Nervous System Active Pharmaceutical Ingredients Market Outlook:

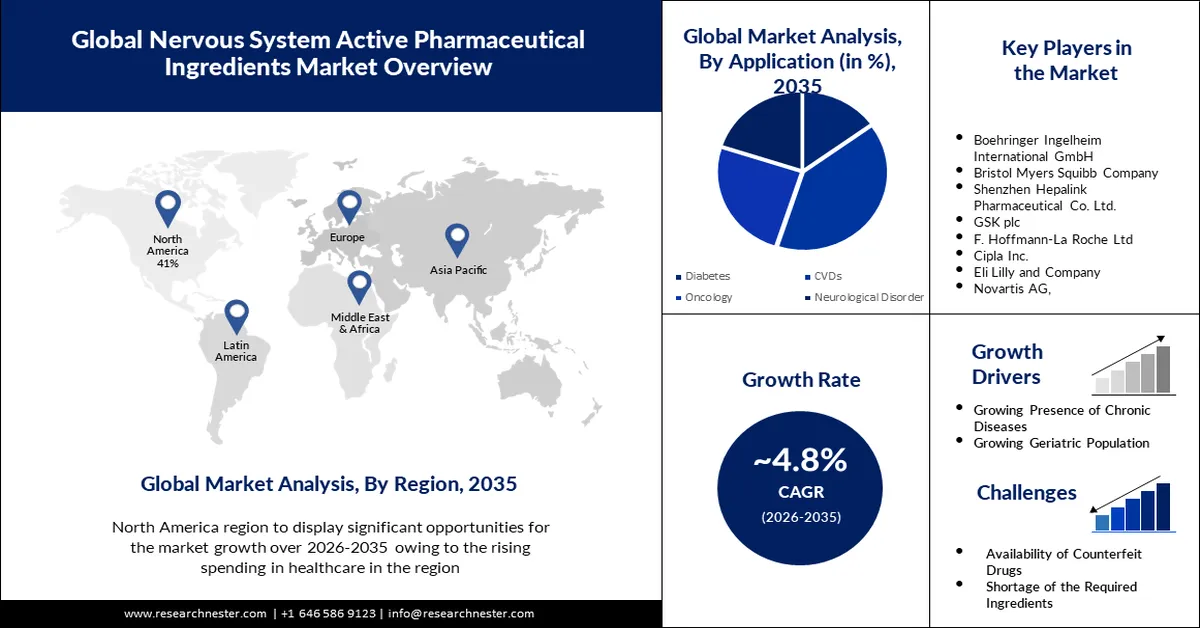

Nervous System Active Pharmaceutical Ingredients Market size was over USD 236.63 billion in 2025 and is projected to reach USD 378.17 billion by 2035, witnessing around 4.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of nervous system active pharmaceutical ingredients is evaluated at USD 246.85 billion.

The reason behind the growth is impelled by the growing presence of chronic diseases across the globe. This as a result is increasing the demand for active pharmaceutical ingredients as they are largely used to treat both acute and chronic pain.

The nervous system gets affected by several chronic disorders which necessitates the use of nervous system active pharmaceutical ingredients to help patients in managing these conditions. Every year, 17 million death take place globally owing to chronic diseases.

The growing geriatric population is believed to fuel the market growth. The elderly population is more prone to several neurological diseases such as Alzheimer’s, and Parkinson’s disease, and the rising number of elderly populations across the globe is estimated to drive market growth. Nervous system APIs help in managing the symptoms of these disorders and also help in pain management resulting from other age-related diseases. According to estimates, the number of individuals in the world who are 60 or older will rise to over 2 billion by 2050.

Key Nervous System Active Pharmaceutical Ingredients Market Insights Summary:

Regional Highlights:

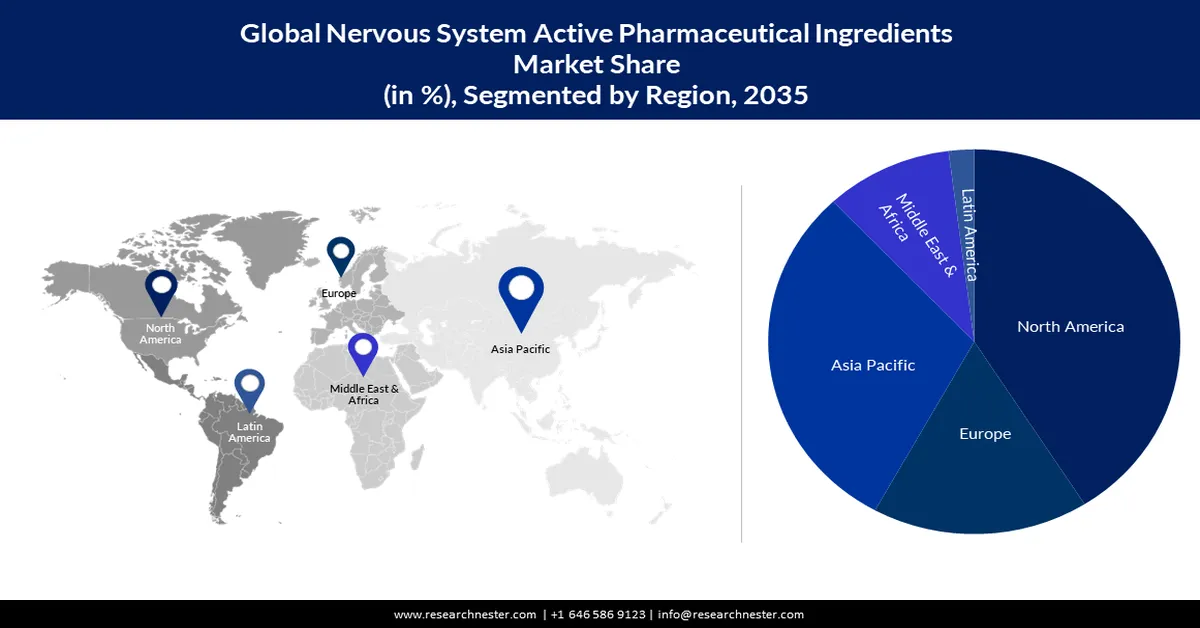

- Asia Pacific is projected to hold a 30% revenue share of the Nervous System Active Pharmaceutical Ingredients Market by 2035, driven by rising healthcare spending.

