Vascular Endothelial Growth Factor Inhibitors Market Outlook:

Vascular Endothelial Growth Factor Inhibitors Market size was valued at USD 15.2 billion in 2025 and is projected to reach USD 26.1 billion by the end of 2035, rising at a CAGR of 6.2% during the forecast period, i.e., 2026 to 2035. In 2026, the industry size of vascular endothelial growth factor (VEGF) inhibitors is evaluated at USD 16.1 billion.

The global market is experiencing vigorous growth, driven by the increasing applications in oncology and ophthalmology. There is a rapid prevalence of cancer cases, such as lung, colorectal, and breast, coupled with retinal disorders, which exceptionally necessitate the VEGF inhibitors across all nations. According to a clinical study by the America Cancer Society in January 2024, 2,001,140 new cancer cases and 611,720 cancer deaths are projected to occur in the U.S., the equivalent of about 5480 diagnoses each day. Therefore, this increasing burden of disorders increases the demand for VEGF inhibitors, thereby propelling the market growth.

Generic drugs are essential to global healthcare systems, offering cost-effective alternatives to brand-name medications. As per a report by USP Quality Matters in April 2025, generic drugs come primarily from India. Generic drugs make up 90% of US prescription volume. China contributes 8% of the total volume of API, and 43% of branded pharmaceutical API comes from Europe. This global supply chain plays a critical role in the production of complex biologics, including vascular endothelial growth factor (VEGF) inhibitors. With rising demand for affordable cancer and ophthalmology treatments, the market is increasingly influenced by the availability of high-quality generics and biosimilars. Emerging markets are expected to play a larger role in manufacturing and consumption.

Key Vascular Endothelial Growth Factor (VEGF) Inhibitors Market Insights Summary:

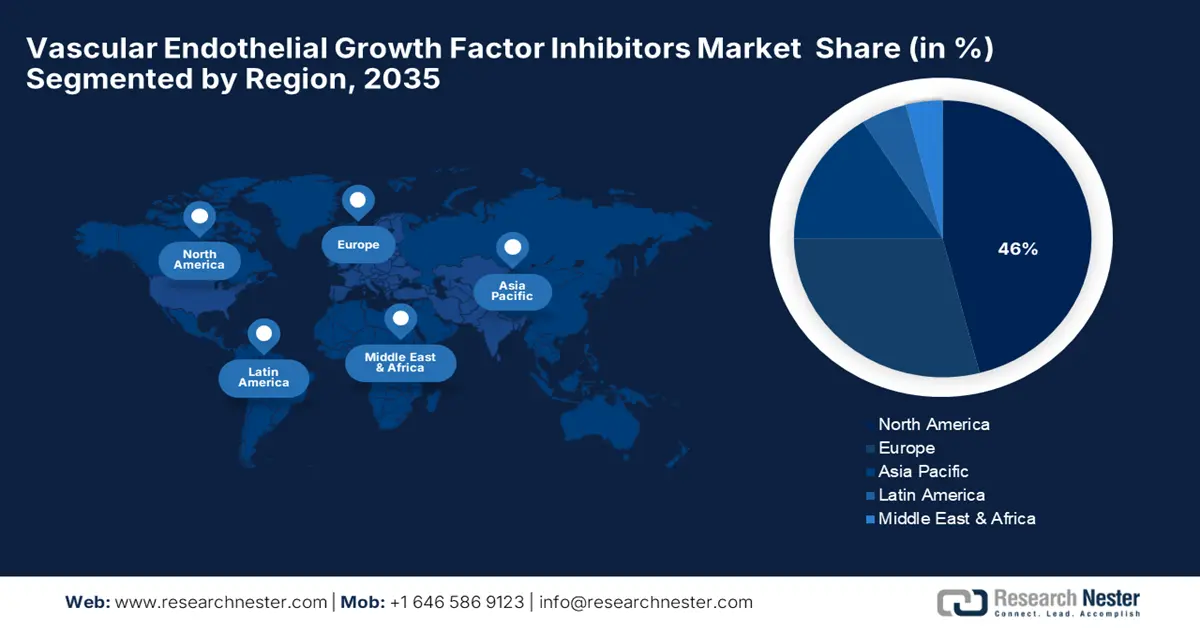

Regional Highlights:

- North America is expected to hold a 46% share in the vascular endothelial growth factor inhibitors market within the forecast period, supported by the high prevalence of cancer and retinal disorders, strong availability of fda-approved biologics, and advanced healthcare infrastructure.

