Multichannel Networks Market Outlook:

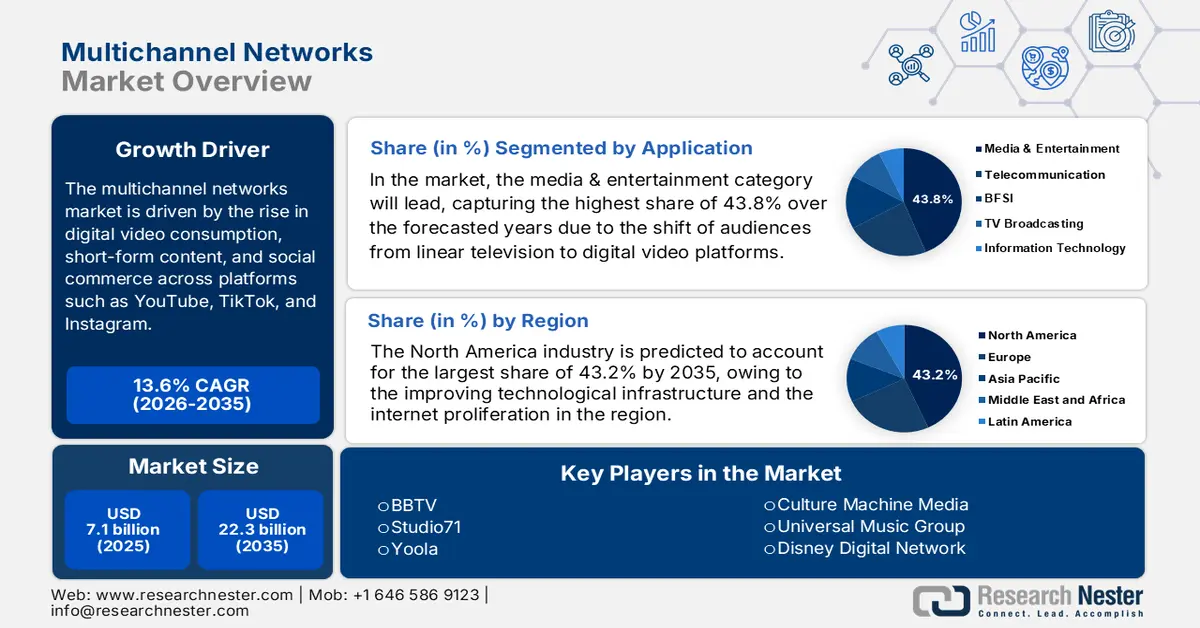

Multichannel Networks Market size was valued at USD 7.1 billion in 2025 and is projected to reach USD 22.3 billion by 2035, rising at a CAGR of 13.6% during the forecast period, i.e., 2026-2035. In 2026, the industry size of multichannel networks is estimated at USD 8 billion.

The multichannel networks market is driven by the rise in digital video consumption, short-form content, and social commerce across platforms such as YouTube, TikTok, and Instagram. In this regard, the Pew Research Center’s 2025 survey, published in November 2025, disclosed that YouTube is identified to be the most widely used online platform among adults in the U.S., with 84% reporting use, closely followed by Facebook at 71%. It also mentioned that about 50% of adults use Instagram, whereas 37% use TikTok, reflecting the growing adoption of short-form and social video content. At the same time, the usage is extremely high among younger adults, with around 80% of 18 to 29-year-olds using Instagram and about 50% using TikTok daily. Hence, these statistics demonstrate the expanding audience for digital video and social commerce, providing a strong foundation for multichannel networks to engage creators.

The organizations in the multichannel networks (MCN) market are making a major shift from simple content aggregation and monetization networks into full-service creator ecosystem platforms by offering services such as analytics, cross-platform distribution, and brand partnerships. For instance, in June 2025, AnyMind Group announced that it had expanded its collaboration with YouTube to support the YouTube Shopping affiliate program across Southeast Asia, which enables creators to tag products in videos and earn commissions on resulting sales. It also notes that a gadget review channel based in Thailand has generated more than USD 100,000 in GMV with AnyMind’s support in brand matching, analytics, and content optimization. Furthermore, through this initiative and its AnyCreator platform, AnyMind is providing creators with multi-platform distribution, monetization tools, and brand partnership opportunities, which exemplify the evolution of MCNs to a full-service creator ecosystem platform.

