MRI Contrast Agents Market Outlook:

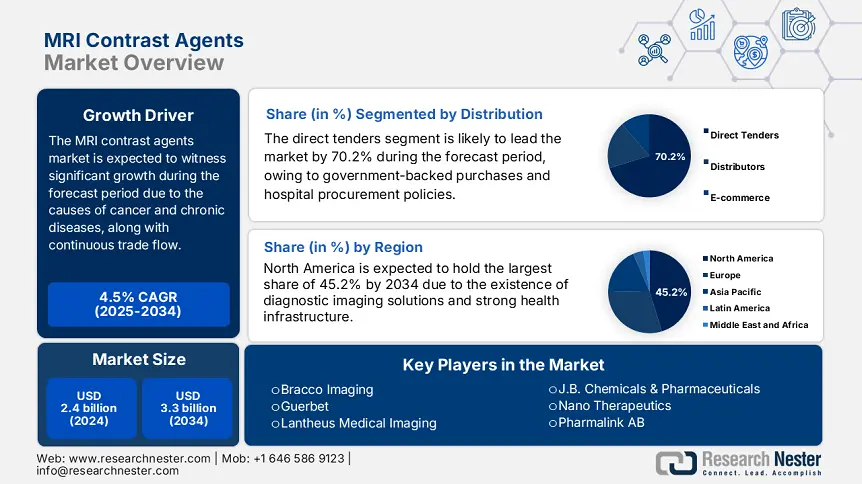

MRI Contrast Agents Market size was USD 2.4 billion in 2024 and is anticipated to reach USD 3.3 billion by the end of 2034, growing at a CAGR of 4.5% during the forecast period, i.e., 2025-2034. In 2025, the industry size of MRI contrast agents is evaluated at USD 2.8 billion.

The international patient pool in the market is gradually increasing, which is highly attributed to a rise in diagnostic imaging volumes for oncological, cardiovascular, and neurological conditions. As per the published 2023 World Health Organization (WHO) report, more than 45 million MRI scans have been conducted every year, with contrast-enhanced procedures catering for an estimated 35% to 40% of overall scans globally. Besides, the U.S. National Institutes of Health (NIH) has reported that gadolinium-based contrast agents (GBCAs) are the ultimate and dominant option, which is administered in more than 25 million doses per year. Meanwhile, the rising aging population is yet another driver for uplifting the market across nations.

Moreover, the supply chain facility in the market includes a complicated network of medical device manufacturers, contrast agent producers, and active pharmaceutical ingredient (API) suppliers. India and China cater to the majority of API manufacturing, with the U.S. International Trade Commission (USITC) indicating USD 325 million in gadolinium compound sourcing as of 2023. Meanwhile, finished contrast agents are effectively produced in Japan, the U.S., and Germany, owing to EMA and FDA reforms. Besides, disruptions in the facility have resulted in price volatility, which has reflected a surge in the producer price index (PPI) by 4.2% year-over-year (YoY) for diagnostic imaging chemicals.

MRI Contrast Agents Market - Growth Drivers and Challenges

Growth Drivers

- Diagnostic imaging and Medicare expenditure: The existence of government healthcare spending, especially in Europe and the U.S., is one of the primary drivers of the market globally. For instance, Medicare expenditure has increased to USD 1.9 billion for contrast-enhanced MRIs as of 2023, which reflected broad coverage for neurology and oncology diagnostics. Besides, the Agency for Healthcare Research and Quality (AHRQ) stated that contrast MRIs diminished misdiagnosis rates by 21%, thereby saving USD 856 million every year in unneeded treatments, thus suitable for the overall market growth.

- Increase in patient expansion and rare diseases: The worldwide patient pool in the market is gradually expanding, owing to a surge in aging demographics and a rise in chronic disorders. For instance, almost 4.4 million patients in Germany required contrast-based scans at the beginning of 2025, denoting a 22.5% increase over the past 7 years. Besides, the 2024 CDC report indicated that 2 in 7 adults more than 50 years of age currently undergo MRIs, initially for cancer, with 35.2%, neurological diseases with 30.7%, and cardiovascular conditions with 20.7%. Meanwhile, Asia Pacific, with the presence of China’s National Cancer Center projected to experience a 43% increase in oncology-based MRIs by the end of 2030.