- Asia-Pacific is projected to be the fastest-growing region within the forecast period, driven by rising incidence of diabetes-related eye disorders and cancer, expansion of healthcare access, and increasing approvals of biosimilar vegf inhibitors.

Segment Insights:

- In the route of administration segment, the injectable subsegment is forecast to account for 71% of the share within the forecast period, due to superior bioavailability and rapid therapeutic effect.

- Under the type segment, the vegf-a inhibitors subsegment is set to capture the highest share within the forecast period, reinforced by its central role in pathological angiogenesis and proven effectiveness across major indications such as cancer and age-related macular degeneration.

Key Growth Trends:

- Affordable medical interventions

- Technological advancements

Major Challenges:

- Pricing limitations by governing bodies

- Stringent regulatory requirements

Key Players: Bayer AG, Novartis AG, Roche (Genentech), Amgen Inc., Biogen, Coherus BioSciences, Bausch Health Companies, Viatris Inc., Eli Lilly and Company, Bristol Myers Squibb, Exelixis, Inc., Takeda Pharmaceuticals, Eisai Co., Ltd., Sanofi (Regeneron).

Global Vascular Endothelial Growth Factor (VEGF) Inhibitors Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 7.41 billion

- 2026 Market Size: USD 7.78 billion

- Projected Market Size: USD 12.66 billion by 2035

- Growth Forecasts: 5.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (46% share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, France, China, Japan

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 29 September, 2025

Vascular Endothelial Growth Factor Inhibitors Market - Growth Drivers and Challenges

Growth Drivers

- Affordable medical interventions: The proven effectiveness of the products from the market makes them preferable for affordable healthcare applications. This also compels the manufacturers of drugs to seek various forms of clinical trials, further intensifying the study of their potential. As per a report by NLM 2024 December, in other bevacizumab biosimilars trials as induction therapy for first-line in metastatic colorectal cancer (mCRC) patients, the objective response rate (ORR) ranges from 49% to 56%, and median progression-free survival (PFS) is approximately 11 months. These optimistic findings indicate the therapeutic value of VEGF inhibitors and warrant further development of these as cost-effective drugs in the market.

- Technological advancements: Another key driver for the vascular endothelial growth factor inhibitors market is the technological advancements in the therapeutic sector. The integration of artificial intelligence (AI) in ophthalmology has revolutionized patient management. AI-based devices are able to generate patient-level prognostic data and predict the requirements of a patient's individual treatment, reducing the time to optimize a patient's treatment regimen. As per a report by the SEC in November 2024, the global market for anti-VEGF therapy is expanding. The market for branded anti-VEGF was approximately USD 14 billion in 2023. These indicate the enormous role played by innovation in generating VEGF inhibitor therapies.

- Rising incidence of age-related macular degeneration: As the global population continues to age, the number of persons who could be affected with age-related macular degeneration (AMD) is increasing. Since VEGF is instrumental in the formation of abnormal blood vessels in wet AMD, the prevailing treatment is the administration of inhibitors of VEGF. Increased awareness of AMD and the potential for irreversible vision loss has led to increased screening and diagnosis rates. Thus, with increased diagnosis of patients comes a greater demand for methods that can effectively slow down or stop the progression of the disease. This recent trend shall cause the vascular endothelial growth factor inhibitors market to grow, with regions having larger elderly populations showing much more growth.

