Enterprise AI Market Outlook:

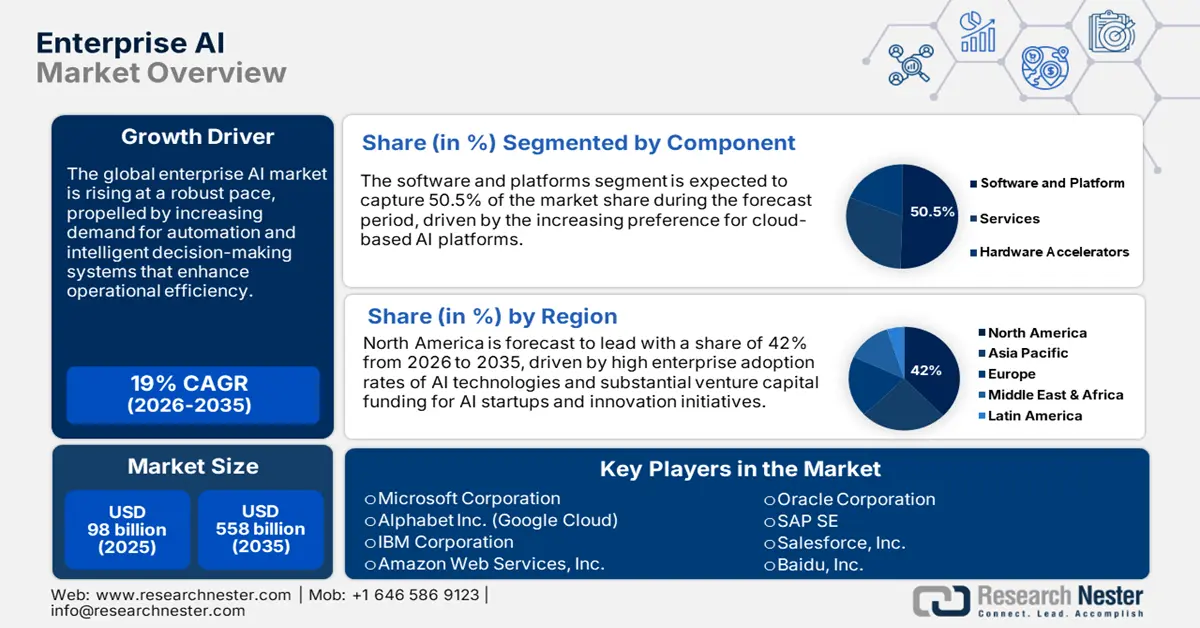

Enterprise AI Market size is valued at USD 98 billion in 2025 and is projected to reach a valuation of USD 558 billion by the end of 2035, rising at a CAGR of 19% during the forecast period, i.e., 2026-2035. In 2026, the industry size of enterprise AI is estimated at USD 116.6 billion.

The global enterprise AI market is rising at a robust pace, propelled by the adoption of advanced machine learning models, automation platforms, and cloud-based AI services across various business functions. Firms are designing end-to-end AI solutions that combine predictive analytics, natural language processing, and computer vision capabilities to inform decision-making and enhance operational efficiency. In July 2025, Microsoft Corporation celebrated the success stories of over 1,000 customers who have transformed their businesses through AI, demonstrating how companies utilize Microsoft's successful AI assets to achieve real business value. These compounding forces create substantial market opportunities in every industry, as companies seek competitive differentiators through the adoption of artificial intelligence.

Government support enables Enterprise AI adoption through extensive funding programs, such as national AI initiatives, research grants, and regulatory overhaul projects, all in the interest of promoting artificial intelligence adoption across the economic landscape. In July 2025, the White House published America's AI Action Plan, outlining federal government support for AI adoption and easing the heavy regulations inherited from the previous administration. The plan designates the formal Chief Artificial Intelligence Officer Council (CAIOC) as the primary interagency forum for collaboration, while creating talent-exchange programs to expedite the deployment of technical AI expertise across agencies. Market expansion is driven by increasing enterprise recognition of AI's strategic importance in maintaining a competitive edge and achieving operational excellence in rapidly evolving business environments.