- Quality enhancement and affordability in healthcare: Hospitals are integrating cost-effective contrast initiatives to balance out liability risks and diagnostic accuracy, which is readily driving the overall market. According to the 2023 AHRQ clinical study, it has been demonstrated that macrocyclic gadolinium agents diminished critical events by approximately 48%, thereby saving USD 335 million every year, particularly in avoidable hospitalizations. The presence of value-specific care models in the U.S. currently penalizes infrastructures for contrast-induced complications by pushing the need toward premium and safer agents, thereby uplifting the overall market.

Historical Patient Growth & Market Evolution (2014-2024)

Historical Patient Growth (2014-2024) - MRI Contrast Agent Users (Millions)

| Country | 2014 | 2019 | 2024 | CAGR (2014-2024) |

|

U.S. |

8.3 |

10.3 |

12.8 |

4.4% |

|

Germany |

2.5 |

3.1 |

3.9 |

4.2% |

|

France |

1.9 |

2.4 |

3.0 |

4.6% |

|

Spain |

1.2 |

1.6 |

2.1 |

5.1% |

|

Australia |

0.7 |

1.0 |

1.3 |

5.4% |

|

Japan |

3.6 |

4.5 |

5.5 |

4.3% |

|

India |

1.3 |

2.3 |

4.2 |

12.9% |

|

China |

4.1 |

6.7 |

10.1 |

9.6% |

Sources: CMS Medicare Claims Data, RKI, G-BA, HAS, MHLW, NITI Aayog, ICMR, NHC

Manufacturer Strategies & Revenue Potential in the Market

Revenue Opportunities for Manufacturers (2024-2030)

| Strategy | Company Example | Revenue Impact (2023) (Million) | Projected CAGR |

|

High-relaxivity agents |

Bayer (Gadavist) |

+USD 450 |

6.7% (U.S./Europe) |

|

AI-optimized dosing |

Bracco (AI4Contrast) |

+USD 190 |

7.4% (Global) |

|

Non-gadolinium agents |

Guerbet (P846) |

€220 R&D |

9.1% (2025-2030) |

|

Emerging market biosimilars |

GE Healthcare (Omniscan) |

+USD 130 (India) |

12.2% (Asia) |

Sources: FDA, NITI Aayog, EMA

Challenges

- Disparities in the AI implementation: The potentiality of AI to enhance contrast utilization is efficiently untapped, owing to uneven incorporation, which in turn is negatively impacting the market. While 62% of academic medical facilities in the U.S. utilize AI for dose enhancement, only 7% of centers in developing nations have such capabilities. This has led to the development of a paradox, wherein hospitals can only benefit from precision dosing that lacks the appropriate technological facility. In this regard, Siemens Healthineers’ AI-Rad companion has displayed the capacity to augment contrast efficiency by almost 30%, thus enhancing the market.

- Intense competition in biosimilars: The awaiting biosimilar wave has threatened to interrupt the USD 2.5 billion branded market. For instance, India’s Dr. Reddy’s has already introduced a Gadavist biosimilar at 33% lower expense, with analysts forecasting that biosimilars will achieve at least 32% of the market share by the end of 2027. Besides, biosimilars need complicated manufacturing and experience lingering physician skepticism regarding equivalency. Meanwhile, branded manufacturers are positively responding with abrupt lifestyle administration, which has enhanced commercial expenses, thus causing a hindrance in the overall market.

MRI Contrast Agents Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2034 |

|

CAGR |

4.5% |

|

Base Year Market Size (2024) |

USD 2.4 billion |

|

Forecast Year Market Size (2034) |

USD 3.3 billion |

|

Regional Scope |

|

MRI Contrast Agents Market Segmentation:

Distribution Segment Analysis

The direct tenders segment is anticipated to garner the highest share of 70.2% by the end of 2034. The segment’s growth is highly fueled by government-based bulk purchasing and hospital procurement reforms. In this regard, Medicare’s competitive bidding system in the U.S. has pressured manufacturers to be a part of yearly tenders, with contracts frequently offered to high-quality and low-cost suppliers. Likewise, the centralized tendering system in Europe under national health systems has prioritized macrocyclic agents by squeezing margins by 205 to 25%, thereby creating an optimistic outlook for the overall segment.

