Network Emulator Market Outlook:

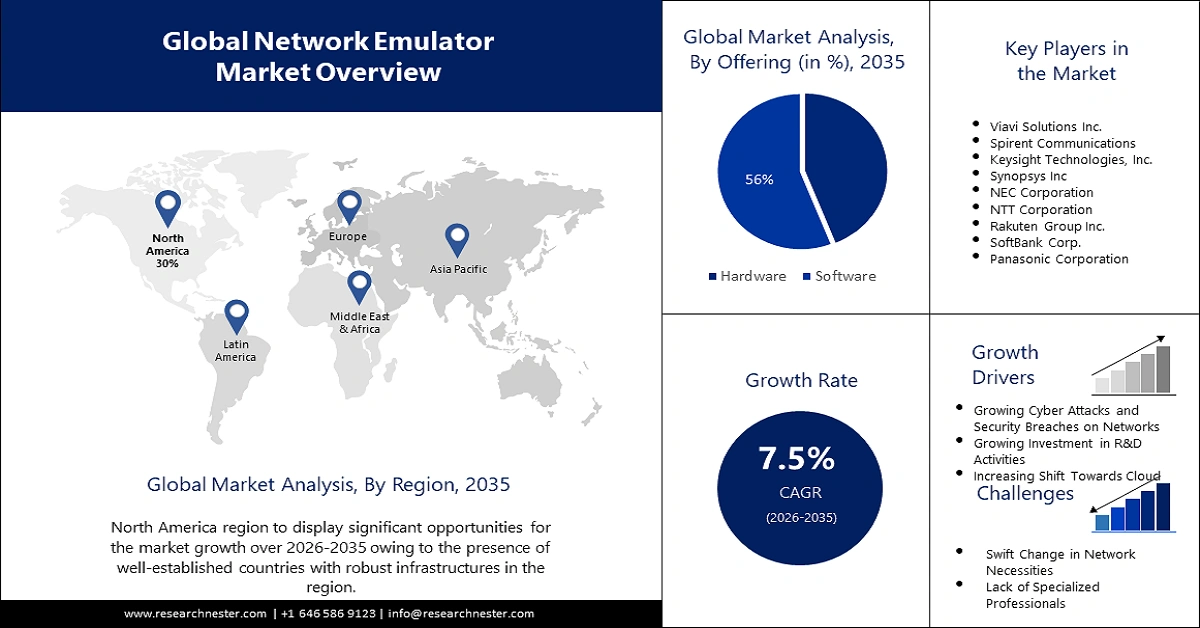

Network Emulator Market size was over USD 318 million in 2025 and is poised to exceed USD 655.41 million by 2035, growing at over 7.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of network emulator is estimated at USD 339.47 million.

The ongoing development of networking technologies, such as edge computing, 5G, and the Internet of Things, makes comprehensive testing essential to guaranteeing their compatibility and performance. As per a report, it is anticipated that there will be almost 30 billion IoT devices in use worldwide by 2030. Network emulators provide a way to test and reproduce these complex situations, which guarantees the smooth operation of new technologies in practical settings.

Network emulators are crucial because they provide a means of simulating and assessing these complex relationships, aiding researchers and developers in identifying potential issues and refining solutions prior to implementation.

Key Network Emulator Market Insights Summary:

Regional Highlights:

