Integrated Marine Automation System Market Outlook:

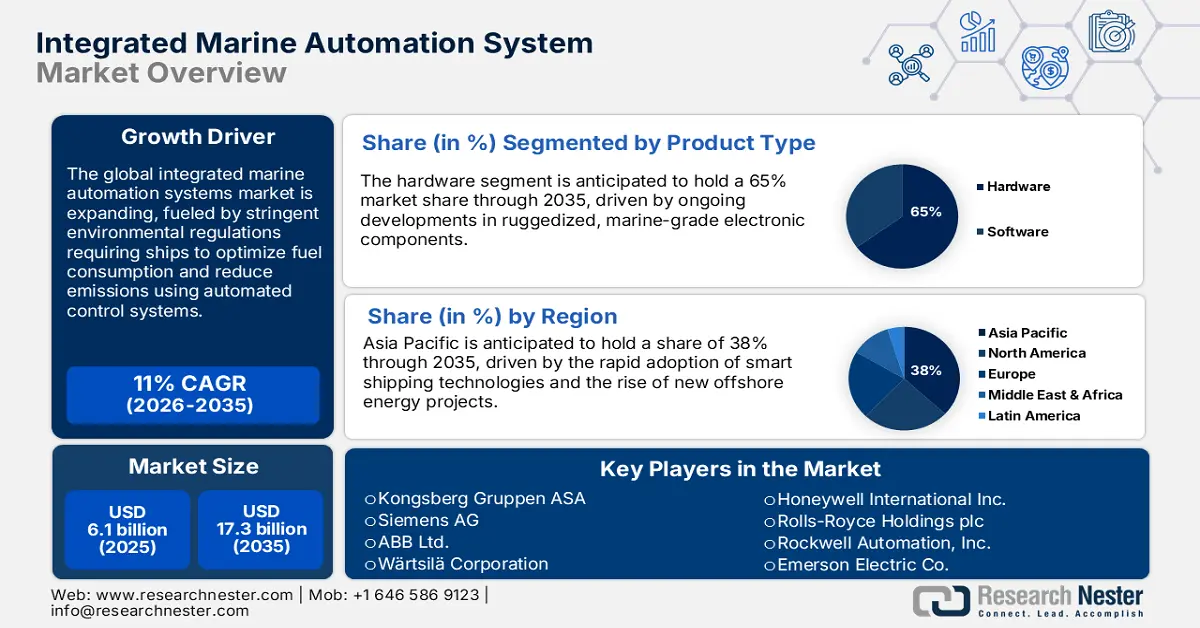

Integrated Marine Automation System Market size is valued at USD 6.1 billion in 2025 and is projected to reach a valuation of USD 17.3 billion by the end of 2035, rising at a CAGR of 11% during the forecast period, i.e., 2026-2035. In 2026, the industry size of integrated marine automation system is estimated at USD 6.7 billion.

The global integrated marine automation system market exhibits steady growth fueled by the advancement of digital technology, integration with AI, and IoT integration in all maritime operations. Contemporary systems improve maritime operations by offering advanced control, monitoring, and predictive maintenance features that allow for safer and more efficient vessel operation. Governments globally encourage marine automation development via strategic funding initiatives, regulatory policies, and joint partnership initiatives, improving industry resilience and ecological compliance. In August 2025, India's Ministry of Ports, Shipping, and Waterways announced comprehensive digital initiatives such as the e-Samudra platform, a cloud-native platform bringing together over 60 maritime services under one digital umbrella. Together, these factors generate extensive market possibilities across commercial and defense marine markets worldwide.

Major manufacturers, such as Kongsberg Gruppen ASA, Siemens AG, ABB Ltd., and Wartsila Corporation, heavily invest in creating future-oriented automation platforms with integrated control systems, enhanced AI capabilities, and cloud-based solutions. Technology solution providers aim to provide overall integration that optimizes vessel operations while maintaining regulatory requirements and environmental criteria. For instance, Kongsberg Gruppen ASA introduced the combined and simplified K-Chief marine automation system in July 2023 at Nor-Shipping 2023, offering a seamless platform for all ship types with increased operational efficiency, lower costs, and enhanced safety. Public-private collaborations enable faster adoption of technology with enhanced supply chain openness and maritime safety for global markets.

Key Integrated Marine Automation System Market Insights Summary:

Regional Highlights:

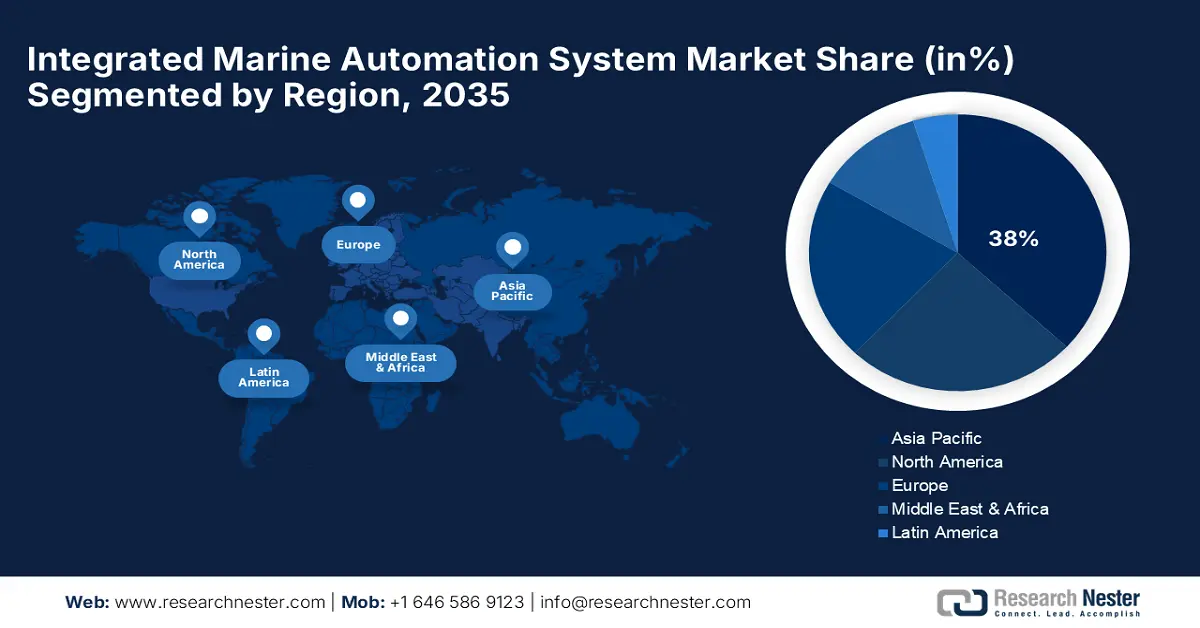

- Asia Pacific integrated marine automation system market is expected to hold a 38% share by 2035, sustained by extensive investments in smart port infrastructure and digitalization enhancing operational efficiency across regional maritime operations.

- North America is forecast to register a CAGR of 10.7% from 2026 to 2035, bolstered by strong government backing for research initiatives and innovation in autonomous vessel and energy management technologies.

Segment Insights:

- The hardware segment is anticipated to account for 65% share of the integrated marine automation system market by 2035, propelled by advancements in sensors, actuators, and control equipment enhancing operational reliability in marine environments.

- The part-automation segment is projected to capture 67% share by 2035, supported by scalable solutions that blend human oversight with automated functionality to ensure safety and compliance across maritime operations.

Key Growth Trends:

- Unified platform integration changes operational efficiency

- Government investment and policy drive market expansion

Major Challenges:

- System interoperability and integration complexity

- Shortage of skilled workforce restrains technology adoption

Key Players: Kongsberg Gruppen ASA, Siemens AG, ABB Ltd., Wärtsilä Corporation, Honeywell International Inc., Rolls-Royce Holdings plc, Rockwell Automation, Inc., Emerson Electric Co., Samsung Heavy Industries, Larsen & Toubro Limited

Global Integrated Marine Automation System Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 6.1 billion

- 2026 Market Size: USD 6.7 billion

- Projected Market Size: USD 17.3 billion by 2035

- Growth Forecasts: 11% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (38% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: Japan, China, United States, Germany, South Korea

- Emerging Countries: India, Singapore, Norway, Australia, United Kingdom

Last updated on : 3 September, 2025

Integrated Marine Automation System Market - Growth Drivers and Challenges

Growth Drivers

-

Unified platform integration changes operational efficiency: The sophisticated integration of control, navigation, and safety functions enables smooth operations and significantly enhances situational awareness throughout the vessel's systems. Industry leaders focus on harmonizing heterogeneous hardware and software elements to establish full automation solutions that achieve higher performance results. In July 2023, Kongsberg Gruppen ASA introduced the unified and streamlined K-Chief marine automation system at Nor-Shipping 2023, featuring a combined platform for all ship classes with enhanced operational efficiency. The new K-Chief offers plug-and-play integration of KONGSBERG gear and simplified operations onboard ships, developed from 40+ years of innovation. This integrated solution showcases how combined platforms revolutionize marine operations through merged control and enhanced automation capabilities.

-

Government investment and policy drive market expansion: Significant government investments and regulation support structures facilitate the rapid development and implementation of maritime automation solutions in commercial and defense markets. Strategic funding initiatives promote technology development while maintaining adherence to environmental protection and safety measures in maritime activities. In September 2023, the U.S. Department of Commerce and NOAA made a $3.9 million investment in the Marine Technology Society (MTS) to create a multi-year Ocean Enterprise engagement framework. The Ocean Enterprise consists of public, private, non-profit, tribal, and academic stakeholders that deliver ocean observation, measurement, and forecasting information. This investment demonstrates the government's commitment to advancing marine automation through inclusive stakeholder collaboration and technology development initiatives.

-

Environmental sustainability and greenhouse gas reduction fuel innovation: The strategic transition of the maritime industry toward environmentally sustainable operations fuels large-scale investments in automation, including hybrid propulsion technology and sophisticated energy management solutions. The carbon footprint reduction and improvement of energy efficiency by the industry generate enormous business opportunities for innovative automation technologies. Wartsila Corporation was selected in August 2025 as the electrical integrator for a large battery extension project on the Wasaline ROPAX ferry 'Aurora Botnia', which will establish the world's largest operational marine battery hybrid system. The project expands the ship's battery capability by 10.4 MWh from 2.2 MWh to 12.6 MWh, resulting in a great reduction in emissions. This hybrid propulsion technology integrates energy storage into mainstream engines, providing several avenues for reducing greenhouse gas emissions and significantly lowering fuel consumption.

Defense Procurement Trends & Opportunities for Integrated Marine Automation Systems (2023–2024)

|

Aspect |

Trend/Statistic |

Implication for Integrated Marine Automation System Market |

|

Total Defense Procurement Spend (2023) |

€61 billion (80% of total defense investments) |

Increased funding available for advanced naval systems, including IMAS |

|

Year-on-Year Growth (2022–2023) |

+19% |

Strong market expansion; rising demand for modernized vessel automation and control systems |

|

Estimated Spend (2024) |

€90+ billion (potential +50% YoY growth) |

Unprecedented opportunity for IMAS providers to secure contracts, especially in EU navies |

|

Strategic Recommendation |

Collaborative EU orders + long-term planning |

Incentive for IMAS suppliers to align with EU defense cooperation goals and secure large-scale contracts |

Source: EDA

Challenges

-

System interoperability and integration complexity: Heterogeneous hardware and software systems from different manufacturers pose significant integration complexities that make comprehensive marine automation implementation across vessel platforms a challenge. Incompatibility among different components of the automation system can lead to higher operating costs, longer deployment schedules, and reduced system performance. Producers invest heavily in creating standardized interfaces and communication protocols to reduce integration complexity and provide seamless operation under various maritime conditions. In March 2024, Transport Canada released its Marine Safety and Security initiatives, scheduled for April 2024 to 2026, including proposed Canadian Marine Pilotage Regulations that implement Administrative Monetary Penalties and Management Systems, as well as harmonizing regional requirements. These regulatory advances underscore the ongoing challenge of system standardization and interoperability across various maritime automation platforms and jurisdictions.

-

Shortage of skilled workforce restrains technology adoption: The complex and advanced nature of integrated marine automation systems necessitates skilled individuals for successful operation, maintenance, and repair across sophisticated maritime environments. Cross-industry gaps in technical skills and specialized knowledge hinder smooth technology adoption, posing operational risks and safety issues for ship operations. Training programs and education alliances become essential for managing workforce challenges while permitting safe and efficient deployment of automation systems across maritime industries. In August 2023, the UK Government unveiled a cadet training modernization program that encompasses a review of the syllabus for maritime navigation systems, focusing on the incorporation of navigational automation technology that is becoming increasingly prevalent at sea. This educational effort highlights the urgent need for modernizing workforce skills to meet the evolving demands of automation technology in maritime operations.

Integrated Marine Automation System Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

11% |

|

Base Year Market Size (2025) |

USD 6.1 billion |

|

Forecast Year Market Size (2035) |

USD 17.3 billion |

|

Regional Scope |

|

Integrated Marine Automation System Market Segmentation:

Product Type Segment Analysis

The hardware segment is anticipated to hold a 65% integrated marine automation system market share through 2035, driven by key components such as sensors, actuators, and control equipment that form the backbone of marine automation systems. Investment emphasis is put into creating rugged and reliable hardware solutions that can withstand harsh marine conditions while providing consistent performance and operational reliability. Businesses such as Siemens AG and ABB Ltd. drive innovation of sensor technologies, actuator systems, and control hardware that improve automation system functionality and performance. In October 2023, Siemens AG strengthened its marine solutions portfolio through Siemens Energy, offering holistic power, drive, and automation technology solutions for nearly every type of vessel. Its large marine portfolio features SISHIP EcoMAIN for ship management, IMAC monitoring system for automated processes, and IPMS integrated automation for naval ships. These solutions cater to emerging market and economic pressures without compromising operational efficiency and competitiveness through cutting-edge hardware integration and complete system architecture.

Autonomy Segment Analysis

The part-automation segment is projected to retain 67% of integrated marine automation system market share during the forecast period with its scalable solution that ensures efficient human control coupled with automated functions to achieve optimized operational safety. The incremental path enables a phased transition toward full automation while maintaining operator control and decision-making in key operational situations and emergencies. Industry players emphasize innovative control algorithms and comprehensive safety redundancies that support balanced autonomy while ensuring operational reliability and regulatory compliance across maritime operations. In September 2023, the UK Government published a final impact assessment for the maritime autonomy and remote operations regulatory framework, estimating that the global market already includes over 1,000 autonomous ships with a market value of $88 billion. The study estimates the market to be worth $150 billion by 2030, with the UK potentially securing a 10% market share through successful regulation. Such regulatory advancements put the UK at the forefront of the autonomous maritime market through a robust legal framework that promotes innovation and the safe deployment of partial automation technologies.

End user Segment Analysis

The OEM segment is predicted to maintain a 69% market share by 2035, as original equipment manufacturers incorporate holistic automation systems during the manufacturing process, rather than retrofitting those already built. Strategic alliances between suppliers of automation technologies and shipbuilding companies enable OEMs to deliver enhanced maritime platforms that address evolving regulatory and market requirements. Early integration in shipbuilding gives tremendous benefits such as system design optimization, superior performance characteristics, and full warranty coverage on integrated automation elements. Honeywell International Inc. received ISO 17894 certification in Integrated Automation Systems (IAS) in January 2025, becoming the first to be awarded this internationally recognized standard for quality, which guarantees system quality and reliability. The system provides a single platform for integrating and automating vessel subsystems, ensuring effective, safe, and reliable operation, which highlights the benefits of full OEM integration strategies.

Our in-depth analysis of the global integrated marine automation system market includes the following segments:

|

Segment |

Subsegments |

|

Product Type |

|

|

Autonomy |

|

|

Ship Type |

|

|

System |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Integrated Marine Automation System Market - Regional Analysis

APAC Market Insights

Asia Pacific integrated marine automation system market is expected to retain a market share of 38% during the forecast period, fueled by steady growth with a focus on environmental sustainability and operation efficiency in various regional economies. Regional authorities invest heavily in automation technology adoption, enabling smart port infrastructure investments and widespread digitalization efforts that support the adoption of automation technology in both commercial and government maritime operations. Sustained market growth is fueled by emerging economies across the region, driven by conducive policy environments and widening maritime trade that necessitate sophisticated automation capabilities. Increased connectivity and digital infrastructure enhancements support broad access to high-end automation technology across hitherto underserved maritime markets and operational environments.

China maritime automation sector is supported by robust governmental support and extensive technical integration throughout port operations and ship management systems within the nation's vast maritime infrastructure. The Maritime Safety Administration encourages the development of innovative autonomous navigation systems and overall safety monitoring technologies that enhance operating efficiency and regulatory compliance. In March 2025, the 24th Session of Asia-Pacific Heads of Maritime Safety Agencies (APHoMSA) Forum, China Maritime Safety Administration, highlighted cooperation in maritime automation technologies and safety monitoring systems at the regional level. The growth of the blue economy and the development of maritime technology are government priorities, promoting continued investment in automated infrastructure and research and development projects along China's extensive coastline and inland waterway networks.

India integrated marine automation system industry is developing through government-driven digitalization efforts that update port facilities and improve maritime service provision throughout the nation's long coastline. Strategic interventions focus on integrating various maritime services into a unified digital platform, enhancing efficiency and regulatory compliance. In August 2025, India's Ministry of Ports, Shipping, and Waterways launched extensive digitalization initiatives such as the e-Samudra platform, a cloud-native system that brings together over 60 maritime services under one digital umbrella. The initiatives contribute to India's emergence as a regional maritime hub while fostering technological advancements among domestic maritime businesses and global shipping operations.

North America Market Insights

North America is projected to achieve a CAGR of 10.7% between 2026 and 2035, positioning the region as a pioneer in the adoption of integrated marine automation systems and technological innovation. The region has firm government support that leads to developed manufacturing facilities which enable sustained innovation and integrated marine automation system market growth in commercial and defense maritime markets. A regional emphasis on environmental regulation compliance and operational effectiveness drives the widespread adoption of pervasive automation systems across vessel operators and ship management companies. Players are supported by extensive supply chain structures and strong research and development systems, facilitating innovative product innovation and rollout. Government initiatives provide substantial funding for research efforts and pilot projects that advance autonomous vessel technology and energy management system installations.

The U.S. Coast Guard and Navy are major adopters of integrated automation systems that improve fleet effectiveness and mission performance in varied operating environments. United States government agencies demonstrate a strong commitment to technological leadership by making focused investments in marine automation research and development efforts. In September 2023, the U.S. Department of Commerce and NOAA made a $3.9 million investment in the Marine Technology Society (MTS) to develop a multi-year Ocean Enterprise engagement model as part of President Biden's Investing in America agenda. Such investment reflects the commitment by government to leadership in technology in the marine industries and promoting extensive stakeholder coordination and innovation building in various maritime automation technologies.

Canada government’s efforts emphasize regulatory coordination and infrastructure improvement that facilitates the deployment of marine automation systems in commercial and government ships' operations. Transport Canada is actively promoting regulatory coordination while facilitating the smooth integration of automation technologies in various maritime applications and operating environments. In May 2024, the Government of Canada released a detailed Blue Economy Regulatory Review, placing Maritime Autonomous Surface Ships (MASS) atthe center stage as cutting-edge technology transforming the marine industry in Canada and around the world. The review highlights MASS's potential to enhance Canada's economic competitiveness, increase the efficiency of trade corridors, improve maritime security and safety, and support job creation and growth opportunities. Collaboration among stakeholders enhances regulatory preparedness for future vessel technologies, promoting sustainable maritime industry growth and environmental conservation across Canadian waters.

Europe Market Insights

Europe is expected to contribute significantly to growth through 2035, driven by extensive innovation in automation technologies and green initiatives across European Union member countries. Regional policies are promoting the development of autonomous ships and integrated control systems to facilitate maritime industry modernization and regulatory compliance needs. Germany is at the forefront of regional development, boasting robust engineering skills and high investment in research and development of sensor technologies and automation platforms. European nations are placing an emphasis on cross-border cooperative initiatives that standardize regulations and technical requirements, while promoting market expansion and technology compatibility across various maritime applications and environments.

The UK integrated marine automation system industry has benefited from extensive government initiatives aimed at digitalization and environmental compliance in the commercial and defense maritime sectors. The Maritime and Coastguard Agency encourage the take-up of unmanned and remotely controlled boats through revised regulatory guidelines that enable innovation and ensure safety standards. In April 2024, the UK Government unveiled the £8 million Smart Shipping Acceleration Fund to stimulate maritime innovation and leverage AI advantages to enhance productivity in the industry. The investment facilitates feasibility studies for advanced technology such as autonomous boats, autonomous ships, and automated ports to improve the economy. Successful projects require matching funding from the private sector, while AI breakthroughs will enable ports to identify safety risks, streamline activities, and reduce environmental impact, making UK waters safer and operations more efficient.

Germany integrated marine automation system industry focuses on developing energy-efficient propulsion systems and integrated sensor technologies that facilitate sustainable maritime activities. Federal government-assisted research programs advance automation technologies for both defense and commercial vessel use across multiple operational needs. In May 2023, the German government introduced the National Action Plan for Climate-Friendly Shipping (NAPS), bringing together maritime industry representatives, scientists, industrial organizations, and environmental organizations to compile comprehensive guidelines for the transformation to climate-neutral shipping. The project demonstrates the government's commitment to supporting sector transformation and enhancing the competitiveness and innovation capacity of various maritime sectors.

Key Integrated Marine Automation System Market Players:

- Kongsberg Gruppen ASA

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Siemens AG

- ABB Ltd.

- Wärtsilä Corporation

- Honeywell International Inc.

- Rolls-Royce Holdings plc

- Rockwell Automation, Inc.

- Emerson Electric Co.

- Samsung Heavy Industries

- Larsen & Toubro Limited

The integrated marine automation system market exhibits high competition among mature technology suppliers, including Kongsberg Gruppen ASA, Siemens AG, ABB Ltd., Wärtsilä Corporation, Honeywell International Inc., and Rolls-Royce Holdings plc. Dominant players compete based on technological advancements, end-to-end system integration capacity, and provision of advanced automated solutions for various types of vessels and operational needs. Key manufacturers, such as Rockwell Automation Inc., Emerson Electric Co., Samsung Heavy Industries, and Larsen & Toubro Limited, invest heavily in research and development to maintain a competitive edge in various global markets. Other players, including Yokogawa Electric Corporation, Mitsubishi Electric Corporation, Omron Corporation, IHI Corporation, and Hitachi Ltd., bring cutting-edge automation technologies and precision engineering expertise.

Competition drives ongoing innovation in AI applications, IoT convergence, and overall system reliability across challenging maritime environments and diverse operational profiles. Market leaders spearhead extensive research and development efforts, while upstart players focus on niche applications and innovative automation technologies designed to address specific maritime challenges. In February 2024, Kongsberg Gruppen ASA reported a NOK 65 billion order intake and achieved 28% revenue growth in 2023, concluding the year with a record-breaking order backlog of NOK 88.6 billion. This overall performance is an indication of the successful implementation of the group's strategic initiatives and robust global demand for sophisticated marine automation and defense solutions.

Here are some leading companies in the global integrated marine automation system market:

Recent Developments

- In September 2025, ABB and Wallenius Marine, a shipping company, have officially formed a new joint venture in Stockholm, Sweden. This collaboration aims to enhance their OVERSEA initiative, providing customers with advanced and future-proof vessel performance management solutions.

- In February 2025, Siemens AG partnered with Compute Maritime to revolutionize ship design through generative AI integration, connecting NeuralShipper platform with Simcenter STAR-CCM+ software for computational fluid dynamics. This collaboration pushes boundaries of generative AI in ship design industry, enabling advanced simulation and optimization capabilities for vessel development.

- Report ID: 8052

- Published Date: Sep 03, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Integrated Marine Automation System Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.