Edge AI Hardware Market Outlook:

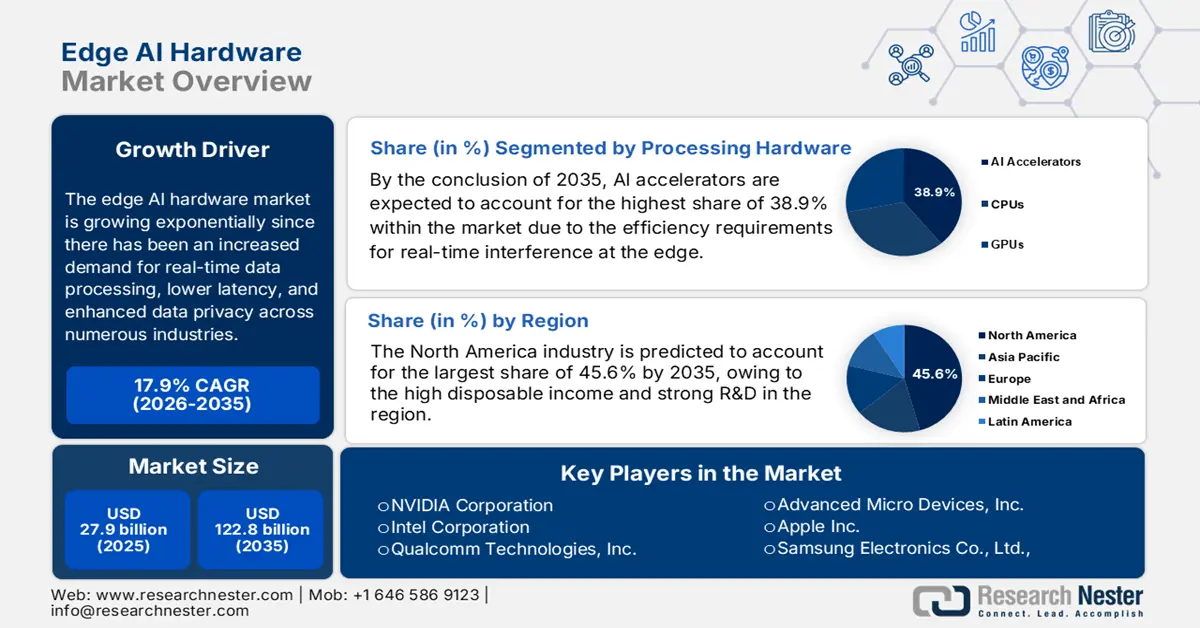

Edge AI Hardware Market size was valued at USD 27.9 billion in 2025 and is projected to reach USD 122.8 billion by the end of 2035, rising at a CAGR of 17.9% during the forecast period, i.e., 2026-2035. In 2026, the industry size of edge AI hardware is assessed at USD 32.8 billion.

The edge AI hardware market is growing exponentially since there has been an increased demand for real-time data processing, lower latency, and enhanced data privacy across numerous industries. Similarly, the sectors such as autonomous vehicles, industrial automation, healthcare devices, and consumer electronics are rapidly adopting specialized hardware, which also includes the AI-optimized processors, chips, GPUs, and NPUs, to facilitate complex on-device computations. In this regard, the article published by the Semiconductor Industry Association in July 2025 reported that large-scale U.S. semiconductor supply-chain investments are exceeding USD 630 billion across over 130 announced projects, which directly strengthens the manufacturing base required for edge AI hardware and improves access to advanced chips, materials, and packaging capacity that are essential for device production.

Furthermore, as per the same article, government incentives, which include USD 32.54 billion in grants and up to USD 5.85 billion in loans from the Department of Commerce, along with dedicated programs such as the USD 3 billion Secure Enclave award, are expected to enhance domestic availability of critical components and reduce upstream sourcing risk. Hence, the existence of these initiatives collectively reinforces supply-chain resilience, stabilizes long-term component pricing, and supports sustained innovation for companies developing Edge AI hardware solutions. In addition, the edge AI hardware market is also bolstered by the advent of IoT devices and the rising deployment of 5G networks, wherein the demand is highly sophisticated.