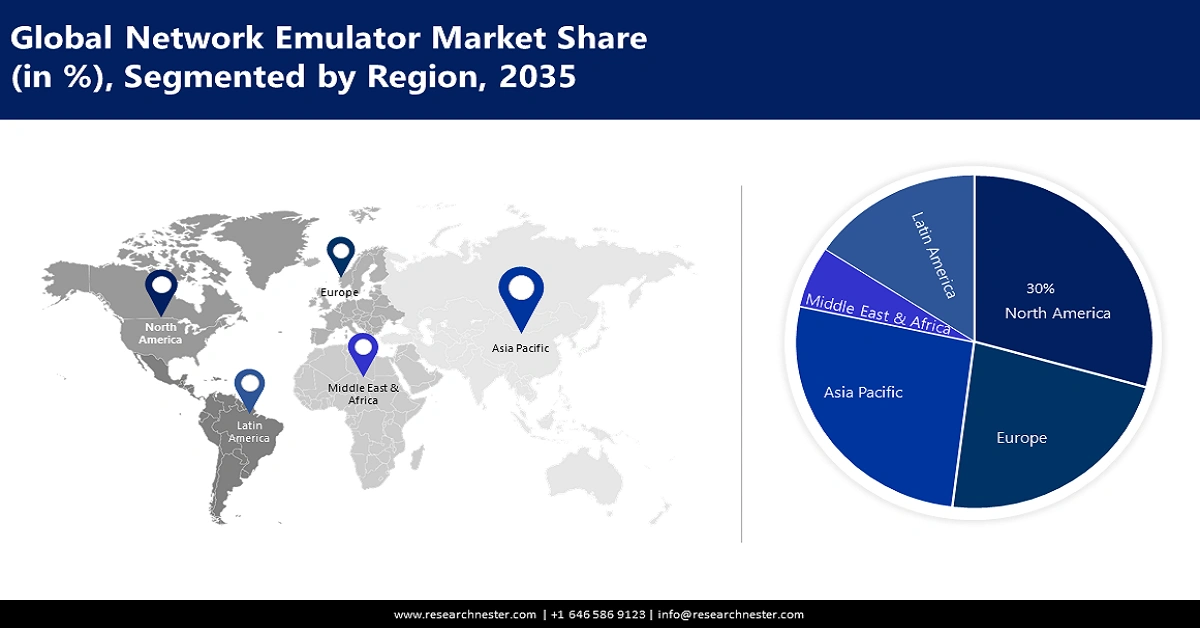

- The North America network emulator market will dominate more than 30% share by 2035, driven by robust infrastructure and investments in IT and telecom technologies.

- The Asia Pacific market will capture a significant share by 2035, attributed to rising security spending and technological advancements.

Segment Insights:

- The software segment in the network emulator market is expected to experience substantial growth through 2035, driven by software-based emulators' ease of setup, scalability, and cost-effectiveness.

- The telecommunication segment in the network emulator market is expected to witness robust growth through 2035, driven by adoption of next-generation networks and increased demand for bandwidth.

Key Growth Trends:

- Growing Cyber Attacks and Security Breaches on Networks

- Growing Investment in R&D Activities and Technological Advancements

Major Challenges:

- High Cost of Network Testing and Emulators

- Swift Change in Network Necessities may Hamper the Market Growth

Key Players: Anritsu Corporation, Viavi Solutions Inc., Spirent Communications, Keysight Technologies, Inc., Synopsys Inc., NEC Corporation, NTT Corporation, Rakuten Group Inc., SoftBank Corp., Panasonic Corporation.

Global Network Emulator Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 318 million

- 2026 Market Size: USD 339.47 million

- Projected Market Size: USD 655.41 million by 2035

- Growth Forecasts: 7.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (30% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Japan, Singapore, South Korea

Last updated on : 11 September, 2025

Network Emulator Market Growth Drivers and Challenges:

Growth Drivers

- Growing Cyber Attacks and Security Breaches on Networks - The importance of reliable network performance and security testing is highlighted by the growing number of cyber-attacks and intrusions, which are being caused by rapidly adopting Digital solutions and connected devices. To avoid cybercrime, proper testing becomes necessary in view of the potential for product vulnerabilities. The role of Network Emulators is crucial as they provide virtual testing environments in a variety of circumstances to ensure the security of networks and devices. With this capability, enterprises are empowered to diagnose, optimize performance, and design reliable networks. The strong role of network emulators in strengthening safety and combating cyber-attacks is becoming a powerful driving force for their broad deployment as threats become more severe. In light of this, the market is estimated to grow significantly.

- Growing Investment in R&D Activities and Technological Advancements - Demand for mobile data and services will be increased by the evolution of 5G technology. The demand for high-speed machine-to-machine communication in the industrial sector will receive a major boost and there will also be increased demand for wide-area network coverage. Network testing instruments and emulators worldwide will also have a great opportunity to take advantage of this. The development and deployment of 5G wireless networks and devices are expected to take place in several key countries, such as the US, United Kingdom, Japan, and China by 2024. This would make it necessary to establish an infrastructure capable of providing connectivity services in extreme weather conditions, leading to significantly increased cell phone subscriber numbers. The network companies and communication service providers, CSPs, are investing heavily in network solutions.

- Rapid Shift Towards Cloud-based Infrastructure - Cloud Based Network Emulators are becoming popular as a flexible and economical tool for performing tests and network functionality assessment, which may also be easily linked with other cloud-based applications such as Continuous Integration Services or continuous delivery of CICD in order to enable software-driven evaluation and certification.