Biosimilar Adoption and Clinical Equivalence in VEGF Inhibitor Therapies

Clinical Trial Comparison of Overall Response Rate and Efficacy Between Bevacizumab Biosimilar (Encoda) and Bevacizumab (2024)

|

Response Category |

Biosimilar |

Bevacizumab |

|

Complete Response (CR) (%) |

2 (0.9) |

1 (0.5) |

|

Partial Response (PR) (%) |

97 (41.5) |

84 (41.6) |

|

Stable Disease (SD) (%) |

108 (46.2) |

97 (48.0) |

|

Progressive Disease (PD) (%) |

7 (3.0) |

7 (3.5) |

|

Not Evaluated (%) |

20 (8.5) |

13 (6.4) |

|

Overall Response Rate (ORR) |

42.3% |

42.1% |

|

95% Exact Confidence Interval |

35.9% - 48.9% |

35.2% - 49.2% |

|

Unstratified ORR Risk Ratio |

1.005 |

— |

|

95% CI of Risk Ratio |

0.807 to 1.253 |

— |

|

90% CI of Risk Ratio |

0.836 to 1.210 |

— |

|

Unstratified ORR Risk Difference |

0.002 |

— |

|

95% CI of Difference |

-0.091 to 0.095 |

— |

|

90% CI of Difference |

-0.076 to 0.080 |

— |

Source: NLM, December 2024

Challenge

- Pricing limitations by governing bodies: The challenge of pricing has remained one of the crucial obstacles that impede the vascular endothelial growth factor inhibitors market from tapping into an optimum consumer base. These price controls, in many places, are stringent for bevacizumab biosimilars and for other VEGF inhibitors, thus posing serious impediments to manufacturers in the successful formulation and marketing of these drugs. This has often led to discrepancies in access to treatment, as reimbursement options and coverage differ from one country to another. Hence, these pricing limitations restrict the capacity of the market to gain profitable penetration and consequently limit the availability of VEGF inhibitors to patients who need these suppressor medicines.

- Stringent regulatory requirements: The market faces significant challenges owing to the various stringent regulatory frameworks in place across distinct countries. All new drugs and biosimilars must undergo clinical trials and expensive procedures that can set back the launch of the product and add to development expenses. There are other set standards in each region, which put a further level of difficulty on entering the market. The regulatory environment holds back the speed of getting new therapeutic alternatives for VEGF inhibitors to patients and, hence, slows down the growth of the market.

Vascular Endothelial Growth Factor Inhibitors Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.2% |

|

Base Year Market Size (2025) |

USD 15.2 billion |

|

Forecast Year Market Size (2035) |

USD 26.1 billion |

|

Regional Scope |

|

Vascular Endothelial Growth Factor Inhibitors Market Segmentation:

Route of Administration Segment Analysis

The injectable subsegment in the route of administration segment in the vascular endothelial growth factor (VEGF) inhibitors market is expected to hold the highest market share of 71% within the forecast period due to its superior bioavailability and rapid therapeutic effect. Most VEGF inhibitors, particularly monoclonal antibodies, require injection for effective delivery. As per a report by NLM January 2023, in Japan, rates of anti-VEGF injections, sex- and age-adjusted per 1000 person-years, increased from 7.9 to 16.1 in the last ten years. This shows the significant rise in medical injections in the treatment of vision-threatening and cancer-related disorders.

Type Segment Analysis

The VEGF‑A inhibitors subsegment in the market is expected to hold the highest market share in the type segment within the forecast period due to its central role in pathological angiogenesis and its proven effectiveness across multiple major indications such as cancer and age-related macular degeneration. VEGF‑A drives both tumor vascularization and retinal neovascularization and vascular permeability, so inhibitors targeting VEGF‑A (e.g., bevacizumab, ranibizumab, aflibercept) form the backbone of therapeutic regimens. Their widespread clinical use is further supported by established guidelines and approvals from major health authorities such as the FDA and EMA.

