Mucopolysaccharidosis (MPS) Treatment Market Outlook:

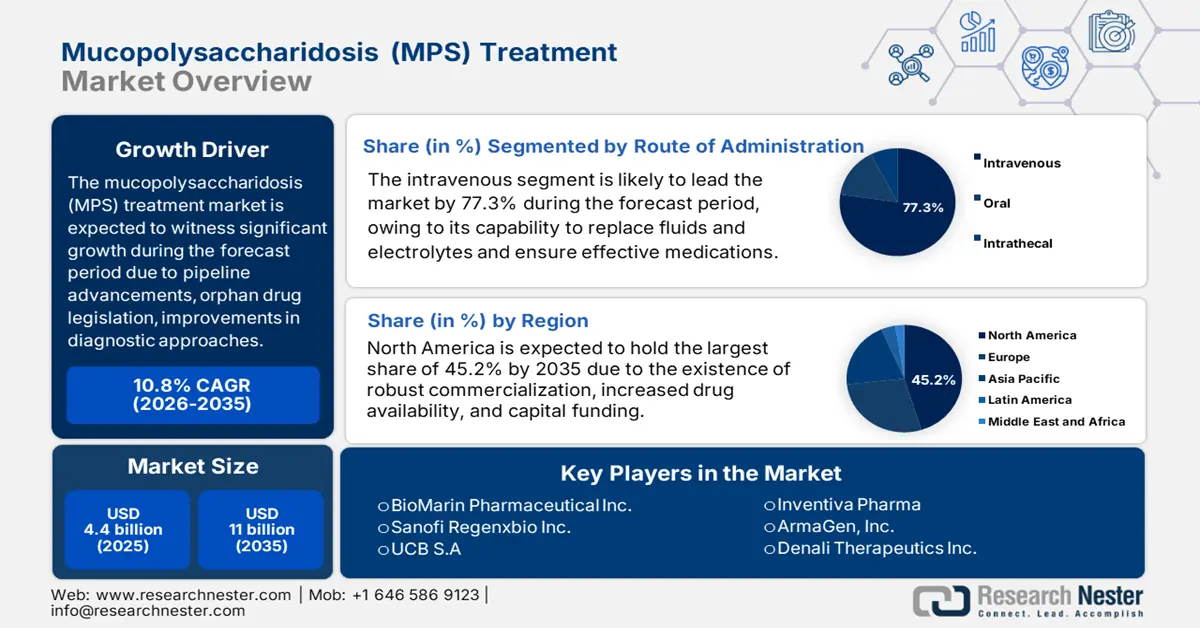

Mucopolysaccharidosis (MPS) Treatment Market size was USD 4.4 billion in 2025 and is anticipated to reach USD 11 billion by the end of 2035, increasing at a CAGR of 10.8% during the forecast period, i.e., 2026-2035. In 2026, the industry size of mucopolysaccharidosis (MPS) treatment is estimated at USD 4.8 billion.

The growth factors for the mucopolysaccharidosis treatment market are readily distilled into a core tactical framework. These factors include advancements in therapeutics, innovation in pipeline treatments, suitable orphan drug legislation, economic models, and optimization in diagnostic pathways. According to an article published by MDPI in March 2025, an estimated 2% of the overall 274,000 clinical trials were conducted in Africa, and in 2022, over 2,000 gene therapies were successfully focused on conditions, such as cardiovascular, hematological, neurological, and oncological diseases. This effectively highlights increased research efforts pertaining to treatment provision, owing to which the market is gaining increased exposure internationally.

Moreover, extension in emerging markets, tactical industrial consolidation, the presence of national institutes of health, administrative clearances, and national organization for rare diseases are also driving the mucopolysaccharidosis treatment market globally. As per the October 2022 NLM article, an estimated 6,000 to 8,000 rare diseases have been identified, with approximately 80% being genetic and 50% to 75% being pediatric onset. Besides, the EU Regulation defined this disease category as conditions severely affecting more than 50 per 100,000 patients in Europe, while the Orphan Drug Act in America defined it as impacting more than 200,000 people in the U.S., thereby bolstering the market demand.

