Net Zero Energy Buildings Market Outlook:

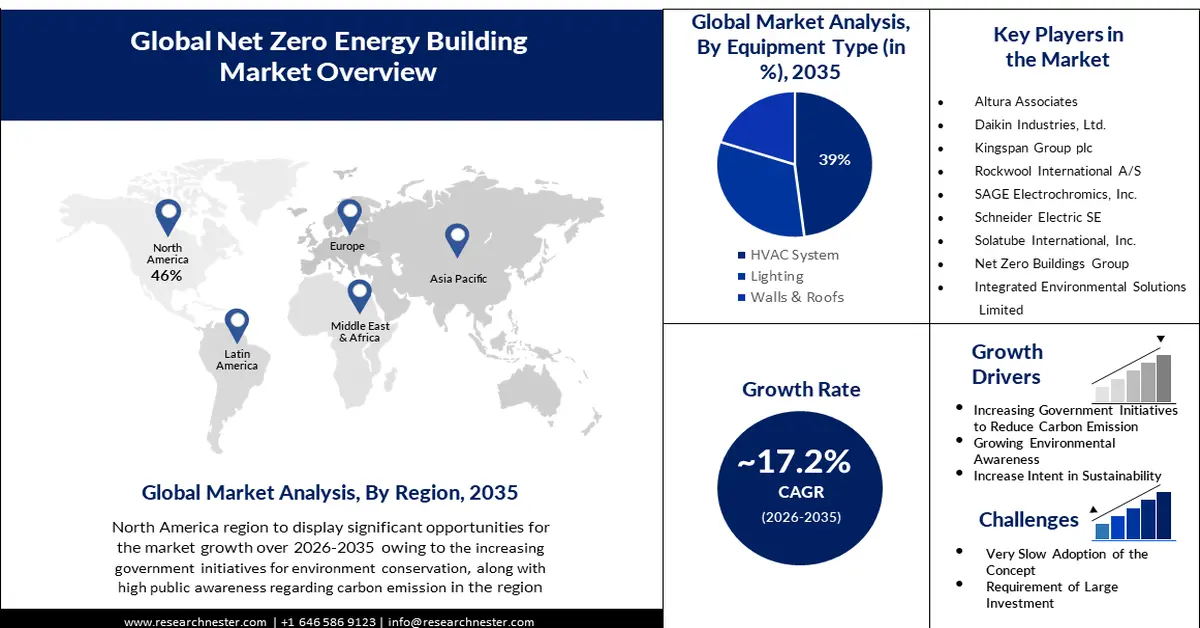

Net Zero Energy Buildings Market size was valued at USD 60.21 billion in 2025 and is set to exceed USD 294.4 billion by 2035, registering over 17.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of net zero energy buildings is evaluated at USD 69.53 billion.

The rapid urbanization across the globe, expansion of the building and construction sector and high energy requirements in modern buildings and infrastructure have raised concerns about energy consumption and environmental degradation. To cater to these issues, several nations and governments are focused on developing net zero energy buildings that use a combination of energy efficiency and renewable energy. These buildings offer several benefits, including reduced energy costs and environmental impact, enhanced energy security as well as increased comfort for occupants. According to the United Nations report, China, the U.S., and India have set ambitious net-zero targets for 2050. For this, the global warming needs to be under control and emissions to be reduced to 45% by 2030. This has resulted in growing inclination towards green buildings and net zero energy solutions.

The energy prices worldwide are rapidly increasing due to geopolitical instability, supply and demand imbalance. This has encouraged construction businesses and home owners to shift to financially viable solutions, including net zero energy buildings. These energy efficient buildings depend on renewable energy solutions such as solar, wind, and battery storage to reduce energy consumption through smart systems, lowering monthly bills. In July 2021, Johnson Controls launched OpenBlue Net Zero Buildings as a Service to provide a one-stop solution for companies willing to achieve net zero carbon and renewable energy goals.

Key Net Zero Energy Buildings Market Insights Summary:

Regional Highlights:

