Anti-retroviral Protease Inhibitors Market Outlook:

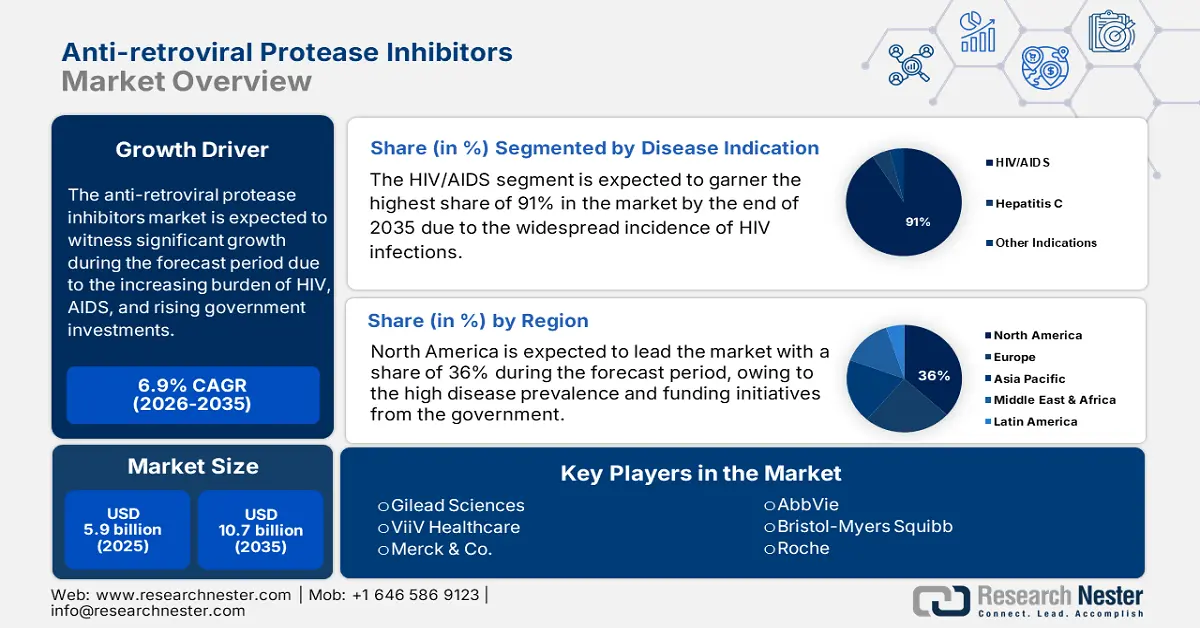

Anti-retroviral Protease Inhibitors Market size was valued at USD 5.9 billion in 2025 and is projected to reach USD 10.7 billion by the end of 2035, rising at a CAGR of 6.9% during the forecast period, i.e., from 2026 to 2035. In 2026, the industry size of anti-retroviral protease inhibitors is evaluated at USD 6.3 billion.

The global market is growing due to the increasing occurrence of HIV, AIDS, and positive innovations in combination therapies, and increasing access to advanced procedures and treatment in developing countries. According to a report by UNAIDS in July 2023, in 2022, 39.0 million people were living with HIV, and 29.8 million people were getting antiretroviral therapy. Besides, globally, 4,000 young women and girls become infected with HIV every week, with women and girls especially in sub-Saharan Africa still disproportionately affected. Due to this continuously increasing burden, the demand for anti-retroviral protease inhibitors is expanding rapidly.

Focus on improved patient outcomes initiated several funding activities for HIV responses in developing countries. According to a report by UNAIDS in July 2023, due to support and investment for stopping AIDS in children, in 2022, treatment was offered to about 82% of pregnant and breastfeeding women with HIV globally. Furthermore, major strides have been taken in low-cost antiretroviral drug manufacturing for greater access in low-income parts of the world. Another export of newer drugs with more investments in research and development promised greater efficacy and tolerability. Furthermore, the government, NGOs, and drug companies collaborate in promoting further innovation and improved linkages to life-saving interventions.