Semiconductor Supply Chain Investments Supporting Edge AI Hardware Development (2020-2025)

|

Company |

Project Type |

Category |

Project Size |

Grants |

|

Yield Engineering Systems |

New Facility |

Equipment |

USD 25 million |

- |

|

X-FAB |

Expansion/Modernization |

Semiconductors |

USD 200 million |

USD 50 million |

|

Wolfspeed (Siler City) |

New Facility |

Semiconductors |

USD 6 billion (2 locations) |

USD 750 million (2 locations) |

|

Wolfspeed (Marcy) |

Expansion |

Semiconductors |

USD 6 billion (2 locations) |

USD 750 million (2 locations) |

|

Western Digital |

Expansion |

Semiconductors |

USD 350 million |

- |

|

Vacom |

New Facility |

Equipment |

USD 90 million |

- |

|

TTM Technologies |

New Facility |

Materials |

USD 130 million |

- |

|

TSMC |

New Facility |

Semiconductors |

USD 165 billion |

- |

Source: Semiconductor Industry Association

Key Edge AI Hardware Market Insights Summary:

Regional Highlights:

- By 2035, North America is expected to command a 45.6% share of the edge AI hardware market, attributable to advancing technological adoption.

- By 2035, the Asia Pacific region is poised to expand its presence with a rising share, supported by accelerating industrial automation.

Segment Insights:

- By 2035, the AI accelerators segment in the edge AI hardware market is projected to capture a 38.9% share, propelled by efficiency requirements for real-time inference at the edge.

- By 2035, the high bandwidth memory segment is expected to hold a significant share, supported by the need for high-throughput memory to sustain model weights and multimodal processing.

Key Growth Trends:

- Proliferation of IoT and connected devices

- Advent of 5G and future 6G networks

Major Challenges:

- Supply chain volatility

- Integration complexity and fragmented standards

Key Players: NVIDIA Corporation (U.S.), Intel Corporation (U.S.), Qualcomm Technologies, Inc. (U.S.), Advanced Micro Devices, Inc. (U.S.), Apple Inc. (U.S.), Samsung Electronics Co., Ltd. (South Korea), MediaTek Inc. (Taiwan), Huawei Technologies Co., Ltd. (China), IBM (U.S.), Micron Technology, Inc. (U.S.), Hailo Technologies Ltd. (Israel), Arm Holdings plc (UK), Broadcom Inc. (U.S.), STMicroelectronics (Switzerland), Lattice Semiconductor (U.S.).

Global Edge AI Hardware Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 27.9 billion

- 2026 Market Size: USD 32.8 billion

- Projected Market Size: USD 122.8 billion by 2035

- Growth Forecasts: 17.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (45.6% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, South Korea

- Emerging Countries: India, Singapore, Taiwan, Brazil, United Arab Emirates

Last updated on : 9 December, 2025

Edge AI Hardware Market - Growth Drivers and Challenges

Growth Drivers

- Proliferation of IoT and connected devices: The rise in the number of smart and connected devices, such as sensors, cameras, and IoT nodes, is readily accelerating the demand for on-device AI processing, prompting a favorable business environment for the edge AI hardware market. This enables low-latency decision-making without any dependency on cloud connectivity. The article published by NIELIT in May 2022 reported that India is extensively leveraging the internet of things through the presence of initiatives such as the Smart City Mission and Digital India Program, which are deploying connected systems such as smart homes, transportation, lighting, and parking. Simultaneously, the government-supported training programs and IoT infrastructure development program are also accelerating the adoption and implementation of IoT across the country’s vast geography.

- Advent of 5G and future 6G networks: This is also an important growth driver for the edge AI hardware market since the widespread adoption of high-speed, low-latency wireless connectivity makes edge-based AI inference and data exchange more feasible, which is encouraging enterprises to deploy edge AI hardware for applications. In September 2025, Tata Consultancy Services and Qualcomm announced that they had launched the TCS innovation lab in Bengaluru to co-develop smart, scalable edge AI solutions utilizing the Qualcomm platforms. The lab is equipped with 5G private networks and will focus on real-time, on-device intelligence for sectors such as healthcare, manufacturing, smart infrastructure, and security. Further, the collaboration aims to create cost-effective, energy-efficient, and software-defined solutions that will enable enterprises to modernize processes and deploy autonomous intelligent devices.

