SGLT2 Inhibitors Treatment Market Outlook:

SGLT2 Inhibitors Treatment Market size was valued at USD 20.7 billion in 2025 and is projected to reach USD 40.3 billion by the end of 2035, rising at a CAGR of 7.7% during the forecast period, from, 2026-2035. In 2026, the industry size of SGLT2 Inhibitors Treatment is estimated at USD 22.2 billion.

The rapidly escalating patient pool affected by type 2 diabetes, chronic kidney disease (CKD), and cardiovascular diseases is the primary fueling factor behind the robust growth of the worldwide market. This can be testified by the report from the International Diabetes Federation published in 2024, which states that around 589 million adults aged between 20 to 79 are living with diabetes across all nations, which means one out of every 9 people. It further underscored that the number is expected to double by the end of 2050, reflecting the huge necessity for SGLT2 inhibitors. Furthermore, this led to USD 1 trillion in health expenditure, marking a 338% increase over the past two decades, hence positively impacting market growth.

Furthermore, the regulatory and administrative support for this merchandise has been constantly growing, which attracts a larger pool of service providers to operate in this field. Guidelines from authorities such as the American Diabetes Association and the European Society of Cardiology currently recommend SGLT2 inhibitors for a broader patient population beyond type 2 diabetes alone. Therefore, as per an article by the joint consensus report from KDIGO and ADA published in November 2022, SGLT2 inhibitors with proven kidney benefits are recommended for most patients with type 2 diabetes and chronic kidney disease, especially those with an estimated glomerular filtration rate (eGFR) of 20 mL/min/1.73 m² or more.

Key SGLT2 Inhibitors Treatment Market Insights Summary:

Regional Highlights:

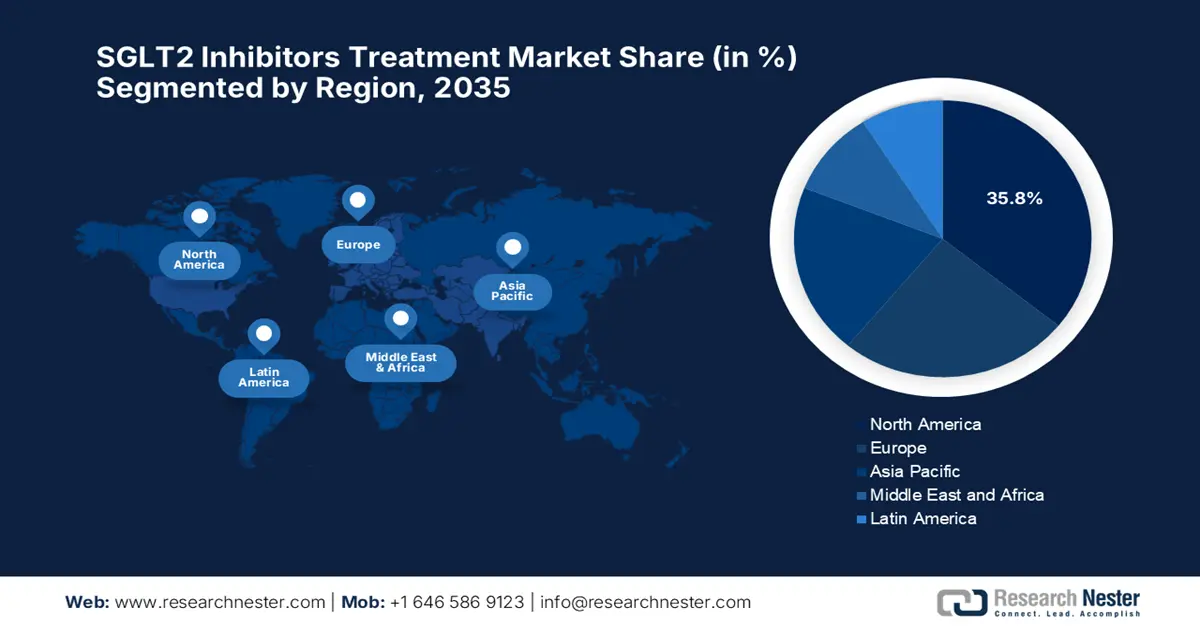

- North America is projected to secure a 35.8% share in the SGLT2 inhibitors treatment market by 2035, upheld by regulatory support and strong manufacturer presence.

- Asia Pacific is anticipated to advance swiftly by 2035, reinforced by rising healthcare awareness and expanding access to advanced therapies.

