Histone Deacetylase Inhibitors Market Outlook:

Histone Deacetylase Inhibitors Market size was valued at USD 1.43 billion in 2025 and is expected to reach USD 2.97 billion by 2035, expanding at around 7.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of histone deacetylase inhibitors is evaluated at USD 1.53 billion.

The reason behind the growth in the market is impelled by the rising cases of cancer across the globe. HDAC inhibitors that allow acetylation equilibrium to be restored are clinically proven to be helpful in oncology, particularly for hematological cancers, as a single agent or in combination therapies. Worldwide, the age-standardized incidence rates of non-Hodgkin lymphoma (NHL) and Hodgkin lymphoma (HL) in males & females are projected to reach 1.2 & 1.0 per 100,000 and 7.3 & 4.9 per 100,000 by 2044, respectively (ScienceDirect). Similarly, a 2024 journal from the ASH publications predicted the number of new leukemia cases in the world to be 519,540 by 2050.

This demography indicates the heightening demand for innovative targeted therapies, including histone deacetylase (HDAC) inhibitors. The economic burden on associated patients is significantly rising, particularly in high-income countries, which is pushing companies and academia to produce therapeutics with value-based payers’ pricing. On this note, a study on healthcare expenses on hematologic malignancy treatments in the U.S. was published by the ASH Publication in March 2024. It concluded the all-cause median cost per patient to be USD 3,31,827.0 during an allogeneic transplant procedure. Thus, the market is currently dedicated to offering affordable alternatives to conventional expensive therapies.

Key Histone Deacetylase Inhibitors Market Insights Summary:

Regional Highlights:

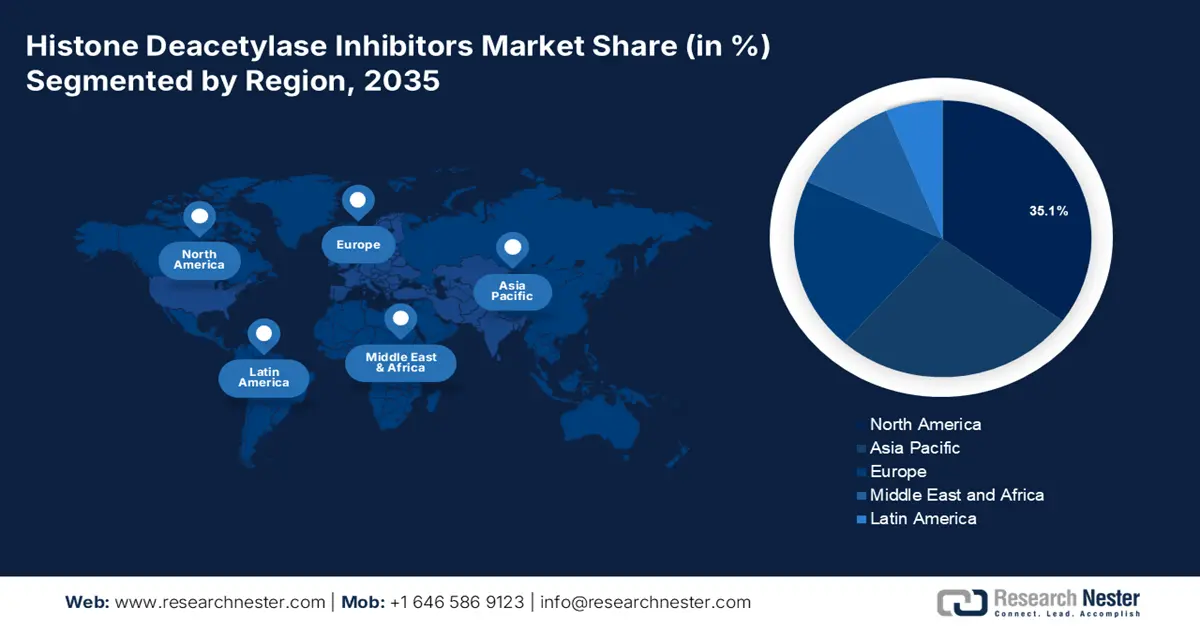

- By 2035, North America is predicted to capture a 35.1% share of the histone deacetylase inhibitors market, underpinned by escalating healthcare technology investments and clinical R&D expansion.

- By 2035, the Asia Pacific region is set to hold the second-largest share and advance at a notable growth pace, reinforced by strengthening governmental initiatives and cancer research programs.

Segment Insights:

- By 2035, the oral HDAC inhibitors segment in the histone deacetylase inhibitors market is expected to command a 55.0% share, supported by the rising global acceptance and accessibility of orally administered therapies.