Key Mucopolysaccharidosis Treatment Market Insights Summary:

Regional Highlights:

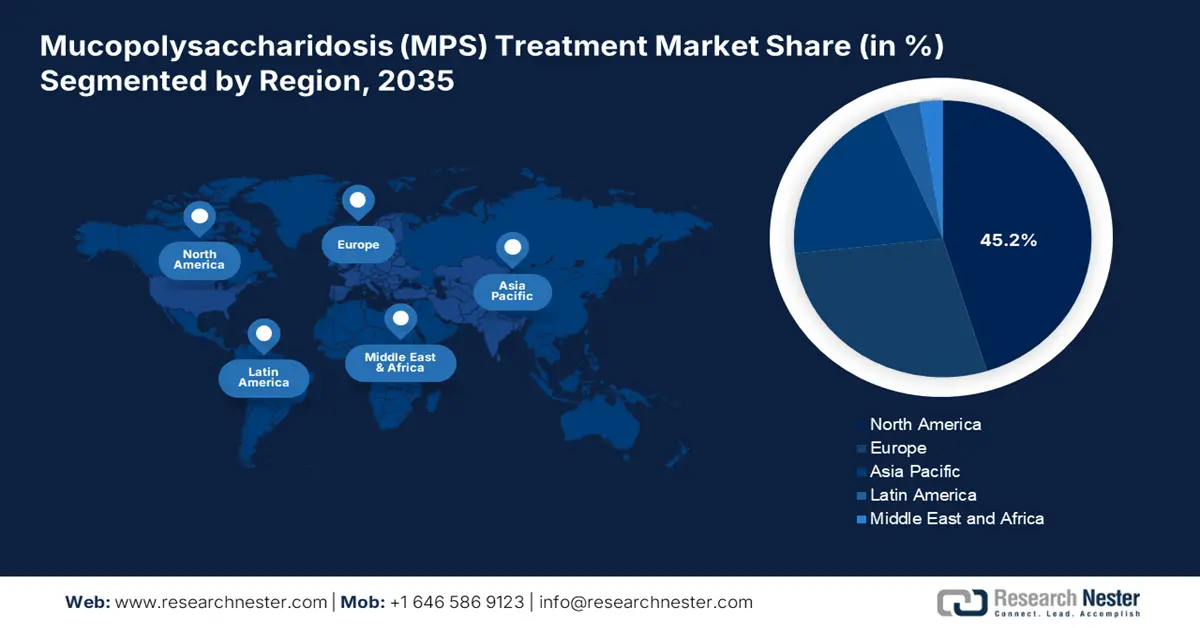

- North America mucopolysaccharidosis treatment market is expected to command the highest 45.2% share by 2035, owing to the presence of a synergistic ecosystem that effectively commercializes, approves, and funds high-cost therapeutic innovations.

- Asia Pacific is anticipated to record the fastest growth during 2026–2035, driven by a large diagnosed population base, enhanced diagnostic infrastructure, and inclusion of costly orphan drugs in national reimbursement programs.

Segment Insights:

- The intravenous (IV) segment in the Mucopolysaccharidosis (MPS) Treatment Market is projected to hold a dominant 77.3% share by 2035, propelled by its capacity to restore fluids and electrolytes, replenish blood volume, and effectively deliver essential medications.

- The specialty clinics segment is expected to secure the third-largest share by 2035, impelled by the specialized multidisciplinary approach required for MPS management and the provision of coordinated intravenous biologic administration.