Segment Insights:

- The type 2 diabetes segment is set to command a 68.6% share by 2035 in the SGLT2 inhibitors treatment market, bolstered by growing disease prevalence and ongoing clinical research.

- The hospital pharmacies segment is anticipated to account for a 60.5% share by 2035, facilitated by their capability to manage high-risk patients and dispense specialized prescriptions.

Key Growth Trends:

- Preceding advances in drug development

- Growing awareness of early diagnosis

Major Challenges:

- Exacerbated therapeutic costs

- Safety as a major concern

Key Players: AstraZeneca, Boehringer Ingelheim, Eli Lilly, Johnson & Johnson (Janssen), Merck & Co. (MSD), Sanofi, Novo Nordisk, Pfizer, Lupin, Sun Pharmaceutical, Cipla, LG Chem, Hanmi Pharmaceutical, CSL Limited, Hikma Pharmaceuticals, Pharmaniaga.

Global SGLT2 Inhibitors Treatment Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 20.7 billion

- 2026 Market Size: USD 22.2 billion

- Projected Market Size: USD 40.3 billion by 2035

- Growth Forecasts: 7.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: India, Brazil, South Korea, Canada, Australia

Last updated on : 19 August, 2025

SGLT2 Inhibitors Treatment Market - Growth Drivers and Challenges

Growth Drivers

-

Preceding advances in drug development: The vigorously expanding drug developments are reshaping the foundation of the market. Players are penetrating into the emerging economies to unlock the complete revenue potential in this field. For instance, in March 2025, Glenmark Pharmaceuticals launched Empagliflozin in India under the brand name Glempa (10/25 mg) that includes fixed-dose combinations Glempa-L (Empagliflozin + Linagliptin) and Glempa-M (Empagliflozin + Metformin). The firm further highlighted the combination's aims to improve glycemic control in adults with type 2 diabetes mellitus, hence a positive market opportunity.

-

Growing awareness of early diagnosis: The market is deliberately reaping advantages from the increasing awareness of early diagnosis. Both the public and private entities are readily investing in early screening programs to diminish complications in the long run. For instance, in April 2021, the World Health Organization (WHO) declared the launch of the Global Diabetes Compact, which is an initiative that aims at diabetes prevention and care, especially in low- and middle-income countries, hence suitable for standard market growth.

-

Mutually beneficial collaborations: The leading pioneers involved in the market are readily expanding their product portfolios through exclusive drug developments and strategic partnerships. In this regard, Boehringer Ingelheim and Eli Lilly and Company in September 2023 jointly announced that the U.S. FDA approved their Jardiance (empagliflozin) 10 mg tablets for treating adults with chronic kidney disease. They further highlighted that this is the first-ever SGLT2 inhibitor to demonstrate a significant reduction in both first and recurrent hospitalizations in CKD patients, thus benefiting the overall market.

Global Diabetes Prevalence by Region (2024)

|

Region |

Number of Diabetes Cases (Millions) |

|

North America and the Caribbean |

56 |

|

South and Central America |

35 |

|

Europe |

66 |

|

Middle East and North Africa |

85 |

|

South-East Asia |

107 |

|

Western Pacific |

215 |

Source: International Diabetes Federation (IDF) Diabetes Atlas 2024

Revenue Opportunities for SGLT2 Inhibitors Manufacturers

|

Company |

Strategy Implemented |

Estimated Revenue Impact |

|

AstraZeneca |

Approval of Farxiga for additional indications |

Expansion of market reach and revenue generation |

|

Viatris Inc. |

Exclusive licensing agreement for sotagliflozin outside the US and Europe |

Expansion into global markets outside the US and Europe |

|

Lexicon Pharmaceuticals |

FDA approval of sotagliflozin for reducing cardiovascular death, heart failure |

Increased revenue from new cardiovascular and heart failure indications in the US market |

|

Alkem Laboratories |

Launch of generic empagliflozin (Empanorm) in India with ~80% price cut |

likely to increase revenue through affordability and scale |

Source: Company Official Press Releases

Challenges

-

Exacerbated therapeutic costs: The presence of inadequate reimbursements in developing economies and expensive drug costs remains a constant hurdle in the market. Besides, these drugs are generally excluded from national formularies, making it challenging for patients from price-sensitive regions to leverage them. Therefore, the existence of pricing restraint without any coverage of the market expansion remains extremely limited, thereby causing a major obstacle.

- Safety as a major concern: Despite the rapidly expanding demand, the market still faces risks in terms of safety concerns and regulatory warnings. This can be evidenced by the fact that these inhibitors are often and very rarely associated with mild effects such as diabetic ketoacidosis, urinary tract infections, and genital infections. Therefore, the existence of these concerns has led to a negative impact on prescriber confidence, ultimately slowing down uptake, especially in primary care settings.