Key Multichannel Networks Market Insights Summary:

Regional Highlights:

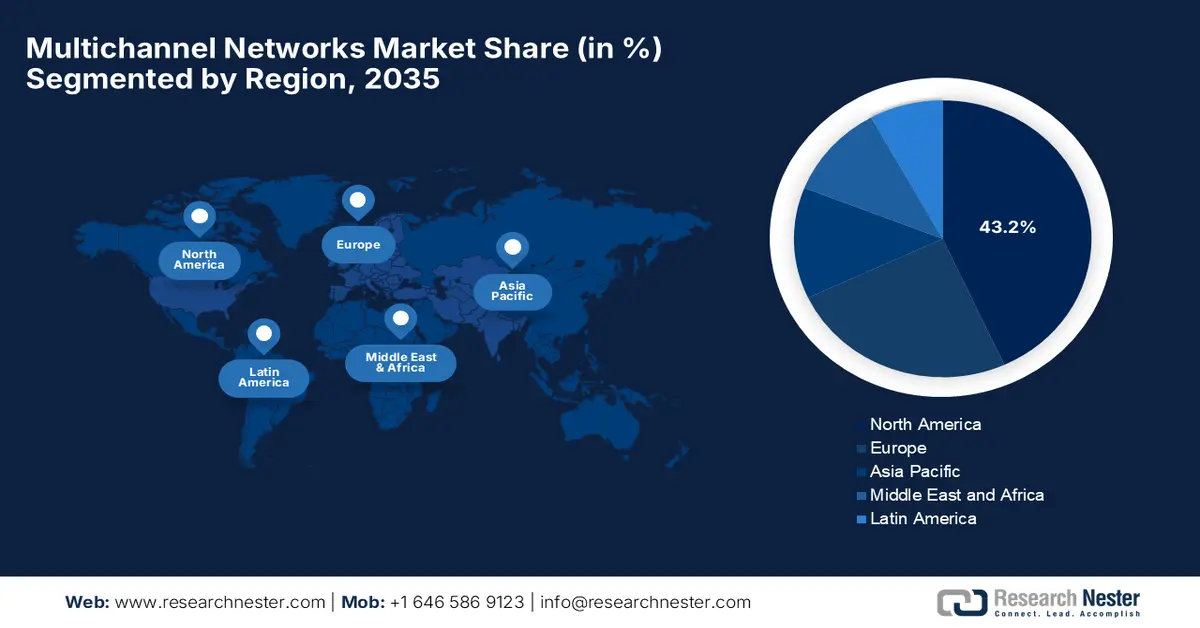

- North America is projected to command a 43.2% share of the multichannel networks market by 2035, reinforced by advanced digital infrastructure, rising internet penetration, and strong creator-driven content consumption.

- Asia Pacific is anticipated to witness the fastest expansion by 2035, catalyzed by rapid smartphone adoption and the surging popularity of short-form video platforms.

Segment Insights:

- Media & entertainment is expected to secure a leading 43.8% share by 2035 in the multichannel networks market, supported by the accelerating shift from linear television to digital on-demand video consumption.

- Production & editing services are set to grow at the quickest rate by 2035, spurred by escalating demand for high-quality digital video content creation.

Key Growth Trends:

- Proliferation of digital platforms

- Increasing internet & mobile users

Major Challenges:

- Revenue dependence on platform policies

- Intense market competition

Key Players: BBTV, Studio71, Yoola, Culture Machine Media, Universal Music Group, Disney Digital Network Maker Studios, Warner Bros Discovery, The Orchard Enterprises, Sony Music Entertainment, Tastemade, VEVO LLC, Brave Bison, Qyuki Digital Media, UTURN Entertainment, WildBrain London

Global Multichannel Networks Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 7.1 billion

- 2026 Market Size: USD 8 billion

- Projected Market Size: USD 22.3 billion by 2035

- Growth Forecasts: 13.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (43.2% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, United Kingdom, Germany