- Need for real-time analytics: This, coupled with the need for on-device processing for applications such as autonomous driving, robotics, industrial automation, video analytics, and predictive maintenance, makes quick decisions highly essential. Therefore, this factor is driving demand for hardware that is capable of running AI models locally. In September 2025, Arm announced that its edge AI technology is efficiently transforming industries by enabling AI directly on local devices, reducing latency, improving privacy, and enhancing the overall system reliability. It also noted the real-world applications, which include smart manufacturing, retail, healthcare, agriculture, robotics, and security, where on-device inference drives real-time analytics and autonomous decision-making. Furthermore, this integration of AI at the edge supports energy efficiency and rapid responsiveness across IoT and connected environments, positively impacting the edge AI hardware market.

Challenges

- Supply chain volatility: This, coupled with component constraints, has been a major challenge for the edge AI hardware market. This is directly associated with the semiconductor wafer availability, packaging bottlenecks, and limited access to specialty components such as AI accelerators, embedded NPUs, and high-density memory. In this regard, manufacturers depend on worldwide distributed fabrication and assembly ecosystems, which makes them highly vulnerable to geopolitical disruptions, export controls, logistics delays, and fabrication-node shortages. Besides, the lead times for critical components are extremely long, which negatively affects the production schedules and hardware rollout planning. Furthermore, when the capacity improves, the competition with data center AI chip demand creates upward pressure on the pricing, thereby reducing allocation for edge-focused devices.

- Integration complexity and fragmented standards: The edge AI hardware market must support multiple deployment environments, such as industrial automation and healthcare instrumentation, to transportation systems and remote sensors. This variety creates complex integration requirements across areas of connectivity, firmware, operating systems, power management, and real-time inference workloads. In this context, the vendors must take in inconsistent customer specifications, limited interoperability standards, as well as fragmented AI frameworks. Also, maintaining compatibility with edge software stacks with deterministic latency and on-device processing accuracy adds to the engineering burden. Furthermore, integration testing, certification, and long-term device support are extending the development cycles since the enterprise deployments often use legacy architectures; vendors must deliver hybrid solutions that interface with aging infrastructure.

Edge AI Hardware Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

17.9% |

|

Base Year Market Size (2025) |

USD 27.9 billion |

|

Forecast Year Market Size (2035) |

USD 122.8 billion |

|

Regional Scope |

|

Edge AI Hardware Market Segmentation:

Processing Hardware Segment Analysis

By the conclusion of 2035, AI accelerators are expected to account for the highest share of 38.9% within the edge AI hardware market. The dominance of the segment is effectively attributable to the efficiency requirements for real-time inference at the edge. In December 2025, Marvell Technology announced that it is acquiring Celestial AI for USD 3.25 billion to advance terabit-scale optical interconnects for AI accelerators in next-generation data centers. In this regard, Celestial AI’s photonic fabric enables ultra-low latency, high-bandwidth, and energy-efficient connections between XPUs, thereby extending its support to multi-rack, scale-up AI architectures. Furthermore, the acquisition positions Marvell to lead in high-performance AI infrastructure, enabling faster and more efficient large-scale AI training and inference, hence denoting a wider segment scope.

Memory & Storage Segment Analysis

In the edge AI hardware market, the high bandwidth memory segment is expected to lead with a significant share over the discussed timeframe. The edge inference workloads are demanding high-throughput memory to support model weights and multimodal processing, positioning the segment at the forefront to generate revenue in this sector. As the processors are moving towards chiplet and 3D integration architectures, HBM becomes highly essential for managing computer memory bottlenecks. In addition, this high bandwidth memory is highly crucial for edge AI devices to handle large AI models and real-time multimodal data efficiently, and improve performance. Its integration in chiplet and 3D architectures allows compact, energy-efficient designs suitable for edge deployments. Furthermore, with the increasing demand for on-device AI in applications, the HBM segment is poised to drive substantial revenue growth in the market.