SGLT2 Inhibitors Treatment Market: Key Insights

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

7.7% |

|

Base Year Market Size (2025) |

USD 20.7 billion |

|

Forecast Year Market Size (2035) |

USD 40.3 billion |

|

Regional Scope |

|

SGLT2 Inhibitors Treatment Market Segmentation:

Indication Segment Analysis

Based on the indication type 2 diabetes segment is projected to garner the largest revenue share of 68.6% in the SGLT2 inhibitors treatment market during the forecast period. The growing disease burden and the notable benefits demonstrated by these SGLT2 inhibitors make the subtype dominant in this sector. As per a DRWF article published in April 2025 Horizon Europe programme dedicated a total of €6.99 million is a large-scale, seven-year clinical trial evaluating the long-term effects of dapagliflozin on cardiovascular and kidney health in over 3,000 high-risk hypertension patients across 53 centres in Europe. This continuous research further strengthens their position in this field.

Distribution Channel Segment Analysis

In terms of distribution channel hospital pharmacies segment is expected to attain a significant share of 60.5% in the SGLT2 inhibitors treatment market during the discussed time frame. The ability of these settings to deliver specialty care and manage high-risk patients allows them to secure higher capital influx through most prescriptions. The NIH study in June 2022 observed that a survey of 348 community pharmacists revealed moderate knowledge about SGLT2 inhibitors, with about one-third aware of their blood pressure-lowering effects and proper patient counseling. Besides, nearly half reported receiving 1 to 5 prescriptions monthly, with patients generally giving positive feedback, hence a wider segment scope.

Drug Segment Analysis

Based on the drug, the empagliflozin segment is expected to grow at a considerable rate, with a share of 52.7% in the SGLT2 inhibitors treatment market by the end of 2035. The growth in the segment originates from efficacious cardiovascular and renal outcomes offered in treating CKD. As per a May 2023 NIH article, the subtype displays efficacy in glycemic control backed by the landmark EMPA-REG OUTCOME trial, which was the first SGLT2 inhibitor approved to reduce cardiovascular death, boosting its clinical value and market adoption. The study further stated that its utility as monotherapy or in fixed-dose combinations enhances patient adherence, hence allowing greater market penetration.

Our in-depth analysis of the SGLT2 inhibitors treatment market includes the following segments:

|

Segment |

Subsegments |

|

Indication |

|

|

Distribution Channel |

|

|

Drug |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

SGLT2 Inhibitors Treatment Market - Regional Analysis

North America Market Insights

North America is projected to hold the largest revenue share of 35.8% in the global SGLT2 inhibitors treatment market by the end of 2035. The region’s proprietorship in the field is attributed to the rising disease burden, regulatory advantages, and the presence of notable manufacturers. For instance, in June 2024, Astrazeneca notified that the U.S. FDA approved its Farxiga (dapagliflozin) for treating paediatric type-2 diabetes in patients aged 10 and above. It further underscored that the approval was based on the T2NOW Phase III trial, which expands Farxiga’s use from adults to children, hence denoting a positive market outlook.Canada has gained enhanced exposure in the market due to the increasing adoption of advanced therapies for managing the burden of chronic diseases. The country is a hub of innovative drugs, wherein both national and international entities are exhibiting significant growth potential. Health Canada also plays a major role in the country’s market, wherein the article from NIH in March 2024 revealed that Health Canada has approved four SGLT2 inhibitors called ertugliflozin, dapagliflozin, canagliflozin, and empagliflozin), with three currently marketed and five fixed-dose combinations. It also underscored that CADTH recommends reimbursement with conditions for almost all SGLT2 inhibitors except ertugliflozin in type 2 diabetes, and for dapagliflozin/empagliflozin in heart failure.

APAC Market Insights

Asia Pacific is likely to showcase rapid upliftment in the market owing to the increasing medical awareness, expanding healthcare infrastructure, and enhanced access to advanced therapies. Besides the countries such as China, India, and Japan dominate the regional market, supported by the existence of huge pharmaceutical firms. For instance, in February 2021, Taisho Pharmaceutical Co., Ltd., notified that it had submitted an application to Japan’s Ministry of Health, Labour and Welfare for approval to manufacture and market orally disintegrating films of its SGLT2 inhibitor drug, Lusefi. It was initially approved and launched in tablet form for treating type 2 diabetes, hence allowing a steady cash influx.