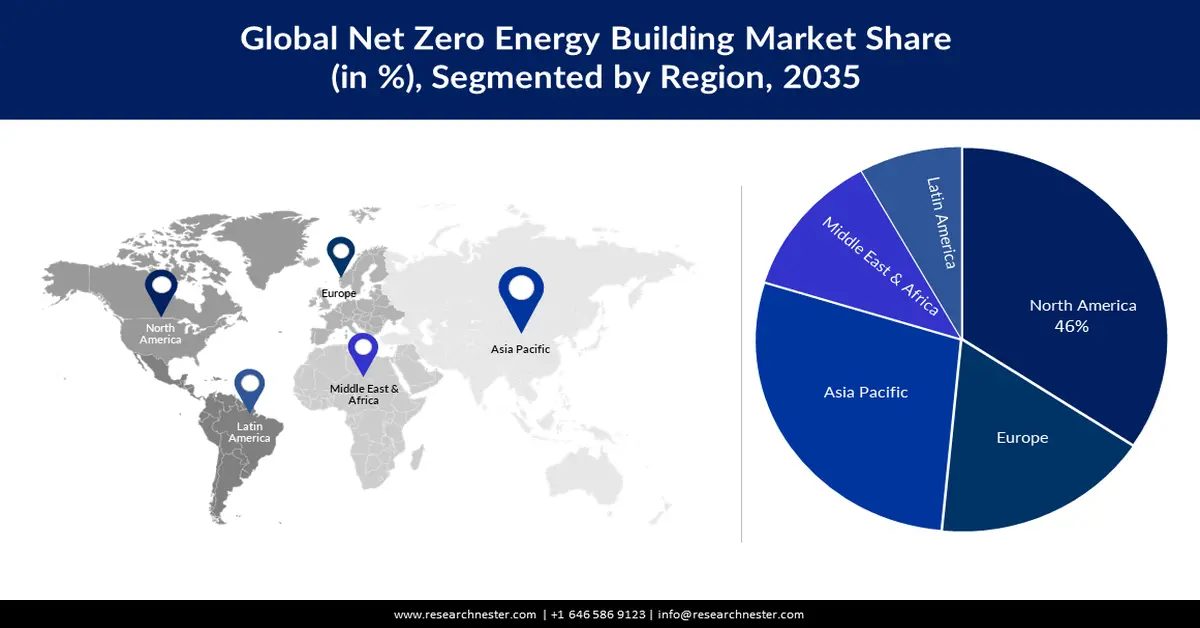

- North America is projected to command a 46% share by 2035 in the Net Zero Energy Buildings Market, propelled by expanding government-led sustainability initiatives and rising consumer preference for energy independence.

- Asia Pacific is anticipated to grow rapidly during 2026–2035, supported by strong environmental awareness and accelerated adoption of sustainable construction technologies across major economies.

Segment Insights:

- The solar energy segment is expected to secure a 58% share by 2035 in the Net Zero Energy Buildings Market, driven by the abundance of sunlight, ease of panel installation, and supportive subsidy programs.

- The HVAC systems segment is set to capture a 39% share by 2035, underpinned by the adoption of high-efficiency climate-control technologies that enhance indoor air quality while minimizing greenhouse gas emissions.

Key Growth Trends:

- Increasing government initiatives to reduce carbon emissions

- Increasing intent in energy efficient and sustainability

Major Challenges:

- Slow adoption of the concept

- Technological integration challenges

Key Players: Daikin Industries, Ltd., Kingspan Group plc, Rockwool International A/S, SAGE Electrochromics, Inc., Schneider Electric SE, Siemens AG, Solatube International, Inc.

Global Net Zero Energy Buildings Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 60.21 billion

- 2026 Market Size: USD 69.53 billion

- Projected Market Size: USD 294.4 billion by 2035

- Growth Forecasts: 17.2%

Key Regional Dynamics:

- Largest Region: North America (46% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, Australia, Brazil, South Korea, United Arab Emirates

Last updated on : 19 November, 2025

Net Zero Energy Buildings Market - Growth Drivers and Challenges

Growth Drivers

-

Increasing government initiatives to reduce carbon emissions: Net zero energy buildings require little energy which can be produced using renewable sources such as solar and wind energy. With the rise in population, the carbon emission rate is increasing gradually, leading to various environmental changes. As a result, several governments have introduced various initiatives to reduce carbon emissions. For instance, The European Union’s 2023 revision of the Energy Performance of Buildings Directive (EPBD) objective is to achieve a neutral climate in the construction sector by 2050 by involving zero emissions for all new buildings that are being constructed for the public sector from 2026. Moreover, the governments are providing tax credits, grants and subsidies for net zero construction projects to encourage adoption.

-

Increasing intent in energy efficient and sustainability: Sustainable development is a strategy that doesn’t compromise the environment’s quality for future generations. As a result, net zero buildings are becoming more popular and can serve this purpose successfully. Many organizations and enterprises are focused on retrofitting older buildings. For instance, the European Commission has introduced the Renovation Wave initiative for public and private buildings as a key initiative to drive energy efficiency, improve quality of life, and cut emissions by increasing house renovations across the EU.

Challenges

-

Slow adoption of the concept: One of the major challenges expected to hamper the adoption of net zero buildings is the low awareness among people about the advantages of net zero buildings and efficient energy use. Despite increasing discussion on sustainability, many potential tenants, and homeowners do not understand the benefits or feasibility of net zero buildings.

-

Technological integration challenges: The integration of advanced technologies such as IoT, energy storage, or automated building controls is complex and can add up the overall costs. In addition, different building components such as solar, HVAC, and sensors might lack seamless compatibility, resulting in restrained net zero energy buildings market growth.