Connectivity Hardware Segment Analysis

In the connectivity hardware segment, the 5G/6G edge modules are expected to command a lucrative revenue share in the edge AI hardware market over the analyzed timeframe. The high-capacity wireless links are necessary for distributed edge inference, remote management, and hybrid edge-cloud architectures, wherein these advancements drive demand for integrated communication chipsets within edge gateways, industrial IoT nodes, and autonomous platforms. In October 2025, NVIDIA, along with Booz Allen, Cisco, MITRE, ODC, and T-Mobile, introduced the first-ever AI-native wireless stack for 6G, built on the NVIDIA AI Aerial platform to integrate AI across hardware, software, and architecture. Besides, the stack enables breakthrough applications like multimodal integrated sensing and communications for public safety and AI-based spectrum agility, delivering higher spectral efficiency and seamless connectivity.

Our in-depth analysis of the edge AI hardware market includes the following segments:

|

Segment |

Subsegments |

|

Processing Hardware |

|

|

Memory Storage |

|

|

Connectivity Hardware |

|

|

Sensors & Interfaces |

|

|

Power & Thermal |

|

|

Device Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Edge AI Hardware Market - Regional Analysis

North America Market Insights

North America in the edge AI hardware market is expected to dominate with the largest revenue stake of 45.6% share by the end of 2035. This represents a mature and high-value market positively influenced by technological adoption, high disposable income, and a strong R&D ecosystem. In December 2025, Armada announced that it had partnered with LTIMindtree to expand the deployment of edge AI across industries by integrating its Galleon modular data centers and Armada Edge Platform for real-time intelligence at the edge. Also, the collaboration supports sovereign AI and federated learning, enabling secure, low-latency AI workloads in manufacturing, healthcare, energy, and other regulated sectors. In addition, this initiative highlights growing enterprise demand for scalable, high-performance edge AI hardware and infrastructure, hence making it suitable for overall market growth.

The U.S. is representing steep growth in the regional edge AI hardware market owing to the high concentration of AI startups, cloud providers, and semiconductor manufacturers. Simultaneously, industries such as defense, aerospace, automation, and smart cities are implementing edge AI solutions to enable real-time analytics, predictive maintenance, and secure data processing at the source. In August 2023, Sidus Space announced that it had acquired Exo-Space to enhance its Edge AI capabilities for space applications by integrating both hardware and software into its satellite and space services offerings. Also, the acquisition expands Sidus’ technology, talent, and market reach, thereby enabling adaptable AI processing on satellites for commercial, government, and defense clients. Furthermore, by combining Exo-Space’s Edge AI platform with its own sensors and satellite constellation, the firm aims to deliver an actionable and high-performance space-based data solution.

Canada has gained immense exposure in the regional edge AI hardware market, efficiently fueled by its strong AI research ecosystem and public-private collaborations. The country is witnessing a rise in AI adoption in various sectors, where real-time data processing is crucial. In addition, local technology incubators and innovation hubs are fostering the development of energy-efficient AI devices. In October 2024, Untether AI announced that it had launched the speedAI240 slim accelerator card, which delivers world-leading AI inference performance and energy efficiency for edge and regional datacenter applications. Besides, the card targets automotive vision, industrial machine vision, and agricultural AI workloads by combining low latency with low power consumption through its At-Memory Compute architecture. Furthermore, with the imAIgine SDKit, it enables scalable, high-performance AI outside traditional datacenters.

APAC Market Insights

In the edge AI hardware market, the Asia Pacific is growing extensively due to the rapid deployments, which are supported by growing IoT adoption, smart city projects, and industrial automation. Countries in the region are focusing on developing AI-enabled devices for transportation, retail, and manufacturing, leveraging low-latency on-device computation. In addition, pioneering firms across prominent countries are increasingly making investments in AI research and edge computing infrastructure, thereby accelerating regional adoption in this field. The region also benefits from a massive population base, rapid urbanization, and strong economic growth, especially in India. Meanwhile, the rising government investments and the rising middle class in China and India are also propelling continued growth in the regional landscape. Hence, the presence of all of these factors is responsibly positioning APAC as the predominant leader in this field.