End user Segment Analysis

The hospital subsegment in the vascular endothelial growth factor (VEGF) inhibitors market is expected to hold the highest market share in the end user segment within the forecast period due to hospitals’ superior infrastructure, access to specialist physicians, and ability to manage severe cases that require advanced care. As per a report by NLM in September 2023, in the last decade, 901,826 injections of VEGF inhibitors were administered to 56,081 patients in hospitals in Denmark; 131,010 injections were given in 2022 alone. Such a large number of injections were given in the hospital, underlining the crucial role these hospitals play in administering VEGF inhibitor therapies to patients who require special medical attention.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Sub-segments |

|

Type |

|

|

Drug Class |

|

|

Application |

|

|

Route of Administration |

|

|

End user |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Vascular Endothelial Growth Factor Inhibitors Market - Regional Analysis

North America Market Insight

The vascular endothelial growth factor (VEGF) inhibitors market in North America is expected to hold the highest market share of 46% within the forecast period due to the high prevalence of cancer and retinal disorders, and strong availability of FDA-approved biologics. The region also benefits from a highly advanced healthcare infrastructure and hefty R&D investments. Government initiatives, such as NIH funding for anti-VEGF therapies, continue to promote innovation, particularly in research on cancers and vision. Through public-private partnerships, the development of biosimilars and clinical trials comes faster. Also, newer VEGF inhibitors are hitting the market with the FDA quicker due to fast-track designation and regulatory flexibility.

The market in the U.S. is growing due to broad insurance coverage, high diagnosis rates, and early adoption of biosimilars. Leading pharma players and frequent product approvals also drive market expansion. As per a report by NCI May 2025, the cancer death rate (cancer mortality) is 145.4 per 100,000 men and women per year in the U.S. This alarming incidence fuels demand for anti-angiogenic treatments such as bevacizumab and ramucirumab, which are standard therapies for several solid tumors. Additionally, significant investments by institutions in oncology research are accelerating the development of next-generation VEGF-targeted therapies.

The inhibitors market in Canada is growing due to continued innovation in biologics and biosimilars and a growing elderly population. Additionally, favorable reimbursement and clinical trial activities support growth. As per a report by Statistics of Canada in April 2022, in the last five years, about 861,000 individuals aged 85 and above have been enumerated in Canada. Being on the older side of the population curve, such patients are more vulnerable to age-related diseases such as macular degeneration and other cancers, conditions that are mainly treated using VEGF inhibitors. As the government healthcare programs provide access to these therapies to a broad population, they create larger adoption rates.

Asia Pacific Market Insight

The vascular endothelial growth factor inhibitors market in the Asia Pacific is expected to hold the fastest-growing market within the forecast period due to the rising incidence of diabetes-related eye disorders and cancer. There are increases in regional growth due to the expansion of healthcare access and generic drug manufacturing. During recent years, the biosimilar VEGF inhibitors have seen increasing approvals in the region, thus enhancing affordability and availability. The key markets, China, India, and South Korea, are pouring investments into clinical trials and local production facilities. Moreover, numerous collaborations exist between multinational pharmaceutical companies and local manufacturers, which are augmenting the pace of market expansion.

The market in China is growing due to government expenditure on oncology and ophthalmology treatment, and increasing approvals of biosimilars. The manufacturing capacity is also reducing the cost of drugs. According to a report by NLM in September 2024, in China, increasing numbers of oncology drugs manifested annually, accounting for 49.2% of all early-phase clinical trials in 2022. Endocrine and hematologic trials also increased consistently, accounting for about 8.5% and 5.3% of all early-phase clinical trials in 2022. Additionally, government support for biotech innovation has driven a boom in domestic development of VEGF inhibitors, with it being one of the fastest-growing markets in the Asia-Pacific region.

The market in India is growing due to a huge number of diabetics susceptible to retinopathy and growing demand for affordable biologics. Growing upscaling of specialty hospitals and public health programs also propels adoption. As per a report by NLM, 2025 May, the prevalence of diabetes in adults in India has been estimated at 6.5%. NCDs account for approximately 60% of India's overall mortality, with diabetes, hypertension, and obesity being particularly prevalent. Increased government initiatives to increase the availability of diabetes care and rising awareness about diabetic eye disease are further driving market development. Moreover, the launch of cost-effective biosimilars is improving access to a broader patient base.