- Emerging Countries: India, South Korea, Indonesia, Brazil, Vietnam

Last updated on : 2 January, 2026

Multichannel Networks Market - Growth Drivers and Challenges

Growth Drivers

- Proliferation of digital platforms: Platforms such as YouTube, Instagram, and TikTok are fueling a surge in content creation wherein pioneers from the multichannel networks market aggregate, manage, and amplify this vast volume of user-generated content, creating opportunities for creators and advertisers as well. In December 2024, Snapchat Inc. announced that it had launched a new unified monetization program for creators, consolidating ad-based revenue opportunities across both Stories and Spotlight content formats. The firm also mentioned that this program enables eligible creators to earn ad revenue not only from short Stories but also from Spotlight videos longer than one minute. According to the company announcement, Spotlight viewership was up 25% year‑over‑year, and the number of creators posting publicly on Snapchat has more than tripled over the past year, underscoring substantial growth in creator participation and engagement on the platform, hence denoting a wider MCN market scope.

- Increasing internet & mobile users: Rising internet penetration, particularly through mobile devices, has efficiently boosted online video consumption, driving demand for diverse content and MCN services that support creators in reaching wider audiences. According to a 2024 Pew Research Center survey, which was published in July 2025, revealed that 90% of teens in the U.S. use YouTube, whereas TikTok and Instagram are used by almost 63% and 61%, respectively, and Snapchat also remains popular. It also mentioned that daily engagement is very high, with 70% of teens visiting YouTube daily and 57% using TikTok, whereas smaller shares access Facebook. Usage patterns vary by demographics, such as Hispanic teens are most likely to be on platforms almost constantly, and teens from lower-income and urban households also report higher constant usage, highlighting the role of mobile internet penetration in driving the multichannel networks (MCN) market.

- Evolving consumer viewing habits: Audiences are making a shift from traditional media toward on-demand, personalized, and engaging video content across genres such as gaming, comedy, music, and education, in which MCNs help optimize content delivery to meet these changing habits. In September 2025 at Brandcast 2025, YouTube highlighted a major shift in viewing habits in India, with audiences now expecting on-demand, personalized content across screens. The platform reported over 650 million monthly shorts viewers and 75 million Connected TV users, demonstrating the move away from traditional media. In addition, YouTube is leveraging this trend by offering multiple formats from long-form creator-led shows to short-form shorts by enabling brands to engage audiences through creator partnerships, hence benefiting the multichannel networks market.

Percentage of U.S. Teens (Ages 13-17) Who Visit or Use Online Platforms Almost Constantly (2024)

|

Demographic |

TikTok (%) |

YouTube (%) |

Snapchat (%) |

Instagram (%) |

Facebook (%) |

|

Boys |

13 |

19 |

13 |

12 |

3 |

|

Girls |

19 |

11 |

12 |

12 |

2 |

|

RACE |

|||||

|

White |

8 |

7 |

13 |

6 |

1 |

|

Black |

28 |

28 |

13 |

22 |

7 |

|

Hispanic |

25 |

24 |

14 |

18 |

4 |

|

AGE |

|||||

|

13-14 |

14 |

16 |

10 |

8 |

2 |

|

15-17 |

17 |

14 |

14 |

14 |

3 |

|

Household Income |

|||||

|

<USD 30,000 |

21 |

27 |

17 |

16 |

7 |

|

USD 30K- USD 74,999 |

19 |

19 |

11 |

14 |

4 |

|

USD 75,000+ |

14 |

12 |

13 |

10 |

2 |

|

Community Type |

|||||

|

Urban |

21 |

26 |

12 |

21 |

6 |

|

Suburban |

14 |

12 |

12 |

10 |

2 |

|

Rural |

13 |

12 |

15 |

8 |

1 |

Source: Pew Research Center

Challenges

- Revenue dependence on platform policies: The multichannel networks market is dependent on platforms such as YouTube, TikTok, and Instagram for content distribution and monetization. Therefore, any changes in these platform algorithms, monetization policies, and advertisement revenue sharing can affect the earnings, which in turn can negatively influence profitability for MCNs. For example, a platform may make changes to ad placement rules, demonetize a few content categories, or change eligibility thresholds for revenue sharing. Such instances create uncertainty for MCNs, compelling them to constantly adapt to evolving policies and maintain diversified platform partnerships. Additionally, disputes in terms of copyright and content strikes can lead to revenue loss, making platform dependency one of the most fundamental operational risks in this entire ecosystem.

