Naval Combat System Market Outlook:

Naval Combat System Market size was valued at USD 53.9 billion in 2025 and is projected to reach USD 98.2 billion by the end of 2035, rising at a CAGR of 6.9% during the forecast period, i.e., 2026-2035. In 2026, the industry size of naval combat system is estimated at USD 57.6 billion.

There is an immense growth potential for the naval combat system market, highly influenced by fleet modernization, rising geopolitical tensions, and advancements in new technologies such as unmanned systems and directed-energy weapons. In this regard, the article published by Securing Defense-Critical Supply Chains in February 2022 states that the recommendation M1.5 emphasizes the need to track and prevent counterfeit microelectronics across defense supply chains. It also stated that the Department of Defense should leverage factor systems from the Naval Air Systems Command’s established counterfeit program to implement similar initiatives across all Military Services. Therefore, this approach will ensure consistent monitoring and reporting of counterfeit microelectronics within the supply system. Hence, it will also enhance reliability and operational readiness, strengthening the overall efficiency and resilience of the global naval combat system market.

Furthermore, the DOE research in August 2022 found that the forging industry was a vital supplier to the defense sector, which is producing high-strength, reliable components that are highly essential for naval combat systems. Simultaneously, the Department of Defense (DoD) has identified the casting and forging supply chain as a critical vulnerability, underscoring the challenges such as aging domestic infrastructure, unpredictable demand, and very complex contracting processes. Therefore, the DoD is developing a strategy to build resilience, which includes investing in the industrial base, exploring additive manufacturing for parts, and creating government-owned technical data to expand the supplier base and ensure competitive pricing for critical defense components, hence positively impacting the naval combat system market.

Key Naval Combat System Market Insights Summary:

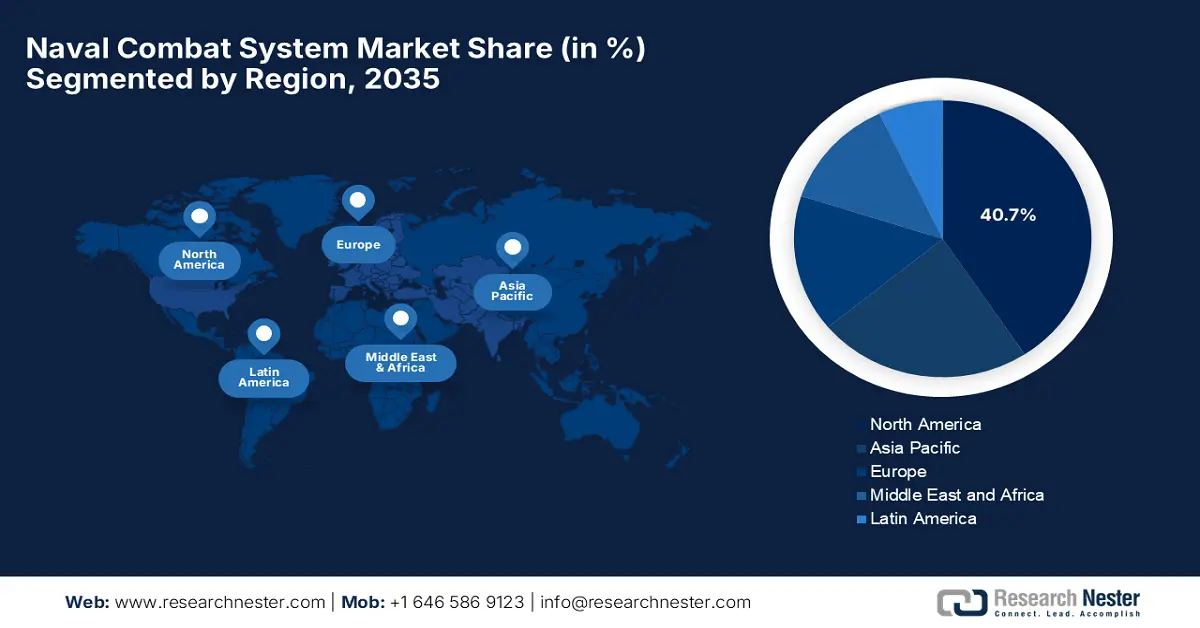

Regional Insights:

- North America is predicted to hold a 40.7% share by 2035 (due to the need to maintain technological superiority across surface, subsurface, and aerial domains).