Segment Insights:

- The CVDs segment in the nervous system active pharmaceutical ingredients market is expected to capture a robust share by 2035, fueled by the growing demand for nervous system APIs used in effective cardiovascular treatments.

Key Growth Trends:

- Growing Popularity of Personalized Medicines

- Rising Focus on Mental Health

Major Challenges:

- Availability of Counterfeit Drugs

- Shortage of the Required Ingredients

Key Players: Pfizer, Inc., Boehringer Ingelheim International GmbH, Bristol Myers Squibb Company, Shenzhen Hepalink Pharmaceutical Co. Ltd., GSK plc, F. Hoffmann-La Roche Ltd, Cipla Inc., Eli Lilly and Company, Novartis AG, Teva Pharmaceutical Industries Ltd.

Global Nervous System Active Pharmaceutical Ingredients Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 236.63 billion

- 2026 Market Size: USD 246.85 billion

- Projected Market Size: USD 378.17 billion by 2035

- Growth Forecasts: 4.8%

Key Regional Dynamics:

- Largest Region: Asia Pacific (30% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Indonesia, Singapore

Last updated on : 21 November, 2025

Nervous System Active Pharmaceutical Ingredients Market - Growth Drivers and Challenges

Growth Drivers

-

Growing Popularity of Personalized Medicines- The healthcare system is paying more attention to precision medicine since it enables more individualized treatments. Nervous system active pharmaceutical ingredients are utilized in personalized medicine approaches, which is estimated to drive market growth.

-

Rising Focus on Mental Health- The pandemic also contributed to a greater focus on mental health, which has resulted in a rise in demand for mental health treatments including nervous system active pharmaceutical ingredients.

Challenges

-

Availability of Counterfeit Drugs– The availability of substandard counterfeit medicines is expected to hinder market growth during the forecast period. For instance, counterfeit drugs are available everywhere around the world and customers find them cost-effective and convenient.

-

Shortage of the Required Ingredients

- Lack of Awareness of Medication

Nervous System Active Pharmaceutical Ingredients Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

4.8% |

|

Base Year Market Size (2025) |

USD 236.63 billion |

|

Forecast Year Market Size (2035) |

USD 378.17 billion |

|

Regional Scope |

|

Nervous System Active Pharmaceutical Ingredients Market Segmentation:

Application (Diabetes, CVDs, Oncology, Neurological Disorder)

The CVDs segment is estimated to gain a robust market share in the coming years owing to the growing demand for nervous system APIs for effective treatments. Several nervous system active pharmaceutical systems are used to treat cardiovascular diseases, such as beta-blockers, and ACE inhibitors. Moreover, for the management of high blood pressure, ACE inhibitors and beta-blockers are utilized, and they are considered among the first-line treatment for heart failure and are highly successful in treating numerous cardiovascular illnesses. Moreover, in terms of decreasing blood pressure, (Angiotensin-converting enzymes) ACE inhibitors and beta-blockers are both equally effective since they can relax blood vessels in addition to reducing heart rate by blocking angiotensin-2.

Our in-depth analysis of the global market includes the following segments:

|

Product |

|

|

Application |

|

|

Expression System |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Nervous System Active Pharmaceutical Ingredients Market - Regional Analysis

Asia Pacific industry is predicted to account for largest revenue share of 30% by 2035, impelled by the rising spending in healthcare. This, as a result, helps the pharmaceutical companies in the region to allocate more resources for the development of new nervous system active pharmaceutical ingredients to combat several neurological and cardiovascular diseases.

Besides this, rising investment in healthcare may also enable the development of novel drug delivery systems in the region for neurological diseases which necessitates the usage of nervous system APIs. According to data, the US spends the most on healthcare, and in 2021, health expenditures in the United States rose by more than 2%.

APAC Market Statistics

The Asia Pacific nervous system active pharmaceutical ingredients market is estimated to be the second largest share of 30%, during the forecast timeframe led by low labor costs. For instance, owing to the availability of cheap labor in countries such as India and Indonesia results in increasing production capacity for nervous system active pharmaceutical ingredients which can lead to an increased demand for these APIs in both local and international markets.

Nervous System Active Pharmaceutical Ingredients Market Players:

- Pfizer, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Boehringer Ingelheim International GmbH

- Bristol Myers Squibb Company

- Shenzhen Hepalink Pharmaceutical Co. Ltd.

- GSK plc

- F. Hoffmann-La Roche Ltd

- Cipla Inc.

- Eli Lilly and Company

- Novartis AG,

- Teva Pharmaceutical Industries Ltd.

Recent Developments

- Boehringer Ingelheim International GmbH to partner with Carthronix, a biopharmaceutical company to develop therapies based on small molecules to cure diseases associated with elderly people. The research & development are further associated with small molecule therapeutics in canine oncology.

- F. Hoffmann-La Roche Ltd to acquire acceptance from FDA for its Biologics License Applications. The application is associated with untreated diffuse large B-cell lymphoma.

- Report ID: 4212

- Published Date: Nov 21, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Nervous System Active Pharmaceutical Ingredients Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.