- Intense market competition: The multichannel networks (MCN) market is highly fragmented and competitive, which is hosting large worldwide players and regional players who are vying for top creators and audience attention. Competing MCNs often differentiate themselves through technology tools, content monetization options, or niche specialization, which raises the cost of acquiring and retaining creators. Also, the presence of high competition pressures MCNs to make continuous investments in AI-based analytics, marketing solutions, and cross-platform distribution strategies. In this context, smaller networks may find it struggling to scale and maintain profitability, whereas larger players must innovate to retain MCN market share. Further, this competitive landscape forces MCNs to balance growth and service quality while sustaining profitable relationships with both creators as well as advertisers.

Multichannel Networks Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

13.6% |

|

Base Year Market Size (2025) |

USD 7.1 billion |

|

Forecast Year Market Size (2035) |

USD 22.3 billion |

Multichannel Networks Market Segmentation:

Application Segment Analysis

In the multichannel networks market, the media & entertainment category will lead, capturing the highest share of 43.8% over the forecasted years. The continued shift of audiences from linear television to digital, on-demand video platforms is the key factor behind the sub-type’s leadership. The presence of this transition increases reliance on MCNs to manage creator content at scale across platforms, in turn encouraging pioneers to make continued innovations. In July 2025, YouTube Shorts introduced new creation tools that are especially designed to accelerate and simplify short-form video production. The tools include a photo-to-video feature that automatically converts images into animated Shorts, being introduced across the U.S., Canada, Australia, and New Zealand. Additionally, new generative AI effects enable creators to transform doodles and selfies into immersive visuals, supporting faster, more engaging content creation, thereby expanding the potential of the media & entertainment sector.

Services Segment Analysis

In the services segment, the production & editing services will grow at the fastest pace in the multichannel networks (MCN) market during the discussed timeframe. Heightened demand for high-quality digital video content fuels growth in production and editing services, driving consistent revenue in this field. In this regard, UNESCO in November 2024 announced the launch of training programs for digital content creators with a prime focus on the accuracy, ethics, and credibility of online information. The initiative also responds to UNESCO findings that 62% of news influencers do not verify content before sharing. It also mentions that through partnerships and large-scale training, UNESCO aims to equip creators to address misinformation while engaging audiences even more responsibly. Furthermore, this creates encouraging opportunities for MCNs to expand professional production, editing, and quality-assurance services for both creators and platforms.

End user Segment Analysis

By the end of 2035, the large enterprises segment in terms of end user is anticipated to garner a lucrative revenue share in the multichannel networks market. The segment is continuously growing as brands allocate increased advertising budgets to digital video and creator-led marketing. The larger enterprises also rely on MCNs to manage complex, multi-platform creator portfolios, ensure brand safety, and maintain compliance with advertising and content regulations. In addition, MCNs provide scalable analytics, audience targeting, and campaign optimization capabilities that align very well with enterprise-level marketing objectives. Furthermore, the ability of MCNs to deliver consistent messaging and measurable outcomes across diverse digital channels further strengthens their value proposition for large enterprises over the years ahead.

Our in-depth analysis of the multichannel networks (MCN) market includes the following segments:

|

Segment |

Subsegments |

|

Application |

|

|

Services |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Multichannel Networks Market - Regional Analysis

North America Market Insights

North America is forecasted to emerge as the largest regional landscape by representing an anticipated 43.2% share of the multichannel networks market by 2035. This regional dominance is mainly propelled by its improving technological infrastructure and the internet proliferation. The presence of key MCN market pioneers and higher content consumption is also fueling market growth efficiently. In June 2025, Faraday Future announced that it held a signing ceremony with its initial partners, including U.S.-based influencer marketing agencies, to advance its FX brand’s co-creation sales model. It also mentioned that this collaboration establishes a world-first B2B2C ecosystem in the automotive industry, where digital creators promote vehicles through influencer-led campaigns and livestream ecommerce. Furthermore, the initiative highlights the expanding role of MCNs in enterprise marketing, content-driven sales, and digital distribution strategies other than traditional media.