Key Antiretroviral Protease Inhibitors Market Insights Summary:

Regional Highlights:

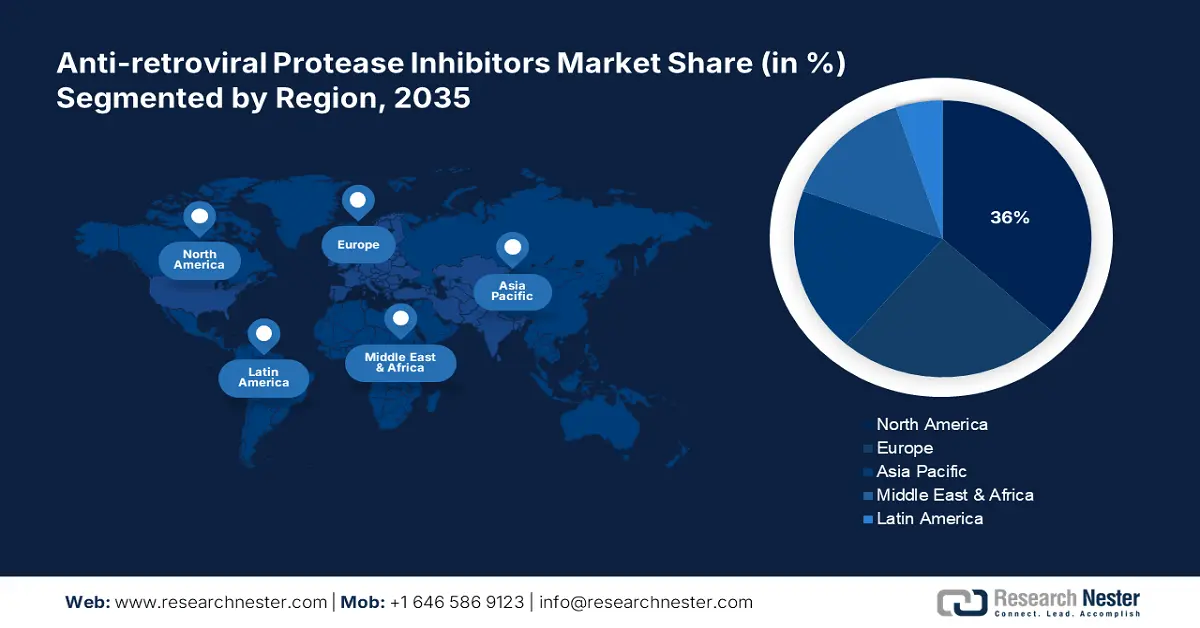

- By 2035, North America is projected to command a 36% share of the anti-retroviral protease inhibitors market, supported by advanced medical infrastructure and strong government funding initiatives.

- Asia Pacific is anticipated to emerge as the fastest-growing region by 2035, propelled by expanding access to treatment procedures.

Segment Insights:

- The HIV/AIDS subsegment is expected to secure a 91% share by 2035 in the anti-retroviral protease inhibitors market, bolstered by the widespread incidence of HIV infections at the global level and the critical function of protease inhibitors.

- The HIV treatment subsegment is projected to dominate the end user category by 2035, sustained by its direct association with health system procurement and treatment processes for patients.

Key Growth Trends:

- Government investments

- Rising burden of chronic diseases

Major Challenges:

- Price controls by government

- High Cost of Treatment

Key Players: Gilead Sciences, ViiV Healthcare, Merck & Co., AbbVie, Bristol-Myers Squibb, Roche, Boehringer Ingelheim, Johnson & Johnson, Aurobindo Pharma, Cipla, Hetero Drugs, Mylan (Viatris), Teva Pharmaceuticals, Lupin, Sun Pharmaceutical.

Global Antiretroviral Protease Inhibitors Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 5.9 billion

- 2026 Market Size: USD 6.3 billion

- Projected Market Size: USD 10.7 billion by 2035

- Growth Forecasts: 6.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (36% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Canada, United Kingdom, Germany, Japan

- Emerging Countries: India, Brazil, South Africa, Thailand, Indonesia

Last updated on : 24 September, 2025

Anti-retroviral Protease Inhibitors Market - Growth Drivers and Challenges

Growth Drivers

- Government investments: One of the fueling factors for the anti-retroviral protease inhibitors sector is government expenditure and in-person expenditure going into PI-based treatments. As per a report by UNAIDS in July 2024, in 2023, HIV resources across the globe were spent near USD 19.8 billion, down by 5% from 2022. However, funding gap highlights the need for increased investments to reach the goal of USD 29.3 billion. Government support must follow for further research, drug accessibility, and, its main purpose, to globally treat HIV and AIDS.