Key Growth Trends:

- Innovative drug delivery technologies

- Rise in suitable biomarkers

Major Challenges:

- Supply chain complexities for biologics

- Demonstrating value across ultra-small populations

Key Players: BioMarin Pharmaceutical Inc. (U.S.), Sanofi (France), Regenxbio Inc. (U.S.), UCB S.A. (Belgium), Inventiva Pharma (France), ArmaGen, Inc. (U.S.), Denali Therapeutics Inc. (U.S.), Sangamo Therapeutics, Inc. (U.S.), Abeona Therapeutics Inc. (U.S.), Green Cross Corp. (South Korea), GC Pharma (South Korea), Amicus Therapeutics, Inc. (U.S.), M6P Therapeutics (U.S.), Passage Bio, Inc. (U.S.), Sarepta Therapeutics, Inc. (U.S.).

Global Mucopolysaccharidosis Treatment Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 4.4 billion

- 2026 Market Size: USD 4.8 billion

- Projected Market Size: USD 11 billion by 2035

- Growth Forecasts: 10.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (45.2% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, United Kingdom, France

- Emerging Countries: China, India, South Korea, Brazil, Australia

Last updated on : 26 September, 2025

Mucopolysaccharidosis (MPS) Treatment Market - Growth Drivers and Challenges

Growth Drivers

- Innovative drug delivery technologies: The purpose of these technologies effectively act as a vehicle or carrier for a bound or an entrapped therapeutic agent to reach effectively and precisely the actual site of action, thus driving the mucopolysaccharidosis treatment market globally. According to an article published by NLM in June 2023, approximately 30% of comprehensive medical entities and almost 50% of advanced drug compounds are accessible for product manufacture, which are further hydrophobic in nature. In this case, it is suggested to utilize a liquid-based carrier system to bolster the bioavailability of lower water-soluble medications, which have readily grown in recent times.

- Rise in suitable biomarkers: These tend to effectively measure indicators that are present in the body, which are essential for personalized treatment, risk assessment, prognosis, and disease diagnosis, thereby uplifting the mucopolysaccharidosis treatment market. As per the June 2022 JTO report, a clinical study was conducted on 17,513 patients, wherein 83,064 genomic biomarker tests were recorded. Of the total participants, 28.3% to 68.1% received biomarker testing methods, thereby creating a positive outlook for the overall market for patients across different countries.

- Expansion of newborn screening programs: These particular programs are crucial since they are able to identify newborns with critical and treatable disorders prior to symptom appearance, which bolsters the mucopolysaccharidosis treatment market. Additionally, this allows timely intervention that can overcome or diminish long-lasting health issues, as well as developmental risks, thus providing children with a healthy life. As per the May 2023 NLM article, newborn screening in the U.S. organized state-level guidance from the Recommended Uniform Screening Panel (RUSP), which comprised 26 secondary and 35 core disorders, suitable for detecting numerous diagnoses, thereby uplifting the overall market.

2024 Quantitative Outcome of Cell and Gene Therapy Boosting the Mucopolysaccharidosis Treatment Market

|

Output |

Number |

|

Scientists supported |

228 |

|

Projects backed |

144 |

|

Manpower (JRF/SRF/RA etc.) supported |

307 |

|

Patents filed/granted |

7 |

|

Technologies / Products developed |

6 |

|

Workshop/Training programmes organized |

5 |

Source: Department of Biotechnology

Large-scale Genome Projects Targeting Rare Diseases and Undiagnosed Diseases, Driving the MPS Treatment Market