The U.S. is growing in the multichannel networks (MCN) market owing to the mature landscape of both content creation and consumption. The country’s market also benefits from the presence of pioneering MCNs, content creators, and a large consumer base, allowing a continued ad revenue stream. In May 2025, Perion Network Ltd. announced that it had acquired Greenbids, which is an advanced AI platform, to enhance its Perion One advertising capabilities across major channels, including YouTube, Facebook, and Instagram. Therefore, the acquisition enables custom, performance-driven campaign optimization, improving media efficiency, client retention, and revenue growth. Furthermore, by integrating Greenbids’ technology, Perion aims to expand MCN market share and deliver brand-specific algorithmic intelligence at scale. Hence, such instances position the country as a predominant leader, attracting more players to make investments in this field.

U.S. Youth Users and Advertising Revenue by Social Media Platform, 2022

|

Social Media Platform |

Users 0-12 yrs (millions) |

Users 13-17 yrs (millions) |

Users 0-17 yrs (millions) |

Ad Revenue 0-12 yrs (USD millions) |

Ad Revenue 13-17 yrs (USD millions) |

% Revenue from Users <18 yrs |

|

|

2.76 |

7.05 |

9.90 |

137.2 |

- |

1.9% |

|

|

3.98 |

12.73 |

16.71 |

801.1 |

4,000 |

16% |

|

Snapchat |

2.87 |

15.13 |

18.00 |

- |

- |

41.4% |

|

TikTok |

3.04 |

15.93 |

18.97 |

- |

2,000 |

35% |

|

|

2.07 |

4.93 |

7.00 |

- |

- |

2.0% |

|

YouTube |

31.45 |

18.34 |

49.79 |

959.1 |

1,200 |

27% |

Source: NLM

In Canada, the multichannel networks market is evolving rapidly as creators in the country embrace bilingual content for multilingual audiences. The country’s market also benefits from strong internet infrastructure and high social media penetration, which encourages collaboration between domestic content creators and global MCNs. The CJF NextGen Creator-Journalists Program in 2025, which is supported by the Google News Initiative, provides independent content creators and small digital-native news organizations in Canada with 12 months of mentorship, skill-building workshops, and resources to build sustainable digital news ventures. Also, participants receive training in modern content creation, distribution, monetization strategies, and platform-specific tools, including YouTube. Furthermore, graduates are eligible for Ambassador stipends to support digital development, innovation projects, and community impact initiatives, strengthening Canada’s MCN and digital journalism landscape.Top of Form In the upcoming years.

APAC Market Insights

Asia Pacific is likely to register the fastest growth in the global multichannel networks (MCN) market, efficiently backed by the widespread adoption of smartphones and short-form video consumption. Platforms such as TikTok, YouTube, and regional equivalents as Bilibili and Naver are driving high engagement, encouraging MCNs to aggregate and manage local creators. In January 2025, AnyMind Group announced that it had launched a service enabling web publishers to monetize content on YouTube with minimal resources. It also underscores that the platform leverages AI to convert articles into short-form videos and provides access to YouTube Partner Sales, including reserved inventory and programmatic ad placements. Furthermore, this initiative supports content creators and publishers in the region to scale revenue streams and optimize engagement, clearly exemplifying APAC’s growing multichannel network ecosystem.

China is augmenting its leadership over the regional multichannel networks market, fueled by strong integration with e-commerce and live-streaming ecosystems, with platforms such as Douyin, Kuaishou, and Bilibili playing a central role. Simultaneously, the aspect of stringent government regulations around content compliance and platform governance requires MCNs to ensure creators adhere to strict content policies. In this regard, China’s Cyberspace Administration in January 2025 released a draft regulation to standardize multi-channel network institutions and their online content services, aiming to create a healthier digital environment. It also mentioned that the rules prohibit activities such as spreading rumors, promoting vulgar content, inciting conflicts, or harming minors, and require MCNs to obtain professional qualifications for certain services. Furthermore, the draft also mandates platforms to set up complaint channels and invites public feedback on the regulation until February 2025.