- Asia-Pacific is exhibiting strong growth during the forecast period 2026–2035 (owing to escalating maritime security concerns and prioritization of modern warships and integrated combat platforms in the naval combat system market).

Segment Insights:

- Combat management systems category is projected to account for a 44.3% share during 2026–2035 (impelled by governments necessitating integrated decision-support systems that improve fleet coordination).

- Weapons integration systems is projected to capture a significant portion of the naval combat system market by 2035 (propelled by increased government programmes to modernize naval lethality and missile-launch capabilities).

Key Growth Trends:

- Increasing defense expenditure

- Modernization of aging naval fleets

Major Challenges:

- Counterfeit and substandard components

- Technological advancements

Key Players: BAE Systems plc (U.K.), Raytheon Technologies Corporation (U.S.), Thales Group (France), Northrop Grumman Corporation (U.S.), General Dynamics Corporation (U.S.), Leonardo S.p.A. (Italy), Saab AB (Sweden), L3Harris Technologies, Inc. (U.S.), Elbit Systems Ltd. (Israel), Kongsberg Gruppen ASA (Norway), Rheinmetall AG (Germany), DCNS / Naval Group (France), Huntington Ingalls Industries, Inc. (U.S.), Mitsubishi Heavy Industries, Ltd. (Japan).

Global Naval Combat System Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 53.9 billion

- 2026 Market Size: USD 57.6 billion

- Projected Market Size: USD 98.2 billion by 2035

- Growth Forecasts: 6.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40.7% Share by 2035)

- Fastest Growing Region: Asia-Pacific

- Dominating Countries: United States, Brazil, China, Norway, United Kingdom

- Emerging Countries: China, India, Singapore, South Korea, Japan

Last updated on : 5 December, 2025

Naval Combat System Market - Growth Drivers and Challenges

Growth Drivers

- Increasing defense expenditure: The growing military budgets both in established and emerging economies are fueling strong investments in advanced maritime warfare capabilities, thereby driving businesses in the naval combat system market. The rising preference for modern surface combatants, submarines, and integrated combat-system upgrades also facilitates growth in this sector. The data from SIPRI in April 2025 revealed that the global military expenditure reached USD 2,718 billion in 2024, which marks a 9.4% increase from 2023, the steepest rise since the end of the Cold War. The report also mentioned that this surge was largely driven by Europe and the Middle East, whereas the top five spenders U.S., China, Russia, Germany, and India, accounted for almost 60% of the worldwide total. Hence, this upward trend underscores growing investments in advanced naval and defense capabilities.

Military Expenditure Statistics (2024)

|

Country/Region |

Military Expenditure (USD Billion) |

% Change YoY |

% of Global Total |

|

U.S. |

997 |

5.7% |

37% |

|

China |

314 |

7.0% |

11.5% |

|

Russia |

149 |

38% |

5.5% |

|

Germany |

88.5 |

28% |

3.3% |

|

India |

86.1 |

1.6% |

3.2% |

|

Europe (total including Russia) |

693 |

17% |

25.5% |

|

Middle East (total) |

243 |

15% |

9% |

|

Global Total |

2,718 |

9.4% |

100% |

Source: SIPRI

- Modernization of aging naval fleets: Most of the navies are undertaking large-scale modernization programs to replace or upgrade legacy systems with advanced sensors, combat management software, missile-launch platforms, and electronic warfare solutions. This replacement cycle boosts demand in the integrated combat system market. In April 2024 the Australia’s Ministry of Defence reported that Australia, the U.K., and the U.S. have reaffirmed their commitment to the AUKUS partnership by advancing Australia’s acquisition of conventionally armed, nuclear-powered submarines under the Optimal Pathway. It also states that strategic industry partnerships with ASC Pty Ltd and BAE Systems will support submarine construction, sustainment, and a resilient trilateral supply chain. In addition, the rotational visits of UK and U.S. SSNs to Australia under submarine rotational force-west will enhance operational readiness and regional security in the Indo-Pacific.