- Rising burden of chronic diseases: Another major driver for the anti-retroviral protease inhibitors market is the large consumer base, which is the expanding patient pool of HIV and AIDS. As per a report by UNAIDS in July 2025, in December 2024, 31.6 million people got access to antiretroviral therapy, while 630,000 people died from AIDS-related illnesses. Increased treatment uptake across the world is due to growing awareness and efforts toward early diagnosis. Additionally, patient pool improvements and quality of life are further enhanced by the constant development of PI-based therapies that are driving market demand.

- Advancements in drug development: A constant flow of innovation in the formulation and delivery of these protease inhibitors has made it possible for treatments to become better, safer, and easier to administer. The advances, such as long-acting injectable therapies and fixed-dose combinations, ensure better patient adherence and minimize side effects, and hence promote market growth. Moreover, there is currently research directed at overcoming resistance and potentiating these protease inhibitors, which is paramount to the long-term efficacy of treatment.

Expansion of Global Access to Antiretroviral Therapy

Global Access to Antiretroviral Therapy Among People Living with HIV (2024)

|

Category |

Value |

Year |

|

People accessing antiretroviral therapy in 2010 |

7.7 million [6.7 to 8 million] |

2010 |

|

Target for people accessing therapy |

34 million |

2025 (target) |

|

Percentage of all people living with HIV accessing treatment |

77% [62 to 90%] |

2024 |

|

Adults (15+ years) accessing treatment |

78% [62 to 91%] |

2024 |

|

Children (0–14 years) accessing treatment |

55% [40 to 73%] |

2024 |

|

Women (15+ years) accessing treatment |

83% [66 to 97%] |

2024 |

|

Men (15+ years) accessing treatment |

73% [57 to 85%] |

2024 |

|

Pregnant women accessing antiretroviral medicines to prevent transmission |

84% [72 to >98%] |

2024 |

Source: UNAIDS July 2025

Challenges

- Price controls by government: One of the major challenges hindering the growth in the anti-retroviral protease inhibitors market is the price controls and reimbursement barriers imposed by governments worldwide. The AMNOG (Arzneimittelmarkt-Neuordnungsgesetz) law in the country lowered prices for next-generation therapies, making it challenging for manufacturers to develop these PI inhibitors. Additionally, Health Canada reported reduced launch prices, further creating a significant hurdle for firms leveraging PI inhibitors.

- High Cost of Treatment: One of the major challenges facing the market is the high price associated with these therapies. The expensive drug-making and manufacturing processes put the treatment out of reach of millions of middle and low-income earners. This financial impediment results in lapses in patient adherence and, thereby, affects mass adoption of protease inhibitors, which is a setback in realizing the target of HIV control. Treatment regimen complexities and side effects also discourage patients from further following up on the treatment, thus negatively impacting market growth.

Anti-retroviral Protease Inhibitors Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.9% |

|

Base Year Market Size (2025) |

USD 5.9 billion |

|

Forecast Year Market Size (2035) |

USD 10.7 billion |

|

Regional Scope |

|

Anti-retroviral Protease Inhibitors Market Segmentation:

Disease Indication Segment Analysis

The HIV/AIDS subsegment is expected to hold the highest market share of 91% in the disease indication segment in the anti-retroviral protease inhibitors market within the forecast period due to the widespread incidence of HIV infections at the global level and the critical function of protease inhibitors. As per a report by WHO 2025, to achieve the first 95–95–95 target, still another 3.2 million individuals with HIV must be tested and notified of their HIV status. Greater emphasis on early diagnosis and early antiretroviral therapy initiation is also propelling demand for quality drug classes such as protease inhibitors.

End user Segment Analysis

The HIV treatment subsegment is expected to hold the highest market share in the end user segment in the anti-retroviral protease inhibitors market within the forecast period due to its direct association with health system procurement and treatment processes for patients. Specialist HIV clinics, hospitals, and public health ART centers are the key settings in which protease inhibitor regimens are prescribed, dispensed, and monitored, and this subsegment has the most purchasing power and volume. There is some role for retail and outpatient pharmacies, yet hospital purchasing dominates the revenue, where the regimens are longer and more expensive.