India in the multichannel networks market is growing on account of the presence of a young and digitally active population. In addition, YouTube, Instagram, and regional platforms support creators who are producing entertainment, educational, and regional language content. In this regard, at the WAVES Summit in Mumbai, which was held in May 2025, the YouTube CEO announced that more than 100 million channels in India uploaded content in the past year, with more than 15,000 surpassing 1 million subscribers, which highlights India’s rise as a Creator Nation. It was also mentioned that YouTube has paid over INR 21,000 crore (approximately USD 2.55 billion) to creators, artists, and media companies in India over the last three years and plans to invest INR 850 crore (around USD 103 million) over the next two years to develop India’s creator ecosystem. Furthermore, the platform is also partnering with government bodies and creative institutions to expand the global reach of the country’s content, hence denoting a positive market outlook.

Key Insights from India’s Creator Economy 2025 & MCN Market Opportunities

|

PIB Insight |

Data |

Trend |

MCN Market Opportunity |

|

Active creators |

2-2.5 million |

Large base |

Onboard non-monetizing creators |

|

Monetization |

Only 8% to 10% earn |

Untapped revenue |

Enable monetization & brand deals |

|

Consumer influence |

USD 350-400 billion today; >USD 1 trillion by 2030 |

High impact |

Connect creators with brands |

|

Content format |

Short-form video; comedy, films, daily soaps, fashion |

Popular formats |

Scale creators in trending content |

|

Audience |

Expanding beyond Gen Z & metros |

Wider reach |

Diversify creator portfolio by age/city |

|

Brand investment |

1.5-3x increase |

Rising demand |

Manage campaigns & track ROI |

|

Revenue models |

Subscriptions, gifting, live commerce |

New streams |

Support multiple monetization channels |

|

Creator revenue |

USD 20 to 25 billion today; USD 100 to 125 billion by 2030 |

Rapid growth |

Expand MCN services |

Source: Ministry of Information & Broadcasting

Europe Market Insights

Europe has acquired the most prominent position in the international multichannel networks market and is supporting creators across multiple languages and countries by addressing a highly fragmented digital media landscape. MCNs in this region are emphasizing content compliance with the EU’s strict copyright and advertising regulations, allowing increased uptake. In December 2025, the European Commission announced that it had secured TikTok’s binding commitments to comply with the EU’s Digital Services Act to ensure complete transparency in advertising across its platform. It also mentioned that TikTok will provide complete ad content, targeting criteria, and aggregated user data in a searchable repository, updated within 24 hours, which allows regulators and researchers to monitor ads for scams, illegal content, or age-inappropriate material. Therefore, such instances illustrate how platforms and MCNs operating in Europe need to align with strict EU regulations to maintain compliance and protect users, especially minors.

In Germany, the multichannel networks market represents a mature ecosystem that emphasizes high-quality production and professionalized content creation. MCNs in the country collaborate closely with creators to navigate strict advertising standards and GDPR regulations. In addition to sponsorships, branded content, and partnerships with broadcasters and streaming platforms are recognized as the prominent revenue avenues in the country. We Are Era, RTL Group’s talent agency and digital studio, announced in November 2024, announced that it had acquired Social Match, which is a Germany-based digital agency specializing in influencer marketing, content creation, channel management, and paid advertising, strengthening its presence in the German-speaking creator economy. Besides, the integration expands We Are Era’s international network across six regional markets, providing enhanced cross-media and community marketing opportunities for creators and brands.

In the U.K., the multichannel networks market is growing on account of a robust digital advertising environment. Entertainment, fashion, and gaming are particularly strong verticals in the country, wherein MCNs offer services ranging from brand collaborations and analytics to rights management and distribution support. In December 2025, Acast UK announced that it had launched an industry-first YouTube program in partnership with Little Dot Studios, creating the UK’s largest premium audio and video podcast offering. This program allows top podcasters, including Fearne Cotton and Peter Crouch, to monetise YouTube video content along with audio, providing advertisers with premium sponsorship and targeted ad opportunities. Furthermore, this initiative extends Acast’s multichannel creator network, integrating analytics, monetisation, and growth support across audio, video, and social platforms, hence making it suitable for overall MCN market growth.