Key Enterprise AI Market Insights Summary:

Regional Insights:

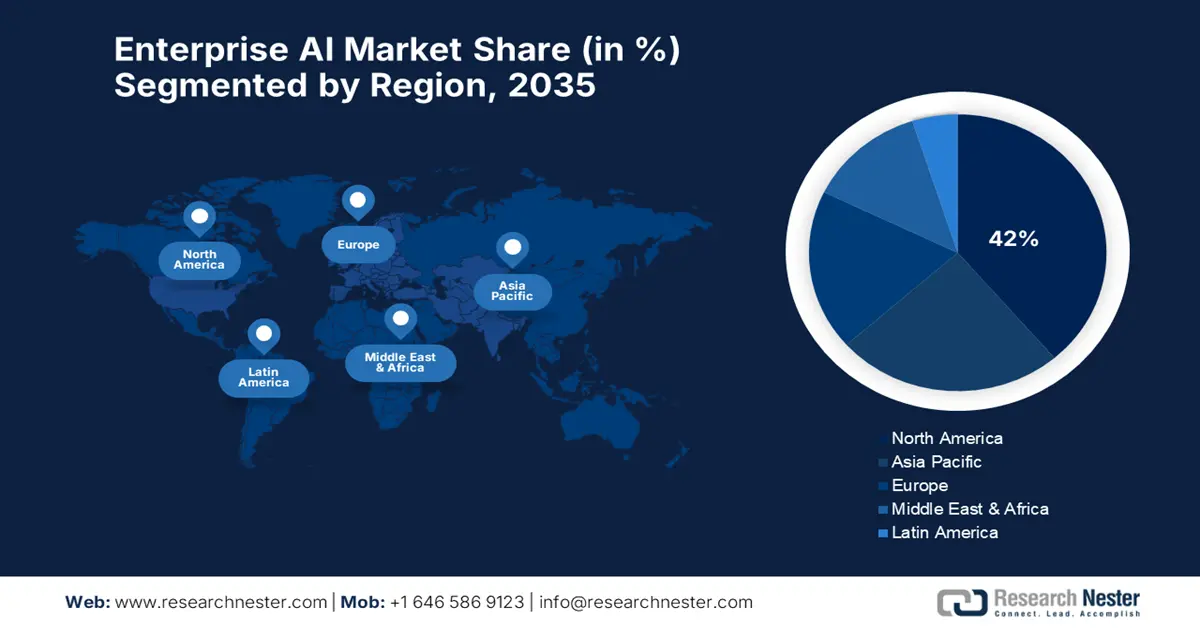

- North America is projected to command a 42% market share by 2035 in the Enterprise AI Market, attributed to its advanced technology ecosystem, robust venture funding, and supportive regulatory environment fostering ethical AI deployment.

- The Asia Pacific region is anticipated to register a 15% CAGR through 2035, fueled by extensive digital transformation programs, government funding, and large-scale AI adoption in manufacturing, finance, and smart city initiatives.

Segment Insights:

- The software and platforms segment is projected to hold a 50.5% share by 2035 in the Enterprise AI Market, propelled by the growing demand for comprehensive AI development environments, pre-trained models, and embedded analytics capabilities.

- The BFSI sector is anticipated to secure a 25% market share by 2035, impelled by the accelerated adoption of AI for risk management, fraud detection, and customer experience enhancement.

Key Growth Trends:

- Higher foundation models and generative AI capabilities redesign business operations

- Cloud-based AI-as-a-Service platforms enable rapid deployment and scalability

Major Challenges:

- Skills gaps and workforce readiness limitations hinder adoption

- Data privacy and governance compliance requirements present implementation challenges

Key Players: Microsoft Corporation, Alphabet Inc. (Google Cloud), IBM Corporation, Amazon Web Services, Inc., Oracle Corporation, SAP SE, Salesforce, Inc., Baidu, Inc., Infosys Limited, Samsung SDS Co., Ltd., Telstra Corporation Limited.

