Nasal Implant Market Outlook:

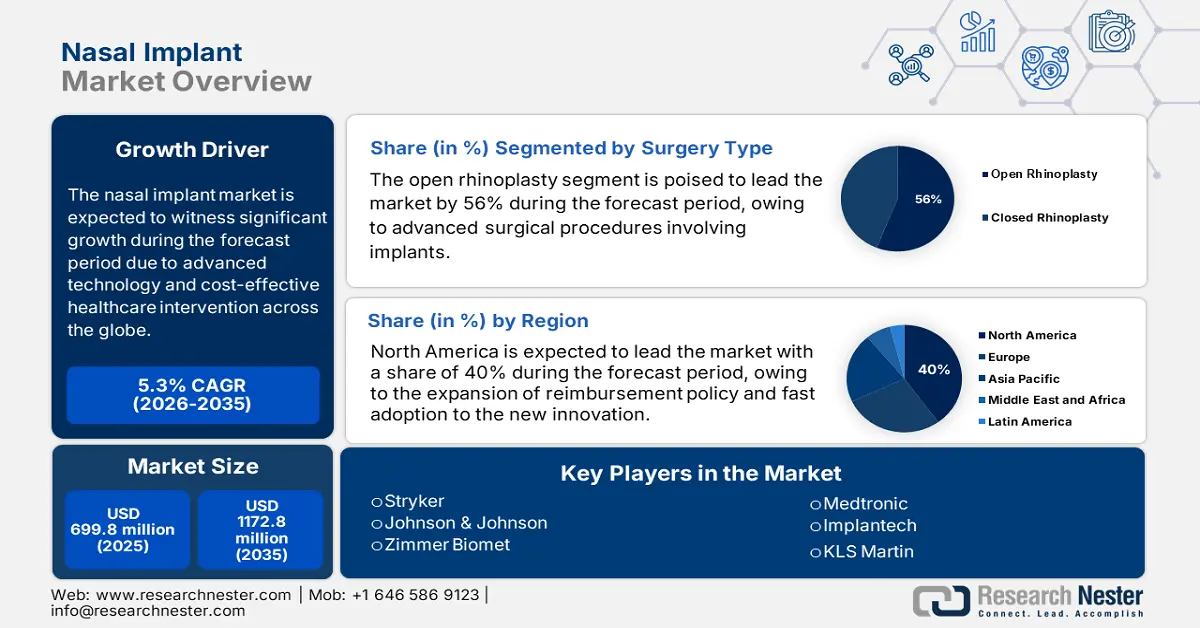

Nasal Implant Market size was valued at USD 699.8 million in 2025 and is projected to reach USD 1172.8 million by the end of 2035, rising at a CAGR of 5.3% during the forecast period, i.e., 2026-2035. In 2026, the industry size of nasal implant is assessed at USD 736.8 million.

The global market serves a growing patient pool, driven by reconstructive and cosmetic surgical needs. As per the NLM report in February 2024, more than 10.7 million patients are operated on for traumatic facial injuries in the global market. Demand for advanced nasal implants elevated in the global market, which uplifted the performance of the cosmetic surgery boom. Technological advancement created a high opportunity to escalate the market performance and deliver better patient outcomes. A wide level of technological integration in 3D printed, porous polyethylene, and many more materials leads to the growth of the market. Food and Drug Approval is one of the leading aspects that generated patient reliance on the advanced nasal advancement and led to the growth of the concerned market.

Raw materials like porous polyethylene, titanium, and many more are required for the manufacturing of devices within the market. North America, Europe, and Asia are the leading regions that are considered to be key production hubs. According to the U.S. International Trade Commission, the growth of the medical device trade rose by 7.81% in 2023, based on the OEC data. Government support through fund allocation for research and development expanded the scope of the market. As per the reporting of the National Institute of Health, a considerable amount is allocated to introduce the next-generation bioabsorbable nasal implant in the U.S. market.

