Market.

- APAC is anticipated to witness the fastest growth by 2035, owing to increasing antiviral stockpiling, government pandemic preparedness, and rising disease prevalence.

Segment Insights:

- Oral (Route of Administration) is projected to account for 53.1% share by 2035, owing to ease of administration, cost efficiency, and suitability for outpatient use in the Neuraminidase Inhibitors Drug Market.

- Oseltamivir (Drug Class) is expected to hold the largest share by 2035, propelled by its oral availability, established safety profile, and inclusion in government stockpiles.

Key Growth Trends:

- Mapping patient pool and disease prevalence

- Manufacturers' strategies and innovations

Major Challenges:

- Supply chain and shelf-life constraints

- Fragmented tender systems

Key Players: F. Hoffmann-La Roche AG,GlaxoSmithKline plc,Daiichi Sankyo Co., Ltd.,BioCryst Pharmaceuticals Inc.,Shionogi & Co., Ltd.,Gilead Sciences, Inc.,Cipla Ltd.,Sanofi,Hetero Drugs Ltd.,Toyama Chemical Co., Ltd.,Pfizer Inc.,Biota Pharmaceuticals Inc.,Glenmark Pharmaceuticals,Daewoong Pharmaceutical Co.,Dr. Reddy’s Laboratories,Sun Pharmaceutical Industries,Yungjin Pharm,Pharmaniaga Berhad,Novartis AG,Takeda Pharmaceutical Co.

Global Neuraminidase Inhibitors Drug Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 5.1 billion

- 2026 Market Size:USD 5.4 billion

- Projected Market Size: USD 9.7 billion by 2035

- Growth Forecasts: 6.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (39.9% Share by 2035)

- Fastest Growing Region: APAC

- Dominating Countries: United States, Japan, Germany, China, Canada

- Emerging Countries: India, Brazil, South Korea, Mexico, Australia

Last updated on : 30 September, 2025

Neuraminidase Inhibitors Drug Market - Growth Drivers and Challenges

Growth Drivers

- Mapping patient pool and disease prevalence: In Germany, 8000 to 11,000 people die every year due to flu, according to the HZI report in 2025. At the same time, the CDC documented that influenza-related hospitalizations in the U.S. is rising every year. These statistics reaffirm a continuously sizable patient pool requiring antiviral treatment throughout North America and Europe. The elderly population and co-morbidities of a chronic nature with diabetes, asthma, and COPD, increase demand for efficacious antivirals such as oseltamivir and zanamivir in inpatient and outpatient facilities as well.

- Manufacturers' strategies and innovations: Roche, a Tamiflu manufacturer, signed a new licensing agreement in 2024 to produce low-cost generic oseltamivir for public health programs, driving overall volume up globally. On the other hand, Shionogi pushed a new peramivir product with better IV stability and introduced pilot programs in Japan and South Korea. These advancements move towards broader availability and greater clinical use. Further, they strengthen alliances with ministries of health and expand access to antivirals in underserved areas, in line with pandemic preparedness.

- Out-of-pocket spending by individuals: According to the NLM study in August 2024, the drug cost of oseltamivir is USD 50.40, which is primarily used as a neuraminidase inhibitor. The consistency in reimbursements and formulary inclusion across multiple years makes these antivirals a reliable part of public healthcare strategies. This impacts robust government backing and affordable access for patients. Sustained funding by the federal government demands the stability and revenue streams to the market for key players dominating in the regulated reimbursement landscape.