Global Enterprise AI Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 98 billion

- 2026 Market Size: USD 116.6 billion

- Projected Market Size: USD 558 billion by 2035

- Growth Forecasts: 19% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (42% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Australia, Mexico

Last updated on : 12 September, 2025

Enterprise AI Market - Growth Drivers and Challenges

Growth Drivers

- Higher foundation models and generative AI capabilities redesign business operations: Enterprise foundation models enable companies to deploy artificial intelligence solutions for various business activities, including content generation, decision-making, and process automation. New-generation generative AI capabilities drive creative workloads, document processing, and customer interaction automation, resulting in notable productivity gains and cost reductions. In August 2025, IBM Corporation accelerated enterprise generative AI transformation with hybrid capabilities that empowered companies to build and deploy AI agents on their own enterprise data. IBM announced at its annual THINK technologies that break down traditional barriers to scaling enterprise AI, with the ability to build AI agents in 5 minutes with the industry's most comprehensive agent capabilities.

- Cloud-based AI-as-a-Service platforms enable rapid deployment and scalability: Complete cloud platforms provide instant access to advanced AI capabilities to companies without significant investments in infrastructure or technical expertise. Large cloud providers offer end-to-end AI capabilities like machine learning model training, natural language processing, and computer vision through scalable, pay-as-you-go pricing models. These platforms enable faster time-to-market for AI initiatives and business-class security, compliance, and governance features mandated by regulated industries. Amazon Web Services, Inc. invested an additional $100 million in the AWS Generative AI Innovation Center in July 2025, making it easier for businesses to transition from testing AI to integrating AI into mainstream business operations. Launched in 2023 with a seed funding of $100 million, the center pairs AWS customers with Amazon engineers, data scientists, and strategists in developing practical AI solutions for businesses.

- Enterprise data volume and analytics require fuel for AI adoption: Substantially increasing enterprise data volumes creates massive demands for analytics platforms based on AI to process and extract insights from heterogeneous, multi-structured information sources. Organizations utilize AI to analyze customer interactions, operational metrics, and market intelligence, thereby facilitating data-driven decision-making and strategic planning efforts. Deep AI solutions offer real-time processing of streaming data as well as predictive analytics capabilities that identify trends, risk, and opportunities in business processes. In June 2025, Oracle Corporation announced that xAI selected Oracle to deliver Grok models via Oracle Cloud Infrastructure (OCI) Generative AI service for content creation, research, and automated business process use cases. xAI leverages OCI's next-generation AI infrastructure scalability, performance, and affordability to train and run inference for new-generation Grok models.

Enterprise AI Market: Compute Scheduling & Management Pain Points

|

Metric |

Finding |

Implication |

|

Overall Satisfaction |

74% are dissatisfied with current job scheduling tools. |

Widespread inefficiency is a major bottleneck in enterprise AI development. |

|

Desired Solution |

74% see high value in a unified AI/ML platform with integrated scheduling. |

A significant market opportunity exists for end-to-end platforms over point solutions. |

|

Current Adoption of Unified Tools |

Only 19% have a tool that effectively optimizes GPU utilization via queues. |

The market is underserved, with most companies lacking the sophisticated tools they need. |

|

Top Scheduling Features in Use |

Quota Management (56%), GPU Partitioning (42%), Node Pools (38%). |

Basic features are most common, but advanced optimization capabilities are not widespread. |

|

Current Solution Providers |

Vendor/Cloud-Specific (65%), Open Source (e.g., Slurm) (25%), Kubernetes alone (9%). |

The market is fragmented, reliant on cloud vendors, and lacks standardized, effective tools. |

|

Self-Serve Access |

Only 22-27% of DSML practitioners can self-serve compute resources. |

A critical productivity blocker for AI teams, creating dependency and delays. |

|

Perceived Impact of Self-Serve |

93% believe productivity would substantially increase with real-time self-serve compute. |

