SONAR System Market Outlook:

SONAR System Market size was valued at USD 5.6 billion in 2025 and is projected to reach USD 8.4 billion by the end of 2035, rising at a CAGR of 4.2% during the forecast period, i.e., 2026-2035. In 2026, the industry size of SONAR system is assessed at USD 5.8 billion.

The global SONAR system market is primarily driven by the sustained public sector investment. The global procurement of the SONAR system is expanding in line with the naval fleet modernization and increased investment in the maritime domain awareness by defense ministries and intergovernmental agencies. According to the U.S. Congressional Research Service report in April 2023, the Navy’s proposed 2024 budget request for USD 32.8 billion in shipbuilding, including the new submarines and ASW-capable surface ships, which is directly related to the market, as each of these platforms requires advanced hull-mounted towed and submarine-integrated sonar suites as a part of their core operational capability. Further, the investments in submarine acoustic superiority and surface ship SONAR upgrades are anchored by the procurement for Virginia-class and Columbia-class platforms.

Governments and organizations around the globe allocate a significant budget to enhance the underwater detection capabilities, with the U.S. Department of Defense reporting that expenditures are high on the acoustic technologies as part of broader fleet modernization efforts. These investments support the procurement contracts that benefit suppliers via long-term agreements, boosting reliable revenue streams for the manufacturers. According to the UK Government of UK July 2025 data, the UK plans to raise its defense spending to 2.5% of the GDP by 2027, to reach 3%. This data highlights that the increased budgets typically expand the procurement for naval modernization, anti-submarine warfare assets, and underwater surveillance capabilities, all of which are highly dependent on the advanced sonar systems. This clear fiscal trajectory underscores a stable and growing demand horizon for sonar system manufacturers within the defense sector.

Key SONAR System Market Insights Summary:

Regional Highlights:

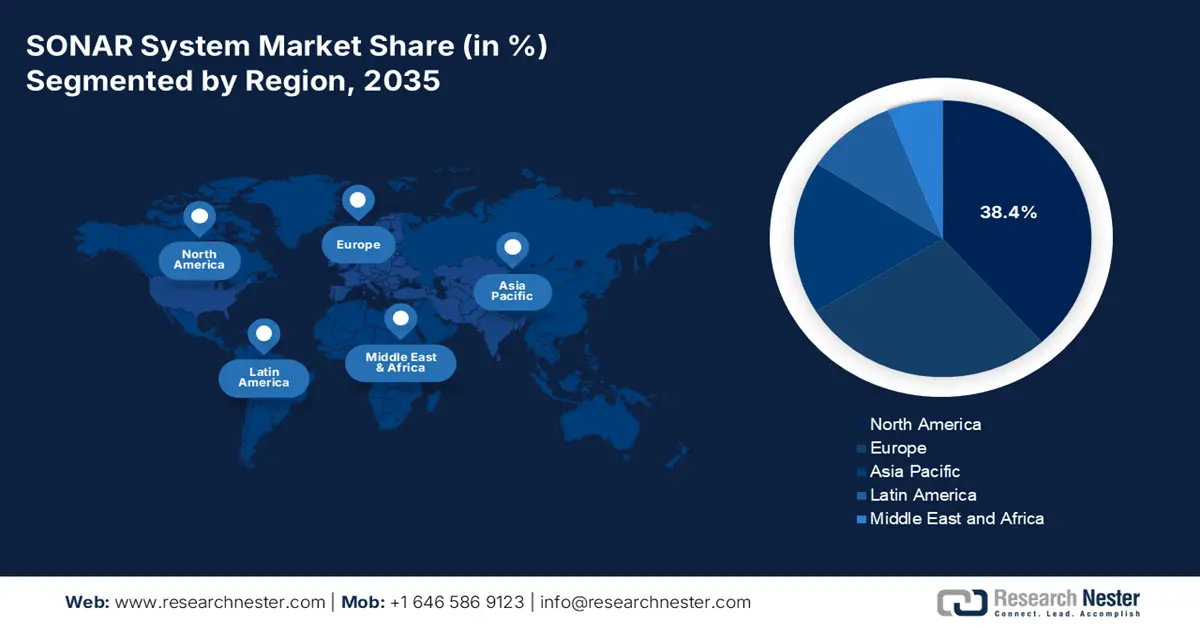

- North America is projected to secure a 38.4% share by 2035 in the SONAR system market, supported by robust defense spending and next-generation undersea warfare programs owing to technological sovereignty.