- Shift toward multi-domain maritime operations: The modern naval

Missions require integration across cyber, surface, subsurface, and air domains, which is readily driving procurement of products from the naval combat system market. In September 2025, the U.S. Navy reported that its Maritime Industrial Base Program mentions the key achievements, which include modernizing production with enhanced manufacturing techniques, such as SUBSAFE-certified cold spray repairs on USS Virginia and components on USS Sampson, enhancing readiness while reducing maintenance time. Furthermore, by the end of 2028, the program aims to deliver one Columbia-class ballistic missile submarine and two Virginia-class attack submarines on a yearly basis, along with multiple surface ship classes, and a robust industrial base to sustain naval capabilities. In addition, the pending major arms orders, including combat aircraft, warships, and missile systems, indicate future naval and defense market trends among the world’s top exporters.

Selected Major Arms on Order or Preselected for Future Delivery After 2024, by Top 10 Exporting Countries

|

Major Arms |

U.S. |

France |

Russia |

China |

Germany |

Italy |

U.K. |

Israel |

Spain |

South Korea |

|

Combat aircraft |

996 |

214 |

71 |

57 |

– |

50 |

14 |

– |

– |

140 |

|

Combat helicopters |

342 |

3 |

13 |

– |

– |

26 |

– |

– |

– |

– |

|

Major warships |

7 |

22 |

4 |

10 |

26 |

8 |

29 |

– |

3 |

4 |

|

SAM systems |

41 |

– |

55+ |

– |

33+ |

– |

2 |

31+ |

– |

26 |

|

Tanks and fire-support vehicles |

403 |

– |

454 |

500 |

416 |

96 |

– |

19 |

– |

916 |

|

Other armoured vehicles |

1,706+ |

537 |

– |

2+ |

1,404+ |

1,865 |

– |

124+ |

517 |

626+ |

|

Artillery |

678+ |

251 |

– |

128+ |

72+ |

– |

– |

51+ |

– |

1,203+ |

Source: SIPRI

Challenges

- Counterfeit and substandard components: The prevalence of substandard microelectronics and other critical parts has been a major challenge to the upliftment of the naval combat system market to capture the estimated success. The utilization of low-quality components can reduce the operational performance, which can increase the maintenance costs and introduce security risks. Therefore, to ensure consistent authenticity necessitates tracking, verification, as well as testing protocols, which adds complexity and costs to procurement and production processes. This also necessitates counterfeit mitigation programs, making it challenging to scale across all nations for multiple suppliers and services. Hence, any failure to address these can reduce system effectiveness and create vulnerabilities that adversaries could exploit, hurting the market.

- Technological advancements: This is yet another challenge for the naval combat system market since these systems must integrate technologies such as radar, AI-based threat detection, and electronic warfare capabilities. Aligning with the technological evolution is quite challenging since research, development, and integration timelines are lengthy, whereas adversaries may deploy new capabilities even faster. Also, manufacturers need to balance innovation with system reliability, necessitating significant investment in R&D and workforce training. Simultaneously, the legacy platforms need to be upgraded to accommodate new technologies, which increases both complexity and cost. Furthermore, falling behind in technology adoption can diminish the growth of the naval combat system market.

Naval Combat System Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.9% |

|

Base Year Market Size (2025) |

USD 53.9 billion |

|

Forecast Year Market Size (2035) |

USD 98.2 billion |

|

Regional Scope |

|

Naval Combat System Market Segmentation:

Combat Management Segment Analysis

The combat management systems category is anticipated to lead the entire naval combat system market, capturing 44.3% of the total share during the forecast period. The dominance of the segment is effectively attributable to the governments that are necessitating integrated decision-support systems that improve fleet coordination. In September 2025, Thales announced that it had completed factory acceptance tests for both the mission system and TACTICOS combat management system on the Royal Navy’s Type 31 frigates, which marks a major milestone in the programme. It also stated that the CMS serves as the operational heart of the frigates, supporting sensor control, situational assessment, and weapon management, whereas the mission system ensures operational readiness. Furthermore, the programme will progress to land-based testing at the shore integration facility before installation on HMS Venturer, the first of five Type 31 Inspiration-class frigates.

Combat Systems Segment Analysis

By 2035, the weapons integration systems segment is projected to capture a significant portion of the naval combat system market. The segment’s growth is highly driven by increased government programs to modernize naval lethality and missile-launch capabilities. This also includes integrating missile-launch platforms, automated gun systems, and advanced fire-control solutions that can interface with radar, sonar, and electronic warfare networks. The demand is further fueled by the need for multi-layered defense architectures that are capable of countering emerging threats such as hypersonic missiles, swarm attacks, and asymmetric naval operations. In addition, continuous investments in R&D and public defense procurement programs are accelerating the adoption of these highly integrated weapons systems, solidifying their naval combat system market presence in the years ahead.