Solving the self-serve problem is considered the highest leverage action for improving |

Source: AI Infrastructure

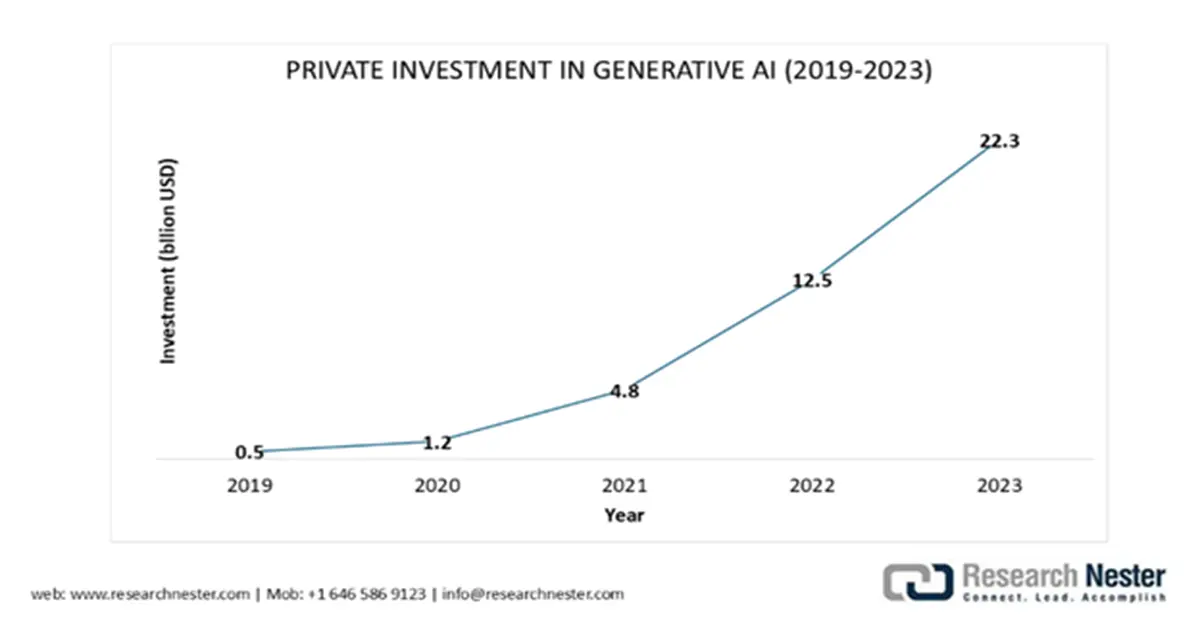

Private Investment in Generative AI (2019-2023)

The rapid growth in private investment in generative AI, which surged from $1.2 billion in 2020 to $12.9 billion in 2022, underscores a massive strategic pivot toward enterprise AI capabilities aimed at automation, content creation, and data-driven decision-making.

Source: IEE

Challenges

- Skills gaps and workforce readiness limitations hinder adoption: The deficient availability of qualified AI specialists and technical skills presents significant barriers to companies adopting and scaling artificial intelligence initiatives within their organizations. Organizations struggle to recruit data scientists, machine learning engineers, and AI specialists, while existing personnel require specialized training in order to utilize AI tools and platforms effectively. The technical complexity of artificial intelligence systems demands specialized knowledge about model building, deployment, and maintenance, which most businesses lack in-house. In September 2024, the U.S. General Services Administration (GSA) published the AI Guide for Government to help federal agencies see clearly what AI means for their work and how to invest in and build AI capabilities responsibly. The guide helps leaders identify concerns most suited for AI solutions, taking into account the building blocks required, and applying AI to targeted use cases at the project level in a manner that ensures responsible deployment.