Key Nasal Implant Market Insights Summary:

Regional Highlights:

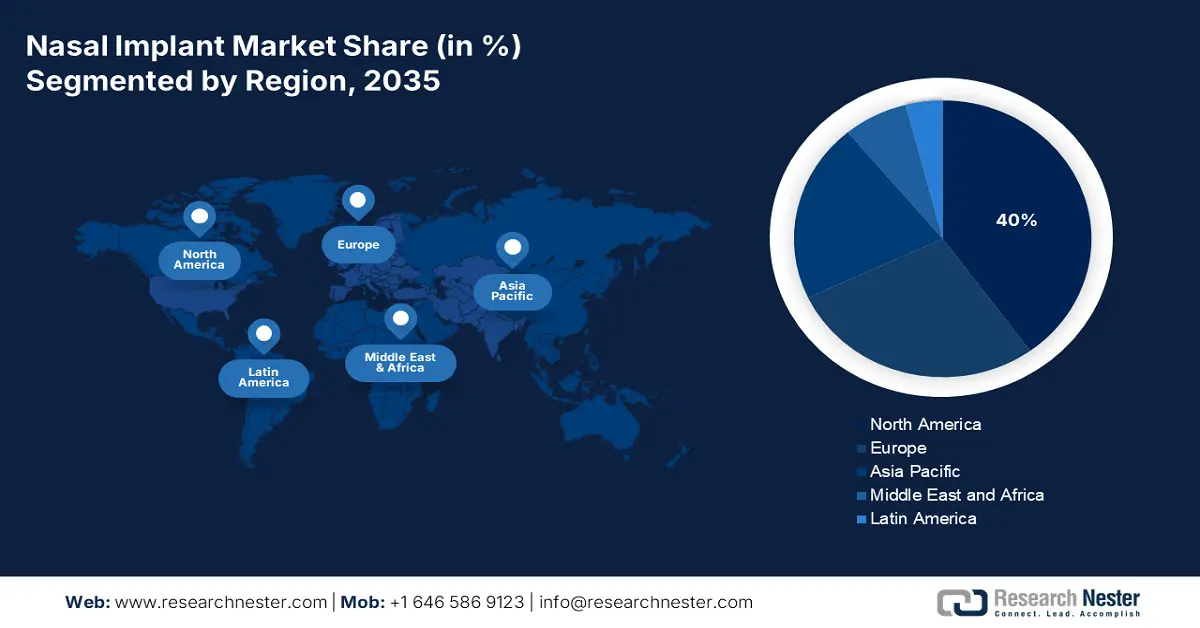

- North America is expected to accumulate a 40% market share in the nasal implant market by 2035, owing to high cosmetic surgery demand, favorable reimbursement policies, and rapid adoption of innovations.

- Europe is projected to maintain substantial growth by 2035, driven by rising ENT disorder prevalence, aging populations, and advancements in patient-specific implants.

Segment Insights:

- The Cosmetic Surgery application segment is projected to lead the nasal implant market by 2035, owing to social media influence, rising disposable income, and growing acceptance of aesthetic procedures.

- The Synthetic Implants segment is expected to dominate the market by 2035, propelled by affordability, improved biocompatibility, and reduced operative time.

Key Growth Trends:

- Advanced and cost-effective healthcare intervention

- Technological advancement and adoption trends

Major Challenges:

- Affordability factors

Key Players: Stryker, Johnson & Johnson, Zimmer Biomet, Medtronic, Implantech, KLS Martin, Polytech Health & Aesthetics, Surgiform, Poriferous, Nagor, Eurosurgical, GC Aesthetics, Toriumi, Implantech, Suneva Medical, Teoxane, Anuva, BioPlast, EverCare

Global Nasal Implant Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 699.8 million

- 2026 Market Size: USD 736.8 million

- Projected Market Size: USD 1172.8 million by 2035

- Growth Forecasts: 5.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, France, United Kingdom, Japan

- Emerging Countries: South Korea, Thailand, India, China, Singapore

Last updated on : 25 September, 2025

Nasal Implant Market - Growth Drivers and Challenges

Growth Drivers

- Advanced and cost-effective healthcare intervention: Technological advancement and alternative manufacturing strategy ensure providing better patient outcomes at an affordable price range. According to the evaluation of the Agency for Healthcare Research and Quality, hospitalization rates and controlled medication expenses are achieved with the help of early-stage nasal reconstruction. According to the Stryker data in 2025, patients save nearly USD 2,200 through the implementation of the advanced nasal implant in the market. A scope of saving long-term expenses and achieving quick development from the health risk has elevated the market demand for nasal implants.