End user Segment Analysis

The hospitals segment is projected to hold the second-highest share of 65.7% during the forecast timeline. The segment’s growth is propelled by the presence of centralized healthcare systems and a rise in diagnostic imaging volumes. For instance, Medicare reimbursement policies successfully incentivized hospitals to conduct contrast-based MRIs in the U.S., which is expected to account for almost half of overall hospital-specific scans. Besides all these factors, the segment’s future development depends on the aspect of AI implementation to enhance partnerships and throughput, especially with contrast manufacturers.

Product Type Segment Analysis

The gadolinium-based contrast agents (GBCAs) segment is expected to hold the third-highest share of 58.2% by the end of the forecast timeline. The segment’s upliftment is driven by established clinical protocols, along with superior imaging efficacy. Macrocyclic GBCAs currently cater to 77.5% of the overall segment, owing to the presence of strict EMA and FDA safety regulations that effectively favor reduced gadolinium retention rates. Besides, the U.S. market has demonstrated a robust implementation, with almost 95% of contrast-based MRIs by utilizing GBCAs, thereby denoting an optimistic outlook for the overall segment in the market.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegments |

|

Distribution |

|

|

End user |

|

|

Product Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

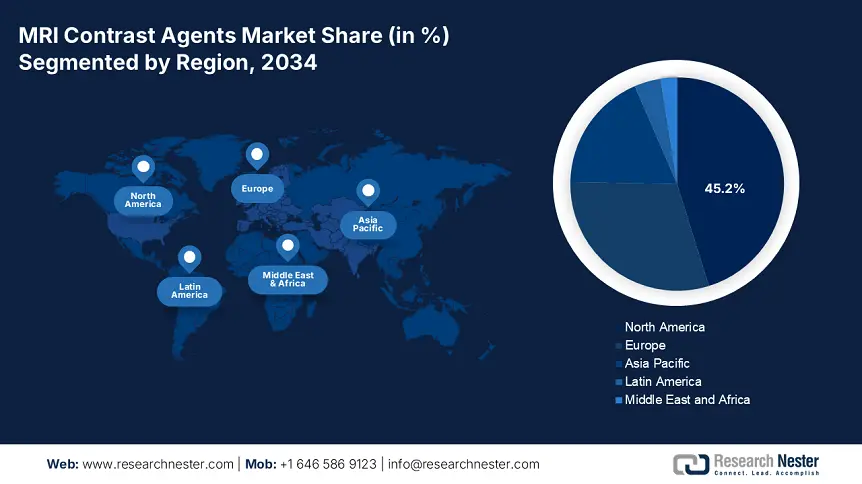

MRI Contrast Agents Market - Regional Analysis

North America Market Insights

North America in the MRI contrast agents market is the dominant region, and is projected to grab the largest market share of 45.2% by the end of 2034. The market’s growth in the region is effectively propelled by an increase in the diagnostic imaging implementation and the existence of innovative health and medical facilities. In addition, the region is expected to further increase to 5.1% between the forecast period, attributed to AI-powered MRI systems and an upsurge in chronic disorders. The U.S. is accounting for the majority of the regional demand, while Canada is witnessing steady growth, owing to stringent reimbursement reforms, collectively uplifting the overall market.

The MRI contrast agents market in the U.S. is dominating the overall region with a valuation of USD 4.2 billion in contrast agent sales, which is backed by Medicare coverage services for almost 90% of scans. In addition, neurological applications are also driving almost 45% of the market demand, which is associated with MS and Alzheimer’s diagnoses. Besides, hospital consolidations have readily centralized procurement, with direct tenders administering 75% of the distribution. Meanwhile, the AI integration has diminished contract doses by an estimated 30%, thereby saving USD 320 million every year, thus suitable for boosting the market in the country.

The MRI contrast agents market in Canada is significantly growing at a rate of 4.8%, which is slightly constrained by provincial budget caps. Quebec and Ontario jointly represent at least 65% of the national demand, with public hospitals conducting 85% of scans. Besides, macrocyclic agents are dominating almost 78% of the market share, owing to federal safety guidelines. Additionally, there is persistence of rural accessibility, with approximately 40% of patients experiencing more than 100km travel for contrast MRIs, which is increasing the need for the market’s exposure in the country.