China has achieved a prominent position in the regional edge AI hardware market, backed by the strong government support for AI initiatives and smart manufacturing programs. Simultaneously, the domestic chipmakers are constantly putting efforts into innovating specialized processors and memory solutions to support high-performance on-device AI. In the article published by SCIO in August 2025, it was observed that China is expanding its AI edge hardware ecosystem through a national computing power platform that integrates regional and industry resources, enabling efficient AI workloads at scale. On the other hand, companies such as Cambricon Technologies are leading the development of AI chips for smartphones, servers, and edge applications, which in turn is fueling domestic demand and reducing reliance on foreign suppliers, hence positioning the country as a key player in the global edge AI hardware market.

India is gaining momentum in the edge AI hardware market, efficiently driven by smart city projects, digital infrastructure expansion, and the need for affordable, low-power AI devices. The country’s market also benefits from collaboration between government, academia, and industry, which supports the development of customized edge AI solutions for local needs. Ministry of Electronics & IT in July 2025 reported that India’s semiconductor startup ecosystem is gaining traction, wherein the government-backed initiatives, such as the DLI Scheme and Chips to Startup (C2S) Programme, are supporting domestic chip design. The article also highlights that Netrasemi secured ₹107 crore (≈ USD 12.9 million) in VC funding for chips targeting smart vision, IoT, and CCTV applications, whereas other startups such as Mindgrove Technologies and Fermionic Design also raised significant private investment, hence strengthening India’s edge AI ecosystem.

Europe Market Insights

Europe has the strong potential to capitalize on the edge AI hardware market, highly favoured by the investments in autonomous systems, industrial IoT, and energy management. Countries in the region are emphasizing privacy-compliant solutions to meet regulatory requirements, whereas research initiatives and industrial partnerships are promoting innovative edge AI solutions for automotive, manufacturing, and healthcare sectors. In December 2025, HPE announced that it is offering AMD Helios AI rack-scale architecture, delivering a turnkey solution for trillion-parameter AI training and high-volume inference with 2.9 AI exaflops of FP4 performance. Besides, the open, integrated platform leverages HPE Juniper Networking and Broadcom’s Tomahawk 6 chip for scale-up Ethernet, providing flexibility and faster deployments for cloud service providers, hence denoting a positive edge AI hardware market outlook.

Germany is expected to dominate the regional edge AI hardware market over the forecasted years, owing to its strong manufacturing base and focus on Industry 4.0. Edge AI solutions are being deployed for quality control and robotics automation. On the other hand, the domestic semiconductor companies are developing high-performance chips to meet the demands of industrial edge applications. In April 2025, Nagarro and Advantech announced that they had entered into a global partnership to co-create advanced edge AI platforms and industrial IoT solutions, combining Advantech’s hardware expertise with Nagarro’s AI software capabilities. The company also stated that this collaboration focuses on scalable, secure edge platforms, real-time AI deployment, and device management across industries such as manufacturing, healthcare, and smart cities, with a collective goal of delivering industrial-grade embedded solutions that expand edge AI applications.

In the U.K., the edge AI hardware market is set to witness extensive progress, highly propelled by the demand to enhance smart city infrastructure, transportation, and healthcare services. The country’s market also benefits from government-backed AI research programs and collaborations, which are accelerating the development of edge AI solutions. In July 2024, Graphcore, the UK-based AI chipmaker, announced that it had been acquired by SoftBank and would continue to operate under its name, with a prime focus on next-generation AI compute technologies. The company aims to improve efficiency and computational power for AI workloads, thereby supporting foundation models and generative AI applications. Hence, such moves will encourage R&D and global deployment, and boost the AI market by expanding access to high-performance, next-generation AI chips.

Key Edge AI Hardware Market Players:

- NVIDIA Corporation (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Intel Corporation (U.S.)

- Qualcomm Technologies, Inc. (U.S.)