- Data privacy and governance compliance requirements present implementation challenges: Complex regulatory landscapes in each region require companies to navigate various data protection regulations, security measures, and ethical AI rules, which complicate system deployment and use. Firms must deploy AI systems in accordance with policies such as GDPR, industry-specific needs, and future AI governance platforms, while maintaining operational efficiency and competitiveness. Data sovereignty concerns and restrictions on cross-border data transfers limit deployment options, increasing compliance costs and administrative overhead for multinational corporations. In July 2024, the Government of China, through the Ministry of Industry and Information Technology, released more than formulation of more than 50 national and industrial standards for artificial intelligence by 2026, setting out a full standard system to lead high-quality industry development.

Enterprise AI Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

19% |

|

Base Year Market Size (2025) |

USD 98 billion |

|

Forecast Year Market Size (2035) |

USD 558 billion |

|

Regional Scope |

|

Enterprise AI Market Segmentation:

Component Segment Analysis

The software and platforms segment is estimated to capture 50.5% of the market share through the forecast period due to an increasing requirement for end-to-end AI development environments, pre-trained models, and embedded analytics features. Premium-priced platform products include automated machine learning functionality, model management features, and integration APIs that enable the quicker adoption of enterprise AI across various business functions. In April 2025, SAP SE transformed business processes with an end-to-end AI integration strategy built around Joule, SAP's generative AI copilot, launched in September 2023. While generic AI chatbots lack context, Joule gets the context of business with actionable recommendations by linking disparate SAP systems and analyzing sales performance and identifying supply chain problems before they become issues and recommending solutions. SAP estimates that 80% of average Fiori-based activities in SAP applications could be addressed, potentially making end users 20% more efficient and enabling 300 million users worldwide.

End user Industry Segment Analysis

The BFSI sector is predicted to account for a market share of 25% by 2035, estimating the financial services industry's aggressive adoption of AI technologies for use cases in risk management, fraud detection, customer care, and regulatory requirements. Banks leverage AI for algorithmic trading, credit scoring, tailored banking services, and anti-money laundering solutions, enhancing operational effectiveness and reducing regulatory risk. Advanced AI solutions in banking include robo-advisors, chatbots, and predictive analytics, which optimize customer experience while maximizing resource utilization and minimizing operational costs. In March 2023, Salesforce, Inc. enhanced AI-powered CRM capabilities with Einstein GPT, enabling natural language model-driven generative AI for tailored customer experiences. Some of the most important tools include automated content generation, generating emails and proposals based on current customer data, sophisticated chatbots and virtual assistants that engage in context-based conversations, and sophisticated predictive analytics that forecast results for the future, ranging from sales projections to customer churn.

Deployment Model Segment Analysis

The cloud segment is projected to command a 71% market share through 2035, driven by the benefits of scalability, cost-effectiveness, and full-service that facilitate rapid AI deployment without significant investments in infrastructure. Major cloud providers offer AI development environments integrated with auto-scaling, security features, and compliance that are required for enterprise adoption within highly regulated sectors. In July 2025, Alphabet Inc. (Google Cloud) achieved milestone enterprise AI achievements since half a billion users tapped into Gemini models, and the AI Overview with Google Search had 1.5 billion monthly users. Google Cloud expanded revenue 26% year-over-year to increase market share from 10% in Q1 2023 to 12% in Q1 2025. Strategic partnerships are key to Hugging Face's partnership with Google Cloud, fortifying the platform as an open-source AI development platform. Additionally, Google Distributed Cloud enables the deployment of Gemini models and Agentspace on-premises, addressing data residency and low-latency requirements for healthcare and government institutions.

Our in-depth analysis of the enterprise AI market includes the following segments:

|

Segment |

Subsegments |

|

Component |

|

|

Organization Size |

|

|

Functional Area |

|

|

Technology |

|

|

End user Industry |

|

|

Deployment Model |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Enterprise AI Market - Regional Analysis

North America Market Insights

North America is predicted to maintain a 42% market share during the forecast period, making it a leader in Enterprise AI adoption, innovation, and commercial deployment across various industry verticals. The region benefits from advanced technology infrastructure, robust venture capital investment, and comprehensive regulatory policies that promote the development of artificial intelligence and ensure its ethical deployment and consumer protection. Headquartered in North America, global leaders in technology drive global AI innovation through investment in research, platform development, and strategic partnerships that drive enterprise adoption worldwide.