- Technological advancement and adoption trends: Better patient outcomes and an increased level of treatment in the market are ensured through technological upgradation and rapid adoption. According to the National Institute of Health, USD 50.174 billion is requested for biomedical and healthcare research, which includes bio-medication devices and leverage the research and development scope for patient-specific nasal implants. Companies such as Stryker collaborated with the Mayo Clinic and ensured AI-associated nasal implantation that provides a higher rate of customization.

- Rising aging population: Demographic shifts towards an older population are a fundamental, long-term driver. Age-related nasal valve collapse and the need for reconstructive surgery following skin cancer resection (e.g., melanoma) become more prevalent with age. This demographic is often covered by government insurance like Medicare, which supports market growth. The U.S. Census Bureau depicts that there is an increase in the elderly population, highlighting a steady expansion of the candidate pool for functional nasal implant procedures for years to come.

Rhinoplasty Procedure Statistics by Country

|

Country |

Total Cosmetic Procedures (2021) |

Rhinoplasty Procedures (2021) |

|

Thailand |

106,372 (surgical) |

23,600 (22.2% of total) |

|

Turkey |

950,000 |

68,029 |

|

Japan |

265,733 (surgical) |

Not specified |

|

Germany |

1,082,892 (surgical + non-surgical) |

Not specified |

|

Brazil |

2.7 million (surgical + non-surgical) |

78,720 |

|

South Korea |

13.5 cosmetic procedures per 1000 individuals |

NA |

Source: Aesthetic Medical Practitioner May 2024

Challenges

- Affordability factors: Availing premium surgery is beyond the affordability rate within the low to medium income group of people. According to the reporting of the National Health Policy, the population in India face the barrier of price constraint while accessing the nasal implant. The cost of the treatment is higher than their average income. Availability of a limited range of insurance is one of the barriers that limit the accessibility rate in the concerned market. As per the study of the World Health Organization, Brazil provides limited private health plan to its citizens for rhinoplasty, which reduces the patient population for the market. Increased rate of cost of production due to inflation rate and economic turmoil elevated the cost of implantation, which failed to provide the implantation service at an affordable price range.

Nasal Implant Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.3% |

|

Base Year Market Size (2025) |

USD 699.8 million |

|

Forecast Year Market Size (2035) |

USD 1172.8 million |

|

Regional Scope |

|

Nasal Implant Market Segmentation:

Surgery Type Segment Analysis

Under the segment of surgery type, open rhinoplasty leads the segment and is expected to hold the share value of 56% by 2035. The segment is driven by its advanced surgical visibility and control, which is important for complicated procedures involving implants. The procedure enables better placement and shaping of implants, resulting in more predictable and stable long-term outcomes, an important factor for surgeons and patients. According to the ISAPS report in 2023, almost 65.8% of rhinoplasties were conducted among overall aesthetic procedures in 2023, highlighting the demand of the segment.

Application Segment Analysis

The application segment is led by cosmetic surgery, which is driven by social media influence, growing social acceptance of aesthetic procedures, and rising disposable income. The demand for minimally invasive and non-surgical procedures often acts as a gateway to surgical interventions like implant-based rhinoplasty. Data from the ISAPS shows aesthetic or cosmetic procedures are showing a higher increase of 5.5% in surgical procedures, with more than 15.8 million procedures performed by plastic surgeons and 19.1 non-surgical procedures, underscoring the massive demand that fuels this segment's revenue dominance.

Product Segment Analysis

Synthetic implants are driven by its extensive availability, affordability, and decreased operative time compared to autograft harvest. Their dominance is driven by new developments in material science, which has improved their biocompatibility and decreased associated complication rates such as extrusion and infection. The FDA's approval of new porous polyethylene implants with enhanced tissue integration capacity helps ensure their adoption. Industry reports from the American Society of Plastic Surgeons show a consistent preference for synthetic materials in primary cosmetic rhinoplasty due to their predictable outcomes.

Our in-depth analysis of the global market includes the following segments:

|

Product |

|

|

Surgery Type |

|

|

Application |

|

|

End user |

|

|

Material |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Nasal Implant Market - Regional Analysis

North America Market Insights

The nasal implant market is dominated by North America, which is expected to expand with a market share accumulation of 40% by 2035. Leadership of the region in the global market is achieved based on key factors like demand for cosmetic surgery, reimbursement policies, adoption rate for innovations, and many more. The Cleveland Clinic report in March 2022 states that more than 345,000 cases of rhinoplasty are conducted annually, which showcases the high demand for the nasal implant in North America. Accessibility of the market is raised through the expansion of the Medicare budget and private insurance.