Newly emerged Neuraminidase Inhibitors Resistant Mutations from 2019 to 2024

|

Mutations conferring resistance |

Subtype |

Year isolated |

Resistance level (fold change) |

|||

|

Oseltamivir |

Zanamivir |

Peramivir |

Laninamivir |

|||

|

T146P/N169S |

B |

2019 |

31 |

573 |

10074 |

280 |

|

I222 V/S246N |

A/N1 |

2023/2024 |

13 |

3 |

4 |

3 |

|

G247D/I361V |

B |

2019 |

2 |

6 |

46 |

3 |

|

G108Ea |

B |

2019 |

5 |

5 |

55 |

3 |

|

V303I/N342K |

A/N2 |

2018/2019 |

Y |

Y |

- |

- |

|

H274Y/I222 V/S246N |

A/N1 |

2023/2024 |

- |

- |

- |

- |

Source: NLM November 2024

Challenges

- Supply chain and shelf-life constraints: Long shelf-life antivirals are required by government stockpiling. The CDC’s Strategic National Stockpile report has stated that millions of oseltamivir doses expired and were wasted during the years 2021 to 2023, surging manufacturers to reform and extend the stability. For instance, the HHS required a heat-stable formulation from Tamiflu’s company in 2023, resulting in a delayed contract for six to seven months. Hence, manufacturers were facing various challenges to meet the stability standard risks and losing the long-term contract during pandemic preparedness.

- Fragmented tender systems: Each region has different tendering structures and inconsistent bidding cycles for procurement procedures. This results in uncertainty in supply chains. In most low- and middle-income countries, procurement approvals and price evaluations tend to cause delayed deliveries and issues in inventory management. Such variability reduces manufacturers’ visibility on order volumes and delivery timelines, complicating production planning. By contrast, harmonized and centralized procurement systems, like those introduced in segments of Europe, facilitate less complicated supplier coordination and more predictable market access.

Neuraminidase Inhibitors Drug Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.8% |

|

Base Year Market Size (2025) |

USD 5.1 billion |

|

Forecast Year Market Size (2035) |

USD 9.7 billion |

|

Regional Scope |

|

Neuraminidase Inhibitors Drug Market Segmentation:

Route of Administration Segment Analysis

In the route of administration segment, oral sub-segment dominates the segment and is forecasted to hold the market share of 53.1% by 2035. Oral dosage forms are used because of the ease of administration, reduced cost of delivery, and highly suitable for outpatient use. As per the NIH's NIAID Influenza Research Program report, oral neuraminidase inhibitors had the largest utilization during pandemic preparedness activities owing to logistical feasibility. Furthermore, oral avenues decrease the burden in the healthcare system by enhancing early intervention in the home or primary care. This pathway is particularly crucial for rural and low-resource areas where intravenous or inhalation avenues are not readily available.

Drug Class Segment Analysis

Under the drug class segment, oseltamivir dominates the market and is anticipated to hold the highest share by 2035. Oseltamivir is driven by its availability as an oral medication, well-established safety profile, and inclusion in government stockpiles. The CDC report in February in 2025 depicts that oseltamivir is FDA-approved for treating people affected by influenza A/B in ≥2 weeks and for prophylaxis in patients ≥1 year. The U.S. Strategic National Stockpile holds millions of oseltamivir treatment courses. Oseltamivir's efficacy during seasonal and pandemic influenza epidemics, as well as its inclusion in the WHO Model List of Essential Medicines, solidifies its position as the most trusted neuraminidase inhibitor. Its global availability and large-scale generic manufacturing ensure widespread adoption, mainly in middle-income nations.

End user Segment Analysis

In the end user segment, the hospitals and clinics lead the segment and are expected to drive the market by 2035. The hospitals and clinics are driven by the rising hospitalization rates due to a severe rise in influenza cases, mainly among the elderly population, people with chronic disease, and immunocompromised patients. According to the CDC report in September 2025, hospitalization cases related to influenza registered in the U.S. is 127.1 per 100,000 in the U.S. during the high flu season, highlighting the key role of inpatient care settings in the administration of antiviral care therapy. Further, hospitals are the key source for managing complications such as pneumonia and secondary infections, necessitating intravenous or antiviral therapies such as peramivir.