|

Countries |

Project Name |

Sample Size |

Project Years |

NGS Technology |

|

Australia |

Genomics Health Future Mission |

200,000 |

2018- ongoing (targeted completion in 2028) |

Depending on projects |

|

Canada |

Genomics partnership for rare diseases |

Nationwide |

2019- ongoing |

Depending on projects |

|

China |

Precision medicine initiative |

100,000 to 100 million |

2015- ongoing (targeted completion in 2030) |

WGS |

|

France |

Genomic medicine France 2025 |

234,000 per year |

2015- ongoing (targeted completion in 2025) |

WGS/WES/RNA |

|

Japan |

Genome medical alliance |

Nationwide |

2018- ongoing |

WGS |

|

UK |

Our future health |

5,000,000 |

2020-ongoing |

Depending on projects |

|

U.S. |

NIH Undiagnosed Diseases Program |

Nationwide |

2008- ongoing |

WES/Microarray |

Source: NLM, October 2022

Challenges

- Supply chain complexities for biologics: The aspect of manufacturing gene therapies and ERTs is extremely complicated, which relies on personalized facilities and a delicate international supply chain for severe raw materials, which negatively impacts the mucopolysaccharidosis treatment market. Besides, effectively maintaining a cold chain for temperature-specific biologics from the factory to patients is logistically expensive and challenging. In addition, any kind of disruption, starting from geopolitical issues to quality control risks in a single facility, can also put a halt to the international production.

- Demonstrating value across ultra-small populations: A part of deliberately conducting powered and robust clinical trials is ethically and scientifically challenging among small populations, which is causing a hindrance in the mucopolysaccharidosis treatment market globally. On the contrary, HTAs frequently dismiss single-arm comparisons and trials to natural data as insufficient, while manufacturers readily struggle to provide high-quality statistical proof, which forces dependency on endpoints and patient-based outcomes, thus creating a gap in the market’s global development.

Mucopolysaccharidosis (MPS) Treatment Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

10.8% |

|

Base Year Market Size (2025) |

USD 4.4 billion |

|

Forecast Year Market Size (2035) |

USD 11 billion |

|

Regional Scope |

|

Mucopolysaccharidosis (MPS) Treatment Market Segmentation:

Route of Administration Segment Analysis

The intravenous (IV) segment in the mucopolysaccharidosis treatment market is anticipated to garner the largest share of 77.3% by the end of 2035. The segment’s growth is highly attributed to its ability to replace electrolytes and fluids, and replenish blood volume, along with ensuring suitable medications. As per an article published by the National Cancer Institute in May 2025, IV administration for vitamin C caters to doses of more than 500 mg, which in turn leads to increased blood concentrations of ascorbate, in comparison to the oral form. Besides, the June 2022 Clinical Microbiology and Infection report indicated that there are different types of IV antimicrobials that constitute different dosage courses, including 23% for flucloxacillin, 17.2% for piperacillin, 11.6% for vancomycin, and 11% for benzylpenicillin, thus suitable for the segment’s growth.

End user Segment Analysis

The specialty clinics segment in the mucopolysaccharidosis treatment market is expected to cater to the third-largest share by the end of the projected timeline. The segment’s development is highly fueled by the focused nature of MPS care, which demands multiple teams, including metabolic disease specialists, neurologists, and geneticists. Besides, the segment serves as the central facility for administering complicated intravenous biologics, diagnosis, and ensuring coordinated and ongoing patient management. In addition, it is also crucial for administering adverse events and protocols, thereby making specialty clinics the most preferred partner for reimbursed payers and pharmaceutical organizations.

Treatment Segment Analysis

The enzyme replacement therapy (ERT) segment in the mucopolysaccharidosis treatment market is projected to constitute the second-largest share during the forecast timeline. The segment’s upliftment is subject to its importance to effectively aid inherited enzyme deficiencies and lysosomal storage diseases by replacing deficient or missing enzymes and diminishing the buildup of toxic substrate. In this regard, a clinical study was conducted on 221 participants, which was published by Molecular Genetics and Metabolism in July 2025. In the study, misdiagnosed participants received ERT, with a treatment duration of 8.7 years, while the average exposure time of the treatment was 11.7 years, equivalent to 2,197 patient-years.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

Route of Administration |

|

|

End user |

|

|

Treatment |

|

|

Type |

|

|

Distribution Channel |

|

|

Therapy Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Mucopolysaccharidosis (MPS) Treatment Market - Regional Analysis

North America Market Insights

North America mucopolysaccharidosis treatment market is anticipated to garner to highest market share of 45.2% by the end of 2035. The market’s growth in the region is highly attributed to the existence of a synergistic ecosystem that strongly commercializes, approves, and funds high-cost advancements. This includes increased drug expenses, robust venture capital funding, and sophisticated insurance. As stated in the February 2023 NLM article, latest orphan and non-orphan drugs have been approved by the FDA, with an expenditure of USD 218,872 and USD 12,798, thus uplifting the market’s development in the region.