Export and Import of Ophthalmic Instruments and Appliances (2023):

|

Country |

Exports |

Imports |

|

Japan |

498 million |

249 million |

|

Singapore |

197 million |

88.8 million |

|

China |

182 million |

962 million |

|

Israel |

102 million |

31.2 million |

|

South Korea |

89.7 million |

106 million |

Source: OEC, 2023

Europe Market Insight

The vascular endothelial growth factor (VEGF) inhibitors market in Europe is expected to grow steadily within the forecast period due to a mature regulatory framework, strong presence of biosimilar producers, and aging demographics. Public health policy and research drive access and innovation. Public health policy and research mandates access and innovation. The European Medicines Agency (EMA) approved several biosimilar versions of bevacizumab, increasing treatment and affordability across the region. Germany and the UK also experienced a steady rise in anti-VEGF therapy prescriptions due to increasing use in oncology and ophthalmology. The developed healthcare infrastructure enables widespread use of VEGF inhibitors.

The vascular endothelial growth factor inhibitors market in the UK is growing due to a well-developed NHS system, allowing for broad adoption of anti-VEGF therapies. Additional impetus to market penetration is also offered by early access programs and clinical trials. According to a report by the Government of the UK, May 2023, a £5.4 billion (USD 6.7 billion) funding deal up to March 2022, of which £1 billion (1.24 billion) is elective activity, focusing on cancer treatment, had been made. £500 million (USD 620 million) billion in capital investment was also made for upgrading hospital infrastructure and facilities for more sophisticated treatments such as VEGF inhibitors. The early adoption of biosimilars and the NHS systematic cancer care pathway also further increases market penetration.

The market in Germany is growing due to high healthcare expenditure, extensive ophthalmology and oncology infrastructure, and favorable reimbursement models. Diseases such as colorectal cancer, lung cancer, and age-related macular degeneration are carefully monitored through national health databases. As per a report by NLM April 2023, statistical analyses include the mean and standard deviation of age at primary diagnosis, 5-year overall survival rates with 95% confidence intervals, and the percentage of female patients as an indicator of gender distribution and an estimator for cohort coverage. This level of stratification ensures precision in treatment planning, supports the evaluation of therapeutic outcomes, and informs regulatory and reimbursement decisions.

Key Vascular Endothelial Growth Factor Inhibitors Market PLayers:

- Regeneron Pharmaceuticals

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Bayer AG

- Novartis AG

- Roche (Genentech)

- Amgen Inc.

- Biogen

- Coherus BioSciences

- Bausch Health Companies

- Viatris Inc.

- Eli Lilly and Company

- Bristol Myers Squibb

- Exelixis, Inc.

- Takeda Pharmaceuticals

- Eisai Co., Ltd.

- Sanofi (Regeneron)

The competition in the market is high, with Regeneron, Bayer, and Novartis at its forefront. There is also a drive for expanding product indications, development of biosimilars, and improvements in delivery systems to ease patient comfort. Regeneron, for instance, has offered higher doses of Eylea for more convenient dose intervals. Furthermore, collaborations are the new trend. As an example, Bristol Myers Squibb and BioNTech are allied to co-develop a PD-L1/VEGF-A bispecific antibody, BNT327, for cancer treatment. These strategic moves are pointing to innovations aiming to cater to the unmet medical needs within the VEGF inhibitors industry.

Here is a list of key players operating in the global market:

Recent Developments

- In August 2024, Lupin Limited announced that they have completed a global Phase 3 clinical study of biosimilar drug LUBT010. his study showed that LUBT010 works just as well as the original drug Lucentis in improving vision for patients with wet age-related macular degeneration (wet AMD).

- In September, 2022, Celltrion USA announced that their drug Vegzelma, a biosimilar to Avastin, for treating six types of cancer, has been approved by the FDA. This drug offers patients a more affordable treatment option.

- Report ID: 2479

- Published Date: Sep 29, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Vascular Endothelial Growth Factor (VEGF) Inhibitors Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.