- Advanced Micro Devices, Inc. (U.S.)

- Apple Inc. (U.S.)

- Samsung Electronics Co., Ltd. (South Korea)

- MediaTek Inc. (Taiwan)

- Huawei Technologies Co., Ltd. (China)

- IBM (U.S.)

- Micron Technology, Inc. (U.S.)

- Hailo Technologies Ltd. (Israel)

- Arm Holdings plc (UK)

- Broadcom Inc. (U.S.)

- STMicroelectronics (Switzerland)

- Lattice Semiconductor (U.S.)

- NVIDIA Corporation is leading the entire global dynamics with its GPU-accelerated Jetson platform, which is extensively used for robotics, autonomous machines, industrial IoT, and smart‑device inference. The company’s strength lies in a mature developer ecosystem, support for AI frameworks, and high compute density. This, in turn, has allowed NVIDIA to maintain a leading share and is mostly viewed as the benchmark for high-throughput edge compute.

- Qualcomm Technologies, Inc. is leveraging its deep experience in mobile and wireless technologies to deliver power-efficient edge‑AI SoCs and platforms that integrate AI acceleration, connectivity, and low-power operation. Qualcomm has readily shifted toward edge AI, covering IoT, automotive, mobile, and embedded systems, which positions it strongly for distributed, on-device inference workloads, especially in places where power consumption and connectivity matter.

- Intel Corporation is hosting a diversified edge‑AI hardware portfolio combining CPUs, VPUs, FPGAs, and AI accelerators. The company has a flexible platform approach that supports computer vision, industrial IoT, and smart‑city applications. In addition, Intel’s modular offerings and software support aim to simplify the deployment of edge‑AI systems in enterprise and industrial settings, thereby allowing it to gain a competitive advantage where there is a huge requirement for versatility and legacy‑system compatibility.

- Advanced Micro Devices, Inc. is one of the most prominent players, especially through its adaptive computing and FPGA-based products, with a prime focus on industrial, automotive, and embedded edge‑AI applications. The firm combines CPU, GPU, and programmable logic through its adaptive SoCs. Hence, this versatility attracts customers who are looking for customizable edge‑AI compute rather than one-size-fits-all solutions.

- MediaTek Inc. is the central player in this field, which focuses on delivering cost- and power-efficient edge‑AI chips for consumer electronics, mobile devices, IoT, and smart devices markets with volume demand. The company is optimizing for energy efficiency and affordability, thereby enabling broader adoption of edge‑AI capabilities across price-sensitive devices and nations, complementing performance-oriented players.

Below is the list of some prominent players operating in the global edge AI hardware market:

In the global edge AI hardware market, firms such as NVIDIA, Intel, Qualcomm, AMD, and Samsung are leveraging extensive R&D, extensive product portfolios, and control over key AI hardware IP. These players are strongly focused on performance-per-watt, energy-efficiency, and integrated platform solutions to meet rising demand across IoT, automotive, robotics, and smart devices. In March 2025, Qualcomm Technologies, Inc. announced that it had acquired EdgeImpulse Inc. to enhance its AI capabilities and developer enablement across IoT, enabling over 170,000 developers to build, deploy, and monitor edge AI models. Also, this move complements the firm’s strategic IoT approach, integrating chipsets, software, services, and ecosystem resources to support multiple industries, which include retail, security, energy, and supply chain management.

Corporate Landscape of the Edge AI Hardware Market:

Recent Developments

- In November 2025, EdgeCortix announced that it had closed an oversubscribed Series B financing round, raising total funding to over USD 110 million to support global deployment of its SAKURA-II AI accelerator and the upcoming SAKURA-X chiplet platform.

- In October 2025, NXP announced that it had officially completed its acquisition of Kinara, marking a significant step in advancing edge AI, in which this move strengthens NXP’s portfolio with Kinara’s Ara-1 and Ara-2 NPUs, which deliver up to 6 and 40 eTOPS², respectively, enabling efficient, low-latency, on-device AI for applications.

- Report ID: 8291

- Published Date: Dec 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Edge AI Hardware Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.