Route of Administration Segment Analysis

The oral subsegment is expected to hold the highest market share in the route of administration segment in the anti-retroviral protease inhibitors market within the forecast period, as it is easy to use, convenient for patients, and already accepted in treatment guidelines. Oral protease inhibitors (frequently boosted with cobicistat or ritonavir) are comprehensively studied, extensively licensed, and logistically easier to manufacture, store, distribute, and deliver than injectables or other new technologies of delivery. Healthcare systems in most low and middle-income countries are founded on oral drug dispensing models, so scaling up access is more feasible.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Sub-segments |

|

Disease Indication |

|

|

Drug Class |

|

|

Distribution Channel |

|

|

End User |

|

|

Route of Administration |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Anti-retroviral Protease Inhibitors Market - Regional Analysis

North America Market Insight

The anti-retroviral protease inhibitors market in North America is expected to hold the largest market share of 36% during the forecast period due to advanced medical infrastructure, the high disease prevalence, and funding initiatives from the government. Additionally, public and private healthcare systems in the region are focusing on improved patient outcomes for which the long-acting injectable therapies were introduced, further enhancing the management of therapies. Government initiatives, such as the U.S. Department of Health & Human Services' funding and Canada's Public Health Agency's programs, further boost business in this sector.

The anti-retroviral protease inhibitors market in Canada is growing exponentially, driven by substantial government-backed funding and growing awareness of prevention and care. According to a report by the Government of Canada in December 2023, there were nearly 1,833 cases of HIV diagnoses in Canada in 2022, out of which 597 were female. Increased national initiatives toward early diagnosis and treatment access have further accelerated the demand for protease inhibitors. All these factors have a significant contribution to the growth of the market during the forecast timeline.

The anti-retroviral protease inhibitors market in the U.S. is growing due to strong government funding, improvements in awareness and prevention, and the high burden of HIV. According to a report by the U.S. Statistics in February 2025, approximately 31,800 people were dealing with HIV in the U.S., although new HIV infections decreased 12% over the last 8 years in 2022. Additionally, People who inject drugs accounted for 7% of the infected population. Additionally, the U.S. government continues investing in programs such as Ending the HIV Epidemic to reduce the incidence of new infections. Increased access to antiretroviral therapy and earlier intervention methods have kept treatment rates at the same level.

Asia Pacific Market Insight

The anti-retroviral protease inhibitors market in the Asia Pacific is expected to hold the fastest-growing market, due to the expanding access to treatment procedures. Due to rising disposable income, the region is experiencing tremendous growth, supported by government initiatives, the availability of generic drug formulations, and technological advancements in developing next-generation protease inhibitors with reduced side effects. According to a report by UNAIDS 2024, in 2023, 6.7 million people living with HIV were residing in Asia and the Pacific. Hence, these rising instances drive demand for advanced PIs in the region.

The anti-retroviral protease inhibitors market in China is growing due to the giant market players and government disbursement of funding. Additionally, as per a report by UNAIDS in October 2024, around 1.4 million people are living with HIV in China, and women make up around 23.7% of them, according to the latest data from the health authorities of China. Government initiatives, such as the National Free Antiretroviral Treatment Program, are increasing the treatment access for HIV patients in China. This growing accessibility, combined with domestic pharmaceutical advancements, is positioning China as a key regional player in the global anti-retroviral protease inhibitors market.

The anti-retroviral protease inhibitors market in India is growing due to strong government-supported healthcare initiatives and growing awareness among the public on matters of health. The National AIDS Control Organisation (NACO), operating under the aegis of the National AIDS Control Programme (NACP), undertakes the primary task of administering free antiretroviral (ART) treatment throughout the country. Initiatives such as the Treat All policy create a platform for early treatment initiation, irrespective of the stage of the disease. The increased establishment of ART Centres and Link ART Centres to cater to the last-mile underserved and rural populations is another facet of the expansive system.

Europe Market Insight

The anti-retroviral protease inhibitors market in Europe is expected to hold steady growth due to a series of aligned policy and programmatic actions. The states of Europe are reviving and enhancing HIV action plans, e.g., the WHO European Region's 2022 2030 Action Plan towards the elimination of HIV, viral hepatitis, and STIs. Increased focus on HIV early diagnosis, higher rates of HIV testing, care linkage, and reduced late HIV presentation are driving demand for successful treatments such as protease inhibitors. Approvals of new injectable and long-acting HIV prevention products also indicate positive policy and market trends towards new antiretroviral options.