The mucopolysaccharidosis treatment market in the U.S. is growing significantly, owing to the complicated interplay between federal regulations, the presence of a multi-payer insurance system, Medicaid and Medicare reimbursements, along with a highly competitive marketplace. Besides, the November 2023 NLM article has indicated that the economic burden of Sanfilippo syndrome has been estimated to be USD 2.0 billion as of 2023, which is vigorously bolstering the market in the country. In addition, the burden for individual families increased by USD 8 million, particularly from the time their children were born with the symptom.

The mucopolysaccharidosis treatment market in Canada is also uplifting due to the affordable evaluation conducted by the Canada Agency for Drugs and Technologies in Health (CADTH), Health Canada’s clearance for review and availability, and subsequent negotiations, which are governed by the pan-Canada Pharmaceutical Alliance (pCPA). Besides, the April 2025 NLM article indicated that the country’s Health Minister declared the latest national strategy for drugs for rare diseases (DRDs) by providing USD 1.5 billion as an investment for more than three years. This has further aimed to optimize accessibility to treatments for rare diseases, and includes almost USD 1.4 billion for territories and provinces to increase drug access.

Historical Savings from Generic Drug Approvals in North America

|

Years |

Total Savings (USD Billion) |

First-Generic Savings (USD Billion) |

|

2018 |

17.8 |

4.0 |

|

2019 |

24.8 |

9.4 |

|

2020 |

10.7 |

1.8 |

|

2021 |

16.6 |

1.7 |

|

2022 |

18.9 |

5.2 |

Source: FDA, October 2024

APAC Market Insights

Asia Pacific market is predicted to emerge as the fastest-growing region during the forecast timeline. The market’s development in the region is extremely driven by the prevalent population, along with diagnosed and aided patients, improved diagnostic capabilities, and suitable negotiation for including ultra-expensive orphan drugs into national reimbursement schemes. Besides, the April 2022 APAC Med report demonstrated that investments in the region’s universal health coverage (UHC) contributed USD 2.5 trillion, which has conventionally underfunded accessibility to technologies of high-quality. Besides, democratized and decentralized testing takes place at the same time, leading to personal care models, which are positively impacting the market’s growth.

The market in China is gaining increased exposure, owing to the presence of the National Reimbursement Drug List (NRDL), standardized discount facilities, volume-for-value model, and strategies implementation through partnerships. According to an article published by the Orphanet Journal of Rare Diseases in September 2024, a clinical study was conducted on 180 MPS patients to evaluate the disease burden. The study revealed that the direct medical expenses for hospitalization were ¥81,086.7, which accounted for 63.7% of the overall cost, thereby effectively contributing towards the market’s upliftment in the overall country.

The mucopolysaccharidosis treatment market in South Korea is also developing due to robust health technology assessment, cost-effective analysis, the government’s increased utilization of Risk-Share Agreements (RSAs), and manufacturers’ ability to represent real-world evidence. In this regard, the May 2024 NCBI article denoted that since the initiation of the health technology reassessment in the country, 262 cases have been successfully reassessed, of which 126 cases, that is 48.1% were related to health services that were initially not covered by the National Health Insurance (NHI).

Europe Market Insights

Europe in the mucopolysaccharidosis treatment market is expected to account for a considerable market share during the projected timeline. The market’s exposure in the region is highly fueled by the aspects of centralized administrative approval by the Europe Medicines Agency (EMA), pricing and reimbursement policies, and suitable medical and scientific instruments sourcing. According to an article published by the NLM in September 2024, the authorization system in the region granted approval for 14 drugs and 12 drugs in the UK. Additionally, as per the developmental status, the region comprises 3 drugs, followed by 5 drugs in the UK, thus suitable for boosting the market’s exposure.