Sensors & Surveillance Segment Analysis

In terms of sensors & surveillance, the radar systems are expected to hold the commanding share in the naval combat system market over the discussed timeframe. The growth in the segment is highly subject to mandated enhancements in maritime domain awareness and long-range threat detection. In November 2025, HENSOLDT introduced TAERVUS, which is a cutting-edge electromagnetic warfare solution designed for integrated battlefield intelligence and electronic disruption. The system combines advanced radio direction finders, receivers, jammers, and HENSOLDT’s spectrum battle management suite to provide both COMINT (communications intelligence) and ELINT (electronic intelligence) capabilities across HF, VHF, UHF, and higher microwave bands. Hence, the firm allows users to gain rapid situational awareness and make faster tactical decisions, establishing a decisive information advantage on the modern battlefield, denoting a wider segment scope.

Our in-depth analysis of the naval combat system market includes the following segments:

|

Segment |

Subsegments |

|

Combat Management |

|

|

Combat Systems |

|

|

Sensors & Surveillance |

|

|

Application |

|

|

Platform |

|

|

Component |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Naval Combat System Market - Regional Analysis

North America Market Insights

North America is expected to hold a commanding share of 40.7% in the global naval combat system market by the end of 2035. The dominance of the segment is effectively attributable to the need to maintain technological superiority across surface, subsurface, and aerial domains. Simultaneously, the regional navies are focusing on integrating next-generation sensors, C4ISR systems, and autonomous platforms into existing fleets, driving consistent business in this field. In November 2025, the U.S. Navy announced that it had officially accepted the USS Cleveland (LCS 31), the 16th and final Freedom-variant littoral combat ship, from Fincantieri Marinette Marine, marking the completion of over two decades of construction and program efforts. It also stated that the ship will be commissioned in Cleveland, Ohio, and homeported in Mayport, Florida, supporting maritime security, sea control, and forward presence missions, hence making it suitable for overall naval combat system market growth.

The U.S. is the key growth engine for the naval combat system market in North America, which is primarily fueled by strong government investment in fleet modernization and innovation. In addition, programs emphasize integration of advanced missile defense systems, electronic warfare capabilities, and AI-enabled decision support within combat management systems. For instance, in June 2025, Leonardo DRS announced that it had been awarded a USD 41 million contract by the U.S. Naval Sea Systems Command to supply combat management system hardware for U.S. Navy surface ships, allied navies, and the U.S. Coast Guard. The contract also includes advanced operator consoles, displays, and peripherals supporting the AEGIS combat system and ship self-defense system, which are designed for interoperability and scalability across multiple platforms. Furthermore, the work will be performed at Leonardo DRS’s Johnstown, PA facility, reinforcing the firm’s role in enhancing multi-domain operational capabilities.

The naval combat system market in Canada is centered around fleet renewal and Arctic operations. Simultaneously, the upgrades to frigates and offshore patrol vessels are focusing on enhancing situational awareness, interoperability with allied forces, and anti-submarine warfare capabilities. In November 2025, the government of Canada announced a government-to-government contract with Germany’s Federal Office of Bundeswehr Equipment, Information Technology, and In-Service Support. The deal, valued at more than USD 1 billion and will equip the German Navy with Lockheed Martin Canada’s CMS 330 combat management system, originally developed for the Royal Canadian Navy’s Halifax-class frigates. Hence, this agreement also strengthens Canada’s defense industrial base, promotes exports, and fosters innovation, marking a major milestone in bilateral security and economic cooperation between Canada and Germany.

APAC Market Insights

The Asia-Pacific is exhibiting strong growth in the naval combat system market, facilitated by escalating maritime security concerns and regional power projection. Countries in this region are prioritizing modern warships, submarines, and integrated combat platforms to safeguard trade routes and territorial waters. UNSI in September 2022 disclosed that Japan’s Ministry of Defense plans to build two 20,000-ton Aegis ballistic missile defense destroyers, which are the largest warships in the JMSDF since World War II, to enhance missile interception and relieve the burden on existing Aegis destroyers. It also notes that each ship will accommodate 110 personnel with upgraded living quarters for extended deployments and be capable of operating in rough weather while countering advanced threats, including hypersonic glide weapons, hence making it suitable for overall naval combat system market growth.