Our in-depth analysis of the neuraminidase inhibitors drug market includes the following segments:

|

Segment |

Subsegments |

|

Drug Class |

|

|

Route of Administration |

|

|

End user |

|

|

Distribution Channel |

|

|

Patient Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Neuraminidase Inhibitors Drug Market - Regional Analysis

North America Market Insights

The North America neuraminidase inhibitors drug market is expected to have a market share of 39.9% at a CAGR of 6.1% through 2035. The market undergoes steady growth, spurred by robust public health investment, extensive antiviral use, and government support. The U.S. leads the market with significant federal funding by agencies such as the CDC, NIH, and CMS, which increased Medicare and Medicaid benefits for influenza antivirals. On the other hand, Canada's Health Ministry and provincial government have raised spending on flu, aided via CIHI and PHAC. Aging populations, recurrent flu outbreaks, and stockpiling tactics are driving market growth in both countries.

The U.S. neuraminidase inhibitors drug market is growing rapidly and is driven by strong federal funding and policy changes in favor of infectious disease preparedness. The CDC report in November 2024 states that the cases of hospitalizations registered in the U.S. due to flu is nearly 120,000 to 710,000. This rise in the flu-related hospitalizations highlights the critical role of neuraminidase inhibitors in reducing severity and aiding national influenza management strategies. Additionally, market demand in hospital sectors and retail pharmacy channels is being increased by active government investment and stockpiling programs.

Canada's neuraminidase inhibitors market is fueled by a publicly funded healthcare system and significant emphasis on pandemic and seasonal influenza planning. The Public Health Agency of Canada (PHAC) holds a national stockpile of antivirals as part of its pandemic strategy. According to the 2025 report from the CMA, the health budget in Canada was USD 344 billion in 2023, equivalent to 12.1% of GDP. The market is also driven by guidelines from the National Advisory Committee on Immunization (NACI), which, along with treatment recommendations, provides backing for the use of antivirals within managed clinical networks to provide stable demand across provinces.

U.S. Influenza Burden (2019-2024)

|

Year |

Hospitalization |

Illness |

Death |

|

2019 - 2020 |

390,000 |

36,000,000 |

26,000 |

|

2021 - 2022 |

120,000 |

11,000,000 |

6,300 |

|

2022 - 2023 |

370,000 |

31,000,000 |

21,000 |

|

2023 - 2024 |

470,000 |

40,000,000 |

28,000 |

Source: CDC, November 2024

Asia Pacific Market Insights

The APAC is the fastest-growing region in the neuraminidase inhibitors drug market and is projected to hold a significant market share of by 2035. The market is driven by the increasing antiviral drug stockpiling, robust governmental focus on influenza pandemic preparedness, and rising disease prevalence in densely populated areas. China and Japan are the major nations that contribute to advanced healthcare infrastructure and elevated seasonal flu cases. In South Korea, the Health Insurance Review & Assessment Service has broadened the reimbursement as part of the national influenza control policy for neuraminidase drugs. Additionally, expanded universal health coverage program, digital surveillance tools, public public-private partnership enhance the market growth.

Japan is the highest shareholder in the neuraminidase inhibitors drug market and is forecasted to hold a considerable market share by 2035. According to the Pharma Japan report in December 2024, 44.2 billion yen is invested for pharmaceutical-related initiatives, including neuraminidase inhibitors, indicating the high level of commitment towards influenza preparedness. This funding was fueled by increasing influenza occurrences and the government's stockpiling programs. These initiatives highlight Japan's strategic focus on antiviral preparedness and local pharmaceutical innovation to address seasonal and pandemic influenza threats.

The China market for neuraminidase inhibitors is marked by large scale and strategic significance. Expansion is driven mainly by the size of the population and high clinical burden of seasonal influenza. Favorable government policies, such as the inclusion of these antivirals in national treatment guidelines and pandemic stockpiles, are the key drivers. The market is also influenced by a robust domestic manufacturing base, which guarantees timely supply and availability across the country's healthcare system.