Net Zero Energy Buildings Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

17.2% |

|

Base Year Market Size (2025) |

USD 60.21 billion |

|

Forecast Year Market Size (2035) |

USD 294.4 billion |

|

Regional Scope |

|

Net Zero Energy Buildings Market Segmentation:

Energy Source (Solar Energy, Biogas)

The solar energy segment is predicted to account for 58% share of the global net zero energy buildings market by 2035. Net-zero buildings require energy generation, and solar is the most feasible option for generating energy. Installation of solar panels can significantly reduce carbon emissions with low energy costs. Power generation technologies using renewable sources of energy can reduce carbon emissions, solar energy has more potential than biogas to produce energy. In addition, the abundance of sunlight, ease of installing solar panels, and government subsidies on solar panels are estimated to boost the segment growth. According to the International Energy Agency, solar electricity accounts for 4.5% of the world's total electricity production and is the third largest source of renewable electricity.

Equipment Type (HVAC System, Lighting, Walls & Roof)

The HVAC systems segment is predicted to account for a 39% share of the global net zero energy buildings market by 2035. HVAC systems regulate humidity, temperature, and airflow to ensure a healthy indoor atmosphere. Modern air, filtration, ventilation, and monitoring technologies are included in HVAC systems in zero-energy buildings to ensure optimal air quality and comfort for occupants. Furthermore, government and regulatory agencies are using a high energy efficiency setup for building construction which includes an HVAC system that is resulting in less emission of greenhouse gases. According to the Building Energy Codes Program, the share of HVAC systems in the building’s total energy ranges from 23.8% to 72.9%, depending on the HVAC selection and climate zone. In June 2024, Brandix became Shri Lanka-based business to join net zero carbon buildings commitment offering zero energy buildings with advanced and energy efficient HVAC systems and air compressors.

Our in-depth analysis of the global net zero energy buildings market includes the following segments:

|

Energy Source |

|

|

Equipment Type |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Net Zero Energy Buildings Market - Regional Analysis

North America Market Analysis

North America net zero energy buildings market is expected to dominate majority revenue share of 46% by 2035, owing to the increasing government initiatives for environment conservation, along with high public awareness regarding carbon emission. Furthermore, the increasing preference to become energy-independent due to growing energy costs has led to a fast adoption of solar energy combined with energy storage devices in the region.

The net zero energy buildings market in the U.S. is rapidly expanding due to stringent energy codes and government regulations, rising energy costs and advancements in building technologies. The American Society of Heating, Refrigerating, and Air-Conditioning Engineers (ASHRAE), published a report in 2023 mentioning the standard operations for zero net energy and zero net carbon standards for buildings operations. This has created an awareness among companies and building owners, encouraging them to switch to zero energy buildings. Moreover, presence of major market players in the country and the adoption of advanced technologies such as super insulate and seal, energy-efficient appliances, and using green construction technology are projected to fuel the regional market growth.

APAC Market Analysis

The Asia Pacific net zero energy buildings market is expected to register rapid growth during the forecast period owing to rising environmental awareness, supportive government policies, and high adoption of sustainable construction technologies. Countries such as China, Japan and Australia have introduced mandatory energy efficiency standards and are leading the green building infrastructure development and plans. For instance, according to U.S. Green Building Council (USGBC), in 2023, China ranked first on its op 10 Countries and Regions for LEED Green Building in 2023. The ranking highlights countries and regions outside the U.S. which are making significant efforts to developing healthy and sustainable buildings.

Rapid urbanization and infrastructure developments in India and expansion of renewable energy is expected to support net zero energy buildings market growth in the country. Moreover, India is planning to accomplish net zero by 2070 and for this, the Union Minister of Environment, Forest and Climate Change declared in February 2023, that the country is focused on cutting down carbon emissions by 45% by 2030. This can only be achieved by focusing on the development of net zero energy buildings infrastructure.

Net Zero Energy Buildings Market Players:

- Altura Associates

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Daikin Industries, Ltd.

- Kingspan Group plc

- Rockwool International A/S

- SAGE Electrochromics, Inc.

- Schneider Electric SE

- Siemens AG

- Solatube International, Inc.

- Net Zero Buildings Group

The net zero energy buildings industry has the presence of several key companies that are seeking to capitalize on the emerging net zero trend. They are capitalizing on supportive government initiatives to propel their product adoption. Some of the top strategies implemented by the market players are product launches, geographical expansions, R&D activities, and mergers and acquisitions.

Here is a list of several key players operating in the global net zero energy buildings market

Recent Developments

- In March 2024, Mahindra Group collaborated with Johnson Controls to launch the Net Zero Buildings Initiative offering essential resources and data to building owners and organizations and helping them create sustainable spaces.

- In April 2022, Mahindra Lifespaces announced its plans to launch India’s first-ever net zero energy homes in Bengaluru from 2030. The design is certified by the Indian Green Building Council (IGBC) and is expected to save over 18 lakh kWh of electricity annually.

- Report ID: 3673

- Published Date: Nov 19, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Net Zero Energy Buildings Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.