The mucopolysaccharidosis treatment market in Germany is also growing, owing to the presence of the Act on the Reform of the Market for Medicinal Products (AMNOG), appropriate comparator therapy, the National Association of Statutory Health Insurance Funds, and strong health and clinical economic data. As per an article published by the Multiple Sclerosis and Related Disorders in August 2024, an estimated 29,604 multiple sclerosis (MS) therapy beginners have been identified in the country, of which 29.6% readily followed the HHAE strategy. Additionally, in 2022, a 14% increase in the strategy has been observed in the country, thereby denoting therapists’ importance for the market’s upliftment.

The mucopolysaccharidosis (MPS) treatment market in France is developing due to the rating and assessment provision by the Transparency Committee under the French National Authority for Health (HAS), the premium price aspect, and broad reimbursement policies. According to the April 2024 WHO report, the complementary health insurance (CHI) in the country has optimized the financial aspect for almost 95% of the population. This is because domestic households with low income are able to utilize it for free or else implement it with a subsidy, which has created a huge opportunity for the market to flourish.

Medical and Scientific Instruments 2023 Export and Import in Europe

|

Countries |

Export (USD) |

Import (USD) |

|

Belgium |

20 million |

4.3 million |

|

Spain |

15.6 million |

- |

|

UK |

15.1 million |

13.2 million |

|

Germany |

13.8 million |

153 million |

|

Ireland |

10.7 million |

29.3 million |

|

Italy |

9.5 million |

24.6 million |

|

Poland |

9.0 million |

4.5 million |

|

Russia |

7.5 million |

1.3 million |

Source: OEC, August 2025

Key Mucopolysaccharidosis (MPS) Treatment Market Players:

- BioMarin Pharmaceutical Inc. (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Sanofi (France)

- Regenxbio Inc. (U.S.)

- UCB S.A. (Belgium)

- Inventiva Pharma (France)

- ArmaGen, Inc. (U.S.)

- Denali Therapeutics Inc. (U.S.)

- Sangamo Therapeutics, Inc. (U.S.)

- Abeona Therapeutics Inc. (U.S.)

- Green Cross Corp. (South Korea)

- GC Pharma (South Korea)

- Amicus Therapeutics, Inc. (U.S.)

- M6P Therapeutics (U.S.)

- Passage Bio, Inc. (U.S.)

- Sarepta Therapeutics, Inc. (U.S.)

The international mucopolysaccharidosis (MPS) treatment market is an oligopoly, which is readily dominated by innovative biotechs and specialized pharmaceutical giants. Besides, notable strategic initiatives include relentless research and development (R&D) funding in cutting-edge therapies, including CNS-penetrant ERTs and gene therapy, with the intention to cater to increased demand for neurological symptoms. Meanwhile, organizations are strongly pursuing orphan drug designations for premium pricing and market exclusivity; for instance, Takeda and BioMarin have leveraged their respective established commercial facilities for worldwide launches, thereby proliferating the mucopolysaccharidosis (MPS) treatment market globally.

Here is a list of key players operating in the global market:

Recent Developments

- In February 2025, Ultragenyx Pharmaceutical Inc. announced that the U.S. FDA has cleared the Biologics License Application (BLA) for effectively seeking escalated acceptance for UX111 AAV gene therapy as a probable treatment for patients with Sanfilippo syndrome type A.

- In November 2024, PTC Therapeutics, Inc. declared that it has achieved the U.S. FDA approval for its gene therapy, which is extremely suitable for aiding AADC deficiency, the first-ever gene therapy cleared in the U.S. that directly administers the brain.

- Report ID: 5215

- Published Date: Sep 26, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.