Influenza Peak Forecast Results in China

|

Province |

Peak date |

Peak week |

Total cases in peak |

|

Shanghai |

2023-12-22 (2023-12-19, 2023-12-26) |

51 (51, 52) |

333460 (288935, 381245.5) |

|

Yunnan |

2023-12-26 (2023-12-22, 2023-12-30) |

52 (51, 52) |

615448.5 (530156, 700422.5) |

|

Sichuan |

2023-12-26 (2023-12-22, 2023-12-30) |

52 (51, 52) |

1102986.5 (950188.5, 1258233) |

|

Anhui |

2023-12-23 (2023-12-19, 2023-12-27) |

51 (51, 52) |

803065.5 (696546, 919976) |

|

Guangdong |

2023-12-23 (2023-12-19, 2023-12-27) |

51 (51, 52) |

1706515 (1485689, 1954301) |

Source: NLM September 2024

Europe Market Insights

The neuraminidase inhibitors market within Europe is a mature but increasingly growing market, characterized by strong public healthcare and government emphasis on pandemic readiness. Major drivers are seasonal influenza disease burden, most notably in the elderly population, and national approaches toward antiviral stockpiling. The European Centre for Disease Prevention and Control (ECDC) collects surveillance and issues recommendations, ensuring uniform treatment approach across member states. One of the key trends is greater cross-border cooperation through the European Health Union, with a view to providing fair access to essential medicines during health emergencies.

Germany is expected to hold the largest revenue share in Europe by 2035, fueled by its huge population, robust healthcare spending, and strong public health strategy. The government agency responsible for disease control at the federal level, delivers intense surveillance and treatment guidelines that directly impact market demand. Germany's early and widespread national stockpiling approach for pandemic flu maintains steady market volume. One of the most important trends is the incorporation of antiviral therapy into usual care pathways among high-risk patients, as recommended by the Standing Committee on Vaccination (STIKO), to ensure continued use off-season.

France is powered by high vaccine and antiviral consumption, highlighted by an extensive national healthcare system. The French Public Health Agency (Santé Publique France) carries out widespread influenza surveillance, which activates regional antiviral deployment plans. As per the OEC report in 2023, the pharmaceutical products exported are accounted to be USD 39.5 billion, highlighting the market demand. On the other hand, government expenditure is an important driver, with the National Authority for Health (HAS) making reimbursement decisions quickly and hence ensuring patient access.

Key Neuraminidase Inhibitors Drug Market Players:

- F. Hoffmann-La Roche AG

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- GlaxoSmithKline plc

- Daiichi Sankyo Co., Ltd.

- BioCryst Pharmaceuticals Inc.

- Shionogi & Co., Ltd.

- Gilead Sciences, Inc.

- Cipla Ltd.

- Sanofi

- Hetero Drugs Ltd.

- Toyama Chemical Co., Ltd.

- Pfizer Inc.

- Biota Pharmaceuticals Inc.

- Glenmark Pharmaceuticals

- Daewoong Pharmaceutical Co.

- Dr. Reddy’s Laboratories

- Sun Pharmaceutical Industries

- Yungjin Pharm

- Pharmaniaga Berhad

- Novartis AG

- Takeda Pharmaceutical Co.

The neuraminidase inhibitors drug market is driven by the top players such as Roche, GSK, and Daiichi Sankyo, together holding one-third of the worldwide revenue. Strategic alliances with governments, rapid approval processes, and next-generation formulation development are priorities among important companies. Japan and the U.S. drive early-phase innovation, but India has the largest share of high-volume generics and emerging market distribution. Various companies are investing in resistance-free molecules, new delivery systems, and pediatric applications. Local players in South Korea and Malaysia also initiate public health collaborations. There is an international competition fueled by stockpiling initiatives, cyclical demand spikes, and pandemic preparedness programs.

Below is the list of some prominent players operating in the global market:

Recent Developments

- In August 2025, AstraZeneca launched FluMist Home, which is the first-of-its-kind, at-home delivery service for FLUMIST, which is the influenza vaccine. FLUMIST is the only seasonal influenza vaccine approved for adults 18 to 49 years of age.

- In June 2025, Cidara Therapeutics announced positive topline results on a non-vaccine preventative of seasonal influenza from its phase 2b navigate trial evaluating CD388, which encompasses various copies of a potent small molecule neuraminidase inhibitor conjugated to a proprietary Fc fragment of a human antibody.

- Report ID: 2563

- Published Date: Sep 30, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.