- By 2035, the oncology segment is projected to secure a significant share, propelled by intensifying clinical research efforts and regulatory prioritization of HDACis in cancer care.

Key Growth Trends:

- Increasing investment and interest in extensive explorations

- Integration of tech based drug discoveries

Major Challenges:

- Adverse events and expensive development of HDAC inhibitors

Key Players: Novartis AG, Midatech Pharma PLC, REGENACY PHARMACEUTICALS, INC., Syndax Pharmaceuticals Inc., Viracta Therapeutics Inc., Xynomic Pharmaceuticals (Nanjing) Co. Ltd., Cetya Therapeutics Inc., Tokyo Chemical Industry Co. Ltd., AstraZeneca Plc.

Global Histone Deacetylase Inhibitors Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.43 billion

- 2026 Market Size: USD 1.53 billion

- Projected Market Size: USD 2.97 billion by 2035

- Growth Forecasts: 7.6%

Key Regional Dynamics:

- Largest Region: North America (35.1% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Singapore, Australia

Last updated on : 26 November, 2025

Histone Deacetylase Inhibitors Market - Growth Drivers and Challenges

Growth Drivers

- Increasing investment and interest in extensive explorations: The growing research & development activities for creating advanced drugs are believed to fuel the histone deacetylase inhibitors market. The discovery of new indications from these medicines has become a trend to expand the field of applications and a key tactic of designing novel combination therapies in this sector. For instance, in June 2022, Celleron Therapeutics shared promising results from the phase II clinical trial on zabadinostat + nivolumab. The evaluation data demonstrated a 3-year survival rate of 7.3% in late-stage microsatellite stable colorectal cancer. Besides, this merchandise is further gaining traction due to the efforts to improve public access to advanced treatments.

- Integration of tech-based drug discoveries: The utilization of artificial intelligence (AI) and machine learning (ML) in R&D is accelerating the global penetration of the market. Hence, pioneers are forming strategic alliances to mitigate hurdles and limitations related to large-scale and fast-paced medication innovation and production. In this regard, in June 2024, Italfarmaco collaborated with Iktos to escalate the development of next-generation HDAC candidates for a variety of non-oncological diseases. This collaboration allowed the company to possess Iktos’s generative modeling technology and retrosynthesis AI technology platforms, Makya and Spaya, to enhance accuracy, binding site, and synthetic tractability in drug targets.

Challenges

- Adverse events and expensive development of HDAC inhibitors: The occurrence of several serious and/or severe side effects, including myelosuppression, diarrhea, ventricular arrhythmia, and other cardiac toxicities often cause treatment discontinuation or drug withdrawal. This may raise questions and concerns about the liability of the safety and cost-effectiveness profile of the market. Additionally, this creates delays and uncertainty in acquiring compliance with stringent regulatory criteria. Moreover, the high cost of commercialization and the add-on costs of managing adverse reactions may present an economic barrier among both drug developers and consumers.

Histone Deacetylase Inhibitors Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

7.6% |

|

Base Year Market Size (2025) |

USD 1.43 billion |

|

Forecast Year Market Size (2035) |

USD 2.97 billion |

|

Regional Scope |

|

Histone Deacetylase Inhibitors Market Segmentation:

Route of Administration Segment Analysis

The oral HDAC inhibitors segment in the histone deacetylase inhibitors market is estimated to hold 55.0% of the revenue share over the assessed timeline. The worldwide availability and acceptability of orally administrated medications are the major driving factors in this segment. These epigenetic agents have several potential benefits, including the seamless regulation of gene expression, a broad spectrum of applications, and patient convenience. Furthermore, the segment’s proprietorship can be testified by the enlarging solid oral medicine industry, which attained a value of USD 550.0 million in 2022. Additionally, it was observed that 54.0% of the total new drug applications approved by the FDA from 1938 to 2022 had oral administration, as per NLM.

Application Segment Analysis

The histone deacetylase inhibitors market from the oncology segment is set to garner a notable share by the end of 2035. HDAC inhibitors (HDACis) hold a promising avenue in the field of oncology as ongoing research and clinical trials are continually exploring their effectiveness in treating different types of cancers. Moreover, as a novel class of anticancer therapeutic targets, this subtype is highly prioritized by international authorities and drug developers, presenting this medical discipline as a profitable segment. On this note, in November 2023, Acrotech Biopharma received clearance from the FDA for its Belinostat (BELEODAQ) relapsed or refractory peripheral T-cell lymphoma. Further, the Oncologic Drugs Advisory Committee suggested the FDA and Acrotech collaborate to work on mitigating approval delays in oncology.