China is augmenting its leadership in the market due to the massive government support and domestic manufacturing capabilities. There has been a wider adoption of these inhibitors in the country, providing an encouraging opportunity for the domestic pioneers. For instance, in February 2024, the country’s National Medical Products Administration (NMPA) recently accepted Ganagliflozin Proline Tablets, an innovative SGLT2 inhibitor by Huisheng Pharmaceutical. The drug also offers an additional option for adult patients with type 2 diabetes to better control blood sugar, either alone or combined with metformin, hence a positive market outlook.

India is actively participating in the market, primarily propelled by large patient pools and growing adoption of these therapeutics. The country also benefits from the increasing government initiatives that are extensively striving to improve diabetes care. As of August 2025, data from MOH&FW through the NP-NCD program under the National Health Mission have implemented extensive initiatives to combat diabetes. The initiative includes the establishment of over 743 District NCD Clinics and 6,237 Community Health Center NCD Clinics to provide accessible care and early diagnosis. The program also focuses on financial support for diabetes medications and glucometers, thereby enhancing care in the country.

Europe Market Insights

Europe is projected to retain its position as the second most critical player in the SGLT2 inhibitors treatment market during the discussed timeframe. The growth in the region is heavily propelled by the endorsements by the clinical guidelines, which extensively support their use, especially among patients at high risk of heart failure and chronic kidney disease. Besides, the regulatory landscape is remarkably emerging with continued indications, thereby allowing broader adoption. Meanwhile, the innovations in terms of combination therapies are productively shaping the market, thereby positioning Europe at the forefront to generate revenue in this sector.

The U.K. is representing strong growth in the SGLT2 inhibitors treatment market, largely owing to the increasing awareness of the drug benefits and rising diabetic patient population. The country has become a targeted landscape for global investors, propelling a favorable business environment. For instance, in February 2025, Biocon Limited introduced a GLP-1 peptide, Liraglutide, for diabetes and obesity in the country, which will be marketed under the brand names Liraglutide Biocon for diabetes (Victoza) and Biolide for weight management (gSaxenda). Therefore, this launch complements and expands diabetes treatment options, potentially boosting the overall market growth.

France also holds a strong position in the SGLT2 inhibitors treatment market due to the extensive research ecosystem that encourages the development of new combination therapies. The guidelines by the country’s healthcare authorities support the use of SGLT2 inhibitors, which have helped drive adoption in both primary and specialized care settings. In June 2024, Insulet Corporation launched its Omnipod 5 automated insulin delivery system in the country, which is compatible with the Dexcom G6 continuous glucose monitor. The launch marks the first availability of the tubeless insulin pump system in the market of France, hence encouraging more integrated, personalized treatment approaches, ultimately supporting market growth

Key SGLT2 Inhibitors Treatment Market Players:

- AstraZeneca

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Boehringer Ingelheim

- Eli Lilly

- Johnson & Johnson (Janssen)

- Merck & Co. (MSD)

- Sanofi

- Novo Nordisk

- Pfizer

- Lupin

- Sun Pharmaceutical

- Cipla

- LG Chem

- Hanmi Pharmaceutical

- CSL Limited

- Hikma Pharmaceuticals

- Pharmaniaga

The worldwide market is thoroughly controlled by the leading pioneers AstraZeneca, Boehringer Ingelheim, and Eli Lilly, who are emphasizing cardiorenal indication expansions. The profitable collaborations, geographic expansion, and R&D emergence are certain fueling factors for this landscape to display significant upliftment. Besides the Japan-based players such as Mitsubishi Tanabe and Daiichi Sankyo, which are leading in the domestic dynamics, whereas generic firms such as Lupin and Sun Pharma are driving affordability in emerging economies, hence creating an optimistic market opportunity.

Below is the list of some prominent players operating in the global market:

Recent Developments

- In May 2025, Mitsubishi Tanabe Pharma Corporation notified that its subsidiary, Mitsubishi Tanabe Pharma (Thailand) Co., Ltd., had successfully begun marketing for CANAGLU Tablets 100mg, an SGLT2 inhibitor, in Thailand that is proven to lower blood glucose by promoting glucose excretion.

- In July 2023, Daewoong Pharmaceutical stated that it received approval for Envlomet SR Tab., which is a combination of enavogliflozin, an SGLT2 inhibitor, and metformin hydrochloride, in South Korea as an addition to diet and exercise for improving blood glucose control in type 2 diabetes patients.

- Report ID: 3972

- Published Date: Aug 19, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

SGLT2 Inhibitors Treatment Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.