China has captured the dominant position in the regional naval combat system market is owing to the modernization of the People’s Liberation Army Navy. Investments in the country are focusing on integrating advanced radar, sonar, and missile defense systems into new destroyers, frigates, and submarines. The country is also advancing autonomous systems, electronic warfare capabilities, and network-centric operations to strengthen maritime deterrence. For instance, in November 2025, as reported by News on Air, Taiwan detected nine military aircraft based in China, which are four naval vessels and two ships operating near its territorial waters, with two sorties crossing into its southwestern air defence identification zone. In this context, the Ministry of National Defence monitored the situation and responded, whereas these incursions coincided with the country’s announcement of live-fire missile exercises in the Yellow Sea, which highlighted rising security concerns in the region.

The increasing prioritization of modernization of its naval combat capabilities to address regional security challenges and safeguard the Indian Ocean is the key factor propelling growth in India’s naval combat system market. Ministry of Defense in May 2025 revealed that the DRDO and the Indian Navy successfully conducted combat firing of the indigenously developed Multi-Influence Ground Mine, significantly enhancing capabilities against modern stealth ships and submarines. It was developed by the Naval Science & Technological Laboratory with support from other DRDO labs, whereas production is handled by Bharat Dynamics Limited and Apollo Microsystems Limited. Furthermore, it also confirmed that following the successful trial, the system is ready for induction into the Indian Navy, strengthening the country’s undersea warfare capabilities, hence denoting a positive naval combat system market outlook.

Europe Market Insights

Europe has acquired a significant stake in the global naval combat system market over the analyzed timeframe. This rapid upliftment is propelled by a strong emphasis on interoperability and modernization of legacy fleets across NATO members. Investments in terms of target integrated combat management systems, electronic warfare suites, and multi-role sensor platforms to maintain competitiveness in high-intensity maritime operations. In June 2025, Saab announced that it had received an order from Denmark’s Defence Acquisition and Logistics Organisation for a Combat Training Centre. Therefore, the centre will include soldier and vehicle training systems, anti-tank and sniper weapons, communication systems, and exercise control software for after-action review. Furthermore, this project will provide Denmark with one of Europe’s most modern and flexible live military training facilities, thereby supporting operations at four designated sites.

Germany is maintaining a strong position in the regional naval combat system market due to its strong focus on upgrading frigates, corvettes, and submarines with command, control, and sensor systems. Also, the country’s participation in joint regional naval programs fosters technology sharing and collaborative development. In February 2025, Rheinmetall announced that it had been contracted by Germany’s Navy to deliver six VTAM simulation-based training systems across six naval bases, which include Wilhelmshaven, Rostock-Warnemünde, Bremerhaven, Eckernförde, Kiel, and Nordholz. The networked system enables integrated training for weapons deployment, damage control, tactical data links, and voice communications, allowing corvettes, frigates, and aviation units to participate in joint virtual exercises. Further, this is a four-year project, valued in the mid double-digit million Euro range, and marks the first introduction of such simulation-based operational training in the German Navy.

The increasing investments in modernization of the Royal Navy, with a focus on Type 26 and Type 31 frigates, are the key factor behind the robust growth of the naval combat system market in the U.K. Combat systems integration, advanced missile defenses, and multi-domain situational awareness are central to these programs. In January 2025, the UK Ministry of Defence announced that it had awarded a £285 million contract to BAE Systems to modernize combat management systems on Royal Navy vessels, which also included Type 23 and Type 26 frigates, Type 45 destroyers, and Queen Elizabeth-class carriers. The upgrades are a part of the RECODE program, which enhances situational awareness, threat evaluation, weapon assignment, and overall operational capabilities by boosting the domestic defence industrial base. Hence, this investment reflects the country’s government’s focus on modernizing naval capabilities and strengthening interoperability.

Key Naval Combat System Market Players:

- Lockheed Martin Corporation (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- BAE Systems plc (U.K.)

- Raytheon Technologies Corporation (U.S.)

- Thales Group (France)

- Northrop Grumman Corporation (U.S.)