Enterprise AI development in the U.S. leads, driven by strong government support, tremendous private investment, and visionary regulatory environments that foster innovation while promoting responsible AI deployment. American technology giants, including Microsoft Corporation, Amazon Web Services Inc., and IBM Corporation, lead platform innovation by hosting enterprise customers across various industries and geographies. The U.S. Department of State rolled out its first-ever Enterprise Artificial Intelligence Strategy FY 2024-2025: Empowering Diplomacy through Responsible AI (EAIS) in April 2024, outlining a framework for responsible deployment of AI throughout diplomatic operations. Government agencies at the federal level utilize AI initiatives, exemplifying public sector leadership and driving private sector change through procurement programs and research partnership initiatives.

Canada Enterprise AI market demonstrates consistent growth through government programs in supporting artificial intelligence research, talent building, and commercial utilization in significant economic sectors like finance, healthcare, and natural resources. Provincial and federal governments are backing AI research institutes, startup incubation schemes, and industry partnership programs to increase Canada's global position in AI innovation. The Government of Canada released the Regional Artificial Intelligence Initiative (RAII), investing $200 million in driving new AI innovations in the marketplace and spurring the adoption of AI by SMEs in Canada in October 2024. These initiatives enable domestic development of the AI industry while promoting responsible AI practices and international collaboration in artificial intelligence standards development and regulation.

Europe Market Insights

Europe industry is expected to rise at a rapid pace between 2026 and 2035, driven by widespread regulatory frameworks, high research investment, and a strategic focus on safe artificial intelligence development among the member states of the European Union. Europe focuses on ethical AI principles, data protection laws, and the implementation of human-centric technology, while advocating for innovation and economic competitiveness through strategic AI actions. European companies invest heavily in AI research and development, collaborating with universities and government institutions to develop accountable AI solutions that meet regulatory requirements.

UK enterprise AI market develops rapidly through inclusive government support for artificial intelligence innovation, strategic funding programs, and visionary regulation, balancing the encouragement of innovation with ethics. Companies employ greater research capabilities, financial services expertise, and international cooperation to develop higher-quality AI solutions that target both domestic and foreign markets. In January 2025, the UK Government launched an extensive AI Opportunities Action Plan, imposing all 50 recommendations to turbocharge artificial intelligence nationwide for a decade of national rebirth. The AI integration plan in the NHS aims to improve the delivery of healthcare, speed up consultation planning, reduce administrative workload, and facilitate pothole detection using AI systems fed through cameras.

Enterprise AI market in Germany is driven by cutting-edge manufacturing capability, a strong presence of the automotive industry, and broad government backing for artificial intelligence innovation and research in industrial exploitation. German companies integrate traditional engineering expertise with AI expertise to develop state-of-the-art solutions addressing Industry 4.0 requirements and digital transformation objectives. The German Federal Government, in July 2025, announced an extensive AI offensive strategy targeting 10% of economic production by artificial intelligence by 2030, with a technology catch-up objective with an ambitious thrust. The German research ministry's draft plan emphasizes the deployment of AI as a vital instrument in top-priority fields of research, aiming to overcome competitive barriers and dependencies by promoting the higher commercialization of AI technologies.

APAC Market Insights

The enterprise AI market in Asia Pacific is estimated to rise at a CAGR of 15% through 2035, driven by high-speed digital transformation initiatives, massive government investments, and growing recognition of the strategic importance of artificial intelligence for economic competitiveness. Local governments are implementing comprehensive AI plans to facilitate technology adoption in manufacturing, financial services, healthcare, and government. Mass-scale data production, state-of-the-art telecommunication networks, and high-tech integration are hallmarks of the region, making enterprise AI deployment easier. The increase in e-commerce payments, smart city proposals, and cross-border commerce requirements drives a massive demand for AI-enabled solutions in regional economic integration and digital trade expansion.