Our in-depth analysis of the global histone deacetylase inhibitors market includes the following segments:

|

Classification |

|

|

Application |

|

|

Drugs |

|

|

End user |

|

|

Distribution Channel |

|

|

Route of Administration |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Histone Deacetylase Inhibitors Market - Regional Analysis

North American Market Insights

North America is predicted to account for the largest revenue share of 35.1% in the histone deacetylase inhibitors market by 2035. The rising investment in healthcare technology and clinical R&D is fostering a progressive trading environment for this landscape. This has led to an escalation in the scale distribution and availability across the region, ensuring continuous capital influx and participant engagement. For instance, in August 2022, Regenacy Pharmaceuticals announced the initiation of a phase II study on its oral selective histone deacetylase 6 (HDAC6) inhibitor, ricolinostat, in treating painful diabetic peripheral neuropathy. The company also secured a series B funding of USD 9.3 million to support this clinical development program.

In 2021, 3.2% of the new malignancy incidences in the U.S. originated from leukemia, accounting for 61,090 (the Surveillance, Epidemiology, and End Results (SEER) database). On the other hand, by 2025, the numbers of new and death cases of cancer in the U.S. are projected to reach 2,041,910 and 618,120 (NLM). This demography showcases an enlarging patient pool and a heightened surge in the market. Besides, the accelerated regulatory approvals are cultivating a favorable business environment for global leaders, inspiring other biotech pioneers to invest and participate in this sector. For instance, in March 2024, the Muscular Dystrophy Association offered foundational research leads funding to accelerate the FDA approval for Duvyzat (givinostat) for children and adolescents with DMD.

APAC Market Insights

The Asia Pacific histone deacetylase inhibitors market is estimated to be the second largest shareholder and to witness a notable pace of growth throughout the analyzed timeframe. The increasingly supporting governmental initiatives are spreading awareness about the associated ailments and available treatment options for them. For instance, in January 2025, the Department of Biotechnology highlighted its efforts in exploring the potential of molecular biology in treating B-cell- and T-cell-based hematological carcinomas. The governing body also mentioned that it is serving this purpose by establishing a dedicated Technical Expert Committee on Cancer Research Biology. Moreover, such research programmes promote wide adoption and investment in this sector.

Japan is steadily becoming a hub of innovation and a large consumer base for the market. According to NLM, the occurrence of cancer in this country is projected to surpass 3,665,900 thousand by 2050, exhibiting a 13.1% increase from 2020. Among this figure, the colorectal, female breast, prostate, lung, and stomach segments are expected to be the most prevalent cases. Similarly, the influence of technological advancements is helping companies introduce new lines of therapeutics, such as HDACis, expanding the territory of this landscape. For instance, in June 2021, Meiji Seika Pharma gained marketing clearance from the Ministry of Health, Labour and Welfare in Japan for its HBI-100, treating T-cell leukemia-lymphoma.

Histone Deacetylase Inhibitors Market Players:

- Acrotech Biopharma Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Bristol Myers Squibb Co.

- Celleron Therapeutics Ltd.

- Novartis AG

- Midatech Pharma PLC

- REGENACY PHARMACEUTICALS, INC.

- Syndax Pharmaceuticals Inc.

- Viracta Therapeutics Inc.

- Xynomic Pharmaceuticals (Nanjing) Co. Ltd.

- Cetya Therapeutics Inc.

- Italfarmaco SpA

- Vanda Pharmaceuticals Inc.

The market evolving its dynamics with the continuous participation in rigorous R&D cohorts by key players. They are heavily investing in advanced technologies to conduct clinical trials more efficiently and to mitigate related hurdles. Furthermore, the support from regulatory frameworks is escalating the pace of both domestic and international commercialization. For instance, in August 2021, Celgene Corporation attained accelerated approval from the FDA for its histone deacetylase (HDAC) inhibitor, Istodax (romidepsin). This drug is indicated to be used as a monotherapy for treating peripheral T-cell lymphoma (PTCL) in adult patients who have received at least one prior therapy. Such key pioneers are:

Recent Developments

- In March 2024, Italfarmaco attained clearance from the FDA for its Duvyzat (givinostat), offering treatment for children aged 6 and over. The approval made this oral histone deacetylase inhibitor a nonsteroidal alternative for duchenne muscular dystrophy (DMD), reducing inflammation and loss of muscle.

- In January 2024, Vanda Pharmaceuticals received an investigational new drug (IND) application allowance from the FDA for its VTR-297. This topical antifungal candidate is intended to treat onychomycosis by inhibiting enzymes, which are involved in the fungal cell cycle.

- Report ID: 5349

- Published Date: Nov 26, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.