- General Dynamics Corporation (U.S.)

- Leonardo S.p.A. (Italy)

- Saab AB (Sweden)

- L3Harris Technologies, Inc. (U.S.)

- Elbit Systems Ltd. (Israel)

- Kongsberg Gruppen ASA (Norway)

- Rheinmetall AG (Germany)

- DCNS / Naval Group (France)

- Huntington Ingalls Industries, Inc. (U.S.)

- Mitsubishi Heavy Industries, Ltd. (Japan)

- Lockheed Martin Corporation is identified as the most influential player in the naval combat system industry, efficiently backed by its long-standing partnerships. The company leads programs which involve Aegis combat system upgrades, advanced radar architectures, surface-ship weapons integration, and undersea warfare technologies. The company’s key focus lies in the continued modernization through digital engineering, open-architecture systems, and integrated combat-system life-cycle management.

- BAE Systems plc plays a central role in naval combat systems across Europe by offering integrated combat-management suites, electronic warfare systems, naval guns, as well as cybersecurity solutions. The company extends its support for major naval shipyards with system-integration expertise for frigates, submarines, and offshore patrol vessels. Furthermore, the firm’s strategy prioritizes long-term government partnerships, especially with the UK Royal Navy and allied European navies, supported by investments in digital C4ISR domains.

- Raytheon Technologies Corporation is one of the dominant suppliers of ship-based missile systems, radar technologies, and integrated air-and-missile-defense components. The company’s position in the naval combat system industry is extensively supported by programs such as SPY-6 radar, ESSM enhancements, and cooperative engagement capabilities. Furthermore, collaborations with global navies and continuous investment in advanced radar processing are solidifying the firm as a core defense-systems integrator.

- Thales Group is also a major supplier in the field, which revolves around European, Middle Eastern, and Asia-Pacific fleets, and is known for its combat management systems, sonar technologies, electronic warfare suites, and maritime communication platforms. Besides, the firm has a strong footprint in underwater warfare and multi-mission frigate systems. Thales extends its support to numerous shipbuilding programs across all nations.

- Northrop Grumman Corporation is maintaining a strong position in naval surveillance, electronic warfare, C4ISR integration, as well as unmanned naval platforms. The company’s primary focus lies in prioritizing advanced networking, joint-force interoperability, and mission-system miniaturization. On the other hand, investments in autonomous maritime systems and cyber-resilient architectures ensure Northrop Grumman continues to be embedded in both current and next-generation naval combat system programs across U.S. and allied fleets.

Below is the list of some prominent players operating in the global naval combat system market:

The global naval combat system market is dominated by the large multi-domain defense contractors and the specialized system integrators. The pioneering firms, such as Lockheed Martin, BAE Systems, Raytheon, Thales, and Northrop Grumman, are maintaining strong global footprints by delivering integrated combat-management, sensor, and weapons-integration systems to major navies. In September 2025, Rheinmetall announced that its planned acquisition of Naval Vessels Lürssen marks a transformational step toward establishing a fully integrated naval-systems powerhouse in Germany. This agreement expands the firm’s capabilities from land and air domains into naval shipbuilding, thereby enabling the company to deliver complete platform-to-combat-system solutions supported by NVL’s shipyards, workforce, and long-standing expertise in military vessel construction.

Corporate Landscape of the Naval Combat System Market:

Recent Developments

- In November 2025, BAE Systems reported that it had secured a new USD 22 million U.S. Navy contract to manufacture Mk 41 Vertical Launch System missile canisters, with the total potential value rising to USD 317 million if all options are exercised, reinforcing the company’s role as the primary supplier of launch canisters for U.S. and allied naval fleets.

- In May 2025, Elbit Systems announced that it won a new international contract totaling approximately USD 330 million, awarded by multiple global and NATO-member customers, thereby enhancing its naval defense footprint. The programs include advanced anti-submarine warfare systems, electronic warfare suites, combat management systems, platform modernization, and unmanned surface vessel capabilities.

- In October 2023, Thales announced that it had signed a contract with Polska Grupa Zbrojeniowa to equip the Polish Navy’s MIECZNIK frigates with the TACTICOS combat management system, sonars, radars, and a 360° infrared sensor.

- Report ID: 1682

- Published Date: Dec 05, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Naval Combat System Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.