The anti-retroviral protease inhibitors market in the UK is experiencing growth due to a mix of government action, social campaigns, and expanded access to treatment. As per a report by the UK Government in June 2023, the UK government has pledged to have an 80% decrease in fresh HIV infections by 2025. According to a February 2025 UK Government report, 95% of all individuals with HIV were diagnosed, 98% of those diagnosed were treated, and 98% of individuals who were treated were suppressed from the virus and could not transmit the virus to other individuals. These programs are extensively propelling the demand for advanced anti-retroviral protease inhibitors within the UK economy.

The anti-retroviral protease inhibitors market in Germany is growing due to interaction among government programs, health education campaigns, and access to care. The government of Germany has utilized extensive techniques to fight HIV infection by increasing testing services and integrating HIV care in primary healthcare clinics. Public education campaigns have tried to make more people aware of HIV prevention as well as the value of early diagnosis. There has also been an attempt at de-stigmatization of HIV, hoping more people would access testing and treatment.

HIV and AIDS Epidemiological Characteristics in the Regions of Europe (2022)

|

Characteristic |

WHO Regions of Europe |

West |

Centre |

East |

EU/EEA |

|

Reporting countries/number of countries |

49/53 |

21/23 |

15/15 |

13/15 |

30/30 |

|

Number of HIV diagnoses |

110,486 |

22,397 |

8,945 |

79,144 |

22,995 |

|

Rate of HIV diagnoses per 100,000 population |

12.4 |

5.1 |

4.5 |

30.7 |

5.1 |

|

Percentage age 15–24 years |

5.7% |

8.9% |

11.7% |

4.2% |

8.9% |

|

Percentage age 50+ years |

16.7% |

21.8% |

15.1% |

15.5% |

19.9% |

|

Male-to-female ratio |

1.8 |

2.4 |

2.9 |

1.6 |

2.4 |

|

Percentage of migrants |

26.7% |

52.3% |

27.0% |

2.2% |

48.3% |

|

AIDS and late HIV diagnosis |

|||||

|

Percentage HIV diagnoses CD4 <350 cells/mm³ |

50.6% |

46.2% |

44.5% |

55.1% |

47.9% |

|

Number of AIDS diagnoses |

7,220 |

1,873 |

825 |

4,522 |

2,349 |

|

Rate of AIDS diagnoses per 100,000 population |

1.1 |

0.5 |

0.4 |

4.4 |

0.6 |

Source: ECDC, 2023

Key Anti-retroviral Protease Inhibitors Market Player:

- Gilead Sciences

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- ViiV Healthcare

- Merck & Co.

- AbbVie

- Bristol-Myers Squibb

- Roche

- Boehringer Ingelheim

- Johnson & Johnson

- Aurobindo Pharma

- Cipla

- Hetero Drugs

- Mylan (Viatris)

- Teva Pharmaceuticals

- Lupin

- Sun Pharmaceutical

Companies in the anti-retroviral protease inhibitors market are adopting various expansion strategies to strengthen their presence in the global market. Leading players such as Gilead, ViiV, and Merck are concentrating on research activities to drive innovation and improve patient outcomes. Meanwhile, key companies in Africa and Asia, including Aurobindo, Cipla, and Mylan, are prioritizing affordable medical solutions to reach a large consumer base in rural areas. Additionally, organizations are increasingly focusing on the development of biosimilars, further boosting market growth during the forecast period.

Here is a list of key players operating in the global market:

Recent Developments

- In October 2024, Gilead Sciences, Inc. announced that they have signed non-exclusive, royalty-free agreements with six pharmaceutical companies to make and sell generic versions of lenacapavir in 120 low- and lower-middle-income countries with high rates of HIV.

- In March 2022, Hetero announced that they had signed a voluntary licensing agreement with the Medicines Patent Pool (MPP) to make and sell a generic version of Pfizer’s COVID-19 oral treatment – a combination of nirmatrelvir and ritonavir.

- Report ID: 2553

- Published Date: Sep 24, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Antiretroviral Protease Inhibitors Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.