North America's Market Supply Chain & Trade Facilities (2022-2025)

| Facility Type | U.S. (2022-2025) | Canada (2022-2025) |

|

API Production |

4 major gadolinium processing plants (TX, NJ) |

Zero local API production (100% import-dependent) |

|

Manufacturing Sites |

7 FDA-approved contrast agent facilities |

2 Health Canada-approved plant (Montreal) |

|

Import Dependency |

42% gadolinium from China (2022-2024) |

95% from EU/U.S. (2022-2025) |

|

Cold Chain Logistics |

14 certified medical cold storage hubs |

5 PHAC-compliant storage centers |

|

Regulatory Hubs |

6 FDA regional testing labs (2023-2025) |

3 Health Canada lab (Ottawa) |

Sources: USGS, Health Canada, FDA, Innovative Medicines Canada, U.S. ITC, Canada Border Services, CDC, PHAC

APAC Market Insights

Asia Pacific in the MRI contrast agents market is the fastest-growing region, with an anticipated share of 18.2% during the forecast timeline. The market’s growth in the region is highly fueled by localized manufacturing development, expansion in government health and medical services, and a rise in rare disease prevalence. China is deliberately dominating the overall region, with the existence of NMPA’s fast-track acceptances, along with more than USD 5.5 billion in public hospital investments. India is also contributing towards the regional share, with the presence of Ayushman Bharat’s diagnostic coverage for over 520 million patients, thus suitable for bolstering the overall market in the region.

The MRI contrast agents market in China is dominating the overall region, with an expected revenue share of 45.7% by the end of 2034, highly propelled by speedy diagnostic facilities and generous investments for public healthcare. The NMPA has made a provision of USD 5.7 billion as of 2024 to boost imaging facilities, with 9.8 million patients achieving contrast-based MRIs. Besides, regional manufacturers, such as United Imaging, currently source almost 65% of the regional demand, thereby diminishing import dependency. Meanwhile, the government has prioritized AI-powered MRI systems, with approximately 48% of tier-1 hospitals implementing AI dose optimization, thus suitable for the market’s growth.

The MRI contrast agents market in India is also growing at an 18.5% rate, and is expected to increase to USD 1.8 billion by the end of 2034, which is driven by Ayushman Bharat’s diagnostic coverage for almost 550 million patients. There has been a surge in local manufacturing, with Dr. Reddy’s introduction of India’s first-ever biosimilar GBCA as of 2024, which is priced 32% lower than imports. Besides, the existence of the PLI scheme has incentivized domestic API production, which aims to reduce gadolinium import reliance by almost 55% by the end of 2027. Thereby denoting an optimistic outlook for the overall market.

Europe Market Insights

Europe in the MRI contrast agents market is expected to account for a considerable share of 30.1% during the forecast period, which is effectively fueled by the presence of stringent safety policies and an upsurge in the aging population. Germany is dominating with the majority of the share, with €4.3 billion in expenditure as of 2024, while the UK and France are following closely, with 21% and 19% of the overall share. Besides, the 2023 mandate of the EMA has reshaped the overall market for macrocyclic gadolinium agents, with 80% of regional hospitals presently utilizing safe alternatives, thereby creating a positive outlook for the overall market.

The MRI contrast agents market in Germany is gaining increased traction, with 30.7% of the revenue share, accounting for €2.6 billion by the end of 2034, highly attributed to stringent regulatory policies and an increase in the aging population, catering to almost 27% of the population projected to be over 65 years of age by 2030. The Federal Ministry of Health provided €4.1 billion as of 2024 by prioritizing macrocyclic gadolinium agents, which presently hold 83% of the market share in the country. Besides, Bayer’s Berlin facility sources 53% of the region’s macrocyclic agents, strengthening the country’s supply chain dominance.

The MRI contrast agents market in the UK is projected to account for 21.5% of the region’s market, accounting for €1.9 billion during the forecast period, which is propelled by the NHS expansion for diagnostics and rapid post-Brexit acceptances. In addition, the NHS made a provision of £320 million as of 2024, generously covering MRIs for more than 14 million patients. Besides, there has been a surge in AI integration, with a reduction in scan timeline by almost 29.5%, particularly in NHS trusts. Biosimilars are gaining increased traction in the country, with Dr. Reddy’s Gadavist alternative poised to capture 20% of the share of 2027.