- By 2035, Asia Pacific is set to record a 7.5% CAGR during 2026–2035, propelled by regional naval modernization and intensifying maritime security requirements.

Segment Insights:

- The system segment in the SONAR system market is anticipated to capture a 68.4% share by 2035, underpinned by procurement priorities favoring integrated hardware platforms such as sonar arrays and processing units integrated onto naval vessels.

- Deep water is expected to represent the leading depth segment by 2035, supported by expanding defense and deep-sea exploration initiatives impelled by increasing anti-submarine warfare and seabed-mapping needs.

Key Growth Trends:

- Great power competition and naval modernization

- Expansion of offshore wind energy infrastructure

Major Challenges:

- Prolonged and unpredictable government procurement cycles

- Immense research and development cost

Key Players: Raytheon Technologies (U.S.), Company Overview, Business Strategy, Key Product Offerings, Financial Performance, Key Performance Indicators, Risk Analysis, Recent Development, Regional Presence, SWOT Analysis, Lockheed Martin (U.S.), L3Harris Technologies (U.S.), General Dynamics (U.S.), Northrop Grumman (U.S.), Thales Group (France), Atlas Elektronik (Germany), Saab AB (Sweden), Kongsberg Gruppen (Norway), Leonardo S.p.A. (Italy), Mitsubishi Heavy Industries (Japan), Furuno Electric Co., Ltd. (Japan), Hanwha Group (South Korea), LIG Nex1 (South Korea), Bharat Electronics Limited (India), Hindustan Aeronautics Limited (India), Sonartech Atlas (Australia), Sinar Jernih Sdn Bhd (Malaysia), Ultra Electronics (UK), ASELSAN (Türkiye).

Global SONAR System Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 5.6 billion

- 2026 Market Size: USD 5.8 billion

- Projected Market Size: USD 8.4 billion by 2035

- Growth Forecasts: 4.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38.4% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, United Kingdom, France, Japan

- Emerging Countries: India, South Korea, Australia, Norway, Singapore

Last updated on : 5 December, 2025

SONAR System Market - Growth Drivers and Challenges

Growth Drivers

- Great power competition and naval modernization: Intensifying strategic competition mainly in the Indo-Pacific is the primary driver of the market. The nations are actively prioritizing naval modernization to secure undersea dominance. This is evidenced by the Deputy Assistant Secretary of the Navy (Budget) report in February 2024 stating that the U.S Navy’s budget request for 2025 is USD 32.4 billion for shipbuilding, heavily focused on the new submarines and Anti-Submarine Warfare capable vessels. Strategic alliances such as the AUKUS pact further amplify the demand for advanced sonar technologies. This environment generates long-term high-value procurement contracts for manufacturers who can deliver integrated undersea warfare systems. The vital emerging trend is the heightened focus on ensuring soar system interoperability among allied navies to enable seamless joint operation and maintain a collective maritime advantage.

- Expansion of offshore wind energy infrastructure: This is a major commercial driver for the SONAR system market. This renewable energy push creates sustained B2B demand for high-resolution multibeam and side scan sonars that are vital for preconstruction site characterization, cable route surveying, and ongoing infrastructure monitoring. A prime example is evidenced in the report from the U.S. Department of Energy data in March 2023 highlighting that the offshore wind is the growing source of clean energy with 50GW installed across more than 250 projects in 2022 and the U.S. has 42 MW installed but maintains a 40 GW project pipeline, supported by federal targets of 30 GW by 2030 and 15 GW of floating offshore wind by 2035, alongside state-level commitments totaling at least 39 GW by 2040. This data highlights that this development requires extensive seabed characterization, underwater cable route surveys, structural monitoring, and environmental assessments, all of which rely on advanced commercial sonar technologies for safe construction and long-term operations.

- Protection of critical subsea infrastructure: The protection of the critical subsea infrastructure, such as the communication cables and energy pipelines, has emerged as the major driver for the SONAR system market. Recent geopolitical events have starkly highlighted their vulnerability, triggering increased government and commercial investment in seabed security. In response, NATO has established a dedicated Critical Undersea Infrastructure Coordination Cell, and member nations are boosting their seabed warfare capabilities. This strategic focus is generating significant demand for advanced networked surveillance sonar systems, autonomous underwater vehicles equipped with advanced sonar payloads, and specialized inspection sonars for continuous monitoring, threat detection, and post-incident damage assessment.

Challenges

- Prolonged and unpredictable government procurement cycles: Dependence on the government defense budgets subjects the suppliers to a lengthy and often politicized procurement process. A program can span a decade from RFP to deployment. For example, the U.S. Navy’s SSN(X) net gen submarine program requires a new sonar suite, which is not expected to begin construction until the 2030s. This demands immense financial resilience from manufacturers who must sustain R&D without guaranteed revenue. Smaller firms often lack the capital to weather these cycles, forcing them into a subcontractor role rather than being a prime system integrator.

- Immense research and development cost: Developing an advanced sonar technology, mainly in areas such as AI-based signal processing and multi-static systems, requires a massive, sustained investment. For example, Raytheon market, a leader in the, invests heavily in sensor R&D across its portfolio, but a new entrant aiming to compete would need to commit hundreds of millions over several years just to achieve technological parity, creating a nearly insurmountable barrier to entry and solidifying the dominance of established defense primes.

SONAR System Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

4.2% |

|

Base Year Market Size (2025) |

USD 5.6 billion |

|

Forecast Year Market Size (2035) |

USD 8.4 billion |

|

Regional Scope |

|

SONAR System Market Segmentation:

Solution Segment Analysis

Within the SONAR system market segmentation by solution, the system is leading and is poised to hold a share value of 68.4% by 2035. This dominance is due to the procurement contracts primarily funding the physical hardware, such as the sonar arrays, transmitters, processing units, and displays integrated onto platforms such as ships and submarines. While software and data services are viral, they are often bundled with the initial systems essential for new vessel construction, and major modernization solidifies their financial lead. For example, the U.S. Navy’s investment in systems is evident in its continuous funding for the Surface Ship Combat System, an integrated anti-submarine warfare suite that combines multiple sonar technologies into a single, cohesive system for its surface fleet.

Depth Segment Analysis

Under the depth segment, the deep water is the largest sub-segment and is expected to hold a considerable share value by 2035. The segment is driven by the defense and resource exploration in oceanic zones. This growth is fueled by the strategic focus on anti-submarine warfare in the open oceans and the expansion of deep-sea mining surveys. Naval operations require deep water sonar to detect the advanced submarines, while organizations such as NOAA and the commercial entities use it to map and monitor vast unexplored regions of the seabed. A key statistical indicator is that the U.S. Navy requested USD 2.4 billion in procurement funding for the second Columbia-class submarine in 2024 and USD 3.4 billion in advance procurement for future boats, totaling USD 5.8 billion, as per the Congressional Research Service in October 2023. This reinforces the Navy’s long-term commitment to building 12 Columbia-class submarines as the most survivable leg of the nuclear triad, with multiple government sources confirming the program’s 2024 funding priority.

Platform Segment Analysis

By 2035, the naval vessels sub-segment is the ruling leader in the platform segment and represents nearly half of the entire market’s revenue. This is a direct result of the sustained global defense spending on maritime security and fleet modernization. The primary driver is the need for advanced anti-submarine warfare capabilities, which require the most advanced and expensive sonar systems, including hull-mounted towed and variable depth arrays. The financial commitment is clear that significant investment is made for shipbuilding covering new Virginia-class submarines and Arleigh Burke-class destroyers platforms whose effectiveness is fundamentally reliant on their integrated sonar suites, ensuring this segment’s continued dominance.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

Platform |

|

|

Product |

|

|

Application |

|

|

Solution |

|

|

Range |

|

|

Depth |

|

|

Installation |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

SONAR System Market - Regional Analysis

North America Market Insights

North America is dominating the market and is expected to hold a revenue share of 38.4% by 2035. The market dominance is driven by the high defense budgets focused on undersea warfare and technological sovereignty. The U.S. Department of Defense prioritizes acoustic superiority to counter peer competitors' funding next-generation systems for the Columbia and Virginia class submarines and the DDG(X) destroyer program. The key trends of the market include the integration of AI/ML for data processing, deployment of multi-static and distributed sonar networks using UUVs, and modernization of existing fleet assets. Strategic alliances such as AUKUS further accelerate advanced sonar development and cross-border collaboration with allied nations. The sustained mergers and acquisitions ensures the region's continued technological and market leadership throughout the forecast period.

SONAR Systems M&A in the U.S. and Canada

|

Year |

Acquirer |

Target/Acquired Company |

Country |

Description/Focus |

|

2023 |

NORBIT ASA |

Ping DSP |

Canada |

Acquisition of a Canadian maritime technology company specializing in advanced interferometric side scan sonar technology for shallow-water mapping and underwater discovery. |

|

2024 |

Kraken Robotics |

- (Contract awards) |

Canada |

Received contracts worth $1.1 million for AquaPix synthetic aperture sonar systems, expanding its sonar tech footprint, though not an acquisition. |

|

2025 |

Kongsberg Discovery |

Sonatech |

US |

Acquisition to expand underwater acoustics and sonar system capabilities, especially for defense applications. |

|

2023 |

General Oceans |

Tritech International (indirectly referenced) |

US |

Major player in underwater sonar systems, involved in various expansions and developments. |

Source: Kraken Robotics, October 2022, Kongsberg June 2025, General Oceans 2023, Ping DSP November 2023

The U.S. market is defined by high-value investments in integrated undersea warfare systems. The market is driven by the National Defense Strategy’s focus on maritime competition. A primary trend is the shift towards multi-static and distributed sonar networks using unmanned vehicles as remote sensing nodes to expand the surveillance areas. This is exemplified by DARPA’s Ocean of Things project. Furthermore, significant R&D is dedicated to AI-enabled signal processing to counter advanced acoustic threats. The foundational driver remains the Navy’s shipbuilding plan, with the Columbia class program alone representing a spend of USD 130 billion to acquire 12 Columbia class nuclear-powered ballistic missile submarines. This data highlights that the large procurement budget drives significant long-term demand for high-performance naval sonar technologies.

Canada’s SONAR market is mainly driven by the imperative to protect Arctic sovereignty and modernize the North American Aerospace Defense Command capabilities. The vital trend is the procurement of new platforms, which are equipped with modern ASW systems, notably the Canadian Surface Combatant program that will feature advanced sonar suites for open ocean and Arctic operations. This aligns with the Strong, Secure, Engaged defense policy that commits USD 62.3 billion in new funding over 20 years for USD 553 billion total defense spending. Investments aimed at addressing the unique acoustic challenges of the Arctic environment require specialized sonar for under-ice detection and monitoring, a critical capability for domain awareness in its northern approaches. This strategic focus establishes Canada as a key market and innovator in specialized Arctic sonar technologies.

APAC Market Insights

Asia Pacific is the fastest-growing SONAR system market and is expected to grow at a CAGR of 7.5% during the forecast period 2026 to 2035. The market is driven by the intense naval modernization, territorial disputes, and the need to secure strategic sea lanes. China’s comprehensive naval expansion, including its submarine fleet, is a primary market driver compelling regional neighbors to invest heavily in anti-submarine warfare capabilities. The key trends include the indigenous development of sonar systems to minimize the import dependency, mainly in South Korea and India, and a growing focus on integrating sonar with unmanned surface and underwater vehicles. Collaborative security agreements such as the Australia, UK, US pact further accelerate advanced technology transfer and create a layered demand structure across allied and non-allied nations in the region.

China’s market is defined by a rapid state-driven expansion focused on achieving acoustic parity with Western powers. The primary driver is the unprecedented growth of the People’s Liberation Army Navy that has become the world's largest navy by number of vessels. This expansion includes a massive submarine fleet, both nuclear and conventional, each requiring advanced indigenous sonar suits. A key trend is the heavy investment in research to overcome China’s traditional weakness in underwater acoustics and signal processing. This is supported by the data from the Brussels School of Governance in June 2024, stating China’s defense budget has increased to CN¥ 1.67 trillion in 2024, ensuring sustained funding for next-generation systems across surface, subsurface, and unmanned platforms to secure China’s near seas and global maritime interests.

The SONAR system market in Japan is defined by the strategic change based on the rising regional maritime threats. This is highlighted by a fundamental policy change, illustrated by its new National Defense Strategy, which identifies counterstrike capabilities as essential. A central driver is the urgent need to enhance anti-submarine warfare capabilities against increasingly active and quiet submarines in surrounding waters. The key trend involves a major fleet modernization with significant investments in new Taigei-class attack submarines and Mogami-class multi-role frigates, all integrated with the most advanced Japan-made sonar systems. According to the East Asia Forum in May 2023, Japan plans to invest 43 trillion yen in defense over the 2023 to 2027 period, directly fueling the sonar procurement and R&D. This concerted national effort boosts Japan's position as a leader in advanced ASW technology and a core driver of the regional SONAR market.

Europe Market Insights

The SONAR system market in Europe is expanding rapidly and is driven by the collaborative defense initiatives and national modernization programs aimed at enhancing maritime security and anti-submarine warfare capabilities. The primary driver is the collective response to the increased undersea activity in the North Atlantic and Baltic Sea, necessitating advanced detection systems. The key trends include the development of unmanned systems with projects such European Defense Fund’s allocates significant funds for naval unmanned systems that include sonar payloads. There is also a strong push for interoperability among NATO allies, leading to standardized procurements. Furthermore, national programs such as the UK’s Type 26 frigate and France’s FDI frigates are incorporating the next-gen sonar suites, fueling the regional market growth and technological advancement.

The UK is projected to hold the highest revenue share in Europe by 2035 and is driven by its independent naval strategy and commitment to a global presence. The key growth factors include the ongoing delivery of the eight-ship Type 26 frigate program for ASW and the planned Type 32 frigates. The UK’s dedication is highlighted by its pledge to increase defense spending, with a significant portion directed to the Royal Navy. The National Shipbuilding strategy outlines a pipeline of new vessels to ensure a sustained demand for advanced sonar systems to maintain underwater dominance in the North Atlantic and beyond. Further, companies' mergers and acquisitions are leading the market, for example, in September 2025, HII and Thales announced the successful integration and field exercise of the Thales SAMDIS1 600 sonar with HII’s next-generation REMUS 620 medium unmanned underwater vehicle. This synergy between the national strategy and industry collaboration stimulates the UK's position as a central hub for next-generation undersea warfare technology.

France is expected to lead Europe’s SONAR system market and is fueled by its commitment to defense sovereignty and a successful naval export market. The growth is driven by the ongoing procurement of five FDI frigates for the French Navy, all equipped with the Kingclip Mk II sonar system, and the development of the SNLE 3G next-generation ballistic missile submarine. According to the RFI July 2025 report, the French Ministry of Armed Forces' 2024 to 2030 military programming law allocates €413 billion with a substantial investment in defense forces. A key trend is the Europe-centric collaboration, such as the Maritime Mine Countermeasures program with the UK, which utilizes unmanned surface vessels with integrated sonar, reinforcing France’s role as a core developer of European undersea warfare technology.

Key SONAR System Market Players:

- Raytheon Technologies (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Lockheed Martin (U.S.)

- L3Harris Technologies (U.S.)

- General Dynamics (U.S.)

- Northrop Grumman (U.S.)

- Thales Group (France)

- Atlas Elektronik (Germany)

- Saab AB (Sweden)

- Kongsberg Gruppen (Norway)

- Leonardo S.p.A. (Italy)

- Mitsubishi Heavy Industries (Japan)

- Furuno Electric Co., Ltd. (Japan)

- Hanwha Group (South Korea)

- LIG Nex1 (South Korea)

- Bharat Electronics Limited (India)

- Hindustan Aeronautics Limited (India)

- Sonartech Atlas (Australia)

- Sinar Jernih Sdn Bhd (Malaysia)

- Ultra Electronics (UK)

- ASELSAN (Türkiye)

- Raytheon Technologies is advancing the SONAR system market by focusing on enhanced domain awareness and autonomy. Their strategic initiatives involve developing advanced acoustic sensors and signal processing algorithms for the U.S. Navy’s surface fleet and submarines. A key advancement is the integration of artificial intelligence to improve the target classification and reduce the operator workload. These efforts, often conducted via contracts with the Pentagon’s research agencies, are aimed at delivering superior undersea warfare capabilities to maintain a strategic advantage in contested maritime environments.

- Lockheed Martin is shaping the SONAR system market via its focus on integrated combat systems and unmanned platforms. The company is pioneering the use of advanced sonar suites for autonomous underwater vehicles, enabling persistent intelligence surveillance and reconnaissance missions. A significant advancement is their work on multi-static sonar systems, where a network of distributed nodes, including unmanned vehicles, works together to create a more comprehensive and resilient underwater picture. The company has made a net sales of USD 71,043 million in 2024.

- L3Harris Technologies is driving innovation in the market by emphasizing compact deployment and networked solutions. Their strategic expansion involves creating advanced sonar payloads for small and medium-sized unmanned underwater vehicles, making advanced capabilities accessible for a wider range of platforms. A key advancement is their focus on the open architecture systems that allow for the rapid fusion of new sonar technologies and seamless data sharing across the naval networks, enhancing fleet interoperability and decision speed.

- General Dynamics is a cornerstone of the SONAR system market primarily via its role as a builder of nuclear-powered submarines for the U.S. Navy. Their strategic initiatives are centered on developing and integrating the most advanced sonar arrays, such as the Large Aperture Bow and lightweight wide aperture arrays for the Virginia and Columbia classes. This advancement in acoustic superiority ensures next-gen submarines can operate with unmatched stealth and detection capabilities, which is the company’s critical contribution to undersea dominance. For the full year in 2024, the revenue of the company increased 12.9% to USD 47.7 billion.

- Northrop Grumman is advancing the SONAR system market by leading in the realm of acoustic sensors and processing innovation. Their strategic focus is on developing and producing the core sonar components, including the Spherical Active Passive arrays and towed array sonars that form the backbone of the U.S. Navy’s surface combatants. A critical advancement is their investment in advanced computing and data fusion technologies that have processed complex SONAR system market data to provide a clear, actionable common operational picture to combat system commanders.

Here is a list of key players operating in the global market:

The global market is very competitive and defined by a mix of established defense giants and specialized technology firms. Key players from the U.S. and Europe dominate the high-end defense sector, driven by the modernization and significant budgets. Strategic initiatives are heavily focusing on research and development to enhance the signal processing, autonomy, and multi-static capabilities. Companies are increasingly pursuing strategic partnerships, mergers, and acquisitions to expand their technological portfolios and global market reach. For example, Coda Octopus Group, Inc., an imaging sonar technology for real-time subsea intelligence and cutting-edge diving technology, announced that it had completed the acquisition of Precision Acoustics Limited in November 2024, based in Dorchester, UK. Further, there is a growing trend of adapting military-grade SONAR for commercial applications in offshore energy, maritime security, and underwater exploration to diversify the revenue streams and tap into emerging markets.

Corporate Landscape of the SONAR System Market:

Recent Developments

- In June 2025, Wavefront Systems has announced that it has expanded its deep-sea Solstice MAS sonar range with 1500 m and 3000 m variants to enhance compatibility with deep-water platforms and autonomous systems.

- In April 2025, Kraken Robotics Inc. has announced the launch of a synthetic aperture sonar (SAS) service for the global offshore energy market. Kraken’s commercial services team will have dedicated KATFISH towed SAS systems available for rental starting July 2025.

- Report ID: 2794

- Published Date: Dec 05, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

SONAR System Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.