The U.S. market is dominating the nasal implant market in North America. Demand for cosmetic surgery is high in the U.S., and it is reported that men get 20% of rhinoplasty surgeries each year, based on a report from the Cleveland Clinic in March 2022. The expansion of Medicare spending, with an estimated valuation of approximately USD 918 billion in 2022 on a normal basis, gained higher patient access in the market, based on the Medpac report in 2022. Reduction of the approval period through the FDA’s fast-track ensured better market penetration and high growth. FDA clearance also advocated for the fast adoption of the bioabsorbable implant and created high demand for the nasal implant.

Cost of Rhinoplasty Surgery

|

Country |

Cost |

|

U.S. |

USD 7,637 |

|

Canada |

USD 4,000 and USD 5,000 |

Source: American Society of Plastic Surgeons 2025, The Landings Surgical Center 2025

Asia Pacific Market Insights

The nasal implant market in the Asia Pacific is exhibiting a high potential factor that makes it an emerging market and is expected to grow with a considerable market share by 2035. The rise in medical tourism is one of the primary growth drivers that has created high opportunities for the market to elevate its revenue-generating ability. For instance, South Korea and Thailand are the leading regions in the global market, and 1 million rhinoplasty surgeries were performed in 2024 in the regions, based on the ISAPS report in 2024. Enhanced rate of government investment in the elevation of healthcare infrastructure and R&D has advocated the growth of nasal implants.

China is the dominating country in the Asia Pacific region in the market, which is poised to expand with a regional market share. Local manufacturing is considered to be the most prominent factor that has elevated the market performance in China. Collaborating with the domestic raw material suppliers controlled the cost of production and enabled the market to provide affordable products to the patients. Government investment encourages local production via allocation of funds, accelerating the market growth of nasal implants. According to the report of the National Medical Products Administration, various nasal trauma cases were diagnosed in 2023, which escalated the market demand for nasal implants.

Europe Market Insights

Europe is the second largest region in the nasal implant market and is driven by the high prevalence of ENT disorders, a rising aging population having functional corrective surgeries, and demand for cosmetic rhinoplasty. Technological advancements in biodegradable and patient-specific 3D-printed implants, provide better biocompatibility and results, are the main factors propelling the market. A robust reimbursement framework for the required procedures in Germany and France ensures patient access, sustaining steady market growth across the region.

Germany is the largest country holding the maximum share in the nasal implant market in Europe. Germany is the world's largest market for medical devices, including those used in implant procedures, with yearly sales of USD 44 billion (EUR 38 billion), according to a report released by the International Trade Administration in August 2025. Germany's leadership is further reinforced by its favorable reimbursement policies and advancements in medical innovations. Further, the nation holds its leading position in the market due to its effective regulatory framework, providing a quick adoption of advanced implant technologies.

Key Nasal Implant Market Players:

- Stryker

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Johnson & Johnson

- Zimmer Biomet

- Medtronic

- Implantech

- KLS Martin

- Polytech Health & Aesthetics

- Surgiform

- Poriferous

- Nagor

- Eurosurgical

- GC Aesthetics

- Toriumi

- Implantech

- Suneva Medical

- Teoxane

- Anuva

- BioPlast

- EverCare

The market is highly competitive, and factors like technological innovation and market expansion are the strategies implemented by the companies to derive a competitive edge. The majority of the leading players relied on better research and development, such as 3D printing and bioabsorbable. The U.S. firms like Stryker and Johnson & Johnson are the dominating players focusing on innovative product introduction in the market. On the contrary, businesses in Europe are leveraging material science, specifically Polytech’s silicone formulation, which has escalated the business performance in the competitive market.

Below is the list of some prominent players operating in the global market:

Recent Developments

- In July 2025, Spirair received FDA clearance for TurbAlign, which is a new bioabsorbable implant that helps patients keep their nasal passages open after sinus surgery by separating the middle turbinate from the lateral nasal wall during the critical healing period.

- In June 2025, Lyra Therapeutics announced positive results from the ENLIGHTEN 2 Phase 3 Trial of LYR-210, achieving significant results for primary and secondary endpoints in the treatment of chronic rhinosinusitis (CRS).

- Report ID: 211

- Published Date: Sep 25, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Nasal Implant Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.