China enterprise AI market leads regional growth through wide-ranging state encouragement, extensive technology company investment, and strategic focus on the integration of artificial intelligence in state enterprises and private companies. Chinese government initiatives drive AI adoption in conjunction with domestic technological advancements and global competitiveness in key industries, such as manufacturing, finance, and telecommunications. In March 2025, the Shenzhen Municipal Government accelerated AI innovation with a comprehensive support ecosystem, including the Training Power Voucher scheme, reducing computing expenses for enterprises and opening low-priced edge computing centers. The above actions demonstrate China's commitment to leading the AI industry, driving domestic enterprise adoption, and fostering international market growth through technological innovation and strategic partnerships.

India enterprise AI industry is experiencing steady growth, driven by government-led digital transformation efforts, strategic global partnerships, and comprehensive initiatives that facilitate the implementation of artificial intelligence across diverse economic sectors. The Indian government encourages AI development through national mission efforts, investments in research, and policy regulation that drives innovation while requiring ethical implementation and social benefit considerations. In March 2025, the Government of India launched IndiaAI Mission initiatives, including the AI Compute Portal, AIKosha Datasets Platform, and AI Competency Framework, under the largest mission funding allocation share, at 45%. The initiatives support India's vision to become a global leader in AI, addressing local challenges in healthcare, education, agriculture, and governance through the application of artificial intelligence.

Key Enterprise AI Market Players:

- Microsoft Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Alphabet Inc. (Google Cloud)

- IBM Corporation

- Amazon Web Services, Inc.

- Oracle Corporation

- SAP SE

- Salesforce, Inc.

- Baidu, Inc.

- Infosys Limited

- Samsung SDS Co., Ltd.

- Telstra Corporation Limited

The enterprise AI market is characterized by intense competition from well-established tech players, including Microsoft Corporation, Alphabet Inc. (Google Cloud), IBM Corporation, Amazon Web Services Inc., and Oracle Corporation, as well as emerging artificial intelligence specialists and industry-specific solution providers. Companies continually strive for platform innovation, strategic partnerships, and the end-to-end delivery of services that cater to diverse enterprise requirements across various vertical markets. Successful providers invest a significant amount of money in research and development, as well as forming strategic relationships with system integrators, consultants, and technology partners, to create market share and encourage customer adoption.

Present market dynamics witness high levels of innovation efforts and strategic alliances fueling the advancement of Enterprise AI capabilities, while opening up new market opportunities across various industry uses and geographical locations. Industry players continue to bring on board advanced products, make strategic partnerships, and make acquisitions to advance their technology capabilities and strengthen their competitive positions in rapidly evolving markets. In September 2023, Microsoft Corporation unveiled next-generation AI-powered innovations, including Microsoft Copilot, which will be launched across Windows 11, Bing, Edge, and Microsoft 365. Enterprise customers will gain general availability starting from November 1, 2023. The AI-powered breakthrough companion changes the way users interact with technology through natural language and intelligent, context-sensitive responses.

Here are some leading companies in the enterprise AI market:

Recent Developments

- In May 2025, Microsoft Corporation showcased transformative AI-driven development vision at Build 2025, emphasizing Copilot innovations, Agentic AI architecture, and multi-agent orchestration capabilities. Copilot Studio introduced dynamic AI agent collaboration across workflows enabling businesses to deploy multiple AI assistants working together for complex task automation.

- In April 2025, Alphabet Inc. (Google Cloud) revolutionized enterprise AI through comprehensive platform expansion including Vertex AI unified development environment, Gemini multimodal foundation models, and next-generation TPU infrastructure. Over 4 million developers build with Gemini models on Vertex AI while platform usage grew 20× over the past year.

- Report ID: 8096

- Published Date: Sep 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Enterprise AI Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.