Key Multichannel Networks Market Players:

- BBTV (BroadbandTV) (Canada)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Studio71 (U.S.)

- Yoola (Israel)

- Culture Machine Media (India)

- Universal Music Group (U.S.)

- Disney Digital Network (Maker Studios) (U.S.)

- Warner Bros. Discovery (U.S.)

- The Orchard Enterprises (U.S.)

- Sony Music Entertainment (Japan/U.S.)

- Tastemade (U.S.)

- VEVO LLC (U.S.)

- Brave Bison (U.K.)

- Qyuki Digital Media (India)

- UTURN Entertainment (Saudi Arabia)

- WildBrain London (U.K.)

- BBTV is a major media and technology company based in Canada that partners with content creators and media brands across the globe to help monetize, distribute, and manage digital video content. The firm is best known for its rights management tools and global distribution capabilities, and supports creators with technology solutions that optimize audience engagement and revenue across platforms. Furthermore, its subsidiaries, such as YoBoHo, expand distribution opportunities through strategic deals.

- Studio71 is one of the leading global media and digital content companies that produces and distributes premium content across YouTube & other video platforms, and is generating billions of monthly views. Moreover, the organization connects creators with brands through extensive ad partnerships, offers channel and content management services, and leverages its global media expertise to scale creator businesses and extend content reach into podcasts, OTT channels, and almost all social platforms.

- Yoola is a YouTube-certified MCN and creator services platform that empowers creators around the globe with audience growth, monetization strategies, content protection, and optimized revenue systems. It manages thousands of channels worldwide, and it provides tools for channel optimization, multi-platform distribution, and flexible payout solutions, thereby enabling creators to expand their reach and earnings across digital ecosystems.

- The Orchard Enterprises is a part of Sony Music, and it operates at the intersection of music and digital content distribution. Besides, Orchard is acting as a hybrid MCN by offering marketing, sales, and distribution services for independent labels and creators. Its platform efficiently facilitates monetization and exposure for music-related video content across digital networks, thereby helping artists and creators maximize revenue through sync deals, rights management, and multi-territory distribution.

- Universal Music Group is one of the most popular brand names in this field, which leverages an entertainment catalog and MCN-style capabilities to support music and entertainment creators with distribution, licensing, and audience engagement. It is a major global music corporation that also integrates content monetization strategies with its artist roster, using digital networks to enhance visibility and revenue from streaming and branded partnerships.

Below is the list of some prominent players operating in the global MCN market:

The multichannel networks market is primarily shaped by a combination of large media pioneers, specialized digital networks, and regional players who are competing to support content creators with monetization, distribution, analytics, as well as rights management. Major players in this field are pursuing distinct initiatives such as global expansion and partnerships to differentiate themselves in this highly competitive landscape. In February 2025, Kevel announced that it had acquired Nexta, which is an AI-based self-serve advertising platform, with a primary focus on enhancing its retail media solution. This integration combines on-site and off-site ad capabilities under a unified, API-driven platform, which allows retailers to manage multi-channel ad investments, optimize performance, and drive revenue growth. Hence, this strategic move positions Kevel to offer a completely customizable, data-driven retail media network, reflecting the trend of MCN and media technology companies that are expanding services to provide end-to-end monetization and audience engagement solutions across digital and physical channels.

Corporate Landscape of the Multichannel Networks Market:

Recent Developments

- In December 2025, AnyMind Group announced the acquisition of Sun Smile to expand its capabilities into offline retail, integrating social media, e-commerce, and nationwide store distribution through an AI-powered online-to-offline (O2O) model.

- In October 2025, Channel Factory announced that it became a launch member of YouTube’s activation partners program, using AI and contextual intelligence to help advertisers place brand-safe, effective ads, highlighting its ability to deliver measurable performance and brand outcomes at scale.

- Report ID: 833

- Published Date: Jan 02, 2026

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Multichannel Networks Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.