Challenges

- High Cost of Network Testing and Emulators - The requirements of emulators vary from type to type of network setup. The type of emulators used in network testing shall be software and hardware emulators. The costs associated with implementing and installing both emulators are considerable. The end users in the network testing ecosystem are very sensitive to prices and tend to choose less expensive emulators. In order to improve their test capabilities and reduce the number of devices, emulator vendors need help. However, increased test capability is accompanied by a substantial price that the end user companies do not often be able to afford.

- Swift Change in Network Necessities may Hamper the Market Growth

- Lack of Specialized Professionals may Hinder the Growth of the Market

Network Emulator Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

7.5% |

|

Base Year Market Size (2025) |

USD 318 million |

|

Forecast Year Market Size (2035) |

USD 655.41 million |

|

Regional Scope |

|

Network Emulator Market Segmentation:

Offering Segment Analysis

Network emulator market from the software segment is expected to hold the largest share of 56% during the projected period. This emulator provides validation, quality assurance, and development facilities that lead to the earliest identification of issues and optimum performance. Software-based network emulators allow enterprises to test and optimize their networks, under a series of scenarios that enable them to detect possible problems and ascertain optimum functioning through the creation of simulated network environments. In addition, software-based emulators have the potential to be useful for research and training because their setup is fairly easy with a lot of benefits in terms of scalability and cost effectiveness.

Vertical Segment Analysis

The telecommunication segment in the network emulator market is poised to account for a share of 45% by the end of 2035. Operators that adopt next-generation networks for innovation services are having a positive impact on the telecommunications sector's growth in market. For the integration of voice, data, or broadband services that serve their customers' needs they want to establish an integrated and customer-centric all-IP platform. The proliferation of devices, such as mobile phones and tablets for which there is a demand for increased bandwidth has led to this transformation. According to an estimation, 68% of people globally used smartphones by the end of 2022. Operators optimize the networks through the constant allocation of resources with a view to capacity and costs. Network Emulators are a crucial element in helping operators test, manage, deploy, and re-deploy their networks in a controlled environment because they replicate actual network scenarios. In order to ensure that services are in line with the market's dynamic and that demand for connectivity grows, these instruments aim to ensure optimal performance.

Our in-depth analysis of the global network emulator market includes the following segments:

|

Offering |

|

|

Application |

|

|

Vertical |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Network Emulator Market Regional Analysis:

North American Market Insights

North America industry is expected to hold largest revenue share of 30% by 2035. The region comprises well-established countries with robust infrastructures, which is consequently driving the demand for network emulator solutions. Strong economies that support investment in technology are benefiting the main contributors, such as the US and Canada. This dominance has been created by their well-established industries, which make it possible to invest in state-of-the-art IT infrastructures and thus provide opportunities for adopting network emulators. Technological developments, such as 5G and 4G, encourage telecommunications providers in the region to integrate network emulators across layers of networks. Also, increasing research and development activities in the region are driving the growth of the market.

APAC Market Insights

Asia Pacific is anticipated to hold significant share of the global network emulator market by 2035. The region is observing an increase in security spending as a result of changing threat environments. The market growth is driven in the region due to technological advancements and efficient government regulations. Also, the market is expanding in the region due to the adoption of new technologies, GDP increases, and strong economic development. Growing rivalry forces businesses to improve customer service as industrialization picks up speed, which boosts possibilities for regional growth. Moreover, the region is expecting a surge in investments and technology breakthroughs across a variety of industrial verticals because of the growing demand for network emulators that are backed and driven by the cloud.

Network Emulator Market Players:

- Anritsu Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Viavi Solutions Inc.

- Spirent Communications

- Keysight Technologies, Inc.

- Synopsys Inc

Recent Developments

- The first and only O-RU (Radio Unit) test solution that leverages application layer testing with any commercial device was introduced in June 2023 by NI and Spirent Communications. This solution offers thorough, real-time O-RU validation. With this special feature, clients can validate their systems more quickly, in a real-world setting, and for less money—all with one powerful validation solution.

- The world-renowned technology company Keysight Technologies, Inc., which provides cutting-edge design and validation solutions to hasten innovation for global connectivity and security, has unveiled the release of its new E7515R solution, which is built on its 5G Network Emulation Solutions platform. This simplified network emulator is intended for protocol, radio frequency (RF), and functional testing of all cellular Internet of Things (CIoT) technologies, including RedCap.

- Report ID: 5426

- Published Date: Sep 11, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Network Emulator Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.