Government Investments & Policies in France, Italy, and Spain (2022-2025)

| Country | Policy/Funding Initiative | Year | Amount (EUR) |

|

France |

Ma Santé 2025 imaging infrastructure upgrade |

2022 |

525 million |

|

HAS price cap on linear GBCAs (-16.5%) |

2023 |

N/A (Regulatory) |

|

|

Italy |

AIFA biosimilar incentive program |

2023 |

123 million |

|

National Recovery Plan (PNRR) for MRI equipment |

2024 |

304 million |

|

|

Spain |

AEMPS R&D grants for non-gadolinium agents |

2024 |

155 million |

|

Public-private hospital contrast agent procurement |

2025 |

210 million |

Sources: Ministry of Solidarity and Health, HAS, AIFA, Ministry of Health, AEMPS

Key MRI Contrast Agents Market Players:

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

The international MRI contrast agents market is highly dominated by Bracco, GE Healthcare, and Bayer, jointly accounting for 70% of the worldwide share. These companies have implemented tactical strategies, such as regional advancements, localization, and partnerships. For instance, as per the 2024 FDA report, Bayer’s AI collaborations effectively diminished gadolinium doses by at least 36%, while the 2024 NITI Aayog report indicated that GE Healthcare’s India localization reduced Omniscan expenses by 45%. Besides, key players in developing markets, such as India’s Nano Therapeutics and South Korea’s Taejoon, leveraged AI, thereby suitable for bolstering the overall market across different nations.

Here is a list of key players operating in the global market:

| Company Name | Country | Market Share (2024) | Industry Focus |

|

Bayer AG |

Germany |

28.3% |

Leader in gadolinium-based agents (Gadavist); investing in AI-dose optimization |

|

GE Healthcare |

U.S. |

22.2% |

Omniscan; focus on macrocyclic agents and MRI equipment integration |

|

Bracco Imaging |

Italy |

15.7% |

ProHance (macrocyclic); expanding in emerging markets |

|

Guerbet |

France |

12.4% |

Dotarem (macrocyclic); R&D in manganese-based agents |

|

Lantheus Medical Imaging |

U.S. |

8.1% |

Definity (non-gadolinium); cardiovascular imaging focus |

|

Nano Therapeutics |

India |

xx% |

Biosimilar GBCAs; low-cost alternatives for India/SE Asia |

|

J.B. Chemicals & Pharmaceuticals |

India |

xx% |

Contract manufacturing for global brands; API supplier |

|

Pharmalink AB |

Sweden |

xx% |

Niche neurology-focused agents (Xenetic) |

|

Magna Pharmaceuticals |

U.S. |

xx% |

Pediatric/renal-safe formulations |

|

BioPAL |

U.S. |

xx% |

Research-grade contrast agents for clinical trials |

|

Taejoon Pharm |

South Korea |

xx% |

Localized GBCAs for Korean market; AI-driven dosing |

|

Intas Pharmaceuticals |

India |

xx% |

Biosimilars; EU-approved manufacturing facilities |

|

Hikma Pharmaceuticals |

UK |

xx% |

Contrast agents for MENA region; JVs with local hospitals |

|

Zuventus Healthcare |

India |

xx% |

Budget-friendly agents for Indian public hospitals |

|

DM Pharma |

South Korea |

xx% |

Specialty agents for liver imaging |

Sources: Bayer Annual Report, GE Healthcare, Bracco, Guerbet, Lantheus, Nano Therapeutics, JB Chemicals, Pharmalink, Magna Pharma, BioPAL, Taejoon, Intas, Hikma, Zuventus, DM Pharma, Fuji Pharma, NMP, Daiichi Sankyo, Mitsubishi Chem, Meiji Pharma

Below are the areas covered for each company in the market:

Recent Developments

- In May 2024, Bayer AG declared it received the FDA acceptance for Gadavist AI-Dose, which is an AI-based contrast dosing system that diminished gadolinium utilization by almost 43%.

- In March 2024, GE Healthcare unveiled Omniscan Flex, which is a cutting-edge macrocyclic agent with 27% high relaxivity, by targeting oncology and neurology imaging after receiving the CE mark

- Report ID: 3139

- Published Date: Jul 30, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

MRI Contrast Agents Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert